Marché des conteneurs maritimes en Asie-Pacifique, par type (conteneurs en polypropylène (PP), conteneurs en polyéthylène (PE) et autres), application (aliments et boissons, produits chimiques, minéraux, agriculture et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché des conteneurs maritimes en Asie-Pacifique

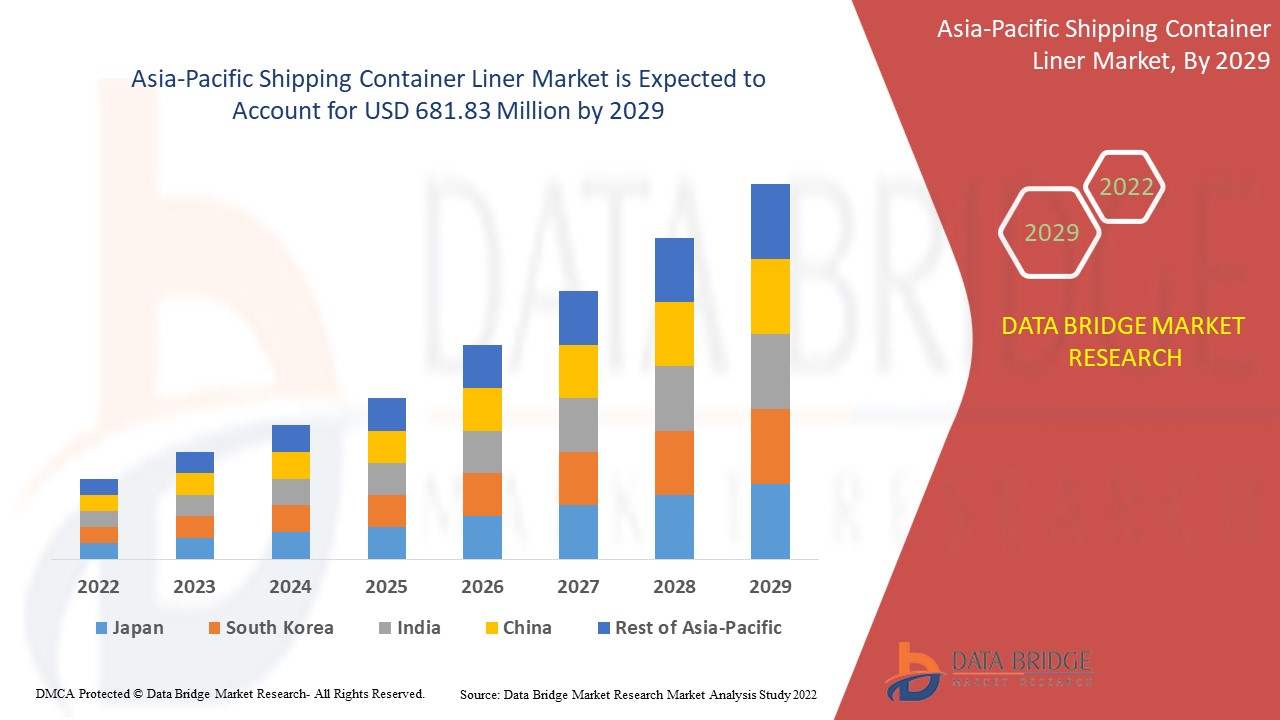

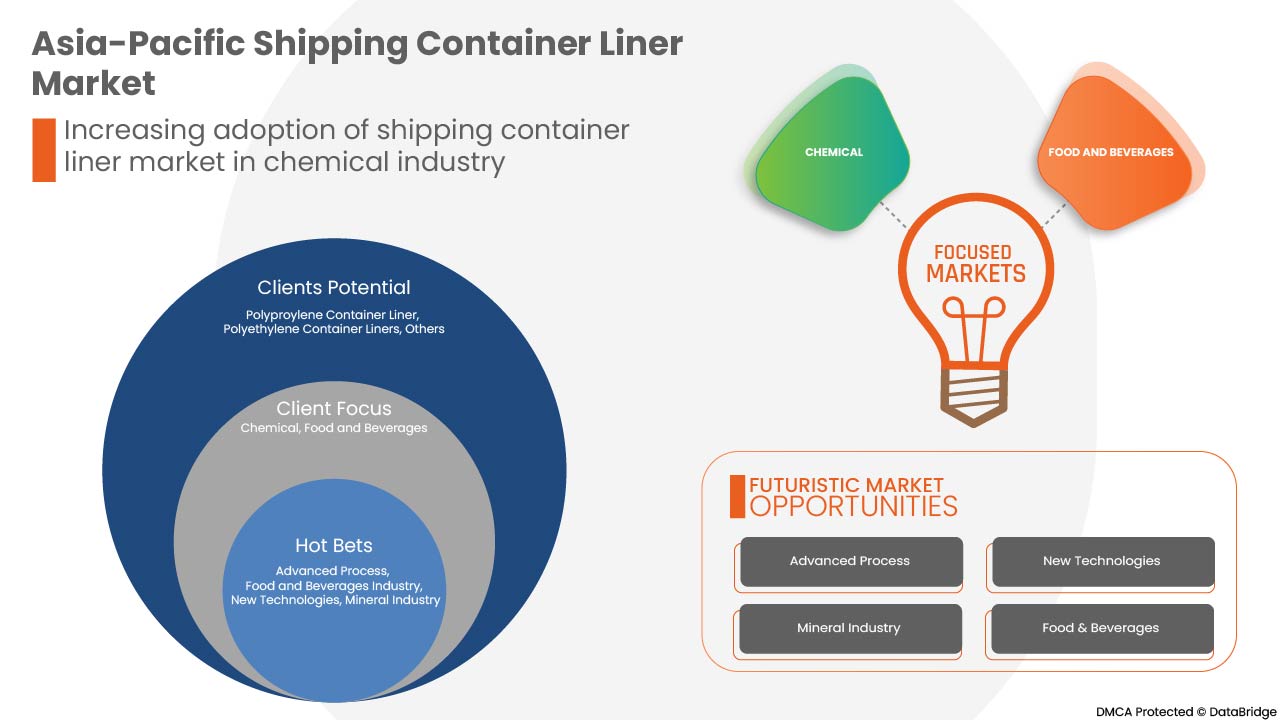

Le marché des conteneurs maritimes de ligne en Asie-Pacifique devrait connaître une croissance significative au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,3% au cours de la période de prévision de 2022 à 2029 et devrait atteindre 681,83 millions USD d'ici 2029. Le principal facteur à l'origine de la croissance du marché des conteneurs maritimes de ligne est la tendance à la consommation d'additifs alimentaires dans l'industrie alimentaire et des boissons, la popularité croissante des conteneurs maritimes de ligne dans l'industrie chimique, l'industrie agricole et la sensibilisation croissante aux propriétés des conteneurs maritimes de ligne.

Les doublures de conteneurs peuvent être utilisées pour emballer toutes sortes d'aliments secs tels que le blé, le riz, le café, les légumineuses, le sucre et d'autres aliments. Pour un emballage sûr et sans contamination, les doublures de conteneurs offrent une solution d'emballage rentable, protectrice et précieuse. La prévalence croissante des doublures de conteneurs dans l'industrie alimentaire et agricole et l'augmentation des activités de transport devraient stimuler le marché des doublures de conteneurs d'expédition en Asie-Pacifique. De plus, la réutilisabilité et la rentabilité des doublures de conteneurs d'expédition propulseront la croissance du marché des doublures de conteneurs d'expédition en Asie-Pacifique. Cependant, les coûts de transport élevés et l'augmentation des taux de fret peuvent entraver la croissance du marché.

Le rapport sur le marché des conteneurs maritimes en Asie-Pacifique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (revêtements de conteneurs en polypropylène (PP), revêtements de conteneurs en polyéthylène (PE) et autres), application (aliments et boissons, produits chimiques, minéraux, produits agricoles et autres) |

|

Pays couverts |

Japon, Chine, Corée du Sud, Inde, Singapour, Thaïlande, Indonésie, Malaisie, Philippines, Australie et Nouvelle-Zélande, et le reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

UNITED BAGS, INC., Bulk Corp International, Nier Systems Inc., Rishi FIBC Solutions PVT. Ltd., Dev Ventures India Pvt. Ltd., Ven Pack, BERRY ASIA-PACIFIC INC., Bulk Handling Australia, Eceplast, Greif., LC Packaging, Thrace Group, CDF Corporation, Composite Containers, LLC, INTERTAPE POLYMER GROUP et BULK FLOW, entre autres |

Définition du marché

Les doublures de conteneurs sont le moyen le plus économique d'emballer et de transporter des produits en vrac secs et fluides. Elles sont d'une importance primordiale pour les exigences d'emballage lors des livraisons en vrac de marchandises et d'autres matériaux. Lorsque les marchandises sont déplacées d'un lieu géographique à un autre, elles entrent naturellement en contact avec des éléments naturels tels que le pétrole, la poussière, l'air et le sol, qui peuvent tous ruiner ou dégrader la qualité des marchandises. Il est possible qu'une contamination excessive rende souvent les marchandises impropres. Les marchandises transportées étant rejetées par les autorités, il est très important que les marchandises répondent aux normes de qualité fixées par le gouvernement compétent du pays de destination. Pour éviter toutes ces situations, les doublures de conteneurs en vrac sont utilisées comme couche protectrice. En utilisant des doublures de conteneurs en vrac pour le transport, les marchandises sont conservées en toute sécurité et la contamination est complètement évitée.

Dynamique du marché des conteneurs maritimes en Asie-Pacifique

Conducteurs

- Prévalence croissante des doublures de conteneurs dans l'industrie agroalimentaire

Les doublures de conteneurs d'expédition sont devenues de plus en plus populaires dans l'industrie du transport maritime, en particulier dans l'alimentation et l'agriculture. Les produits et articles alimentaires doivent être transportés avec des chaînes et des précautions bien entretenues pour maintenir leur qualité et leur sécurité alimentaire. De même, dans l' industrie agricole , le transport de semences, d'engrais et de divers produits chimiques doit être transporté avec soin et manipulé avec précaution. Les doublures de conteneurs empêchent l'humidité, la température et d'autres contaminations dans la marchandise. Divers fabricants fournissent de telles doublures de conteneurs en fonction des besoins des utilisateurs finaux pour diverses applications. La large applicabilité des doublures de conteneurs dans l'alimentation et l'agriculture entraîne une demande plus élevée et devrait stimuler la croissance du marché

- Augmentation des activités de transport nécessitant des lignes de conteneurs maritimes

L'essor du transport de marchandises à travers le monde a entraîné une augmentation de la demande de conteneurs maritimes. Ces conteneurs assurent la sécurité des marchandises et sont très efficaces lors du chargement et du déchargement. Avec l'augmentation du transport, la demande de conteneurs maritimes augmente également et devrait stimuler la croissance du marché.

- Des exigences plus élevées en raison de la rentabilité et de la réutilisabilité des doublures de conteneurs maritimes

Les doublures de conteneurs sont composées de polyéthylène haute densité et de polypropylène , ce qui permet aux utilisateurs finaux de les réutiliser. Les doublures de conteneurs peuvent être utilisées plusieurs fois, ce qui se traduit par une rentabilité. Les fabricants fournissent des doublures de conteneurs d'expédition dans divers matériaux, ce qui contribue à leur rentabilité et à leur qualité. Par conséquent, les doublures de conteneurs sont très demandées en raison de leur rentabilité et de leur réutilisabilité, ce qui devrait stimuler la croissance du marché.

Opportunités

- Initiatives stratégiques des principales organisations

L'acceptation et l'utilisation élevée des doublures de conteneurs maritimes sur le marché ont augmenté la demande pour ce produit. Pour répondre à ces demandes en fonction des besoins des utilisateurs finaux liés à diverses applications, il est utilisé pour ; les fabricants prennent des décisions stratégiques et fournissent des produits nouveaux et innovants sur le marché.

- Demande croissante de grands emballages pour les marchandises en vrac

Les doublures de conteneurs empêchent la contamination des marchandises et autres produits transportés après l'emballage. Elles protègent la cargaison en vrac de l'humidité et garantissent que la cargaison est expédiée de manière sûre et hygiénique. Avec les doublures de conteneurs, très peu de manipulations sont nécessaires lors de l'expédition, ce qui facilite toutes les opérations. Les fabricants proposent des doublures de conteneurs de différentes conceptions et tailles pour transporter des marchandises en vrac tout en garantissant la sécurité des produits. Par conséquent, la demande croissante d'emballages de grande taille pour les marchandises en vrac pourrait créer des opportunités pour le marché des doublures de conteneurs maritimes en Asie-Pacifique.

Contraintes/Défis

- Coûts élevés du transport

En raison de cette augmentation des prix du transport de marchandises, l’industrie du transport maritime est globalement affectée. Des données empiriques montrent qu’une augmentation de 10 % des coûts de transport réduit les volumes d’échanges de plus de 20 %. Les coûts de transport élevés ont un impact sur la structure des activités économiques et sur le commerce international, affectant en fin de compte la demande de navires porte-conteneurs.

- Pénurie de conteneurs d'expédition pour le transport

Pour atténuer ces pertes, de nouveaux conteneurs d'expédition doivent être fabriqués pour rétablir l'efficacité de la chaîne d'approvisionnement mondiale, mais le nombre de conteneurs présents est toujours bien inférieur au nombre réel requis. Cette différence dans le nombre et la pénurie de conteneurs d'expédition affectent considérablement la demande de navires porte-conteneurs

Par conséquent, cette pénurie de conteneurs maritimes aura un impact négatif sur le marché des conteneurs de ligne et devrait entraver la croissance du marché.

- Réglementations environnementales strictes

En raison de nombreuses règles et réglementations strictes, les fabricants réfléchissent à deux fois avant de se lancer dans une telle activité où de nombreuses règles et réglementations doivent être respectées tout en maintenant les directives appropriées. Cela constitue un défi majeur pour l'industrie du transport maritime et affecte en fin de compte le marché des conteneurs maritimes de ligne en Asie-Pacifique

Développement récent

United Bags Inc. s'est associée à une entreprise de recyclage qui installe des machines de mise en balles et récupère périodiquement les FIBC usagés gratuitement auprès des clients. Les participants à cette initiative reçoivent une certification attestant que tous leurs FIBC ont été recyclés, sans nuire à l'environnement

Portée du marché des porte-conteneurs maritimes en Asie-Pacifique

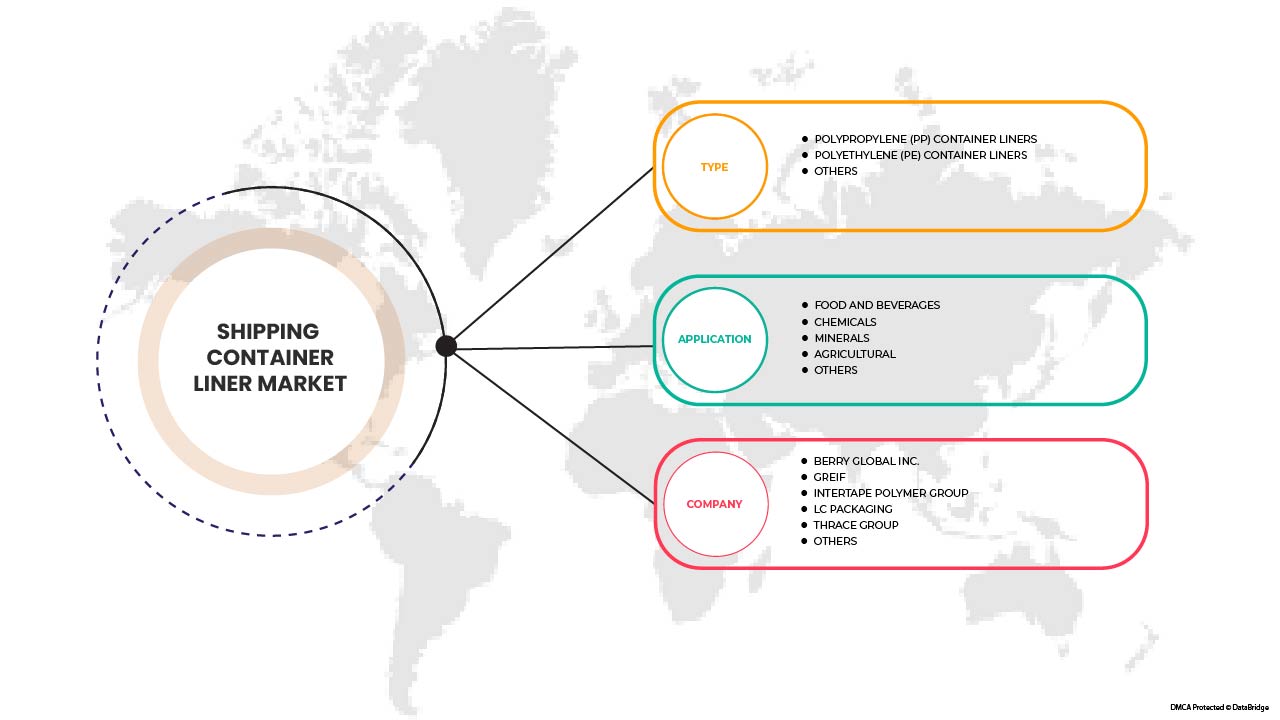

Le marché des conteneurs maritimes de ligne en Asie-Pacifique est classé en fonction du type et de l'application. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Doublures de conteneurs en polypropylène (PP)

- Doublures de conteneurs en polyéthylène (PE)

- Autres

En fonction du type, le marché des doublures de conteneurs d'expédition en Asie-Pacifique est classé en deux segments : les doublures de conteneurs en polypropylène (PP), les doublures de conteneurs en polyéthylène (PE) et autres.

Application

- Alimentation et boissons

- Produits chimiques

- Minéraux

- Agricole

- Autres

En fonction des applications, le marché des conteneurs maritimes de ligne Asie-Pacifique est classé en cinq segments : aliments et boissons, produits chimiques , minéraux, agriculture et autres.

Analyse/perspectives régionales du marché des conteneurs maritimes en Asie-Pacifique

Le marché des conteneurs maritimes de ligne en Asie-Pacifique est segmenté en fonction du type et de l'application.

Les pays du marché des conteneurs maritimes de ligne en Asie-Pacifique sont le Japon, la Chine, la Corée du Sud, l'Inde, Singapour, la Thaïlande, l'Indonésie, la Malaisie, les Philippines, l'Australie et la Nouvelle-Zélande, ainsi que le reste de l'Asie-Pacifique. La Chine domine le marché des conteneurs maritimes de ligne en Asie-Pacifique en termes de part de marché et de chiffre d'affaires en raison de la prise de conscience croissante des excellentes caractéristiques et propriétés des conteneurs maritimes de ligne dans la région.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données par pays.

Analyse du paysage concurrentiel et des parts de marché des transporteurs de conteneurs maritimes en Asie-Pacifique

Le paysage concurrentiel du marché des conteneurs maritimes de ligne en Asie-Pacifique fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que les entreprises se concentrant sur le marché des conteneurs maritimes de ligne en Asie-Pacifique.

Français Certains des principaux acteurs opérant sur le marché des conteneurs maritimes de ligne en Asie-Pacifique sont UNITED BAGS, INC., Bulk Corp International, Nier Systems Inc., Rishi FIBC Solutions PVT. Ltd., Dev Ventures India Pvt. Ltd., Ven Pack, BERRY ASIA-PACIFIC INC., Bulk Handling Australia, Eceplast, Greif. LC Packaging, Thrace Group, CDF Corporation, Composite Containers, LLC, INTERTAPE POLYMER GROUP et BULK FLOW, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données comprennent les grilles de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, les grilles de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse des parts de marché Asie-Pacifique par rapport aux régions et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC SHIPPING CONTAINER LINER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CONSUMER BUYING BEHAVIOR

4.1.1 OVERVIEW

4.1.1.1 COMPLEX BUYING BEHAVIOR

4.1.1.2 DISSONANCE-REDUCING BUYING BEHAVIOR

4.1.1.3 HABITUAL BUYING BEHAVIOR

4.1.1.4 VARIETY-SEEKING BEHAVIOR

4.1.1.5 conclusion

4.2 FACTORS INFLUENCING BUYING DECISION

4.3 PORTER'S FIVE ANALYSIS FOR THE ASIA PACIFIC SHIPPING CONTAINER LINER MARKET

4.3.1 BARGAINING POWER OF BUYERS/CONSUMERS

4.3.2 BARGAINING POWER OF SUPPLIERS

4.3.3 THE THREAT OF NEW ENTRANTS

4.3.4 THREAT OF SUBSTITUTES

4.3.5 RIVALRY AMONG EXISTING COMPETITORS

4.4 PRICING INDEX

4.4.1 FOB & B2B PRICES –ASIA PACIFIC SHIPPING CONTAINER LINER MARKET

4.4.2 B2B PRICES – ASIA PACIFIC SHIPPING CONTAINER LINER MARKET

4.5 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: RAW MATERIAL SOURCING ANALYSIS

4.5.1 POLYETHYLENE (PE)

4.5.2 POLYPROPYLENE (PP)

4.5.3 HIGH DENSITY POLYETHYLENE(HDPE) AND LOW DENSITY POLYETHYLENE (LDPE)

4.6 TRADE ANALYSIS

4.6.1 ASIA PACIFIC EXPORTERS OF SHIPPING CONTAINER LINERS, HS CODE OF PRODUCT: 392321

4.6.2 ASIA PACIFIC IMPORTERS OF SHIPPING CONTAINER LINER, HS CODE OF PRODUCT: 392321

4.6.3 IMPORTS BY RUSSIAN FEDERATION, HS CODE OF PRODUCT: 392321

4.6.4 EXPORTS BY RUSSIAN FEDERATION, HS CODE OF PRODUCT: 392321

4.7 PRODUCT ADOPTION SCENARIO

4.7.1 OVERVIEW

4.7.2 PRODUCT AWARENESS

4.7.3 PRODUCT INTEREST

4.7.4 PRODUCT EVALUATION

4.7.5 PRODUCT TRIAL

4.7.6 PRODUCT ADOPTION

4.7.7 CONCLUSION

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

6 REGULATION COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING PREVALENCE OF CONTAINER LINERS IN THE FOOD AND AGRICULTURE INDUSTRY

7.1.2 INCREASED TRANSPORTATION ACTIVITIES REQUIRING SHIPPING CONTAINER LINERS

7.1.3 HIGHER DEMANDS DUE TO THE COST-EFFECTIVE AND REUSABILITY OF SHIPPING CONTAINER LINERS

7.1.4 WIDE APPLICABILITY OF CONTAINER LINERS IN CHEMICAL AND MINERAL TRANSPORTATION

7.2 RESTRAINTS

7.2.1 HIGH COSTS FOR TRANSPORTATION

7.2.2 SHORTAGE IN SHIPPING CONTAINERS FOR TRANSPORTATION

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVES BY LEADING ORGANIZATIONS

7.3.2 INCREASING DEMANDS FOR LARGE PACKAGING FOR BULK CARGO COMMODITIES

7.4 CHALLENGES

7.4.1 LACK OF EMPLOYEES ON PORTS

7.4.2 STRINGENT ENVIRONMENTAL REGULATIONS

8 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET, BY TYPE

8.1 OVERVIEW

8.2 POLYETHYLENE

8.3 POLYPROPYLENE

8.4 OTHERS

9 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 FOOD AND BEVERAGE

9.2.1 POLYPROPYLENE

9.2.2 POLYETHYLENE

9.2.3 OTHERS

9.3 CHEMICAL

9.3.1 POLYPROPYLENE

9.3.2 POLYETHYLENE

9.3.3 OTHERS

9.4 AGRICULTURAL

9.4.1 POLYPROPYLENE

9.4.2 POLYETHYLENE

9.4.3 OTHERS

9.5 MINERAL

9.5.1 POLYPROPYLENE

9.5.2 POLYETHYLENE

9.5.3 OTHERS

9.6 OTHERS

9.6.1 POLYPROPYLENE

9.6.2 POLYETHYLENE

9.6.3 OTHERS

10 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 INDIA

10.1.3 JAPAN

10.1.4 SOUTH KOREA

10.1.5 THAILAND

10.1.6 SINGAPORE

10.1.7 INDONESIA

10.1.8 AUSTRALIA & NEW ZEALAND

10.1.9 PHILIPPINES

10.1.10 MALAYSIA

10.1.11 REST OF ASIA-PACIFIC

11 COMPANY LANDSCAPE, ASIA PACIFIC SHIPPING CONTAINER LINER MARKET

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12 COMPANY PROFILES

12.1 BERRY ASIA PACIFIC INC.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 SWOT

12.1.5 PRODUCT PORTFOLIO

12.1.6 RECENT UPDATES

12.2 GREIF

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 SWOT

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT UPDATE

12.3 INTERTAPE POLYMER GROUP

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 SWOT

12.3.5 RECENT UPDATE

12.4 LC PACKAGING

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 SWOT

12.4.5 RECENT UPDATES

12.5 BULK HANDLING AUSTRALIA

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT

12.5.5 RECENT UPDATE

12.6 BULK CORP INTERNATIONAL

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 SWOT

12.6.4 RECENT UPDATES

12.7 BULK FLOW

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 SWOT

12.7.4 RECENT UPDATES

12.8 COMPOSITE CONTAINERS, LLC

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 SWOT

12.8.4 RECENT UPDATE

12.9 CDF CORPORATION

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 SWOT

12.9.4 RECENT UPDATE

12.1 DEV VENTURES INDIA PVT. LTD.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 SWOT

12.10.4 RECENT DEVELOPMENT

12.11 ECEPLAST

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 SWOT

12.11.4 RECENT UPDATES

12.12 NIER SYSTEMS INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 SWOT

12.12.4 RECENT UPDATES

12.13 RISHI FIBC SOLUTIONS PVT. LTD.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 SWOT

12.13.4 RECENT UPDATE

12.14 THRACE GROUP

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 SWOT

12.14.4 PRODUCT PORTFOLIO

12.14.5 RECENT UPDATE

12.15 UNITED BAGS, INC

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 SWOT

12.15.4 RECENT UPDATE

12.16 VEN PACK

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 SWOT

12.16.4 RECENT UPDATES

13 SWOT ANALYSIS AND DATABRIDGE MARKET RESEARCH ANALYSIS

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 FREE ON BOARD (FOB) OF SCREEN PRINTING MESH

TABLE 2 EXPORTERS OF SHIPPING CONTAINER LINERS UNIT: USD THOUSAND

TABLE 3 IMPORTERS OF SHIPPING CONTAINER LINER , UNIT: USD THOUSAND

TABLE 4 IMPORTS BY RUSSIAN FEDERATION , UNIT: USD THOUSAND

TABLE 5 EXPORTS BY RUSSIAN FEDERATION UNIT: USD THOUSAND

TABLE 6 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC POLYETHYLENE IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC POLYPROPYLENE IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC OTHERS IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC FOOD AND BEVERAGE IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC FOOD AND BEVERAGE IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC MINERAL IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC OTHERS IN SHIPPING CONTAINER LINER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 22 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 ASIA-PACIFIC FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 CHINA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 CHINA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 CHINA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 CHINA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 CHINA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 CHINA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 CHINA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 INDIA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 INDIA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 INDIA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 INDIA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 INDIA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 INDIA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 INDIA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 JAPAN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 JAPAN SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 JAPAN FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 JAPAN CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 JAPAN AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 JAPAN MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 JAPAN OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 SOUTH KOREA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 SOUTH KOREA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 SOUTH KOREA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 SOUTH KOREA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 SOUTH KOREA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 SOUTH KOREA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 SOUTH KOREA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 THAILAND SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 THAILAND SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 THAILAND FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 HAILAND CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 THAILAND AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 THAILAND MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 THAILAND OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 SINGAPORE SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 SINGAPORE SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 SINGAPORE FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 SINGAPORE CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 SINGAPORE AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SINGAPORE MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 SINGAPORE OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 INDONESIA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 INDONESIA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 INDONESIA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 INDONESIA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 INDONESIA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 INDONESIA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 INDONESIA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 AUSTRALIA & NEW ZEALAND SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 AUSTRALIA & NEW ZEALAND SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 AUSTRALIA & NEW ZEALAND FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 AUSTRALIA & NEW ZEALAND CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 AUSTRALIA & NEW ZEALAND AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 AUSTRALIA & NEW ZEALAND MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 AUSTRALIA & NEW ZEALAND OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 PHILIPPINES SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 PHILIPPINES SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 PHILIPPINES FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 PHILIPPINES CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 PHILIPPINES AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 PHILIPPINES MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 PHILIPPINES OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 MALAYSIA SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 MALAYSIA SHIPPING CONTAINER LINER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 MALAYSIA FOOD & BEVERAGES IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 MALAYSIA CHEMICAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 MALAYSIA AGRICULTURAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 MALAYSIA MINERAL IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 MALAYSIA OTHERS IN SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 REST OF ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: APPLICATION COVERAGE GRID

FIGURE 9 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: SEGMENTATION

FIGURE 10 RISING PREVALANCE OF SHIPPING CONTAINER LINER IN FOOD AND AGRICULTURE INSUTRY IS DRIVING THE ASIA PACIFIC SHIPPING CONTAINER LINER MARKET IN THE FORECAST PERIOD

FIGURE 11 XXX SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC SHIPPING CONTAINER LINER MARKET IN 2022 & 2029

FIGURE 12 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: TYPES OF CONSUMER BUYING BEHAVIOR

FIGURE 13 PORTER'S 5 ANALYSIS

FIGURE 14 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: PRODUCT ADOPTION SCENARIO

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC SHIPPING CONTAINER LINER MARKET

FIGURE 16 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: BY TYPE, 2021

FIGURE 17 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: BY APPLICATION, 2021

FIGURE 18 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: SNAPSHOT (2021)

FIGURE 19 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021)

FIGURE 20 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 ASIA-PACIFIC SHIPPING CONTAINER LINER MARKET: BY TYPE (2022 & 2029)

FIGURE 23 ASIA PACIFIC SHIPPING CONTAINER LINER MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.