Asia Pacific Refractories Market

Taille du marché en milliards USD

TCAC :

%

USD

18.02 Billion

USD

27.24 Billion

2024

2031

USD

18.02 Billion

USD

27.24 Billion

2024

2031

| 2025 –2031 | |

| USD 18.02 Billion | |

| USD 27.24 Billion | |

|

|

|

|

Segmentation du marché des réfractaires en Asie-Pacifique, par alcalinité (réfractaires acides et neutres et carbone), type de forme (façonné et non façonné), type de produit (argile et non argileux), température de fusion (réfractaire normal (1 580-1 780 °C), hautement réfractaire (1 780-2 000 °C) et super réfractaire ( 2 000 °C)), application (fer et acier, ciment et chaux, énergie et produits chimiques, verre, métaux non ferreux et autres), technologie (isostatique et vannes coulissantes) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des réfractaires

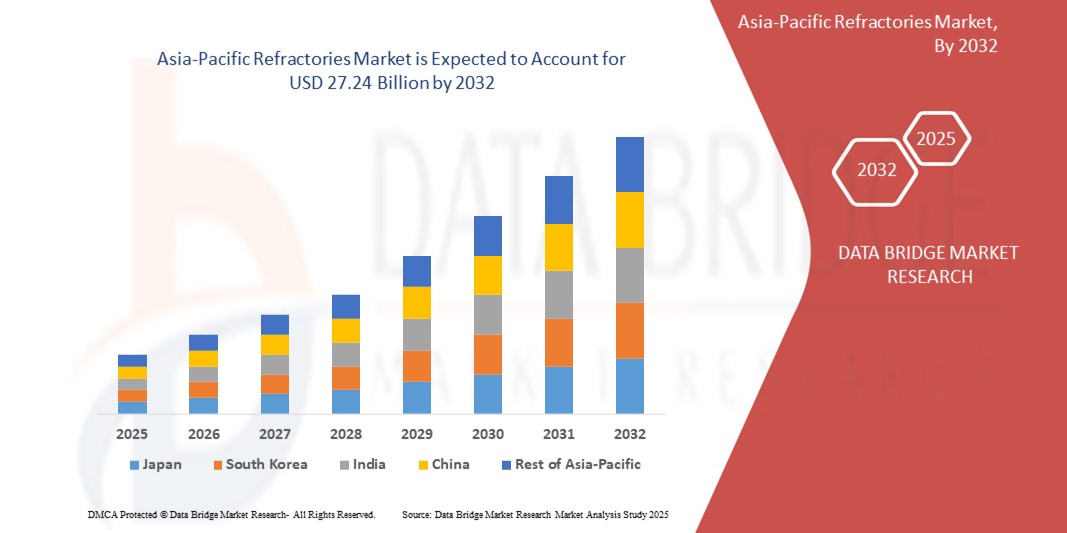

- La taille du marché des réfractaires en Asie-Pacifique était évaluée à 18,02 milliards USD en 2024 et devrait atteindre 27,24 milliards USD d'ici 2032 , à un TCAC de 5,30 % au cours de la période de prévision.

- Cette croissance est tirée par des facteurs tels que l'adoption croissante de l'automatisation dans les industries manufacturières, la demande croissante d'inspection de la qualité et de détection des défauts, ainsi que les progrès technologiques dans l'apprentissage automatique et le traitement d'images.

Analyse du marché des réfractaires

- Les réfractaires sont des matériaux essentiels utilisés dans les procédés industriels à haute température pour revêtir les fours, les fourneaux, les incinérateurs et les réacteurs, offrant une isolation thermique et une résistance aux attaques chimiques, en particulier dans les industries comme l'acier, le ciment, le verre et la pétrochimie.

- La demande de réfractaires en Asie-Pacifique est principalement motivée par l'industrialisation rapide de la région, l'expansion de la production d'acier et les projets d'infrastructure et d'énergie à grande échelle dans des pays comme la Chine, l'Inde, le Japon et la Corée du Sud.

- La Chine est en tête du marché des réfractaires en Asie-Pacifique, représentant environ 65 % de la part de marché régionale, en raison de sa vaste capacité de production d'acier, de ses efforts de modernisation et de l'adoption accrue de solutions réfractaires avancées pour améliorer l'efficacité énergétique et réduire les émissions.

- L'Inde est en train de devenir un marché en pleine croissance, détenant environ 20 % des parts de marché régionales, soutenue par des initiatives gouvernementales visant à stimuler la fabrication, le développement des infrastructures et l'augmentation des investissements dans l'extraction des ressources et les industries pétrochimiques.

- Le secteur de la fabrication du fer et de l'acier devrait dominer le marché nord-américain des réfractaires avec la plus grande part d'environ 50 % en 2025, en raison de la dépendance de l'industrie à l'égard des matériaux réfractaires haute performance pour résister aux températures extrêmes pendant les processus de fusion, de coulée et de traitement thermique.

Portée du rapport et segmentation du marché des réfractaires

|

Attributs |

Informations clés sur le marché des réfractaires |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des réfractaires

« Vers des solutions réfractaires avancées et économes en énergie dans la fabrication industrielle »

- L'une des tendances marquantes du marché nord-américain des réfractaires est l'évolution croissante vers des matériaux réfractaires avancés et économes en énergie qui améliorent les performances thermiques tout en réduisant la consommation d'énergie et les émissions dans les processus industriels à haute température.

- Ces matériaux innovants sont conçus pour résister aux environnements de fonctionnement extrêmes tout en améliorant la longévité et l'efficacité des équipements dans des industries telles que l'acier, le ciment et la pétrochimie.

- Par exemple, les fabricants développent des réfractaires à faible conductivité thermique et légers qui réduisent les pertes de chaleur et favorisent des opérations industrielles durables. Les entreprises intègrent également des matériaux recyclés et des liants écologiques pour répondre aux réglementations environnementales de plus en plus strictes.

- Ces avancées transforment l’industrie des réfractaires en Amérique du Nord, car les utilisateurs finaux exigent de plus en plus des solutions qui s’alignent sur les objectifs de décarbonisation, réduisent les coûts de maintenance et améliorent l’efficacité opérationnelle des fours, des fours et des réacteurs.

Dynamique du marché des réfractaires

Conducteur

« Demande croissante de matériaux haute performance dans la fabrication industrielle »

- Le besoin croissant de matériaux durables et performants dans la fabrication industrielle contribue de manière significative à la demande croissante de produits réfractaires avancés en Amérique du Nord.

- Alors que les secteurs manufacturiers tels que l'acier, le ciment, le verre et la pétrochimie recherchent une plus grande efficacité énergétique et une plus grande fiabilité de la production, les réfractaires jouent un rôle essentiel pour permettre des opérations dans des conditions thermiques et chimiques extrêmes.

- Les réfractaires sont essentiels pour le revêtement des fours, des fours, des incinérateurs et des réacteurs, et leurs performances ont un impact direct sur la durée de vie opérationnelle et la rentabilité de ces procédés à haute température.

Par exemple,

- En novembre 2023, RHI Magnesita a annoncé une expansion de ses opérations aux États-Unis en mettant l'accent sur la production de matériaux réfractaires de nouvelle génération adaptés aux industries à forte intensité énergétique, citant la demande croissante de matériaux qui prolongent la durée de vie et réduisent les temps d'arrêt pour maintenance.

- Alors que les industries accordent de plus en plus d’importance à la résilience opérationnelle et au contrôle des coûts, la demande de solutions réfractaires innovantes et durables continue de croître dans le paysage industriel nord-américain.

Opportunité

« Demande croissante de solutions réfractaires durables et économes en énergie »

- L'importance croissante accordée au développement durable et à l'efficacité énergétique offre une opportunité d'innovation majeure sur le marché nord-américain des réfractaires. Les fabricants se concentrent de plus en plus sur le développement de réfractaires qui minimisent les pertes thermiques, réduisent les émissions et respectent les réglementations environnementales.

- Les secteurs à forte intensité énergétique tels que l'acier et le ciment sont soumis à des pressions pour réduire leur empreinte carbone, ce qui entraîne une demande de matériaux réfractaires avancés qui améliorent l'isolation thermique et l'efficacité opérationnelle.

- Les réfractaires ayant une durée de vie plus longue, une recyclabilité améliorée et un impact environnemental plus faible gagnent du terrain parmi les industries qui cherchent à atteindre leurs objectifs de décarbonisation.

Par exemple,

- En août 2024, Saint-Gobain a lancé en Amérique du Nord une nouvelle gamme de produits réfractaires éco-conçus, offrant une efficacité énergétique accrue et des émissions de carbone réduites. Ces produits sont conçus pour soutenir des pratiques de fabrication durables dans des applications à haute température telles que les fours rotatifs et les hauts fourneaux.

- À mesure que les réglementations environnementales se durcissent et que les objectifs de développement durable des entreprises deviennent plus ambitieux, la demande de réfractaires de nouvelle génération, respectueux de l'environnement, devrait augmenter considérablement, ouvrant de nouvelles voies à l'innovation des produits et à l'expansion du marché.

Retenue/Défi

« Volatilité des prix des matières premières et perturbations de la chaîne d'approvisionnement »

- L’un des principaux défis du marché nord-américain des réfractaires est la volatilité des prix des matières premières critiques telles que la bauxite, la magnésie, l’alumine et le graphite , qui sont essentielles à la fabrication de produits réfractaires.

- Les fluctuations des chaînes d’approvisionnement mondiales, les restrictions commerciales et les tensions géopolitiques ont entraîné une disponibilité incohérente et des flambées de prix, ce qui a eu un impact sur les coûts de production et la fiabilité de l’approvisionnement des fabricants de la région.

- Bon nombre de ces matières premières sont importées de régions comme la Chine et l'Amérique du Sud, ce qui rend les producteurs nord-américains vulnérables à l'instabilité du marché international et aux perturbations des transports.

Par exemple,

- En septembre 2024, l'Association mondiale des réfractaires a signalé une hausse de 25 % des prix de la magnésie en glissement annuel, due aux contraintes d'approvisionnement des principaux pays exportateurs, notamment la Chine, et à la hausse des coûts de transport. Cette hausse a affecté plusieurs fabricants nord-américains de réfractaires, les obligeant soit à augmenter les prix de leurs produits, soit à absorber la hausse des coûts des intrants.

- Une telle imprévisibilité dans l'approvisionnement en matières premières constitue un obstacle important à la fixation de prix cohérents pour les produits et à l'exécution des contrats à long terme, ce qui pose des risques pour la rentabilité et limite la croissance, en particulier pour les producteurs de réfractaires de taille moyenne et spécialisés.

Portée du marché des réfractaires

Le marché est segmenté en fonction de l'alcalinité, du type de produit, du type de forme, de la température de fusion, de l'application et de la technologie.

|

Segmentation |

Sous-segmentation |

|

Par alcalinité |

|

|

Par type de formulaire |

|

|

Par type de produit |

|

|

Par température de fusion |

|

|

Par applications |

|

|

Par technologie |

|

En 2025, le segment de la fabrication du fer et de l'acier devrait dominer le marché avec la plus grande part dans le segment des applications

En 2025, le secteur de la sidérurgie devrait dominer le marché nord-américain des réfractaires avec une part de marché d'environ 50 %, en raison de sa forte dépendance aux matériaux réfractaires haute performance pour des procédés critiques tels que la fusion, le moulage et le traitement thermique. Les réfractaires jouent un rôle essentiel dans le maintien de l'efficacité opérationnelle et la prolongation de la durée de vie des équipements des hauts fourneaux, des poches de coulée et des convertisseurs. La croissance de la production nationale d'acier aux États-Unis, stimulée par les investissements en infrastructures et la relocalisation de la production, ainsi que par la demande des secteurs de l'automobile, de la construction et de l'énergie, stimule considérablement la consommation de réfractaires.

Les réfractaires acides et neutres devraient représenter la plus grande part au cours de la période de prévision dans les segments d'alcalinité

En 2025, le segment des réfractaires acides et neutres devrait dominer le marché nord-américain des réfractaires, représentant environ 70,1 % du marché. Cette domination est due à l'utilisation répandue de matériaux tels que la silice, l'alumine et la chromite dans des industries comme l'acier, le verre et le ciment, où la résistance aux environnements acides est cruciale. La polyvalence et la rentabilité de ces réfractaires, associées aux avancées technologiques de fabrication améliorant leurs performances et leur efficacité énergétique, ont consolidé leur position dominante sur le marché.

Analyse régionale du marché des réfractaires

« La Chine détient la plus grande part du marché des réfractaires en Asie-Pacifique »

- La Chine est leader sur le marché des réfractaires en Asie-Pacifique avec environ 65 % de parts de marché régionales, grâce à sa vaste base industrielle et à son statut de premier producteur d'acier au monde.

- Les industries robustes du ciment, du verre et de la pétrochimie du pays, combinées à une urbanisation rapide et au développement des infrastructures, entraînent une demande importante de matériaux réfractaires à haute performance.

- Les investissements continus dans la modernisation des installations de fabrication, l’adoption de technologies écoénergétiques et le respect de réglementations environnementales plus strictes soutiennent l’utilisation accrue de réfractaires avancés.

- La solide chaîne d'approvisionnement nationale de la Chine, sa vaste capacité de production et le soutien du gouvernement à la modernisation industrielle renforcent sa position de leader sur le marché des réfractaires en Asie-Pacifique.

« L'Inde devrait enregistrer le TCAC le plus élevé du marché des réfractaires de la région Asie-Pacifique »

- L'Inde devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé sur le marché des réfractaires de la région Asie-Pacifique, représentant actuellement environ 20 % de la part de marché régionale.

- L'industrialisation rapide, le développement des infrastructures et l'expansion de la fabrication d'acier et de ciment alimentent la demande de matériaux réfractaires avancés.

- Les initiatives gouvernementales telles que « Make in India » et l’accent accru mis sur les processus de production durables et économes en énergie stimulent la croissance du marché.

- L'augmentation des investissements dans les produits pétrochimiques, les métaux non ferreux et les collaborations en matière de R&D entre les secteurs public et privé continuent de soutenir la forte trajectoire de croissance de l'Inde sur le marché des réfractaires.

Part de marché des réfractaires

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence mondiale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les principaux leaders du marché opérant sur le marché sont :

- Saint-Gobain (France)

- ALMATIS (Allemagne)

- Groupe Alteo (France)

- ALLIED MINERAL PRODUCTS (États-Unis)

- Puyang Refractories Group Co., Ltd. (Chine)

- HWI (Chine)

- AluChem (États-Unis)

- RHI Magnesita GmbH (Autriche)

- Morgan Advanced Materials (Royaume-Uni)

- SHINAGAWA RÉFRACTAIRES CO., LTD. (Japon)

- Krosaki Harima Corporation (Japon)

- CoorsTek Inc. (États-Unis)

- Vésuve (Royaume-Uni)

- Refratechnik. (Allemagne)

- Imerys (États-Unis)

- IFGL Refractories Limited. (Inde)

- TYK CORPORATION (Japon)

Derniers développements sur le marché des réfractaires en Amérique du Nord

- En mai 2024, l'adoption de fours à arc électrique (FAE) économes en énergie aux États-Unis s'est accélérée, stimulant la demande de matériaux réfractaires de haute qualité, capables de résister à des conditions extrêmes. Les FAE offrent une consommation énergétique et des émissions réduites, ce qui en fait un choix privilégié pour la production d'acier durable. L'adoption de la technologie FAE s'inscrit dans le cadre des efforts mondiaux de décarbonation de l'industrie sidérurgique, les principaux fabricants investissant dans des solutions réfractaires avancées pour améliorer l'efficacité et la durabilité dans les environnements à haute température.

- En avril 2024, RHI Magnesita, société autrichienne, a annoncé son projet d'acquisition de Resco Group, producteur d'alumine américain, pour un montant maximal de 430 millions de dollars. Cette acquisition devrait élargir l'offre de produits et améliorer l'efficacité de la chaîne d'approvisionnement en Amérique du Nord. Resco Group est spécialisé dans les réfractaires façonnés et non façonnés, destinés à des secteurs tels que la pétrochimie, le ciment, l'aluminium et la sidérurgie. Cet accord s'inscrit dans la stratégie de croissance de RHI Magnesita, qui vise à accroître la production locale et à renforcer sa présence sur le marché. La finalisation de la transaction est prévue au second semestre 2024.

- En mars 2024, environ 20 % des principaux fabricants de réfractaires d'Amérique du Nord ont intégré des systèmes de surveillance intelligents pour améliorer le suivi en temps réel des données de température et d'usure. Ces systèmes exploitent des capteurs IoT et des analyses basées sur l'IA pour optimiser la maintenance prédictive, réduisant ainsi les temps d'arrêt et les coûts d'exploitation. L'adoption de technologies de surveillance avancées a permis d'augmenter l'efficacité de 25 %, améliorant la longévité des matériaux et la stabilité des procédés dans les industries à haute température telles que la sidérurgie, la production de ciment et la fabrication de verre.

- En février 2024, l'adoption de matériaux réfractaires auto-cicatrisants a progressé de 15 %, notamment dans les secteurs de l'acier et de l'énergie. Ces matériaux avancés améliorent la durée de vie des revêtements et réduisent considérablement les coûts de maintenance grâce à des mécanismes de cicatrisation in situ qui réparent les fissures et l'usure au fil du temps. Cette technologie intègre des céramiques à haute entropie et des oxydes à entropie moyenne, améliorant ainsi la résistance thermique et l'intégrité structurelle dans les applications industrielles à haute température. Face à la demande croissante de solutions réfractaires économiques et durables, les fabricants continuent d'affiner leurs capacités d'auto-cicatrisation pour une adoption plus large par l'industrie.

- En janvier 2024, les fabricants et distributeurs nord-américains de produits réfractaires ont élargi leurs canaux de distribution en ligne, améliorant ainsi l'accessibilité en ligne pour leurs clients. Cette évolution comprend des informations détaillées sur les produits, des systèmes de livraison efficaces et des processus d'approvisionnement simplifiés via les plateformes numériques. L'adoption de stratégies de commerce électronique avancées vise à améliorer l'engagement client, à réduire les frictions transactionnelles et à optimiser l'efficacité de la chaîne d'approvisionnement. Avec l'adoption croissante de la transformation numérique par les fabricants, le secteur des produits réfractaires devrait bénéficier d'une plus grande portée commerciale et d'améliorations opérationnelles au cours de l'année à venir.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.