Asia Pacific Refractive Surgery Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

316.16 Million

USD

654.98 Million

2021

2029

USD

316.16 Million

USD

654.98 Million

2021

2029

| 2022 –2029 | |

| USD 316.16 Million | |

| USD 654.98 Million | |

|

|

|

Marché des dispositifs de chirurgie réfractive en Asie-Pacifique , par type de produit (laser, lentille intraoculaire phaque (IOL), aberromètre/aberrométrie de front d'onde, instruments et accessoires chirurgicaux , kits de chirurgie réfractive, diamètres pupillaires, épikératomes, microkératomes, thermokératoplastie, kits d'incision de relaxation limbique et autres), type de chirurgie (LASIK (kératomileusis in situ au laser, kératectomie photoréfractive (PRK), lentilles intraoculaires phaques (IOL), kératotomie astigmatique (AK), kératoplastie lamellaire automatisée (ALK), anneau intracornéen (INTACS), kératoplastie thermique au laser (LTK), kératoplastie conductrice (CK), kératotomie radiale (RK) et autres), application (myopie (myopie), hypermétropie (hypermétropie), astigmatisme et presbytie), utilisateur final (hôpitaux, spécialité) Cliniques, centres de chirurgie ambulatoire et autres, canaux de distribution (appels d'offres directs, distributeurs tiers et autres) Tendances et prévisions de l'industrie jusqu'en 2029.

Définition et perspectives du marché

Les appareils de chirurgie réfractive sont utilisés pour améliorer ou corriger les erreurs de réfraction telles que la myopie , l'hypermétropie, la presbytie ou l'astigmatisme. Ces appareils comprennent les lasers excimer, les lasers YAG , les microkératomes et les lasers femtosecondes. Les chirurgies réfractives réduisent considérablement la dépendance aux lunettes ou aux lentilles de contact. Divers appareils réfractifs sont utilisés sur le marché pour traiter les défauts de vision.

Les erreurs de réfraction sont causées par une forme incorrecte de la cornée ou des globes oculaires. La chirurgie réfractive consiste à remodeler les globes oculaires ou la cornée à l'aide de divers dispositifs de chirurgie réfractive tels que des lasers avancés, des traitements LASIK, une kératectomie photoréfractive et diverses lentilles telles que des lentilles intraoculaires phaques et des lentilles intraoculaires toriques.

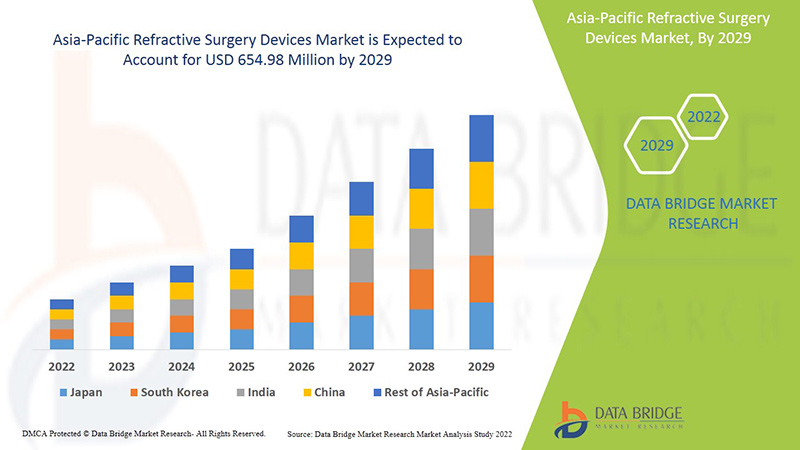

Le marché des dispositifs de chirurgie réfractive devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 9,8 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 654,98 millions USD d'ici 2029 contre 316,16 millions USD en 2021.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type de produit (laser, lentille intraoculaire phaque (IOL), aberromètres/aberrométrie de front d'onde, instruments et accessoires chirurgicaux, kits de chirurgie réfractive, appareils de mesure du diamètre pupillaire, épikératomes, microkératomes, thermokératoplastie, kits d'incision de relaxation limbique et autres), type de chirurgie (LASIK (kératomileusis in situ au laser, kératectomie photoréfractive (PRK), lentilles intraoculaires phaques (IOL), kératotomie astigmatique (AK), kératoplastie lamellaire automatisée (ALK), anneau intracornéen (INTACS), kératoplastie thermique au laser (LTK), kératoplastie conductrice (CK), kératotomie radiale (RK) et autres), application (myopie, hypermétropie, astigmatisme et presbytie), utilisateur final (hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire) et autres), canal de distribution (appel d'offres direct, distributeurs tiers et autres) |

|

Pays couverts |

Chine, Japon, Inde, Corée du Sud, Australie, Singapour, Thaïlande, Malaisie, Indonésie, Philippines, Vietnam, Reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Tracey Technologies, Bausch + Lomb Incorporated, BD, STAAR SURGICAL, SCHWIND eye-tech-solutions, Hoya Surgical Optics, Johnson & Johnson Services, Inc., Ophtec BV, Glaukos Corporation, Amplitude Laser, Reichert, Inc., NIDEK CO., LTD., Ziemer Ophthalmic Systems, ROWIAK GmbH, Moria, LENSAR, Inc., Topcon Canada Inc. (une filiale de Topcon Corporation), Aaren Scientific Inc., Rayner Intraocular Lenses Limited., iVIS Technologies, Alcon, entre autres |

La dynamique du marché des dispositifs de chirurgie réfractive comprend

Conducteurs

- Augmentation du progrès technologique

L'accélération du développement technologique dans le secteur de la santé a considérablement augmenté au cours des dernières années. Les progrès de la technologie des appareils de chirurgie réfractive permettent un traitement indolore et simple lors de la gestion d'une maladie. De plus, l'innovation et la mise à niveau de divers appareils de chirurgie réfractive contribuent à un résultat précis et rapide du diagnostic de la maladie. L'innovation dans les appareils de chirurgie réfractive permet également la rentabilité des outils thérapeutiques basés sur la technologie lors du traitement de la maladie.

Par exemple,

- Selon Contoura Vision India, la chirurgie oculaire Contoura est la dernière avancée en matière de chirurgie oculaire dans le domaine de l'élimination des lunettes. Il s'agit de l'une des avancées technologiques les plus sûres en matière de chirurgie oculaire, qui corrige non seulement la puissance des lunettes, mais également les irrégularités cornéennes.

- Selon l'organisation Eye and Laser Centre, en mai 2017, il a été découvert que la technologie laser femtoseconde Visumax est l'un des traitements chirurgicaux réfractifs les plus avancés. Elle est capable de traiter les défauts visuels des yeux

Les progrès technologiques croissants dans divers dispositifs de chirurgie réfractive, tels que les progrès dans le balayage à spot variable au laser, devraient stimuler le marché des dispositifs de chirurgie réfractive. Par conséquent, l'innovation croissante et les progrès technologiques dans les dispositifs de chirurgie réfractive devraient soutenir la croissance du marché au cours de la période de prévision.

- Hausse des dépenses de santé

Au cours de la dernière décennie, les dépenses de santé ont augmenté de manière drastique pour améliorer les services de santé aux patients. Les États-Unis sont le plus grand marché de la santé, où les dépenses totales de santé ont augmenté de manière drastique au cours des dernières années. L'objectif fondamental de la croissance des dépenses est de fournir des appareils de chirurgie réfractive appropriés, abordables et de haute qualité. Pour promouvoir une population en meilleure santé et répondre aux urgences sanitaires dans les pays développés et en développement, les organismes gouvernementaux et les organisations de santé concernés prennent l'initiative d'accélérer les dépenses de santé.

Par exemple,

- Selon l'Organisation des affaires de santé, les dépenses de santé aux États-Unis ont augmenté de 9,7 % pour atteindre 4 100 milliards de dollars en 2020, soit un rythme beaucoup plus rapide que celui observé en 2019.

- Selon le gouvernement britannique, en 2020, le gouvernement a débloqué près de 250 millions de livres sterling, soit environ 300 millions de dollars américains, pour numériser et faire progresser les soins de diagnostic dans l'ensemble du NHS (National Health Service) en utilisant les dernières technologies. Ce financement a été alloué spécifiquement aux améliorations technologiques des services de diagnostic du NHS afin de détecter et de commencer à traiter les problèmes de santé le plus tôt possible

- L'Initiative nationale de services de diagnostic gratuits a été lancée dans le cadre de la Mission nationale de santé par le gouvernement indien. Il était important de fournir des soins de santé complets et de qualité gratuitement sous un même toit. Grâce à cette initiative du gouvernement indien, plusieurs États ont essayé plusieurs modèles pour garantir la disponibilité des diagnostics dans les établissements de santé publique

L'augmentation des dépenses de santé est également bénéfique pour la croissance économique et la croissance du secteur de la santé. Elle affecte considérablement le développement de nouveaux tests de diagnostic et de nouveaux outils chirurgicaux. Par conséquent, des dépenses de santé importantes constituent un facteur favorable à la croissance du marché.

Opportunités

- Réalisations en chirurgie LASIK

Le taux de réussite ou les résultats du LASIK sont bien connus, avec des milliers d'études cliniques examinant l'acuité visuelle et la satisfaction des patients. Des recherches récentes ont montré que 99 % des patients obtiennent une vision supérieure à 20/40, et plus de 90 % obtiennent une vision de 20/20 ou plus. De plus, le LASIK affiche un taux de satisfaction des patients sans précédent de 96 %, le plus élevé de toutes les procédures électives.

Par exemple,

- Une étude de 2016 publiée dans le Journal of Cataract & Refractive Surgery a révélé que le LASIK avait un taux de satisfaction des patients de 96 %

Selon l'article « LASIK : Connaître les avantages et les risques », 2018

- Le Dr Eric Donnenfeld, ancien président de l'American Society of Cataract and Refractive Surgery, a réalisé environ 85 000 interventions au cours de ses 28 ans de carrière.

- Selon Market Scope, environ 10 millions d'Américains ont subi une chirurgie LASIK depuis que la FDA l'a approuvée pour la première fois en 1999. Environ 700 000 chirurgies LASIK sont pratiquées chaque année, mais ce chiffre est en baisse par rapport au pic de 1,4 million enregistré en 2000.

Désormais, le nombre croissant d'opérations LASIK réussies dans le monde est positivement associé au développement, à l'enregistrement et au lancement de produits. Ainsi, cela devrait stimuler le marché des dispositifs de chirurgie réfractive dans les années à venir.

- Initiatives stratégiques des acteurs du marché

L'augmentation du nombre d'erreurs de réfraction dans le monde a créé une demande accrue pour le marché des dispositifs de chirurgie réfractive. L'objectif principal est d'améliorer la gestion de la santé grâce au développement de produits et de types de chirurgie innovants pour des soins de qualité avec une application pratique. Les principaux acteurs du marché des dispositifs de chirurgie réfractive ont pris des initiatives stratégiques, qui incluent des lancements de produits, des acquisitions et bien d'autres, et devraient diriger et créer davantage d'opportunités sur le marché des dispositifs de chirurgie réfractive.

Par exemple,

- En juin 2021, Glaukos Corporation a reçu l'approbation réglementaire de la Therapeutic Goods Administration (TGA) d'Australie pour PRESERFLO MicroShunt. PRESERFLO MicroShunt vise à réduire la pression intraoculaire (PIO) dans les yeux des patients atteints de glaucome primaire à angle ouvert, où la PIO resterait incontrôlable, tout en étant le traitement médical maximal toléré et/ou lorsque la progression du glaucome nécessite une intervention chirurgicale

- En juin 2021 : Bausch & Lomb Incorporated a signé un accord avec Lochan, une société du secteur des services informatiques. Ces sociétés avaient pour objectif de développer la prochaine génération du logiciel d'aide à la décision clinique eyeTELLIGENCE de Bausch & Lomb Incorporated. En utilisant l'infrastructure cloud actuelle d'eyeTELLIGENCE, ce logiciel serait développé pour permettre aux chirurgiens de combiner sans effort tous les facteurs des procédures de chirurgie de la cataracte, de la rétine et de la réfraction afin d'améliorer l'efficacité globale de leur pratique

- En mars 2021, NIDEK a dévoilé le RT-6100 CB pour Windows, un logiciel de contrôle optionnel pour le réfracteur intelligent RT-6100 et le système de réfraction de table TS-610. Ce logiciel s'adapte aux exigences distinctes des patients et des opérateurs. De plus, le logiciel permet des réfractions qui répondent aux exigences de distanciation sociale

Ces nombreux produits stratégiques lancés et les acquisitions par les grandes entreprises du marché des dispositifs de chirurgie réfractive ont ouvert une opportunité pour les entreprises du monde entier. Ces stratégies permettent aux entreprises de renforcer leur présence sur le marché. Par conséquent, il est prévu que l'initiative stratégique soit l'occasion en or pour les acteurs du marché d'accélérer la croissance de leurs revenus sur le marché.

Défis/Restrictions

- Manque de sensibilisation et de confiance des gens quant aux avantages de la procédure

Dans de nombreux pays, la population n'est pas au courant de la chirurgie réfractive ni de ses divers avantages pour les défauts de réfraction tels que la myopie, l'astigmatisme, la presbytie et autres. Les gens ont peur de la chirurgie car elle peut entraîner des effets secondaires graves qui devraient représenter un grand défi pour le marché.

Par exemple,

- Selon l'étude de l'Institut national de la santé (NIH) de 2021, les personnes refusaient de subir une intervention chirurgicale parce qu'elles craignaient des complications et manquaient d'informations sur la procédure. De plus, l'étude a montré que 82,5 % des participants ne savaient pas que la chirurgie réfractive pouvait améliorer leur acuité visuelle en raison du manque de sensibilisation

- Selon l’étude réalisée par l’International Journal of Medicine in Developing Countries en 2019, il a été déclaré que-

- 32,2 % du total des participants pensaient que la chirurgie réfractive était dangereuse et 9,5 % pensaient qu'elle entraînait des complications avancées

- En outre, l’étude menée en Inde a montré que 64 % des participants ne savaient pas que la chirurgie réfractive pouvait améliorer leur vision.

Le manque de sensibilisation aux avantages de la chirurgie réfractive et la peur des complications chirurgicales devraient constituer un défi majeur pour la croissance du marché.

- Manque d'établissements de santé pour le traitement des yeux

Les populations pauvres des pays à revenu faible et intermédiaire souffrent davantage de cécité et de troubles ophtalmiques que les populations plus aisées. Les progrès et les plans stratégiques adoptés dans les pays développés ne sont pas mis en œuvre de la même manière dans les pays à faible revenu. De nombreux pays à faible revenu s'appuient généralement sur des agents de santé communautaires, des assistants médicaux et des chirurgiens de la cataracte pour leurs premiers soins oculaires primaires. L'ophtalmologie dans les pays à faible revenu (PFR) est très difficile en raison de ses complexités telles que les climats tropicaux, la fragilité des réseaux électriques, la médiocrité des infrastructures routières et hydrauliques, les capacités de diagnostic limitées et les options de traitement limitées.

Par exemple,

- Selon l'article « Outils de diagnostic innovants pour l'ophtalmologie dans les pays à faible revenu », le rapport 2020 indique que la prévalence de la cécité et des troubles oculaires dans les pays à revenu élevé est de 0,3 pour 1 000 personnes, mais dans les pays à faible revenu, l'estimation est de 1,5 pour 1 000. Cela montre le besoin non satisfait de soins ophtalmologiques dans les pays à faible revenu

Un autre problème majeur dans les pays à faible revenu est le manque de sensibilisation de la population aux douleurs oculaires et à d’autres troubles. De nombreuses études de recherche font état des besoins élevés des pays à faible revenu en matière de soins oculaires, et leurs besoins non satisfaits continuent de susciter l’attention de nombreuses organisations de soins de santé.

Par exemple,

- En 2014, le British Journal of Ophthalmology rapportait que le plan Vision 2020 initié par le gouvernement était encore loin d’être atteint en raison du manque d’initiatives prises ciblant les pays à revenu moyen et faible.

Par conséquent, les faibles capacités de soins de santé pour les traitements oculaires dans les pays à revenu faible et intermédiaire sont considérées comme le plus grand défi à la croissance du marché des dispositifs de chirurgie réfractive.

Impact post-COVID-19 sur le marché des dispositifs de chirurgie réfractive

The COVID-19 has affected the market. Lockdowns and isolation during pandemics restricted the movement of the masses. As a result surgeries date and times were delayed. Hence, the pandemic has negatively affected this market

Recent Development

- In July 2021, Johnson & Johnson Vision launched the VERITAS Vision System, next-generation phacoemulsification (phaco) system. This system is developed to look after three important areas: surgeon efficiency, patient safety, and comfort. This has increased the company's product portfolio

Refractive Surgery Devices Market Scope

Refractive surgery devices market is segmented into product type, surgery type, application, end user, and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Laser

- Phakic Intraocular Lens (IOL)

- Aberrometers / Wavefront Aberrometry

- Surgical Instruments & Accessories

- Refractive Surgery Kits

- Pupillary Diameter Meters

- Epikeratomes

- Microkeratomes

- Thermokeratoplasty

- Limbal Relaxing Incision Kits

- Others

On the basis of product type, the refractive surgery devices market is segmented into a laser, phakic intraocular lens (IOL), aberrometer/wavefront aberrometry, surgical instruments & accessories, refractive surgery kits, pupillary diameter meters, epikeratomes, microkeratomes, thermokeratoplasty, limbal relaxing incision kits, and others.

Surgery Type

- Lasik (Laser In-Situ Keratomileusis)

- Photorefractive Keratectomy (PRK)

- Phakic Intraocular Lenses (IOL)

- Astigmatic Keratotomy (AK)

- Automated Lamellar Keratoplasty (ALK)

- Intracorneal Ring (INTACS)

- Laser Thermal Keratoplasty (LTK)

- Conductive Keratoplasty (CK)

- Radial Keratotomy (RK)

- Others

On the basis of surgery type, the refractive surgery devices market is segmented into LASIK (laser in-situ keratomileusis), photorefractive keratectomy (PRK), phakic intraocular lenses (IOL), astigmatic keratotomy (AK), automated lamellar keratoplasty (ALK), intracorneal ring (INTACS), laser thermal keratoplasty (LTK), conductive keratoplasty (CK), radial keratotomy (RK), and others.

Application

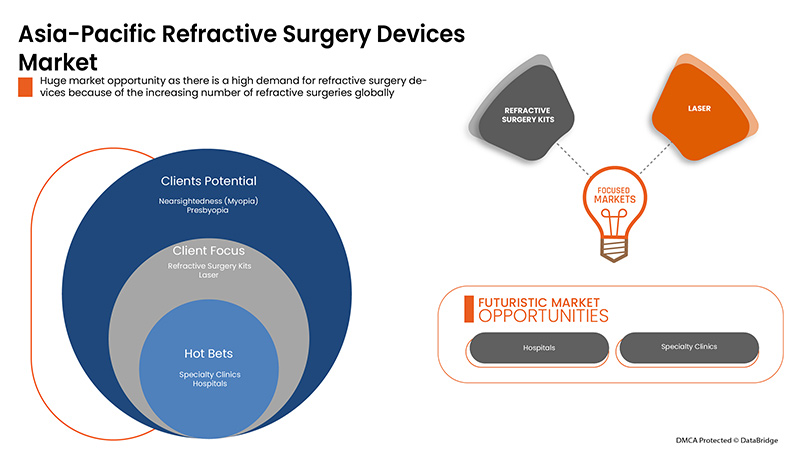

- Nearsightedness (Myopia)

- Farsightedness (Hyperopia)

- Astigmatism

- Presbyopia

On the basis of application, the refractive surgery devices market is segmented into nearsightedness (myopia), farsightedness (hyperopia), astigmatism, and presbyopia.

End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

On the basis of end user, the refractive surgery devices market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and others.

Distribution Channel

- Direct Tender

- Third Party Distributors

- Others

On the basis of distribution channel, the refractive surgery devices market is segmented into direct tender, third party distributors, and others.

Refractive Surgery Devices Market Regional Analysis/Insights

The refractive surgery devices market is analysed and market size insights and trends are provided by country, product type, surgery type, application, end user, and distribution channel as referenced above.

The countries covered in the refractive surgery devices market report are the China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Vietnam, Rest of Asia-Pacific.

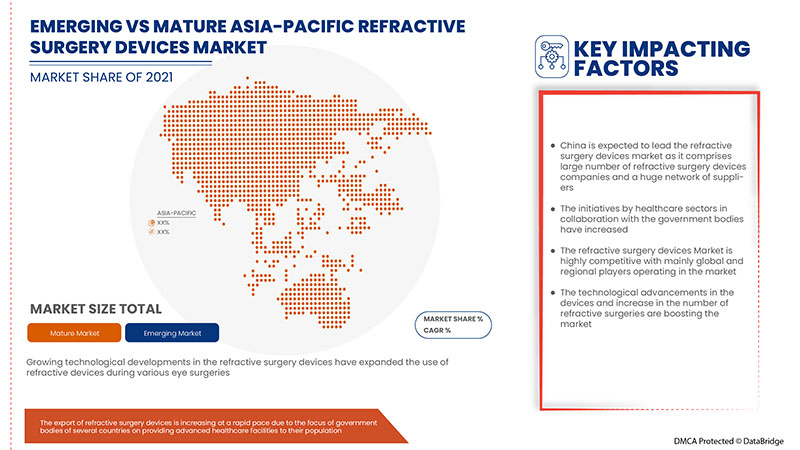

China dominates the refractive surgery devices market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period due to increase in the number of refractive surgeries in the region and technological advancements.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Refractive Surgery Devices Market Share Analysis

The refractive surgery devices market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on refractive surgery devices market.

Some of the major companies dealing in the refractive surgery devices market are Tracey Technologies, Bausch + Lomb Incorporated, BD, STAAR SURGICAL, SCHWIND eye-tech-solutions, Hoya Surgical Optics, Johnson & Johnson Services, Inc., Ophtec BV, Glaukos Corporation, Amplitude Laser, Reichert, Inc., NIDEK CO., LTD., Ziemer Ophthalmic Systems, ROWIAK GmbH, Moria, LENSAR, Inc., Topcon Canada Inc. (A subsidiary of Topcon Corporation), Aaren Scientific Inc., Rayner Intraocular Lenses Limited., iVIS Technologies, Alcon, among others.

Research Methodology

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport aux régions et la part des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

Personnalisation disponible

Data Bridge Market Research est un leader dans la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'aux stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez pour obtenir des données dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Factbook) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL'S MODEL

4.2 PORTER'S FIVE FORCES MODEL

4.3 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: REGULATIONS

4.3.1 REGULATION IN THE U.S.

4.3.2 REGULATIONS IN EUROPE

4.3.3 REGULATIONS IN SINGAPORE

4.3.4 REGULATIONS IN AUSTRALIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING TECHNOLOGICAL ADVANCEMENT

5.1.2 RISE IN HEALTHCARE EXPENDITURE

5.1.3 INCREASE IN POPULATION WITH MACULAR DEGENERATION

5.1.4 RISE IN ADOPTION OF MINIMALLY INVASIVE SURGERIES

5.2 RESTRAINTS

5.2.1 STRINGENT RULES AND REGULATIONS

5.2.2 HIGH COST ASSOCIATED WITH REFRACTIVE SURGERY DEVICES

5.2.3 SIDE EFFECTS OF SURGERY

5.3 OPPORTUNITIES

5.3.1 ACHIEVEMENTS IN LASIK SURGERIES

5.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

5.3.3 INCREASING GERIATRIC POPULATION

5.3.4 EXCESSIVE USAGE OF DIGITAL DEVICES

5.4 CHALLENGES

5.4.1 DEARTH OF SKILLED PROFESSIONALS

5.4.2 LACK OF HEALTHCARE FACILITIES FOR EYE TREATMENT

6 COVID-19 IMPACT ON ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON DEMAND

6.3 IMPACT ON SUPPLY

6.4 STRATEGIC DECISIONS BY MANUFACTURERS

6.5 CONCLUSION

7 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 LASER

7.2.1 EXCIMER LASERS

7.2.2 FEMTOSECOND LASER/ULTRASHORT PULSE LASER

7.2.3 OTHERS

7.3 PHAKIC INTRAOCULAR LENS (IOL)

7.4 ABERROMETERS / WAVEFRONT ABERROMETRY

7.5 SURGICAL INSTRUMENTS & ACCESSORIES

7.6 REFRACTIVE SURGERY KITS

7.7 PUPILLARY DIAMETER METERS

7.8 EPIKERATOMES

7.9 MICROKERATOMES

7.1 THERMOKERATOPLASTY

7.11 LIMBAL RELAXING INCISION KITS

7.12 OTHERS

8 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY SURGERY TYPE

8.1 OVERVIEW

8.2 LASIK (LASER IN-SITU KERATOMILEUSIS)

8.3 PHOTOREFRACTIVE KERATECTOMY (PRK)

8.4 PHAKIC INTRAOCULAR LENSES (IOL)

8.5 ASTIGMATIC KERATOTOMY (AK)

8.6 AUTOMATED LAMELLAR KERATOPLASTY (ALK)

8.7 INTRACORNEAL RING (INTACS)

8.8 LASER THERMAL KERATOPLASTY (LTK)

8.9 CONDUCTIVE KERATOPLASTY (CK)

8.1 RADIAL KERATOTOMY (RK)

8.11 OTHERS

9 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 NEARSIGHTEDNESS (MYOPIA)

9.3 FARSIGHTEDNESS (HYPEROPIA)

9.4 PRESBYOPIA

9.5 ASTIGMATISM

10 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITAL

10.3 SPECIALTY CLINICS

10.4 AMBULATORY SURGICAL CENTERS

10.5 OTHERS

11 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 THIRD PARTY DISTRIBUTORS

11.4 OTHERS

12 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 INDIA

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 VIETNAM

12.1.12 REST OF ASIA-PACIFIC

13 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 JOHNSON AND JOHNSON SERVICES, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.1.5.1 PRODUCT LAUNCH

15.2 ALCON INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.2.5.1 ACQUISITION

15.2.5.2 PRODUCT LAUNCH

15.3 STAAR SURGICAL

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BAUSCH + LOMB INCORPORATED

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.4.5.1 ACQUISITION

15.4.5.2 CE APPROVAL

15.5 TOPCON CANADA INC., (A SUBSIDIARY OF TOPCON CORPORATION)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.5.5.1 PARTNERSHIP

15.5.5.2 ACQUISITION

15.6 AAREN SCIENTIFIC INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AMPLITUDE LASER

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.7.3.1 PARTNERSHIP

15.8 BD

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.8.4.1 CONFERENCE

15.8.4.2 PRODUCT LAUNCH

15.9 GLAUKOS CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.9.4.1 PRODUCT LAUNCH

15.9.4.2 ACQUISITION

15.1 HOYA SURGICAL OPTICS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.10.3.1 CONFERENCE

15.11 IVIS TECHNOLOGIES

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 LENSAR INC. (A SUBSDIARY OF PDL BIOPHARMA, INC.)

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 MORIA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 NIDEK CO., LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.14.3.1 WEBSITE LAUNCH

15.15 OPHTEC BV

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.15.3.1 PRODUCT LAUNCH

15.16 RAYNER INTRAOCULAR LENSES LIMITED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.16.3.1 NEW DISTRIBUTION UNIT

15.16.3.2 ACQUISITION

15.16.3.3 ACQUISITION

15.17 REICHERT, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.17.3.1 CONFERENCE

15.18 ROWIAK GMBH

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.18.3.1 R&D FACILITY

15.19 SCHWIND EYE-TECH-SOLUTIONS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TRACEY TECHNOLOGIES

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.3.1 R&D FACILITY

15.21 ZIEMER OPHTHALMIC SYSTEMS

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.21.3.1 AGREEMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC PHAKIC INTRAOCULAR LENS (IOL) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC ABBEROMETERS/WAFEFRONT ABERROMETRY IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC SURGICAL INSTRUMENT & ACCESSORIES IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC REFRACTIVE SURGERY KITS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC PUPILLARY DIAMETER METERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC EPIKERATOMES IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC MICROKERATOMES IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC THERMOKERATOPLASTY IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC LIMBAL RELAXING INCISION KITS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC LASIK (LASER IN-SITU KERATOMILEUSIS) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC PHOTOREFRACTIVE KERATECTOMY (PRK) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC PHAKIC INTRAOCULAR LENSES (IOL) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ASTIGMATIC KERATOTOMY (AK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC AUTOMATED LAMELLAR KERATOPLASTY (ALK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC INTRACORNEAL RING (INTACS) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC LASER THERMAL KERATOPLASTY (LTK) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC CONDUCTIVE KERATOPLASTY (CK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC RADIAL KERATOTOMY (RK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC NEARSIGHTEDNESS (MYOPIA) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC FARSIGHTEDNESS (HYPEROPIA) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC PRESBYOPIA IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC ASTIGMATISM IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC HOSPITALS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC SPECIALTY CLINICS IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC AMBULATORY SURGICAL CENTERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC DIRECT TENDER IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC THIRD PARTY DISTRIBUTORS IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 CHINA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 CHINA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 CHINA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 49 CHINA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 CHINA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 CHINA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 52 JAPAN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 55 JAPAN REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 JAPAN REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 JAPAN REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 INDIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 INDIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 INDIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 61 INDIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 INDIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 INDIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 64 SOUTH KOREA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 SOUTH KOREA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 SOUTH KOREA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 67 SOUTH KOREA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 SOUTH KOREA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 SOUTH KOREA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 AUSTRALIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 AUSTRALIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 AUSTRALIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 73 AUSTRALIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 AUSTRALIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 AUSTRALIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 SINGAPORE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 SINGAPORE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 SINGAPORE REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 79 SINGAPORE REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 SINGAPORE REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 SINGAPORE REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 THAILAND REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 THAILAND LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 THAILAND REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 85 THAILAND REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 THAILAND REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 87 THAILAND REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 MALAYSIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 MALAYSIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 MALAYSIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 91 MALAYSIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 MALAYSIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 MALAYSIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 INDONESIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 INDONESIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 INDONESIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 97 INDONESIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 INDONESIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 99 INDONESIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 100 PHILIPPINES REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 PHILIPPINES LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 PHILIPPINES REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 103 PHILIPPINES REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 104 PHILIPPINES REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 PHILIPPINES REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 106 VIETNAM REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 VIETNAM LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 VIETNAM REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 109 VIETNAM REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 VIETNAM REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 111 VIETNAM REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 112 REST OF ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: SEGMENTATION

FIGURE 11 INCREASING TECHNOLOGICAL ADVANCEMENTS IN THE REFRACTIVE SURGERY DEVICES ARE EXPECTED TO DRIVE THE ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINT, OPPORTUNITIES, CHALLENGES FOR ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET

FIGURE 15 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, 2021

FIGURE 16 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, 2020-2029 (USD MILLION)

FIGURE 17 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, 2021

FIGURE 20 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, 2020-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, 2021

FIGURE 24 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, 2021

FIGURE 28 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 32 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET: SNAPSHOT (2021)

FIGURE 36 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2021)

FIGURE 37 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 ASIA-PACIFIC REFRACTIVE SURGERY DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 40 ASIA PACIFIC REFRACTIVE SURGERY DEVICES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.