Asia Pacific Pulse Protein Market

Taille du marché en milliards USD

TCAC :

%

USD

7.27 Billion

USD

12.87 Billion

2025

2033

USD

7.27 Billion

USD

12.87 Billion

2025

2033

| 2026 –2033 | |

| USD 7.27 Billion | |

| USD 12.87 Billion | |

|

|

|

|

Segmentation du marché des protéines de légumineuses en Asie-Pacifique, par type de légumineuse (lentilles noires, lentilles vertes, pois, haricots blancs, pois chiches, haricots noirs, haricots rouges, lupins, fèves et autres), catégorie (biologique et conventionnelle), procédé d'extraction (traitement à sec et traitement humide), forme (isolats, concentrés et hydrolysats), fonction (solubilité, hydratation, émulsification, pouvoir moussant et autres), application (alimentation humaine et animale, produits pharmaceutiques et cosmétiques) - Tendances du secteur et prévisions jusqu'en 2033

Quelle est la taille et le taux de croissance du marché des protéines de légumineuses en Asie-Pacifique ?

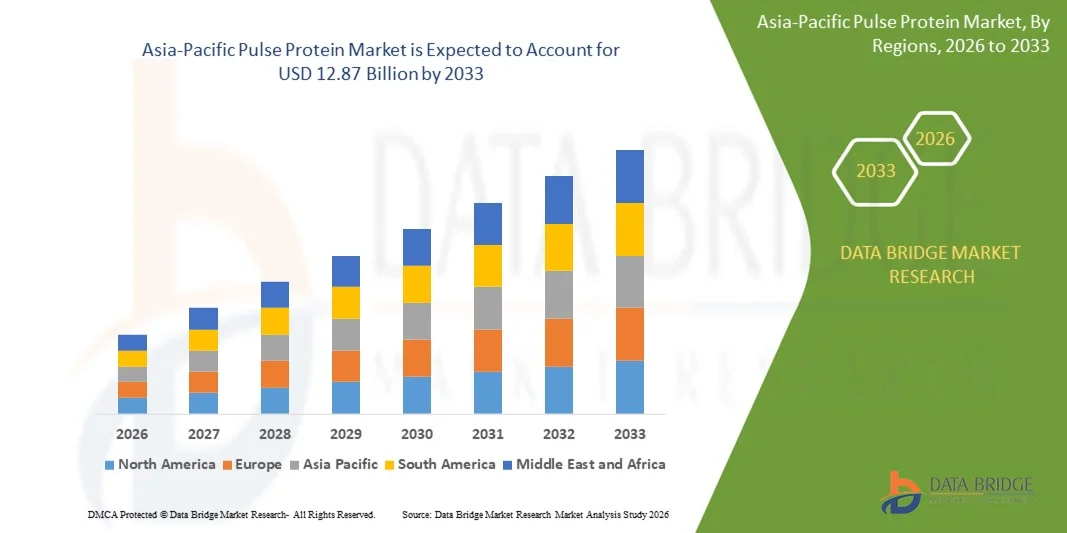

- Le marché des protéines de légumineuses en Asie-Pacifique était évalué à 7,27 milliards de dollars américains en 2025 et devrait atteindre 12,87 milliards de dollars américains d'ici 2033 , avec un TCAC de 7,40 % au cours de la période de prévision.

- La demande croissante de produits sans gluten et sans allergènes stimule la croissance du marché des protéines de légumineuses. Le coût élevé des protéines de légumineuses biologiques freine cependant cette croissance.

Quels sont les principaux enseignements du marché des protéines de légumineuses ?

- L'utilisation des protéines de légumineuses a augmenté car les plantes à légumineuses contribuent à la biodiversité et améliorent la qualité des sols. Les protéines de légumineuses peuvent être obtenues par deux procédés d'extraction : le traitement par voie humide et le traitement par voie sèche.

- La Chine a dominé le marché des protéines de légumineuses en Asie-Pacifique avec une part de revenus estimée à 41,87 % en 2025, portée par une forte demande des industries agroalimentaires, de la boulangerie, des produits laitiers et de la transformation de la viande et de la volaille.

- L'Inde devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, soit 8,45 %, entre 2026 et 2033, grâce à la croissance rapide des installations de transformation alimentaire, à la forte consommation de protéines végétales et à l'expansion des industries de la boulangerie, des produits laitiers et de la transformation de la viande.

- Le segment des pois a dominé le marché avec une part estimée à 28,4 % en 2025, grâce à sa teneur élevée en protéines, sa saveur neutre et ses propriétés fonctionnelles polyvalentes, ce qui en fait un ingrédient idéal pour la boulangerie, les boissons, les en-cas et les alternatives à la viande.

Portée du rapport et segmentation du marché des protéines de légumineuses

|

Attributs |

Principales informations sur le marché des protéines de légumineuses |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché des protéines de légumineuses ?

Tendance croissante vers des protéines de légumineuses de haute qualité, fonctionnelles et adaptées à des applications spécifiques

- Le marché des protéines de légumineuses connaît une adoption croissante d'isolats et de concentrés de protéines de haute pureté, exempts de contaminants et standardisés, afin de répondre aux normes strictes en matière de sécurité alimentaire et de nutrition.

- Les fabricants élargissent leurs gammes de produits avec des protéines de légumineuses enrichies et fonctionnelles, notamment des mélanges enrichis en acides aminés essentiels, en fibres ou en nutriments d'origine végétale pour les applications alimentaires et les boissons.

- La demande croissante de solubilité, de digestibilité et de performances fonctionnelles constantes stimule l'adoption de ces technologies dans les secteurs de la transformation alimentaire, des produits à base de plantes et des compléments nutritionnels.

- Par exemple, des entreprises telles que Cargill, Ingredion, ADM, Kerry et AGT Food and Ingredients augmentent leur production d'isolats et de concentrés de protéines de légumineuses de haute qualité pour les aliments et les boissons à étiquetage clair.

- L'intérêt croissant pour les régimes à base de plantes, l'enrichissement en protéines et la nutrition sportive accélère la demande en ingrédients protéinés polyvalents issus des légumineuses.

- Avec la croissance des exigences réglementaires, la sensibilisation à la nutrition et la préférence des consommateurs pour les régimes alimentaires à base de plantes, les protéines de légumineuses restent des intrants essentiels pour les industries alimentaires, des boissons et des compléments alimentaires.

Quels sont les principaux moteurs du marché des protéines de légumineuses ?

- Demande croissante d'ingrédients végétaux, naturels et riches en protéines dans les aliments emballés, les alternatives aux produits laitiers, les barres nutritionnelles et les compléments alimentaires pour sportifs.

- Par exemple, au cours de la période 2024-2025, des entreprises de premier plan telles que Cargill, ADM, Kerry et AGT Food and Ingredients ont augmenté leurs capacités de production d'isolats et de concentrés de protéines de légumineuses de haute pureté afin de répondre à la demande mondiale croissante.

- La croissance de la consommation d'aliments à base de plantes, de produits enrichis en protéines et des tendances en matière de nutrition fonctionnelle aux États-Unis, en Europe et en Asie-Pacifique stimule l'expansion du marché.

- Les progrès réalisés dans les technologies d'extraction, la purification des protéines et la fonctionnalisation améliorent la solubilité, le goût et l'applicabilité dans de multiples formats alimentaires.

- L'intégration croissante des protéines de légumineuses dans les substituts de viande, les boissons sans produits laitiers, les produits de boulangerie et les collations favorise encore davantage leur adoption.

- Soutenu par la croissance des consommateurs soucieux de leur santé et l'adoption croissante des régimes alimentaires à base de plantes, le marché des protéines de légumineuses devrait connaître une forte croissance à long terme.

Quel facteur freine la croissance du marché des protéines de légumineuses ?

- Les coûts élevés associés aux techniques avancées d'extraction, de purification et d'enrichissement en protéines peuvent limiter leur adoption par les petits fabricants de produits alimentaires.

- Par exemple, entre 2024 et 2025, les fluctuations de la disponibilité des légumineuses brutes, des coûts logistiques et des prix de l'énergie ont eu un impact sur l'efficacité de la production et les marges des principaux fabricants.

- Les variations de propriétés fonctionnelles, de goût et de solubilité entre différentes sources de protéines de légumineuses peuvent poser des défis de formulation aux développeurs de produits alimentaires.

- La préférence des consommateurs pour les protéines animales dans certaines régions peut limiter la pénétration des protéines végétales.

- La concurrence d'autres protéines végétales telles que les protéines de soja, de pois ou de riz exerce une pression sur les prix et les parts de marché.

- Pour surmonter ces défis, les entreprises se concentrent sur le développement de protéines fonctionnelles axé sur la R&D, l'optimisation des coûts, l'approvisionnement durable et la diversification des produits afin d'accroître l'adoption mondiale des protéines de légumineuses.

Comment le marché des protéines de légumineuses est-il segmenté ?

Le marché est segmenté en fonction du type de légumineuses, de la catégorie, du procédé d'extraction, de la forme, de la fonction et de l'application .

- Par type d'impulsion

Le marché des protéines de légumineuses est segmenté selon leur type : lentilles noires, lentilles vertes, pois, haricots blancs, pois chiches, haricots noirs, haricots rouges, lupins, fèves et autres. Le segment des pois dominait le marché avec une part estimée à 28,4 % en 2025, grâce à sa haute teneur en protéines, sa saveur neutre et ses propriétés fonctionnelles polyvalentes, qui en font un ingrédient idéal pour la boulangerie, les boissons, les en-cas et les substituts de viande. Les protéines de pois sont largement utilisées en raison de leur composition naturelle, de leurs propriétés hypoallergéniques et de leur facilité de transformation en isolats, concentrés et hydrolysats.

Le segment des pois chiches devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par la demande croissante de protéines végétales dans les aliments fonctionnels, les boissons et les compléments alimentaires. La préférence grandissante des consommateurs pour les protéines de légumineuses sans gluten, riches en fibres et en nutriments accélère leur adoption sur les marchés développés et émergents du monde entier.

- Par catégorie

Le marché est segmenté en deux catégories : biologique et conventionnel. Le segment conventionnel dominait le marché en 2025 avec une part de 62,1 %, grâce à une production à grande échelle, des prix stables et une large disponibilité dans les secteurs de l’alimentation humaine et animale. Les protéines de légumineuses conventionnelles sont largement utilisées en boulangerie, dans les substituts laitiers, les analogues de viande et les barres nutritionnelles, en raison de leur teneur constante en protéines et de leurs propriétés fonctionnelles.

Le segment des produits biologiques devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par une sensibilisation accrue des consommateurs au développement durable, aux ingrédients naturels et à l'agriculture sans produits chimiques. L'adoption croissante de ces produits dans les en-cas haut de gamme, les produits végétaux et les aliments fonctionnels enrichis soutient la croissance à long terme en Amérique du Nord, en Europe et en Asie-Pacifique.

- Par procédé d'extraction

Selon le procédé d'extraction, le marché des protéines de légumineuses se divise en deux segments : le traitement à sec et le traitement par voie humide. Ce dernier segment, estimé à 54,7 % en 2025, dominait le marché grâce à sa capacité à produire des isolats de haute pureté présentant une solubilité, une émulsification et une saveur neutre supérieures, les rendant ainsi adaptés aux boissons, aux barres protéinées et aux produits de boulangerie. Le traitement par voie humide garantit des performances fonctionnelles plus élevées et une teneur en facteurs antinutritionnels plus faible que le traitement à sec.

Le segment du traitement à sec devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, grâce à une production rentable, une consommation d'eau réduite et une adoption croissante dans les applications d'alimentation animale à grande échelle, les poudres de protéines en vrac et les formulations d'ingrédients fonctionnels.

- Par formulaire

Selon leur forme, le marché est segmenté en isolats, concentrés et hydrolysats. Le segment des isolats dominait le marché en 2025 avec une part de 46,2 %, grâce à leur teneur élevée en protéines, leur faible teneur en matières grasses et leur polyvalence dans les formulations alimentaires et de boissons. Les isolats de protéines sont privilégiés dans les boissons fonctionnelles, les barres nutritionnelles, les produits de boulangerie et les alternatives aux produits laitiers en raison de leur solubilité supérieure, de leur goût neutre et de leurs performances constantes.

Le segment des hydrolysats devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par la demande croissante de protéines bioactives prédigérées dans la nutrition infantile, les compléments sportifs et les produits de nutrition clinique. La prise de conscience accrue des avantages d'une absorption plus rapide et des bienfaits fonctionnels pour la santé accélère l'adoption des hydrolysats à l'échelle mondiale.

- Par fonction

En fonction de leur fonction, les produits de solubilité sont segmentés en solubilité, hydratation, émulsification, pouvoir moussant et autres. Le segment de la solubilité dominait le marché avec une part estimée à 38,5 % en 2025, grâce à son rôle essentiel dans les formulations de boissons, de boissons protéinées, d'alternatives aux produits laitiers et d'aliments fonctionnels liquides. Une solubilité élevée garantit une meilleure dispersion, une texture et une sensation en bouche optimales dans les préparations prêtes à consommer et instantanées.

Le segment des émulsifications devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par l'utilisation croissante de protéines de légumineuses dans les produits laitiers végétaux, les mayonnaises, les sauces et les vinaigrettes. La demande croissante d'ingrédients multifonctionnels améliorant la texture, la stabilité et la durée de conservation soutient la croissance dans l'ensemble des applications alimentaires et des boissons.

- Sur demande

En fonction de l'application, le marché est segmenté en alimentation et boissons, alimentation animale et produits pharmaceutiques, et cosmétiques. Le segment de l'alimentation et des boissons dominait le marché avec une part estimée à 59,8 % en 2025, portée par la consommation croissante d'aliments d'origine végétale, de collations enrichies en protéines, de produits de boulangerie et de boissons. La forte adoption de ces produits dans les domaines de la nutrition sportive, des aliments fonctionnels et des produits à étiquetage clair alimente une demande soutenue.

Le segment de l'alimentation animale et des produits pharmaceutiques devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par l'utilisation croissante des protéines de légumineuses dans la nutrition animale, les formulations nutraceutiques et les compléments alimentaires. L'élargissement des gammes de produits fonctionnels et axés sur la santé accélère leur adoption sur les marchés développés et émergents.

Quelle région détient la plus grande part du marché des protéines de légumineuses ?

- La Chine a dominé le marché des protéines de légumineuses en Asie-Pacifique avec une part de marché estimée à 41,87 % en 2025, portée par une forte demande des industries agroalimentaires, de la boulangerie, des produits laitiers et de la transformation de la viande et de la volaille. L'expansion rapide de la production d'aliments emballés, la robustesse des infrastructures de production nationales et la consommation croissante de régimes riches en protéines favorisent l'adoption généralisée des protéines de légumineuses à travers le pays.

- Les principaux producteurs de protéines et fournisseurs d'ingrédients de la région investissent dans des technologies d'extraction avancées, des protéines de légumineuses enrichies et fonctionnelles, ainsi que dans des pratiques de production durables, renforçant ainsi le leadership de la Chine. La croissance de la production alimentaire à grande échelle et l'efficacité des réseaux de distribution consolident davantage la domination du marché régional.

- Les initiatives gouvernementales visant à promouvoir la sécurité alimentaire, les normes nutritionnelles et la modernisation industrielle continuent de consolider le rôle de premier plan de la Chine sur le marché des protéines de légumineuses en Asie-Pacifique.

Analyse du marché indien des protéines de légumineuses

L'Inde devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, à 8,45 %, entre 2026 et 2033, grâce à une forte croissance des installations de transformation alimentaire, une consommation importante de protéines végétales et l'expansion des secteurs de la boulangerie, des produits laitiers et de la transformation de la viande. L'adoption croissante d'ingrédients protéiques de légumineuses enrichis et standardisés dans l'alimentation humaine et animale soutient la croissance soutenue du marché.

Analyse du marché japonais des protéines de légumineuses

Le Japon contribue de manière significative à la demande régionale, grâce à un secteur agroalimentaire transformé mature, à une consommation croissante d'aliments fonctionnels et à une incorporation accrue de protéines de légumineuses dans les produits de boulangerie, laitiers et nutraceutiques.

Analyse du marché australien des protéines de légumineuses

L'Australie affiche une croissance soutenue, portée par des industries de transformation de la viande et de la volaille performantes, des secteurs de la boulangerie et des produits laitiers en expansion, et une demande croissante d'ingrédients végétaux riches en protéines pour l'alimentation humaine et animale. Les investissements dans les technologies de transformation avancées et la conformité réglementaire favorisent l'expansion du marché à long terme.

Aperçu du marché des protéines de légumineuses en Corée du Sud

La Corée du Sud contribue à la croissance régionale grâce à une sensibilisation accrue des consommateurs aux régimes alimentaires à base de plantes, à une consommation croissante d'aliments fonctionnels et à une adoption grandissante des protéines de légumineuses dans les applications de boulangerie, de produits laitiers et de boissons.

Quelles sont les principales entreprises du marché des protéines de légumineuses ?

L'industrie des protéines de légumineuses est principalement dominée par des entreprises bien établies, notamment :

- Ingredion Incorporated (États-Unis)

- Cargill, Incorporated (États-Unis)

- AGT Aliments et Ingrédients (Canada)

- ADM (États-Unis)

- Kerry (Irlande)

- DuPont (États-Unis)

- Axiom Foods, Inc. (États-Unis)

- Groupe Emsland (Allemagne)

- ET-Chem (Chine)

Quels sont les développements récents sur le marché mondial des protéines de légumineuses ?

- En juin 2025, Roquette a lancé NUTRALYS T Pea 700XC, une protéine de pois texturée à gros morceaux, contenant 70 % de protéines et présentant une haute résistance thermique. Cette innovation répond à la demande croissante de textures consistantes, proches de celles de la viande, dans les plats cuisinés, les sauces et les recettes traditionnelles d'origine végétale, facilitant ainsi la création d'alternatives attrayantes et riches en protéines pour les fabricants de produits alimentaires. Son faible besoin en hydratation et son processus de formulation simplifié optimisent la production, tout en offrant aux consommateurs une expérience sensorielle améliorée. Avec ce produit, Roquette a renforcé son portefeuille sur le marché des protéines de légumineuses, répondant ainsi à la tendance croissante des ingrédients végétaux durables et polyvalents.

- En février 2024, Roquette a enrichi sa gamme de protéines végétales NUTRALYS avec quatre protéines de pois multifonctionnelles, conçues pour améliorer le goût, la texture et les propriétés fonctionnelles des aliments et produits nutritionnels d'origine végétale. Cet élargissement permet aux fabricants de produits alimentaires d'innover et de diversifier leur offre, tout en répondant à la demande croissante des consommateurs pour des solutions végétales riches en protéines. Cette initiative renforce la position de leader de Roquette sur le marché des protéines de légumineuses, en proposant des ingrédients polyvalents adaptés aux boissons, aux produits de boulangerie et aux en-cas enrichis en protéines, répondant ainsi aux préférences changeantes des consommateurs pour des protéines naturelles et durables.

- En octobre 2022, Roquette a lancé une nouvelle gamme d'ingrédients biologiques à base de pois, notamment de l'amidon et des protéines de pois biologiques, produits dans son usine canadienne. Ce lancement répondait à la demande croissante des consommateurs pour des ingrédients biologiques et végétaux, en fournissant aux fabricants des sources de protéines durables et de haute qualité. En proposant des alternatives biologiques, Roquette a renforcé sa position concurrentielle sur le marché des protéines de légumineuses et a accompagné la transition vers des produits alimentaires plus sains et respectueux de l'environnement. Cette initiative a également permis à l'entreprise de cibler les marchés émergents où les ingrédients biologiques et naturels prennent une importance croissante.

- En juin 2022, Roquette a lancé la gamme NUTRALYS, composée de protéines texturées biologiques issues de pois et de fèves. Ce lancement stratégique a permis à Roquette d'élargir sa clientèle en proposant aux fabricants de produits alimentaires des solutions saines, durables et riches en protéines. Ce lancement répondait à l'intérêt croissant des consommateurs pour les régimes à base de plantes et les aliments fonctionnels, aidant ainsi les marques à proposer des produits riches en protéines, à la texture et à la valeur nutritionnelle améliorées. En renforçant son engagement en faveur de l'innovation végétale, Roquette a consolidé sa présence sur le marché en pleine croissance des protéines de légumineuses.

- En juin 2021, Roquette a lancé la protéine de pois texturée P6511C au salon FI Europe, positionnée comme une alternative durable à la viande. Ce produit répond à la demande croissante des consommateurs pour des aliments d'origine végétale aux profils nutritionnels complets, permettant aux fabricants de créer des produits innovants riches en protéines, à la texture et à la polyvalence améliorées. En investissant ce créneau, Roquette a renforcé sa position concurrentielle sur le marché des protéines de légumineuses et a accompagné la transition du secteur vers des ingrédients durables et fonctionnels.

- En juillet 2020, Ingredion Incorporated EMEA a lancé un amidon natif fonctionnel biologique instantané pour répondre à la demande du secteur en ingrédients végétaux polyvalents et de haute qualité. Cette innovation a permis aux fabricants de produits alimentaires et de boissons de disposer d'amidons fonctionnels adaptés aux produits « clean label » et axés sur la santé. Ce lancement a permis à Ingredion d'anticiper une hausse de ses ventes et de renforcer sa présence sur le marché des protéines de légumineuses et des ingrédients végétaux, contribuant ainsi à la tendance plus large vers des solutions alimentaires durables et enrichies en protéines.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.