Asia Pacific Premium Wine Market

Taille du marché en milliards USD

TCAC :

%

USD

11,250.16 Million

USD

19,164.08 Million

2021

2029

USD

11,250.16 Million

USD

19,164.08 Million

2021

2029

| 2022 –2029 | |

| USD 11,250.16 Million | |

| USD 19,164.08 Million | |

|

|

|

|

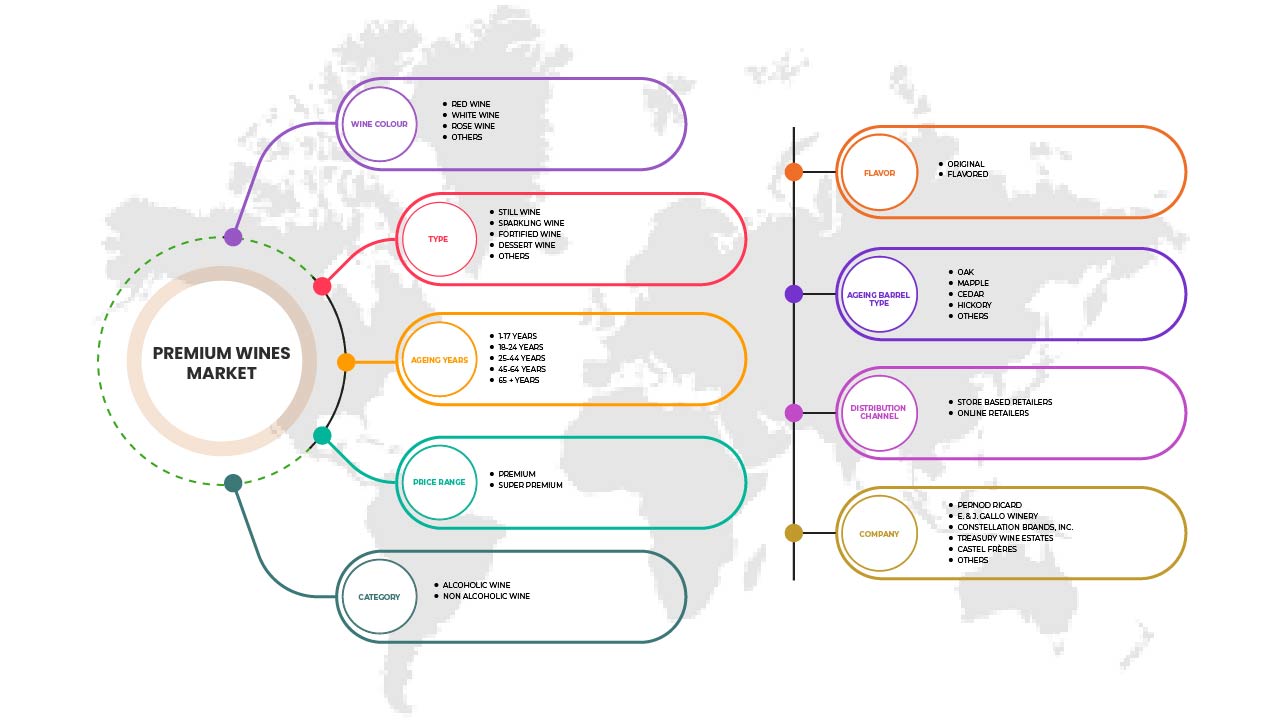

Asia-Pacific Premium Wine Market, By Wine Colour (Red Wine, White Wine, Rose Wine, and Others), Product Type (Still Wine, Fortified Wine, Sparkling Wine, Dessert Wine), Product Category (Alcoholic Wine and Non-Alcoholic Wine), Flavour (Original and Flavoured), Aging Years (1-17 Years, 18-24 Years, 25-44 Years, 45-64 Years and 65+ Years), Ageing Barrel Type (Oak, Maple, Cedar, Hickory and Others), Price Range (Premium and Super Premium), Distribution Channel (Store Based Retailers and Online Retailers) - Industry Trends and Forecast to 2029.

Asia-Pacific Premium Wine Market Analysis and Insights

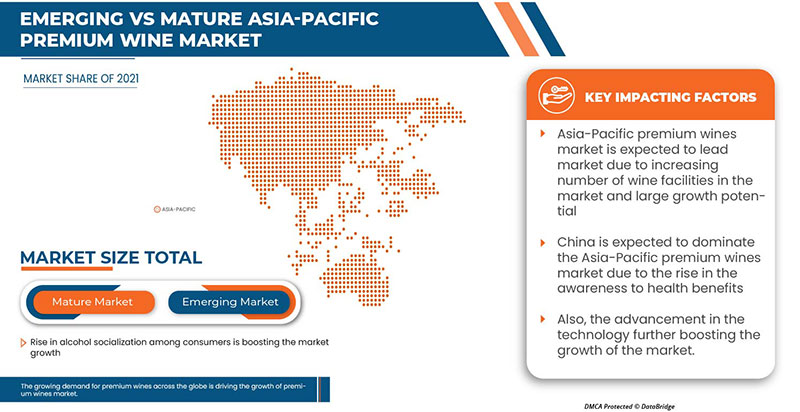

The growing demand of wine owing to different health benefits is helping to boost the overall market growth. The rising e-commerce, courier, wine delivery services are also attributing in the growth of the market. The major market players are highly focusing on various new wine launches. In addition, the rise in the alcohol socialization among consumers also contributing in the rising demand for the market.

The Asia-Pacific premium wine market is growing in the forecast year due to the rise in market players and the availability of various premium wine brands in the market. Along with this, manufacturers are engaged in producing different wines in the market. The increasing bars and restaurants is further boosting the market growth. However, the high cost of wine production and gradual shift of consumers toward other alcoholic beverages might hamper the growth of the Asia-Pacific premium wine market in the forecast period.

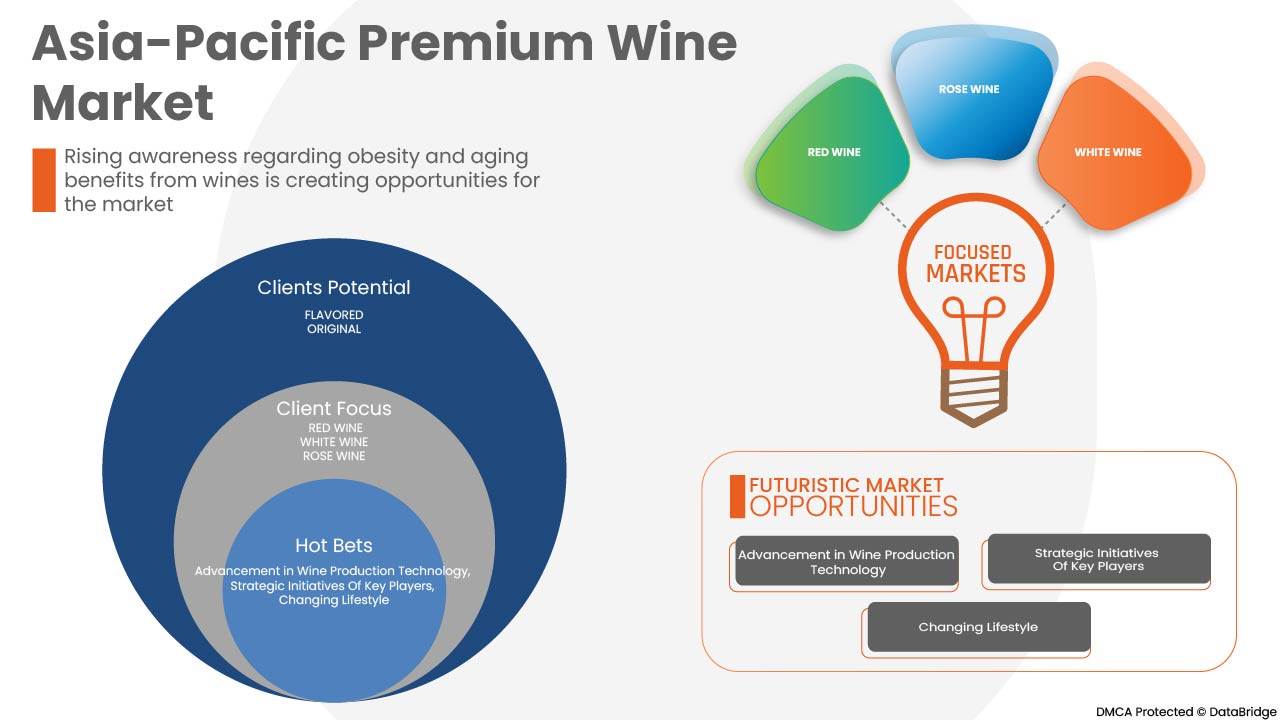

The various health benefits, changing lifestyle, strategic initiatives by market players are giving opportunities to the market. However, the over consumption of wine hampering to the various serious diseases, completion and complications in completing the consumer demand are key challenges for the market growth.

Asia-Pacific premium wine market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.0% in the forecast period of 2022 to 2029 and is expected to reach USD 19,164.08 million by 2029 from USD 11,250.16 million in 2021.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customisable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Par couleur de vin ( vin rouge , vin blanc, vin rosé et autres), type de produit ( vin tranquille , vin fortifié, vin mousseux, vin de dessert), catégorie de produit (vin alcoolisé et vin sans alcool), saveur (originale et aromatisée), années de vieillissement (1 à 17 ans, 18 à 24 ans, 25 à 44 ans, 45 à 64 ans et 65 ans et plus), type de fût de vieillissement (chêne, érable, cèdre, noyer et autres), gamme de prix (premium et super premium), canal de distribution (détaillants en magasin et détaillants en ligne) |

|

Pays couverts |

Chine, Japon, Inde, Corée du Sud, Australie, Singapour, Thaïlande, Malaisie, Indonésie, Philippines, Vietnam, Nouvelle-Zélande, Reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Les principales entreprises présentes sur le marché sont : Vina Concha Y Toro, Treasury Wine Estates, Mount Mary Vineyard, Vins Grands Crus, Sula Vineyards, Moss Wood, Leeuwin Estate, E. & J. Gallo Winery, Constellation Brands, Inc., Castel Freres, The Wine Group, Accolade Wines, Pernod Ricard, Rockford, Henschke Cellars, Gioconda, Cullen Wines, Bass Philip, Changyu Pioneer Wine Company, Casella, Chateau Cheval Blanc, Miguel Torres SA, Fetzer, GRUPO PENFLOR et entre autres. |

Définition du marché des vins haut de gamme

Le vin est une boisson alcoolisée dont l'alcool est produit naturellement par fermentation. La fermentation est la première étape du processus, qui est réalisée par des bactéries présentes sur la peau du raisin. Ensuite, une souche spécifique de levure est ajoutée au produit fermenté principal pour obtenir le résultat souhaité. Le sucre du raisin est transformé en dioxyde de carbone et en éthanol par les levures ou les bactéries du vin. Les vins riches en sucre ont un goût différent, et le vin de dessert en fait partie. Le foulage, la fermentation alcoolique, la fermentation malolactique, le débourbage, la stabilisation et le vieillissement, ainsi que l'affinage en bouteille sont les six processus fondamentaux impliqués dans la production de vin.

Dynamique du marché des vins haut de gamme

Conducteurs

- La demande croissante de vin en raison de ses différents bienfaits pour la santé

La consommation de vin a augmenté ces dernières années en raison de la sensibilisation accrue à ses différents bienfaits pour la santé. Selon les chercheurs, une consommation modérée de vin, dont la teneur en alcool est de 12 à 15 % par jour, aide à prévenir plusieurs maladies. Voici quelques-uns des bienfaits du vin pour la santé :

Le vin a des propriétés antioxydantes. Les antioxydants sont des composés qui préviennent les dommages cellulaires causés par l’inflammation et le stress oxydatif. Les raisins contiennent des niveaux élevés de polyphénols et d’antioxydants qui réduisent le stress oxydatif et l’inflammation.

- Le commerce électronique, les services de messagerie et de livraison de vin en plein essor

Le secteur du commerce électronique est en constante évolution et joue un rôle essentiel dans notre vie quotidienne. Le commerce électronique offre une plateforme permettant aux gens d'acheter ou de vendre ce qu'ils veulent, quand ils le souhaitent. Les commerçants créent et améliorent en permanence les stratégies et les approches de leurs activités de commerce électronique pour répondre à l'évolution de la demande des consommateurs.

Le commerce électronique a transformé la façon de faire des affaires dans le monde entier. Une grande partie de la croissance de ce secteur a été déclenchée par une augmentation de la pénétration d'Internet et des smartphones. En outre, les progrès technologiques et la croissance des marchés disponibles ont facilité l'achat et la vente de biens via des portails en ligne. Les commerçants et les services de livraison continuent de suivre la demande des consommateurs sur les plateformes en ligne, affluant vers le commerce électronique en nombre record.

- Augmentation de la socialisation de l'alcool parmi les consommateurs

La production et la consommation de vin ont connu une croissance rapide au cours des dernières décennies, ce qui a entraîné une augmentation de la consommation. De nos jours, les interactions sociales, la modernisation et l'adoption croissante de la culture occidentale sont quelques-uns des éléments qui encouragent les consommateurs à socialiser avec l'alcool, ce qui accélérera encore la croissance du marché.

La consommation d'alcool devient un signe de statut social, ce qui favorise la croissance du marché des boissons à faible teneur en alcool. Elle gagne également en popularité auprès des millennials et des jeunes, en raison de son attrait rafraîchissant et de son faible taux d'alcool par volume. Elle est principalement associée à plusieurs occasions et servie comme boisson de table avec des aliments ordinaires dans les pays en développement.

La demande croissante encourage davantage les fabricants à lancer et à introduire des produits innovants, ce qui devrait également stimuler la croissance du marché dans les années à venir.

Opportunités

- Changer de style de vie

Les gens préfèrent les vins de qualité supérieure en raison de leur goût authentique. Les vins sont devenus un élément de statut social et générique pour les fêtes et diverses occasions, malgré des composés à la fois sains et nocifs. Des études épidémiologiques menées auprès de nombreuses populations disparates révèlent que les personnes ayant l'habitude de consommer quotidiennement du vin avec modération bénéficient d'une réduction significative de la mortalité toutes causes confondues et en particulier cardiovasculaire par rapport aux personnes qui s'abstiennent ou boivent de l'alcool de manière excessive.

- De plus en plus de bars et de salons

La demande de vins haut de gamme augmente en raison de l'augmentation du nombre de restaurants, de bars et de bars à vins spécialisés dans le monde entier. Comme ces vins haut de gamme sont facilement disponibles dans les bars et les salons, la demande pour des bars à vins particuliers augmente également. Les bars à vin et les salons qui proposent l'abonnement annuel pour des vins haut de gamme authentifiés rendent les gens plus gourmands

Contraintes/Défis

- Augmentation du coût de production du vin

Partout dans le monde, les coûts de production du vin ont augmenté. Les industries vinicoles sont confrontées à plusieurs défis, comme le coût des marchandises et leur expédition en raison de la hausse des prix du gaz. La bouteille de vin elle-même devient de plus en plus difficile à obtenir, en particulier en raison des défis de la chaîne d'approvisionnement et de l'augmentation des prix du gaz. En raison du Covid, de l'augmentation des prix du gaz et de l'inflation, il n'est pas facile de se procurer des bouteilles de vin. L'industrie du vin a connu une augmentation de 30 % des coûts en 2022. Par conséquent, l'augmentation du coût de la production du vin freine la croissance du marché

- Évolution progressive des consommateurs vers d’autres boissons alcoolisées

La modernisation croissante et l'augmentation de la consommation d'alcool sont des tendances actuelles dans le monde entier, ce qui a poussé les producteurs d'alcool à lancer des variantes innovantes et audacieuses de boissons alcoolisées. Les consommateurs orientent progressivement leurs préférences vers diverses boissons alcoolisées telles que les liqueurs, les spiritueux, la bière et d'autres en raison de leur disponibilité à des prix économiques.

Impact post-COVID-19 sur le marché des vins haut de gamme

Le COVID-19 a eu un impact négatif sur le marché. Les confinements et l'isolement pendant la pandémie ont entraîné la fermeture de la plupart des bars et restaurants et ont donc affecté la vente de vin. Les achats de vin en ligne ont augmenté par rapport aux achats auprès des vendeurs. Ainsi, le COVID-19 a eu un impact négatif sur le marché des vins haut de gamme.

Développements récents

- En juin 2022, Pernod Ricard a annoncé le lancement d'un système d'étiquetage numérique pour mieux informer les consommateurs sur les produits qu'ils achètent ainsi que sur la consommation responsable. Cette initiative vise à offrir aux consommateurs une solution efficace à leur souhait de plus de transparence sur le contenu des produits et les informations sanitaires. Un programme pilote européen a été lancé en juillet 2022, avant d'être déployé à l'échelle mondiale sur toutes les marques du portefeuille du Groupe d'ici 2024. Cela a permis à l'entreprise de fournir de meilleurs services aux consommateurs grâce à de telles innovations organisationnelles.

- En août 2022, E. & J. Gallo Winery a annoncé que Gallo était le sponsor officiel des vins de la National Football League (NFL). Cela a aidé l'entreprise à accroître sa présence sur le marché de l'Asie-Pacifique

Portée du marché des vins haut de gamme en Asie-Pacifique

Le marché des vins haut de gamme de la région Asie-Pacifique est segmenté en fonction de la couleur du vin, du type de produit, de la catégorie de produit, du type de fût de vieillissement, de la gamme de prix et du canal de distribution. La croissance de ces segments vous aidera à analyser les segments de faible croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Couleur du vin

- Vin rouge

- Vin blanc

- Vin rosé

- Autres

Sur la base de la couleur du vin, le marché des vins haut de gamme de la région Asie-Pacifique est segmenté en vin rouge, vin blanc, vin rosé et autres.

Type de produit

- Vin tranquille

- Vin pétillant

- Vin fortifié et

- Vin de dessert

En fonction du type de produit, le marché des vins haut de gamme de la région Asie-Pacifique est segmenté en vins tranquilles, vins mousseux, vins fortifiés et vins de dessert.

Catégorie de produit

- Vin alcoolisé

- Vin sans alcool

En fonction de la catégorie de produits, le marché des vins haut de gamme de la région Asie-Pacifique est segmenté en vins alcoolisés et vins non alcoolisés.

Saveur

- Original

- Parfumé

En fonction de la saveur, le marché des vins haut de gamme de la région Asie-Pacifique est segmenté en vins originaux et aromatisés.

Les années de vieillissement

- 1-7 ans

- 18-24 ans

- 25-44 ans

- 45-64 ans

- 65+ ans

En fonction des années de vieillissement, le marché des vins haut de gamme de la région Asie-Pacifique est segmenté en 1 à 7 ans, 18 à 24 ans, 25 à 44 ans, 45 à 64 ans et 65 ans et plus.

Type de barrique de vieillissement

- Chêne

- Érable

- Cèdre

- Hickory

- Autres

En fonction du type de fût, le marché des vins haut de gamme de la région Asie-Pacifique est segmenté en chêne, érable, cèdre, caryer et autres.

Par gamme de prix

- Prime

- Super Premium

En fonction de la gamme de prix, le marché des vins haut de gamme de la région Asie-Pacifique est segmenté en premium et super premium.

Canal de distribution

- Détaillants en magasin

- Détaillants en ligne

En fonction du canal de distribution, le marché des vins haut de gamme de la région Asie-Pacifique est segmenté en détaillants en magasin et en détaillants en ligne.

Analyse/perspectives régionales du marché des vins haut de gamme

Le marché des vins haut de gamme est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, couleur du vin, type de produit, catégorie de produit, type de fût de vieillissement, par gamme de prix, canal de distribution.

Les pays présents sur le marché des vins haut de gamme sont la Chine, le Japon, l'Inde, la Corée du Sud, l'Australie, Singapour, la Thaïlande, la Malaisie, l'Indonésie, les Philippines, le Vietnam, la Nouvelle-Zélande et le reste de l'Asie-Pacifique.

La Chine domine le marché du marketing des vins haut de gamme en termes de part de marché et de revenus du marché et continuera à accroître sa domination au cours de la période de prévision.

Le marché chinois des vins haut de gamme devrait croître en raison d'une augmentation de la consommation de vin avec les repas, de la consommation de vins haut de gamme lors de réunions sociales et de célébrations, d'une augmentation de la préférence des consommateurs pour les vins haut de gamme, d'une augmentation des options de personnalisation de la saveur, de la couleur et de l'emballage des vins haut de gamme devraient stimuler le marché régional au cours de la période prévue.

Les progrès technologiques rapides et la perfection de l'art traditionnel de la vinification augmentent la demande de vins de qualité supérieure. La population croissante d'adultes consommateurs d'alcool alimente encore davantage la croissance du marché. De plus, les différentes options de conditionnement des vins de qualité supérieure, ainsi que leur personnalisation, leur disponibilité en ligne, la présence d'acteurs majeurs du marché dans la région et le niveau de vie élevé stimulent également la croissance du marché.

Analyse du paysage concurrentiel et des parts de marché du vin haut de gamme

Le paysage concurrentiel du marché des vins haut de gamme fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives de marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de produits, la largeur et l'étendue des produits et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises vers le marché des vins haut de gamme.

Certains des principaux acteurs opérant sur le marché du vin haut de gamme sont Vina Concha Y Toro, Treasury Wine Estates, Mount Mary Vineyard, Vins Grands Crus, Sula Vineyards, Moss Wood, Leeuwin Estate, E. & J. Gallo Winery, Constellation Brands, Inc., Castel Freres, The Wine Group, Accolade Wines, Pernod Ricard, Rockford, Henschke Cellars, Gioconda, Cullen Wines, Bass Philip, Changyu Pioneer Wine Company, Casella, Chateau Cheval Blanc, Miguel Torres SA, Fetzer, GRUPO PENFLOR et entre autres.

Méthodologie de recherche

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analysed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific vs. Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC PREMIUM WINE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 WINE COLOUR LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET WINE COLOUR COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT EXPORT ANALYSIS

4.2 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.3 REGULATORY FRAMEWORK AND GUIDELINES

4.3.1 ADVERTISING & PROMOTIONS –

4.4 TAXATION AND DUTY LEVIES

4.5 COMPARATIVE ANALYSIS OF TYPES OF WINE

4.6 DEMOGRAPHIC PREFERENCES

4.7 BRAND COMPETITIVE ANALYSIS

5 PRICING INDEX

6 PRODUCTION CAPACITY OF KEY MANUFACTURERS

7 ASIA PACIFIC PREMIUM WINE MARKET: REGULATIONS

8 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON SUPPLY CHAIN

8.3 IMPACT ON SHIPMENT

8.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

9 BRAND OUTLOOK –

9.1 COMPARATIVE BRAND ANALYSIS

9.2 PRODUCT VS BRAND OVERVIEW –

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 GROWING DEMAND FOR WINE OWING TO DIFFERENT HEALTH BENEFITS

10.1.2 RISING E-COMMERCE, COURIER, AND WINE DELIVERY SERVICES

10.1.3 RISE IN ALCOHOL SOCIALIZATION AMONG CONSUMERS

10.2 RESTRAINTS

10.2.1 INCREASED COST OF WINE PRODUCTION

10.2.2 GRADUAL SHIFT OF CONSUMERS TOWARD OTHER ALCOHOLIC BEVERAGES

10.3 OPPORTUNITIES

10.3.1 CHANGING LIFESTYLE

10.3.2 INCREASING NUMBER OF BARS AND LOUNGES

10.3.3 RISING AWARENESS REGARDING OBESITY AND AGING BENEFITS FROM WINES

10.4 CHALLENGES

10.4.1 HIGH CONSUMPTION LEADING SEVERE HEALTH PROBLEMS

10.4.2 LABOUR-INTENSIVE AND TIME-CONSUMING

11 ASIA PACIFIC PREMIUM WINE MARKET, BY WINE COLOR

11.1 OVERVIEW

11.2 RED WINE

11.2.1 FULL-BODIED

11.2.2 MEDIUM-BODIED

11.2.3 LIGHT-BODIED

11.3 WHITE WINE

11.4 ROSE WINE

11.5 OTHERS

12 ASIA PACIFIC PREMIUM WINE MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 STILL WINE

12.3 SPARKLING WINE

12.4 FORTIFIED WINE

12.5 DESSERT WINE

12.5.1 LIGHT SWEET

12.5.2 RICHLY SWEET

12.5.3 SWEET RED WINE

13 ASIA PACIFIC PREMIUM WINE MARKET, BY PRODUCT CATEGORY

13.1 OVERVIEW

13.2 ALCOHOLIC

13.3 NON-ALCOHOLIC

13.3.1 0.5% ABV

13.3.2 MORE THAN 0.05% ABV

13.3.3 0.05% ABV

13.3.4 LESS THAN 0.05% ABV

14 ASIA PACIFIC PREMIUM WINE MARKET, BY FLAVOR

14.1 OVERVIEW

14.2 FLAVORED

14.2.1 FRUITS

14.2.1.1 CHERRY

14.2.1.2 PEACH

14.2.1.3 LEMON

14.2.1.4 GREEN APPLE

14.2.1.5 ORANGE

14.2.1.6 POMOGRANATE

14.2.1.7 MELON

14.2.1.8 FIG

14.2.1.9 MANGO

14.2.1.10 PINEAPPLE

14.2.1.11 OTHERS

14.2.2 BERRY

14.2.2.1 CRANBERRIES

14.2.2.2 BLUEBERRY

14.2.2.3 RASPBERRY

14.2.2.4 STRAWBERRY

14.2.2.5 OTHERS

14.2.3 FLORAL

14.2.3.1 ROSE

14.2.3.2 HIBISCUS

14.2.3.3 OTHERS

14.2.4 HERBAL

14.2.4.1 SMOKED TOBACCO

14.2.4.2 TRUFFLE

14.2.4.3 OTHERS

14.2.5 SPICES

14.2.5.1 CINNAMON

14.2.5.2 NUTMEG

14.2.5.3 PEPPER

14.2.5.4 GINGER

14.2.5.5 CLOVES

14.2.5.6 OTHERS

14.2.6 CHOCOLATE

14.2.7 MAPLE

14.2.8 HONEY

14.2.9 VANILLA

14.2.10 CARAMEL

14.3 ORIGINAL

15 ASIA PACIFIC PREMIUM WINE MARKET, BY AGEING YEARS

15.1 OVERVIEW

15.2 1-17 YEARS

15.3 18-24 YEARS

15.4 25-44 YEARS

15.5 45-64 YEARS

15.6 65+ YEARS

16 ASIA PACIFIC PREMIUM WINE MARKET, BY AGEING BARREL TYPE

16.1 OVERVIEW

16.2 OAK

16.3 HICKORY

16.4 MAPLE

16.5 CEDAR

16.6 OTHERS

17 ASIA PACIFIC PREMIUM WINE MARKET, BY PRICE RANGE

17.1 OVERVIEW

17.2 PREMIUM

17.3 SUPER PREMIUM

18 ASIA PACIFIC PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 STORE BASED RETAILERS

18.2.1 LIQUOR STORES

18.2.2 CONVENIENCE STORE

18.2.3 SUPERMARKETS/HYPERMARKETS

18.2.4 WHOLESALERS

18.2.5 SPECIALITY STORES

18.2.6 GROCERY STORES

18.2.7 OTHERS

18.3 ONLINE RETAILERS

19 ASIA PACIFIC PREMIUM WINE MARKET, BY REGION

19.1 ASIA-PACIFIC

19.1.1 CHINA

19.1.2 AUSTRALIA

19.1.3 JAPAN

19.1.4 SOUTH KOREA

19.1.5 INDIA

19.1.6 THAILAND

19.1.7 SINGAPORE

19.1.8 VIETNAM

19.1.9 NEW ZEALAND

19.1.10 MALAYSIA

19.1.11 PHILIPPINES

19.1.12 REST OF ASIA-PACIFIC

20 COMPANY LANDSCAPE

20.1 ASIA PACIFIC PREMIUM WINE MARKET: COMPANY LANDSCAPE

20.1.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

21 SWOT ANALYSIS

22 COMPANY PROFILE

22.1 PERNOD RICARD

22.1.1 COMPANY SNAPSHOT

22.1.2 REVENUE ANALYSIS

22.1.3 COMPANY SHARE ANALYSIS

22.1.4 PRODUCT PORTFOLIO

22.1.5 RECENT DEVELOPMENT

22.2 E. & J. GALLO WINERY

22.2.1 COMPANY SNAPSHOT

22.2.2 COMPANY SHARE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 RECENT DEVELOPMENTS

22.3 CONSTELLATION BRANDS, INC.

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 COMPANY SHARE ANALYSIS

22.3.4 PRODUCT PORTFOLIO

22.3.5 RECENT DEVELOPMENTS

22.4 TREASURY WINE ESTATES

22.4.1 COMPANY SNAPSHOT

22.4.2 REVENUE ANALYSIS

22.4.3 COMPANY SHARE ANALYSIS

22.4.4 PRODUCT PORTFOLIO

22.4.5 RECENT DEVELOPMENTS

22.5 CASTEL FRÈRES

22.5.1 COMPANY SNAPSHOT

22.5.2 PRODUCT PORTFOLIO

22.5.3 RECENT DEVELOPMENTS

22.6 ACCOLADE WINES

22.6.1 COMPANY SNAPSHOT

22.6.2 PRODUCT PORTFOLIO

22.6.3 RECENT DEVELOPMENTS

22.7 BASS PHILLIP WINES

22.7.1 COMPANY SNAPSHOT

22.7.2 PRODUCT PORTFOLIO

22.7.3 RECENT DEVELOPMENT

22.8 CASELLA

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENT

22.9 CHANGYU

22.9.1 COMPANY SNAPSHOT

22.9.2 REVENUS ANALYSIS

22.9.3 PRODUCT PORTFOLIO

22.9.4 RECENT DEVELOPMENT

22.1 CHATEAU CHEVAL BLANC

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENTS

22.11 CULLEN WINES

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENTS

22.12 FETZER

22.12.1 COMPANY SNAPSHOT

22.12.2 PRODUCT PORTFOLIO

22.12.3 RECENT DEVELOPMENTS

22.13 GIACONDA MARKETING PTY. LTD.

22.13.1 COMPANY SNAPSHOT

22.13.2 PRODUCT PORTFOLIO

22.13.3 RECENT DEVELOPMENTS

22.14 GRUPO PEÑAFLOR

22.14.1 COMPANY SNAPSHOT

22.14.2 PRODUCT PORTFOLIO

22.14.3 RECENT DEVELOPMENTS

22.15 HENSCHKE

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENTS

22.16 LEEUWIN ESTATE

22.16.1 COMPANY SNAPSHOT

22.16.2 PRODUCT PORTFOLIO

22.16.3 RECENT DEVELOPMENT

22.17 MIGUEL TORRES S.A

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENTS

22.18 MOSS WOOD

22.18.1 COMANY SNAPSHOT

22.18.2 PRODUCT PORTFOLIO

22.18.3 RECENT DEVELOPMENT

22.19 MOUNT MARY VINEYARD

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENTS

22.2 ROCKFORD

22.20.1 COMPANY SNAPSHOT

22.20.2 PRODUCT PORTFOLIO

22.20.3 RECENT DEVELOPMENTS

22.21 SULA VINEYARDS PVT. LTD.

22.21.1 COMPANY SNAPSHOT

22.21.2 PRODUCT PORTFOLIO

22.21.3 RECENT DEVELOPMENT

22.22 THE WINE GROUP

22.22.1 COMPANY SNAPSHOT

22.22.2 PRODUCT PORTFOLIO

22.22.3 RECENT DEVELOPMENTS

22.23 VINA CONCHA Y TORO

22.23.1 COMPANY SNAPSHOT

22.23.2 REVENUE ANALYSIS

22.23.3 PRODUCT PORTFOLIO

22.23.4 RECENT DEVELOPMENT

22.24 VINS GRAND CRUS

22.24.1 COMPANY SNAPSHOT

22.24.2 PRODUCT PORTFOLIO

22.24.3 RECENT DEVELOPMENTS

23 QUESTIONNAIRE

24 RELATED REPORTS

Liste des tableaux

TABLE 1 BELOW ARE THE MOST COMMON RED WINE TYPES BY AROMA, BODY, AND SWEETNESS:

TABLE 2 BELOW ARE THE MOST COMMON WHITE WINE TYPES BY AROMA, BODY, AND SWEETNESS:

TABLE 3 BELOW IS THE TABULAR REPRESENTATION OF THE OVERALL TOTAL CONSUMPTION OF WINE IN DIFFERENT COUNTRIES :

TABLE 4 THE PRICES OF THESE WINES VARY FROM REGION TO REGION. BELOW ARE THE PRICES OF SOME OF THE MOST POPULAR RED WINES ACROSS THE GLOBE.

TABLE 5 BELOW ARE THE PRICES OF SOME OF THE WORLD’S BEST WHITE WINES ACROSS THE GLOBE.

TABLE 6 ASIA PACIFIC PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC RED WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC RED WINE IN PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC WHITE WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC ROSE WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC OTHERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC STILL WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC SPARKLING WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC FORTIFIED WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC DESSERT WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC ALCOHOLIC IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC NON-ALCOHOLIC IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC NON-ALCOHOLIC IN PREMIUM WINE MARKET, BY ABV %, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC FLAVORED IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC FRUITS IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC ORIGINAL IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC PREMIUM WINE MARKET, BY AGEING, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC 1-17 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC 18-24 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC 25-44 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC 45-64 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC 65+ YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC OAK IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC HICKORY IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC MAPLE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC CEDAR IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC OTHERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC PREMIUM WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC SUPER PREMIUM WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC ONLINE RETAILERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC PREMIUM WINE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 ASIA-PACIFIC DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 55 ASIA-PACIFIC NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 57 ASIA-PACIFIC FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 59 ASIA-PACIFIC BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 60 ASIA-PACIFIC FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 61 ASIA-PACIFIC HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 62 ASIA-PACIFIC SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 63 ASIA-PACIFIC PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 64 ASIA-PACIFIC PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 65 ASIA-PACIFIC PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 66 ASIA-PACIFIC PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 ASIA-PACIFIC STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 68 CHINA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 69 CHINA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 CHINA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 CHINA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 CHINA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 73 CHINA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 74 CHINA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 75 CHINA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 76 CHINA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 77 CHINA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 78 CHINA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 79 CHINA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 80 CHINA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 81 CHINA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 82 CHINA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 83 CHINA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 84 CHINA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 CHINA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 AUSTRALIA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 87 AUSTRALIA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 AUSTRALIA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 AUSTRALIA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 93 AUSTRALIA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 99 AUSTRALIA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 100 AUSTRALIA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 101 AUSTRALIA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 AUSTRALIA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 104 JAPAN PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 105 JAPAN RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 JAPAN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 JAPAN DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 JAPAN PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 109 JAPAN NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 110 JAPAN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 111 JAPAN FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 112 JAPAN FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 113 JAPAN BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 114 JAPAN FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 115 JAPAN HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 116 JAPAN SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 117 JAPAN PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 118 JAPAN PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 119 JAPAN PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 120 JAPAN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 121 JAPAN STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 122 SOUTH KOREA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 123 SOUTH KOREA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 SOUTH KOREA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 SOUTH KOREA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 SOUTH KOREA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 127 SOUTH KOREA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 128 SOUTH KOREA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 129 SOUTH KOREA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 130 SOUTH KOREA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 131 SOUTH KOREA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 132 SOUTH KOREA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 133 SOUTH KOREA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 134 SOUTH KOREA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 135 SOUTH KOREA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 136 SOUTH KOREA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 137 SOUTH KOREA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 138 SOUTH KOREA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 139 SOUTH KOREA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 140 INDIA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 141 INDIA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 INDIA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 INDIA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 INDIA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 145 INDIA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 146 INDIA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 147 INDIA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 148 INDIA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 149 INDIA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 150 INDIA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 151 INDIA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 152 INDIA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 153 INDIA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 154 INDIA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 155 INDIA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 156 INDIA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 157 THAILAND PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 158 THAILAND RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 THAILAND PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 160 THAILAND DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 161 THAILAND PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 162 THAILAND NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 163 THAILAND PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 164 THAILAND FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 165 THAILAND FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 166 THAILAND BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 167 THAILAND FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 168 THAILAND HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 169 THAILAND SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 170 THAILAND PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 171 THAILAND PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 172 THAILAND PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 173 THAILAND PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 174 THAILAND STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 175 SINGAPORE PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 176 SINGAPORE RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 SINGAPORE PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 178 SINGAPORE DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 179 SINGAPORE PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 180 SINGAPORE NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 181 SINGAPORE FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 182 SINGAPORE FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 183 SINGAPORE BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 184 SINGAPORE FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 185 SINGAPORE HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 186 SINGAPORE SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 187 SINGAPORE PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 188 SINGAPORE PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 189 SINGAPORE PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 190 SINGAPORE PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 191 SINGAPORE STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 192 VIETNAM PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 193 VIETNAM RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 VIETNAM PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 195 VIETNAM DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 196 VIETNAM PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 197 VIETNAM NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 198 VIETNAM PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 199 VIETNAM FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 200 VIETNAM FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 201 VIETNAM BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 202 VIETNAM FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 203 VIETNAM HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 204 VIETNAM SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 205 VIETNAM PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 206 VIETNAM PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 207 VIETNAM PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 208 VIETNAM PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 209 VIETNAM STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 210 NEW ZEALAND PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 211 NEW ZEALAND RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 NEW ZEALAND PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 213 NEW ZEALAND DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 214 NEW ZEALAND PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 215 NEW ZEALAND NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 216 NEW ZEALAND PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 217 NEW ZEALAND FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 218 NEW ZEALAND FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 219 NEW ZEALAND BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 220 NEW ZEALAND FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 221 NEW ZEALAND HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 222 NEW ZEALAND SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 223 NEW ZEALAND PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 224 NEW ZEALAND PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 225 NEW ZEALAND PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 226 NEW ZEALAND PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 227 NEW ZEALAND STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 228 MALAYSIA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 229 MALAYSIA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 MALAYSIA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 231 MALAYSIA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 232 MALAYSIA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 233 MALAYSIA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 234 MALAYSIA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 235 MALAYSIA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 236 MALAYSIA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 237 MALAYSIA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 238 MALAYSIA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 239 MALAYSIA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 240 MALAYSIA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 241 MALAYSIA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 242 MALAYSIA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 243 MALAYSIA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 244 MALAYSIA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 245 MALAYSIA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 246 PHILIPPINES PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 247 PHILIPPINES RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 248 PHILIPPINES PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 249 PHILIPPINES DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 250 PHILIPPINES PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 251 PHILIPPINES NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 252 PHILIPPINES PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 253 PHILIPPINES FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 254 PHILIPPINES FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 255 PHILIPPINES BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 256 PHILIPPINES FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 257 PHILIPPINES HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 258 PHILIPPINES SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 259 PHILIPPINES PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 260 PHILIPPINES PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 261 PHILIPPINES PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 262 PHILIPPINES PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 263 PHILIPPINES STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 264 REST OF ASIA-PACIFIC PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC PREMIUM WINE MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC PREMIUM WINE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC PREMIUM WINE MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC PREMIUM WINE MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC PREMIUM WINE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC PREMIUM WINE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC PREMIUM WINE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC PREMIUM WINE MARKET: MARKET WINE COLOUR COVERAGE GRID

FIGURE 9 ASIA PACIFIC PREMIUM WINE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC PREMIUM WINE MARKET: SEGMENTATION

FIGURE 11 THE GROWING DEMAND OF WINE OWING TO DIFFERENT HEALTH BENEFITS AND RISING E-COMMERCE, COURIER AND WINE DELIVERY SERVICES ARE EXPECTED TO DRIVE THE ASIA PACIFIC PREMIUM WINE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 RED WINE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC PREMIUM WINE MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC PREMIUM WINE MARKET

FIGURE 14 THE FOLLOWING GRAPH SHOWCASES THE INCREASE IN THE CONSUMPTION OF WINE IN THE U.S.

FIGURE 15 TOP FIVE LARGEST E-COMMERCE MARKETS IN 2019 (USD BILLION)

FIGURE 16 ASIA PACIFIC PREMIUM WINE MARKET: BY WINE COLOR, 2021

FIGURE 17 ASIA PACIFIC PREMIUM WINE MARKET: BY WINE COLOR, 2022-2029 (USD MILLION)

FIGURE 18 ASIA PACIFIC PREMIUM WINE MARKET: BY WINE COLOR, CAGR (2022-2029)

FIGURE 19 ASIA PACIFIC PREMIUM WINE MARKET: BY WINE COLOR, LIFELINE CURVE

FIGURE 20 ASIA PACIFIC PREMIUM WINE MARKET: BY PRODUCT TYPE, 2021

FIGURE 21 ASIA PACIFIC PREMIUM WINE MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 22 ASIA PACIFIC PREMIUM WINE MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 23 ASIA PACIFIC PREMIUM WINE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 24 ASIA PACIFIC PREMIUM WINE MARKET: BY PRODUCT CATEGORY, 2021

FIGURE 25 ASIA PACIFIC PREMIUM WINE MARKET: BY PRODUCT CATEGORY, 2022-2029 (USD MILLION)

FIGURE 26 ASIA PACIFIC PREMIUM WINE MARKET: BY PRODUCT CATEGORY, CAGR (2022-2029)

FIGURE 27 ASIA PACIFIC PREMIUM WINE MARKET: BY PRODUCT CATEGORY, LIFELINE CURVE

FIGURE 28 ASIA PACIFIC PREMIUM WINE MARKET: BY FLAVOR, 2021

FIGURE 29 ASIA PACIFIC PREMIUM WINE MARKET: BY FLAVOR, 2022-2029 (USD MILLION)

FIGURE 30 ASIA PACIFIC PREMIUM WINE MARKET: BY FLAVOR, CAGR (2022-2029)

FIGURE 31 ASIA PACIFIC PREMIUM WINE MARKET: BY FLAVOR, LIFELINE CURVE

FIGURE 32 ASIA PACIFIC PREMIUM WINE MARKET: BY AGEING YEARS, 2021

FIGURE 33 ASIA PACIFIC PREMIUM WINE MARKET: BY AGEING YEARS, 2022-2029 (USD MILLION)

FIGURE 34 ASIA PACIFIC PREMIUM WINE MARKET: BY AGEING YEARS, CAGR (2022-2029)

FIGURE 35 ASIA PACIFIC PREMIUM WINE MARKET: BY AGEING YEARS, LIFELINE CURVE

FIGURE 36 ASIA PACIFIC PREMIUM WINE MARKET: BY AGEING BARREL TYPE, 2021

FIGURE 37 ASIA PACIFIC PREMIUM WINE MARKET: BY AGEING BARREL TYPE, 2022-2029 (USD MILLION)

FIGURE 38 ASIA PACIFIC PREMIUM WINE MARKET: BY AGEING BARREL TYPE, CAGR (2022-2029)

FIGURE 39 ASIA PACIFIC PREMIUM WINE MARKET: BY AGEING BARREL TYPE, LIFELINE CURVE

FIGURE 40 ASIA PACIFIC PREMIUM WINE MARKET: BY PRICE RANGE, 2021

FIGURE 41 ASIA PACIFIC PREMIUM WINE MARKET: BY PRICE RANGE, 2022-2029 (USD MILLION)

FIGURE 42 ASIA PACIFIC PREMIUM WINE MARKET: BY PRICE RANGE, CAGR (2022-2029)

FIGURE 43 ASIA PACIFIC PREMIUM WINE MARKET: BY PRICE RANGE, LIFELINE

FIGURE 44 ASIA PACIFIC PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 45 ASIA PACIFIC PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 46 ASIA PACIFIC PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 47 ASIA PACIFIC PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE

FIGURE 48 ASIA-PACIFIC PREMIUM WINE MARKET: SNAPSHOT (2021)

FIGURE 49 ASIA-PACIFIC PREMIUM WINE MARKET: BY COUNTRY (2021)

FIGURE 50 ASIA-PACIFIC PREMIUM WINE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 51 ASIA-PACIFIC PREMIUM WINE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 52 ASIA-PACIFIC PREMIUM WINE MARKET: BY WINE COLOUR (2022-2029)

FIGURE 53 ASIA PACIFIC PREMIUM WINE MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.