Asia Pacific Powder Sulfur Market

Taille du marché en milliards USD

TCAC :

%

USD

422,922.18 Thousand

USD

559,699.00 Thousand

2022

2030

USD

422,922.18 Thousand

USD

559,699.00 Thousand

2022

2030

| 2023 –2030 | |

| USD 422,922.18 Thousand | |

| USD 559,699.00 Thousand | |

|

|

|

Marché du soufre en poudre en Asie-Pacifique, par qualité (qualité agricole, qualité caoutchouc, qualité industrielle, qualité pharmaceutique, qualité alimentaire et autres), produit (soufre en poudre non rempli d'huile et soufre en poudre rempli d'huile), finesse (200 Mesh, 300 Mesh, 325 Mesh, 400 Mesh, 500 Mesh et autres) - Tendances de l'industrie et prévisions jusqu'en 2030.

Analyse et taille du marché du soufre en poudre en Asie-Pacifique

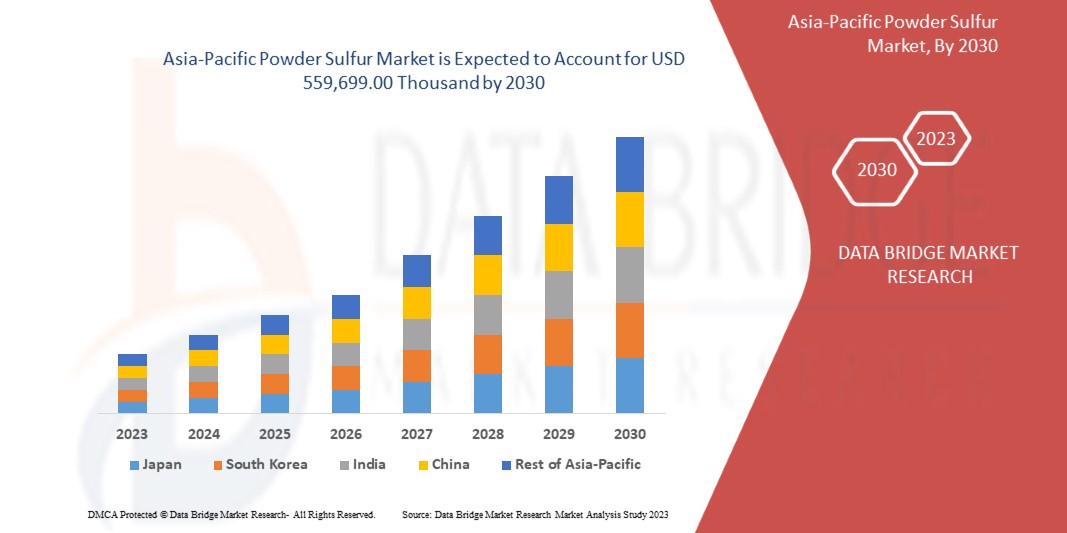

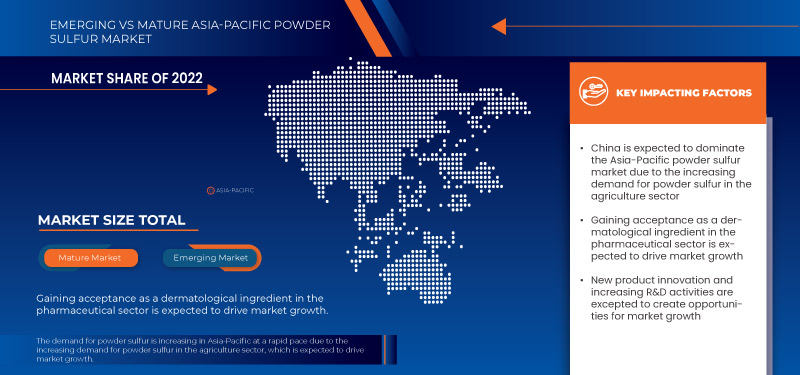

Data Bridge Market Research analyse que le marché du soufre en poudre en Asie-Pacifique devrait atteindre 559 699,00 milliers USD d'ici 2030, contre 422 922,18 milliers USD en 2022, avec un TCAC substantiel de 3,6 % au cours de la période de prévision de 2023 à 2030.

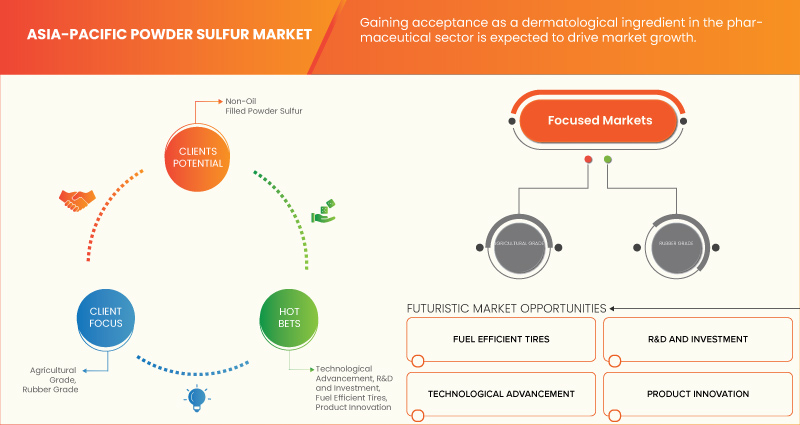

Les perspectives positives pour l'industrie agricole et l'acceptation croissante en tant qu'ingrédient dermatologique dans le secteur pharmaceutique sont quelques-uns des facteurs moteurs qui devraient stimuler la croissance du marché. Cependant, les problèmes dangereux associés à la nature chimique du soufre en poudre et la disponibilité de substituts dans certains segments d'application devraient freiner la croissance du marché. L'augmentation des dépenses en R&D dans les segments des véhicules électriques et des énergies renouvelables devrait offrir des opportunités de croissance du marché. Cependant, la mise en œuvre de règles et de réglementations visant à empêcher l'utilisation du stockage de produits chimiques devrait remettre en cause la croissance du marché.

Le rapport sur le marché du soufre en poudre en Asie-Pacifique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Qualité (qualité agricole, qualité caoutchouc, qualité industrielle, qualité pharmaceutique, qualité alimentaire et autres), produit (soufre en poudre non rempli d'huile et soufre en poudre rempli d'huile), finesse (200 Mesh, 300 Mesh, 325 Mesh, 400 Mesh, 500 Mesh et autres) |

|

Pays couverts |

Chine, Japon, Inde, Corée du Sud, Australie et Nouvelle-Zélande, Thaïlande, Singapour, Philippines, Malaisie, Indonésie, Reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Grupa Azoty, Kaycee Chem Industries, MK CHEMICAL INDUSTRIES, Jordan Sulphur, Golden Chemicals, Sulphur., JK Industries, Solar Chemferts Pvt Ltd, American Elements, JAINSON CHEMICALS et Jaishil Sulphur & Chemical Industries, entre autres |

Définition du marché

Le soufre en poudre est une forme finement broyée de soufre élémentaire, couramment utilisée dans diverses industries et applications. Il se caractérise par sa consistance pulvérulente, généralement composée de petites particules d'un degré de pureté élevé. Il sert d'ingrédient clé dans la production d'engrais, de pesticides et de fongicides, ainsi que dans la fabrication de produits chimiques et pharmaceutiques. Sa nature polyvalente lui permet d'être utilisé comme additif dans les processus industriels, tels que la vulcanisation du caoutchouc et les applications métallurgiques. Il joue un rôle essentiel dans divers secteurs en raison de ses propriétés chimiques uniques et de sa large utilité industrielle.

Dynamique du marché du soufre en poudre en Asie-Pacifique

Conducteurs

- Perspectives positives pour le secteur agricole

Le soufre est utilisé dans l'agriculture pour de nombreuses utilisations, comme la protection des cultures en tant que produit phytosanitaire, ses propriétés fongicides et acaricides, et le potentiel qu'il offre en tant qu'agronutriment en raison de son potentiel comme engrais et biostimulant naturel. En effet, le soufre encourage les plantes à produire elles-mêmes des acides aminés essentiels tels que la cystéine, la cystine et la méthionine, renforçant ainsi leurs défenses naturelles contre les champignons.

La poudre de soufre sera bénéfique pour toutes les plantes si les niveaux de soufre du sol sont faibles, car le soufre est nécessaire à la croissance des plantes. Certains légumes, comme l'oignon, l'ail et la moutarde, ont besoin de soufre pour devenir plus savoureux. En conséquence, le secteur agricole en bénéficiera considérablement, ce qui devrait stimuler la croissance du marché car il s'agit de l'ingrédient le plus efficace pour une croissance exceptionnelle des cultures.

- Scénario favorable dans le secteur automobile

L'industrie du pneumatique est l'un des composants automobiles les plus importants du marché automobile. Le pneu et la chambre à air, qui sont des composants essentiels des véhicules automobiles, sont essentiels à l'économie d'un pays. Les pneus sont utilisés par les véhicules de tourisme, les véhicules utilitaires, les gros camions, les camionnettes et d'autres types de véhicules.

En conséquence, les ventes, la demande et la production de pneus sont en hausse à l'échelle mondiale. Il existe donc une demande croissante de pneus efficaces. Pour augmenter l'élasticité, la résistance et la durabilité, il est ajouté au caoutchouc naturel et synthétique. Les liaisons croisées sont créées par les molécules de soufre et de caoutchouc, conférant au caoutchouc ses caractéristiques distinctives. Ces facteurs en font une matière première nécessaire dans la production de pneus. La poudre de soufre est par conséquent largement utilisée dans la fabrication de pneus. De plus, les pneus ont le potentiel d'être un moteur important de la croissance du marché en raison de leur demande, de leur production et de leurs ventes croissantes.

Opportunité

- Perspectives favorables à l'égard du traitement chimique dans le monde entier

Des produits chimiques tels que l'acide sulfurique, les sulfites et le dioxyde de soufre sont tous produits à partir de poudre de soufre. La fabrication du papier, la filtration de l'eau et le traitement des métaux ne sont que quelques-unes des utilisations industrielles de ces composés. La production d'explosifs tels que le TNT (trinitrotoluène) et de fioul contenant du nitrate d'ammonium l'utilise également comme composant. Il donne au mélange explosif la quantité essentielle de soufre dont il a besoin tout en aidant à maintenir la stabilité de la réaction. La poudre de soufre est parfois utilisée dans la purification de l'eau pour éliminer les contaminants et pour empêcher la croissance de bactéries et d'algues dans les systèmes d'eau, ainsi que comme agent de blanchiment dans la fabrication du papier, de la laine et de la soie. En outre, il est utilisé dans la production de plusieurs types de savons et de détergents

L'utilisation de produits chimiques transformés à partir de poudre de soufre est présente dans de nombreux secteurs industriels tels que le traitement de l'eau, les feux d'artifice et la construction, entre autres. En outre, on s'attend à ce que les différentes utilisations des produits chimiques dans diverses industries offrent des perspectives pour l'industrie.

Contraintes/Défis

- Menace crédible de substitutions dans certains segments d'application

Le soufre en poudre joue divers rôles dans la production de différents produits dans différents secteurs tels que l'automobile, l'agriculture, les produits pharmaceutiques et autres. Le rôle multisegment peut avoir des impacts à la fois positifs et négatifs sur le marché global, car chaque segment d'application peut avoir divers substituts qui peuvent renverser efficacement l'utilisation du soufre en poudre.

Les exemples ci-dessus montrent qu'il existe déjà de nombreux composés chimiques de substitution qui peuvent être utilisés comme substituts du soufre en poudre. Par conséquent, la disponibilité de ces substituts devrait freiner la croissance du marché.

- Mise en œuvre des règles et réglementations visant à prévenir l'utilisation de produits chimiques

L'inquiétude croissante concernant l'utilisation de produits chimiques dangereux dans son processus de fabrication a conduit à l'application de règles et de réglementations strictes au secteur du soufre en poudre. Ces directives et lois couvrent l'utilisation de produits chimiques impliqués dans la production de soufre lui-même ainsi que l'utilisation de soufre dans la production d'autres produits. Ainsi, des réglementations strictes devraient freiner la croissance du marché.

La restriction de l'utilisation de certains matériaux, produits chimiques et processus de production oblige l'entreprise à investir davantage dans de nouvelles méthodes de recherche et développement, de nouveaux matériaux, de nouveaux schémas de production, de nouvelles technologies et de nouveaux équipements pour répondre aux exigences de la réglementation, ce qui aura à son tour un impact sur le coût et la disponibilité des produits, ce qui aura finalement une incidence sur le marché. D'autre part, le véritable objectif de ces règles et réglementations est de mettre l'accent sur la durabilité et l'innovation, ainsi que sur la collaboration entre diverses entreprises pour la viabilité à long terme et la livraison de produits inoffensifs au client. Les fabricants doivent donc considérer ces réglementations comme un défi et prendre les mesures nécessaires pour les surmonter et se démarquer des autres fabricants.

Portée du marché du soufre en poudre en Asie-Pacifique

Le marché du soufre en poudre de la région Asie-Pacifique est segmenté en trois segments notables en fonction de la qualité, du produit et de la finesse. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Grade

- Qualité agricole

- Qualité du caoutchouc

- Qualité industrielle

- Qualité pharmaceutique

- Qualité alimentaire

- Autres

Sur la base de la qualité, le marché du soufre en poudre Asie-Pacifique est segmenté en qualité agricole, qualité caoutchouc, qualité industrielle, qualité pharmaceutique, qualité alimentaire et autres.

Produit

- Poudre de soufre remplie d'huile

- Poudre de soufre non remplie d'huile

Sur la base du produit, le marché du soufre en poudre Asie-Pacifique est segmenté en soufre en poudre rempli d'huile et en soufre en poudre non rempli d'huile.

Finesse

- 200 mailles

- 300 mailles

- Maille 325

- 400 mailles

- 500 mailles

- Autres

Sur la base de la finesse, le marché du soufre en poudre Asie-Pacifique est segmenté en 200 mesh, 300 mesh, 325 mesh, 400 mesh, 500 mesh et autres.

Analyse/perspectives régionales du marché du soufre en poudre en Asie-Pacifique

Le marché du soufre en poudre de la région Asie-Pacifique est segmenté en trois segments notables en fonction de la qualité, du produit et de la finesse.

Les pays couverts dans ce rapport de marché sont la Chine, le Japon, l'Inde, la Corée du Sud, l'Australie et la Nouvelle-Zélande, la Thaïlande, Singapour, les Philippines, la Malaisie, l'Indonésie et le reste de l'Asie-Pacifique.

La Chine devrait dominer le marché du soufre en poudre en Asie-Pacifique en raison de la demande croissante de soufre en poudre dans le secteur agricole.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques régionales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du soufre en poudre en Asie-Pacifique

Le paysage concurrentiel du marché du soufre en poudre en Asie-Pacifique fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications et la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Certains des principaux acteurs du marché opérant sur le marché du soufre en poudre en Asie-Pacifique sont Grupa Azoty, Kaycee Chem Industries, MK CHEMICAL INDUSTRIES, Jordan Sulphur, Golden Chemicals, Sulphur., JK Industries, Solar Chemferts Pvt Ltd, American Elements, JAINSON CHEMICALS et Jaishil Sulphur & Chemical Industries, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 IMPORT-EXPORT SCENARIO

4.5 PRICE ANALYSIS

4.6 PRODUCTION CONSUMPTION ANALYSIS

4.7 PRODUCTION CAPACITY OVERVIEW

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTICS COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.1 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 POSITIVE OUTLOOK TOWARDS AGRICULTURE INDUSTRY

6.1.2 FAVORABLE SCENARIO IN THE AUTOMOTIVE SECTOR

6.1.3 GAINING ACCEPTANCE AS A DERMATOLOGICAL INGREDIENT IN PHARMA SECTOR

6.2 RESTRAINTS

6.2.1 CREDIBLE THREAT OF SUBSTITUTES IN SOME OF THE APPLICATION SEGMENTS

6.2.2 HAZARDOUS ISSUES ASSOCIATED WITH THE CHEMICAL NATURE OF POWDERED SULFUR

6.3 OPPORTUNITIES

6.3.1 SUPPORTIVE OUTLOOK TOWARD CHEMICAL PROCESSING AROUND THE GLOBE

6.3.2 RISING R&D SPENDING IN EV AND RENEWABLE ENERGY SEGMENTS

6.4 CHALLENGES

6.4.1 IMPLEMENTATION OF RULES AND REGULATIONS AIMED AT PREVENTING THE USAGE OF CHEMICAL USAGE

6.4.2 FLUCTUATING DEMAND-SUPPLY DYNAMICS OF SULFUR

7 ASIA PACIFIC POWDER SULFUR MARKET, BY REGION

7.1 ASIA-PACIFIC

7.1.1 CHINA

7.1.2 INDIA

7.1.3 INDONESIA

7.1.4 JAPAN

7.1.5 SOUTH KOREA

7.1.6 THAILAND

7.1.7 MALAYSIA

7.1.8 AUSTRALIA & NEW ZEALAND

7.1.9 SINGAPORE

7.1.10 PHILIPPINES

7.1.11 REST OF ASIA-PACIFIC

8 ASIA PACIFIC POWDER SULFUR MARKET: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

9 COMPANY PROFILES

9.1 GRUPA AZOTY

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 SWOT ANALYSIS

9.1.4 COMPANY SHARE ANALYSIS

9.1.5 PRODUCT PORTFOLIO

9.1.6 RECENT DEVELOPMENTS

9.2 JAISHIL SULPHUR & CHEMICAL INDUSTRIES

9.2.1 COMPANY SNAPSHOT

9.2.2 SWOT

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 RECENT DEVELOPMENTS

9.3 JAINSON CHEMICALS

9.3.1 COMPANY SNAPSHOT

9.3.2 SWOT

9.3.3 COMPANY SHARE ANALYSIS

9.3.4 PRODUCT PORTFOLIO

9.3.5 RECENT DEVELOPMENTS

9.4 AMERICAN ELEMENTS

9.4.1 COMPANY SNAPSHOT

9.4.2 SWOT ANALYSIS

9.4.3 COMPANY SHARE ANALYSIS

9.4.4 PRODUCT PORTFOLIO

9.4.5 RECENT DEVELOPMENTS

9.5 SOLAR CHEMFERTS PVT LTD

9.5.1 COMPANY SNAPSHOT

9.5.2 SWOT ANALYSIS

9.5.3 COMPANY SHARE ANALYSIS

9.5.4 PRODUCT PORTFOLIO

9.5.5 RECENT DEVELOPMENTS

9.6 GOLDEN CHEMICALS

9.6.1 COMPANY SNAPSHOT

9.6.2 SWOT

9.6.3 PRODUCT PORTFOLIO

9.6.4 RECENT DEVELOPMENTS

9.7 J K INDUSTRIES

9.7.1 COMPANY SNAPSHOT

9.7.2 SWOT

9.7.3 PRODUCT PORTFOLIO

9.7.4 RECENT DEVELOPMENTS

9.8 JORDAN SULPHUR

9.8.1 COMPANY SNAPSHOT

9.8.2 SWOT ANALYSIS

9.8.3 PRODUCT PORTFOLIO

9.8.4 RECENT DEVELOPMENT

9.9 KAYCEE CHEM INDUSTRIES

9.9.1 COMPANY SNAPSHOT

9.9.2 SWOT

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENTS

9.1 M. K. CHEMICAL INDUSTRIES

9.10.1 COMPANY SNAPSHOT

9.10.2 SWOT

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENTS

9.11 SULPHUR.

9.11.1 COMPANY SNAPSHOT

9.11.2 SWOT ANALYSIS

9.11.3 PRODUCT PORTFOLIO

9.11.4 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY COVERAGE

TABLE 2 ASIA-PACIFIC POWDER SULFUR MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC POWDER SULFUR MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 4 ASIA-PACIFIC POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 6 ASIA-PACIFIC AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 15 ASIA-PACIFIC POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 17 CHINA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 18 CHINA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 19 CHINA AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 20 CHINA RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 21 CHINA RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 CHINA INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 23 CHINA PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 24 CHINA FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 25 CHINA OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 26 CHINA POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 27 CHINA POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 28 CHINA POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 29 CHINA POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 30 INDIA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 31 INDIA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 32 INDIA AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 33 INDIA RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 34 INDIA RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 INDIA INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 36 INDIA PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 37 INDIA FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 38 INDIA OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 39 INDIA POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 40 INDIA POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 41 INDIA POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 42 INDIA POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 43 INDONESIA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 44 INDONESIA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 45 INDONESIA AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 46 INDONESIA RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 47 INDONESIA RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 INDONESIA INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 49 INDONESIA PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 50 INDONESIA FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 51 INDONESIA OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 52 INDONESIA POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 53 INDONESIA POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 54 INDONESIA POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 55 INDONESIA POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 56 JAPAN POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 57 JAPAN POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 58 JAPAN AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 59 JAPAN RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 60 JAPAN RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 JAPAN INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 62 JAPAN PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 63 JAPAN FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 64 JAPAN OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 65 JAPAN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 66 JAPAN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 67 JAPAN POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 68 JAPAN POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 69 SOUTH KOREA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 70 SOUTH KOREA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 71 SOUTH KOREA AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 72 SOUTH KOREA RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 73 SOUTH KOREA RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 SOUTH KOREA INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 75 SOUTH KOREA PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 76 SOUTH KOREA FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 77 SOUTH KOREA OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 78 SOUTH KOREA POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 79 SOUTH KOREA POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 80 SOUTH KOREA POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 81 SOUTH KOREA POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 82 THAILAND POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 83 THAILAND POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 84 THAILAND AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 85 THAILAND RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 86 THAILAND RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 THAILAND INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 88 THAILAND PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 89 THAILAND FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 90 THAILAND OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 91 THAILAND POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 92 THAILAND POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 93 THAILAND POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 94 THAILAND POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 95 MALAYSIA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 96 MALAYSIA POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 97 MALAYSIA AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 98 MALAYSIA RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 99 MALAYSIA RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 MALAYSIA INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 101 MALAYSIA PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 102 MALAYSIA FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 103 MALAYSIA OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 104 MALAYSIA POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 105 MALAYSIA POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 106 MALAYSIA POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 107 MALAYSIA POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 108 AUSTRALIA & NEW ZEALAND POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 109 AUSTRALIA & NEW ZEALAND POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 110 AUSTRALIA & NEW ZEALAND AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 111 AUSTRALIA & NEW ZEALAND RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 112 AUSTRALIA & NEW ZEALAND RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 AUSTRALIA & NEW ZEALAND INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 114 AUSTRALIA & NEW ZEALAND PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 115 AUSTRALIA & NEW ZEALAND FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 116 AUSTRALIA & NEW ZEALAND OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 117 AUSTRALIA & NEW ZEALAND POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 118 AUSTRALIA & NEW ZEALAND POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 119 AUSTRALIA & NEW ZEALAND POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 120 AUSTRALIA & NEW ZEALAND POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 121 SINGAPORE POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 122 SINGAPORE POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 123 SINGAPORE AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 124 SINGAPORE RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 125 SINGAPORE RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 SINGAPORE INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 127 SINGAPORE PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 128 SINGAPORE FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 129 SINGAPORE OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 130 SINGAPORE POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 131 SINGAPORE POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 132 SINGAPORE POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 133 SINGAPORE POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 134 PHILIPPINES POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 135 PHILIPPINES POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 136 PHILIPPINES AGRICULTURAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 137 PHILIPPINES RUBBER GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 138 PHILIPPINES RUBBER GRADE IN POWDER SULFUR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 139 PHILIPPINES INDUSTRIAL GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 140 PHILIPPINES PHARMA GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 141 PHILIPPINES FOOD GRADE IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 142 PHILIPPINES OTHERS IN POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 143 PHILIPPINES POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 144 PHILIPPINES POWDER SULFUR MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 145 PHILIPPINES POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (USD THOUSAND)

TABLE 146 PHILIPPINES POWDER SULFUR MARKET, BY FINENESS, 2021-2030 (TONS)

TABLE 147 REST OF ASIA-PACIFIC POWDER SULFUR MARKET, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 148 REST OF ASIA-PACIFIC POWDER SULFUR MARKET, BY GRADE, 2021-2030 (TONS)

Liste des figures

FIGURE 1 ASIA PACIFIC POWDER SULFUR MARKET

FIGURE 2 ASIA PACIFIC POWDER SULFUR MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC POWDER SULFUR MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC POWDER SULFUR MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC POWDER SULFUR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC POWDER SULFUR MARKET: THE PRODUCT LIFELINE CURVE

FIGURE 7 ASIA PACIFIC POWDER SULFUR MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC POWDER SULFUR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC POWDER SULFUR MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC POWDER SULFUR MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 ASIA PACIFIC POWDER SULFUR MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 ASIA PACIFIC POWDER SULFUR MARKET: SEGMENTATION

FIGURE 13 A POSITIVE OUTLOOK TOWARDS THE BUILDING AND CONSTRUCTION SECTOR IS EXPECTED TO DRIVE THE ASIA PACIFIC POWDER SULFUR MARKET IN THE FORECAST PERIOD

FIGURE 14 THE AGRICULTURAL GRADE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC POWDER SULFUR MARKET IN 2023 AND 2030

FIGURE 15 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 16 PRICE ANALYSIS FOR ASIA PACIFIC POWDER SULFUR MARKET (USD/TON)

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC SULFUR POWDER MARKET

FIGURE 19 ASIA-PACIFIC POWDER SULFUR MARKET: SNAPSHOT (2022)

FIGURE 20 ASIA-PACIFIC POWDER SULFUR MARKET: BY COUNTRY (2022)

FIGURE 21 ASIA-PACIFIC POWDER SULFUR MARKET: BY COUNTRY (2023 & 2030)

FIGURE 22 ASIA-PACIFIC POWDER SULFUR MARKET: BY COUNTRY (2022 & 2030)

FIGURE 23 ASIA-PACIFIC POWDER SULFUR MARKET: BY GRADE (2023 - 2030)

FIGURE 24 ASIA PACIFIC POWDER SULFUR MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.