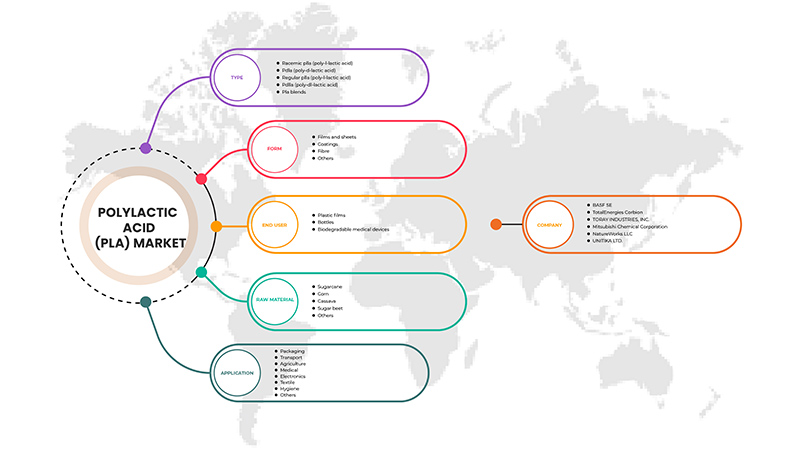

Marché de l'acide polylactique (PLA) en Asie-Pacifique, par type (PLLA racémique (acide poly-L-lactique), PLLA ordinaire ( acide poly-L-lactique ), PDLA (acide poly-D-lactique) et PDLLA (acide poly-Dl-lactique)), matière première (maïs, manioc, canne à sucre, betterave sucrière et autres), forme (films et feuilles, revêtements, fibres, autres), application (emballage, transport, agriculture, médical, électronique, textile, hygiène, autres), utilisateur final (films plastiques, bouteilles, dispositifs médicaux biodégradables) - Tendances et prévisions jusqu'en 2029.

Analyse et perspectives du marché de l'acide polylactique (PLA) en Asie-Pacifique

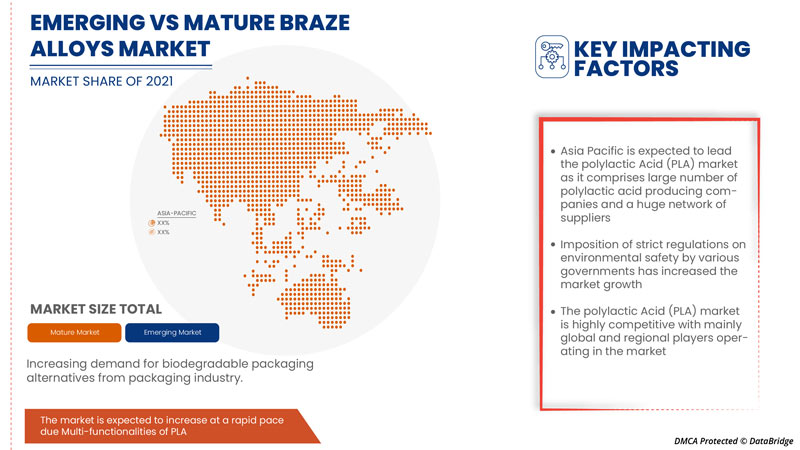

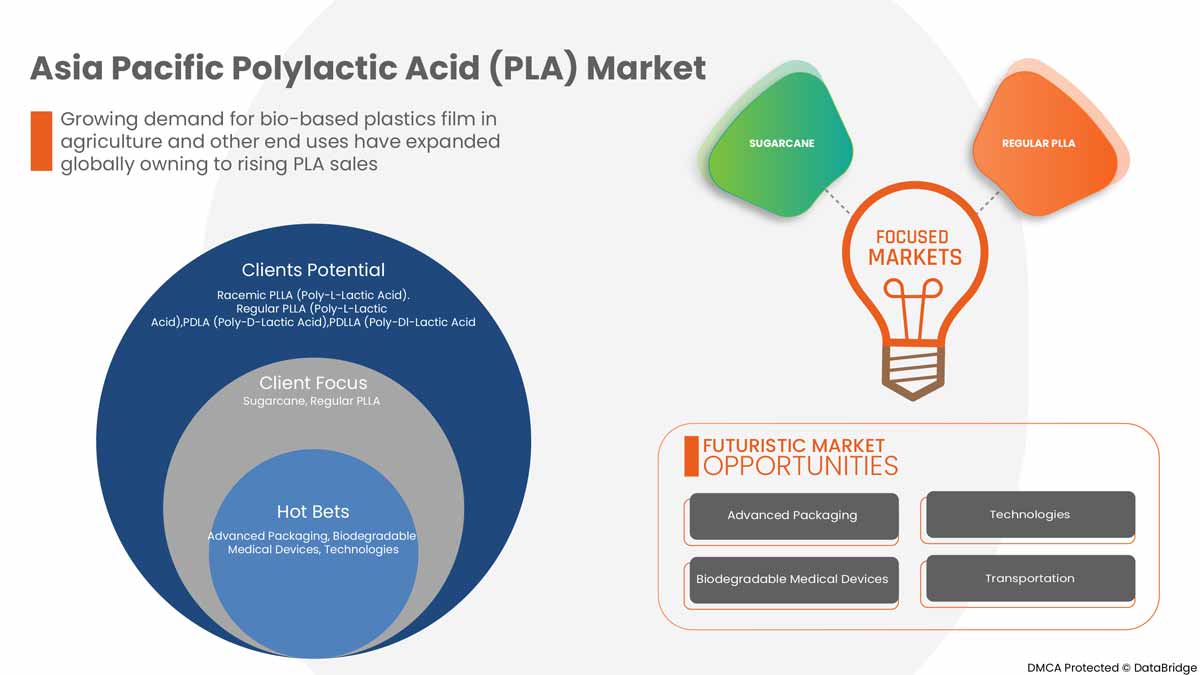

Français Le marché de l'acide polylactique (PLA) en Asie-Pacifique devrait croître de manière significative au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 12,1 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 1 136 475,79 milliers de dollars d'ici 2029. Le principal facteur à l'origine de la croissance du marché de l'acide polylactique (PLA) est la demande croissante d'emballages multicouches pour empêcher la perméation de l'oxygène et de l'eau, la demande croissante d'alternatives d'emballage biodégradables de la part de l'industrie de l'emballage, le PLA peut être une alternative aux polymères à base de pétrole, la demande croissante de films plastiques biosourcés dans l'agriculture, l'imposition de réglementations strictes sur la sécurité environnementale par divers gouvernements.

L'acide polylactique (PLA) est un type de plastique renouvelable principalement dérivé de matières renouvelables comme l'amidon de maïs et la canne à sucre. L'acide polylactique (PLA) possède plusieurs propriétés mécaniques avantageuses par rapport aux autres polymères biodégradables . L'acide polylactique (PLA) est un polymère aliphatique thermoplastique, et ce bioplastique est produit à partir de la cristallisation de l'acide lactique . Ayant une formule chimique (C3H4O2) n, l'acide polylactique (PLA) est un polymère hydrophobe semi-cristallin et biodégradable. L'acide polylactique (PLA) peut être décomposé en une gamme de composants biodégradables, ce qui le rend idéal pour une application dans un large éventail d'applications.

Le rapport sur le marché de l'acide polylactique (PLA) en Asie-Pacifique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volume en kilotonnes |

|

Segments couverts |

Par type (PLLA racémique (acide poly-L-lactique), PLLA ordinaire (acide poly-L-lactique), PDLA (acide poly-D-lactique) et PDLLA (acide poly-Dl-lactique)), matière première (maïs, manioc, canne à sucre, betterave sucrière et autres), forme (films et feuilles, revêtements, fibres, autres), application (emballage, transport, agriculture, médecine, électronique, textile, hygiène, autres), utilisateur final (films plastiques, bouteilles, dispositifs médicaux biodégradables) |

|

Pays couverts |

Japon, Chine, Corée du Sud, Inde, Singapour, Thaïlande, Indonésie, Malaisie, Philippines, Australie et reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Français BASF SE, Futerro, NatureWorks LLC, TotalEnergies Corbion, Sulzer Ltd, Mitsubishi Chemical Corporation, TORAY INDUSTRIES, INC., Merck KGaA, Musashino Chemical Laboratory, Ltd., Evonik Industries AG, Polyvel Inc., UNITIKA LTD., Jiangxi Academy of Sciences Biological New Materials Co., Ltd., Shanghai Tong-jie-liang Biomaterials Co., Ltd., Zhejiang Hisun Biomaterials Co., Ltd., et Radici Partecipazioni SpA. |

Définition du marché

La demande croissante d'alternatives d'emballage biodégradables de la part de l'industrie de l'emballage est un moteur important pour le marché de l'acide polylactique (PLA) en Asie-Pacifique. Le PLA peut être une alternative aux polymères à base de pétrole. La demande croissante de films plastiques biosourcés dans l'agriculture devrait stimuler la croissance du marché de l'acide polylactique (PLA) en Asie-Pacifique. Les multifonctionnalités du PLA et l'inclination croissante des consommateurs pour les produits en plastique respectueux de l'environnement sont reconnues comme offrant des opportunités au marché de l'acide polylactique (PLA) en Asie-Pacifique. Cependant, les problèmes de performances médiocres par rapport au plastique conventionnel remettent en cause la croissance du marché de l'acide polylactique (PLA) en Asie-Pacifique.

Dynamique du marché de l'acide polylactique (PLA) en Asie-Pacifique

Conducteurs

- Demande croissante d'alternatives d'emballage biodégradables de la part de l'industrie de l'emballage

La pandémie a eu un impact positif sur la croissance de l'industrie de l'emballage. Elle a entraîné une forte demande d'emballages en plastique, notamment de substituts écologiques aux plastiques tels que les matériaux d'emballage en PLA. Les fabricants de produits alimentaires, qui avaient initialement opté pour d'autres types d'emballages, ont commencé à utiliser des emballages à base de PLA, car les produits sont économiques, sûrs et durables. De plus, en raison de l'augmentation de la durabilité dans l'industrie de l'emballage pour maintenir la qualité des produits, les matériaux d'emballage en biopolymères tels que les matériaux à base de PLA augmentent, car le PLA se décompose en eau et en dioxyde de carbone en environ 47 à 90 jours. Quatre fois plus vite que les sacs à base de PET utilisés dans divers emballages. De plus, leur faible coût, leurs matières premières renouvelables et leur utilisation de déchets agro-industriels stimulent leur demande, car l'acide polylactique est obtenu à partir de sources renouvelables.

- Le PLA peut être une alternative aux polymères à base de pétrole

En outre, l'acide polylactique est utilisé dans la fabrication de divers composants utilisés dans le secteur automobile. Les acides polylactiques sont utilisés dans des applications telles que les pièces intérieures et les composants sous le capot. Ces produits sont connus pour réduire leur empreinte carbone en raison de leur teneur élevée en bio. L'utilisation du PLA offre de nombreuses propriétés telles que la résistance aux UV, la résistance aux chocs, une brillance élevée, une stabilité dimensionnelle et une capacité de coloration. Ces facteurs en font une alternative à la plupart des plastiques traditionnels composés de produits pétroliers et de matières premières telles que le polyéthylène téréphtalate, le polycarbonate, le polybutylène téréphtalate et l'acrylonitrile butadiène styrène, ainsi que le polyamide, qui sont préférés pour les compartiments et intérieurs de moteurs automobiles et d'autres utilisations également.

- Demande croissante de films plastiques biosourcés dans l'agriculture

Avec la prise de conscience croissante des problèmes d'élimination des films non dégradables, les applications des films de paillage à base d'acide polylactique devraient augmenter dans l'agriculture. Les films de paillage sont largement utilisés dans la culture des fruits et légumes. Les propriétés mécaniques du PLA sont comparables à celles des films de paillage existants et présentent l'avantage d'être entièrement biodégradables en une seule saison de croissance. Cela aura un impact positif sur la croissance du marché et agira comme un moteur pour le marché de l'acide polylactique (PLA) en Asie-Pacifique.

- Imposition de réglementations strictes en matière de sécurité environnementale par divers gouvernements

En raison des préoccupations environnementales et des facteurs de changement climatique rapide, les autorités réglementaires, telles que l'EPA, la FDA et bien d'autres, optent de plus en plus pour des plastiques biodégradables tels que l'acide polylactique (PLA) et se concentrent sur la sensibilisation accrue des consommateurs concernant la nécessité d'utiliser des produits biodégradables.

Opportunités

- Multifonctionnalités du PLA

Français Les multifonctions et l'utilisation extensive du PLA dans différentes industries et applications offriront des opportunités lucratives de croissance sur le marché de l'acide polylactique (PLA) en Asie-Pacifique. Bas L'acide polylactique est biodégradable et compostable industriellement. Parmi les premiers polymères renouvelables, nous pouvons rivaliser avec les polymères existants, en combinant leurs caractéristiques fonctionnelles, telles que la transparence, la brillance et la rigidité. L'acide polylactique est actuellement utilisé dans de nombreuses industries et applications, notamment l'emballage, la vaisselle à usage unique, les textiles, le pétrole et le gaz, l'électronique, l'automobile et l'impression 3D. En raison des utilisations diverses et polyvalentes de l'acide polylactique dans de multiples industries et des multifonctions des acides polylactiques, le marché devrait connaître des opportunités de croissance importantes dans un avenir proche.

- Inclination croissante des consommateurs vers des produits en plastique respectueux de l'environnement

En outre, la richesse de la biomasse, les ressources issues de la recherche, la forte demande industrielle en aval, l’approvisionnement en matériaux et le soutien des politiques gouvernementales ont créé d’importantes opportunités commerciales pour les bioplastiques dans ces régions. La croissance a également été soutenue par une meilleure sensibilisation des consommateurs aux solutions plastiques durables et par des efforts accrus pour éliminer l’utilisation de plastiques conventionnels non biodégradables comme le PLA. Les plastiques à base de pétrole traditionnellement utilisés mettent des décennies à se décomposer ou à se dégrader et restent longtemps dans les décharges. Le PLA se décompose plus rapidement lorsqu’il est jeté et réabsorbé dans le système naturel. De plus, le taux de décomposition des plastiques biodégradables tels que le PLA par les activités des micro-organismes est beaucoup plus rapide que celui des plastiques traditionnels.

Contraintes/Défis

- Préoccupations concernant le coût et le système spécifique de compostage industriel

L'utilisation d'acides polylactiques dans les petites et moyennes entreprises est difficile en raison du manque de ressources ou de la technologie et des installations nécessaires à l'extraction et à la fermentation d'acide lactique et d'acide polylactique de haute qualité. De plus, la sélection de la bonne composition d'acide polylactique est un aspect clé que de nombreuses entreprises n'ont pas compris avec précision. Cela augmente le coût de production de l'acide polylactique en raison d'un manque de technologie et de techniques appropriées. La sélection de la bonne composition d'acide lactique pour la production d'acide polylactique est une méthode complexe qui nécessite une validation à l'échelle du laboratoire et de l'usine.

- Des prix des matières premières imprévisibles

Les coûts de production de l'acide polylactique et des produits connexes connaissent une augmentation significative en raison des coûts plus élevés des matières premières ainsi que du transport, de l'énergie consommée et des produits chimiques, ce qui réduit les marges des fabricants, des distributeurs et des fournisseurs. Cela entraîne des prix d'application élevés pour l'utilisateur final.

- Problèmes de performances médiocres par rapport au plastique conventionnel

Les faibles propriétés de barrière à l'air, à l'eau et à l'oxygène et la faible résistance à la chaleur sont quelques-uns des principaux problèmes de performance liés au PLA par rapport aux plastiques conventionnels. Cela limite sa pénétration dans diverses industries, notamment l'électronique et l'automobile. De plus, les mauvaises propriétés mécaniques telles que la faible résistance aux chocs et à la traction et les capacités de traitement limitent la pénétration du PLA dans diverses applications. Ces limitations de performance du PLA constituent un défi majeur pour la croissance du marché. De plus, le PLA est un polymère biosourcé et biodégradable construit à partir de molécules d'acide lactique. Étant un polyester thermoplastique, il se ramollit lorsqu'il est chauffé et durcit lorsqu'il est refroidi.

Développement récent

En juin 2022, le fabricant australien d'emballages alimentaires Confoil et BASF se sont associés pour développer une barquette alimentaire certifiée compostable et pouvant aller au four à double paroi à base de papier. L'intérieur de la barquette en papier est recouvert d'ecovio PS 1606 de BASF, un biopolymère partiellement biosourcé et certifié compostable spécialement développé pour le revêtement des emballages alimentaires en papier ou en carton. Ce partenariat intensifiera les opérations de l'entreprise sur le marché de la région Asie-Pacifique.

Portée du marché de l'acide polylactique (PLA) en Asie-Pacifique

Le marché de l'acide polylactique (PLA) en Asie-Pacifique est classé en fonction du type, de la matière première, de la forme, de l'application et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- PLLA racémique (acide poly-l-lactique)

- PDLA (acide poly-D-lactique)

- PLLA régulier (acide poly-l-lactique)

- PDLLA (acide poly-dl-lactique)

- Mélanges PLA

En fonction du type, le marché de l'acide polylactique (PLA) Asie-Pacifique est classé en cinq segments, à savoir le PLLA racémique (acide poly-l-lactique), le PDLA (acide poly-d-lactique), le PLLA ordinaire (acide poly-l-lactique), le PDLLA (acide poly-dl-lactique) et les mélanges de PLA.

Matière première

- Canne à sucre

- Maïs

- Manioc

- Betterave à sucre

- Autres

Sur la base des matières premières, le marché de l'acide polylactique (PLA) de la région Asie-Pacifique est classé en canne à sucre, maïs, manioc, betterave sucrière et autres.

Formulaire

- Films et feuilles

- Revêtements

- Fibre

- Autres

En fonction de la forme, le marché de l'acide polylactique (PLA) de la région Asie-Pacifique est classé en films et feuilles, revêtements, fibres et autres.

Application

- Conditionnement

- Transport

- Agriculture

- Médical

- Électronique

- Textile

- Hygiène

- Autres

En fonction des applications, le marché de l'acide polylactique (PLA) de l'Asie-Pacifique est segmenté en emballage, transport, agriculture, médecine, électronique, textile, hygiène et autres.

Utilisateur final

- Films plastiques

- Bouteilles

- Dispositifs médicaux biodégradables

En fonction de l’utilisateur final, le marché de l’acide polylactique (PLA) de la région Asie-Pacifique est classé en films plastiques, bouteilles et dispositifs médicaux biodégradables.

Analyse/perspectives régionales du marché de l'acide polylactique (PLA) en Asie-Pacifique

Le marché de l’acide polylactique (PLA) en Asie-Pacifique est segmenté en fonction du type, de la matière première, de la forme, de l’application et de l’utilisateur final.

Les pays du marché de l'acide polylactique (PLA) en Asie-Pacifique sont le Japon, la Chine, la Corée du Sud, l'Inde, Singapour, la Thaïlande, l'Indonésie, la Malaisie, les Philippines, l'Australie et le reste de l'Asie-Pacifique. La Chine domine le marché de l'acide polylactique (PLA) en Asie-Pacifique en termes de part de marché et de chiffre d'affaires en raison de la préférence croissante des consommateurs pour les solutions d'emballage en film PLA dans la région.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données par pays.

Analyse du paysage concurrentiel et des parts de marché de l'acide polylactique (PLA) en Asie-Pacifique

Le paysage concurrentiel du marché de l'acide polylactique (PLA) en Asie-Pacifique fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché de l'acide polylactique (PLA) en Asie-Pacifique.

Français Certains des principaux acteurs opérant sur le marché de l'acide polylactique (PLA) en Asie-Pacifique sont BASF SE, Futerro, NatureWorks LLC, TotalEnergies Corbion, Sulzer Ltd, Mitsubishi Chemical Corporation, TORAY INDUSTRIES, INC., Merck KGaA, Musashino Chemical Laboratory, Ltd., Evonik Industries AG, Polyvel Inc., UNITIKA LTD., Jiangxi Academy of Sciences Biological New Materials Co., Ltd., Shanghai Tong-jie-liang Biomaterials Co., Ltd., Zhejiang Hisun Biomaterials Co., Ltd. et Radici Partecipazioni SpA.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent des grilles de positionnement des fournisseurs, une analyse de la chronologie du marché, un aperçu et un guide du marché, des grilles de positionnement des entreprises, une analyse des parts de marché des entreprises, des normes de mesure, une analyse des parts de marché Asie-Pacifique par rapport aux régions et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT'S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 LEGAL FRAMEWORK

4.3 PESTLE ANALYSIS

4.3.1 POLITICAL FACTORS

4.3.2 ECONOMIC FACTORS

4.3.3 SOCIAL FACTORS

4.3.4 TECHNOLOGICAL FACTORS

4.3.5 LEGAL FACTORS

4.3.6 ENVIRONMENTAL FACTORS

4.4 PORTER’S FIVE FORCES

4.4.1 THREAT OF NEW ENTRANTS

4.4.2 THREAT OF SUBSTITUTES

4.4.3 CUSTOMER BARGAINING POWER

4.4.4 SUPPLIER BARGAINING POWER

4.4.5 INTERNAL COMPETITION (RIVALRY)

4.5 RAW MATERIAL PRODUCTION COVERAGE

4.6 REGULATORY COVERAGE

4.7 RUSSIA AND UKRAINE CONFLICT ANALYSIS – ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET

4.8 TECHNOLOGY ADVANCEMENT

4.8.1 SORONA FIBERS FROM DUPONT:

4.8.2 DEVELOPMENT AND DEPLOYMENT OF NOVEL SEPARATIONS TECHNOLOGIES

4.8.3 SULZER TECHNOLOGY TURNKEY PROJECTS WITH SUGAR:

4.9 VENDOR SELECTION CRITERIA

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 RAW MATERIAL PROCUREMENT

4.10.2 MANUFACTURING AND PACKING

4.10.3 MARKETING AND DISTRIBUTION

4.10.4 END USERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR BIODEGRADABLE PACKAGING ALTERNATIVES FROM THE PACKAGING INDUSTRY

5.1.2 PLA CAN BE AN ALTERNATIVE TO PETROLEUM-BASED POLYMERS

5.1.3 GROWING DEMAND FOR BIO-BASED PLASTICS FILM IN AGRICULTURE

5.1.4 IMPOSITION OF STRICT REGULATIONS ON ENVIRONMENTAL SAFETY BY VARIOUS GOVERNMENTS

5.2 RESTRAINTS

5.2.1 CONCERNS OVER COST AND SPECIFIC INDUSTRIAL COMPOSTING SYSTEM

5.2.2 UNPREDICTABLE RAW MATERIAL PRICES

5.3 OPPORTUNITIES

5.3.1 MULTI-FUNCTIONALITIES OF PLA

5.3.2 GROWING CONSUMER INCLINATION TOWARDS ECO-FRIENDLY PLASTIC PRODUCT

5.4 CHALLENGES

5.4.1 POOR PERFORMANCE ISSUES AS COMPARED TO CONVENTIONAL PLASTIC

6 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET, TYPE

6.1 OVERVIEW

6.2 RACEMIC PLLA (POLY-L-LACTIC ACID)

6.3 PDLA (POLY-D-LACTIC ACID)

6.4 REGULAR PLLA (POLY-L-LACTIC ACID)

6.5 PDLLA (POLY-DL-LACTIC ACID)

6.6 PLA BLENDS

7 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 SUGARCANE

7.3 CORN

7.4 CASSAVA

7.5 SUGAR BEET

7.6 OTHERS

8 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET, BY FORM

8.1 OVERVIEW

8.2 FILMS AND SHEETS

8.3 COATINGS

8.4 FIBER

8.5 OTHERS

9 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET, APPLICATION

9.1 OVERVIEW

9.2 PACKAGING

9.2.1 FLEXIBLE FILMS FOR FOOD APPLICATIONS

9.2.2 LIGHT CARRIER BAGS/FRUITS & VEGETABLE BAGS/TRASH LINERS

9.2.3 CLING FILMS

9.2.4 INDUSTRIAL FILMS: STRETCH FILMS

9.2.5 RIGID APPLICATIONS

9.2.5.1 CUTLERY

9.2.5.2 TRAY

9.2.5.3 POTS

9.2.5.4 PODS

9.3 TRANSPORT

9.4 AGRICULTURE

9.4.1 MULCHING FILM

9.4.2 HORTICULTURAL POTS

9.4.3 CLIPS

9.5 MEDICAL

9.6 ELECTRONICS

9.7 TEXTILE

9.8 HYGIENE

9.8.1 NON-WOVEN FIBERS

9.8.2 DIAPERS

9.8.3 FILTERS

9.9 OTHERS

10 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET, END USER

10.1 OVERVIEW

10.2 PLASTIC FILMS

10.3 BOTTLES

10.4 BIODEGRADABLE MEDICAL DEVICES

10.4.1 SCREWS

10.4.2 PINS

10.4.3 PLATES

10.4.4 RODS

11 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET, BY GEOGRAPHY

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 INDIA

11.1.3 JAPAN

11.1.4 SOUTH KOREA

11.1.5 THAILAND

11.1.6 SINGAPORE

11.1.7 INDONESIA

11.1.8 AUSTRALIA

11.1.9 PHILIPPINES

11.1.10 MALAYSIA

11.1.11 REST OF ASIA-PACIFIC

12 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12.1.1 PARTNERSHIP

12.1.2 PRODUCT LAUNCHES

12.1.3 AWARD

12.1.4 FACILITY EXPANSION

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BASF SE

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATES

14.2 TOTALENERGIES CORBION

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT UPDATES

14.3 TORAY INDUSTRIES, INC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT UPDATES

14.4 MITSUBISHI CHEMICAL CORPORATION

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATES

14.5 NATUREWORKS LLC.

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT UPDATES

14.6 UNITIKA LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT UPDATES

14.7 EVONIK INDUSTRIES AG

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATES

14.8 ZHEJIANG HISUN BIOMATERIALS CO., LTD

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 MERCK KGAA

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT UPDATES

14.1 SULZER LTD

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT UPDATES

14.11 MUSASHINO CHEMICAL LABORATORY, LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATES

14.12 FUTERRO

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 SHANGHAI TONG-JIE-LIANG BIOMATERIALS CO., LTD.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 POLYVEL INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 JIANGXI ACADEMY OF SCIENCES BIOLOGICAL NEW MATERIALS CO., LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 RADICI PARTECIPAZIONI SPA

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF POLYLACTIC ACID, IN PRIMARY FORMS; HS CODE - PRODUCT: 390770 (USD THOUSAND)

TABLE 2 EXPORT DATA OF POLYLACTIC ACID, IN PRIMARY FORMS; HS CODE - PRODUCT: 390770 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 TIME TAKEN FOR GARBAGE TO DECOMPOSE IN THE ENVIRONMENT (2015)

TABLE 5 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 7 ASIA PACIFIC RACEMIC PLLA (POLY-L-LACTIC ACID) IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 ASIA PACIFIC RACEMIC PLLA (POLY-L-LACTIC ACID) IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 9 ASIA PACIFIC PDLA (POLY-D-LACTIC ACID) IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 ASIA PACIFIC PDLA (POLY-D-LACTIC ACID) IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 ASIA PACIFIC REGULAR PLLA (POLY-L-LACTIC ACID) IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC REGULAR PLLA (POLY-L-LACTIC ACID) IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 13 ASIA PACIFIC PDLLA (POLY-DL-LACTIC ACID) IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC PDLLA (POLY-DL-LACTIC ACID) IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 15 ASIA PACIFIC PLA BLENDS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC PLA BLENDS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 17 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC SUGARCANE IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC CORN IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC CASSAVA IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC SUGAR BEET IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC OTHERS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET, FORM, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC FILMS AND SHEETS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC COATINGS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC FIBER IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC OTHERS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA PACIFIC PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 32 ASIA PACIFIC TRANSPORT IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA PACIFIC AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 ASIA PACIFIC AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA PACIFIC MEDICAL IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 ASIA PACIFIC ELECTRONICS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA PACIFIC TEXTILE IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA PACIFIC HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 ASIA PACIFIC HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 ASIA PACIFIC OTHERS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 42 ASIA PACIFIC PLASTIC FILMS IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 ASIA PACIFIC BOTTLES IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 44 ASIA PACIFIC BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 ASIA PACIFIC BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 48 ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 50 ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 59 CHINA POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 CHINA POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 61 CHINA POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 62 CHINA POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 63 CHINA POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 64 CHINA PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 65 CHINA RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 66 CHINA AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 67 CHINA HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 CHINA POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 69 CHINA BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 70 INDIA POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 INDIA POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 72 INDIA POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 73 INDIA POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 74 INDIA POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 75 INDIA PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 76 INDIA RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 77 INDIA AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 78 INDIA HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 INDIA POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 80 INDIA BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 81 JAPAN POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 JAPAN POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 83 JAPAN POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 84 JAPAN POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 85 JAPAN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 86 JAPAN PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 87 JAPAN RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 88 JAPAN AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 89 JAPAN HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 90 JAPAN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 91 JAPAN BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 92 SOUTH KOREA POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 SOUTH KOREA POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 94 SOUTH KOREA POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 95 SOUTH KOREA POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 96 SOUTH KOREA POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 97 SOUTH KOREA PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 98 SOUTH KOREA RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 99 SOUTH KOREA AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 100 SOUTH KOREA HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 101 SOUTH KOREA POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 102 SOUTH KOREA BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 103 THAILAND POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 104 THAILAND POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 105 THAILAND POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 106 THAILAND POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 107 THAILAND POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 108 THAILAND PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 109 THAILAND RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 110 THAILAND AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 111 THAILAND HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 112 THAILAND POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 113 THAILAND BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 114 SINGAPORE POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 SINGAPORE POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 116 SINGAPORE POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 117 SINGAPORE POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 118 SINGAPORE POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 SINGAPORE PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 120 SINGAPORE RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 121 SINGAPORE AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 122 SINGAPORE HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 123 SINGAPORE POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 124 SINGAPORE BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 125 INDONESIA POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 126 INDONESIA POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 127 INDONESIA POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 128 INDONESIA POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 129 INDONESIA POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 INDONESIA PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 131 INDONESIA RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 132 INDONESIA AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 133 INDONESIA HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 134 INDONESIA POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 135 INDONESIA BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 136 AUSTRALIA POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 137 AUSTRALIA POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 138 AUSTRALIA POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 139 AUSTRALIA POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 140 AUSTRALIA POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 141 AUSTRALIA PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 142 AUSTRALIA RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 143 AUSTRALIA AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 144 AUSTRALIA HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 145 AUSTRALIA POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 146 AUSTRALIA BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 147 PHILIPPINES POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 148 PHILIPPINES POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 149 PHILIPPINES POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 150 PHILIPPINES POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 151 PHILIPPINES POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 152 PHILIPPINES PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 153 PHILIPPINES RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 154 PHILIPPINES AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 155 PHILIPPINES HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 156 PHILIPPINES POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 157 PHILIPPINES BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 158 MALAYSIA POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 159 MALAYSIA POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 160 MALAYSIA POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 161 MALAYSIA POLYLACTIC ACID (PLA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 162 MALAYSIA POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 163 MALAYSIA PACKAGING IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 164 MALAYSIA RIGID APPLICATION IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 165 MALAYSIA AGRICULTURE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 166 MALAYSIA HYGIENE IN POLYLACTIC ACID (PLA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 167 MALAYSIA POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 168 MALAYSIA BIODEGRADABLE MEDICAL DEVICES IN POLYLACTIC ACID (PLA) MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 169 REST OF ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 170 REST OF ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2020-2029 (KILO TONS)

Liste des figures

FIGURE 1 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET

FIGURE 2 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET: THE TYPE LIFELINE CURVE

FIGURE 7 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET: SEGMENTATION

FIGURE 14 ASIA PACIFIC IS EXPECTED TO DOMINATE THE ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 GROWING DEMAND FOR BIO-BASED PLASTICS FILM IN AGRICULTURE IS DRIVING ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 RACEMIC PLLA (POLY-L-LACTIC ACID) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET IN 2022 & 2029

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 SUPPLY CHAIN ANALYSIS- ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET

FIGURE 20 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET, BY TYPE, 2021

FIGURE 21 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET, BY RAW MATERIAL, 2021

FIGURE 22 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET,BY FORM, 2021

FIGURE 23 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET, APPLICATION, 2021

FIGURE 24 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET, END USER, 2021

FIGURE 25 ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET: SNAPSHOT (2021)

FIGURE 26 ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET: BY COUNTRY (2021)

FIGURE 27 ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 ASIA-PACIFIC POLYLACTIC ACID (PLA) MARKET: BY TYPE (2022-2029)

FIGURE 30 ASIA PACIFIC POLYLACTIC ACID (PLA) MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.