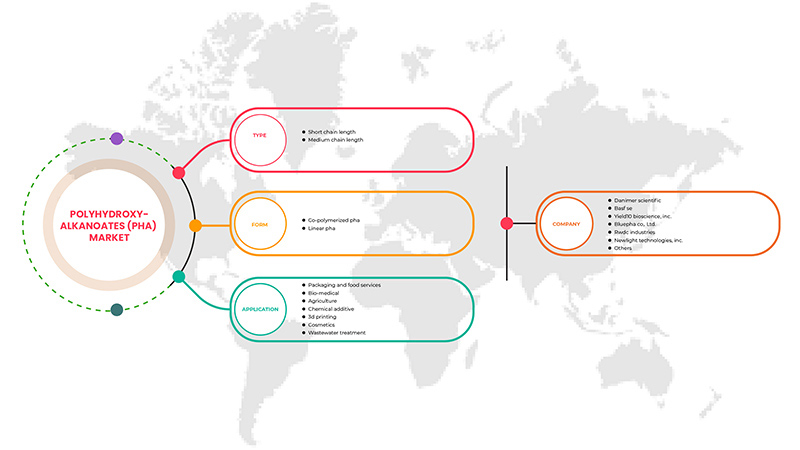

Marché des polyhydroxyalcanoates (PHA) en Asie-Pacifique, par type (chaîne courte et chaîne moyenne), forme (PHA copolymérisé et PHA linéaire), application (emballage et services alimentaires , biomédical, agriculture, traitement des eaux usées , cosmétiques, impression 3D et addiction chimique), tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et perspectives du marché des polyhydroxyalcanoates (PHA) en Asie-Pacifique

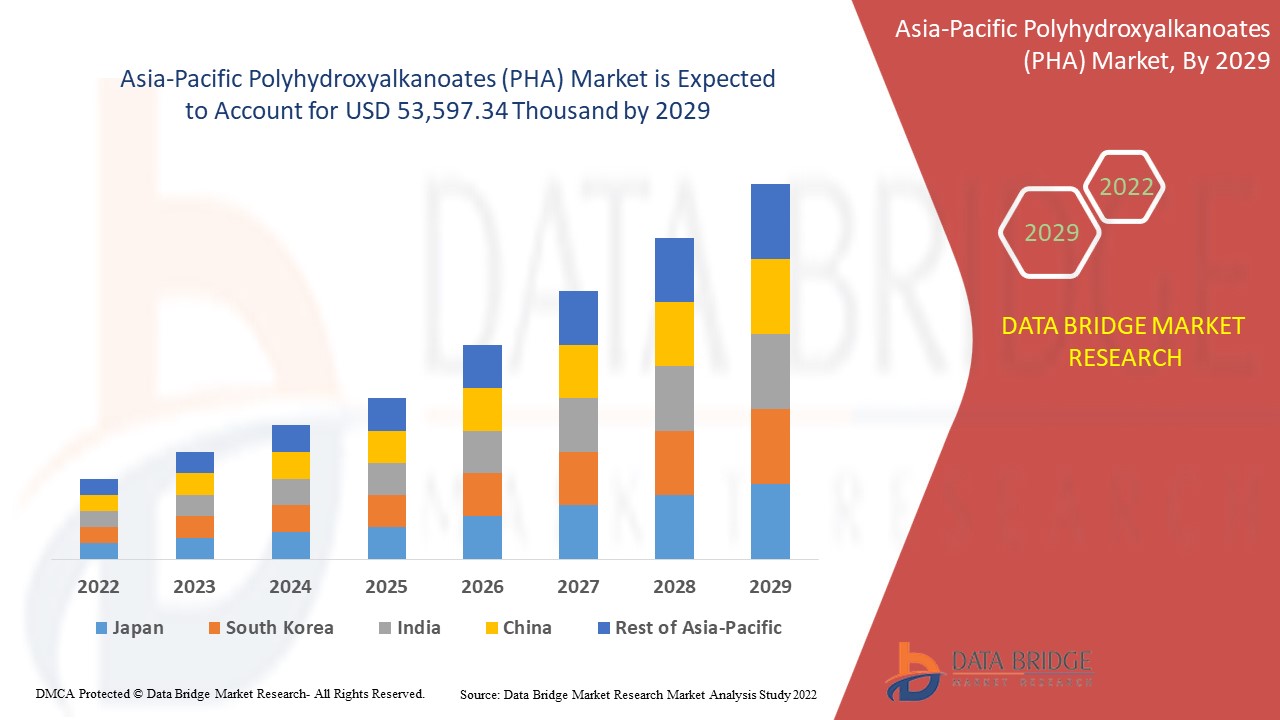

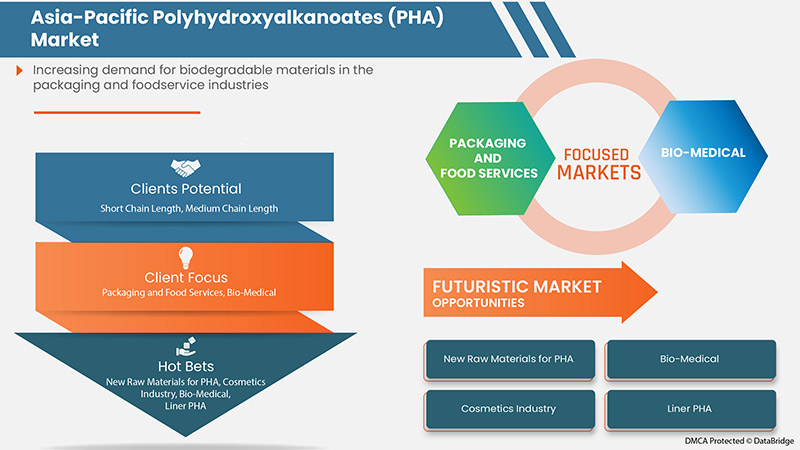

Français Le marché des polyhydroxyalcanoates (PHA) de la région Asie-Pacifique devrait connaître une croissance significative au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 6,0 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 53 597,34 milliers USD d’ici 2029. Le principal facteur à l’origine de la croissance du marché des polyhydroxyalcanoates (PHA) est la demande croissante de matériaux biodégradables dans les secteurs de l’emballage et de la restauration, l’émergence de matières premières nouvelles et rentables pour la production de PHA et les préoccupations croissantes concernant la santé et la sécurité humaines.

Les polyhydroxyalcanoates (PHA) gagnent en importance et en attention dans diverses applications, notamment l'emballage alimentaire et les applications biomédicales, en raison de leur excellente biodégradabilité, de leur biocompatibilité et de leurs propriétés thermiques . Étant donné que les PHA sont non toxiques, inertes et hydrophobes, ces attributs en font des PHA idéaux pour l'usage humain et ne menacent pas la santé et la sécurité humaines.

Le rapport sur le marché des polyhydroxyalcanoates (PHA) en Asie-Pacifique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par type (chaîne courte et chaîne moyenne), forme (PHA copolymérisé et PHA linéaire), application (emballage et services alimentaires, biomédical, agriculture, traitement des eaux usées , cosmétiques, impression 3D et dépendance chimique) |

|

Pays couverts |

Japon, Chine, Corée du Sud, Inde, Singapour, Thaïlande, Indonésie, Malaisie, Philippines, Australie et Nouvelle-Zélande, et le reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

BASF SE, PolyFerm Canada, Bioplastiques à cycle complet, CJ CHEILJEDANG CORP., BIO-ON, Bluepha Co, Ltd, TERRAVERDAE BIOWORKS INC., RWDC Industries, NEWLIGHT TECHNOLOGIES, INC. TianAn Biologic Materials Co, Ltd., Danimer Scientific, YIELD10 BIOSCIENCE, INC. |

Définition du marché

Les polyhydroxyalcanoates (PHA) sont des polymères biodégradables fabriqués par fermentation microbienne du glucose ou du sucre. En d'autres termes, les polyhydroxyalcanoates (PHA) sont produits par de nombreux micro-organismes, notamment par fermentation bactérienne de lipides. En raison de leurs propriétés biodégradables, les polyhydroxyalcanoates (PHA) sont utilisés dans de nombreuses applications industrielles. Les polyhydroxyalcanoates (PHA) servent de source d'énergie et de réserve de carbone lorsqu'ils sont produits à l'aide de bactéries.

Dynamique du marché des polyhydroxyalcanoates (PHA) en Asie-Pacifique

Conducteurs

- Demande croissante de matériaux biodégradables dans les secteurs de l'emballage et de la restauration

Les facteurs de croissance du marché des polyhydroxyalcanoates (PHA) comprennent la demande croissante de matériaux biodégradables dans les secteurs de l'emballage et de la restauration, car ces matériaux atténueront la pollution de l'environnement et soutiendront les initiatives de développement durable. De plus, des facteurs tels que la demande croissante d'emballages alimentaires et la demande croissante de plastiques biodégradables sous diverses formes d'emballage devraient stimuler la demande de polyhydroxyalcanoates (PHA) sous peu.

- Apparition de nouvelles matières premières rentables pour la production de PHA

La demande en polyhydroxyalcanoate (PHA) est principalement motivée par l’abondance de sources de sucre présentes dans la canne à sucre, la betterave, la mélasse et la bagasse, qui peuvent être facilement consommées et converties par des bactéries pour produire du PHA. En outre, la fabrication de plastiques biodégradables peut bénéficier de matières premières dérivées de produits non alimentaires ou de résidus de déchets du monde entier. Cela est dû à la demande mondiale croissante de céréales, notamment de maïs, de blé, d’orge et d’autres céréales pour l’alimentation humaine et animale et les biocarburants. En outre, les ressources brutes non alimentaires telles que les déchets organiques, la biomasse et les plantes mortes devraient améliorer la gestion des déchets.

- Préoccupations croissantes pour la santé et la sécurité humaines

Les fabricants du marché des polyhydroxyalcanoates mélangent les PHA avec d'autres polymères pour offrir de précieuses options d'utilisation humaine. De plus, des méthodes de décomposition thermique telles que la pyrolyse sont utilisées pour décomposer chimiquement les PHA en d'autres substances, notamment des monomères ou des oligomères, par la présence de chaleur et sans nuire à l'environnement.

Opportunités

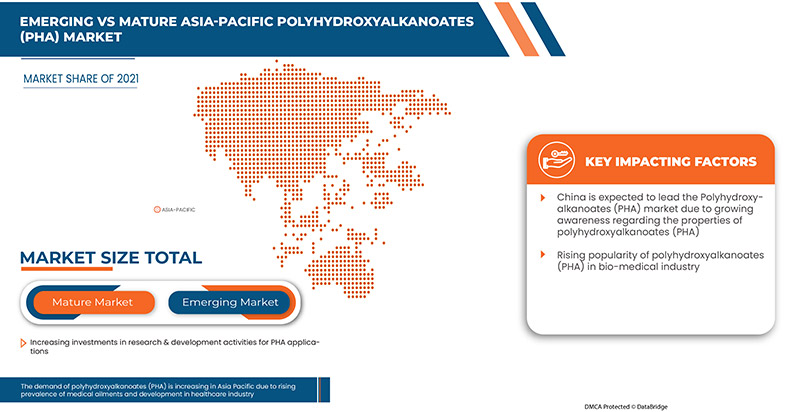

- Augmenter les investissements dans les activités de recherche et développement pour les applications PHA

Les polyhydroxyalcanoates (PHA) sont un groupe diversifié de polyesters biodégradables qui peuvent être synthétisés par des voies biologiques et non biologiques. Les polyhydroxyalcanoates (PHA) sont des composés qui appartiennent à la classe des polyesters fabriqués à partir de ressources renouvelables telles que l'amidon de maïs ou la bagasse de canne à sucre. Avec l'acceptation croissante des PHA dans divers secteurs et segments, les entreprises investissent massivement pour explorer de nouvelles applications pour les PHA, notamment les produits biomédicaux, les peintures et revêtements et les textiles, ce qui devrait offrir des opportunités lucratives pour la croissance du marché des polyhydroxyalcanoates (PHA).

- Réglementations gouvernementales strictes concernant l'utilisation de produits en plastique

La législation gouvernementale stricte contre le plastique à usage unique et les préoccupations croissantes concernant la santé et la sécurité humaines devraient offrir des opportunités de croissance sur le marché des polyhydroxyalcanoates (PHA). Le besoin de produits respectueux de l'environnement stimule l'innovation dans l'industrie des bioplastiques. L'industrie de l'emballage et de la restauration exige des plastiques à usage unique et des emballages durables. Cela augmente le besoin de bioplastiques. De plus, il existe de nombreux fabricants de PHA dans le monde avec un énorme marché intérieur dans leurs régions.

Contraintes/Défis

- Prix plus élevé du PHA par rapport aux polymères conventionnels

Le coût considérablement plus élevé du PHA que celui des autres polymères constitue également l’un des principaux obstacles à l’expansion de l’industrie. Les plastiques biodégradables, comme le PHA, ont un coût de production de 20 à 80 % supérieur à celui des plastiques classiques. Ces matériaux et technologies biosourcés en sont encore aux premiers stades de développement et n’ont pas encore atteint le même niveau de commercialisation que leurs homologues pétrochimiques.

- Progrès lents dans les technologies de fabrication pour la production de PHA

Les menaces économiques entravent la pénétration du marché des PHA : la production de ces matériaux reste nettement plus coûteuse que la fabrication à grande échelle et bien établie de plastiques à base de pétrole. En particulier, l'allocation des matières premières nécessaires à la production de PHA contribue considérablement au prix de production encore élevé de ces polyesters. Les principales limitations de la production de PHA sont les conditions de croissance particulières requises, la composition du substrat, l'état des cultures, les procédés de fermentation (par lots, par lots alimentés, par lots répétés ou par lots alimentés et en continu) et le coût élevé de la récupération. De plus, la production de PHA génère une grande quantité de déchets de biomasse.

Développement récent

- En janvier 2021, Danimer Scientific a ouvert sa nouvelle usine au 605 Rolling Hills Lane, Winchester, KY 40391, qui est la première usine de production commerciale de PHA au monde. Grâce à cette nouvelle installation, l'entreprise a doublé sa capacité de production en 2021.

Portée du marché des polyhydroxyalcanoates (PHA) en Asie-Pacifique

Le marché des polyhydroxyalcanoates (PHA) de la région Asie-Pacifique est classé en fonction du type, de la forme et de l'application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Longueur de chaîne courte

- Longueur de chaîne moyenne

En fonction du type, le marché des polyhydroxyalcanoates (PHA) de l'Asie-Pacifique est classé en deux segments : chaîne courte et chaîne moyenne.

Formulaire

- PHA copolymérisé

- PHA linéaire

Sur la base de la forme, le marché des polyhydroxyalcanoates (PHA) de l'Asie-Pacifique est classé en deux segments : le PHA copolymérisé et le PHA linéaire.

Application

- Emballage et services alimentaires

- Biomédical

- Agriculture

- Additif chimique

- Impression 3D

- Produits de beauté

- Traitement des eaux usées

Sur la base de l'application, le marché des polyhydroxyalcanoates (PHA) de l'Asie-Pacifique est classé en sept segments : emballage et services alimentaires, biomédical, agriculture, additifs chimiques, impression 3D, cosmétiques et traitement des eaux usées.

Analyse/perspectives régionales du marché des polyhydroxyalcanoates (PHA) en Asie-Pacifique

Le marché des polyhydroxyalcanoates (PHA) d’Asie-Pacifique est segmenté en fonction du type, de la forme et de l’application.

Les pays du marché des polyhydroxyalcanoates (PHA) de la région Asie-Pacifique sont le Japon, la Chine, la Corée du Sud, l'Inde, Singapour, la Thaïlande, l'Indonésie, la Malaisie, les Philippines, l'Australie et la Nouvelle-Zélande, ainsi que le reste de la région Asie-Pacifique. La Chine domine le marché des polyhydroxyalcanoates (PHA) de la région Asie-Pacifique en termes de part de marché et de chiffre d'affaires en raison de la tendance croissante des consommateurs à l'égard des produits en plastique respectueux de l'environnement.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données par pays.

Analyse du paysage concurrentiel et des parts de marché des polyhydroxyalcanoates (PHA) en Asie-Pacifique

Le paysage concurrentiel du marché des polyhydroxyalcanoates (PHA) en Asie-Pacifique fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché des polyhydroxyalcanoates (PHA) en Asie-Pacifique.

Français Certains des principaux acteurs opérant sur le marché des polyhydroxyalcanoates (PHA) de l'Asie-Pacifique sont BASF SE, PolyFerm Canada, Full Cycle Bioplastics, CJ CHEILJEDANG CORP., BIO-ON, Bluepha Co, Ltd, TERRAVERDAE BIOWORKS INC., RWDC Industries, NEWLIGHT TECHNOLOGIES, INC. TianAn Biologic Materials Co, Ltd., Danimer Scientific, YIELD10 BIOSCIENCE, INC.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données comprennent les grilles de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, les grilles de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse des parts de marché Asie-Pacifique par rapport aux régions et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 BMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES:

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 POLYHYDROXYALKANOATES (PHA) PLANT CAPITAL /INSTALLATION COST

4.3 PRODUCTION COST ANALYSIS

4.4 PRODUCT VALUE CHAIN & MARGIN ANALYSIS

4.5 CONSUMER BUYING BEHAVIOUR

4.6 FACTORS AFFECTING BUYING DECISION

4.7 IMPORT EXPORT SCENARIO

4.8 IMPACT OF ECONOMIC SLOWDOWN

4.8.1 OVERVIEW

4.8.2 IMPACT ON PRICE

4.8.3 IMPACT ON SUPPLY CHAIN

4.8.4 IMPACT ON SHIPMENT

4.8.5 IMPACT ON COMPANY'S STRATEGIC DECISIONS

4.8.6 CONCLUSION

4.9 PRICING ANALYSIS

4.1 PRODUCT ADOPTION CRITERIA

4.10.1 OVERVIEW

4.10.2 PRODUCT AWARENESS

4.10.3 PRODUCT INTEREST

4.10.4 PRODUCT EVALUATION

4.10.5 PRODUCT TRIAL

4.10.6 PRODUCT ADOPTION

4.10.7 CONCLUSION

4.11 RAW MATERIAL SOURCING ANALYSIS

4.12 SUPPLY CHAIN ANALYSIS

4.12.1 OVERVIEW

4.12.2 LOGISTIC COST SCENARIO

4.12.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR BIODEGRADABLE MATERIALS IN THE PACKAGING AND FOODSERVICE INDUSTRIES

6.1.2 EMERGENCE OF NEW AND COST-EFFECTIVE RAW MATERIALS FOR PHA PRODUCTION

6.1.3 INCREASING CONCERNS FOR HUMAN HEALTH AND SAFETY

6.2 RESTRAINTS

6.2.1 HIGHER PRICE OF PHA AS COMPARED TO CONVENTIONAL POLYMERS

6.2.2 PERFORMANCE ISSUES OF PHA RELATED TO ITS PROPERTIES

6.3 OPPORTUNITIES

6.3.1 INCREASING INVESTMENTS IN RESEARCH & DEVELOPMENT ACTIVITIES FOR PHA APPLICATIONS

6.3.2 STRINGENT GOVERNMENT REGULATIONS REGARDING THE USE OF PLASTIC PRODUCTS

6.4 CHALLENGE

6.4.1 SLOW ADVANCEMENT IN MANUFACTURING TECHNOLOGIES FOR PHA PRODUCTION

7 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE

7.1 OVERVIEW

7.2 SHORT CHAIN LENGTH

7.3 MEDIUM CHAIN LENGTH

8 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM

8.1 OVERVIEW

8.2 CO-POLYMERIZED PHA

8.3 LINEAR PHA

9 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PACKAGING AND FOOD SERVICES

9.3 BIO-MEDICAL

9.4 AGRICULTURE

9.5 CHEMICAL ADDITIVE

9.6 3D PRINTING

9.7 COSMETICS

9.8 WASTEWATER TREATMENT

10 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 INDIA

10.1.3 JAPAN

10.1.4 SOUTH KOREA

10.1.5 THAILAND

10.1.6 SINGAPORE

10.1.7 INDONESIA

10.1.8 AUSTRALIA & NEW ZEALAND

10.1.9 PHILIPPINES

10.1.10 MALAYSIA

10.1.11 REST OF ASIA-PACIFIC

11 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11.2 AWARD

11.3 NEW PRODUCTION FACILITY

11.4 EVENT

11.5 FUNDING

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 DANIMER SCIENTIFIC

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 SWOT

13.1.5 PRODUCT PORTFOLIO

13.1.6 RECENT UPDATE

13.2 BASF SE

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SWOT

13.2.5 PRODUCT PORTFOLIO

13.2.6 RECENT UPDATE

13.3 YIELD10 BIOSCIENCE, INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 SWOT

13.3.5 PRODUCT PORTFOLIO

13.3.6 RECENT UPDATES

13.4 BLUEPHA CO., LTD

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 SWOT

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT UPDATES

13.5 RWDC INDUSTRIES

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 SWOT

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT UPDATES

13.6 BIO-ON

13.6.1 COMPANY SNAPSHOT

13.6.2 SWOT

13.6.3 PRODUCTION CAPACITY

13.6.4 PRODUCT PORTFOLIO

13.6.5 RECENT UPDATE

13.7 CHEILJEDANG CORP.

13.7.1 COMPANY SNAPSHOT

13.7.2 SWOT

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT UPDATE

13.8 FULL CYCLE BIOPLASTICS

13.8.1 COMPANY SNAPSHOT

13.8.2 SWOT

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATES

13.9 NEWLIGHT TECHNOLOGIES, INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 SWOT

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT UPDATES

13.1 POLYFERM CANADA

13.10.1 COMPANY SNAPSHOT

13.10.2 SWOT

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT UPDATES

13.11 TERRAVERDAE BIOWORKS INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 SWOT

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT UPDATE

13.12 TIANAN BIOLOGIC MATERIALS CO, LTD.

13.12.1 COMPANY SNAPSHOT

13.12.2 SWOT

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF SATURATED POLYESTERS IN PRIMARY FORMS (EXCLUDING POLYCARBONATES, ALKYD RESINS, POLYETHYLENE AND POLYLACTIC ACID); HS CODE – 390799 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SATURATED POLYESTERS IN PRIMARY FORMS (EXCLUDING POLYCARBONATES, ALKYD RESINS, POLYETHYLENE AND POLYLACTIC ACID); HS CODE – 390799 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 6 ASIA PACIFIC SHORT CHAIN LENGTH IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 ASIA PACIFIC SHORT CHAIN LENGTH IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (TONS)

TABLE 8 ASIA PACIFIC MEDIUM CHAIN LENGTH IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC MEDIUM CHAIN LENGTH IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (TONS)

TABLE 10 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC CO-POLYMERIZED PHA IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC LINEAR PHA IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC PACKAGING AND FOOD SERVICES IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC BIO-MEDICAL IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC AGRICULTURE IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC CHEMICAL ADDITIVE IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC 3D PRINTING IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC COSMETICS IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC WASTEWATER TREATMENT IN POLYHYDROXYALKANOATES (PHA) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 24 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 26 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 28 CHINA POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 CHINA POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 30 CHINA POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 31 CHINA POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 32 INDIA POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 INDIA POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 34 INDIA POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 35 INDIA POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 36 JAPAN POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 JAPAN POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 38 JAPAN POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 39 JAPAN POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 SOUTH KOREA POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 SOUTH KOREA POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 42 SOUTH KOREA POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 43 SOUTH KOREA POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 44 THAILAND POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 THAILAND POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 46 THAILAND POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 47 THAILAND POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 48 SINGAPORE POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 SINGAPORE POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 50 SINGAPORE POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 51 SINGAPORE POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 INDONESIA POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 INDONESIA POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 54 INDONESIA POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 55 INDONESIA POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 56 AUSTRALIA & NEW ZEALAND POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 AUSTRALIA & NEW ZEALAND POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 58 AUSTRALIA & NEW ZEALAND POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 59 AUSTRALIA & NEW ZEALAND POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 PHILIPPINES POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 PHILIPPINES POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 62 PHILIPPINES POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 63 PHILIPPINES POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 64 MALAYSIA POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 MALAYSIA POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 66 MALAYSIA POLYHYDROXYALKANOATES (PHA) MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 67 MALAYSIA POLYHYDROXYALKANOATES (PHA) MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 REST OF ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 REST OF ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET, BY TYPE, 2020-2029 (TONS)

Liste des figures

FIGURE 1 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET

FIGURE 2 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND FOR BIODEGRADABLE MATERIALS IN THE PACKAGING AND FOODSERVICE INDUSTRIES IS EXPECTED TO DRIVE ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET IN THE FORECAST PERIOD

FIGURE 15 SHORT CHAIN LENGTH SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET IN 2022 & 2029

FIGURE 16 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 PRICE ANALYSIS FOR ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET (USD/KG)

FIGURE 18 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: PRODUCT ADOPTION SCENARIO

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THE ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET

FIGURE 20 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: BY TYPE, 2021

FIGURE 21 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: BY FORM, 2021

FIGURE 22 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: BY APPLICATION, 2021

FIGURE 23 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: SNAPSHOT (2021)

FIGURE 24 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: BY COUNTRY (2021)

FIGURE 25 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: BY TYPE (2022-2029)

FIGURE 28 ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.