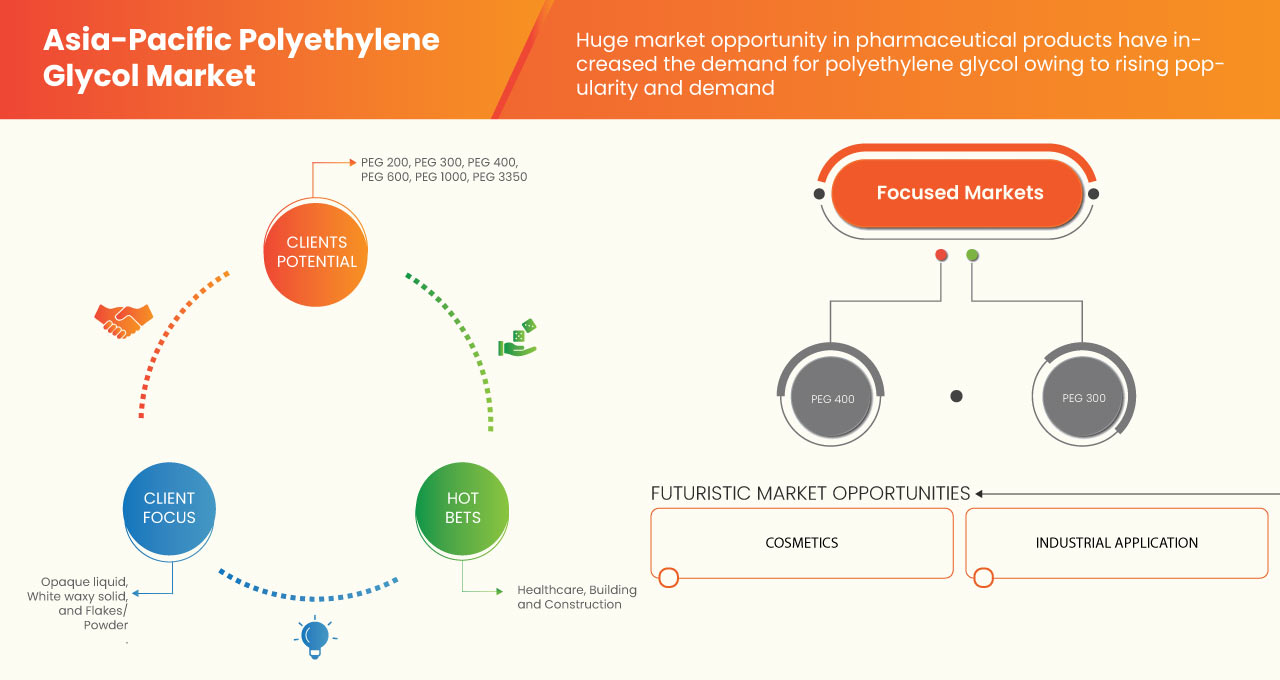

Marché du polyéthylène glycol en Asie-Pacifique, par qualité (PEG 200, PEG 300, PEG 400, PEG 600, PEG 1000, PEG 3350, PEG 4000, PEG 6000, PEG 8000, PEG 10000 et PEG 20000), forme (liquide opaque, solide cireux blanc et flocons/poudre), taille de l'emballage (bouteilles et fûts en plastique), application (santé, bâtiment et construction, industrie, cosmétiques/soins personnels et autres), tendances de l'industrie et prévisions jusqu'en 2030.

Analyse et taille du marché du polyéthylène glycol en Asie-Pacifique

Le marché du polyéthylène glycol en Asie-Pacifique est porté par l'industrie pharmaceutique, qui est un facteur clé de l'expansion du marché. Les polyéthylène glycols sont des composants essentiels des formulations pharmaceutiques utilisées pour créer des traitements topiques, oraux, ophtalmiques et rectaux. Dans un certain nombre d'applications médicinales, ils servent de lubrifiants et d'agents de pelliculage. De plus, l'utilisation du polyéthylène glycol dans les produits de peinture et de revêtement ouvrira davantage de potentiel commercial pour les marchés du polyéthylène glycol. Cependant, des réglementations gouvernementales strictes pourraient freiner la croissance du marché.

Data Bridge Market Research analyse que le marché du polyéthylène glycol en Asie-Pacifique devrait atteindre la valeur de 2 958,97 millions USD d'ici 2030, à un TCAC de 6,7 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en tonnes, prix en USD |

|

Segments couverts |

Par grade (PEG 200, PEG 300, PEG 400, PEG 600, PEG 1000, PEG 3350, PEG 4000, PEG 6000, PEG 8000, PEG 10000 et PEG 20000), forme (liquide opaque, solide cireux blanc et flocons/poudre), taille de l'emballage (bouteilles et fûts en plastique), application (soins de santé, bâtiment et construction, industrie, cosmétiques /soins personnels et autres). |

|

Pays couverts |

Japon, Chine, Corée du Sud, Inde, Australie, Nouvelle-Zélande, Vietnam, Taïwan, Singapour, Thaïlande, Indonésie, Malaisie, Philippines, reste de l'Asie-Pacifique. |

|

Acteurs du marché couverts |

SABIC, Dow, BASF SE, Merck KGaA, INEOS, Croda International Plc, Clariant, India Glycols Limited, Pro Chem, Inc., GFS Chemicals, Inc, Liaoning Oxiranchem Inc., Liaoning Kelong Fine Chemical Co., Ltd., LOTTE Chemical Corporation, Hefei TNJ Chemical Industry Co., Ltd., Noah Chemicals et Mil-Spec Industries Corporation, entre autres |

Définition du marché

Le PEG ou polyéthylène glycol est un matériau polymère composé d'oxyde d'éthylène et d'eau comme monomères qui sont non seulement hydrophiles mais également biocompatibles. Cependant, il s'agit d'une molécule synthétique synthétisée par polymérisation d'oxyde d'éthylène où une ouverture de cycle a lieu. Comme il est composé d'eau et d'oxyde d'éthylène , il trouve d'innombrables applications dans des industries allant de la pharmacie à la construction.

Les polyéthylène glycols sont rendus réactifs par le remplacement du groupe hydroxyle terminal par plusieurs groupes fonctionnels réactifs tels que des thiols, des groupes carboxyles, des esters N-hydroxysuccinimides, des azotures ou des groupes alcynes réactifs, qui initient la formation de liaisons croisées. C'est la chimie de conjugaison qui joue un rôle majeur dans leur synthèse et, en fonction du groupe fonctionnel attaché, différentes conditions et méthodes sont choisies. Par exemple, les polyéthylène glycols à terminaison acrylate peuvent subir une réaction rapide dans des conditions de réaction douces. Il est incolore, peu toxique, non irritant par nature et présente une biocompatibilité très élevée. Il est largement utilisé comme agent antimousse, lubrifiant, agent dispersif et laxatif. Il est applicable à une variété d'industries, telles que les produits pharmaceutiques, les soins de santé, le bâtiment et la construction, les soins personnels et les cosmétiques.

Dynamique du marché du polyéthylène glycol en Asie-Pacifique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs :

- Demande croissante de médicaments

La découverte de médicaments est un processus fastidieux qui prend de nombreuses années. La recherche et le développement visant à créer de nouveaux produits pharmaceutiques innovants deviennent importants en raison du nombre croissant de maladies chroniques, du vieillissement de la population et de l'arrivée de concurrents génériques sur le marché du futur.

L'industrie pharmaceutique connaît une croissance rapide dans la région Asie-Pacifique, les médicaments Pfizer affichant le taux de vente le plus élevé du marché. Le département de recherche et développement de Pfizer prévoit également que les principales recherches seront consacrées aux médicaments oncologiques et analgésiques, aux régulateurs lipidiques, aux antidiabétiques, aux agents respiratoires et autres, les États-Unis affichant la plus forte croissance des revenus.

Dans l'évaluation de la pharmacodynamique des composés candidats, le métabolisme des médicaments joue un rôle direct. Le polyéthylène glycol agit comme ingrédient inactif dans l'industrie pharmaceutique, généralement comme agent mouillant et épaississant dans les pommades et les crèmes, et est utilisé pour ajouter des revêtements protecteurs aux comprimés. De plus, son utilisation comme solution électrolytique pour l'examen des troubles et des dysfonctionnements du côlon humain est bien connue.

- Utilisation de la technologie PEGlycation dans les applications biotechnologiques et pharmaceutiques

La pégylation est une technique de modification des produits biopharmaceutiques contenant du polyéthylène glycol pour améliorer les propriétés pharmacologiques des protéines et d'autres grosses molécules des médicaments biothérapeutiques. Cette technique allonge la demi-vie des médicaments parentaux et améliore la solubilité aqueuse des substances médicamenteuses.

La pégylation des molécules protéiques implique l'ajout de molécules de PEG à la structure protéique, ce qui modifie ses propriétés pharmacocinétiques et réduit l'immunogénicité des molécules qui aident à prévenir les infections, en particulier dans le traitement du cancer. La technique implique la conjugaison de molécules protéiques qui prolonge la circulation sanguine des protéines avec une réduction de l'immunogénicité. En effet, certains groupes d'anticorps, appelés anti-PEG, dans le système immunitaire reconnaissent et se lient aux molécules de polyéthylène glycols. Les anticorps anti-PEG sont non toxiques par nature et ne causent aucun dommage aux tissus humains.

Opportunités

- Production de polyéthylène glycol-400 pour applications en gouttes ophtalmiques

Le polyéthylène glycol 400 est un liquide clair et incolore dérivé principalement du pétrole et possédant les caractéristiques d'un polyéthylène glycol de pétrole standard. La durée de conservation de ces gouttes oculaires est d'un an lorsqu'elles sont stockées dans un endroit frais et bien ventilé.

Le polyéthylène glycol-400 est un composé de faible poids moléculaire et moins toxique. Il est très hydrophile, ce qui le rend utile dans les formulations de médicaments. Son application principale réside dans les solutions ophtalmiques, généralement utilisées pour le traitement des brûlures, de l'inconfort ou de la sécheresse des yeux. Il existe différents noms, tels que les larmes de gel blink, les larmes blink ou les liquides de larmes vision true, pour les solutions de gouttes oculaires qui contiennent le même composé.

RESTRICTIONS/DÉFIS

- Problèmes de stabilité de la viscosité dans le PEG

Le polyéthylène glycol est un composé largement utilisé dans les formulations pharmaceutiques, notamment toutes sortes de préparations pour les troubles parentaux, topiques, oraux, rectaux et ophtalmiques. Les qualités solides de polyéthylène glycol avec l'ajout de polyéthylène glycol de qualité liquide peuvent être utilisées dans les pommades topiques et comme bases de pommade. De plus, ces polyéthylène glycols liquides sont utilisés comme solvants hydrosolubles dans les capsules de gélatine molle.

Cependant, l'adsorption d'humidité par le polyéthylène glycol de la gélatine peut parfois conduire au durcissement de l'enveloppe de la capsule, ce qui peut également affecter la santé du patient qui la consomme.

Impact post-COVID-19 sur le marché du polyéthylène glycol en Asie-Pacifique

Après la pandémie, la demande de produits à base de polyéthylène glycol a augmenté, car il n'y aura plus de restrictions de mouvement, ce qui facilitera l'approvisionnement en produits. En outre, les entreprises ont développé leurs unités de traitement pour fabriquer des produits à base de polyéthylène glycol, et la demande de polyéthylène glycol dans les secteurs de la beauté et de la santé a également augmenté, ce qui pourrait propulser la croissance du marché.

La demande croissante dans le secteur du bâtiment et de la construction permet aux fabricants de produire davantage de nouveaux produits, ce qui augmente en fin de compte la demande de polyéthylène glycol et a contribué à la croissance du marché.

De plus, la forte demande dans le secteur de la santé stimulera la croissance du marché. En outre, la demande de polyéthylène glycol dans le secteur de la santé après la pandémie de COVID-19 a augmenté en raison de la sensibilisation croissante aux avantages pour la santé et de la forte demande du secteur des services de santé qui a entraîné une croissance du marché. En outre, l'intérêt des consommateurs pour le nouveau polyéthylène glycol et le développement de la recherche devraient alimenter la croissance du marché du polyéthylène glycol en Asie-Pacifique.

Développements récents

- En mai 2022, EA Pharma Co., Ltd. a annoncé le lancement de MOVICOL® HD, une nouvelle forme posologique ajoutée au traitement de la constipation chronique au polyéthylène glycol pour la première fois au Japon. Le MOVICOL® HD est une formulation à haute dose du « MOVICOL® LD » existant, le premier polyéthylène glycol indiqué pour le traitement de la constipation chronique.

- En octobre 2021, le service client de Camber a lancé 4 nouveaux produits en vente libre, dont la poudre de polyéthylène glycol. La société propose désormais des médicaments génériques en vente libre dans une gamme de concentrations et de dosages pour le soulagement des allergies, de la douleur et des troubles gastro-intestinaux, bénéficiant à un large éventail de patients.

Portée du marché du polyéthylène glycol en Asie-Pacifique

Le marché du polyéthylène glycol en Asie-Pacifique est divisé en quatre segments notables, à savoir la qualité, la forme, la taille de l'emballage et l'application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Grade

- PEG 200

- PEG 300

- PEG 400

- PEG 600

- PEG 1000

- PEG 3350

- PEG 4000

- PEG 6000

- PEG 8000

- PEG 10000

- PEG 20000

Sur la base de la qualité, le marché est segmenté en PEG 200, PEG 300, PEG 400, PEG 600, PEG 1000, PEG 3350, PEG 4000, PEG 6000, PEG 8000, PEG 10000 et PEG 20000.

Formulaire

- Liquide opaque,

- Solide cireux blanc

- Flocons/poudre

Sur la base de la forme, le marché est segmenté en liquide opaque, solide cireux blanc et flocons/poudre.

Taille de l'emballage

- Bouteilles en plastique

- Sacs pour batterie

Sur la base de la taille de l’emballage, le marché est segmenté en bouteilles et fûts en plastique.

Application

- Soins de santé

- Bâtiment et construction

- Industriel

- Cosmétiques/Soins personnels

- Autres

Sur la base des applications, le marché est segmenté en soins de santé, bâtiment et construction, industrie, cosmétiques/soins personnels et autres.

Analyse/perspectives régionales du marché du polyéthylène glycol en Asie-Pacifique

Le marché du polyéthylène glycol est analysé et des informations et tendances sur la taille du marché sont fournies par pays sur la qualité, la forme, la taille de l'emballage, l'application et des informations et tendances sur la taille du marché sont fournies sur la base des références ci-dessus.

Les pays couverts dans le rapport sur le marché du polyéthylène glycol en Asie-Pacifique sont le Japon, la Chine, la Corée du Sud, l’Inde, l’Australie, la Nouvelle-Zélande, le Vietnam, Taïwan, Singapour, la Thaïlande, l’Indonésie, la Malaisie, les Philippines et le reste de l’Asie-Pacifique.

La Chine domine le marché du polyéthylène glycol en Asie-Pacifique. Le polyéthylène glycol et ses dérivés trouvent une large gamme d'applications dans les médicaments, les diagnostics et les dispositifs médicaux. C'est la principale raison de la croissance du marché du polyéthylène glycol en Chine. Cependant, les problèmes de stabilité de la viscosité du PEG devraient limiter la croissance du marché.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du polyéthylène glycol en Asie-Pacifique

Le paysage concurrentiel du marché du polyéthylène glycol en Asie-Pacifique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché du polyéthylène glycol.

Français Certains des principaux acteurs opérant sur le marché du polyéthylène glycol en Asie-Pacifique sont SABIC, Dow, BASF SE, Merck KGaA, INEOS, Croda International Plc, Clariant, India Glycols Limited, Pro Chem, Inc., GFS Chemicals, Inc, Liaoning Oxiranchem Inc., Liaoning Kelong Fine Chemical Co., Ltd., LOTTE Chemical Corporation, Hefei TNJ Chemical Industry Co., Ltd., Noah Chemicals et Mil-Spec Industries Corporation, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC POLYETHYLENE GLYCOL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES:

4.3 REGULATORY FRAMEWORK

4.4 IMPORT EXPORT SCENARIO

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 RAW MATERIAL COVERAGE – ASIA PACIFIC POLYETHYLENE GLYCOL MARKET

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 VENDOR SELECTION CRITERIA

5 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET: PRICE INDEX

6 PRODUCTION CAPACITY

7 SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 GROWING DEMAND FOR MEDICINES

8.1.2 HIGH DEMAND OF ICE-CREAMS

8.1.3 USAGE OF PEGLYCATION TECHNOLOGY IN BIOTECHNOLOGICAL AND PHARMACEUTICAL APPLICATIONS

8.1.4 HIGH DEMAND FOR WATER-BASED PAINTS

8.2 RESTRAINTS

8.2.1 VISCOSITY STABILITY ISSUES IN PEG

8.2.2 STRICT REGULATIONS IN THE PHARMACEUTICAL INDUSTRY

8.2.3 ENVIRONMENTAL REGULATIONS

8.2.4 HIGH DEMAND FOR SUBSTITUTES

8.3 OPPORTUNITIES

8.3.1 PRODUCTION OF POLYETHYLENE GLYCOL- 400 FOR EYE DROP APPLICATIONS

8.3.2 PRODUCTION OF PEG FOR SKIN THERAPY AND OINTMENT APPLICATIONS

8.3.3 USE OF POLYETHYLENE GLYCOL AS AN ADDITIVES TO IMPROVE THE PROPERTIES OF PAINT AND COATINGS

8.4 CHALLENGES

8.4.1 FLUCTUATING RAW MATERIAL PRICES

8.4.2 HIGH IMPORT TARIFFS AND REGULATIONS

8.4.3 IMMEDIATE ALLERGIC REACTIONS OF PEG

9 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY GRADE

9.1 OVERVIEW

9.2 PEG 400

9.3 PEG 600

9.4 PEG 200

9.5 PEG 300

9.6 PEG 1000

9.7 PEG 3350

9.8 PEG 4000

9.9 PEG 8000

9.1 PEG 6000

9.11 PEG 10000

9.12 PEG 20000

10 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY FORM

10.1 OVERVIEW

10.2 OPAQUE LIQUID

10.3 FLAKES/POWDER

10.4 WHITE WAXY SOLID

11 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE

11.1 OVERVIEW

11.2 DRUMS

11.3 PLASTIC BOTTLES

12 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 HEALTHCARE

12.2.1 PHARMACEUTICALS

12.2.1.1 TABLETS

12.2.1.2 OINTMENTS

12.2.2 COLONOSCOPY

12.2.3 BARIUM ENEMA PREPARATION

12.3 INDUSTRIAL

12.4 COSMETICS/PERSONAL CARE

12.4.1 SKIN CREAM

12.4.2 TOOTHPASTE

12.4.3 PERSONAL LUBRICANTS

12.4.4 OTHERS

12.5 BUILDING AND CONSTRUCTION

12.5.1 PAINTS AND COATINGS

12.5.2 CERAMIC TILES

12.5.3 OTHERS

12.6 OTHERS

13 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 INDIA

13.1.3 JAPAN

13.1.4 SOUTH KOREA

13.1.5 SINGAPORE

13.1.6 AUSTRALIA

13.1.7 TAIWAN

13.1.8 INDONESIA

13.1.9 THAILAND

13.1.10 MALAYSIA

13.1.11 VIETNAM

13.1.12 NEW ZEALAND

13.1.13 PHILIPPINES

13.1.14 REST OF ASIA-PACIFIC

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 SABIC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 MERCK KGAA

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 DOW

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 BASF SE

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 INEOS

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 LOTTE CHEMICAL CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 COMPANY SHARE ANALYSIS

16.6.4 PRODUCT PORTFOLIO

16.6.5 RECENT DEVELOPMENTS

16.7 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CLARIANT

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 CRODA INTERNATIONAL PLC

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 GFS CHEMICALS, INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 INDIA GLYCOLS LIMITED

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 LIAONING KELONG FINE CHEMICAL CO., LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 LIAONING OXIRANCHEM INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 MIL-SPEC INDUSTRIES CORPORATION

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 NOAH CHEMICALS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 PROCHEM, INC

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 2 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 3 ASIA PACIFIC PEG 400 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 ASIA PACIFIC PEG 400 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 5 ASIA PACIFIC PEG 600 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 ASIA PACIFIC PEG 600 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 7 ASIA PACIFIC PEG 200 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 ASIA PACIFIC PEG 200 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 9 ASIA PACIFIC PEG 300 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION

TABLE 10 ASIA PACIFIC PEG 300 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 11 ASIA PACIFIC PEG 1000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 ASIA PACIFIC PEG 1000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 13 ASIA PACIFIC PEG 3350 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 ASIA PACIFIC PEG 3350 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 15 ASIA PACIFIC PEG 4000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 ASIA PACIFIC PEG 4000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 17 ASIA PACIFIC PEG 8000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 ASIA PACIFIC PEG 8000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 19 ASIA PACIFIC PEG 6000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 ASIA PACIFIC PEG 6000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 21 ASIA PACIFIC PEG 10000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 ASIA PACIFIC PEG 10000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 23 ASIA PACIFIC PEG 20000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 ASIA PACIFIC PEG 20000 IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 25 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 26 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 27 ASIA PACIFIC OPAQUE LIQUID IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 ASIA PACIFIC OPAQUE LIQUID IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 29 ASIA PACIFIC FLAKES/POWDER IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 ASIA PACIFIC FLAKES/POWDER IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 31 ASIA PACIFIC WHITE WAXY SOLID IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 ASIA PACIFIC WHITE WAXY SOLID IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 33 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 34 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 35 ASIA PACIFIC DRUMS IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 ASIA PACIFIC DRUMS IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 37 ASIA PACIFIC PLASTIC BOTTLES IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 ASIA PACIFIC PLASTIC BOTTLES IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 39 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 40 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 41 ASIA PACIFIC HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 ASIA PACIFIC HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 43 ASIA PACIFIC HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 44 ASIA PACIFIC HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 45 ASIA PACIFIC PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 46 ASIA PACIFIC PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 47 ASIA PACIFIC INDUSTRIAL IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 48 ASIA PACIFIC INDUSTRIAL IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 49 ASIA PACIFIC COSMETIC/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 ASIA PACIFIC COSMETIC/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 51 ASIA PACIFIC COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 52 ASIA PACIFIC COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 53 ASIA PACIFIC BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 ASIA PACIFIC BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 55 ASIA PACIFIC BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 ASIA PACIFIC BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 57 ASIA PACIFIC OTHERS IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 ASIA PACIFIC OTHERS IN POLYETHYLENE GLYCOL MARKET, BY REGION, 2021-2030 (TONS)

TABLE 59 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 60 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 61 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 62 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 63 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 64 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 65 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 66 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 67 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 68 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 69 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 70 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 71 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 72 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 73 ASIA-PACIFIC HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 ASIA-PACIFIC HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 75 ASIA-PACIFIC PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 76 ASIA-PACIFIC PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 77 ASIA-PACIFIC COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 78 ASIA-PACIFIC COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 79 ASIA-PACIFIC BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 80 ASIA-PACIFIC BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 81 CHINA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 82 CHINA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 83 CHINA POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 84 CHINA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 85 CHINA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 86 CHINA POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 87 CHINA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 88 CHINA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 89 CHINA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 90 CHINA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 91 CHINA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 92 CHINA POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 93 CHINA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 94 CHINA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 95 CHINA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 96 CHINA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 97 CHINA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 98 CHINA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 99 CHINA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 100 CHINA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 101 INDIA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 102 INDIA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 103 INDIA POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 104 INDIA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 105 INDIA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 106 INDIA POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 107 INDIA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 108 INDIA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 109 INDIA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 110 INDIA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 111 INDIA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 112 INDIA POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 113 INDIA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 114 INDIA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 115 INDIA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 116 INDIA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 117 INDIA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 118 INDIA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 119 INDIA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 120 INDIA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 121 JAPAN POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 122 JAPAN POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 123 JAPAN POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 124 JAPAN POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 125 JAPAN POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 126 JAPAN POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 127 JAPAN POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 128 JAPAN POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 129 JAPAN POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 130 JAPAN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 131 JAPAN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 132 JAPAN POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 133 JAPAN HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 134 JAPAN HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 135 JAPAN PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 136 JAPAN PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 137 JAPAN COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 138 JAPAN COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 139 JAPAN BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 140 JAPAN BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 141 SOUTH KOREA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 142 SOUTH KOREA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 143 SOUTH KOREA POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 144 SOUTH KOREA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 145 SOUTH KOREA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 146 SOUTH KOREA POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 147 SOUTH KOREA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 148 SOUTH KOREA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 149 SOUTH KOREA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 150 SOUTH KOREA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 151 SOUTH KOREA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 152 SOUTH KOREA POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 153 SOUTH KOREA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 154 SOUTH KOREA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 155 SOUTH KOREA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 156 SOUTH KOREA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 157 SOUTH KOREA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 158 SOUTH KOREA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 159 SOUTH KOREA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 160 SOUTH KOREA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 161 SINGAPORE POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 162 SINGAPORE POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 163 SINGAPORE POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 164 SINGAPORE POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 165 SINGAPORE POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 166 SINGAPORE POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 167 SINGAPORE POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 168 SINGAPORE POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 169 SINGAPORE POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 170 SINGAPORE POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 171 SINGAPORE POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 172 SINGAPORE POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 173 SINGAPORE HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 174 SINGAPORE HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 175 SINGAPORE PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 176 SINGAPORE PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 177 SINGAPORE COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 178 SINGAPORE COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 179 SINGAPORE BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 180 SINGAPORE BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 181 AUSTRALIA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 182 AUSTRALIA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 183 AUSTRALIA POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 184 AUSTRALIA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 185 AUSTRALIA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 186 AUSTRALIA POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 187 AUSTRALIA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 188 AUSTRALIA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 189 AUSTRALIA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 190 AUSTRALIA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 191 AUSTRALIA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 192 AUSTRALIA POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 193 AUSTRALIA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 194 AUSTRALIA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 195 AUSTRALIA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 196 AUSTRALIA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 197 AUSTRALIA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 198 AUSTRALIA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 199 AUSTRALIA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 200 AUSTRALIA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 201 TAIWAN POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 202 TAIWAN POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 203 TAIWAN POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 204 TAIWAN POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 205 TAIWAN POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 206 TAIWAN POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 207 TAIWAN POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 208 TAIWAN POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 209 TAIWAN POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 210 TAIWAN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 211 TAIWAN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 212 TAIWAN POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 213 TAIWAN HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 214 TAIWAN HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 215 TAIWAN PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 216 TAIWAN PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 217 TAIWAN COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 218 TAIWAN COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 219 TAIWAN BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 220 TAIWAN BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 221 INDONESIA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 222 INDONESIA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 223 INDONESIA POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 224 INDONESIA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 225 INDONESIA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 226 INDONESIA POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 227 INDONESIA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 228 INDONESIA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 229 INDONESIA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 230 INDONESIA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 231 INDONESIA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 232 INDONESIA POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 233 INDONESIA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 234 INDONESIA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 235 INDONESIA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 236 INDONESIA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 237 INDONESIA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 238 INDONESIA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 239 INDONESIA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 240 INDONESIA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 241 THAILAND POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 242 THAILAND POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 243 THAILAND POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 244 THAILAND POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 245 THAILAND POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 246 THAILAND POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 247 THAILAND POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 248 THAILAND POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 249 THAILAND POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 250 THAILAND POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 251 THAILAND POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 252 THAILAND POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 253 THAILAND HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 254 THAILAND HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 255 THAILAND PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 256 THAILAND PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 257 THAILAND COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 258 THAILAND COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 259 THAILAND BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 260 THAILAND BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 261 MALAYSIA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 262 MALAYSIA POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 263 MALAYSIA POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 264 MALAYSIA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 265 MALAYSIA POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 266 MALAYSIA POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 267 MALAYSIA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 268 MALAYSIA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 269 MALAYSIA POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 270 MALAYSIA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 271 MALAYSIA POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 272 MALAYSIA POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 273 MALAYSIA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 274 MALAYSIA HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 275 MALAYSIA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 276 MALAYSIA PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 277 MALAYSIA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 278 MALAYSIA COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 279 MALAYSIA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 280 MALAYSIA BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 281 VIETNAM POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 282 VIETNAM POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 283 VIETNAM POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 284 VIETNAM POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 285 VIETNAM POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 286 VIETNAM POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 287 VIETNAM POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 288 VIETNAM POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 289 VIETNAM POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 290 VIETNAM POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 291 VIETNAM POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 292 VIETNAM POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 293 VIETNAM HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 294 VIETNAM HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 295 VIETNAM PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 296 VIETNAM PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 297 VIETNAM COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 298 VIETNAM COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 299 VIETNAM BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 300 VIETNAM BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 301 NEW ZEALAND POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 302 NEW ZEALAND POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 303 NEW ZEALAND POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 304 NEW ZEALAND POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 305 NEW ZEALAND POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 306 NEW ZEALAND POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 307 NEW ZEALAND POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 308 NEW ZEALAND POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 309 NEW ZEALAND POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 310 NEW ZEALAND POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 311 NEW ZEALAND POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 312 NEW ZEALAND POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 313 NEW ZEALAND HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 314 NEW ZEALAND HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 315 NEW ZEALAND PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 316 NEW ZEALAND PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 317 NEW ZEALAND COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 318 NEW ZEALAND COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 319 NEW ZEALAND BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 320 NEW ZEALAND BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 321 PHILIPPINES POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 322 PHILIPPINES POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 323 PHILIPPINES POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

TABLE 324 PHILIPPINES POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 325 PHILIPPINES POLYETHYLENE GLYCOL MARKET, BY FORM, 2021-2030 (TONS)

TABLE 326 PHILIPPINES POLYETHYLENE GLYCOL MARKET, BY FORM ASP, 2021-2030 (USD/TON)

TABLE 327 PHILIPPINES POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 328 PHILIPPINES POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2021-2030 (TONS)

TABLE 329 PHILIPPINES POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE ASP, 2021-2030 (USD/ TON)

TABLE 330 PHILIPPINES POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 331 PHILIPPINES POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 332 PHILIPPINES POLYETHYLENE GLYCOL MARKET, BY APPLICATION ASP, 2021-2030 (USD/TON)

TABLE 333 PHILIPPINES HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 334 PHILIPPINES HEALTHCARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 335 PHILIPPINES PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 336 PHILIPPINES PHARMACEUTICALS IN POLYETHYLENE GLYCOL MARKET, BY CATEGORY, 2021-2030 (TONS)

TABLE 337 PHILIPPINES COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 338 PHILIPPINES COSMETICS/PERSONAL CARE IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 339 PHILIPPINES BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 340 PHILIPPINES BUILDING AND CONSTRUCTION IN POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2021-2030 (TONS)

TABLE 341 REST OF ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 342 REST OF ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY GRADE, 2021-2030 (TONS)

TABLE 343 REST OF ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET, BY GRADE ASP, 2021-2030 (USD/TON)

Liste des figures

FIGURE 1 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET: SEGMENTATION

FIGURE 10 THE GROWTH IN CONSTRUCTION AND BUILDING INDUSTRIES AND RISING DEMAND FOR WATER-BASED PAINTS TO PROVIDE A HIGH QUALITY PROTECTIVE COATING IS DRIVING THE GROWTH OF THE ASIA PACIFIC POLYETHYLENE GLYCOL MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 PEG 400 SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC POLYETHYLENE GLYCOL MARKET IN 2023- 2030

FIGURE 12 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC POLYETHYLENE GLYCOL MARKET

FIGURE 14 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY GRADE, 2022

FIGURE 15 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY FORM, 2022

FIGURE 16 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY PACKAGING SIZE, 2022

FIGURE 17 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET, BY APPLICATION, 2022

FIGURE 18 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET: SNAPSHOT (2022)

FIGURE 19 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET: BY COUNTRY (2022)

FIGURE 20 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 ASIA-PACIFIC POLYETHYLENE GLYCOL MARKET: BY GRADE (2023-2030)

FIGURE 23 ASIA PACIFIC POLYETHYLENE GLYCOL MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.