Asia Pacific Photoacoustic Imaging Market

Taille du marché en milliards USD

TCAC :

%

USD

8.59 Million

USD

26.83 Million

2025

2033

USD

8.59 Million

USD

26.83 Million

2025

2033

| 2026 –2033 | |

| USD 8.59 Million | |

| USD 26.83 Million | |

|

|

|

|

Segmentation du marché de l'imagerie photoacoustique en Asie-Pacifique, par composant (matériel [composants et milieu de diffusion], logiciels et services), type (système d'imagerie photoacoustique, système de tomographie photoacoustique et informatisée), application (préclinique et clinique), modalité (portable, autonome et de poche), plateforme (diode laser pulsée, LED, flash au xénon et autres), dimension (2D et 3D), application diagnostique (oncologie, hématologie, dermatologie, cardiologie, neurologie et autres), utilisateur final (centres de chirurgie ambulatoire, laboratoires de recherche, hôpitaux et cliniques, centres d'imagerie diagnostique, entreprises pharmaceutiques et biotechnologiques et autres), canal de distribution (appel d'offres direct, vente au détail, vente en ligne et autres) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché de l'imagerie photoacoustique en Asie-Pacifique

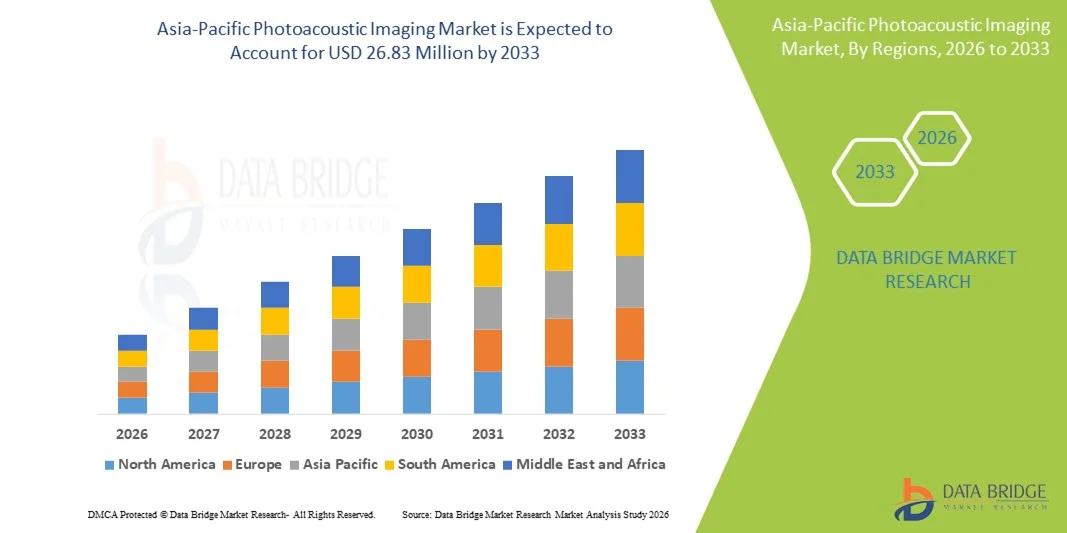

- Le marché de l'imagerie photoacoustique en Asie-Pacifique était évalué à 8,59 millions de dollars américains en 2024 et devrait atteindre 26,83 millions de dollars américains d'ici 2033 , avec un TCAC de 15,30 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'adoption croissante et les progrès technologiques constants dans le domaine de l'imagerie biomédicale et des systèmes de diagnostic, notamment en ce qui concerne les techniques d'imagerie non invasives et en temps réel. L'imagerie photoacoustique, qui combine les modalités optiques et ultrasonores, gagne en popularité grâce à sa résolution supérieure, sa profondeur de pénétration et sa capacité à visualiser les informations structurelles et fonctionnelles, améliorant ainsi la précision du diagnostic dans diverses applications médicales.

- De plus, la demande croissante d'outils de diagnostic plus sûrs, plus précis et non ionisants positionne l'imagerie photoacoustique comme une alternative de pointe aux techniques d'imagerie conventionnelles telles que l'IRM , le scanner et le PET. Ces facteurs convergents accélèrent l'adoption des solutions d'imagerie photoacoustique en oncologie, cardiologie, neurologie et dermatologie, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché de l'imagerie photoacoustique en Asie-Pacifique

- L'imagerie photoacoustique, qui exploite l'effet photoacoustique pour fournir des images à haute résolution et à contraste élevé des tissus biologiques, est une composante de plus en plus essentielle des systèmes modernes de diagnostic et de recherche médicale, tant en milieu clinique que préclinique, grâce à son caractère non invasif, sa pénétration tissulaire profonde et ses capacités d'imagerie fonctionnelle.

- La demande croissante en imagerie photoacoustique est principalement alimentée par la prévalence croissante des maladies chroniques, le besoin accru de diagnostics précoces et précis, et une préférence grandissante pour les modalités d'imagerie non ionisantes et non invasives.

- La Chine a dominé le marché de l'imagerie photoacoustique en 2024, avec une part de marché de 42,10 %. Cette position de leader s'explique par d'importants investissements publics dans les infrastructures de santé de pointe, le développement de la recherche biomédicale, la croissance rapide du secteur de l'imagerie médicale et l'adoption généralisée de technologies de diagnostic innovantes dans les principaux hôpitaux et instituts de recherche.

- L'Inde devrait être la région connaissant la croissance la plus rapide sur le marché de l'imagerie photoacoustique au cours de la période de prévision, grâce à l'augmentation des dépenses de santé, la prévalence croissante des maladies chroniques, l'expansion des activités de R&D, le développement du tourisme médical et l'amélioration de l'accès aux outils de diagnostic avancés dans les régions urbaines et semi-urbaines.

- Le segment du matériel a dominé le marché avec la plus grande part de revenus (62,4 %) en 2024, soutenu par la forte demande de systèmes d'imagerie avancés, de transducteurs et de sources lumineuses utilisés dans la recherche préclinique et clinique.

Portée du rapport et segmentation du marché de l'imagerie photoacoustique

|

Attributs |

Imagerie photoacoustique : principaux enseignements du marché |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché de l'imagerie photoacoustique en Asie-Pacifique

Les progrès technologiques favorisent l'adoption clinique et la précision de l'imagerie

- Une tendance majeure et en pleine accélération sur le marché mondial de l'imagerie photoacoustique (PAI) est le développement continu de systèmes d'imagerie hybrides intégrant la PAI à l'échographie, à la tomographie par cohérence optique (OCT) et à d'autres modalités afin d'améliorer la précision du diagnostic clinique et la profondeur d'image.

- Par exemple, FUJIFILM VisualSonics a lancé le système Vevo LAZR-X, qui combine ultrasons haute fréquence et photoacoustique, permettant aux chercheurs et aux cliniciens de visualiser simultanément des données moléculaires, fonctionnelles et anatomiques. Cette intégration multimodale améliore considérablement la caractérisation tissulaire, notamment en oncologie et en imagerie vasculaire.

- L'intégration de sources laser accordables et d'algorithmes de démixage spectral en temps réel a amélioré la spécificité et la résolution des images photoacoustiques, permettant une meilleure visualisation de l'hémoglobine, de la mélanine, des lipides et d'autres chromophores. Cette avancée est cruciale pour des applications telles que le suivi de l'angiogenèse tumorale, l'évaluation de l'hypoxie et l'imagerie métabolique.

- Des sondes d'imagerie et des agents de contraste avancés sont en cours de développement pour cibler des marqueurs moléculaires spécifiques, permettant ainsi l'imagerie photoacoustique moléculaire pour la médecine personnalisée. Par exemple, des agents de contraste à base de nanoparticules, conçus spécifiquement pour les biomarqueurs du cancer, sont étudiés afin d'accroître la sensibilité de la détection tumorale par imagerie photoacoustique.

- La miniaturisation des composants d'imagerie permet le développement de dispositifs photoacoustiques portables et de poche, particulièrement prometteurs pour les diagnostics au chevet du patient et l'imagerie peropératoire. Ces systèmes compacts offrent un guidage en temps réel pendant les interventions chirurgicales, améliorant potentiellement les résultats des résections tumorales et des chirurgies vasculaires.

- L'importance croissante accordée à l'innovation technologique et à l'intégration clinique transforme le paysage de l'imagerie photoacoustique. Alors que le secteur s'oriente vers une adoption plus large en milieu hospitalier, des entreprises telles que iThera Medical, Seno Medical et TomoWave Laboratories accélèrent le développement de leurs produits et leurs essais cliniques afin de positionner l'imagerie photoacoustique comme un outil d'imagerie standard en oncologie, en cardiologie et en dermatologie.

Dynamique du marché de l'imagerie photoacoustique en Asie-Pacifique

Conducteur

Besoin croissant dû à la demande croissante d'imagerie non invasive et de détection précoce des maladies

- La demande croissante d'outils de diagnostic non invasifs et à haute résolution dans les contextes cliniques et de recherche est un facteur important de l'adoption croissante des technologies d'imagerie photoacoustique (PAI) dans divers domaines médicaux.

- Par exemple, en mars 2024, FUJIFILM VisualSonics, Inc. a annoncé une nouvelle génération de son système Vevo LAZR-X, intégrant des capacités d'imagerie multispectrale améliorées pour une meilleure caractérisation des tumeurs et une imagerie vasculaire plus précise. Des innovations comme celle-ci devraient stimuler la croissance du marché de l'imagerie photoacoustique (PAI) au cours de la période de prévision.

- Alors que les systèmes de santé du monde entier évoluent vers le dépistage précoce des maladies et le diagnostic de précision, l'imagerie photoacoustique (PAI) offre une alternative intéressante aux méthodes d'imagerie traditionnelles en combinant le contraste optique et la pénétration des ultrasons, permettant ainsi une visualisation détaillée des tissus, de l'oxygénation sanguine et des marqueurs moléculaires sans rayonnement ionisant.

- De plus, la prévalence croissante de maladies chroniques telles que le cancer et les troubles cardiovasculaires a intensifié le besoin d'imagerie fonctionnelle en temps réel, favorisant l'adoption de solutions photoacoustiques dans les hôpitaux et les instituts de recherche.

- La capacité de l'imagerie photoacoustique (PAI) à visualiser in vivo des processus biologiques tels que l'angiogenèse, l'hypoxie et l'inflammation, sans intervention invasive, en fait un outil de choix en recherche préclinique et en diagnostic clinique. La reconnaissance croissante et la validation clinique devraient accélérer son intégration dans les pratiques d'imagerie médicale courantes.

Retenue/Défi

Coût élevé et adoption commerciale limitée en raison de la complexité technologique

- Malgré ses avantages cliniques et de recherche considérables, le coût élevé des systèmes d'imagerie photoacoustique avancés demeure un obstacle majeur à leur adoption à plus grande échelle. Ces systèmes nécessitent des lasers de précision, des transducteurs et des logiciels spécialisés, ce qui les rend onéreux pour de nombreux établissements, notamment dans les contextes aux ressources limitées.

- Par exemple, de nombreuses plateformes PAI haute performance actuellement utilisées dans les laboratoires de R&D universitaires ou pharmaceutiques nécessitent des investissements de plusieurs centaines de milliers de dollars, limitant ainsi leur accès principalement aux grandes universités ou aux centres de recherche bien financés.

- De plus, la complexité technologique de l'imagerie photoacoustique (PAI) – notamment la nécessité d'une formation des opérateurs, d'un étalonnage précis et d'une maintenance – engendre des difficultés opérationnelles susceptibles de freiner son utilisation clinique. La courbe d'apprentissage requise pour interpréter les données multispectrales et intégrer la PAI aux flux de travail cliniques constitue un autre obstacle à son adoption dans les petits hôpitaux ou les laboratoires de diagnostic.

- De plus, bien que l'IAP ait montré des résultats prometteurs lors des études préliminaires, l'absence d'approbation réglementaire généralisée et de standardisation en milieu clinique freine son expansion sur le marché. L'industrie doit investir dans des essais cliniques rigoureux, une harmonisation réglementaire et des données probantes en situation réelle afin de démontrer l'efficacité et la rentabilité de cette technologie dans des applications à grande échelle.

Portée du marché de l'imagerie photoacoustique en Asie-Pacifique

Le marché est segmenté en fonction du composant, du type, de l'application, de la modalité, de la plateforme, de la dimension, de l'application de diagnostic, de l'utilisateur final et du canal de distribution.

- Par composant

Le marché de l'imagerie photoacoustique est segmenté, selon les composants, en matériel (composants et milieu de transmission), logiciels et services. Le segment du matériel a dominé le marché en 2024, représentant 62,4 % des revenus, grâce à une forte demande en systèmes d'imagerie avancés, transducteurs et sources lumineuses utilisés en recherche préclinique et clinique. Le matériel demeure essentiel à la génération, à la détection et à l'intégration des signaux, ce qui explique les investissements importants des instituts de recherche et des hôpitaux. L'intérêt croissant pour l'amélioration de la profondeur, de la résolution et de la vitesse d'imagerie alimente les mises à niveau matérielles continues. Par ailleurs, le développement des applications en oncologie, en imagerie vasculaire et en dermatologie stimule la demande en solutions matérielles sophistiquées. L'adoption croissante des systèmes d'imagerie multimodaux renforce encore la position dominante du matériel. Le marché bénéficie également d'importants financements et collaborations pour le développement de dispositifs photoacoustiques de nouvelle génération. La croissance du segment du matériel est également soutenue par la demande croissante de systèmes portables et compacts. En conclusion, le matériel reste le principal contributeur aux revenus du marché de l'imagerie photoacoustique.

Le segment des logiciels et services devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 14,1 %, entre 2026 et 2033. Cette croissance est portée par le besoin croissant de solutions avancées de traitement d'images, d'analyse basée sur l'IA et de gestion des données dans le cloud. Elle est également soutenue par l'importance grandissante de la visualisation en temps réel et de l'analyse quantitative pour la prise de décision clinique. Les progrès logiciels améliorent la précision des diagnostics et permettent une meilleure intégration avec d'autres modalités d'imagerie. La demande d'outils logiciels augmente dans les hôpitaux, les centres de diagnostic et les laboratoires de recherche afin d'optimiser les flux de travail. Par ailleurs, le développement de l'IA et de l'apprentissage automatique dans l'interprétation d'images stimule l'adoption des logiciels. Les services tels que la maintenance, la formation et le conseil gagnent également du terrain, contribuant ainsi à la croissance globale. Avec l'essor de l'adoption clinique, le besoin de plateformes logicielles conformes à la réglementation s'accroît. Le segment des logiciels et services est ainsi promis à une croissance rapide, portée par ces tendances technologiques et cliniques.

- Par type

Le marché de l'imagerie photoacoustique (PAI) est segmenté, selon le type de système, en systèmes d'imagerie photoacoustique et systèmes de tomographie photoacoustique. En 2024, le segment des systèmes d'imagerie photoacoustique dominait le marché avec une part de revenus de 58,6 %, grâce à son utilisation répandue dans la recherche préclinique pour l'étude de la vascularisation tumorale, de l'oxygénation et l'imagerie moléculaire. Les chercheurs privilégient les systèmes PAI pour leurs capacités d'imagerie à contraste et résolution élevés, sans rayonnement ionisant. Ce segment bénéficie d'une forte adoption dans les institutions académiques, la R&D pharmaceutique et les laboratoires précliniques. Sa polyvalence en imagerie fonctionnelle, en études sur petits animaux et en surveillance non invasive contribue à une demande soutenue. L'intérêt croissant porté à la recherche sur le cancer et aux études vasculaires renforce encore la position dominante de ce segment. De plus, les systèmes PAI sont de plus en plus intégrés à l'échographie et à d'autres modalités d'imagerie. L'innovation continue en matière de miniaturisation des systèmes et d'amélioration des détecteurs soutient également le leadership du marché. En définitive, le segment des systèmes PAI demeure le principal contributeur aux revenus grâce à sa présence établie et à son utilisation généralisée.

Le segment des systèmes de tomographie photoacoustique (PACT) devrait connaître le taux de croissance le plus rapide, soit 12,4 %, entre 2026 et 2033. Cette croissance s'explique par son rôle croissant dans l'imagerie des tissus profonds et par l'augmentation des essais cliniques axés sur l'oncologie et les maladies cardiovasculaires. La profondeur d'imagerie avancée et la capacité de reconstruction 3D sont de plus en plus utilisées en recherche translationnelle et pour le diagnostic clinique. La multiplication des études de validation clinique pour le cancer du sein, l'imagerie vasculaire et la dermatologie contribue également à cette croissance. Le segment bénéficie par ailleurs des améliorations apportées aux algorithmes de reconstruction et à la technologie des détecteurs. L'intérêt croissant pour le diagnostic clinique non invasif encourage l'adoption des systèmes PACT dans les hôpitaux et les centres de diagnostic. La demande d'imagerie haute profondeur en oncologie et en neurologie stimule la croissance du segment. Avec l'émergence de nouvelles autorisations réglementaires et d'applications cliniques, le marché de la PACT devrait connaître une expansion significative.

- Sur demande

Selon l'application, le marché de l'imagerie photoacoustique se divise en deux segments : préclinique et clinique. Le segment préclinique a généré la plus grande part de revenus (61,2 %) en 2024, principalement grâce à son utilisation intensive dans la recherche et le développement académiques et pharmaceutiques pour évaluer l'efficacité des médicaments, la biologie tumorale et la recherche vasculaire. Les chercheurs apprécient l'imagerie photoacoustique pour ses capacités non invasives et multimodales, notamment sur les modèles animaux de petite taille. Les études précliniques bénéficient de l'imagerie en temps réel et de la visualisation haute résolution des modifications moléculaires et fonctionnelles. Ce segment est également soutenu par d'importants financements académiques et des collaborations entre universités et entreprises de biotechnologie. La demande croissante de nouveaux médicaments et de recherche en médecine de précision renforce encore sa position dominante. La présence d'infrastructures d'imagerie préclinique bien établies en Amérique du Nord et en Europe favorise sa croissance. En définitive, les applications précliniques demeurent le principal moteur de revenus du marché de l'imagerie photoacoustique.

Le segment clinique devrait connaître la croissance annuelle composée la plus rapide (13,8 %) entre 2026 et 2033, portée par l'intérêt croissant pour l'imagerie photoacoustique appliquée au diagnostic humain, notamment pour le dépistage du cancer du sein, la dermatologie et les troubles vasculaires. À mesure que son efficacité sera validée par davantage d'essais cliniques, son utilisation clinique devrait se développer considérablement. La demande de solutions d'imagerie non invasives à contraste élevé et visualisation en temps réel est en hausse dans les hôpitaux et les centres de diagnostic. L'accent mis sur le dépistage précoce des maladies et les traitements personnalisés favorise l'adoption clinique de cette technologie. Les progrès réalisés dans le domaine des systèmes portables et de poche rendent également les applications cliniques plus accessibles. Par ailleurs, l'intégration avec l'échographie et d'autres modalités d'imagerie renforce l'utilité diagnostique. La croissance de ce segment est également soutenue par l'augmentation des autorisations réglementaires et des études de validation clinique à l'échelle mondiale.

- Par modalité

Selon la modalité d'utilisation, le marché se divise en systèmes portables, autonomes et de poche. Le segment des systèmes autonomes a dominé le marché en 2024, représentant 54,9 % des revenus, grâce à l'adoption massive de systèmes complets dans les instituts de recherche et les hôpitaux. Ces systèmes offrent des capacités d'imagerie complètes grâce à des détecteurs avancés et des lasers haute performance, ce qui les rend idéaux pour les applications précliniques et cliniques. Ce segment bénéficie d'une forte demande dans la recherche en oncologie, les études vasculaires et le développement de médicaments. Leurs performances robustes, leur précision et leur intégration avec d'autres modalités d'imagerie contribuent à leur position dominante. De plus, les systèmes autonomes sont privilégiés pour les flux de travail d'imagerie complexes et les projets de recherche à long terme. Les investissements dans les infrastructures et la disponibilité de personnel qualifié soutiennent également ce segment.

Le segment des systèmes portables devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, soit 15,2 %, entre 2026 et 2033, en raison de la demande croissante de solutions d'imagerie compactes et mobiles en milieu clinique. Les systèmes portables gagnent en popularité grâce à leur facilité de transport, leur installation rapide et leur utilisation pour les diagnostics au chevet du patient. L'intérêt croissant pour la surveillance au chevet du patient et les diagnostics ambulatoires alimente cette croissance. Ce segment bénéficie également des progrès technologiques réalisés dans le domaine des lasers et des détecteurs miniaturisés. L'adoption de l'imagerie portable par les établissements de santé pour le dépistage et le suivi rapides devrait stimuler la demande. Le développement de la télémédecine et de la surveillance à distance des patients encourage par ailleurs l'adoption des dispositifs photoacoustiques portables.

- Par plateforme

Selon la plateforme utilisée, le marché se segmente en diodes laser pulsées, LED, flash au xénon et autres. Le segment des diodes laser pulsées a dominé le marché en 2024, représentant 57,3 % des revenus, grâce à leur haute efficacité énergétique et à leur profondeur de pénétration supérieure. Offrant des performances stables et un rendement fiable, les diodes laser pulsées sont largement utilisées dans les systèmes photoacoustiques précliniques et cliniques. Ce segment bénéficie de l'innovation continue et de la baisse des coûts des diodes laser. De plus, leur compatibilité avec l'imagerie haute résolution et le fonctionnement multi-longueurs d'onde favorise des applications variées. Leur forte adoption dans la recherche en oncologie et l'imagerie vasculaire renforce encore ce segment.

Le segment des systèmes à LED devrait connaître la croissance annuelle composée la plus rapide, soit 14,6 %, entre 2026 et 2033, portée par la demande croissante de sources lumineuses compactes et économiques. Les systèmes à LED offrent un coût réduit, une taille plus compacte et une intégration plus aisée, ce qui les rend parfaitement adaptés aux appareils portables et de poche. Cette croissance est soutenue par le développement d'applications en dermatologie et en imagerie superficielle. Le développement de matrices de LED haute puissance et l'amélioration du rendement lumineux favorisent également leur adoption. Ce segment devrait s'accélérer avec l'essor des applications cliniques et de diagnostic au chevet du patient.

- Par dimension

En fonction de la dimension, le marché est segmenté en imagerie 2D et 3D. Le segment 2D a dominé le marché en 2024, représentant 59,1 % des revenus. Cette domination s'explique par son utilisation répandue en imagerie de routine, grâce à sa simplicité de mise en œuvre et à sa moindre complexité opérationnelle. L'imagerie photoacoustique 2D est largement utilisée dans les études précliniques car elle permet une acquisition rapide et une visualisation claire des structures vasculaires, des niveaux d'oxygénation et des modifications fonctionnelles des tissus. Le rapport coût-efficacité des systèmes 2D les rend populaires dans les laboratoires universitaires et les petites structures de recherche. Ils offrent également des performances d'imagerie fiables pour l'analyse des tissus superficiels et les études sur les petits animaux. De plus, les systèmes 2D sont plus faciles à intégrer à l'échographie et à d'autres modalités, ce qui favorise leur adoption. Les exigences en matière de formation et de flux de travail sont minimales par rapport aux systèmes 3D, ce qui en fait un choix privilégié pour la recherche précoce et les diagnostics de routine. En définitive, l'imagerie 2D demeure la principale source de revenus grâce à sa présence établie dans les environnements de recherche et cliniques.

Le segment 3D devrait connaître la croissance annuelle composée la plus rapide (13,9 %) entre 2026 et 2033, portée par la demande croissante d'imagerie volumétrique et de capacités de reconstruction avancées en diagnostic clinique et en recherche translationnelle. L'imagerie photoacoustique 3D permet une visualisation détaillée des volumes tumoraux, des réseaux vasculaires et des structures organiques, essentielle à une évaluation précise de la maladie et à la planification du traitement. Le nombre croissant d'essais cliniques en oncologie, cardiologie et neurologie favorise l'adoption des systèmes 3D. Les progrès réalisés en matière de détecteurs, d'algorithmes de reconstruction et de puissance de calcul améliorent la qualité et la rapidité de l'imagerie 3D. À mesure que les hôpitaux et les centres de diagnostic se concentrent sur la cartographie précise des maladies et la surveillance en temps réel, l'imagerie 3D acquiert une valeur ajoutée. La capacité à fournir une visualisation tissulaire plus profonde et un meilleur contexte anatomique encourage également son adoption à plus grande échelle. Par conséquent, l'imagerie 3D devrait enregistrer une forte croissance au cours de la période de prévision.

- Par application de diagnostic

En fonction de l'application diagnostique, le marché est segmenté en oncologie, hématologie, dermatologie, cardiologie, neurologie et autres. Le segment de l'oncologie a dominé le marché en 2024, représentant la plus grande part de revenus (45,8 %), grâce à une forte demande en imagerie tumorale, suivi de la réponse au traitement et évaluation de la vascularisation et de l'oxygénation tumorales. L'imagerie photoacoustique offre une visualisation à contraste élevé des vaisseaux sanguins et de la saturation en oxygène, ce qui la rend précieuse pour la recherche et le diagnostic du cancer. Cette technologie est de plus en plus utilisée dans les études précliniques et translationnelles pour suivre la croissance tumorale et évaluer l'efficacité des thérapies. L'augmentation de l'incidence mondiale du cancer et la hausse des investissements dans la recherche en oncologie confortent la position dominante de ce segment. De plus, la possibilité de combiner l'imagerie photoacoustique à l'échographie renforce sa valeur diagnostique pour la localisation et la caractérisation des tumeurs. L'innovation continue dans les agents de contraste et l'imagerie multi-longueurs d'onde élargit les applications en oncologie. Par conséquent, l'oncologie demeure le principal moteur de croissance du marché de l'imagerie photoacoustique.

Le segment de la dermatologie devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 15,5 %, entre 2026 et 2033, porté par la demande croissante d'imagerie cutanée non invasive et de détection précoce des affections cutanées telles que le mélanome et le psoriasis. L'imagerie photoacoustique offre une visualisation haute résolution des couches de la peau et des structures vasculaires, permettant aux cliniciens d'évaluer la profondeur des lésions, le flux sanguin et l'oxygénation sans biopsie invasive. L'adoption croissante des technologies d'imagerie avancées par les cliniques esthétiques et dermatologiques soutient la croissance du marché. Par ailleurs, la sensibilisation accrue au dépistage et au diagnostic précoce du cancer de la peau favorise également cette adoption. Les progrès technologiques réalisés dans le domaine des appareils portables rendent l'imagerie photoacoustique plus accessible aux applications dermatologiques. La croissance de ce segment est en outre soutenue par l'intensification de la recherche sur les maladies de la peau et le développement de systèmes d'imagerie photoacoustique spécialisés pour la dermatologie.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en centres de chirurgie ambulatoire, laboratoires de recherche, hôpitaux et cliniques, centres d'imagerie diagnostique, entreprises pharmaceutiques et biotechnologiques, et autres. Le segment des laboratoires de recherche a dominé le marché en 2024, grâce à une forte demande d'outils d'imagerie préclinique, à d'importants financements académiques et à l'essor de la recherche en imagerie fonctionnelle et moléculaire. Les institutions de recherche adoptent de plus en plus les systèmes d'imagerie photoacoustique pour faire progresser la découverte biomédicale, le développement de médicaments et la recherche translationnelle. Cette technologie est largement utilisée dans les études sur les petits animaux pour la biologie tumorale, l'imagerie vasculaire et l'évaluation de l'efficacité des médicaments. Par ailleurs, les collaborations entre universités et entreprises de biotechnologie stimulent les investissements dans les systèmes d'imagerie photoacoustique. La présence d'infrastructures de recherche préclinique bien établies en Amérique du Nord et en Europe contribue également à la domination de ce segment. Globalement, les laboratoires de recherche demeurent la principale source de revenus en raison de la forte demande d'outils d'imagerie haut de gamme.

Le segment des hôpitaux et cliniques devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé, soit 14,7 %, entre 2026 et 2033, grâce à l'adoption croissante de modalités d'imagerie innovantes en milieu clinique. Les hôpitaux investissent de plus en plus dans des solutions d'imagerie non invasives et en temps réel pour le dépistage précoce des maladies et le suivi des traitements. L'importance croissante accordée à la médecine personnalisée et aux diagnostics de précision favorise l'intégration de l'imagerie photoacoustique dans les flux de travail cliniques. La capacité de cette technologie à fournir des informations fonctionnelles et moléculaires, en plus de l'imagerie structurelle, la rend précieuse en oncologie, en dermatologie et en pathologie vasculaire. Par ailleurs, l'amélioration de la validation clinique et des approbations réglementaires stimule son adoption. La demande croissante d'outils de diagnostic avancés sur les marchés émergents contribue également à cette croissance.

- Par canal de distribution

Selon le canal de distribution, le marché est segmenté en appels d'offres, ventes au détail, ventes en ligne et autres. Le segment des appels d'offres a dominé le marché en 2024, représentant la plus grande part de revenus (52,6 %), grâce aux achats institutionnels de systèmes photoacoustiques par les hôpitaux, les laboratoires de recherche et les organismes gouvernementaux. Ce mode d'achat est privilégié pour les acquisitions importantes car il offre des prix plus avantageux, des contrats de service à long terme et des configurations système personnalisées. Il est particulièrement prisé par les établissements de santé publique et les institutions académiques qui exigent des équipements d'imagerie haut de gamme avec un support de maintenance complet. La présence des principaux fabricants d'équipements d'imagerie et leurs solides réseaux de distribution contribuent également à la domination des appels d'offres. De plus, ces derniers incluent souvent des services groupés, l'installation et la formation, ce qui représente une valeur ajoutée pour les acheteurs.

Le segment des ventes en ligne devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, à 16,2 %, entre 2026 et 2033. Cette croissance est soutenue par la digitalisation croissante, l'adoption du commerce électronique et un accès facilité aux petits accessoires d'imagerie, aux logiciels et aux appareils portables. Les plateformes en ligne offrent une grande facilité d'achat et une livraison rapide, notamment pour les laboratoires de recherche et les petites cliniques. La croissance des ventes en ligne est également alimentée par la demande croissante d'approvisionnement à distance et de remplacement rapide des composants. Enfin, la confiance accrue dans les transactions en ligne et l'amélioration de la logistique dans les marchés émergents contribuent à la croissance de ce segment.

Analyse régionale du marché de l'imagerie photoacoustique en Asie-Pacifique

- Le marché de l'imagerie photoacoustique en Asie-Pacifique devrait enregistrer le TCAC le plus rapide, soit 14,8 %, au cours de la période de prévision, la région représentant 21,3 % des revenus mondiaux en 2024.

- Cette croissance rapide est alimentée par l'augmentation des dépenses de santé, les programmes de santé numérique mis en œuvre par les gouvernements et le développement des infrastructures d'imagerie dans des pays comme la Chine, le Japon et l'Inde.

- L'augmentation du nombre de partenariats public-privé, associée à la production nationale de dispositifs médicaux, améliore l'accès à des systèmes d'IAP abordables et de haute qualité dans toute la région.

Aperçu du marché chinois de l'imagerie photoacoustique

En 2024, le marché chinois de l'imagerie photoacoustique détenait la plus grande part de marché en Asie-Pacifique, représentant environ 11,7 % du chiffre d'affaires mondial. La croissance rapide de ce marché est soutenue par un secteur biotechnologique florissant, des politiques gouvernementales favorables à l'innovation dans le domaine de la santé et des investissements croissants dans les infrastructures de diagnostic. Les principaux hôpitaux des zones urbaines adoptent activement les systèmes d'imagerie photoacoustique pour un usage clinique, tandis que les fabricants locaux continuent d'améliorer l'accessibilité et de stimuler l'innovation dans ce secteur.

Analyse du marché indien de l'imagerie photoacoustique

Le marché indien de l'imagerie photoacoustique devrait connaître la croissance la plus rapide au cours de la période de prévision, portée par l'augmentation des dépenses de santé, la prévalence croissante des maladies chroniques, le développement des activités de R&D, l'essor du tourisme médical et l'amélioration de l'accès aux outils de diagnostic avancés dans les zones urbaines et périurbaines. Le pays connaît un développement rapide de ses infrastructures hospitalières et de ses centres de diagnostic, soutenu par les initiatives gouvernementales promouvant les technologies de pointe en matière de santé. L'augmentation des investissements des acteurs privés du secteur de la santé et la demande croissante de solutions d'imagerie non invasives accélèrent encore l'adoption du marché. Le développement de l'écosystème de recherche biomédicale en Inde et le nombre croissant d'essais cliniques renforcent également la demande de systèmes d'imagerie photoacoustique dans les laboratoires de recherche et les hôpitaux.

Part de marché de l'imagerie photoacoustique en Asie-Pacifique

L'industrie de l'imagerie photoacoustique est principalement dominée par des entreprises bien établies, notamment :

- PreXion Inc. (États-Unis)

- iThera Medical GmbH (Allemagne)

- PST Inc. (Corée du Sud)

- HÜBNER Photonics (Allemagne)

- Lasers Litron (Royaume-Uni)

- FUJIFILM Visualsonics, Inc. (Canada)

- Kibero (Suisse)

- InnoLas Laser GmbH (Allemagne)

- LASER QUANTEL (France)

- GE HealthCare (États-Unis)

- Ekspla (Lituanie)

- Laboratoires TomoWave, Inc. (États-Unis)

- Aspectus GmbH (Allemagne)

- Solutions d'éclairage naturel (États-Unis)

- ADVANTEST CORPORATION (Japon)

- illumiSonics Inc. (États-Unis)

- OPOTEK LLC (États-Unis)

- Seno Medical (États-Unis)

- Vibronix, Inc. (États-Unis)

Dernières évolutions du marché de l'imagerie photoacoustique en Asie-Pacifique

- En avril 2025, des chercheurs ont introduit le facteur de sonie acoustique (ALF) , un nouveau paramètre de référence conçu pour les sondes photoacoustiques à petites molécules. L'ALF permet de prédire avec précision les performances du colorant in vivo, accélérant ainsi la conception des sondes et améliorant la qualité du signal en imagerie diagnostique.

- En février-mars 2025, des scientifiques de l'Université Wayne State ont utilisé l'imagerie par résonance magnétique probabiliste (IPP) combinée à la reconnaissance de formes pour révéler des schémas d'activation neuronale distincts dans le cortex préfrontal lors de l'apprentissage conditionné chez le rat, soulignant ainsi le rôle émergent de l'IPP dans la recherche en neurosciences.

- En avril 2025, des chercheurs de l'université Duke ont publié des résultats sur l'utilisation du facteur de sonie acoustique pour l'évaluation comparative et l'amélioration des sondes photoacoustiques à petites molécules, établissant ainsi une nouvelle norme pour la conception et l'évaluation préclinique.

- En mai 2025, un groupe conjoint A*STAR–NHG à Singapour a dévoilé un premier essai clinique chez l'humain combinant la MSOT et la segmentation basée sur l'IA pour l'imagerie tumorale 3D — y compris le diagnostic du carcinome basocellulaire — démontrant une efficacité à haute résolution et un potentiel pour guider la planification chirurgicale

- En mars 2025, la revue Nature Reviews Bioengineering a publié un article intitulé « Définir le créneau clinique de l'imagerie photoacoustique », soulignant son importance thérapeutique croissante en oncologie et en diagnostic cardiovasculaire, et mettant en évidence son adoption clinique accélérée.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.