Asia Pacific Pharmaceutical Vials Market

Taille du marché en milliards USD

TCAC :

%

USD

17.23 Billion

USD

28.31 Billion

2025

2033

USD

17.23 Billion

USD

28.31 Billion

2025

2033

| 2026 –2033 | |

| USD 17.23 Billion | |

| USD 28.31 Billion | |

|

|

|

|

Segmentation du marché des flacons pharmaceutiques en Asie-Pacifique : par matériau (verre, plastique et autres), type de col (à vis, à sertir, à double chambre, à clapet et autres), diamètre du bouchon (13-425 mm, 15-425 mm, 18-400 mm, 22-350 mm, 24-400 mm, 8-425 mm, 9 mm et autres), canal de distribution (vente directe, pharmacies, e-commerce et autres), capacité (1 ml, 2 ml, 3 ml, 4 ml, 8 ml, 10 ml, 20 ml, 30 ml, 50 ml et autres), type de médicament (injectable et non injectable), application (orale, nasale, injectable et autres), utilisateur final (entreprises pharmaceutiques, entreprises biopharmaceutiques, entreprises de développement et de fabrication à façon, pharmacies de préparation magistrale et autres), marché (parentéral, gastro-intestinal, ORL et autres). - Tendances et prévisions du secteur jusqu'en 2033

Taille du marché des flacons pharmaceutiques en Asie-Pacifique

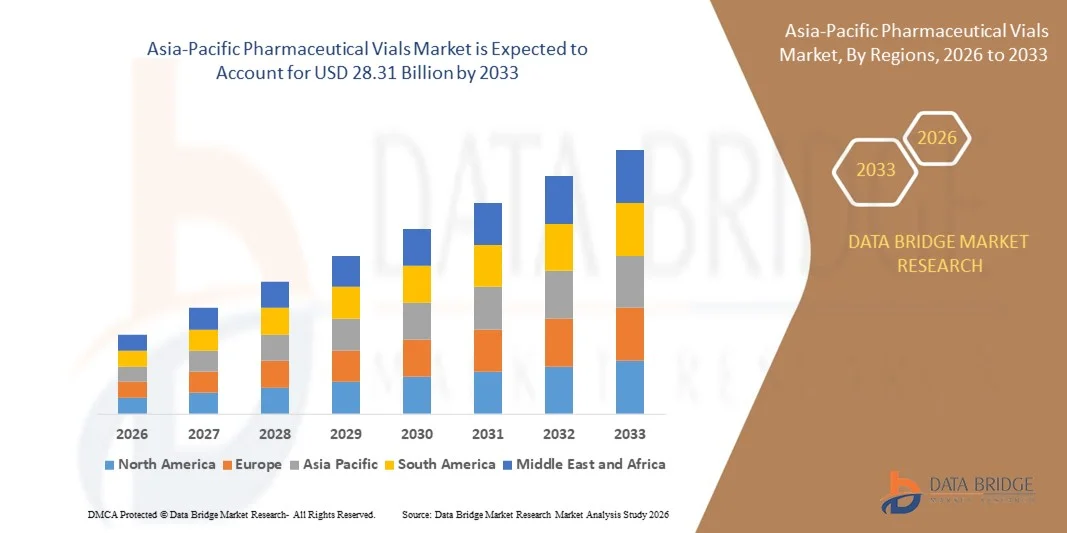

- Le marché des flacons pharmaceutiques en Asie-Pacifique était évalué à 17,23 milliards de dollars en 2025 et devrait atteindre 28,31 milliards de dollars d'ici 2033 , avec un TCAC de 6,40 % au cours de la période de prévision.

- La croissance du marché est largement tirée par l'augmentation de la production pharmaceutique et la demande croissante de médicaments injectables, de vaccins et de produits biologiques dans toute la région, soutenues par le développement des infrastructures de santé et l'obtention des autorisations réglementaires.

- Par ailleurs, les progrès réalisés dans les technologies de fabrication des flacons, tels que la stérilisation, l'amélioration de la qualité du verre et les solutions multidoses, contribuent à accroître l'efficacité de la production et à renforcer les normes de sécurité. La convergence de ces facteurs accélère l'adoption des flacons pharmaceutiques, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des flacons pharmaceutiques en Asie-Pacifique

- Les flacons pharmaceutiques, utilisés pour stocker et transporter les médicaments injectables, les vaccins et les produits biologiques, sont des éléments de plus en plus essentiels des chaînes d'approvisionnement modernes en soins de santé et en produits pharmaceutiques, tant dans les hôpitaux que dans les laboratoires, en raison de leur stérilité accrue, de leur durabilité et de leur compatibilité avec les systèmes d'administration de médicaments avancés.

- La demande croissante de flacons pharmaceutiques est principalement alimentée par la production croissante de médicaments injectables, la multiplication des programmes de vaccination et l'adoption croissante des produits biologiques et des médicaments de spécialité.

- La Chine a dominé le marché des flacons pharmaceutiques en Asie-Pacifique avec la plus grande part de revenus (32,2 %) en 2025, grâce à une infrastructure de fabrication pharmaceutique bien établie, des dépenses de santé élevées et une forte présence de fabricants de flacons de premier plan. Les États-Unis ont connu une croissance substantielle de l'utilisation des flacons multidoses et préremplis, grâce aux innovations en matière de qualité du verre, de procédés de stérilisation et de conformité réglementaire.

- L'Inde devrait être la région à la croissance la plus rapide du marché des flacons pharmaceutiques Asie-Pacifique au cours de la période de prévision, en raison de l'expansion de la production pharmaceutique, de la multiplication des initiatives gouvernementales en matière de santé et de la demande croissante de vaccins et de produits biologiques.

- Le segment du verre a dominé le marché avec la plus grande part de revenus (47,5 %) en 2025, grâce à sa résistance chimique éprouvée, sa stérilité et sa compatibilité avec une large gamme de formulations médicamenteuses, y compris les produits biologiques et les vaccins.

Portée du rapport et segmentation du marché des flacons pharmaceutiques en Asie-Pacifique

|

Attributs |

Flacons pharmaceutiques : principaux enseignements du marché |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des flacons pharmaceutiques en Asie-Pacifique

Amélioration de l'efficacité grâce aux technologies de flacons avancées

- L'adoption de technologies de fabrication avancées et de solutions numériques, telles que l'automatisation, les systèmes de remplissage de précision et le contrôle qualité en temps réel, constitue une tendance majeure et en pleine accélération sur le marché des flacons pharmaceutiques en Asie-Pacifique. Ces innovations améliorent considérablement l'efficacité de la production, la sécurité des produits et la constance de la qualité tout au long de la chaîne d'approvisionnement pharmaceutique.

- Par exemple, les lignes de remplissage automatisées avec systèmes intégrés de stérilisation et de bouchage permettent aux fabricants de maintenir un débit élevé tout en minimisant les risques de contamination. De même, les solutions de flacons préremplis et multidoses simplifient l'administration des médicaments et réduisent les erreurs de dosage en milieu clinique et hospitalier.

- L'intégration numérique dans la fabrication des flacons permet des fonctionnalités telles que la surveillance en temps réel des paramètres de production, la maintenance prédictive et une traçabilité renforcée tout au long de la chaîne d'approvisionnement. Par exemple, certaines solutions des groupes Stevanato et Schott AG utilisent des capteurs connectés pour contrôler l'intégrité des flacons et garantir la conformité aux normes réglementaires. De plus, les systèmes automatisés de suivi et d'étiquetage simplifient la gestion des stocks et la traçabilité des lots.

- L'intégration fluide des flacons pharmaceutiques aux plateformes numériques de contrôle qualité et aux solutions d'emballage intelligentes facilite la supervision centralisée de la production, du stockage et de la distribution. Grâce à un système unique, les fabricants peuvent surveiller plusieurs lignes de production, garantir la stérilité et suivre les lots en temps réel, ce qui permet un flux de travail hautement efficace et fiable.

- Cette tendance vers des systèmes de fabrication et de contrôle qualité plus automatisés, précis et interconnectés redéfinit en profondeur les attentes en matière de production de flacons pharmaceutiques. Par conséquent, des entreprises telles que Corning, West Pharmaceutical Services et Stevanato Group développent des flacons de haute technologie dotés de fonctionnalités comme le contrôle qualité assisté par l'IA, une conception compatible avec l'automatisation et la compatibilité avec les systèmes d'administration de médicaments avancés.

- La demande de flacons pharmaceutiques offrant une efficacité de fabrication, une sécurité et une intégration numérique accrues croît rapidement dans les secteurs pharmaceutiques hospitaliers et commerciaux, les fabricants privilégiant de plus en plus la qualité des produits, la conformité réglementaire et la rationalisation des opérations.

Dynamique du marché des flacons pharmaceutiques en Asie-Pacifique

Conducteur

Besoins croissants liés à la demande croissante de médicaments injectables et de vaccins

- La prévalence croissante des maladies chroniques, associée à la demande croissante de vaccins et de produits biologiques, est un facteur important de l'adoption accrue des flacons pharmaceutiques.

- Par exemple, en 2025, des fabricants clés tels que Schott AG et Stevanato Group ont annoncé l'expansion de leurs lignes de production automatisées de flacons afin de répondre à la demande croissante de vaccins multidoses contre la COVID-19 et la grippe. Ces stratégies mises en œuvre par les grandes entreprises devraient stimuler la croissance du marché des flacons pharmaceutiques au cours de la période de prévision.

- Alors que les prestataires de soins de santé et les sociétés pharmaceutiques s'efforcent de garantir une administration de médicaments sûre, stérile et efficace, les flacons pharmaceutiques offrent des fonctionnalités avancées telles que la capacité multidose, la compatibilité avec les seringues préremplies et une stérilité accrue, offrant un avantage convaincant par rapport aux autres formats d'emballage.

- De plus, l'importance croissante accordée aux programmes de vaccination, aux produits biologiques et aux médicaments injectables spécialisés fait des flacons pharmaceutiques un élément essentiel des chaînes d'approvisionnement modernes en soins de santé, facilitant une intégration transparente avec les systèmes automatisés de remplissage, de stockage et de distribution.

- La praticité des flacons préremplis, multidoses et compatibles avec les systèmes automatisés, ainsi que leur conformité réglementaire et leur traçabilité, sont des facteurs clés qui favorisent leur adoption dans les hôpitaux, les cliniques et l'industrie pharmaceutique. La tendance aux lignes de production évolutives et à la conception de flacons ergonomiques contribue également à la croissance du marché.

Retenue/Défi

Préoccupations relatives à la conformité réglementaire et aux coûts de production

- Les exigences réglementaires strictes et les coûts de production élevés constituent un frein important à l'expansion du marché. Les flacons pharmaceutiques doivent répondre à des normes rigoureuses de stérilité, de qualité du verre et de biocompatibilité, ce qui accroît la complexité et les coûts de fabrication.

- Par exemple, la conformité aux normes FDA, EMA et ISO exige des tests et une validation rigoureux, ce qui peut ralentir la mise sur le marché des nouveaux modèles de flacons.

- Relever ces défis réglementaires grâce à un contrôle qualité rigoureux, des systèmes de production automatisés et le respect des normes internationales est essentiel pour instaurer la confiance entre les entreprises pharmaceutiques. Des fabricants comme West Pharmaceutical Services et Corning insistent sur la conformité et l'assurance qualité de leurs processus de production afin de rassurer leurs clients. Par ailleurs, le coût relativement élevé des flacons en verre de pointe ou multidoses, comparé aux flacons classiques, peut constituer un frein pour les petits fabricants pharmaceutiques, notamment sur les marchés émergents.

- Bien que les gains d'efficacité en matière de production et les économies d'échelle contribuent progressivement à réduire les coûts, la prime perçue pour les flacons stériles de haute qualité peut encore freiner leur adoption à grande échelle, notamment auprès des acheteurs sensibles aux prix.

- Pour une croissance durable du marché, il est essentiel de surmonter ces défis grâce à une automatisation accrue, des méthodes de production rentables et un respect constant des normes de qualité internationales.

Portée du marché des flacons pharmaceutiques en Asie-Pacifique

Le marché des flacons pharmaceutiques est segmenté en fonction du matériau, du type de col, de la taille du bouchon, du canal de distribution, de la capacité, du type de médicament, de l'application, de l'utilisateur final et du marché.

- Par matériau

Le marché des flacons pharmaceutiques en Asie-Pacifique est segmenté, selon le matériau, en verre, plastique et autres. Le segment du verre a dominé le marché en 2025, représentant 47,5 % des revenus. Cette domination s'explique par la résistance chimique, la stérilité et la compatibilité éprouvées des flacons en verre avec une large gamme de formulations médicamenteuses, notamment les produits biologiques et les vaccins. Les fabricants de produits pharmaceutiques privilégient largement les flacons en verre pour les médicaments injectables à forte valeur ajoutée, en raison de leur stabilité et de leur faible réactivité.

Le segment du plastique devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 22,3 %, entre 2026 et 2033, grâce à sa légèreté, sa résistance aux chocs et son adéquation à la distribution à grande échelle de vaccins. Les flacons en plastique sont de plus en plus utilisés pour leur rentabilité, notamment sur les marchés émergents, et pour les applications exigeant un faible risque de casse lors du transport. La demande croissante de contenants de médicaments sûrs, légers et faciles à transporter devrait stimuler la croissance globale des deux types de matériaux.

- Par type de cou

Selon le type de col, le marché est segmenté en col vissé, col serti, col à double chambre, col à clapet et autres. Le segment du col vissé dominait le marché avec une part de 44,6 % en 2025, grâce à sa facilité de fermeture, sa compatibilité avec les machines de capsulage automatisées et son utilisation répandue dans les médicaments injectables et les produits biologiques. Les flacons à col vissé offrent une fermeture étanche et sont privilégiés pour les applications à dose unique et à doses multiples.

Le segment des flacons à double compartiment devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 20,8 %, entre 2026 et 2033. Cette croissance est portée par leur capacité à stocker les médicaments lyophilisés séparément des solvants, ce qui facilite l'administration et la stabilité des médicaments. L'adoption croissante des produits biologiques lyophilisés et des thérapies combinées devrait stimuler la croissance de ce segment, notamment auprès des fabricants biopharmaceutiques à la recherche de flacons innovants pour les formulations complexes.

- Par taille de casquette

Le marché des flacons pharmaceutiques en Asie-Pacifique est segmenté en plusieurs tailles de bouchon, allant de 8 à 425 mm et de 24 à 400 mm. Le segment de 13 à 425 mm dominait le marché en 2025 avec une part de 41,2 %, grâce à sa polyvalence pour le conditionnement d'une grande variété de médicaments injectables et à sa facilité d'utilisation avec les machines de capsulage standard. Cette taille de bouchon est privilégiée dans les hôpitaux et les programmes de vaccination à grande échelle pour sa compatibilité avec les seringues et les équipements de remplissage couramment utilisés.

Le segment des flacons de 22 à 350 mm devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 21,0 %, entre 2026 et 2033, sous l'effet de la demande croissante de flacons de grand volume utilisés dans les vaccins et produits biologiques multidoses. L'augmentation de la production de traitements injectables à grand volume et l'expansion des programmes de vaccination dans la région Asie-Pacifique favorisent l'adoption de ces formats de bouchon dans les secteurs commercial et hospitalier.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en vente directe, pharmacies/magasins médicaux, commerce électronique et autres. Le segment de la vente directe dominait le marché en 2025 avec une part de 45,7 %, grâce aux relations étroites entre les fabricants de produits pharmaceutiques et les hôpitaux, les cliniques et les grands distributeurs de médicaments. La vente directe permet des achats en gros, garantit la qualité et assure la conformité réglementaire, ce qui en fait le canal privilégié des grandes entreprises pharmaceutiques.

Le segment du commerce électronique devrait connaître le taux de croissance annuel composé le plus rapide, soit 23,1 %, entre 2026 et 2033. Cette croissance est alimentée par le développement des plateformes de vente de produits pharmaceutiques en ligne, la digitalisation croissante et la commodité de la livraison à domicile pour les petits établissements de santé et les pharmacies. L'adoption croissante des canaux de commerce électronique est particulièrement notable sur les marchés émergents d'Asie-Pacifique, où l'accès aux fournitures médicales se développe rapidement.

- Par capacité

En fonction de la capacité, le marché est segmenté selon différents volumes de flacons. Le segment des flacons de 10 ml dominait le marché avec une part de 42,8 % en 2025, grâce à son utilisation répandue pour les médicaments injectables, les vaccins et les formulations multidoses. Il offre un équilibre optimal entre flexibilité de dosage et efficacité de stockage.

Le segment des flacons de 2 ml devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 22,6 %, entre 2026 et 2033, sous l'effet de la production croissante de produits biologiques et de vaccins à forte valeur ajoutée nécessitant un dosage en faible volume. Les flacons de petite capacité sont privilégiés pour les médicaments lyophilisés, les seringues préremplies et les formulations pédiatriques, ce qui génère une forte demande auprès des hôpitaux, des cliniques et des fabricants de produits pharmaceutiques.

- Par type de médicament

Selon le type de médicament, le marché est segmenté en médicaments injectables et non injectables. Le segment des médicaments injectables dominait le marché en 2025 avec une part de 56,3 %, grâce à l'adoption croissante des vaccins, des produits biologiques et des médicaments injectables spécialisés en milieu hospitalier et clinique. Les flacons injectables sont essentiels pour garantir la stérilité, la précision du dosage et la sécurité du stockage.

Le segment des produits non injectables devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 20,5 %, entre 2026 et 2033, porté par la demande croissante de formulations liquides orales, de sprays nasaux et de médicaments topiques conditionnés en petits flacons. L'expansion des portefeuilles de produits pharmaceutiques et le développement de formulations centrées sur le patient devraient accélérer la croissance de ce segment.

- Sur demande

Selon le mode d'application, le marché est segmenté en administration orale, nasale, injectable et autres. Le segment des injectables dominait le marché en 2025 avec une part de 57,1 %, en raison de la forte demande en vaccins, produits biologiques et médicaments parentéraux. Les flacons injectables garantissent la stérilité, la précision du dosage et la stabilité à long terme, ce qui les rend indispensables dans les hôpitaux, les cliniques et l'industrie pharmaceutique.

Le segment nasal devrait connaître le taux de croissance annuel composé le plus rapide, soit 21,9 %, entre 2026 et 2033, porté par la popularité croissante des vaccins nasaux, des systèmes d'administration de médicaments pour les maladies chroniques et des thérapies non invasives plébiscitées par les patients. L'innovation croissante dans les formulations de médicaments nasaux et la compatibilité des dispositifs favorisent l'adoption de ces traitements dans la région.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en entreprises pharmaceutiques, entreprises biopharmaceutiques, entreprises de développement et de fabrication à façon (CDMO), pharmacies de préparation magistrale et autres. Le segment des entreprises pharmaceutiques dominait le marché avec une part de 48,5 % en 2025, grâce à la production à grande échelle de vaccins, de produits biologiques et de médicaments injectables. Les entreprises pharmaceutiques établies privilégient les fournisseurs fiables pour garantir une qualité constante des flacons et le respect des réglementations.

Le segment des sociétés biopharmaceutiques devrait connaître le TCAC le plus rapide, soit 22,7 %, entre 2026 et 2033, alimenté par le secteur en pleine croissance des produits biologiques et biosimilaires, l'augmentation des projets de R&D et le besoin de formats de flacons spécialisés pour les composés sensibles.

- Par marché : parentéral, gastro-intestinal, ORL et autres

Le marché des flacons pharmaceutiques en Asie-Pacifique est segmenté selon les besoins du marché : produits parentéraux, gastro-intestinaux, ORL et autres. Le segment des produits parentéraux dominait le marché en 2025 avec une part de 54,2 %, portée par la forte demande de médicaments injectables, de vaccins et de produits biologiques nécessitant un stockage stérile et fiable en flacons. Les flacons pour produits parentéraux sont essentiels dans les hôpitaux et les établissements de soins pour garantir la sécurité des patients et préserver l’efficacité des médicaments.

Le segment ORL devrait connaître le taux de croissance annuel composé le plus rapide, soit 21,3 %, entre 2026 et 2033. Cette croissance est soutenue par l'utilisation croissante de systèmes d'administration de médicaments spécialisés pour les traitements des affections de l'oreille, du nez et de la gorge, notamment en consultation externe et dans les cliniques spécialisées. La sensibilisation accrue aux traitements spécifiques à chaque pathologie et l'innovation pharmaceutique croissante sont les principaux moteurs de cette croissance.

Analyse régionale du marché des flacons pharmaceutiques en Asie-Pacifique

- La Chine a dominé le marché des flacons pharmaceutiques en Asie-Pacifique avec la plus grande part de revenus (32,2 %) en 2025, grâce à une base de fabrication pharmaceutique en croissance, une forte demande de vaccins et de produits biologiques et une infrastructure de soins de santé bien établie.

- Les prestataires de soins de santé et les sociétés pharmaceutiques de la région privilégient les flacons de haute qualité en raison de leur fiabilité, de leur stérilité et de leur compatibilité avec une large gamme de médicaments injectables et biologiques.

- Cette adoption généralisée est également soutenue par des normes réglementaires rigoureuses, des technologies de fabrication avancées et des relations solides entre les fournisseurs de flacons et les grandes sociétés pharmaceutiques, faisant des flacons en verre de haute qualité et des flacons spéciaux le choix privilégié tant pour la production commerciale que pour l'usage hospitalier.

Aperçu du marché des flacons pharmaceutiques en Chine et en Asie-Pacifique

En 2025, le marché chinois des flacons pharmaceutiques représentait la plus grande part de revenus de la région Asie-Pacifique, grâce à la solidité de son industrie pharmaceutique, à l'expansion de sa production de vaccins et à la demande croissante de produits biologiques et de médicaments injectables. L'urbanisation rapide, la hausse des dépenses de santé et les initiatives gouvernementales favorisant l'accès aux soins contribuent également à cette croissance. La Chine s'impose par ailleurs comme un pôle de production majeur de flacons pharmaceutiques, permettant la fabrication de flacons en verre et en plastique de haute qualité et à un coût compétitif, destinés aux chaînes d'approvisionnement nationales et internationales.

Aperçu du marché des flacons pharmaceutiques au Japon et en Asie-Pacifique

Le marché japonais des flacons pharmaceutiques connaît une croissance soutenue, portée par la forte demande du pays en produits biologiques de pointe, vaccins et médicaments injectables. L'accent mis par le Japon sur l'innovation technologique, des normes de qualité rigoureuses et le vieillissement de sa population favorisent l'adoption de flacons préremplis et multidoses, qui offrent praticité, stérilité et sécurité. L'intégration de systèmes automatisés de remplissage et de conditionnement dans la production pharmaceutique japonaise contribue également à l'expansion du marché.

Aperçu du marché des flacons pharmaceutiques en Inde et en Asie-Pacifique

Le marché indien des flacons pharmaceutiques devrait connaître la plus forte croissance annuelle composée (TCAC) de la région Asie-Pacifique au cours de la période de prévision, portée par l'essor de la production pharmaceutique, la hausse de la production de vaccins et le développement des infrastructures biopharmaceutiques. Les initiatives gouvernementales en faveur des campagnes de vaccination, la sensibilisation accrue aux soins de santé et la croissance des exportations de médicaments injectables contribuent à l'adoption rapide des flacons en verre et en plastique. L'écosystème de production indien, compétitif en termes de coûts, attire également les entreprises pharmaceutiques internationales à la recherche d'un approvisionnement fiable en flacons.

Aperçu du marché des flacons pharmaceutiques en Corée du Sud et en Asie-Pacifique

Le marché sud-coréen des flacons pharmaceutiques connaît une croissance soutenue, portée par l'augmentation des investissements dans la production de produits biologiques, de vaccins et de médicaments injectables stériles. L'adoption croissante de flacons en verre de haute qualité, le respect rigoureux des réglementations et les progrès technologiques en matière de stérilisation et de remplissage des flacons contribuent à cette croissance. Par ailleurs, l'infrastructure pharmaceutique performante du pays et sa production axée sur l'exportation stimulent la demande, tant pour le marché intérieur que pour les marchés internationaux.

Part de marché des flacons pharmaceutiques en Asie-Pacifique

L'industrie des flacons pharmaceutiques est principalement dominée par des entreprises bien établies, notamment :

• Schott AG (Allemagne)

• Stevanato Group (Italie)

• Corning Inc. (États-Unis)

• West Pharmaceutical Services, Inc. (États-Unis)

• BD (Becton, Dickinson and Company) (États-Unis)

• Suzhou Hengrui Medicine (Chine)

• Vials India Limited (Inde)

• Sun Pharmaceutical Industries Ltd. (Inde)

• Flexion Therapeutics (États-Unis)

• SG Pharma (Inde)

• Huhtamaki PPL (Finlande)

• Daikyo Seiko Ltd. (Japon)

• Agilent Technologies (États-Unis)

• Camber Pharma (Royaume-Uni)

• Kangtai Biological Products (Chine)

• Hikma Pharmaceuticals (Royaume-Uni)

• Ricerca Biosciences (États-Unis)

• Stein Pharma (Chine)

• Corning Life Sciences (États-Unis)

• Daikyo Pharmaceutical Packaging (Japon)

Quels sont les développements récents sur le marché des flacons pharmaceutiques en Asie-Pacifique ?

- En avril 2024, Schott AG, leader mondial des solutions en verre spécialisé, a lancé une initiative stratégique en Inde visant à optimiser la production et la fourniture de flacons pharmaceutiques de haute qualité pour les vaccins et les produits biologiques. Cette initiative témoigne de l'engagement de l'entreprise à fournir des flacons fiables, stériles et conformes aux réglementations, adaptés aux besoins croissants du secteur de la santé dans la région. Forte de son expertise mondiale et de ses technologies de fabrication de pointe, Schott AG relève les défis pharmaceutiques régionaux et renforce sa position sur le marché en pleine expansion des flacons pharmaceutiques en Asie-Pacifique.

- En mars 2024, le groupe Stevanato, fabricant italien de flacons et de seringues préremplies, a lancé une nouvelle gamme de flacons multidoses spécialement conçus pour les campagnes de vaccination à grande échelle en Asie du Sud-Est. La conception innovante de ces flacons garantit une stérilité accrue, un risque de contamination réduit et une compatibilité avec les lignes de remplissage automatisées. Ce développement témoigne de l'engagement du groupe Stevanato à soutenir les efforts de vaccination de masse et à optimiser l'efficacité opérationnelle des professionnels de santé.

- En mars 2024, Corning Inc. a augmenté avec succès sa capacité de production de flacons injectables en Chine afin de répondre à la demande croissante de vaccins, de produits biologiques et de médicaments de spécialité. Cette initiative s'appuie sur des technologies de production de pointe pour garantir un approvisionnement en flacons stériles, de haute qualité et constant, témoignant de l'engagement de Corning à soutenir l'industrie pharmaceutique en pleine expansion dans la région.

- En février 2024, West Pharmaceutical Services, Inc., fournisseur majeur de solutions d'administration de médicaments injectables, a annoncé un partenariat stratégique avec plusieurs fabricants biopharmaceutiques régionaux au Japon pour la fourniture de flacons préremplis et multidoses. Cette collaboration vise à optimiser l'efficacité de la production, à renforcer la fiabilité de la chaîne d'approvisionnement et à simplifier la distribution aux hôpitaux et cliniques. Cette initiative témoigne de l'engagement de West en faveur de l'innovation et de l'excellence opérationnelle dans le secteur pharmaceutique.

- En janvier 2024, BD (Becton, Dickinson and Company) a dévoilé sa gamme avancée de flacons préremplis en verre lors du salon Asia-Pacific Pharmaceutical Expo 2024. Offrant une stérilité renforcée et une compatibilité avec les systèmes de remplissage automatisés, ces flacons permettent aux entreprises pharmaceutiques d'optimiser la production et la distribution. Les flacons BD témoignent de l'engagement de l'entreprise à intégrer des technologies de pointe dans ses solutions d'emballage pharmaceutique, garantissant ainsi aux fabricants une qualité, une sécurité et une facilité d'utilisation accrues.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.