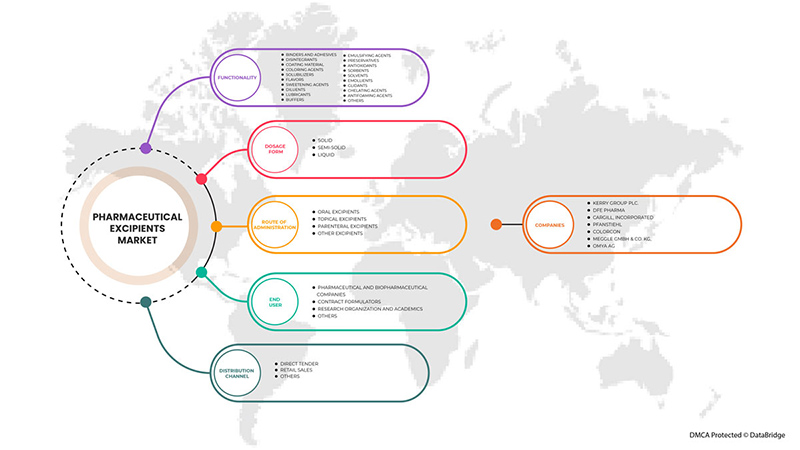

Asia-Pacific Pharmaceutical Excipients Market, By Functionality (Binders And Adhesives, Disintegrants, Coating Material, Coloring Agents, Solubilizers, Flavors, Sweetening Agents, Diluents, Lubricant, Buffers, Emulsifying Agents, Preservatives, Antioxidants, Sorbents, Solvents, Emollients, Glidents, Chelating Agents, Antifoaming Agents, and Others), Dosage Form (Solid, Semi-Solid, Liquid), Route of Administration (Oral Excipients, Topical Excipients, Parenteral Excipients, Other Excipients), End User (Pharmaceutical and Biopharmaceutical Companies, Contract Formulators, Research Organization and Academics, Others), Distribution Channel (Direct Tender, Retail Sales, Others), Industry Trends and Forecast to 2029.

Asia-Pacific Pharmaceutical Excipients Market Analysis and Insights

Pharmaceutical excipients play a major role in drug formulation and its development. These substances involve substances other than the pharmacologically active drug or prodrug. Pharmaceutical excipients provide the drug with efficient drug delivery to the target site. These molecules prevent the drug from being released too early while assimilation and enhancing the drug efficacy. Some pharmaceutical excipients promote drug integration which boosts drug absorption in the bloodstream.

Moreover, pharmaceutical excipients are also used for drug identification. Pharmaceutical excipients are also used to enhance the drug flavor, which increases patients' compliance, especially children's compliance. Based on the chemical nature of pharmaceutical excipients, these can be obtained from organic and inorganic sources. Organic chemicals include carbohydrates, petrochemicals, oleochemicals, and proteins, among others. Pharmaceutical excipients can act as binders, fillers, diluents, suspension or coating agents, flavoring agents, disintegrants, colorants, lubricants and glidants, sweeteners, and preservatives, among others. Pharmaceutical excipients possess several functionalities used for different purposes, including binders and adhesives, disintegrants, solubilizers, flavors, emulsifying agents, preservatives, antioxidants, glidients, and chelating agents, among others.

However, the increasing regulatory stringency regarding the approval of drugs and excipients, along with the cost and time-intensive drug development process, are expected to restrain the growth of this market.

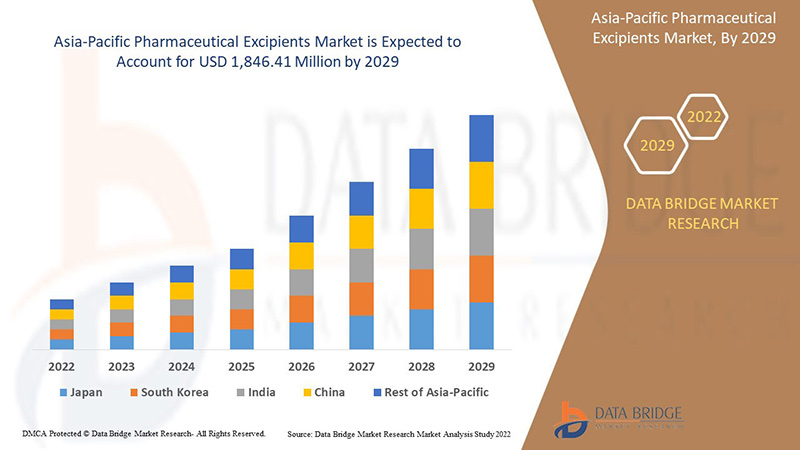

Data Bridge Market Research analyzes that the Asia-Pacific pharmaceutical excipients market is expected to reach a value of USD 1,846.41 million by 2029, at a CAGR of 7.5% during the forecast period. Functionality accounts for the largest type segment in the market due to the rapid demand for IT solutions and services in Asia-Pacific. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Functionality (Binders And Adhesives, Disintegrants, Coating Material, Coloring Agents, Solubilizers, Flavors, Sweetening Agents, Diluents, Lubricants, Buffers, Emulsifying Agents, Preservatives, Antioxidants, Sorbents, Solvents, Emollients, Glidents, Chelating Agents, Antifoaming Agents, and Others), Dosage Form (Solid, Semi-Solid, Liquid), Route of Administration (Oral Excipients, Topical Excipients, Parenteral Excipients, Other Excipients), End User (Pharmaceutical and Biopharmaceutical Companies, Contract Formulators, Research Organization and Academics, Others), Distribution Channel (Direct Tender, Retail Sales, Others). |

|

Countries Covered |

China, Japan, India, Australia, South Korea, Singapore, Thailand, Malaysia, Indonesia, Philippines, Vietnam, Rest of the Asia-Pacific. |

|

Market Players Covered |

Kerry Group plc., DFE Pharma, Cargill, Incorporated, Pfanstiehl, Colorcon, MEGGLE GmbH & Co. KG, Omya AG, Peter Greven GmbH & Co. KG, Ashland., Evonik, Dow, Croda International Plc, Roquette Frères., The Lubrizol Corporation, BASF SE, Avantor, Inc., BENEO, Chemie Trade, among others. |

Asia-Pacific Pharmaceutical Excipients Market Definition

Pharmaceutical excipients involve everything in a drug except the active pharmaceutical ingredients. These molecules don’t possess medicinal properties and are ultimately used to enhance the drug's physiological absorption. Pharmaceutical excipients are inert in nature, allowing the drug molecule to apply to patients in the right form. Traditionally the pharmaceutical excipients were simple molecules, but technological innovation and increasing demand for novel drug delivery systems enhanced the pharmaceutical excipient's complexity. Pharmaceutical excipients promote the patient’s drug acceptability and boost the drug's stability and bioavailability.

Moreover, pharmaceutical excipients help maintain drug integrity, which helps in drug storage. Different pharmaceutical excipients are based on their chemical nature, including inorganic and organic chemicals. Organic chemicals include carbohydrates, petrochemicals, oleochemicals, and proteins, among others. Pharmaceutical excipients can act as binders, fillers, diluents, suspension or coating agents, flavoring agents, disintegrants, colorants, lubricants and glidants, sweeteners, and preservatives, among others.

The future of excipients science and technology has changed and continues to change. Better progress has been made in such areas as harmonizing excipient pharmacopeial monographs and applying new analytical methods to characterize excipients better.

Asia-Pacific Pharmaceutical Excipients Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rise in Generic Drug Production and Uses

According to the U.S. Food and Drug Administration (U.S. Food and Drug Administration). FDA) and the National Center for Biotechnology Information (NCBI), a generic drug is a drug that has been created to look like an approved brand-name drug that is available in dosage form, with safety, strength, route of administration, quality, and performance. After the drug's patent expires, the cost savings associated with conventional drug use are not immediately apparent. Generic drugs, like brand-name drugs, require competition in the generic drug market before reducing costs; two to three years after the loss of exclusivity, the price of a generic drug is usually 60-70% lower than that of a brand-name drug. Since India has the highest per capita spending, these generic drugs will save a lot of money that can be used for other health problems. Nationally, the use of generic drugs has increased significantly in recent years. The fact that cheap substitutes for branded drugs are a major reason likely to spur the growth of the pharmaceutical industry. The generic drug industry in the near future.

Thus, increasing demand for generic drugs and rising production are expected to drive the growth of the Asia-Pacific pharmaceutical excipients market. Also, the cost of generic drugs is less, which increases the use of generic drugs.

- The Surge in Demand for Excipients

Pharmaceutical excipients are substances in pharmaceutical dosage forms not for direct therapeutic use but to facilitate the manufacture, protection, support, or improvement of stability and availability. With the increased development of the Asia-Pacific pharmaceutical industry, excipients also have a light part. Recently, there has been an increasing demand for generic drugs, which has led to an increase in the excipients demand. In addition, there has been a sharp increase in cases of chronic diseases.

Excipients are inert substances, other than pharmaceutically active drugs, introduced into the manufacturing process or included in the dosage form of pharmaceutical products. Excipients are widely used in drug formulations to add bulk to solid formulations, provide long-term stability, and facilitate drug absorption. Furthermore, it also improves the product's overall safety or functional properties during use or storage.

Thus, wide uses of excipients in drug formulation and applications of excipients are expected to drive the Asia-Pacific pharmaceutical excipients market.

Restraint

- Increasing Regulatory Stringency Regarding The Approval of Drugs and Excipients

Generic drug approval rules are largely the same worldwide, with little difference in developing countries. This is because he is not required to undergo bioequivalence (BE) study in this part of the world to obtain generic drug approval. Governments must ensure consistent quality of all generic drugs, medical experts say. Only then will doctors be happy and confident in prescribing generic drugs. A major reason for physicians' (and even patients') lack of confidence in generic drugs has been the lack of strict regulatory requirements regarding the number of generic drugs and the number of impurities allowed.

Controlling the manufacture and distribution of excipients is now considered a top priority by regulators and drug manufacturers, as mixing excipients has resulted in adverse patient events. Furthermore, with the emergence of new excipients and delivery systems, better control of the quality and supply of pharmaceutical excipients has become increasingly important in the context of in vivo activity. Recognizing the important role of excipients in pharmaceutical dosage forms requires excipient suppliers to meet the quality requirements of the pharmaceutical industry, and the pharmaceutical industry, in general, must work to ensure the product's safety. The integrity of use or storage in the supply chain. Hence, the increasing regulatory stringency regarding the approval of drugs and excipients is expected to restrain the Asia-Pacific pharmaceutical excipients market growth.

Opportunity

-

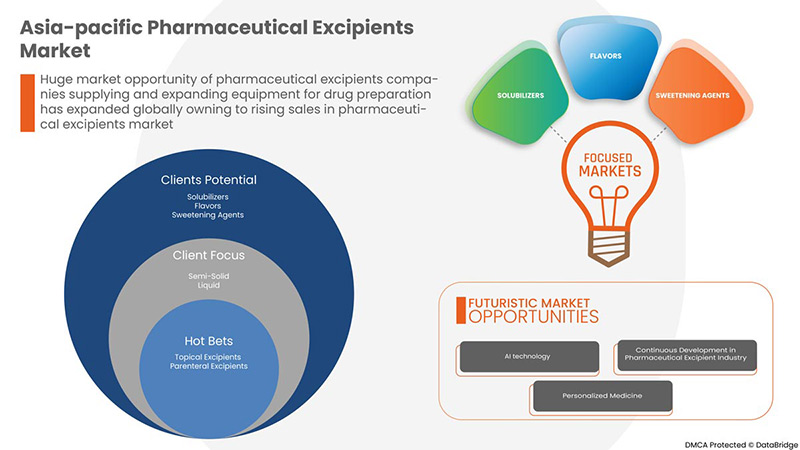

Strategic Initiatives by Market Players

The rise in the pharmaceutical excipients market increases the need for strategic business ideas. It includes a partnership, business expansion, and other development. The rising demand for pharmaceuticals is significantly increasing the demand for pharmaceutical excipients, and to cope with this demand, companies are building new manufacturing sites, among other strategic initiatives.

These strategic initiatives, such as product launches, acquisitions, agreements, and business expansion by the major market player, will boost the pharmaceutical excipients market growth and is expected to act as an opportunity for the Asia-Pacific pharmaceutical excipients market.

Challenge

- Associated Side Effects

Adverse effects due to pharmaceutical excipients in drug formulations are generally uncommon, but the potential for toxicity is increased at high mg per kg doses, especially in neonates and infants. Methyl and Propyl para-hydroxybenzoate (Parabens), Benzyl Alcohol, Sodium Benzoate, Benzoic Acid, and Propylene Glycol, among others, are some of the common pharmaceutical excipients that have reported side effects.

Pharmaceutical excipients are not always the inert substances that we presume. They are intolerant to an individual or, if not properly screened, can cause chemical changes in the drug, causing the side-effect. This can affect the demand for the excipient and is expected to act as a challenge for the Asia-Pacific pharmaceutical excipients market.

Post-COVID-19 Impact on Asia-Pacific Pharmaceutical Excipients Market

The pharmaceutical industry has been severely affected by the COVID-19 pandemic. Lockdowns imposed due to the epidemic have disrupted the supply of raw materials from manufacturing centers such as India and China. This slowed drug development and production, severely affecting companies that relied heavily on outsourcing. Initially, the entire pharmaceutical ecosystem was disrupted. In addition, regulatory agencies had to draft and draft new laws to ensure maximum patient safety after using drugs. After the shutdowns ended, the pharmaceutical industry gained steam, especially due to the demand for drugs such as hydroxychloroquine and Remdesivir, which showed positive results against COVID-19. The growing demand for these drugs boosted the turnover of some companies.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launches, and strategic partnerships to improve the technology and test results involved in the pharmaceutical excipients market.

Recent Developments

- In February 2022, Kerry Group Plc., the world’s leading taste and nutrition company, announced that it had made two significant biotechnology acquisitions that have expanded its expertise, technology portfolio, and manufacturing capabilities. The company has announced that it has acquired the leading biotechnology innovation company, c-LEcta, and Mexican-based enzyme manufacturer, Enmex. c-LEcta is a leading biotechnology innovation company specializing in precision fermentation, optimized bio-processing, and bio-transformation. Also, Enmex is a well-established enzyme manufacturer based in Mexico, supplying multiple bio-process solutions for food, beverage, and animal nutrition markets. This has helped company to increase its revenue.

- In September 2022, DFE Pharma, an Asia-Pacific leader in pharma- and nutraceutical excipient solutions, opened its new “Closer to the Formulator” (C2F), a Center of Excellence, in Hyderabad, India. C2F helped pharmaceutical companies to shorten the time from concept to finished commercial product through its expertise in all phases of pharmaceutical development. This has helped the company to showcase its progress.

Asia-Pacific Pharmaceutical Excipients Market Scope

Asia-Pacific pharmaceutical excipients market is segmented into functionality, dosage forms, route of administration, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

ASIA-PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY

- BINDERS AND ADHESIVES

- DISINTEGRANTS

- COATING MATERIAL

- COLORING AGENTS

- SOLUBILIZERS

- FLAVORS

- SWEETENING AGENTS

- DILUENTS

- LUBRICANTS

- BUFFERS

- EMULSIFYING AGENTS

- PRESERVATIVES

- ANTIOXIDANTS

- SORBENTS

- SOLVENTS

- EMOLLIENTS

- GLIDENTS

- CHELATING AGENTS

- ANTIFOAMING AGENTS

- OTHERS

On the basis of functionality, the Asia-Pacific pharmaceutical excipients market is segmented into binders and adhesives, disintegrants, coating material, coloring agents, solubilizers, flavors, sweetening agents, diluents, lubricants, buffers, emulsifying agents, preservatives, antioxidants, sorbents, solvents, emollients, glidents, chelating agents, antifoaming agents, and others.

ASIA-PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM

- SOLID

- SEMI-SOLID

- LIQUID

On the basis of dosage forms, the Asia-Pacific pharmaceutical excipients market is segmented into solid, semi-solid, and liquid

ASIA-PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY ROUTE OF ADMINISTRATION

- ORAL EXCIPIENTS

- TOPICAL EXCIPIENTS

- PARENTERAL EXCIPIENTS

- OTHER EXCIPIENTS

On the basis of route of administration, the Asia-Pacific pharmaceutical excipients market is segmented into oral pharmaceutical excipients, topical pharmaceutical excipients, parenteral excipients, and other excipients.

ASIA-PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY END-USER

- PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES

- CONTRACT FORMULATORS

- RESEARCH ORGANIZATION AND ACADEMICS

- OTHERS

On the basis of end users, the Asia-Pacific pharmaceutical excipients market is segmented into pharmaceutical and biopharmaceutical companies, contract formulators, research organizations and academics, others.

ASIA-PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL

- DIRECT TENDER

- RETAIL SALES

- OTHERS

On the basis of distribution channel, the Asia-Pacific pharmaceutical excipients market is segmented into direct tender, retail sales, and others.

Asia-Pacific Pharmaceutical Excipients Market Regional Analysis/Insights

The Asia-Pacific pharmaceutical excipients market is analyzed, and market size information is provided functionality, dosage forms, route of administration, end-user, and distribution channel.

The countries covered in this market report are China, Japan, India, Australia, South Korea, Singapore, Thailand, Malaysia, Indonesia, Philippines, Vietnam, and Rest of the Asia-Pacific.

In 2022, Asia-Pacific is dominating due to the presence of key market players in the largest consumer market. China is expected to grow due to the rise in technological advancement in Healthcare IT.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Pharmaceutical Excipients Market Share Analysis

Asia-Pacific pharmaceutical excipients market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the Asia-Pacific pharmaceutical excipients market.

Some of the major players operating in the Asia-Pacific pharmaceutical excipients market are Kerry Group plc. DFE Pharma, Cargill, Incorporated, Pfanstiehl, Colorcon, MEGGLE GmbH & Co. KG, Roquette Frères., The Lubrizol Corporation, BASF SE, Avantor, Inc., BENEO, Chemie Trade.

Research Methodology: Asia-Pacific Pharmaceutical Excipients Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include the Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 FUNCTIONALITY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL

3.2 PORTER'S FIVE FORCES MODEL

3.3 INDUSTRIAL INSIGHTS:

4 ASIA PACIFIC PHARMACEUTICAL EXCIPIENT MARKET: REGULATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN GENERIC DRUG PRODUCTION AND USES

5.1.2 THE SURGE IN DEMAND FOR EXCIPIENTS

5.1.3 TECHNOLOGICAL ADVANCEMENTS IN MULTIFUNCTIONAL EXCIPIENTS

5.1.4 RISING FOCUS ON ORPHAN DRUGS

5.2 RESTRAINTS

5.2.1 INCREASING REGULATORY STRINGENCY REGARDING THE APPROVAL OF DRUGS AND EXCIPIENTS

5.2.2 HIGH PRODUCTION COST

5.3 OPPORTUNITIES

5.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

5.3.2 RISING DEMAND FOR EASE OF USE

5.3.3 RISING DISPOSABLE INCOME

5.3.4 INCREASING DEMAND FOR ALTERNATIVE ROUTES OF DELIVERY/DOSAGE FORMS

5.4 CHALLENGES

5.4.1 ASSOCIATED SIDE EFFECTS

5.4.2 SAFETY CONSIDERATION OF PHARMACEUTICAL EXCIPIENTS IN STORAGE & TRANSPORTATION

5.4.3 LACK OF NOVEL PHARMACEUTICAL PHARMACEUTICAL EXCIPIENTS

6 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY

6.1 OVERVIEW

6.2 BINDERS AND ADHESIVES

6.2.1 ORGANIC

6.2.2 INORGANIC

6.3 DISINTEGRANTS

6.3.1 ORGANIC

6.3.2 INORGANIC

6.4 COATING MATERIAL

6.4.1 ORGANIC

6.4.2 INORGANIC

6.5 COLORING AGENTS

6.5.1 ORGANIC

6.5.2 INORGANIC

6.6 SOLUBILIZERS

6.6.1 ORGANIC

6.6.2 INORGANIC

6.7 FLAVORS

6.7.1 ORGANIC

6.7.2 INORGANIC

6.8 SWEETENING AGENTS

6.8.1 ORGANIC

6.8.2 INORGANIC

6.9 DILUENTS

6.9.1 ORGANIC

6.9.2 INORGANIC

6.1 LUBRICANTS

6.10.1 ORGANIC

6.10.2 INORGANIC

6.11 BUFFERS

6.11.1 ORGANIC

6.11.2 INORGANIC

6.12 EMULSIFYING AGENTS

6.12.1 ORGANIC

6.12.2 INORGANIC

6.13 PRESERVATIVES

6.13.1 ORGANIC

6.13.2 INORGANIC

6.14 ANTIOXIDANTS

6.14.1 ORGANIC

6.14.2 INORGANIC

6.15 SORBENTS

6.15.1 ORGANIC

6.15.2 INORGANIC

6.16 SOLVENTS

6.16.1 ORGANIC

6.16.2 INORGANIC

6.17 EMOLLIENTS

6.17.1 ORGANIC

6.17.2 INORGANIC

6.18 GLIDENTS

6.18.1 ORGANIC

6.18.2 INORGANIC

6.19 CHELATING AGENTS

6.19.1 ORGANIC

6.19.2 INORGANIC

6.2 ANTIFOAMING AGENTS

6.20.1 ORGANIC

6.20.2 INORGANIC

6.21 OTHERS

7 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM

7.1 OVERVIEW

7.2 SOLID

7.2.1 PLANT

7.2.2 ANIMALS

7.2.3 SYNTHETIC

7.2.4 MINERALS

7.3 SEMI-SOLID

7.3.1 PLANT

7.3.2 ANIMALS

7.3.3 SYNTHETIC

7.3.4 MINERALS

7.4 LIQUID

7.4.1 PLANT

7.4.2 ANIMALS

7.4.3 SYNTHETIC

7.4.4 MINERALS

8 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY ROUTE OF ADMINISTRATION

8.1 OVERVIEW

8.2 ORAL EXCIPIENTS

8.3 TOPICAL EXCIPIENTS

8.4 PARENTERAL EXCIPIENTS

8.5 OTHER EXCIPIENTS

9 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 DIRECT TENDER

9.2.1 COMPANY TENDER

9.2.2 TENDER THROUGH MARCH MERCHANDISER

9.3 RETAIL SALES

9.4 OTHERS

10 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES

10.3 CONTRACT FORMULATORS

10.4 RESEARCH ORGANIZATION

10.5 OTHERS

11 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 SOUTH KOREA

11.1.5 AUSTRALIA

11.1.6 SINGAPORE

11.1.7 THAILAND

11.1.8 INDONESIA

11.1.9 PHILIPPINES

11.1.10 MALAYSIA

11.1.11 VIETNAM

11.1.12 REST OF ASIA-PACIFIC

12 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 DOW

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 ROQUETTE FRÈRES.

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 EVONIK

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 THE LUBRIZOL CORPORATION

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 BASF SE

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ASHLAND (2021)

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AVANTOR, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 BENEO

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 CARGILL, INCORPORATED.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 CHEMIE TRADE

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 COLORCON

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 CRODA INTERNATIONAL PLC

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 DFE PHARMA (SUBSIDIARY OF ROYAL FRIESLANDCAMPINA N.V)

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 KERRY GROUP PLC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 MEGGLE GMBH & CO. KG

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 OMYA AG

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 PETER GREVEN GMBH & CO. KG

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 PFANSTIEHL

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC BINDERS AND ADHESIVES IN PHARMACEUTICAL EXCIPIENTS MARKETS, BY REGION, 2015-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC BINDERS AND ADHESIVES IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC DISINTEGRANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC DISINTEGRANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC COATING MATERIAL IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC COATING MATERIAL IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC COLORING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC COLORING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC SOLUBILIZERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC SOLUBILIZERS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC FLAVORS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC FLAVORS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC SWEETENING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC SWEETENING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC DILUENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC DILUENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC LUBRICANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC LUBRICANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC BUFFERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC BUFFERS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC EMULSIFYING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC EMULSIFYING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC PRESERVATIVES IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC PRESERVATIVES IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ANTIOXIDANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC ANTIOXIDANTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC SORBENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC SORBENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC SOLVENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC SOLVENTS PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC EMOLLIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC EMOLLIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC GLIDENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC GLIDENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC CHELATING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC CHELATING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC ANTIFOAMING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC ANTIFOAMING AGENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, FUNCTIONALITY, 2015-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC OTHERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC SEMI-SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC SEMI-SOLID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC LIQUID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC LIQUID IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DOSAGE FORM, 2015-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY ROUTE OF ADMINISTRATION, 2015-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC ORAL EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC TOPICAL EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 51 ASIA PACIFIC PARENTERAL EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC OTHER EXCIPIENTS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 53 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC DIRECT TENDER IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 55 ASIA PACIFIC DIRECT TENDER IN PHARMACEUTICAL EXCIPIENTS MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 56 ASIA PACIFIC RETAIL SALES IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 57 ASIA PACIFIC OTHERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 58 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET, BY END USER, 2015-2029 (USD MILLION)

TABLE 59 ASIA PACIFIC PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 60 ASIA PACIFIC CONTRACT FORMULATORS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 61 ASIA PACIFIC RESEARCH ORGANIZATION AND ACADEMICS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 62 ASIA PACIFIC OTHERS IN PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION, 2015-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: SEGMENTATION

FIGURE 12 THE RISE IN GENERIC DRUG PRODUCTION AND TECHNOLOGICAL FOCUS ON PHARMACEUTICAL EXCIPIENTS IS DRIVING THE ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE BINDERS AND ADHESIVES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET

FIGURE 15 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, 2021

FIGURE 16 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, 2022-2029 (USD MILLION)

FIGURE 17 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, CAGR (2022-2029)

FIGURE 18 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET : BY FUNCTIONALITY, LIFELINE CURVE

FIGURE 19 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, 2021

FIGURE 20 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, 2022-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY DOSAGE FORM, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 24 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 28 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, 2021

FIGURE 32 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET : BY END USER, LIFELINE CURVE

FIGURE 35 ASIA-PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: SNAPSHOT (2021)

FIGURE 36 ASIA-PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY COUNTRY (2021)

FIGURE 37 ASIA-PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 ASIA-PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 ASIA-PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: BY FUNCTIONALITY (2022-2029)

FIGURE 40 ASIA PACIFIC PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.