Asia Pacific Orthopedic Surgical Energy Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

157.95 Billion

USD

329.97 Billion

2021

2029

USD

157.95 Billion

USD

329.97 Billion

2021

2029

| 2022 –2029 | |

| USD 157.95 Billion | |

| USD 329.97 Billion | |

|

|

|

Marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique, par produit (pièces à main et accessoires), technologie (rayonnement, radiofréquence, ultrasons, micro-ondes, autres), application (hanche, genou), utilisateur final (hôpital et clinique, centres de chirurgie ambulatoire (ASC) et autres), canal de distribution (appel d'offres direct, distributeurs tiers), par pays Asie-Pacifique (Japon, Chine, Australie, Corée du Sud, Inde, Singapour, Thaïlande, Indonésie, Malaisie, Philippines et reste de l'Asie-Pacifique) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché : Marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique

Analyse et perspectives du marché : Marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique

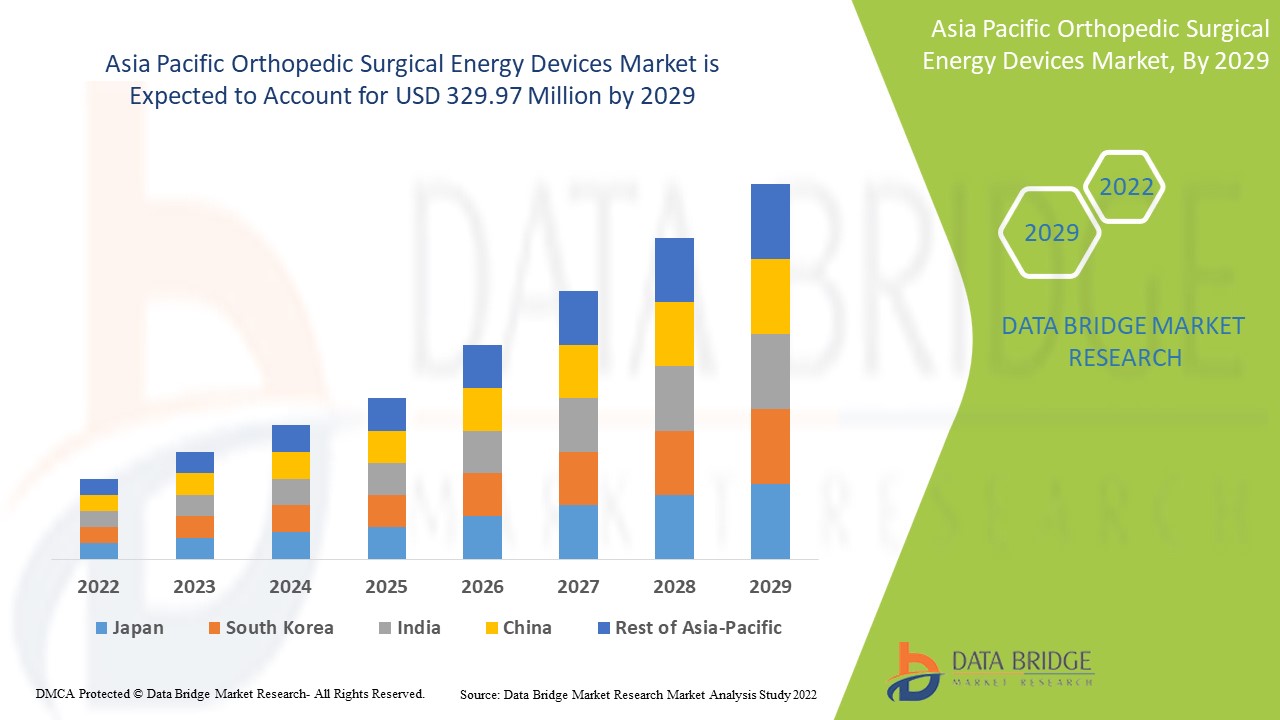

Le marché des dispositifs d’énergie chirurgicale orthopédique en Asie-Pacifique devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 9,3 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 329,97 millions USD d’ici 2029 contre 157,95 millions USD en 2021. L’augmentation de l’incidence des traumatismes et des blessures sportives et le besoin croissant de remplacement du genou et de la hanche sont susceptibles d’être les principaux moteurs qui propulsent la demande du marché au cours de la période de prévision.

Les dispositifs chirurgicaux orthopédiques sont des dispositifs qui sont utilisés pour corriger les déformations osseuses et restaurer la fonction du système squelettique humain. Les dispositifs énergétiques chirurgicaux orthopédiques utilisent de l'énergie telle que le rayonnement, la radiofréquence et les ultrasons pour sceller la peau et le tissu osseux. Les dispositifs énergétiques chirurgicaux orthopédiques nécessitent une source d'énergie, telle qu'un générateur d'électrochirurgie (ESU), et un instrument pour transférer l'énergie au patient. Les types importants comprennent la radiofréquence (RF), qui est essentiellement un courant électrique modifié et les ultrasons, qui convertissent le courant électrique en mouvement mécanique. Les technologies plus spécialisées comprennent celles qui utilisent du gaz argon, du plasma ou une combinaison de technologies.

Les types d'appareils chirurgicaux orthopédiques à énergie sont les pièces à main et les accessoires. Les pièces à main orthopédiques sont utilisées par les médecins du service d'orthopédie pour créer des trous dans les os. Les raisons courantes pour lesquelles les os sont percés en chirurgie sont la fixation d'implants et l'ajustement de prothèses. Le foret à os est parfois appelé scie et certains types peuvent également être utilisés manuellement, bien que cela soit moins courant à l'heure actuelle. Les accessoires orthopédiques aident à soutenir et à protéger les blessures et les sources de douleur dans le corps.

Dans ce mode de traitement, les dispositifs d'énergie chirurgicale orthopédique sont conçus pour réduire la douleur après la chirurgie et d'autres facteurs qui confèrent aux dispositifs d'énergie chirurgicale orthopédique un avantage sur les autres dispositifs d'énergie chirurgicale existants. Les développements technologiques visent à réduire la douleur invasive causée pendant la chirurgie osseuse. Les dispositifs d'énergie chirurgicale orthopédique sont utilisés pour des chirurgies vitales telles que le remplacement de la hanche, l'arthroplastie totale de la hanche, le remplacement du genou et le remplacement total du genou.

Les facteurs responsables de la croissance du marché mondial des dispositifs d'énergie chirurgicaux orthopédiques sont l'augmentation du nombre d'interventions chirurgicales orthopédiques, l'augmentation de la population gériatrique, les avancées technologiques dans les dispositifs chirurgicaux orthopédiques et l'augmentation de l'incidence des blessures sportives et traumatiques. Cependant, les facteurs qui devraient freiner le marché sont le coût élevé associé aux dispositifs d'énergie chirurgicaux orthopédiques et le manque de professionnels qualifiés. De plus, les initiatives stratégiques des acteurs du marché et l'augmentation des dépenses de santé stimuleront la croissance des dispositifs d'énergie chirurgicaux orthopédiques.

Le rapport sur le marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique

Portée et taille du marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique

Le marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique est segmenté en fonction du produit, de la technologie, de l'application, de l'utilisateur final et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Le marché des dispositifs d’énergie chirurgicale orthopédique en Asie-Pacifique est classé en cinq segments notables en fonction du produit, de la technologie, de l’application, de l’utilisateur final et du canal de distribution.

- Sur la base du produit, le marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique est segmenté en pièces à main et accessoires. En 2022, le segment des pièces à main devrait dominer le marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique en raison de leurs avantages par rapport aux pièces à main conventionnelles utilisées pour les chirurgies orthopédiques et des avancées technologiques croissantes pour faciliter la procédure chirurgicale pour le patient ainsi que pour le chirurgien.

- Sur la base de la technologie, le marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique est segmenté en radiofréquence, rayonnement, ultrasons, micro-ondes et autres. En 2022, le segment de la radiofréquence devrait dominer le marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique en raison de ses avantages et les études croissantes sur cette technologie stimuleront le marché au cours de la période de prévision dans la région Asie-Pacifique.

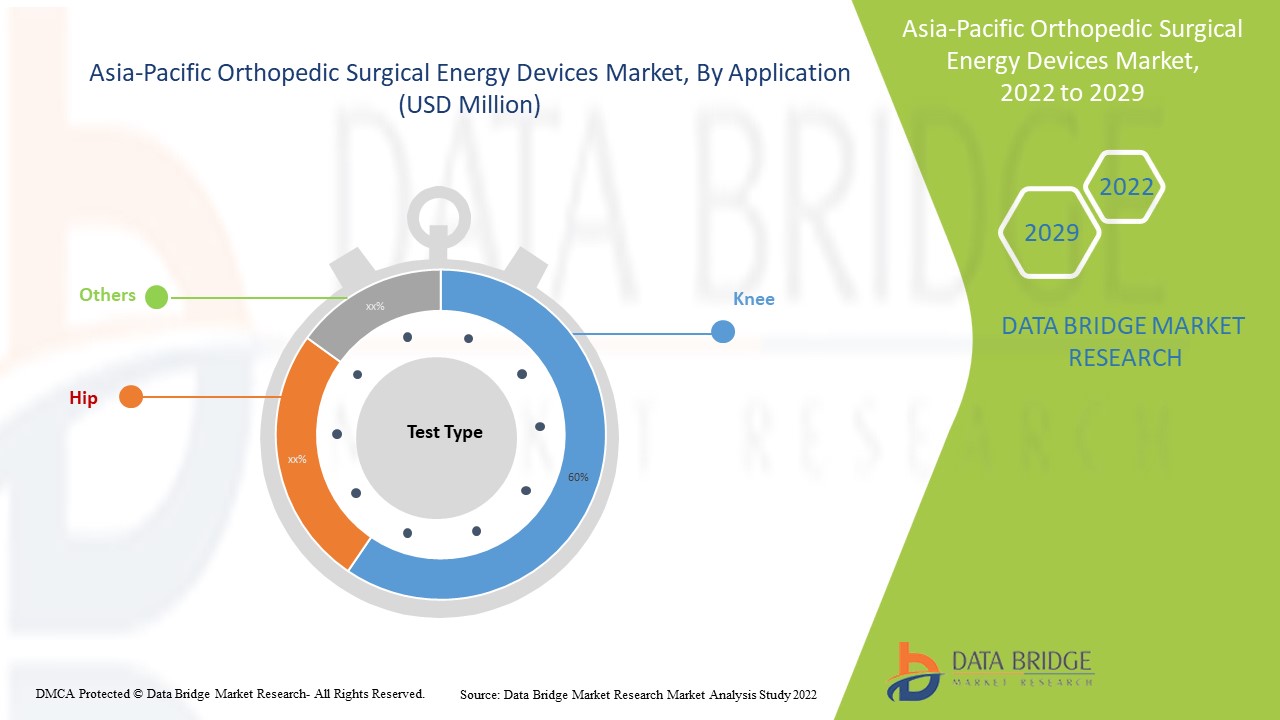

- En fonction des applications, le marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique est segmenté en hanche, genou et autres. En 2022, le segment du genou devrait dominer le marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique en raison de la prévalence croissante de l'arthrose. Par exemple, environ 1,2 milliard de personnes souffrent d'arthrose en Chine et plus de 50 000 arthroplasties de la hanche ou du genou sont pratiquées chaque année.

- Sur la base de l'utilisateur final, le marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique est segmenté en hôpitaux et cliniques, centres de chirurgie ambulatoire (ASC) et autres. En 2022, le segment des hôpitaux et des cliniques devrait dominer le marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique, car l'infrastructure des soins de santé s'améliore dans la région APAC et en raison de la présence de pays en développement, les hôpitaux publics sont facilement accessibles dans cette région.

- Sur la base du canal de distribution, le marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique est segmenté en appels d'offres directs et distributeurs tiers. En 2022, le segment des appels d'offres directs devrait dominer le marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique en raison de l'augmentation des accords contractuels entre fabricants et distributeurs pour les tests de diagnostic rapide et de l'équité dans le processus d'appel d'offres.

Analyse du marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique

Le marché des dispositifs d’énergie chirurgicale orthopédique en Asie-Pacifique est analysé et des informations sur la taille du marché sont fournies par produit, technologie, application, utilisateur final et canal de distribution.

Les pays couverts dans le rapport sur le marché des dispositifs énergétiques chirurgicaux orthopédiques sont le Japon, la Chine, l’Inde, la Corée du Sud, l’Australie, Singapour, l’Indonésie, les Philippines et le reste de l’Asie-Pacifique.

L'Asie-Pacifique devrait connaître le TCAC le plus élevé au cours des périodes prévues, car dans les pays de l'Asie-Pacifique, la demande de produits d'appareils d'énergie chirurgicaux orthopédiques augmente très rapidement avec l'urbanisation et l'automatisation des laboratoires. La Chine devrait dominer le marché de l'Asie-Pacifique. La Chine est l'un des principaux pays à inculquer le marché des appareils d'énergie chirurgicaux orthopédiques.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Le potentiel de croissance des dispositifs d'énergie chirurgicale orthopédique dans les économies émergentes et les initiatives stratégiques des acteurs du marché créent de nouvelles opportunités sur le marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique

Le marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique vous fournit également une analyse de marché détaillée pour chaque pays, la croissance d'un secteur particulier avec les ventes de dispositifs d'énergie chirurgicale orthopédique, l'impact des progrès dans les dispositifs d'énergie chirurgicale orthopédique et les changements dans les scénarios réglementaires avec leur soutien au marché des dispositifs d'énergie chirurgicale orthopédique. Les données sont disponibles pour la période historique de 2019 à 2020.

Analyse du paysage concurrentiel et des parts de marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique

Le paysage concurrentiel du marché des dispositifs d'énergie chirurgicale orthopédique en Asie-Pacifique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise liée au marché des dispositifs d'énergie chirurgicale orthopédique.

Les principales entreprises fournissant des dispositifs d'énergie chirurgicale orthopédique à l'échelle mondiale sont Medtronic, Stryker, CONMED Corporation, KARL STORZ, Smith & Nephew, Auxein Medical, MatOrtho Limited, Zimmer Biomet, B. Braun Melsungen AG, boston Scientific Corporation, Soring GmbH, Apothecaries Sundries Mfg. Co., Nouvag AG, De Soutter Medical, Misonix (Bioventus, Inc), Olympus Corporation, DePuy Synthes (Johnson and Johnson, Inc.), Portescap, entre autres.

Les analystes DBMR comprennent les atouts concurrentiels et fournissent une analyse concurrentielle pour chaque concurrent séparément.

Les initiatives stratégiques des acteurs du marché ainsi que les nouvelles avancées technologiques pour les dispositifs d’énergie chirurgicale orthopédique en Asie-Pacifique facilitent le processus chirurgical des chirurgies orthopédiques.

Par exemple,

- En octobre 2018, Zimmer Biomet a collaboré avec Apple pour lancer une étude clinique majeure qui explique l'expérience des patients et l'amélioration du remplacement articulaire. Cette collaboration a permis de fournir à Zimmer Biomet l'application mymobilty. L'application mobile utilise Apple Watch pour permettre un nouveau niveau de connexion entre les patients et les équipes de soins chirurgicaux. Cette collaboration a abouti à un traitement potentiel pour le remplacement articulaire et à l'utilisation de l'application mobile dans les hôpitaux et les centres universitaires.

La collaboration, les coentreprises et d’autres stratégies des acteurs du marché améliorent le marché de l’entreprise sur le marché des dispositifs énergétiques chirurgicaux orthopédiques, ce qui offre également l’avantage à l’organisation d’améliorer son offre pour le marché des dispositifs énergétiques chirurgicaux orthopédiques.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES MODEL

4.2 PESTEL ANALYSIS

4.3 AQUAMANTYS ASIA-PACIFIC DATA

5 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN PREVALENCE OF OSTEOPOROSIS

6.1.2 RISE IN INCIDENCE OF SPORTS AND TRAUMA INJURIES

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN ORTHOPEDIC SURGICAL ENERGY DEVICES

6.1.4 RISE IN GERIATRIC POPULATION

6.1.5 RISE IN PRODUCT LAUNCHES

6.2 RESTRAINTS

6.2.1 HIGH COST ASSOCIATED WITH ORTHOPEDIC SURGICAL ENERGY DEVICES

6.2.2 RISE IN TECHNICAL ISSUES IN ORTHOPEDIC SURGICAL ENERGY DEVICES

6.2.3 RISKS OBSERVED WHILE USING ORTHOPEDIC SURGICAL ENERGY DEVICES

6.2.4 LACK OF AWARENESS ABOUT ORTHOPEDIC SURGERIES

6.3 OPPORTUNITIES

6.3.1 RISE IN NUMBER OF ORTHOPEDIC SURGERIES

6.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.3 RISE IN HEALTHCARE EXPENDITURE

6.4 CHALLENGES

6.4.1 SHORTAGE OF SKILLED PROFESSIONALS REQUIRED FOR THE USE OF ORTHOPEDIC SURGICAL ENERGY DEVICES

6.4.2 STRINGENT REGULATIONS

7 COVID-19 IMPACT ON ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET

7.1 IMPACT ON PRICE

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS BY MANUFACTURERS

7.5 CONCLUSION

8 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 HANDPIECES

8.2.1 DRILLS

8.2.2 SAWS

8.2.3 SHAVERS

8.2.4 REAMERS

8.2.5 WIRE/PIN DRIVERS

8.2.6 STAPLER

8.2.7 OTHERS

8.3 ACCESSORIES

8.3.1 SURGICAL ACCESSORIES

8.3.2 ELECTRICAL ACCESSORIES

8.3.3 OTHERS

9 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 RADIOFREQUENCY

9.2.1 MONOPOLAR

9.2.2 BIPOLAR

9.3 RADIATION

9.4 ULTRASOUND

9.5 MICROWAVE

9.6 OTHERS

10 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 KNEE

10.2.1 BY TYPE

10.2.1.1 Total Knee Replacement

10.2.1.2 Knee Replacement

10.2.1.3 others

10.2.2 BY TECHNOLOGY

10.2.2.1 Radiofrequency

10.2.2.2 Radiation

10.2.2.3 Ultrasound

10.2.2.4 Microwave

10.2.2.5 others

10.3 HIP

10.3.1 BY TYPE

10.3.1.1 Total Hip Arthroplasty

10.3.1.2 Hip Replacement

10.3.1.3 others

10.3.2 BY INSTRUMENTS

10.3.2.1 Surgical Automated Systems

10.3.2.2 Bipolar Sealers

10.3.2.3 others

10.3.3 BY TECHNOLOGY

10.3.3.1 Radiofrequency

10.3.3.2 Radiation

10.3.3.3 Ultrasound

10.3.3.4 Microwave

10.3.3.5 others

10.4 OTHERS

11 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS AND CLINICS

11.3 AMBULATORY SURGICAL CENTERS (ASC)

11.4 OTHERS

12 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDERS

12.3 THIRD PARTY DISTRIBUTORS

13 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 INDIA

13.1.4 SOUTH KOREA

13.1.5 AUSTRALIA

13.1.6 SINGAPORE

13.1.7 THAILAND

13.1.8 MALAYSIA

13.1.9 INDONESIA

13.1.10 PHILIPPINES

13.1.11 REST OF ASIA-PACIFIC

14 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MEDTRONIC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 DEPUY SYNTHES (A SUBSIDIARY OF JOHNSON AND JOHNSON, INC )

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 SMITH AND NEPHEW

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 CONMED CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 B. BRAUN MELSUNGEN AG (A SUBSIDIARY OF B. BRAUN HOLDING GMBH & CO. KG )

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 STRYKER

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 BOSTON SCIENTIFIC CORPORATION

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 APOTHECARIES SUNDRIES MFG CO.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 AUXEIN MEDICAL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DE SOUTTER MEDICAL

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 KARL STORZ -ENDOSKOPE

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 MISONIX (ACQUIRED BY BIOVENTUS, INC)

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 MATORTHO LIMITED

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 OLYMPUS CORPORATION

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 NOUVAG AG

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 PORTESCAP

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 SÖRING GMBH

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 ZIMMER BIOMET

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 AQUAMANTYS DATA

TABLE 2 AQUAMANTYS SALES VOLUME DATA (2021)

TABLE 3 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 5 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 6 ASIA-PACIFIC HANDPIECES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 7 ASIA-PACIFIC HANDPIECES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020 -2029 (USD MILLION)

TABLE 8 ASIA-PACIFIC ACCESSORIES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 9 ASIA-PACIFIC ACCESSORIES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020 -2029 (USD MILLION)

TABLE 10 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 11 ASIA-PACIFIC RADIOFREQUENCY IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA-PACIFIC RADIOFREQUENCY IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020 -2029 (USD MILLION)

TABLE 13 ASIA-PACIFIC RADIATION IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA-PACIFIC ULTRASOUND IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA-PACIFIC MICROWAVE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA-PACIFIC OTHERS IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 ASIA-PACIFIC KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA-PACIFIC KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020 -2029 (USD MILLION)

TABLE 20 ASIA-PACIFIC KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020 -2029 (USD MILLION)

TABLE 21 ASIA-PACIFIC HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA-PACIFIC HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020 -2029 (USD MILLION)

TABLE 23 ASIA-PACIFIC HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY INSTRUMENTS, 2020 -2029 (USD MILLION)

TABLE 24 ASIA-PACIFIC HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020 -2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC OTHERS IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC HOSPITALS AND CLINICS IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC AMBULATORY SURGICAL CENTERS (ASC) IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC OTHERS IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC DIRECT TENDERS IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC THIRD PARTY DISTRIBUTORS IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 36 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 37 ASIA-PACIFIC HAND PIECES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC ACCESSORIES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC RADIOFREQUENCY IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY INSTRUMENTS, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 49 CHINA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 50 CHINA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 51 CHINA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 52 CHINA HAND PIECES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 CHINA ACCESSORIES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 54 CHINA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 55 CHINA RADIOFREQUENCY IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 56 CHINA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 CHINA KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CHINA KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 59 CHINA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 CHINA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY INSTRUMENTS, 2020-2029 (USD MILLION)

TABLE 61 CHINA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 62 CHINA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 CHINA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 64 JAPAN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 JAPAN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 66 JAPAN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 67 JAPAN HAND PIECES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 JAPAN ACCESSORIES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 69 JAPAN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 JAPAN RADIOFREQUENCY IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 71 JAPAN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 JAPAN KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 JAPAN KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 JAPAN HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 JAPAN HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY INSTRUMENTS, 2020-2029 (USD MILLION)

TABLE 76 JAPAN HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 JAPAN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 JAPAN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 79 INDIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 80 INDIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 81 INDIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 82 INDIA HAND PIECES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 INDIA ACCESSORIES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 84 INDIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 85 INDIA RADIOFREQUENCY IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 86 INDIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 INDIA KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 INDIA KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 89 INDIA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 INDIA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY INSTRUMENTS, 2020-2029 (USD MILLION)

TABLE 91 INDIA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 92 INDIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 INDIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 SOUTH KOREA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 95 SOUTH KOREA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 96 SOUTH KOREA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 97 SOUTH KOREA HAND PIECES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 98 SOUTH KOREA ACCESSORIES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 99 SOUTH KOREA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 100 SOUTH KOREA RADIOFREQUENCY IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 101 SOUTH KOREA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 102 SOUTH KOREA KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SOUTH KOREA KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 104 SOUTH KOREA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SOUTH KOREA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY INSTRUMENTS, 2020-2029 (USD MILLION)

TABLE 106 SOUTH KOREA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 107 SOUTH KOREA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 108 SOUTH KOREA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 111 AUSTRALIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 112 AUSTRALIA HAND PIECES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 113 AUSTRALIA ACCESSORIES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 114 AUSTRALIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 115 AUSTRALIA RADIOFREQUENCY IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 116 AUSTRALIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 AUSTRALIA KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 AUSTRALIA KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 119 AUSTRALIA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 AUSTRALIA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY INSTRUMENTS, 2020-2029 (USD MILLION)

TABLE 121 AUSTRALIA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 122 AUSTRALIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 123 AUSTRALIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 124 SINGAPORE ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 125 SINGAPORE ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 126 SINGAPORE ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 127 SINGAPORE HAND PIECES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 128 SINGAPORE ACCESSORIES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 129 SINGAPORE ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 130 SINGAPORE RADIOFREQUENCY IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 131 SINGAPORE ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 SINGAPORE KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 SINGAPORE KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 134 SINGAPORE HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 SINGAPORE HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY INSTRUMENTS, 2020-2029 (USD MILLION)

TABLE 136 SINGAPORE HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 137 SINGAPORE ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 SINGAPORE ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 139 THAILAND ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 140 THAILAND ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 141 THAILAND ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 142 THAILAND HAND PIECES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 143 THAILAND ACCESSORIES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 144 THAILAND ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 145 THAILAND RADIOFREQUENCY IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 146 THAILAND ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 147 THAILAND KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 THAILAND KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 149 THAILAND HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 THAILAND HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY INSTRUMENTS, 2020-2029 (USD MILLION)

TABLE 151 THAILAND HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 152 THAILAND ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 153 THAILAND ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 154 MALAYSIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 155 MALAYSIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 156 MALAYSIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 157 MALAYSIA HAND PIECES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 158 MALAYSIA ACCESSORIES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 159 MALAYSIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 160 MALAYSIA RADIOFREQUENCY IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 161 MALAYSIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 162 MALAYSIA KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 MALAYSIA KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 164 MALAYSIA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 MALAYSIA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY INSTRUMENTS, 2020-2029 (USD MILLION)

TABLE 166 MALAYSIA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 167 MALAYSIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 168 MALAYSIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 169 INDONESIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 170 INDONESIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 171 INDONESIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 172 INDONESIA HAND PIECES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 173 INDONESIA ACCESSORIES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 174 INDONESIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 175 INDONESIA RADIOFREQUENCY IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 176 INDONESIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 177 INDONESIA KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 INDONESIA KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 179 INDONESIA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 INDONESIA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY INSTRUMENTS, 2020-2029 (USD MILLION)

TABLE 181 INDONESIA HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 182 INDONESIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 183 INDONESIA ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 184 PHILIPPINES ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 185 PHILIPPINES ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 186 PHILIPPINES ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 187 PHILIPPINES HAND PIECES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 188 PHILIPPINES ACCESSORIES IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 189 PHILIPPINES ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 190 PHILIPPINES RADIOFREQUENCY IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 191 PHILIPPINES ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 192 PHILIPPINES KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 PHILIPPINES KNEE IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 194 PHILIPPINES HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 PHILIPPINES HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY INSTRUMENTS, 2020-2029 (USD MILLION)

TABLE 196 PHILIPPINES HIP IN ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 197 PHILIPPINES ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 198 PHILIPPINES ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 199 REST OF ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 200 REST OF ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 201 REST OF ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET, BY PRODUCT, 2020-2029 (ASP)

Liste des figures

FIGURE 1 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET : SEGMENTATION

FIGURE 2 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: ASIA-PACIFIC L VS REGIONALARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: DBMR POSITION GRID

FIGURE 8 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: END USERCOVERAGE GRID

FIGURE 10 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: SEGMENTATION

FIGURE 11 INCREASED BURDEN OF OSTEOPOROSIS, RISE IN GERIATRIC POPULATION, AND PRODUCT LAUNCHES IS EXPECTED TO DRIVE ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET FROM 2022 TO 2029

FIGURE 12 HANDPIECES SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET FROM 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET

FIGURE 14 RELATIVE INCREASE OF OSTEOPOROSIS IN WOMEN AS COMPARED TO MEN IN 2020

FIGURE 15 INCREASE INCIDENCE OF SPORTS INJURIES IN 2020

FIGURE 16 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY PRODUCT, 2021

FIGURE 17 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY PRODUCT, 2020-2029 (USD MILLION)

FIGURE 18 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 19 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY TECHNOLOGY, 2021

FIGURE 21 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY TECHNOLOGY, 2020-2029 (USD MILLION)

FIGURE 22 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 23 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 24 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY APPLICATION, 2021

FIGURE 25 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 26 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 27 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY END USER, 2021

FIGURE 29 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 30 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 31 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 32 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 33 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 34 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 35 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 36 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: SNAPSHOT (2021)

FIGURE 37 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY COUNTRY (2021)

FIGURE 38 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: BY PRODUCT (2022-2029)

FIGURE 41 ASIA-PACIFIC ORTHOPEDIC SURGICAL ENERGY DEVICES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.