Asia Pacific Non Stick Cookware Market

Taille du marché en milliards USD

TCAC :

%

USD

3.46 Billion

USD

5.43 Billion

2025

2033

USD

3.46 Billion

USD

5.43 Billion

2025

2033

| 2026 –2033 | |

| USD 3.46 Billion | |

| USD 5.43 Billion | |

|

|

|

|

Segmentation du marché des ustensiles de cuisine antiadhésifs en Asie-Pacifique, par produit (poêles, casseroles, moules à pâtisserie, autocuiseurs, sauteuses, grils carrés, plaques de cuisson, cocottes en fonte, moules à pain, appareils à croque-monsieur, woks, cuiseurs à œufs pochés et autres), matière première (matériau de base et revêtement), nombre de couches de revêtement (simple, double et triple), canal de distribution (supermarchés/hypermarchés, magasins d'ustensiles de cuisine, commerce électronique et autres), utilisateur final (résidentiel et commercial) - Tendances du secteur et prévisions jusqu'en 2033

Quelle est la taille et le taux de croissance du marché des ustensiles de cuisine antiadhésifs en Asie-Pacifique ?

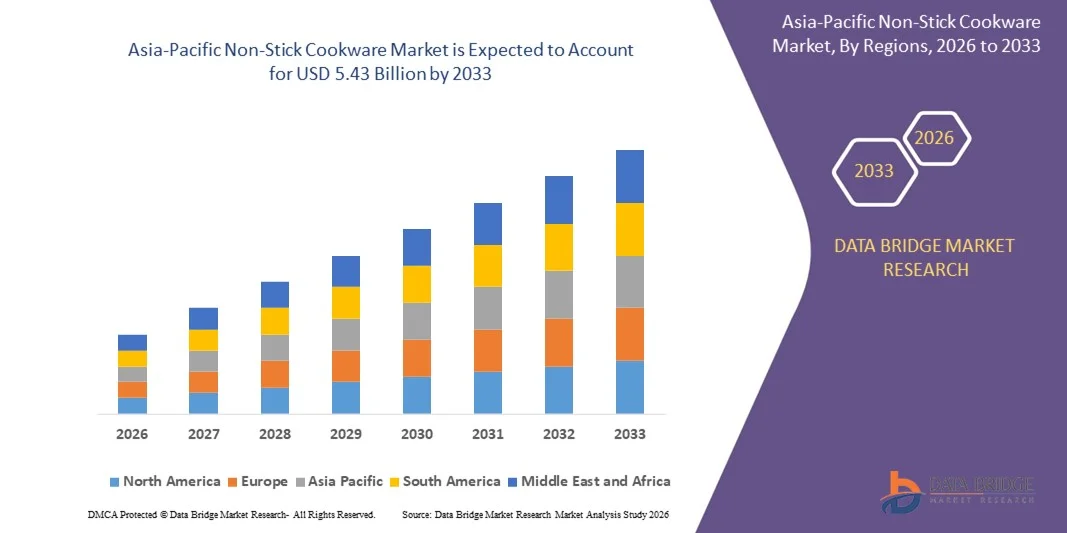

- Le marché des ustensiles de cuisine antiadhésifs en Asie-Pacifique était évalué à 3,46 milliards de dollars américains en 2025 et devrait atteindre 5,43 milliards de dollars américains d'ici 2033 , avec un TCAC de 5,80 % au cours de la période de prévision.

- La disponibilité de nombreux types de produits de cuisine antiadhésifs devrait stimuler et dynamiser la demande sur le marché des ustensiles de cuisine antiadhésifs.

- La tendance de certains matériaux antiadhésifs à libérer des substances chimiques toxiques dans les aliments devrait freiner la demande sur le marché des ustensiles de cuisine antiadhésifs.

Quels sont les principaux enseignements du marché des ustensiles de cuisine antiadhésifs ?

- La participation croissante des hommes à la cuisine devrait constituer une opportunité pour le marché des ustensiles de cuisine antiadhésifs. Cependant, la tendance de ces ustensiles à se brûler et à se rayer facilement en l'absence d'entretien adéquat devrait représenter un défi pour ce marché.

- La Chine a dominé le marché des ustensiles de cuisine antiadhésifs en Asie-Pacifique avec une part de marché estimée à 38,6 % en 2025, grâce à sa population nombreuse, sa forte capacité de production nationale et la forte pénétration de ses produits, tant abordables que haut de gamme.

- L'Inde devrait enregistrer le taux de croissance annuel composé le plus rapide, soit 10,1 %, entre 2026 et 2033, sous l'effet d'une urbanisation rapide, de l'expansion de sa classe moyenne et de l'adoption croissante des cuisines modulaires.

- Le segment des poêles a dominé le marché avec une part estimée à 34,6 % en 2025, grâce à son utilisation quotidienne généralisée pour frire, sauter et cuire rapidement dans les foyers et les établissements de restauration.

Portée du rapport et segmentation du marché des ustensiles de cuisine antiadhésifs

|

Attributs |

Principaux enseignements du marché des ustensiles de cuisine antiadhésifs |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché des ustensiles de cuisine antiadhésifs ?

Tendance croissante vers des ustensiles de cuisine antiadhésifs légers, durables et sains

- Le marché des ustensiles de cuisine antiadhésifs connaît une demande croissante pour des produits légers, faciles à nettoyer et ergonomiques, stimulée par les habitudes culinaires modernes et le souci du gain de temps.

- Les fabricants développent de plus en plus de revêtements sans PFOA, de surfaces antiadhésives en céramique et de constructions multicouches avancées pour améliorer la durabilité, la répartition de la chaleur et la sécurité alimentaire.

- L'intérêt croissant des consommateurs pour une cuisine saine, une consommation d'huile réduite et un entretien facile accélère l'adoption de ces technologies dans les cuisines résidentielles et commerciales.

- Par exemple, des entreprises comme Tefal, Cuisinart, Tramontina, Le Creuset et Hawkins développent leurs gammes d'ustensiles de cuisine antiadhésifs haut de gamme et écologiques.

- L'utilisation croissante d'ustensiles de cuisine antiadhésifs dans les foyers urbains, les restaurants à service rapide et les cuisines virtuelles stimule une croissance soutenue du marché.

- Alors que les consommateurs privilégient la commodité, la performance et la sécurité, les ustensiles de cuisine antiadhésifs resteront un élément central des solutions de cuisine modernes.

Quels sont les principaux moteurs du marché des ustensiles de cuisine antiadhésifs ?

- La demande croissante d'ustensiles de cuisine faciles à utiliser et nécessitant peu d'entretien, permettant une cuisson plus rapide et un nettoyage simple, explique cette demande.

- Par exemple, entre 2024 et 2025, les grandes marques ont lancé des ustensiles de cuisine antiadhésifs à revêtement céramique et sans toxines afin de se conformer à l'évolution des réglementations sanitaires.

- L'urbanisation croissante, l'augmentation du revenu disponible et le développement de la cuisine maison et des expérimentations culinaires stimulent l'adoption des produits.

- Les progrès réalisés dans les technologies de revêtement, la résistance aux rayures et l'efficacité thermique améliorent la durée de vie et les performances des produits.

- La sensibilisation croissante à la cuisine sans huile et à une préparation des aliments plus saine soutient la demande sur les marchés mondiaux.

- Soutenu par l'évolution des modes de vie et la modernisation des cuisines haut de gamme, le marché des ustensiles de cuisine antiadhésifs devrait connaître une croissance soutenue à long terme.

Quel facteur freine la croissance du marché des ustensiles de cuisine antiadhésifs ?

- Les coûts plus élevés associés aux revêtements haut de gamme, aux matériaux multicouches et aux produits de marque limitent leur adoption dans les régions sensibles aux prix.

- Entre 2024 et 2025, les fluctuations des prix des matières premières et des intrants de revêtement ont augmenté les coûts de fabrication et de vente au détail.

- Les préoccupations concernant la durabilité du revêtement, les rayures et la sécurité à long terme affectent la confiance des consommateurs envers les produits de mauvaise qualité.

- Un manque de connaissances sur l'utilisation et l'entretien appropriés des ustensiles de cuisine réduit leur durée de vie et la satisfaction qui en découle.

- La forte concurrence de l'acier inoxydable, de la fonte et des alternatives bon marché sans marque exerce une pression sur les prix

- Pour surmonter ces défis, les fabricants misent sur l'éducation des consommateurs, l'assurance qualité et l'innovation dans les technologies de revêtement plus sûres.

Comment le marché des ustensiles de cuisine antiadhésifs est-il segmenté ?

Le marché est segmenté en fonction du produit, de la matière première, de la couche de revêtement, du canal de distribution et de l'utilisateur final .

- Sous-produit

Le marché des ustensiles de cuisine antiadhésifs est segmenté, selon le type de produit, en poêles, casseroles, moules à pâtisserie, autocuiseurs, sauteuses, grils carrés, plaques de cuisson, cocottes en fonte, moules à cake, appareils à croque-monsieur, woks, cuiseurs à œufs pochés et autres. Le segment des poêles dominait le marché avec une part estimée à 34,6 % en 2025, grâce à leur utilisation quotidienne généralisée pour frire, sauter et cuisiner rapidement, aussi bien dans les foyers que dans les établissements de restauration. Les poêles antiadhésives offrent une répartition rapide de la chaleur, une consommation d'huile réduite et un nettoyage facile, ce qui en fait un choix privilégié dans les cuisines urbaines.

Le segment des articles de pâtisserie devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, porté par l'essor de la pâtisserie maison, la consommation croissante de produits de boulangerie et l'influence grandissante des contenus culinaires en ligne. Le développement de la culture des cafés, la modernisation des cuisines haut de gamme et la demande d'ustensiles spécialisés tels que les woks, les grils et les autocuiseurs contribuent également à la diversification des produits et à la croissance du marché à long terme.

- Par matière première

Selon la matière première utilisée, le marché se divise en deux segments : les matériaux de base et les revêtements. Le segment des matériaux de base dominait le marché en 2025 avec une part d'environ 57,8 %, car des matériaux tels que l'aluminium, l'acier inoxydable et les métaux anodisés durs constituent la structure de base des ustensiles de cuisine. Les ustensiles en aluminium, en particulier, sont largement utilisés en raison de leur légèreté, de leur prix abordable et de leur excellente conductivité thermique.

Le segment des revêtements devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par une sensibilisation accrue des consommateurs aux revêtements sans PFOA, céramiques et écologiques. Les innovations en matière de revêtements résistants aux rayures, durables et sans toxines améliorent la durabilité et la sécurité. Face à l'importance croissante accordée par les consommateurs à la santé, à la performance et au développement durable, les technologies de revêtement avancées deviennent un facteur de différenciation clé dans l'adoption des ustensiles de cuisine antiadhésifs.

- Par couche de revêtement

Le marché des ustensiles de cuisine antiadhésifs se divise en trois segments selon le nombre de couches de revêtement : monocouche, bicouche et tricouche. En 2025, le segment bicouche dominait le marché avec une part d'environ 41,2 %, grâce à son excellent rapport durabilité/prix et à ses performances antiadhésives supérieures aux revêtements monocouches. Les ustensiles bicouches sont largement utilisés dans les cuisines domestiques de milieu de gamme et les cuisines professionnelles.

Le segment des revêtements triple couche devrait enregistrer le taux de croissance annuel composé le plus rapide entre 2026 et 2033, porté par la demande croissante d'ustensiles de cuisine haut de gamme offrant une résistance supérieure aux rayures, une durée de vie prolongée et une meilleure répartition de la chaleur. La préférence grandissante pour les ustensiles de cuisine performants dans les cuisines professionnelles et les foyers exigeants accélère l'adoption des technologies de revêtement multicouches à l'échelle mondiale.

- Par canal de distribution

Selon le canal de distribution, le marché est segmenté en supermarchés/hypermarchés, magasins d'ustensiles de cuisine, commerce électronique et autres. Le segment des supermarchés/hypermarchés dominait le marché avec une part estimée à 46,5 % en 2025, grâce à une forte notoriété de la marque, une grande variété de produits, des promotions en magasin et la préférence des consommateurs pour l'examen physique des produits avant l'achat.

Le segment du commerce électronique devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, grâce à une pénétration en ligne croissante, la livraison à domicile, des prix compétitifs et des comparatifs de produits détaillés. L'adoption croissante du numérique, le marketing d'influence et les stratégies de vente directe aux consommateurs des marques d'articles culinaires renforcent encore les canaux de vente en ligne, notamment auprès des jeunes consommateurs et des citadins.

- Par l'utilisateur final

Selon l'utilisateur final, le marché des ustensiles de cuisine antiadhésifs se divise en deux segments : résidentiel et commercial. Le segment résidentiel dominait le marché en 2025 avec une part d'environ 62,9 %, porté par l'essor de la cuisine maison, la multiplication des familles nucléaires, les modes de vie urbains et la demande croissante d'ustensiles pratiques et faciles d'entretien. La croissance des habitudes alimentaires saines et l'amélioration des cuisines haut de gamme contribuent également à soutenir la demande résidentielle.

Le segment commercial devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par l'expansion des restaurants, des hôtels, des cuisines virtuelles et des établissements de restauration rapide. Les exigences liées à la préparation de volumes importants de repas, au gain de temps et à la constance de la qualité des aliments accélèrent l'adoption d'ustensiles de cuisine antiadhésifs durables dans les établissements de restauration commerciale.

Quelle région détient la plus grande part du marché des ustensiles de cuisine antiadhésifs ?

- La Chine a dominé le marché des ustensiles de cuisine antiadhésifs en Asie-Pacifique avec une part de marché estimée à 38,6 % en 2025, grâce à sa population nombreuse, sa forte capacité de production nationale et la forte pénétration de ses produits, tant abordables que haut de gamme.

- L'urbanisation rapide, la hausse des revenus disponibles et la préférence croissante pour des ustensiles de cuisine pratiques, faciles à nettoyer et sans PFOA favorisent une adoption généralisée.

- L'expansion des plateformes de commerce électronique et la forte présence de marques locales et internationales renforcent encore le leadership de la Chine sur le marché.

Analyse du marché japonais des ustensiles de cuisine antiadhésifs

Le Japon représente un marché mature et axé sur la qualité, soutenu par une forte préférence des consommateurs pour des ustensiles de cuisine haut de gamme, durables et technologiquement avancés. La demande est alimentée par la tendance aux cuisines compactes, les besoins d'une population vieillissante et l'importance accordée aux méthodes de cuisson saines. Des réseaux de distribution performants, la fidélité des consommateurs aux marques et l'innovation dans les revêtements céramiques et antiadhésifs multicouches contribuent à une croissance soutenue du marché, tant pour les particuliers que pour les professionnels.

Analyse du marché indien des ustensiles de cuisine antiadhésifs

L'Inde devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, à 10,1 %, entre 2026 et 2033, sous l'effet d'une urbanisation rapide, de l'expansion de la classe moyenne et de l'adoption croissante des cuisines modulaires. La sensibilisation accrue aux ustensiles de cuisine permettant un gain de temps, l'augmentation de la population active et la forte croissance des plateformes de vente en ligne accélèrent l'adoption des ustensiles antiadhésifs dans les foyers et les établissements de restauration.

Quelles sont les principales entreprises du marché des ustensiles de cuisine antiadhésifs ?

L'industrie des ustensiles de cuisine antiadhésifs est principalement dominée par des entreprises bien établies, notamment :

- Tramontina USA Inc. (Brésil)

- TEFAL SAS (filiale du Groupe SEB) (France)

- Le Creuset (France)

- Cuisinart (États-Unis)

- Diamant suisse (Suisse)

- Crown Cookware (Canada)

- Hawkins Cookers Limited (Inde)

- Sub Zero Group, Inc. (États-Unis)

- John Wright Company (États-Unis)

- Newell Brands (États-Unis)

- SCANPAN USA, INC. (Danemark)

- RangeKleen (États-Unis)

- Gibson Overseas, Inc. (États-Unis)

- Batterie de cuisine Moneta (Italie)

- La société Vollrath, LLC (États-Unis)

- Batterie de cuisine Berndes (Allemagne)

- Ustensiles de cuisine Cie., Ltd de ZHEJIANG HANXIN. (Chine)

- Zhejiang Zhongxin Cookware Co., Ltd. (Chine)

Quels sont les développements récents sur le marché mondial des cosmétiques sans eau ?

- En octobre 2024, le célèbre chef Bobby Flay a lancé une nouvelle collection d'ustensiles de cuisine en collaboration avec GreenPan, une entreprise basée à New York. Cette collection élargit l'offre de produits antiadhésifs haut de gamme axés sur la performance et la durabilité, renforçant ainsi la croissance du marché des ustensiles de cuisine portée par l'innovation.

- En septembre 2024, SKB, entreprise californienne, a dévoilé sa gamme d'ustensiles de cuisine antiadhésifs à l'hôtel Pan Pacific Sonargaon, une présentation stratégique de ses produits visant à renforcer la visibilité de la marque et sa présence sur le marché régional.

- En août 2024, Paris Hilton a lancé une collection d'ustensiles de cuisine élégants sous sa marque Epoca, présentant des motifs rose pastel et fuchsia pailleté, soulignant l'influence croissante du marketing et de l'esthétique des célébrités dans le secteur des ustensiles de cuisine.

- En avril 2024, la société Our Place, basée à Los Angeles, a lancé la Titanium Always Pan Pro, une poêle antiadhésive pratiquement indestructible, soulignant la demande croissante des consommateurs pour des ustensiles de cuisine durables, de haute qualité et résistants.

- En janvier 2024, Flavortown, la marque de Guy Fieri basée au Tennessee, s'est associée à Mon Chateau pour lancer trois nouvelles gammes d'ustensiles de cuisine, témoignant de l'expansion continue des marques dirigées par des chefs et ciblant les passionnés de cuisine, qu'ils soient amateurs ou professionnels.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.