Asia Pacific Next Generation Anode Materials Market

Taille du marché en milliards USD

TCAC :

%

USD

1.72 Billion

USD

4.84 Billion

2025

2033

USD

1.72 Billion

USD

4.84 Billion

2025

2033

| 2026 –2033 | |

| USD 1.72 Billion | |

| USD 4.84 Billion | |

|

|

|

|

Asia-pacific Next Generation Anode Materials Market Segmentation, By Material (Silicon/Silicon Oxide Blends, Lithium Titanium Oxide, Silicon Carbon Fibre, Silicon Graphene, Lithium Metal, and Others), and Application (Transportation, Electrical and Electronics, Energy Storage, and Others) - Industry Trends and Forecast to 2033

What is the Asia-pacific Next Generation Anode Materials Market Size and Growth Rate?

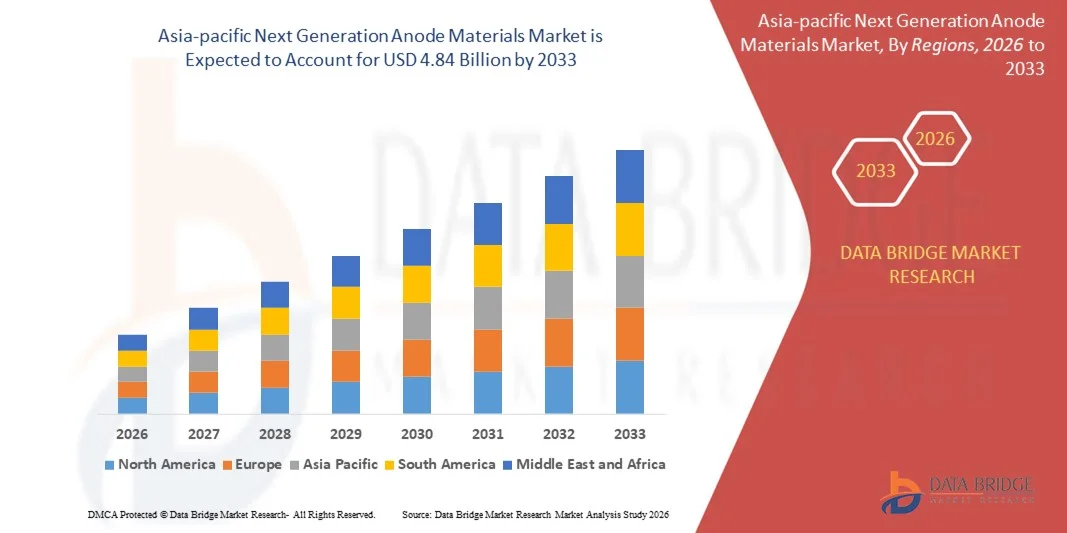

- The Asia-pacific next generation anode materials market size was valued at USD 1.72 billion in 2025 and is expected to reach USD 4.84 billion by 2033, at a CAGR of 13.8% during the forecast period

- The rise in demand for fast-charging batteries has had a significant impact on the expansion of the market for next-generation anode materials. In line with this, the rapid increase in the number of R&D initiatives for improving battery chemistry, and the constant demand for efficient lithium-ion batteries in electric vehicles and other consumer electronic devices, is a key determinant favouring the growth of the next generation anode materials market

What are the Major Takeaways of Next Generation Anode Materials Market?

- The various challenges associated with the production of lithium metal batteries, and the inability to produce high-quality graphene on a large scale at a low cost, may act as major restraints on the growth rate of the next-generation anode materials market

- Developing new electrolytes for lithium metal batteries may act as a new opportunity avenue for the market. In contrast, the rapid increase and degradation of silicon anodes might challenge the growth of the next generation anode materials market during the forecast period

- China dominated the Asia-Pacific next generation anode materials market with the largest revenue share of 34.7% in 2024, driven by massive investments in battery materials manufacturing, strong lithium-ion battery supply chains, and large-scale EV production capacity

- The Japan next generation anode materials market is witnessing fastest growth rate of 9.21%, supported by strong demand for high-performance batteries used in electric vehicles, consumer electronics, and industrial energy storage systems

- The Surfactants segment dominated the market with a 28.6% share in 2025, owing to their extensive use in drilling fluids, enhanced oil recovery (EOR), and production operations. Surfactants play a critical role in reducing interfacial tension, improving oil displacement efficiency, and enhancing fluid performance across both conventional and unconventional reservoirs

Report Scope and Next Generation Anode Materials Market Segmentation

|

Attributes |

Next Generation Anode Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Next Generation Anode Materials Market?

Rapid Shift Toward High-Capacity, Sustainable, and Application-Specific Anode Materials for Advanced Batteries

- The next generation anode materials market is witnessing a strong shift toward high-capacity and application-specific materials such as silicon-based, lithium metal, and composite anodes to overcome the energy density limitations of conventional graphite

- Manufacturers are increasingly focusing on silicon-dominant, nano-structured, and hybrid anode materials that offer higher charge capacity, faster charging, and improved cycle life for electric vehicles, consumer electronics, and energy storage systems

- Rising emphasis on eco-friendly, low-carbon, and recyclable anode materials is driving innovation in response to tightening sustainability norms and battery recycling regulations

- For instance, companies such as Sila Nanotechnologies, Enovix, Nexeon, Albemarle Corporation, and POSCO Chemical are investing in silicon anodes, lithium metal technologies, and sustainable material processing

- Growing demand for long-range EVs, fast-charging batteries, and high-power applications is accelerating the adoption of next-generation anode solutions

- As battery performance expectations continue to rise, next generation anode materials are becoming critical for enabling higher energy density, longer lifespan, and improved safety

What are the Key Drivers of Next Generation Anode Materials Market?

- Rising demand for high-energy-density batteries across electric vehicles, consumer electronics, and grid-scale energy storage is a major growth driver

- For instance, during 2024–2025, leading battery and material manufacturers expanded silicon and lithium-based anode development programs to support next-generation EV platforms

- Increasing global investments in electric mobility, renewable energy integration, and battery gigafactories across the U.S., Europe, and Asia-Pacific are accelerating anode material demand

- Advancements in nano-engineering, material coating technologies, and composite anode architectures are improving performance while reducing degradation issues

- Growing adoption of solid-state batteries and lithium-metal batteries is creating sustained demand for advanced anode chemistries

- Supported by government incentives, decarbonization targets, and battery innovation initiatives, the next generation anode materials market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Next Generation Anode Materials Market?

- High production costs and complex manufacturing processes associated with silicon-rich and lithium-metal anodes limit large-scale commercialization

- For instance, during 2024–2025, scalability challenges and yield issues delayed mass adoption of several advanced anode technologies

- Cycle life degradation, volume expansion, and safety concerns remain critical technical challenges for next-generation anode materials

- Stringent quality control, safety testing, and regulatory compliance increase development timelines and operational costs

- Raw material price volatility and supply chain constraints, especially for lithium and specialty chemicals, create cost pressures for manufacturers

- To address these challenges, companies are focusing on material stabilization techniques, scalable manufacturing methods, and cost-efficient hybrid anode designs, strengthening future market adoption

How is the Next Generation Anode Materials Market Segmented?

The market is segmented on the basis of material and application.

- By Material

On the basis of material, the next generation anode materials market is segmented into Silicon/Silicon Oxide Blends, Lithium Titanium Oxide, Silicon Carbon Fibre, Silicon Graphene, Lithium Metal, and Others. The Silicon/Silicon Oxide Blends segment dominated the market with a 34.8% share in 2025, driven by its ability to deliver significantly higher energy density than conventional graphite while maintaining better cycle stability compared to pure silicon. These blends are widely adopted in lithium-ion batteries for electric vehicles, consumer electronics, and fast-charging applications due to their balanced performance, scalability, and compatibility with existing battery manufacturing infrastructure. Continuous advancements in nano-coating and composite engineering further support widespread adoption.

The Lithium Metal segment is expected to grow at the fastest CAGR from 2026 to 2033, owing to rising development of solid-state batteries and next-generation EV platforms. Lithium metal anodes offer ultra-high theoretical capacity, making them critical for long-range electric vehicles and high-performance energy storage, despite ongoing challenges related to safety and commercialization.

- By Application

On the basis of application, the next generation anode materials market is segmented into Transportation, Electrical & Electronics, Energy Storage, and Others. The Transportation segment dominated the market with a 46.2% revenue share in 2025, supported by rapid growth in electric vehicle production, stringent emission regulations, and increasing consumer demand for longer driving range and faster charging batteries. Automakers and battery manufacturers are aggressively integrating silicon-rich and advanced anode materials to enhance energy density, reduce charging time, and improve overall battery efficiency. Government incentives for EV adoption across the U.S., Europe, and Asia-Pacific further reinforce segment dominance.

The Energy Storage segment is projected to register the fastest CAGR from 2026 to 2033, driven by rising deployment of grid-scale energy storage systems, renewable energy integration, and demand for high-cycle-life batteries. Increasing investments in stationary storage, smart grids, and backup power solutions are accelerating adoption of durable and high-capacity next-generation anode materials.

Which Region Holds the Largest Share of the Next Generation Anode Materials Market?

- China dominated the Asia-Pacific next generation anode materials market with the largest revenue share of 34.7% in 2024, driven by massive investments in battery materials manufacturing, strong lithium-ion battery supply chains, and large-scale EV production capacity. The country’s aggressive push toward electric mobility, renewable energy storage, and grid-scale battery deployment is significantly accelerating demand for silicon-based, lithium metal, and composite anode materials

- China’s leadership in materials science R&D, integrated battery manufacturing ecosystems, and large domestic demand supports high-volume production of advanced anode materials. Major regional and global players such as BTR New Material Group, Shanshan Technology, and Ganfeng Lithium are focusing on high-capacity, long-cycle-life, and cost-efficient anode solutions to meet next-generation battery requirements

- Strong government support through industrial policies, battery localization initiatives, and clean energy targets firmly positions China as the innovation and export hub for next generation anode materials across the Asia-Pacific region

Japan Next Generation Anode Materials Market Insight

The Japan next generation anode materials market is witnessing fastest growth rate of 9.21%, supported by strong demand for high-performance batteries used in electric vehicles, consumer electronics, and industrial energy storage systems. Japanese manufacturers are focusing on silicon-carbon composites, lithium titanate, and advanced graphite alternatives to enhance safety, fast-charging capability, and energy density. Continuous investment in precision manufacturing, materials innovation, and collaboration between battery OEMs and research institutes is strengthening Japan’s role in premium anode material development across Asia-Pacific.

South Korea Next Generation Anode Materials Market Insight

South Korea’s Next Generation Anode Materials market is expanding rapidly, driven by the presence of global battery leaders and rising exports of EV batteries. Strong demand for silicon-graphene and silicon-carbon anode materials is supported by advancements in high-energy-density lithium-ion and solid-state battery technologies. Government-backed R&D programs, advanced manufacturing infrastructure, and close integration with automotive OEMs are accelerating commercialization of next-generation anode solutions.

India Next Generation Anode Materials Market Insight

India is emerging as a high-growth market for Next Generation Anode Materials, supported by expanding EV adoption, government-led battery manufacturing initiatives, and renewable energy storage deployment. Increasing investments in domestic cell manufacturing, mineral processing, and energy storage infrastructure are boosting demand for cost-effective and scalable anode materials. Policy support under clean mobility and energy transition programs is steadily positioning India as a future manufacturing and consumption hub for advanced battery materials in Asia-Pacific.

Which are the Top Companies in Next Generation Anode Materials Market?

The next generation anode materials industry is primarily led by well-established companies, including:

- Altairnano (U.S.)

- LeydenJar Technologies BV (Netherlands)

- Nexeon Ltd. (U.K.)

- pH Matter LLC (U.S.)

- Sila Nanotechnologies Inc. (U.S.)

- Cuberg (U.S.)

- Shanghai Shanshan Technology Co., Ltd. (China)

- AMPIRUS TECHNOLOGIES (U.S.)

- California Lithium Battery (U.S.)

- Enovix (U.S.)

- POSCO CHEMICAL (South Korea)

- Albemarle Corporation (U.S.)

- Talga Group Ltd. (Australia)

- Tianqi Lithium Corporation (China)

- Jiangxi Ganfeng Lithium Co., Ltd. (China)

- OneD Battery Sciences (U.S.)

- JSR Corporation (Japan)

- SCT HK (Hong Kong)

- Edgetech Industries L.L.C. (U.S.)

- Enevate Corporation (U.S.)

What are the Recent Developments in Asia-pacific Next Generation Anode Materials Market?

- In May 2024, the industry witnessed rising adoption of digitalization and automation technologies, with specialty oilfield chemical suppliers developing remotely monitored and controlled solutions to optimize treatment processes and improve operational efficiency, highlighting the sector’s shift toward smarter and more efficient oilfield operations

- In March 2024, consolidation activity continued within the specialty oilfield chemicals market as leading players engaged in mergers and acquisitions to expand product portfolios and strengthen geographic presence, indicating an industry-wide focus on scale, competitiveness, and long-term growth

- In October 2023, The Lubrizol Corporation announced a new distribution agreement with IMCD Group, a leading Asia-pacific distributor and developer of specialty chemicals and ingredients, reinforcing Lubrizol’s market reach and supply chain capabilities

- In July 2022, Solvay SA stated that it would seek advisory support from Bank of America to evaluate the potential sale of its oilfield chemicals business as part of a strategic review, reflecting efforts to streamline operations and refocus on core growth areas

- In March 2022, Halliburton inaugurated its first oilfield specialty chemical manufacturing plant in Saudi Arabia to support next-generation chemical solutions and strengthen regional production capabilities, marking a significant expansion of the company’s footprint in the eastern hemisphere

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.