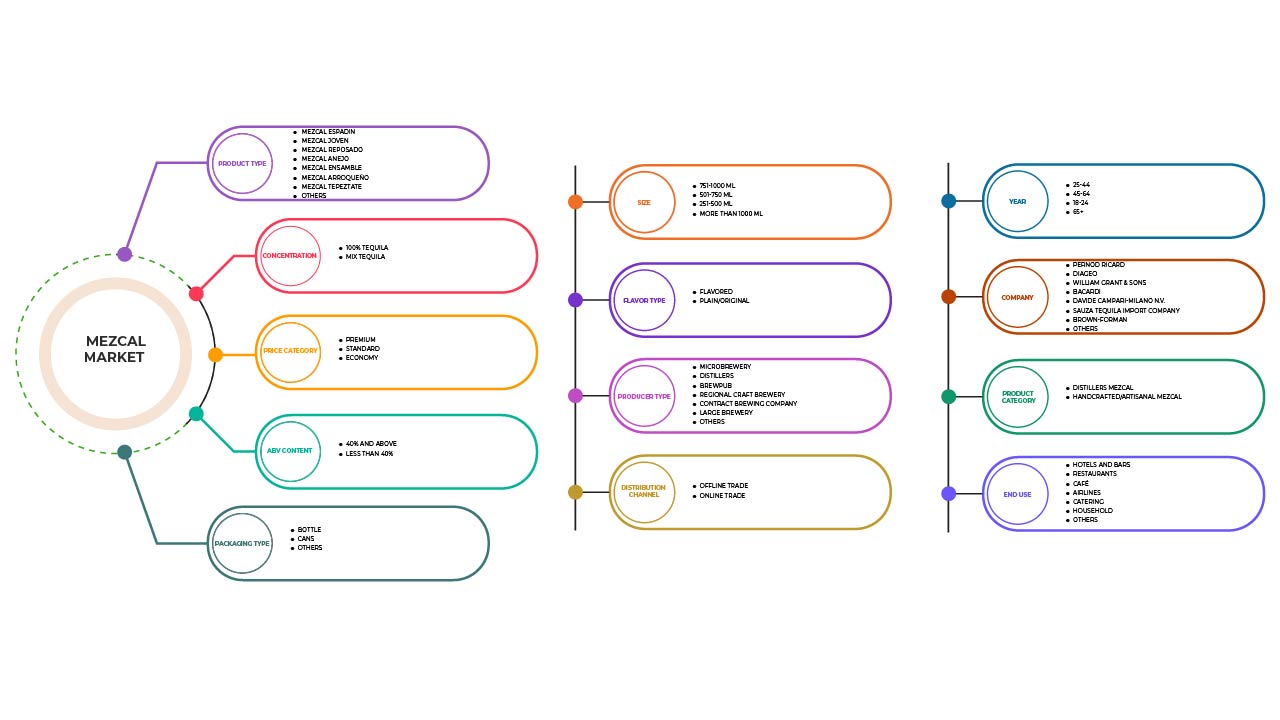

Asia-Pacific Mezcal Market, By Product Type (Mezcal Joven, Mezcal Reposado, Mezcal Anejo, Mezcal Espadin, Mezcal Tepztate, Mezcal Arroqueño, Mezcal Ensamble, And Others), Concentrate (100% Tequila And Mix Tequila), Price Category (Premium, Standard And Economy), ABV Content (40% And Above And Less Than 40%), Year (18-24 Years, 25-44 Years, 45-64 Years, 65+ Years), Packaging Type (Bottle, Cans, And Others), Size (251-500 Ml, 501-750 Ml, 751-1000 Ml, And More Than 100 Ml), Flavour Type (Plain/Original And Flavored), Producer Type (Microbrewery, Distillers, Brewpub, Contract Brewing Company, Regional Craft Brewery, Large Brewery, And Others), Product Category (Distillers Mezcan And Handicrafted Mezcan/Artisanal Mezcan), End User (Restaurants, Hotels And Bars, Café, Catering, Airlines, Household, And Others), Distribution Channel (Offline Trade And Online Trade) – Industry Trends and Forecast to 2029.

Asia-Pacific Mezcal Market Analysis and Size

The different agave species used, which have a wide variety of terpene compounds, the ability to use agave leaves in mezcal fermentation, variations in the ripening stage of agave, cooking of agave that can be done in ground holes with burning wood and heated stones that produce furans and smoky volatiles and are retained in the agave, and some herbs or other natural materials (such as worms) can all contribute to the flavor differences between mezcal.

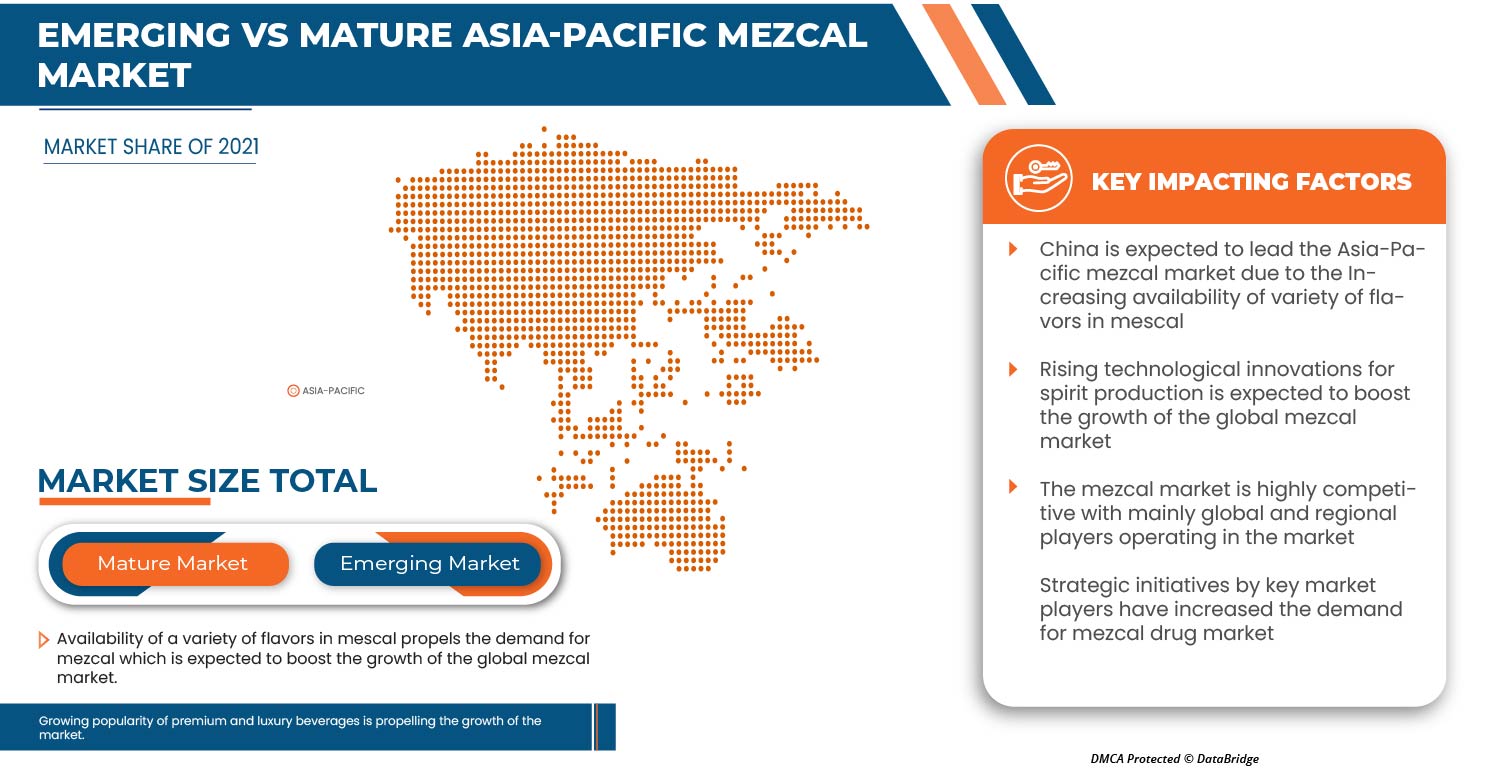

The increasing consumer demand for the mezcal beverage, positive outlook towards advanced and smart packaging solutions, and rise in the number of production units are propelling the demand of the mezcal market in the forecast period. However, the heavy taxation and duties and stringent rules and regulations are expected to hamper the mezcal market growth in the forecast period.

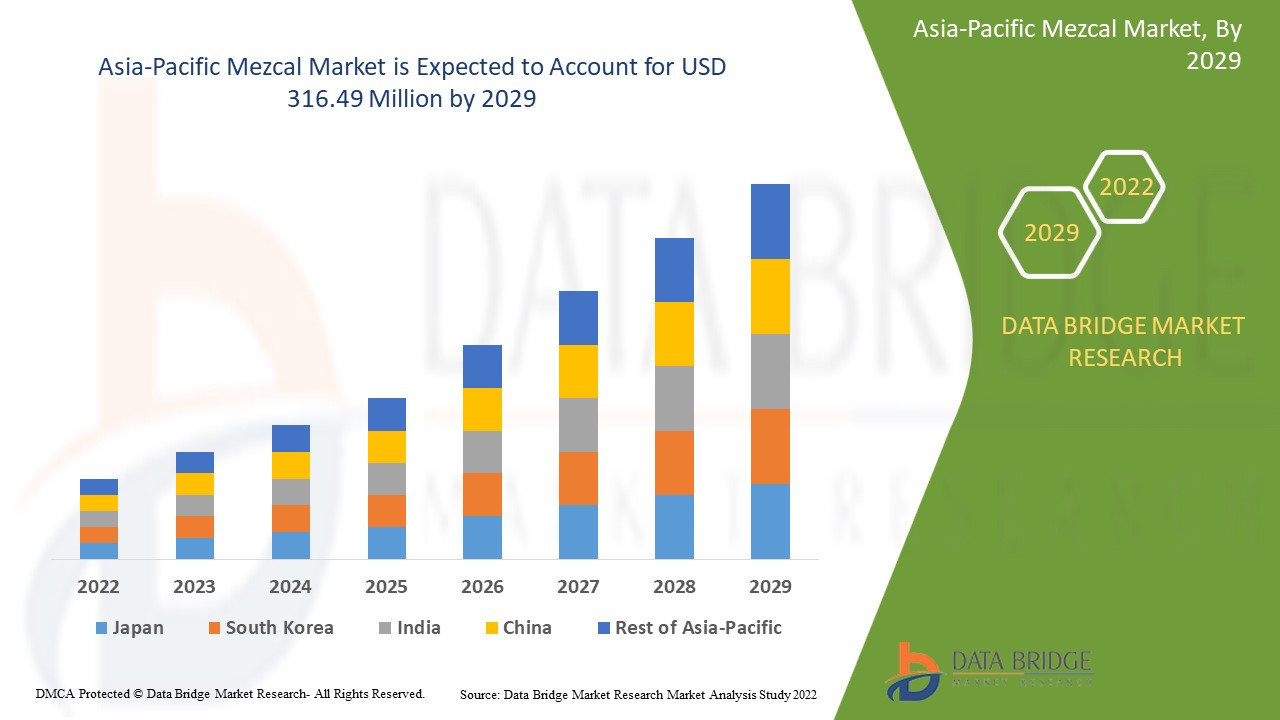

Data Bridge Market Research analyses that the mezcal market is expected to reach a value of USD 316.49 million by 2029, at a CAGR of 22.7% during the forecast period. The increasing consumer demand for the mezcal beverage, positive outlook towards advanced and smart packaging solutions, and rise in the number of production units are propelling the demand of the mezcal market. The mezcal market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Kilo Liters |

|

Segments Covered |

By Product Type (Mezcal Joven, Mezcal Reposado, Mezcal Anejo, Mezcal Espadin, Mezcal Tepztate, Mezcal Arroqueño, Mezcal Ensamble, And Others), Concentrate (100% Tequila And Mix Tequila), Price Category (Premium, Standard And Economy), ABV Content (40% And Above And Less Than 40%), Year (18-24 Years, 25-44 Years, 45-64 Years, 65+ Years), Packaging Type (Bottle, Cans, And Others), Size (251-500 Ml, 501-750 Ml, 751-1000 Ml, And More Than 100 Ml), Flavour Type (Plain/Original And Flavored), Producer Type (Microbrewery, Distillers, Brewpub, Contract Brewing Company, Regional Craft Brewery, Large Brewery, And Others), Product Category (Distillers Mezcan And Handicrafted Mezcan/Artisanal Mezcan), End User (Restaurants, Hotels And Bars, Café, Catering, Airlines, Household, And Others), Distribution Channel (Offline Trade And Online Trade) |

|

Countries Covered |

China, South Korea, Japan, India, Australia, Singapore, Malaysia, Indonesia, Thailand, Philippines, Rest of Asia-Pacific |

|

Market Players Covered |

The major companies which are dealing in the market are Brown-Forman, Diageo, Pernod Ricard, WILLIAM GRANT & SONS LTD, Rey Campero, Tequila & Mezcal Private Brands S.A. de C.V., Destilería Tlacolula, El Silencio Holdings, INC., Sauza Tequila Import Company, Dos Hombres LLC. , Del Maguey, Wahaka Mezcal., BOZAL MEZCAL among others. |

Market Definition

Mezcal is the name given to traditional distilled alcoholic beverages made in various rural areas of Mexico, from certain northern states up to south states, which is nahuatl mexcalli, "baked agave." These alcoholic beverages are made from the cooked stems of species of the genus Agave, also known as "maguey," which have fermented sugars. It is a traditional Mexican distilled beverage produced from the fermented juices of the cooked agave plant core. It is a type of distilled alcoholic beverage made from the cooked and fermented hearts, or piñas, of agave plants.

Mezcal Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

- AVAILABILITY OF A VARIETY OF FLAVORS IN MEZCAL

The quality and authenticity of mezcal are highly crucial because of the beverage's unique alcoholic flavor, which results from the volatile and non-volatile compounds, the direct precursors of which come from the raw agave itself. These include fatty acids, ranging from capric to lignoceric, free fatty acids, β-sitosterol, and groups of mono-, di-, and triacylglycerols, as well as fructans, the principal carbohydrate of the Agave. Due to higher temperatures and a lower pH in the agave cooking process, fructans could form Maillard compounds, such as furans, pyrans, and ketones.

De plus, le paramètre important qui définit la qualité des boissons à base d'agave est le système de distillation utilisé. La composition de l'arôme du mezcal est extrêmement complexe. Les similitudes et les différences entre les échantillons de mezcal peuvent être attribuées aux conditions et aux matières premières utilisées, en plus de l'origine et de la saison de production.

En raison de la disponibilité de diverses saveurs de mezcal, les consommateurs le préfèrent aux autres spiritueux artisanaux. De plus, l'intérêt croissant des consommateurs pour les produits d'origine éthique et la tendance à promouvoir des boissons telles que la bière artisanale, les jus pressés à froid et les smoothies à base d'ingrédients naturels comme étant de qualité supérieure devraient stimuler la croissance du marché au cours de la période de prévision.

- INNOVATIONS TECHNOLOGIQUES EN CROISSANCE POUR LA PRODUCTION DE SPIRITUEUX

L'agave est extraite et utilisée dans la fabrication de spiritueux, enrichissant le profil volatil du mezcal. Le processus d'extraction traditionnel entraîne souvent une consommation de solvants plus élevée, des temps d'extraction plus longs, des rendements plus faibles et une qualité d'extraction plus médiocre. La distillation du maguey fermenté est nécessaire pour produire plusieurs boissons alcoolisées distillées, telles que la bacanora, la tequila et le mezcal. Ainsi, les progrès technologiques ont créé une opportunité pour une production durable d'extraits et de spiritueux. Les fabricants sont engagés dans des innovations de produits et technologiques pour réduire les coûts d'extraction et de fabrication. Les entreprises peuvent améliorer la traçabilité des produits en utilisant des technologies innovantes qui peuvent considérablement améliorer l'efficacité et l'efficience des chaînes d'approvisionnement, en particulier dans des secteurs tels que l'alimentation et les boissons, les produits pharmaceutiques et les soins de santé.

Le processus de fermentation génère de l'éthanol, des alcools supérieurs, des esters, des acides organiques et d'autres composés. Certains de ces composés volatils sont plus importants que d'autres en raison de leurs concentrations ou de leurs caractéristiques aromatiques ; certains pourraient être spécifiques à l'espèce d'agave. Ainsi, l'essor de la technologie de production avancée devrait stimuler le marché du mezcal en Asie-Pacifique.

- PERSPECTIVES POSITIVES ENVERS DES SOLUTIONS D'EMBALLAGE AVANCÉES ET INTELLIGENTES

L’industrie de l’emballage du vin adopte des solutions intelligentes et durables pour rendre l’emballage des produits plus orienté vers le consommateur et plus respectueux de l’environnement. La premiumisation rend une marque ou un produit plus attrayant pour les consommateurs en soulignant sa qualité supérieure et son exclusivité dans la catégorie des boissons à base d’agave, ce qui rend une marque plus attrayante et, par conséquent, plus chère. Cela peut provenir de nouveaux emballages, d’une production artisanale, d’ingrédients de meilleure qualité, de nouvelles saveurs et de messages sociaux/environnementaux.

De plus, l'emballage imprimé numériquement offre un potentiel d'économies considérable par rapport aux autres procédés d'impression et des coûts de configuration réduits. Les fabricants peuvent se passer de commandes en gros grâce à de grands tirages et à la conservation de stocks. Les entreprises de conception de marques populaires préfèrent les bouteilles en verre pour l'emballage du mezcal. Les avantages de l'impression numérique sont essentiels pour le secteur de l'emballage d'aujourd'hui. L'impression numérique est le procédé idéal pour les petits et moyens tirages et permet la création d'impressions personnalisées pour les emballages et les présentoirs. De plus, la plupart du mezcal disponible en ligne est conditionné dans des bouteilles en verre.

Ainsi, en raison des lancements et des développements de nouveaux produits, une augmentation de la demande d’emballages avancés et intelligents devrait agir comme un moteur pour le marché du mezcal en Asie-Pacifique.

Restrictions

- TAXATION ET DROITS LOURDS

La demande croissante de boissons alcoolisées dans le monde entier a entraîné une augmentation des importations sur ce marché en pleine croissance. Cependant, les lourdes taxes et droits de douane devraient freiner ce marché, car ils limitent la croissance du marché et rendent le produit cher. Cela devrait par conséquent restreindre la demande pour ces produits.

Ainsi, la forte taxation et les droits d'accise augmentent automatiquement les prix des produits et rendent l'alcool plus cher, ce qui entraîne une baisse de la demande pour ce produit. Cela entraîne même une perte de clientèle, ce qui entrave directement le marché dans son ensemble et devrait limiter sa croissance.

Opportunités/ Défis

- POPULARITÉ CROISSANTE DES BOISSONS HAUT DE GAMME ET DE LUXE

La capacité de surveiller le taux de cholestérol et de sucre dans le sang. La croissance du marché est encore alimentée par l'augmentation du revenu disponible et du pouvoir d'achat des consommateurs, qui renforcent tous deux la demande des consommateurs pour une variété de produits. La demande de mezcal augmente en raison de la tendance à la premiumisation, encourageant la consommation de boissons alcoolisées et non alcoolisées haut de gamme. La consommation d'alcool ne fait pas que faire partie de la tendance à la premiumisation. Parmi les clients de la génération du millénaire, il existe une demande croissante de produits mezcal haut de gamme. En raison de l'augmentation du revenu disponible dans les pays développés comme l'Amérique du Nord et l'Europe occidentale, ils sont prêts à dépenser beaucoup d'argent pour des produits haut de gamme et super premium. En raison de l'augmentation du revenu disponible des consommateurs par personne et de l'expansion continue de l'économie, le marché des spiritueux haut de gamme a augmenté de 5 à 6 % par an en volume de 2019 à 2021.

Le marché devrait connaître une expansion au cours de la période de prévision, car la demande de mezcal a considérablement augmenté au cours des dernières années. La demande croissante de mezcal de qualité supérieure constitue une opportunité pour la croissance du marché du mezcal en Asie-Pacifique.

- POPULARITÉ CROISSANTE DES BOISSONS SAINES ET NON ALCOOLISÉES

L'un des secteurs qui connaît le plus fort développement est celui des boissons, qui consiste à fabriquer diverses boissons telles que le mezcal. La prise de conscience croissante des consommateurs quant à l'utilisation de composants naturels et biologiques dans les aliments et les boissons devrait constituer un défi pour le taux de croissance de l'industrie du mezcal à l'avenir.

De nombreux aliments et boissons fermentés contiennent du carbamate d'éthyle (EC), un cancérigène génotoxique connu. Le carbamate d'éthyle est non seulement cancérigène, mais aussi un agent toxique pour le foie chez l'homme. De plus, la consommation de boissons gazeuses a été associée aux calculs rénaux, tous facteurs de risque de maladie rénale chronique. Le nombre croissant de maladies chroniques du foie et des reins incite les consommateurs à boire sainement. Les gens préfèrent aujourd'hui davantage les boissons non alcoolisées en raison de ces problèmes de santé.

Ainsi, l’augmentation des maladies chroniques incite les consommateurs à consommer des boissons non alcoolisées, ce qui peut constituer un défi à la croissance du marché.

Impact post-COVID-19 sur le marché du mezcal

L’épidémie de COVID-19 a eu un impact significatif sur l’industrie du mezcal. Le confinement a porté préjudice à la production de la région Asie-Pacifique et aggravera l’incertitude commerciale et le marasme manufacturier actuel. En comparaison, la pandémie a eu peu d’effet sur les opérations du secteur de l’alimentation et des boissons, mais sa chaîne d’approvisionnement en Asie-Pacifique a été gravement perturbée, ce qui a empêché toute nouvelle croissance. Le changement de mode de consommation a eu un impact négatif sur le comportement d’achat des consommateurs. Le secteur a subi des effets à court et à long terme en raison de l’émergence de nombreux obstacles, notamment la suspension de nombreuses opérations, le ralentissement de la croissance des entreprises et d’autres problèmes. Ces problèmes ont eu un impact significatif sur l’offre et la demande. Le secteur de l’alimentation et des boissons a été l’un de ceux touchés par les interruptions de production et d’approvisionnement en matières premières.

Les chaînes d’approvisionnement mondiales ont été entravées par la fermeture de nombreuses industries, ce qui a interrompu les activités industrielles, les calendriers de livraison et la vente de divers produits. Un certain nombre d’entreprises ont déjà averti que tout retard dans les livraisons de produits pourrait nuire aux ventes futures de leurs produits. La perturbation des voyages affecte le secteur industriel car elle interfère avec la planification et le travail d’équipe de l’entreprise. Les détaillants hors ligne et en ligne fournissent du mezcal ; le secteur hors ligne a subi des pertes importantes en raison des fermetures et des avertissements contre les déplacements à l’extérieur pour atténuer l’effet du COVID-19, mais l’industrie en ligne a connu une croissance accrue. De plus, la situation s’améliore car il y a moins de cas de COVID dans le monde et le marché croît rapidement et continuera de le faire pendant la période de projection. En conséquence, il est prévu que le marché se développera considérablement après le COVID-19.

Développements récents

- En janvier 2022, Diageo PLC a acquis Mezcal Union via l'acquisition de Casa UM. Mezcal Union est l'une des principales marques de production de mezcal. La société a utilisé cette acquisition pour développer son activité de boissons au mezcal

- En avril 2021, Madre Mezcal, l'une des marques de mezcal connaissant la croissance la plus rapide en Amérique, a levé 3 millions de dollars pour appliquer la stratégie de croissance réussie de la marque à de nouveaux produits et marchés. Le tour de financement de série A a été mené par Room 9, un studio de capital-risque basé à New York et spécialisé dans l'investissement dans le secteur de la consommation

Portée du marché du mezcal en Asie-Pacifique

Le marché du mezcal en Asie-Pacifique est segmenté en fonction du type de produit, du concentré, de la catégorie de prix, de la teneur en alcool, de l'année, du type d'emballage, de la taille, du type de saveur, du type de producteur, de la catégorie de produit, de l'utilisateur final et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de produit

- Mezcal Espadin

- Mezcal Jeune

- Mezcal reposé

- Mezcal Añejo

- Ensemble Mezcal

- Mezcal Arroqueño

- Mezcal Tepeztate

- Autres

Sur la base du type de produit, le marché du mezcal Asie-Pacifique est segmenté en mezcal joven, mezcal reposado, mezcal anejo, mezcal espadin, mezcal tepztate, mezcal arroqueño, mezcal ensamble et autres.

SE CONCENTRER

- 100% Téquila

- Mélanger la tequila

Sur la base du concentré, le marché du mezcal de la région Asie-Pacifique a été segmenté en tequila 100 % et tequila mélangée.

CATÉGORIE DE PRIX

- Prime

- Standard

- Économie

Sur la base de la catégorie de prix, le marché du mezcal Asie-Pacifique a été segmenté en premium, standard et économique.

TENEUR EN ABV

- 40% et plus

- Moins de 40%

Sur la base de la teneur en ABV, le marché du mezcal de l'Asie-Pacifique a été segmenté en moins de 40 %, plus de 40 % et moins de 40 %.

ANNÉE

- 18-24

- 25-44

- 45-64

- 65+

Sur la base de l'année, le marché du mezcal de l'Asie-Pacifique a été segmenté en 18-24 ans, 25-44 ans, 45-64 ans et 65 ans et plus.

TYPE D'EMBALLAGE

- Bouteille

- Canettes

- Autres

Sur la base du type d'emballage, le marché du mezcal de l'Asie-Pacifique a été segmenté en bouteilles, canettes et autres.

TAILLE

- 251-500 ml

- 501-750 ml

- 751-1000 ml

- plus de 100 ml

Sur la base de la taille, le marché du mezcal Asie-Pacifique a été segmenté en 251-500 ml, 501-750 ml, 751-1000 ml, plus de 100 ml

TYPE DE SAVEUR

- Plaine/Originale

- Parfumé

Sur la base du type de saveur, le marché du mezcal Asie-Pacifique a été segmenté en nature/original et aromatisé.

TYPE DE PRODUCTEUR

- Microbrasserie

- Distillateurs

- Brasserie

- Entreprise de brassage sous contrat

- Brasserie artisanale régionale

- Grande brasserie

- Autres

Sur la base du type de producteur, le marché du mezcal de l'Asie-Pacifique a été segmenté en microbrasseries, distilleries, brasseries, sociétés de brassage sous contrat, brasseries artisanales régionales, grandes brasseries et autres.

CATÉGORIE DE PRODUIT

- Distillateurs Mezcan

- Mezcan artisanal/mezcan artisanal

Sur la base de la catégorie de produits, le marché du mezcal de l'Asie-Pacifique a été segmenté en mezcan de distillerie et mezcan artisanal

UTILISATION FINALE

- Restaurants

- Hôtels et bars

- Café

- Restauration

- Compagnies aériennes

- Ménage

- Autres

Sur la base de l'utilisateur final, le marché du mezcal de l'Asie-Pacifique a été segmenté en restaurants, hôtels et bars, cafés, restauration, compagnies aériennes, ménages et autres

CANAL DE DISTRIBUTION

- Commerce hors ligne

- Commerce en ligne

On the basis of distribution channel, the Asia-Pacific mezcal market has been segmented into offline trade and online trade.

Mezcal Market Regional Analysis/Insights

The mezcal market is analyzed, and market size insights and trends are provided by country, product type, concentrate, price category, ABV content, year, packaging type, size, flavor type, producer type, product category, end user, and distribution channel, as referenced above.

The countries covered in the Asia-Pacific mezcal market report are China, South Korea, Japan, India, Australia, Singapore, Malaysia, Indonesia, Thailand, Philippines, and Rest of Asia-Pacific in Asia-Pacific (APAC)

China is dominating the Asia-Pacific mezcal market with a CAGR of around 22.7%. The broad base of the beverage industry in the country is set to drive market growth.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Mezcal Market Share Analysis

The mezcal market competitive landscape provides details of the competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies focus on the mezcal market.

Some of the major players operating in the mezcal market are Davide Campari-Milano N.V., BACARDI, Craft Distillers, MADRE MEZCAL, Familia Camarena, Brown-Forman, Diageo, Pernod Ricard, WILLIAM GRANT & SONS LTD, Rey Campero, Tequila & Mezcal Private Brands S.A. de C.V., Destilería Tlacolula, El Silencio Holdings, INC., Sauza Tequila Import Company, Dos Hombres LLC. , Del Maguey, Wahaka Mezcal., BOZAL MEZCAL Sombra , Pensador Mezcal, Ilegal Mezcal among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC MEZCAL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKETING STRATEGY OPTED BY MICROBREWERIES

4.1.1 CREATING CUSTOM PACKAGING

4.1.2 PROVIDING BUSINESS PERSPECTIVES

4.1.3 SOCIAL MEDIA USE

4.1.4 DESIGNING CUSTOMER LOYALTY INITIATIVES

4.1.5 GETTING INVOLVED WITH THE COMMUNITY

4.2 KEY TRENDS SCENARIO

4.2.1 PREMIUMISATION

4.2.2 VALUE FOR MONEY

4.2.3 HEALTH AND WELL BEING

4.2.4 CONSUMER AWARENESS

4.2.5 PRODUCT INNOVATION

4.2.6 AVAILABILITY OF LOCAL PRODUCTS

4.2.7 OTHERS

4.3 FACTORS INFLUENCING PURCHASE DECISION

4.4 KEY DEMOGRAPHIC CONSUMER BASE INCLUDE:

4.5 PRICE ANALYSIS

4.6 PROMOTIONAL ACTIVITIES ADOPTED BY KEY MARKET PLAYERS

4.7 PRIVATE LABEL VS BRAND LABEL

4.8 TAXATION AND DUTY LEVIES

5 SUPPLY CHAIN OF ASIA PACIFIC MEZCAL MARKET

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING

5.3 MARKETING AND DISTRIBUTION

5.4 END USERS

5.5 LOGISTIC COST SCENARIO

5.6 IMPORTANCE OF LOGISTIC SERVICE PROVIDER

6 ASIA PACIFIC MEZCAL MARKET: SHOPPING BEHAVIOUR

6.1 RECOMMENDATIONS FROM FAMILY & FRIENDS-

6.2 RESEARCH

6.3 IMPULSIVE

6.4 ADVERTISEMENT:

6.4.1 TELEVISION ADVERTISEMENT

6.4.2 ONLINE ADVERTISEMENT

6.4.3 IN-STORE ADVERTISEMENT

7 ASIA PACIFIC MEZCAL MARKET: REGULATIONS

7.1 REGULATION IN U.S

7.2 REGULATION IN EUROPE

7.3 REGULATION IN AUSTRALIA

8 ASIA PACIFIC MEZCAL MARKET, NEW PRODUCT LAUNCH STRATEGY

8.1 OVERVIEW

8.2 NUMBER OF PRODUCT LAUNCHES

8.2.1 LINE EXTENSION

8.2.2 NEW PACKAGING

8.2.3 RE-LAUNCHED

8.2.4 NEW FORMULATION

8.3 DIFFERENTIAL PRODUCT OFFERING

8.4 MEETING CONSUMER REQUIREMENT

8.5 PACKAGE DESIGNING

8.6 PRICING ANALYSIS

8.7 PRODUCT POSITIONING

8.8 CONCLUSION

9 EXPORT AND IMPORT TRADE ANALYSIS

9.1 EXPORT ANALYSIS OF SPIRIT DRINKS

9.2 IMPORT ANALYSIS OF SPIRIT DRINKS

10 ASIA PACIFIC MEZCAL MARKET, CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

10.1 OVERVIEW

10.2 SOCIAL FACTORS

10.3 CULTURAL FACTORS

10.4 PSYCHOLOGICAL FACTORS

10.5 PERSONAL FACTORS

10.6 ECONOMIC FACTORS

10.7 PRODUCT TRAITS

10.8 MARKET ATTRIBUTES

10.9 ASIA PACIFIC CONSUMERS DISPOSABLE INCOME/SPEND DYNAMICS

10.1 CONCLUSION

11 MARKET OVERVIEW

11.1 DRIVERS

11.1.1 AVAILABILITY OF A VARIETY OF FLAVORS IN MEZCAL

11.1.2 RISING TECHNOLOGICAL INNOVATIONS FOR SPIRIT PRODUCTION

11.1.3 POSITIVE OUTLOOK TOWARDS ADVANCED AND SMART PACKAGING SOLUTIONS

11.1.4 RISING INITIATIVE OF COMPANIES TO EXPAND THEIR BUSINESS ASIA PACIFICLY

11.2 RESTRAINTS

11.2.1 HEAVY TAXATION AND DUTIES

11.2.2 STRINGENT RULES AND REGULATIONS

11.3 OPPORTUNITIES

11.3.1 GROWING POPULARITY OF PREMIUM AND LUXURY BEVERAGES

11.3.2 INCREASING CUSTOMERS FOR MEZCAL PRODUCTS

11.3.3 INCREASED AVAILABILITY OF MEZCAL ON E-COMMERCE PLATFORMS

11.4 CHALLENGES

11.4.1 RISING POPULARITY OF DRINKING HEALTHFUL, NON-ALCOHOLIC BEVERAGES

11.4.2 HIGH COST OF MEZCAL

12 ASIA PACIFIC MEZCAL MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 MEZCAL ESPADIN

12.2.1 BY CONCENTRATION

12.2.1.1 100% TEQUILA

12.2.1.2 MIX TEQUILA

12.2.2 BY ABV CONTENT

12.2.2.1 40% AND ABOVE

12.2.2.2 LESS THAN 40%

12.3 MEZCAL JOVEN

12.3.1 BY CONCENTRATION

12.3.1.1 100% TEQUILA

12.3.1.2 MIX TEQUILA

12.3.2 BY ABV CONTENT

12.3.2.1 40% AND ABOVE

12.3.2.2 LESS THAN 40%

12.3.3 BY DISTILLATION

12.3.3.1 COPPER

12.3.3.2 STEEL

12.4 MEZCAL REPOSADO

12.4.1 BY CONCENTRATION

12.4.1.1 100% TEQUILA

12.4.1.2 MIX TEQUILA

12.4.2 BY ABV CONTENT

12.4.2.1 40% AND ABOVE

12.4.2.2 LESS THAN 40%

12.4.3 BY DISTILLATION

12.4.3.1 COPPER

12.4.3.2 STEEL

12.5 MEZCAL ANEJO

12.5.1 BY CONCENTRATION

12.5.1.1 100% TEQUILA

12.5.1.2 MIX TEQUILA

12.5.2 BY ABV CONTENT

12.5.2.1 40% AND ABOVE

12.5.2.2 LESS THAN 40%

12.5.3 BY DISTILLATION

12.5.3.1 COPPER

12.5.3.2 STEEL

12.6 MEZCAL ENSAMBLE

12.6.1 BY CONCENTRATION

12.6.1.1 100% TEQUILA

12.6.1.2 MIX TEQUILA

12.6.2 BY ABV CONTENT

12.6.2.1 40% AND ABOVE

12.6.2.2 LESS THAN 40%

12.7 MEZCAL ARROQUEÑO

12.7.1 BY CONCENTRATION

12.7.1.1 100% TEQUILA

12.7.1.2 MIX TEQUILA

12.7.2 BY ABV CONTENT

12.7.2.1 40% AND ABOVE

12.7.2.2 LESS THAN 40%

12.8 MEZCAL TEPEZTATE

12.8.1 BY CONCENTRATION

12.8.1.1 100% TEQUILA

12.8.1.2 MIX TEQUILA

12.8.2 BY ABV CONTENT

12.8.2.1 40% AND ABOVE

12.8.2.2 LESS THAN 40%

12.9 OTHERS

12.9.1 BY CONCENTRATION

12.9.1.1 100% TEQUILA

12.9.1.2 MIX TEQUILA

12.9.2 BY ABV CONTENT

12.9.2.1 40% AND ABOVE

12.9.2.2 LESS THAN 40%

13 ASIA PACIFIC MEZCAL MARKET, BY CONCENTRATION

13.1 OVERVIEW

13.2 100% TEQUILA

13.3 MIX TEQUILA

14 ASIA PACIFIC MEZCAL MARKET, BY PRICE CATEGORY

14.1 OVERVIEW

14.2 PREMIUM

14.3 STANDARD

14.4 ECONOMY

15 ASIA PACIFIC MEZCAL MARKET, BY ABV CONTENT

15.1 OVERVIEW

15.2 40% AND ABOVE

15.3 LESS THAN 40%

16 ASIA PACIFIC MEZCAL MARKET, BY YEAR

16.1 OVERVIEW

16.2 25-44

16.3 45-64

16.4 18-24

16.5 65+

17 ASIA PACIFIC MEZCAL MARKET, BY PACKAGING TYPE

17.1 OVERVIEW

17.2 BOTTLE

17.3 CANS

17.4 OTHERS

18 ASIA PACIFIC MEZCAL MARKET, BY SIZE

18.1 OVERVIEW

18.2 751-1000 ML

18.3 501-750 ML

18.4 251-500 ML

18.5 MORE THAN 1000 ML

19 ASIA PACIFIC MEZCAL MARKET, BY FLAVOR TYPE

19.1 OVERVIEW

19.2 FLAVORED

19.2.1 CITRUS FRUITS

19.2.1.1 ORANGE

19.2.1.2 LEMON

19.2.1.3 GRAPE FRUIT

19.2.1.4 OTHERS

19.2.2 FLORALS

19.2.3 SMOKED

19.2.4 GREEN PEPPER

19.2.5 OTHERS

19.3 PLAIN/ORIGINAL

20 ASIA PACIFIC MEZCAL MARKET, BY PRODUCER TYPE

20.1 OVERVIEW

20.2 MICROBREWERY

20.3 DISTILLERS

20.4 BREWPUB

20.5 REGIONAL CRAFT BREWERY

20.6 CONTRACT BREWING COMPANY

20.7 LARGE BREWERY

20.8 OTHERS

21 ASIA PACIFIC MEZCAL MARKET, BY PRODUCT CATEGORY

21.1 OVERVIEW

21.2 DISTILLERS MEZCAL

21.3 HANDCRAFTED/ARTISANAL MEZCAL

22 ASIA PACIFIC MEZCAL MARKET, BY END USE

22.1 OVERVIEW

22.2 HOTELS AND BARS

22.3 RESTAURANTS

22.3.1 RESTAURANTS, BY TYPE

22.3.1.1 CHAIN RESTAURANTS

22.3.1.2 INDEPENDENT RESTAURANTS

22.3.2 RESTAURANTS, BY SERVICE CATEGORY

22.3.2.1 FULL SERVICE RESTAURANTS

22.3.2.2 QUICK SERVICE RESTAURANTS

22.4 CAFE

22.4.1 AIRLINES

22.4.2 CATERING

22.4.3 HOUSEHOLD

22.4.4 OTHERS

23 ASIA PACIFIC MEZCAL MARKET, BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 OFFLINE TRADE

23.2.1 NON-STORE BASED RETAILERS

23.2.1.1 VENDING MACHINE

23.2.1.2 OTHERS

23.2.2 STORE BASED RETAILER

23.2.2.1 HYPERMARKET/SUPERMARKET

23.2.2.2 CONVENIENCE STORES

23.2.2.3 SPECIALTY STORES

23.2.2.4 GROCERY STORES

23.2.2.5 OTHERS

23.3 ONLINE TRADE

23.4 COMPANY OWNED WEBSITE

23.5 E-COMMERCE

24 ASIA PACIFIC MEZCAL MARKET, BY REGION

24.1 ASIA-PACIFIC

24.1.1 CHINA

24.1.2 JAPAN

24.1.3 SOUTH KOREA

24.1.4 INDIA

24.1.5 AUSTRALIA & NEW ZEALAND

24.1.6 SINGAPORE

24.1.7 THAILAND

24.1.8 MALAYSIA

24.1.9 INDONESIA

24.1.10 PHILIPPINES

24.1.11 REST OF ASIA-PACIFIC

25 ASIA PACIFIC MEZCAL MARKET: COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

26 SWOT ANALYSIS

27 COMPANY PROFILE

27.1 PERNOD RICARD

27.1.1 COMPANY SNAPSHOT

27.1.2 REVENUE ANALYSIS

27.1.3 COMPANY SHARE ANALYSIS

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENT

27.2 DIAGEO

27.2.1 COMPANY SNAPSHOT

27.2.2 REVENUE ANALYSIS

27.2.3 COMPANY SHARE ANALYSIS

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 WILLIAM GRANT & SONS

27.3.1 COMPANY SNAPSHOT

27.3.2 COMPANY SHARE ANALYSIS

27.3.3 PRODUCT PORTFOLIO

27.3.4 RECENT DEVELOPMENTS

27.4 BACARDI

27.4.1 COMPANY SNAPSHOT

27.4.2 COMPANY SHARE ANALYSIS

27.4.3 PRODUCT PORTFOLIO

27.4.4 RECENT DEVELOPMENT

27.5 DAVIDE CAMPARI-MILANO N.V.

27.5.1 COMPANY SNAPSHOT

27.5.2 REVENUE ANALYSIS

27.5.3 COMPANY SHARE ANALYSIS

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENT

27.6 BROWN-FORMAN

27.6.1 COMPANY SNAPSHOT

27.6.2 REVENUE ANALYSIS

27.6.3 PRODUCT PORTFOLIO

27.6.4 RECENT DEVELOPMENT

27.7 BOZAL MEZCAL

27.7.1 COMPANY SNAPSHOT

27.7.2 PRODUCT PORTFOLIO

27.7.3 RECENT DEVELOPMENT

27.8 CRAFT DISTILLERS

27.8.1 COMPANY SNAPSHOT

27.8.2 PRODUCT PORTFOLIO

27.8.3 RECENT DEVELOPMENTS

27.9 DOS HOMBRES LLC.

27.9.1 COMPANY SNAPSHOT

27.9.2 PRODUCT PORTFOLIO

27.9.3 RECENT DEVELOPMENTS

27.1 DEL MAGUEY SINGLE VILLAGE MEZCAL

27.10.1 COMPANY SNAPSHOT

27.10.2 PRODUCT PORTFOLIO

27.10.3 RECENT DEVELOPMENTS

27.11 DESTILERÍA TLACOLULA

27.11.1 COMPANY SNAPSHOT

27.11.2 PRODUCT PORTFOLIO

27.11.3 RECENT DEVELOPMENT

27.12 EL SILENCIO HOLDINGS, INC.

27.12.1 COMPANY SNAPSHOT

27.12.2 PRODUCT PORTFOLIO

27.12.3 RECENT DEVELOPMENTS

27.13 FAMILIA CAMARENA

27.13.1 COMPANY SNAPSHOT

27.13.2 PRODUCT PORTFOLIO

27.13.3 RECENT DEVELOPMENTS

27.14 ILEGAL MEZCAL

27.14.1 COMPANY SNAPSHOT

27.14.2 PRODUCT PORTFOLIO

27.14.3 RECENT DEVELOPMENTS

27.15 KING CAMPERO

27.15.1 COMPANY SNAPSHOT

27.15.2 PRODUCT PORTFOLIO

27.15.3 RECENT DEVELOPMENTS

27.16 MADRE MEZCAL

27.16.1 COMPANY SNAPSHOT

27.16.2 PRODUCT PORTFOLIO

27.16.3 RECENT DEVELOPMENTS

27.17 MEZCAL SOMBRA

27.17.1 COMPANY SNAPSHOT

27.17.2 PRODUCT PORTFOLIO

27.17.3 RECENT DEVELOPMENT

27.18 PENSADOR MEZCAL

27.18.1 COMPANY SNAPSHOT

27.18.2 PRODUCT PORTFOLIO

27.18.3 RECENT DEVELOPMENTS

27.19 SAUZA TEQUILA IMPORT COMPANY

27.19.1 COMPANY SNAPSHOT

27.19.2 PRODUCT PORTFOLIO

27.19.3 RECENT DEVELOPMENTS

27.2 TEQUILA & MEZCAL PRIVATE BRANDS S.A. DE C.V.

27.20.1 COMPANY SNAPSHOT

27.20.2 PRODUCT PORTFOLIO

27.20.3 RECENT DEVELOPMENTS

27.21 WAHAKA MEZCAL

27.21.1 COMPANY SNAPSHOT

27.21.2 PRODUCT PORTFOLIO

27.21.3 RECENT DEVELOPMENT

28 QUESTIONNAIRE

29 RELATED REPORTS

Liste des tableaux

TABLE 1 THE FOLLOWING ARE THE DIFFERENT PRICES OF DIFFERENT BRANDS.

TABLE 2 ASIA PACIFIC MEZCAL MARKET, BY PRODUCT TYPE, 2020- 2029 (USD MILLION)

TABLE 3 ASIA PACIFIC MEZCAL MARKET, BY PRODUCT TYPE, 2020- 2029, VOLUME (KILO LITERS)

TABLE 4 ASIA PACIFIC MEZCAL ESPADIN IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 5 ASIA PACIFIC MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 6 ASIA PACIFIC MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MEZCAL JOVEN IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 8 ASIA PACIFIC MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 9 ASIA PACIFIC MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 10 ASIA PACIFIC MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 11 ASIA PACIFIC MEZCAL REPOSADO IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 12 ASIA PACIFIC MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 13 ASIA PACIFIC MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 14 ASIA PACIFIC MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 15 ASIA PACIFIC MEZCAL ANEJO IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 16 ASIA PACIFIC MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 17 ASIA PACIFIC MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 18 ASIA PACIFIC MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 19 ASIA PACIFIC MEZCAL ENSAMBLE IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 20 ASIA PACIFIC MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 21 ASIA PACIFIC MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 22 ASIA PACIFIC MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 23 ASIA PACIFIC MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 24 ASIA PACIFIC MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 25 ASIA PACIFIC MEZCAL TEPEZTATE IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 26 ASIA PACIFIC MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 27 ASIA PACIFIC MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 28 ASIA PACIFIC OTHERS IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 29 ASIA PACIFIC OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 31 ASIA PACIFIC MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC 100% TEQUILA IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC MIX TEQUILA IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC PREMIUM IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC STANDARD IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC ECONOMY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC 40% AND ABOVE IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC LESS THAN 40% IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC 25-44 IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC 45-64 IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC 18-24 IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC 65+ IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC BOTTLES IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC CANS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC OTHERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 51 ASIA PACIFIC 751-1000 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC 501-750 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 ASIA PACIFIC 251-500 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC MORE THAN 1000 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 ASIA PACIFIC MEZCAL MARKET, BY FLAVOR TYPE, 2020- 2029 (USD MILLION)

TABLE 56 ASIA PACIFIC FLAVORED IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 57 ASIA PACIFIC FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020- 2029 (USD MILLION)

TABLE 58 ASIA PACIFIC CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 59 ASIA PACIFIC PLAIN/ORIGINAL IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 60 ASIA PACIFIC MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 61 ASIA PACIFIC MICROBREWERY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 ASIA PACIFIC DISTILLERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 ASIA PACIFIC BREWPUB IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 ASIA PACIFIC REGIONAL CRAFT BREWERY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 ASIA PACIFIC CONTRACT BREWING COMPANY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 ASIA PACIFIC LARGE BREWERY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 ASIA PACIFIC OTHERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 68 ASIA PACIFIC MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 69 ASIA PACIFIC DISTILLERS MEZCAL IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 70 ASIA PACIFIC HANDCRAFTED/ARTISANAL MEZCAL IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 ASIA PACIFIC MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 72 ASIA PACIFIC HOTELS AND BARS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 ASIA PACIFIC RESTAURANTS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 74 ASIA PACIFIC RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 ASIA PACIFIC RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 76 ASIA PACIFIC CAFÉ IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 ASIA PACIFIC AIRLINES IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 ASIA PACIFIC CATERING IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 79 ASIA PACIFIC HOUSEHOLD IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 80 ASIA PACIFIC OTHERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 81 ASIA PACIFIC MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 82 ASIA PACIFIC OFFLINE TRADE IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 83 ASIA PACIFIC OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 84 ASIA PACIFIC NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 85 ASIA PACIFIC STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 86 ASIA PACIFIC ONLINE TRADE IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 87 ASIA PACIFIC ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 88 ASIA-PACIFIC MEZCAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 89 ASIA-PACIFIC MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 ASIA-PACIFIC MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 91 ASIA-PACIFIC MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 92 ASIA-PACIFIC MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 93 ASIA-PACIFIC MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 94 ASIA-PACIFIC MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 95 ASIA-PACIFIC MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 96 ASIA-PACIFIC MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 97 ASIA-PACIFIC MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 98 ASIA-PACIFIC MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 99 ASIA-PACIFIC MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 100 ASIA-PACIFIC MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 101 ASIA-PACIFIC MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 102 ASIA-PACIFIC MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 103 ASIA-PACIFIC MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 104 ASIA-PACIFIC MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 105 ASIA-PACIFIC MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 106 ASIA-PACIFIC MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 107 ASIA-PACIFIC MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 108 ASIA-PACIFIC OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 109 ASIA-PACIFIC OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 110 ASIA-PACIFIC MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 111 ASIA-PACIFIC MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 112 ASIA-PACIFIC MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 113 ASIA-PACIFIC MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 114 ASIA-PACIFIC MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 115 ASIA-PACIFIC MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 116 ASIA-PACIFIC MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 117 ASIA-PACIFIC FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 118 ASIA-PACIFIC CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 ASIA-PACIFIC MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 120 ASIA-PACIFIC MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 121 ASIA-PACIFIC MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 122 ASIA-PACIFIC RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 ASIA-PACIFIC RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 124 ASIA-PACIFIC MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 125 ASIA-PACIFIC OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 ASIA-PACIFIC NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 127 ASIA-PACIFIC STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 128 ASIA-PACIFIC ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 129 CHINA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 CHINA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 131 CHINA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 132 CHINA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 133 CHINA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 134 CHINA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 135 CHINA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 136 CHINA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 137 CHINA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 138 CHINA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 139 CHINA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 140 CHINA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 141 CHINA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 142 CHINA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 143 CHINA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 144 CHINA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 145 CHINA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 146 CHINA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 147 CHINA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 148 CHINA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 149 CHINA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 150 CHINA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 151 CHINA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 152 CHINA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 153 CHINA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 154 CHINA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 155 CHINA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 156 CHINA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 157 CHINA MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 158 CHINA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 159 CHINA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 CHINA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 161 CHINA MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 162 CHINA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 163 CHINA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 CHINA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 165 CHINA MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 166 CHINA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 167 CHINA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 168 CHINA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 169 CHINA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 170 JAPAN MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 171 JAPAN MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 172 JAPAN MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 173 JAPAN MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 174 JAPAN MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 175 JAPAN MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 176 JAPAN MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 177 JAPAN MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 178 JAPAN MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 179 JAPAN MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 180 JAPAN MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 181 JAPAN MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 182 JAPAN MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 183 JAPAN MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 184 JAPAN MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 185 JAPAN MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 186 JAPAN MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 187 JAPAN MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 188 JAPAN MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 189 JAPAN MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 190 JAPAN OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 191 JAPAN OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 192 JAPAN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 193 JAPAN MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 194 JAPAN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 195 JAPAN MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 196 JAPAN MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 197 JAPAN MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 198 JAPAN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 199 JAPAN FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 200 JAPAN CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 JAPAN MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 202 JAPAN MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 203 JAPAN MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 204 JAPAN RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 JAPAN RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 206 JAPAN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 207 JAPAN OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 208 JAPAN NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 209 JAPAN STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 210 JAPAN ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 211 SOUTH KOREA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 212 SOUTH KOREA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 213 SOUTH KOREA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 214 SOUTH KOREA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 215 SOUTH KOREA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 216 SOUTH KOREA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 217 SOUTH KOREA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 218 SOUTH KOREA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 219 SOUTH KOREA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 220 SOUTH KOREA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 221 SOUTH KOREA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 222 SOUTH KOREA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 223 SOUTH KOREA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 224 SOUTH KOREA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 225 SOUTH KOREA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 226 SOUTH KOREA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 227 SOUTH KOREA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 228 SOUTH KOREA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 229 SOUTH KOREA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 230 SOUTH KOREA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 231 SOUTH KOREA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 232 SOUTH KOREA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 233 SOUTH KOREA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 234 SOUTH KOREA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 235 SOUTH KOREA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 236 SOUTH KOREA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 237 SOUTH KOREA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 238 SOUTH KOREA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 239 SOUTH KOREA MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 240 SOUTH KOREA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 241 SOUTH KOREA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 SOUTH KOREA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 243 SOUTH KOREA MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 244 SOUTH KOREA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 245 SOUTH KOREA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 SOUTH KOREA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 247 SOUTH KOREA MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 248 SOUTH KOREA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 249 SOUTH KOREA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 250 SOUTH KOREA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 251 SOUTH KOREA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 252 INDIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 253 INDIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 254 INDIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 255 INDIA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 256 INDIA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 257 INDIA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 258 INDIA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 259 INDIA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 260 INDIA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 261 INDIA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 262 INDIA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 263 INDIA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 264 INDIA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 265 INDIA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 266 INDIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 267 INDIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 268 INDIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 269 INDIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 270 INDIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 271 INDIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 272 INDIA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 273 INDIA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 274 INDIA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 275 INDIA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 276 INDIA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 277 INDIA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 278 INDIA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 279 INDIA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 280 INDIA MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 281 INDIA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 282 INDIA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 283 INDIA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 284 INDIA MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 285 INDIA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 286 INDIA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 287 INDIA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 288 INDIA MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 289 INDIA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 290 INDIA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 291 INDIA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 292 INDIA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 293 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 294 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 295 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 296 AUSTRALIA & NEW ZEALAND MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 297 AUSTRALIA & NEW ZEALAND MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 298 AUSTRALIA & NEW ZEALAND MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 299 AUSTRALIA & NEW ZEALAND MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 300 AUSTRALIA & NEW ZEALAND MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 301 AUSTRALIA & NEW ZEALAND MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 302 AUSTRALIA & NEW ZEALAND MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 303 AUSTRALIA & NEW ZEALAND MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 304 AUSTRALIA & NEW ZEALAND MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 305 AUSTRALIA & NEW ZEALAND MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 306 AUSTRALIA & NEW ZEALAND MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 307 AUSTRALIA & NEW ZEALAND MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 308 AUSTRALIA & NEW ZEALAND MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 309 AUSTRALIA & NEW ZEALAND MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 310 AUSTRALIA & NEW ZEALAND MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 311 AUSTRALIA & NEW ZEALAND MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 312 AUSTRALIA & NEW ZEALAND MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 313 AUSTRALIA & NEW ZEALAND OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 314 AUSTRALIA & NEW ZEALAND OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 315 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 316 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 317 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 318 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 319 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 320 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 321 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 322 AUSTRALIA & NEW ZEALAND FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 323 AUSTRALIA & NEW ZEALAND CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 324 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 325 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 326 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 327 AUSTRALIA & NEW ZEALAND RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 328 AUSTRALIA & NEW ZEALAND RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 329 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 330 AUSTRALIA & NEW ZEALAND OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 331 AUSTRALIA & NEW ZEALAND NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 332 AUSTRALIA & NEW ZEALAND STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 333 AUSTRALIA & NEW ZEALAND ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 334 SINGAPORE MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 335 SINGAPORE MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 336 SINGAPORE MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 337 SINGAPORE MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 338 SINGAPORE MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 339 SINGAPORE MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 340 SINGAPORE MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 341 SINGAPORE MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 342 SINGAPORE MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 343 SINGAPORE MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 344 SINGAPORE MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 345 SINGAPORE MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 346 SINGAPORE MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 347 SINGAPORE MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 348 SINGAPORE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 349 SINGAPORE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 350 SINGAPORE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 351 SINGAPORE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 352 SINGAPORE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 353 SINGAPORE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 354 SINGAPORE OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 355 SINGAPORE OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 356 SINGAPORE MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 357 SINGAPORE MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 358 SINGAPORE MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 359 SINGAPORE MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 360 SINGAPORE MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 361 SINGAPORE MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 362 SINGAPORE MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 363 SINGAPORE FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 364 SINGAPORE CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 365 SINGAPORE MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 366 SINGAPORE MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 367 SINGAPORE MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 368 SINGAPORE RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 369 SINGAPORE RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 370 SINGAPORE MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 371 SINGAPORE OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 372 SINGAPORE NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 373 SINGAPORE STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 374 SINGAPORE ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 375 THAILAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 376 THAILAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 377 THAILAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 378 THAILAND MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 379 THAILAND MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 380 THAILAND MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 381 THAILAND MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 382 THAILAND MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 383 THAILAND MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 384 THAILAND MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 385 THAILAND MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 386 THAILAND MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 387 THAILAND MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 388 THAILAND MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 389 THAILAND MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 390 THAILAND MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 391 THAILAND MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 392 THAILAND MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 393 THAILAND MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 394 THAILAND MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 395 THAILAND OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 396 THAILAND OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 397 THAILAND MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 398 THAILAND MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 399 THAILAND MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 400 THAILAND MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 401 THAILAND MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 402 THAILAND MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 403 THAILAND MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 404 THAILAND FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 405 THAILAND CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 406 THAILAND MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 407 THAILAND MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 408 THAILAND MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 409 THAILAND RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 410 THAILAND RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 411 THAILAND MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 412 THAILAND OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 413 THAILAND NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 414 THAILAND STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 415 THAILAND ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 416 MALAYSIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 417 MALAYSIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 418 MALAYSIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 419 MALAYSIA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 420 MALAYSIA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 421 MALAYSIA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 422 MALAYSIA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 423 MALAYSIA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 424 MALAYSIA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 425 MALAYSIA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 426 MALAYSIA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 427 MALAYSIA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 428 MALAYSIA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 429 MALAYSIA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 430 MALAYSIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 431 MALAYSIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 432 MALAYSIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 433 MALAYSIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 434 MALAYSIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 435 MALAYSIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 436 MALAYSIA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 437 MALAYSIA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 438 MALAYSIA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 439 MALAYSIA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 440 MALAYSIA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 441 MALAYSIA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 442 MALAYSIA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 443 MALAYSIA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 444 MALAYSIA MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 445 MALAYSIA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 446 MALAYSIA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 447 MALAYSIA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 448 MALAYSIA MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 449 MALAYSIA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 450 MALAYSIA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 451 MALAYSIA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 452 MALAYSIA MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 453 MALAYSIA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 454 MALAYSIA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 455 MALAYSIA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 456 MALAYSIA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 457 INDONESIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 458 INDONESIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 459 INDONESIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 460 INDONESIA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 461 INDONESIA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 462 INDONESIA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 463 INDONESIA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 464 INDONESIA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 465 INDONESIA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 466 INDONESIA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 467 INDONESIA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 468 INDONESIA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 469 INDONESIA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 470 INDONESIA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 471 INDONESIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 472 INDONESIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 473 INDONESIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 474 INDONESIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 475 INDONESIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 476 INDONESIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 477 INDONESIA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 478 INDONESIA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 479 INDONESIA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 480 INDONESIA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 481 INDONESIA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 482 INDONESIA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 483 INDONESIA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 484 INDONESIA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)