Asia Pacific Medical Device Warehouse And Logistics Market

Taille du marché en milliards USD

TCAC :

%

USD

8.18 Billion

USD

11.99 Billion

2024

2032

USD

8.18 Billion

USD

11.99 Billion

2024

2032

| 2025 –2032 | |

| USD 8.18 Billion | |

| USD 11.99 Billion | |

|

|

|

|

Segmentation du marché des entrepôts et de la logistique de dispositifs médicaux en Asie-Pacifique, par offres (services, matériel et logiciels), température (ambiante, réfrigérée, congelée et autres), mode de transport (logistique de fret maritime, logistique de fret aérien et logistique terrestre), application (dispositifs de diagnostic, dispositifs thérapeutiques, dispositifs de surveillance, dispositifs chirurgicaux et autres dispositifs), utilisation finale (hôpitaux et cliniques, fabricants de dispositifs médicaux, instituts universitaires et de recherche, laboratoires de référence et de diagnostic, entreprises de services médicaux d'urgence et autres), canal de distribution (logistique conventionnelle et tierce partie) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des entrepôts et de la logistique des dispositifs médicaux en Asie-Pacifique

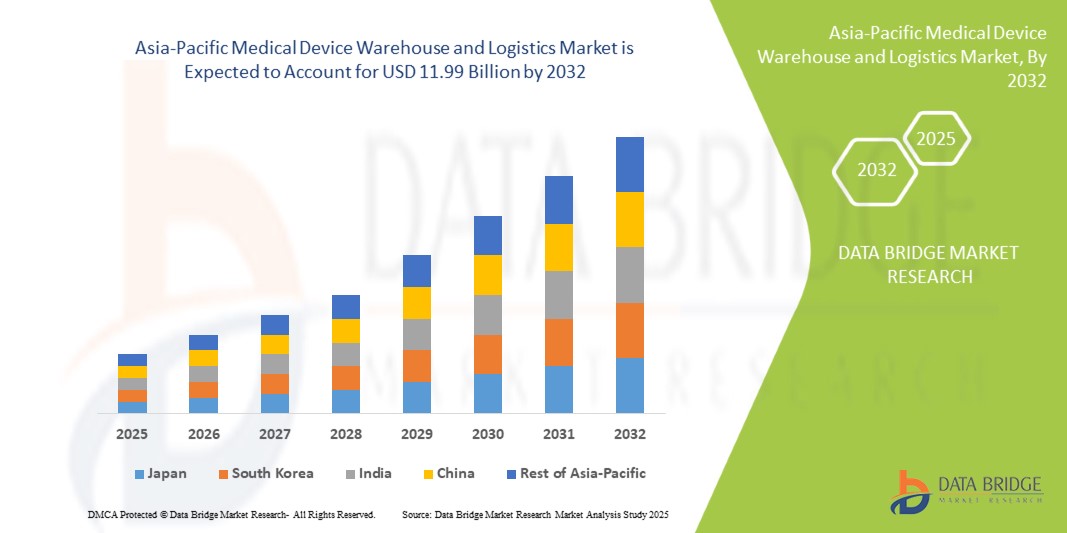

- La taille du marché des entrepôts et de la logistique des dispositifs médicaux en Asie-Pacifique était évaluée à 8,18 milliards USD en 2024 et devrait atteindre 11,99 milliards USD d'ici 2032 , à un TCAC de 4,90 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'adoption croissante de technologies avancées de chaîne d'approvisionnement et la transformation numérique de la logistique des soins de santé, conduisant à une efficacité accrue du stockage et de la distribution des dispositifs médicaux dans la région Asie-Pacifique.

- Par ailleurs, la demande croissante d'équipements médicaux thermosensibles et de grande valeur, conjuguée à une conformité réglementaire stricte en matière de traçabilité et de sécurité des dispositifs médicaux, favorise l'adoption de solutions d'entreposage et de logistique pour dispositifs médicaux en Asie-Pacifique. Ces facteurs convergents accélèrent l'adoption de plateformes logistiques technologiques, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des entrepôts et de la logistique des dispositifs médicaux en Asie-Pacifique

- Les services d'entreposage et de logistique des dispositifs médicaux deviennent des piliers essentiels de l'infrastructure de santé en Asie-Pacifique, notamment dans les hôpitaux, les centres de diagnostic et les services de soins à domicile. La région est en effet confrontée à une demande croissante de livraison de technologies médicales sophistiquées, conformes, rapides et conformes à la chaîne du froid. Ces services garantissent la disponibilité des produits, améliorent la traçabilité et aident les parties prenantes à se conformer aux réglementations régionales complexes.

- La forte augmentation de la demande en logistique de dispositifs médicaux en Asie-Pacifique est principalement due à la croissance de la base manufacturière dans des pays comme la Chine, l'Inde et la Corée du Sud, à l'expansion rapide du commerce électronique, aux innovations dans le transport à température contrôlée et aux cadres réglementaires stricts tels que les BPD (bonnes pratiques de distribution) et le MDR (réglementation des dispositifs médicaux) dans les principales économies d'Asie-Pacifique.

- La Chine a dominé le marché des entrepôts et de la logistique de dispositifs médicaux en Asie-Pacifique, avec une part de chiffre d'affaires de 28,3 % en 2024. Cette domination s'explique par son leadership mondial dans la production de dispositifs médicaux, son infrastructure logistique hautement développée et son fort engagement dans l'automatisation, l'IA et les solutions de chaîne d'approvisionnement numérique. Des investissements majeurs dans le suivi par RFID et les plateformes de distribution régionales ont consolidé la position de la Chine dans ce secteur.

- L'Inde devrait connaître la croissance la plus rapide sur le marché de l'entreposage et de la logistique des dispositifs médicaux en Asie-Pacifique en 2024, grâce à la multiplication des collaborations public-privé dans le secteur de la santé, à l'essor rapide de la production nationale de dispositifs et à la forte croissance des infrastructures de la chaîne du froid dans les villes de niveau 2 et 3. Les initiatives gouvernementales telles que « Make in India » stimulent la demande locale en matière d'entreposage et renforcent le rôle de l'Inde comme acteur clé du développement du marché régional.

- Le segment ambiant a dominé le marché de l'entreposage et de la logistique des dispositifs médicaux en Asie-Pacifique, avec une part de marché de 52,3 % en 2024. Cette situation s'explique par le volume important de dispositifs (instruments chirurgicaux, équipements d'imagerie et outils de diagnostic non invasifs, par exemple) ne nécessitant pas de réfrigération. Le stockage ambiant est largement privilégié pour sa rentabilité, sa simplicité d'utilisation et sa compatibilité avec les modes de transport standard de la région.

Portée du rapport et segmentation du marché des entrepôts et de la logistique des dispositifs médicaux en Asie-Pacifique

|

Attributs |

Aperçu du marché des entrepôts et de la logistique des dispositifs médicaux en Asie-Pacifique |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des entrepôts et de la logistique des dispositifs médicaux en Asie-Pacifique

« Opérations rationalisées grâce à l'automatisation et au suivi numérique »

- L'adoption de technologies avancées d'automatisation et de suivi numérique constitue une tendance majeure et croissante sur le marché de l'entreposage et de la logistique des dispositifs médicaux en Asie-Pacifique . Ces innovations améliorent l'efficacité opérationnelle, réduisent les erreurs manuelles et permettent une visibilité en temps réel des stocks tout au long de la chaîne d'approvisionnement.

- Par exemple, de nombreux prestataires logistiques tiers (3PL) intègrent des systèmes de gestion d'entrepôt numérique (WMS) avec des technologies RFID et de lecture de codes-barres pour optimiser le stockage, la récupération et la distribution des dispositifs médicaux. Cela garantit la conformité réglementaire, minimise les écarts de stock et accélère l'exécution des commandes.

- En outre, la mise en œuvre de plateformes logistiques basées sur le cloud permet aux parties prenantes de surveiller l'état des expéditions en temps réel, de recevoir des alertes automatisées et de rationaliser la documentation douanière et réglementaire, réduisant ainsi les retards et améliorant la satisfaction des clients.

- L'automatisation des systèmes de surveillance de la température et de contrôle de l'humidité dans les entrepôts est particulièrement cruciale pour les dispositifs médicaux thermosensibles et de grande valeur, tels que les kits de diagnostic, les dispositifs implantables et les instruments chirurgicaux. Ces systèmes garantissent des conditions environnementales constantes pour préserver l'intégrité des produits.

- La préférence croissante pour les stocks juste à temps (JIT) et la logistique axée sur la demande encourage les fabricants et les distributeurs à collaborer étroitement avec des partenaires logistiques capables de proposer des solutions d'entreposage évolutives et flexibles.

- Par conséquent, des acteurs clés tels que DB Schenker, CEVA Logistics et Kuehne+Nagel investissent dans des entrepôts de dispositifs médicaux spécialement conçus et conformes aux BPD, dotés d'une infrastructure spécialisée pour répondre aux besoins évolutifs des fabricants et des prestataires de soins de santé dans toute la région Asie-Pacifique.

Dynamique du marché des entrepôts et de la logistique des dispositifs médicaux en Asie-Pacifique

Conducteur

« Besoin croissant dû à la demande croissante d'une chaîne du froid efficace et d'une conformité réglementaire »

- La demande croissante de dispositifs médicaux sensibles à la température, ainsi que les réglementations strictes en matière de manipulation et de distribution de dispositifs médicaux dans la région Asie-Pacifique, constituent un moteur majeur de l'expansion du marché des entrepôts et de la logistique de dispositifs médicaux en Asie-Pacifique.

- Par exemple, en avril 2024, UPS Healthcare a annoncé l'extension de ses capacités logistiques de chaîne du froid en Asie-Pacifique afin de répondre à la demande croissante de transport conforme et à température régulée de dispositifs médicaux et de produits biologiques. Ces investissements de la part d'acteurs clés devraient stimuler la croissance du marché sur la période de prévision.

- Alors que les prestataires de soins de santé accordent la priorité à la livraison rapide et sécurisée des dispositifs de diagnostic et thérapeutiques, les partenaires logistiques améliorent leurs capacités en matière de traçabilité, de sérialisation et de surveillance de l'état, garantissant ainsi la conformité avec les directives MDR et GDP de l'UE.

- De plus, l'évolution vers des dispositifs mini-invasifs et des solutions de soins de santé à domicile augmente le besoin de livraison au dernier kilomètre, de gestion efficace des stocks et d'emballages spécialisés, faisant des services d'entreposage et de logistique un maillon essentiel de la chaîne d'approvisionnement des dispositifs médicaux.

- La prévalence croissante des maladies chroniques et des interventions chirurgicales, ainsi que le nombre croissant d'essais cliniques et de services de diagnostic, accélèrent encore le besoin de solutions d'entreposage agiles et évolutives adaptées aux conditions de stockage spécifiques et aux délais d'exécution requis par les technologies médicales.

Retenue/Défi

« Coûts opérationnels élevés et paysage réglementaire complexe »

- Le marché de l'entreposage et de la logistique des dispositifs médicaux en Asie-Pacifique est confronté à des défis en raison des coûts élevés liés aux infrastructures de la chaîne du froid, à la formation spécialisée du personnel et à la conformité réglementaire. La construction et l'entretien d'installations et de réseaux de transport conformes aux BPD, notamment pour les segments réfrigérés et congelés, nécessitent des investissements importants.

- De plus, la gestion des cadres réglementaires complexes et évolutifs des différents pays d'Asie-Pacifique présente des difficultés opérationnelles. Les fabricants et les prestataires logistiques doivent s'adapter à des exigences nationales variées tout en garantissant une visibilité et une conformité centralisées.

- Par exemple, les retards dans le transport transfrontalier dus à des erreurs de documentation ou à des différences dans les protocoles douaniers peuvent affecter les délais de livraison et l'intégrité du produit, en particulier pour les appareils sensibles à la température.

- De plus, les fabricants de dispositifs médicaux de petite et moyenne taille peinent souvent à respecter ces exigences de coût et de conformité, ce qui les conduit à dépendre fortement des prestataires logistiques tiers (3PL). Si cela améliore leur portée, cela peut également réduire le contrôle direct sur la qualité et les délais.

- Pour surmonter ces contraintes, les acteurs du secteur doivent investir dans l'automatisation, les systèmes de suivi numérique et la formation du personnel, tout en favorisant une collaboration plus étroite avec les organismes de réglementation. Le développement des plateformes d'entreposage régionales et l'adoption de plateformes numériques standardisées seront également essentiels pour rationaliser les opérations et soutenir la croissance à long terme.

Portée du marché de l'entreposage et de la logistique des dispositifs médicaux en Asie-Pacifique

Le marché de l'entreposage et de la logistique des dispositifs médicaux en Asie-Pacifique est segmenté en sept segments notables en fonction des offres, de la température, du mode de transport, de l'application, de l'utilisation finale et du canal de distribution.

• Par offrandes

Sur la base des offres, le marché de l'entreposage et de la logistique des dispositifs médicaux en Asie-Pacifique est segmenté en services, matériel et logiciels. Le segment des services a dominé avec la plus grande part de chiffre d'affaires (48,6 %) en 2024, porté par l'externalisation croissante des fonctions logistiques et la demande de manutention spécialisée.

Le segment des logiciels devrait connaître le TCAC le plus rapide de 23,5 % au cours de la période de prévision, attribué à l'utilisation croissante d'outils logistiques numériques tels que les plateformes WMS et TMS.

• Par température

En termes de température, le marché de l'entreposage et de la logistique des dispositifs médicaux en Asie-Pacifique est segmenté en produits à température ambiante, réfrigérés, congelés et autres. Le segment à température ambiante détenait la plus grande part de marché, avec 52,3 % en 2024, grâce à la large gamme de dispositifs ne nécessitant pas de contrôle de température.

Le segment des produits réfrigérés devrait connaître le TCAC le plus rapide, soit 21,1 %, entre 2025 et 2032, grâce à la demande croissante de logistique de la chaîne du froid pour les dispositifs médicaux sensibles.

• Par mode de transport

En fonction du mode de transport, le marché de l'entreposage et de la logistique des dispositifs médicaux en Asie-Pacifique est segmenté en logistique de fret maritime, logistique de fret aérien et logistique terrestre. Le segment de la logistique terrestre a dominé le marché avec 45,7 % de parts de chiffre d'affaires en 2024, grâce à des réseaux routiers et ferroviaires bien établis dans toute la région Asie-Pacifique.

Le segment de la logistique du fret aérien devrait connaître un TCAC maximal de 19,4 % entre 2025 et 2032, soutenu par la demande croissante d'expéditions médicales rapides et de grande valeur.

• Sur demande

En fonction des applications, le marché est segmenté en dispositifs de diagnostic, dispositifs thérapeutiques, dispositifs de surveillance, dispositifs chirurgicaux et autres dispositifs. Le segment des dispositifs de diagnostic représentait la part la plus importante (34,2 %) en 2024, grâce à un volume d'utilisation élevé et à des cycles de réapprovisionnement récurrents.

Le segment des dispositifs chirurgicaux devrait connaître une croissance annuelle composée (TCAC) rapide de 20,2 % au cours de la période de prévision, soutenue par l'augmentation des volumes de procédures et les exigences de manipulation de dispositifs de précision.

• Par utilisation finale

En fonction de l'utilisation finale, le marché est segmenté en hôpitaux et cliniques, fabricants de dispositifs médicaux, instituts universitaires et de recherche, laboratoires de référence et de diagnostic, entreprises de services médicaux d'urgence, etc. Le segment des hôpitaux et cliniques a enregistré la part de chiffre d'affaires la plus élevée, soit 39,6 % en 2024, grâce à une consommation élevée d'appareils et à des achats centralisés.

Le segment des entreprises de dispositifs médicaux devrait connaître le TCAC le plus rapide, soit 22,8 %, entre 2025 et 2032, car elles externalisent de plus en plus la logistique à des fournisseurs tiers spécialisés.

• Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en logistique conventionnelle et logistique tierce. Le segment de la logistique tierce a capturé la plus grande part de marché, soit 61,2 % en 2024, les fabricants d'appareils optant pour des modèles de distribution rentables et flexibles.

Le segment de la logistique conventionnelle devrait connaître une croissance TCAC très rapide de 13,9 % entre 2025 et 2032, conservant ainsi sa pertinence dans les régions dotées de systèmes de distribution internes ou spécifiques à la réglementation.

Analyse régionale du marché des entrepôts et de la logistique des dispositifs médicaux en Asie-Pacifique

- L'Asie-Pacifique détenait 21,4 % du marché mondial des entrepôts et de la logistique des dispositifs médicaux en 2024, grâce à la robuste infrastructure de soins de santé de la région, à l'expansion des pôles logistiques et à un contrôle réglementaire accru pour garantir une distribution sûre et conforme des dispositifs médicaux.

- L'accent mis par la région sur la fiabilité de la chaîne du froid, le suivi numérique de la chaîne d'approvisionnement et la logistique verte a accéléré l'adoption de technologies d'entreposage avancées et de solutions de livraison sensibles à la température.

- La présence croissante des fabricants mondiaux et régionaux de technologies médicales et pharmaceutiques, ainsi que l'adoption rapide de l'automatisation, de la robotique et des systèmes d'inventaire basés sur l'IA, continuent de propulser l'expansion du marché dans toute la région Asie-Pacifique.

Aperçu du marché chinois des entrepôts et de la logistique des dispositifs médicaux

Le marché chinois des entrepôts et de la logistique de dispositifs médicaux a dominé le marché Asie-Pacifique avec une part de chiffre d'affaires record de 28,3 % en 2024, grâce à son leadership dans la production de dispositifs médicaux, ses infrastructures de pointe et ses capacités logistiques de chaîne du froid en pleine croissance. L'expansion du marché intérieur du pays et le soutien gouvernemental à la modernisation de la logistique renforcent son rôle de plaque tournante incontournable pour l'entreposage et la distribution de dispositifs médicaux.

Aperçu du marché japonais des entrepôts et de la logistique des dispositifs médicaux

Le marché japonais de l'entreposage et de la logistique des dispositifs médicaux a représenté une part de chiffre d'affaires significative de 18,4 % en 2024, grâce à la maturité de son système de santé, à la forte production nationale de dispositifs médicaux et à l'adoption généralisée de l'entreposage automatisé et technologique. L'intégration de la robotique et de l'IoT dans les installations logistiques améliore l'efficacité opérationnelle et le respect des normes médicales strictes du Japon.

Aperçu du marché indien des entrepôts et de la logistique des dispositifs médicaux

Le marché indien des entrepôts et de la logistique de dispositifs médicaux représentait 14,3 % du marché régional en 2024, grâce à l'intensification des collaborations public-privé dans le secteur de la santé, à l'expansion rapide de la fabrication nationale de dispositifs et à la forte croissance des infrastructures de la chaîne du froid dans les villes de niveau 2 et 3. Les initiatives gouvernementales telles que « Make in India » stimulent également la demande locale en matière d'entreposage.

Aperçu du marché de la logistique et des entrepôts de dispositifs médicaux en Corée du Sud et en Asie-Pacifique

Le marché sud-coréen de l'entreposage et de la logistique des dispositifs médicaux a conquis 9,1 % du marché Asie-Pacifique en 2024, grâce à une infrastructure d'exportation robuste, une technologie logistique avancée et l'adoption croissante de systèmes d'entreposage intelligents. L'écosystème d'innovation du pays en matière de dispositifs médicaux et l'importance accordée à la conformité stimulent une croissance continue.

Part de marché des entrepôts et de la logistique des dispositifs médicaux en Asie-Pacifique

Le secteur de l'entreposage et de la logistique des dispositifs médicaux en Asie-Pacifique est principalement dirigé par des entreprises bien établies, notamment :

- Deutsche Post AG (Allemagne)

- FedEx (États-Unis)

- United Parcel Service of America, Inc. (États-Unis)

- Kuehne+Nagel (Royaume-Uni)

- DB SCHENKER (Allemagne)

- AWL India Private Limited (Inde)

- CH Robinson Worldwide, Inc. (États-Unis)

- CEVA (France)

- Dimerco (Taïwan)

- DSV (Danemark)

- FM Logistic (France)

- Hansa International (Chine)

- Hellmann Worldwide Logistics SE & Co. KG (Allemagne)

- Impérial (Afrique du Sud)

- OIA Global (États-Unis)

- Omni Logistics, LLC (États-Unis)

- Groupe Rhenus (Allemagne)

- SEKO (États-Unis)

- TIBA (Espagne)

- Toll Holdings Limited (Australie)

- XPO, Inc. (États-Unis)

Derniers développements sur le marché de l'entreposage et de la logistique des dispositifs médicaux en Asie-Pacifique

- En novembre 2023, DHL Express a officiellement inauguré son hub d'Asie centrale agrandi à Hong Kong, investissant 562 millions d'euros pour renforcer ses capacités dans un contexte de croissance du commerce mondial. Ce hub, essentiel pour relier l'Asie au reste du monde, a vu sa capacité de traitement des expéditions de pointe augmenter de près de 70 % et peut désormais gérer un volume six fois supérieur à celui de sa création en 2004. Cette expansion souligne l'engagement de DHL à soutenir la croissance de ses clients et à consolider le statut de Hong Kong comme plaque tournante internationale incontournable de l'aviation.

- En décembre 2022, DHL Supply Chain a annoncé un investissement de 10,93 millions de dollars américains pour étendre ses capacités d'entreposage dans le nord de Taïwan, en se concentrant notamment sur les secteurs des semi-conducteurs, des sciences de la vie et de la santé. Le nouveau centre de distribution de Taoyuan-Jian Guo ajoute 10 000 mètres carrés à la surface d'entreposage totale de DHL à Taoyuan, la portant à 37 000 mètres carrés. Cette installation améliore la connectivité pour des opérations logistiques efficaces et soutient l'objectif de l'entreprise d'atteindre 200 000 mètres carrés d'empreinte totale à Taïwan d'ici 2027.

- En septembre 2024, FedEx a lancé la plateforme fdx, une solution commerciale basée sur les données, désormais accessible aux entreprises américaines. Cette plateforme s'appuie sur le réseau FedEx pour améliorer l'expérience client en améliorant la croissance de la demande, les taux de conversion et l'optimisation du traitement des commandes. Parmi ses fonctionnalités notables figurent les estimations de livraison prédictives, les analyses de durabilité, le suivi des commandes personnalisé et la simplification des processus de retour. Raj Subramaniam, PDG de FedEx, a souligné le rôle de la plateforme dans des chaînes d'approvisionnement plus intelligentes lors de l'événement Dreamforce 2024.

- En mars 2024, UPS Healthcare a lancé UPS Supply Chain Symphony R, une plateforme cloud conçue pour intégrer et gérer les données de la chaîne d'approvisionnement des soins de santé issues de divers systèmes opérationnels. Cet outil offre aux clients du secteur de la santé une visibilité complète sur leur logistique, leur permettant de prendre des décisions éclairées, d'améliorer leur planification et d'établir des prévisions précises. En améliorant le contrôle, l'efficacité et la transparence, cette plateforme répond au besoin crucial de rationalisation des chaînes d'approvisionnement dans le secteur de la santé. Kate Gutmann a souligné son potentiel transformateur pour optimiser les opérations mondiales et les soins aux patients.

- En septembre 2024, Kuehne+Nagel, prestataire logistique de premier plan, a inauguré un nouveau centre de traitement des commandes à température contrôlée pour Medtronic à Milton, en Ontario, à seulement 50 km de Toronto. D'une superficie de 25 000 m², ce centre distribuera des dispositifs médicaux aux hôpitaux et abritera les centres d'entretien, de réparation et de maintenance préventive de Medtronic pour ses équipements.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.