Asia Pacific Medical Device Testing Market

Taille du marché en milliards USD

TCAC :

%

USD

527.22 Million

USD

1,237.03 Million

2021

2029

USD

527.22 Million

USD

1,237.03 Million

2021

2029

| 2022 –2029 | |

| USD 527.22 Million | |

| USD 1,237.03 Million | |

|

|

|

Marché des tests de dispositifs médicaux en Asie-Pacifique , par type de service (services de test, services d'inspection et services de certification), type de test (tests physiques, tests chimiques/biologiques, tests de cybersécurité, tests de microbiologie et de stérilité et autres), phase (préclinique et clinique), type d'approvisionnement (interne et externalisé), classe de dispositif (classe I, classe II et classe III), produit ( dispositif médical implantable actif , dispositif médical actif, dispositif médical non actif, dispositif médical de diagnostic in vitro, dispositif médical ophtalmique, dispositif médical orthopédique et dentaire, dispositif médical vasculaire et autres) Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et perspectives du marché des tests de dispositifs médicaux en Asie-Pacifique

Les tests des dispositifs médicaux sont le processus qui permet de démontrer que le dispositif est utilisé de manière fiable et sûre. Lors du développement de nouveaux produits, des tests de validation de conception approfondis sont appliqués. Cela comprend des tests de performance, de toxicité, d'analyse chimique et parfois des tests cliniques ou des tests sur les facteurs humains. Les tests d'assurance qualité continus sont généralement plus limités. Cela comprend généralement des contrôles dimensionnels, certains tests fonctionnels et la vérification de l'emballage. Différents types de services de tests médicaux sont disponibles sur le marché, tels que des services d'inspection, des services de certification et autres.

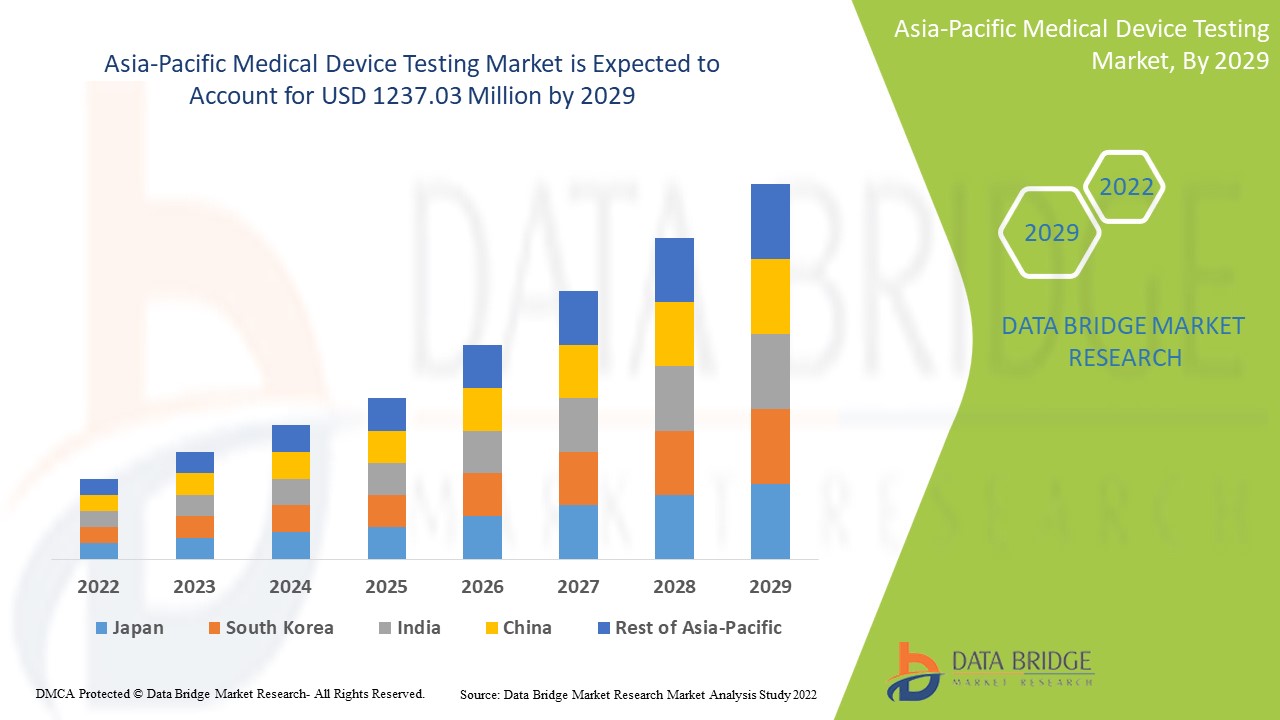

Le marché des tests de dispositifs médicaux en Asie-Pacifique devrait croître au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 11,7 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 1 237,03 millions USD d'ici 2029 contre 527,22 millions USD en 2021.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type de service (services de test, service d'inspection et services de certification), type de test (tests physiques, tests chimiques/biologiques, tests de cybersécurité, tests de microbiologie et de stérilité et autres), phase (préclinique et clinique), type d'approvisionnement (interne et externalisé), classe de dispositif (classe I, classe II et classe III), produit (dispositif médical implantable actif, dispositif médical actif, dispositif médical non actif, dispositif médical de diagnostic in vitro, dispositif médical ophtalmique, dispositif médical orthopédique et dentaire, dispositif médical vasculaire et autres) |

|

Pays couverts |

Chine, Japon, Inde, Corée du Sud, Australie, Singapour, Thaïlande, Malaisie, Indonésie, Philippines, Reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Intertek Group plc, SGS SA, Bureau Veritas, TUV SUD, TUV Rheinland, Biomedical Device Labs, UL LLC, North American Science Associates, LLC, WuXi AppTec, NSF, Eurofins Scientific, Nelson Laboratories, LLC- Une société de Sotera Health, Element Materials Technology, Medical Engineering Technologies Ltd., Bioneeds, Cigniti, Arbro Pharmaceuticals Private Limited et Auriga Research Private Limited, IMR Test Labs et entre autres |

Définition du marché

Les tests des dispositifs médicaux sont le processus qui permet de démontrer que le dispositif fonctionne de manière fiable et sûre. Lors du développement de nouveaux produits, des tests de validation de conception approfondis sont appliqués. Cela comprend des tests de performance, des analyses de toxicité et chimiques, et parfois des tests sur les facteurs humains ou même des tests cliniques. Les tests d'assurance qualité continus sont généralement plus limités. Ils comprennent généralement des contrôles dimensionnels, certains tests fonctionnels et la vérification de l'emballage. Différents types de services de tests médicaux sont disponibles sur le marché, tels que des services d'inspection, des services de certification, etc.

Dynamique du marché des tests de dispositifs médicaux

Conducteurs

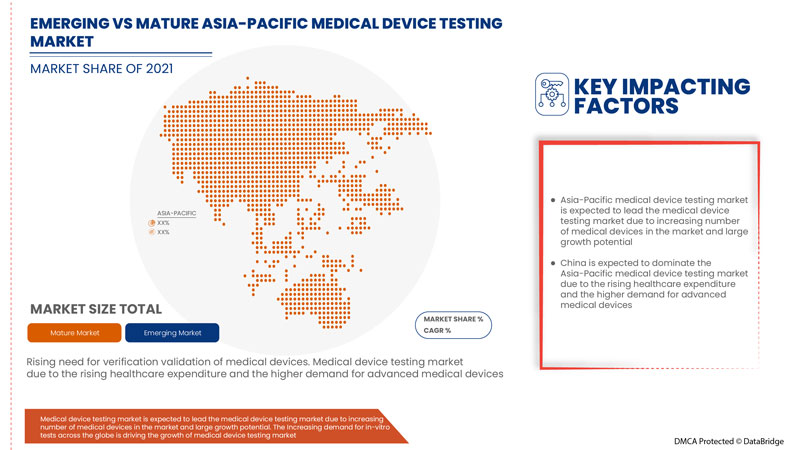

- Augmentation du besoin de vérification et de validation des dispositifs médicaux

Les méthodes de vérification et de validation sont largement utilisées dans le secteur de la santé. En général, la vérification est la phase de développement d'un produit pour savoir s'il est conforme aux exigences spécifiées, tandis que la validation vérifie si l'utilisation prévue a été respectée et, par conséquent, si les spécifications d'utilisabilité sont respectées. Les types de vérification et de validation les plus courants pour les dispositifs médicaux sont la vérification et la validation de la conception, des processus et des logiciels. Les dispositifs médicaux deviennent également plus petits et plus complexes dans leur conception, utilisant parfois des plastiques techniques avancés. Cela rend la validation et la vérification (V&V) d'autant plus importantes. Le résultat est une meilleure répétabilité, moins d'erreurs, moins de retouches et de reconceptions, des délais de commercialisation plus rapides, une compétitivité améliorée et des coûts de production réduits.

- Augmentation de la demande de tests in vitro

Les diagnostics in vitro (DIV) sont des tests effectués sur des échantillons tels que du sang ou des tissus prélevés sur le corps humain. Les diagnostics in vitro peuvent détecter des maladies ou d'autres affections et peuvent être utilisés pour surveiller l'état de santé général d'une personne afin de contribuer à guérir, traiter ou prévenir des maladies. Les tests in vitro sont utilisés dans la détection de diverses maladies telles que les infections par le VIH, le paludisme, l'hépatite, entre autres. La prévalence de ces maladies augmente rapidement à l'échelle mondiale, ce qui entraîne une demande croissante de tests in vitro et de divers dispositifs médicaux.

Opportunité

-

Augmentation des dépenses de santé

Les dépenses de santé ont augmenté dans le monde entier, en raison de l'augmentation du revenu disponible des citoyens dans divers pays. De plus, pour répondre aux besoins de la population, les organismes gouvernementaux et les organisations de santé prennent des initiatives en accélérant les dépenses de santé. L'augmentation des dépenses de santé aide simultanément les établissements de santé à améliorer leurs services de test des dispositifs médicaux au cours des dernières années.

En outre, les initiatives stratégiques prises par les principaux acteurs du marché assureront l’intégrité structurelle et les opportunités futures du marché des tests de dispositifs médicaux au cours de la période de prévision 2022-2029.

Retenue/Défi

- Obstacles au développement local des dispositifs médicaux

Cependant, les obstacles au développement local des dispositifs médicaux et le coût élevé des dispositifs médicaux dans certaines régions peuvent entraver la production de dispositifs médicaux, ce qui freine la croissance du marché. En outre, la forte concurrence dans les industries de technologie médicale et les longs délais d'obtention de la qualification à l'étranger peuvent constituer des facteurs difficiles pour le développement du marché.

Ce rapport sur le marché des tests de dispositifs médicaux fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché de l'ataxie, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact post-COVID-19 sur le marché des tests de dispositifs médicaux

La COVID-19 a eu un impact positif sur le marché. L'utilisation d'appareils médicaux a augmenté au cours de ces années, tels que les scanners IRM, les ventilateurs et autres. Par conséquent, l'utilisation de divers appareils a augmenté considérablement dans le monde entier. Par conséquent, la pandémie a eu un effet positif sur ce marché des tests

Développement récent

- En avril 2021, TÜV SÜD a annoncé sa présence au Medtec LIVE pour démontrer sa capacité à être un guichet unique pour les tests de dispositifs médicaux. Les services proposés couvraient les tests de sécurité électrique et fonctionnelle, de cybersécurité et de logiciels, de CEM et de biocompatibilité. Les experts de TÜV SÜD ont participé au programme du salon et du congrès en ligne avec diverses conférences, un live hack et un pitch éclair.

Portée du marché des tests de dispositifs médicaux en Asie-Pacifique

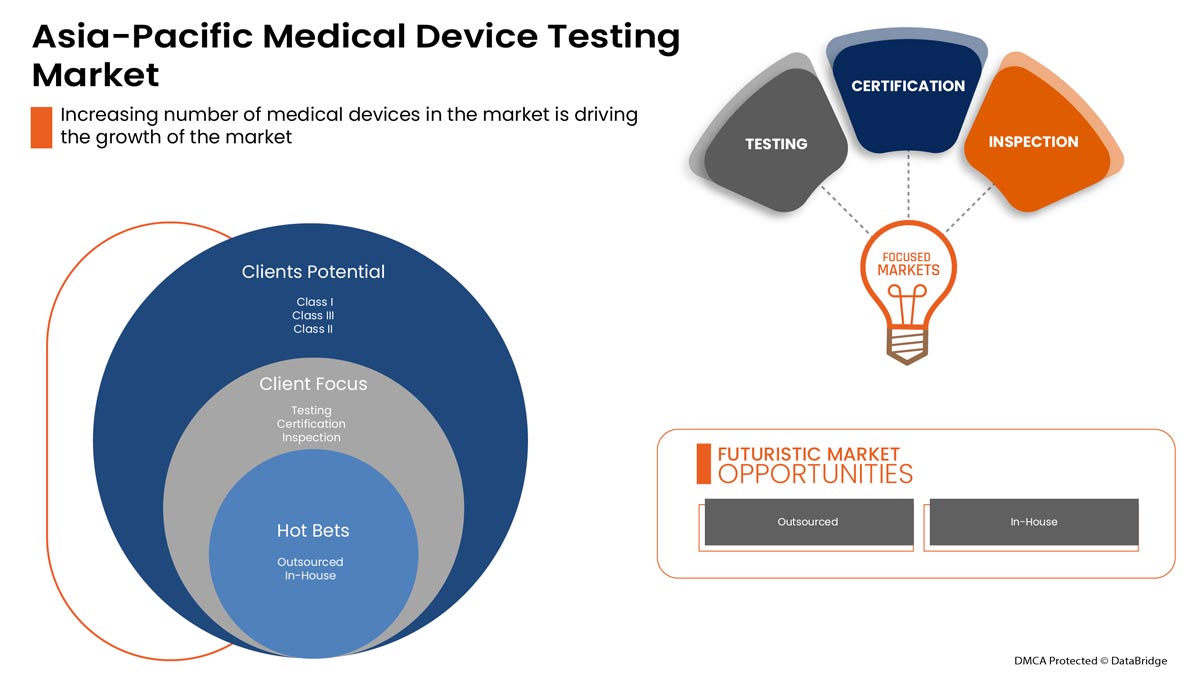

Le marché des tests de dispositifs médicaux en Asie-Pacifique est segmenté en type de service, type de test, phase, type d'approvisionnement, classe d'appareil et produit. La croissance parmi ces segments vous aidera à analyser les segments de faible croissance dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de service

- Services de test

- Services d'inspection

- Services de certification

Sur la base du type de service, le marché des tests de dispositifs médicaux en Asie-Pacifique est segmenté en services de test, services d'inspection et services de certification.

Type de test

- Tests physiques

- Tests chimiques/biologiques

- Tests de cybersécurité

- Microbiologie et tests de stérilité

- Autres

Sur la base du type de test, le marché des tests de dispositifs médicaux en Asie-Pacifique est segmenté en tests physiques, tests chimiques/biologiques, tests de cybersécurité, tests de microbiologie et de stérilité et autres.

Phase

- Préclinique

- Clinique

Sur la base de la phase, le marché des tests de dispositifs médicaux de la région Asie-Pacifique est segmenté en préclinique et clinique.

Type d'approvisionnement

- Externalisé

- En interne

Sur la base du type d'approvisionnement, le marché des tests de dispositifs médicaux en Asie-Pacifique est segmenté en interne et en externalisé.

Classe d'appareil

- Classe I

- Classe II

- Classe III

Sur la base de la classe d'appareils, le marché des tests d'appareils médicaux de la région Asie-Pacifique est segmenté en classe I, classe II et classe III.

Produit

- Dispositif médical implantable actif

- Dispositif médical actif

- Dispositif médical non actif

- Dispositif médical de diagnostic in vitro

- Dispositif médical ophtalmique

- Dispositif médical orthopédique et dentaire

- Dispositif médical vasculaire

- Autres

Sur la base du produit, le marché des tests de dispositifs médicaux de la région Asie-Pacifique est segmenté en dispositif médical implantable actif, dispositif médical actif, dispositif médical non actif, dispositif médical de diagnostic in vitro, dispositif médical ophtalmique, dispositif médical orthopédique et dentaire, dispositif médical vasculaire et autres.

Analyse/perspectives régionales du marché des tests de dispositifs médicaux

Le marché des tests de dispositifs médicaux est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de service, type de test, phase, type d'approvisionnement, classe d'appareil et produit comme référencé ci-dessus.

Les pays couverts dans cette région sont la Chine, l’Inde, le Japon, l’Australie, la Corée du Sud, Singapour, l’Indonésie, la Thaïlande, la Malaisie, les Philippines et le reste de l’Asie-Pacifique.

La Chine domine le marché des tests de dispositifs médicaux en termes de part de marché et de chiffre d'affaires et continuera à accroître sa domination au cours de la période de prévision. Cela est dû à l'escalade de l'innovation et des technologies dans le pays pour les dispositifs médicaux.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des tests de dispositifs médicaux

Le paysage concurrentiel du marché des tests de dispositifs médicaux fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'accent mis par les entreprises sur les tests de dispositifs médicaux.

Certains des principaux acteurs opérant sur le marché des tests de dispositifs médicaux sont Intertek Group plc, SGS SA, Bureau Veritas, TUV SUD, TUV Rheinland, Biomedical Device Labs, UL LLC, North American Science Associates, LLC, WuXi AppTec, NSF, Eurofins Scientific, Nelson Laboratories, LLC- A Sotera Health company, Element Materials Technology, Medical Engineering Technologies Ltd., Bioneeds, Cigniti, Arbro Pharmaceuticals Private Limited & Auriga Research Private Limited, IMR Test Labs et entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse de la part de marché Asie-Pacifique par rapport à la région et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC MEDICAL DEVICE TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SERVICE TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET TESTING TYPE COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

5 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING NEED FOR VERIFICATION VALIDATION OF MEDICAL DEVICES

6.1.2 INCREASING DEMAND FOR IN-VITRO TESTS

6.1.3 ESCALATION IN INNOVATION AND TECHNOLOGIES

6.2 RESTRAINTS

6.2.1 BARRIERS TO THE LOCAL DEVELOPMENT OF MEDICAL DEVICES

6.2.2 HIGH COST OF MEDICAL DEVICES

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 DEVELOPMENT IN AI AND IOT IN VARIOUS MEDICAL DEVICES

6.3.3 STRATEGIC INITIATIVES OF KEY PLAYERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION IN MEDICAL TECHNOLOGY INDUSTRY

6.4.2 LONG LEAD TIME FOR OVERSEAS QUALIFICATION

7 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE

7.1 OVERVIEW

7.2 TESTING SERVICES

7.3 INSPECTION SERVICES

7.4 CERTIFICATION SERVICES

8 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 CHEMICAL/BIOLOGICAL TESTING

8.3 MICROBIOLOGY AND STERILITY TESTING

8.3.1 STERILITY TEST & VALIDATION

8.3.2 BIO BURDEN DETERMINATION

8.3.3 ANTIMICROBIAL ACTIVITY TESTING

8.3.4 PYROGEN & ENDOTOXIN TESTING

8.3.5 OTHERS

8.4 PHYSICAL TESTING

8.4.1 ELECTRICAL SAFETY TESTING

8.4.2 FUNCTIONAL SAFETY TESTING

8.4.3 EMC TESTING

8.4.4 ENVIRONMENTAL TESTING

8.4.5 OTHERS

8.5 CYBERSECURITY TESTING

8.6 OTHERS

9 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY PHASE

9.1 OVERVIEW

9.2 PRECLINICAL

9.3 CLINICAL

10 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE

10.1 OVERVIEW

10.2 OUTSOURCED

10.3 IN-HOUSE

11 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS

11.1 OVERVIEW

11.2 CLASS I

11.3 CLASS III

11.4 CLASS II

12 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY PRODUCT

12.1 OVERVIEW

12.2 NON-ACTIVE MEDICAL DEVICE

12.3 ORTHOPEDIC AND DENTAL MEDICAL DEVICE

12.4 ACTIVE IMPLANT MEDICAL DEVICE

12.5 VASCULAR MEDICAL DEVICE

12.6 ACTIVE MEDICAL DEVICE

12.7 IN-VITRO DIAGNOSTICS MEDICAL DEVICE

12.8 OPTHALMIC MEDICAL DEVICE

12.9 OTHERS

13 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY GEOGRAPHY

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 INDIA

13.1.4 SOUTH KOREA

13.1.5 AUSTRALIA

13.1.6 INDONESIA

13.1.7 THAILAND

13.1.8 PHILIPPINES

13.1.9 MALAYSIA

13.1.10 SINGAPORE

13.1.11 REST OF ASIA-PACIFIC

14 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 LABCORP

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 CHARLES RIVER LABORATORIES.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 TUV SUD

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 WUXI APPTEC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 SGS SA

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 NORTH AMERICAN SCIENCE ASSOCIATES, LLC

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 HOHENSTEIN

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ARBRO PHARMACEUTICALS PRIVATE LIMITED & AURIGA RESEARCH PRIVATE LIMITED

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BIOMEDICAL DEVICE LABS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 BIONEEDS

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 BUREAU VERITAS

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 CIGNITI

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 ELEMENT MATERIALS TECHNOLOGY

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 ENDOLAB MECHANICAL ENGINEERING GMBH

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 EUROFINS SCIENTIFIC

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 GATEWAY ANALYTICAL.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 IMR TEST LABS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 INTERTEK GROUP PLC

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 ITC ZLIN

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 MEDICAL ENGINEERING TECHNOLOGIES LTD.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 MEDISTRI SA

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 NELSON LABORATORIES, LLC- A SOTERA HEALTH COMPANY

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 NSF.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 PACE

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 Q LABORATORIES

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 TUV RHEINLAND

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENTS

16.27 UL LLC

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 FDA REGULATIONS BASED ON DEVICES TYPE

TABLE 2 PRICES OF ESSENTIAL MEDICAL DEVICES

TABLE 3 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC TESTING SERVICES IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC INSPECTION SERVICES IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC CERTIFICATION SERVICES IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC CHEMICAL/BIOLOGICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC CYBERSECURITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC OTHERS IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC PRECLINICAL IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC CLINICAL IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC OUTSOURCED IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC IN-HOUSE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC CLASS I IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC CLASS III IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC CLASS II IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC NON-ACTIVE MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC ORTHOPEDIC AND DENTAL MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC ACTIVE IMPLANT MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC VASCULAR MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC ACTIVE MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC IN-VITRO MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC OPTHALMIC MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC OTHERS IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 CHINA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 44 CHINA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 45 CHINA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 46 CHINA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 47 CHINA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 48 CHINA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 49 CHINA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 50 CHINA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 JAPAN MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 52 JAPAN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 55 JAPAN MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 56 JAPAN MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 57 JAPAN MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 58 JAPAN MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 59 INDIA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 60 INDIA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 61 INDIA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 62 INDIA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 63 INDIA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 64 INDIA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 65 INDIA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 66 INDIA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 SOUTH KOREA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 68 SOUTH KOREA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH KOREA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 70 SOUTH KOREA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH KOREA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH KOREA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH KOREA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 AUSTRALIA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 76 AUSTRALIA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 77 AUSTRALIA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 78 AUSTRALIA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 79 AUSTRALIA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 80 AUSTRALIA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 81 AUSTRALIA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 82 AUSTRALIA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 INDONESIA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 84 INDONESIA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 85 INDONESIA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 86 INDONESIA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 87 INDONESIA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 88 INDONESIA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 89 INDONESIA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 90 INDONESIA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 91 THAILAND MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 92 THAILAND MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 93 THAILAND MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 94 THAILAND PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 95 THAILAND MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 96 THAILAND MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 97 THAILAND MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 98 THAILAND MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 99 PHILIPPINES MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 100 PHILIPPINES MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 101 PHILIPPINES MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 102 PHILIPPINES PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 103 PHILIPPINES MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 104 PHILIPPINES MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 105 PHILIPPINES MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 106 PHILIPPINES MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 107 MALAYSIA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 108 MALAYSIA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 109 MALAYSIA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 110 MALAYSIA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 111 MALAYSIA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 112 MALAYSIA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 113 MALAYSIA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 114 MALAYSIA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 SINGAPORE MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 116 SINGAPORE MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 117 SINGAPORE MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 118 SINGAPORE PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 119 SINGAPORE MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 120 SINGAPORE MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 121 SINGAPORE MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 122 SINGAPORE MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 123 REST OF ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: MARKET TESTING TYPE COVERAGE GRID

FIGURE 9 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND FOR IN-VITRO TESTS AND DEVELOPMENT IN AI AND IOT IN VARIOUS MEDICAL DEVICES ARE EXPECTED TO DRIVE THE ASIA PACIFIC MEDICAL DEVICE TESTING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TESTING SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC MEDICAL DEVICE TESTING MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC MEDICAL DEVICE TESTINGMARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC MEDICAL DEVICE TESTING MARKET

FIGURE 15 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, 2021

FIGURE 16 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, 2022-2029 (USD MILLION)

FIGURE 17 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, CAGR (2022-2029)

FIGURE 18 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, LIFELINE CURVE

FIGURE 19 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, 2021

FIGURE 20 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, 2022-2029 (USD MILLION)

FIGURE 21 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, CAGR (2022-2029)

FIGURE 22 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, LIFELINE CURVE

FIGURE 23 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY PHASE, 2021

FIGURE 24 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY PHASE, 2022-2029 (USD MILLION)

FIGURE 25 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY PHASE, CAGR (2022-2029)

FIGURE 26 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY PHASE, LIFELINE CURVE

FIGURE 27 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, 2021

FIGURE 28 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, 2022-2029 (USD MILLION)

FIGURE 29 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, CAGR (2022-2029)

FIGURE 30 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, LIFELINE CURVE

FIGURE 31 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, 2021

FIGURE 32 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, 2022-2029 (USD MILLION)

FIGURE 33 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, CAGR (2022-2029)

FIGURE 34 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, LIFELINE CURVE

FIGURE 35 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY PRODUCT, 2021

FIGURE 36 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 37 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 38 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 39 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET: SNAPSHOT (2021)

FIGURE 40 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET: BY COUNTRY (2021)

FIGURE 41 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 ASIA-PACIFIC MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE (2022-2029)

FIGURE 44 ASIA PACIFIC MEDICAL DEVICE TESTING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.