Asia-Pacific Machine Control System Market, By Technology (Global Navigation Satellite System (GNSS), Laser Scanners, GIS Collectors, Total Stations, Airborne Systems, and Others), Vehicle Equipment (Excavators, Loaders, Dozers, Scrapers, Graders, Rollers, Drillers and Pillars, Pavers and Cold Planers, and Others), Controller Type (Computer Numerical Control (CNC), Programmable Logic Controller (PLC), Programmable Automation Controller (PAC), Personal Computer (PC), Motion Controllers, and Others), Application (Motion and Control, Guidance and Automation, Mass Excavation, Spot-Bulldozing, and Others), Industry (Building and Construction, Agriculture, Mining, Transportation, Aerospace and Defense, Automotive, Marine, Waste Management, Utilities, and Others) Industry Trends and Forecast to 2029.

Asia-Pacific Machine Control System Market Analysis and Size

Manufacturers were continuously trying to increase the precision of work, enhance services, safety, and work with growing technology. The requirement for these reasons is being fulfilled by implementing the machine control system as they are used to provide enhanced, uninterrupted, free, and timely services at the industrial operations. The machine control system in various industries is being used widely due to the rising adoption of digital technologies in the industrial sector. It enables industries to enhance their operations and productivity. Machine control systems help end-users make better decisions around supply chain, machinery, assets performance, drilling, and others. The Asia-Pacific machine control system market is growing rapidly due to increasing digitization in various industries, which drives the demand for the machine control system. The companies are even launching new products to gain a larger market share.

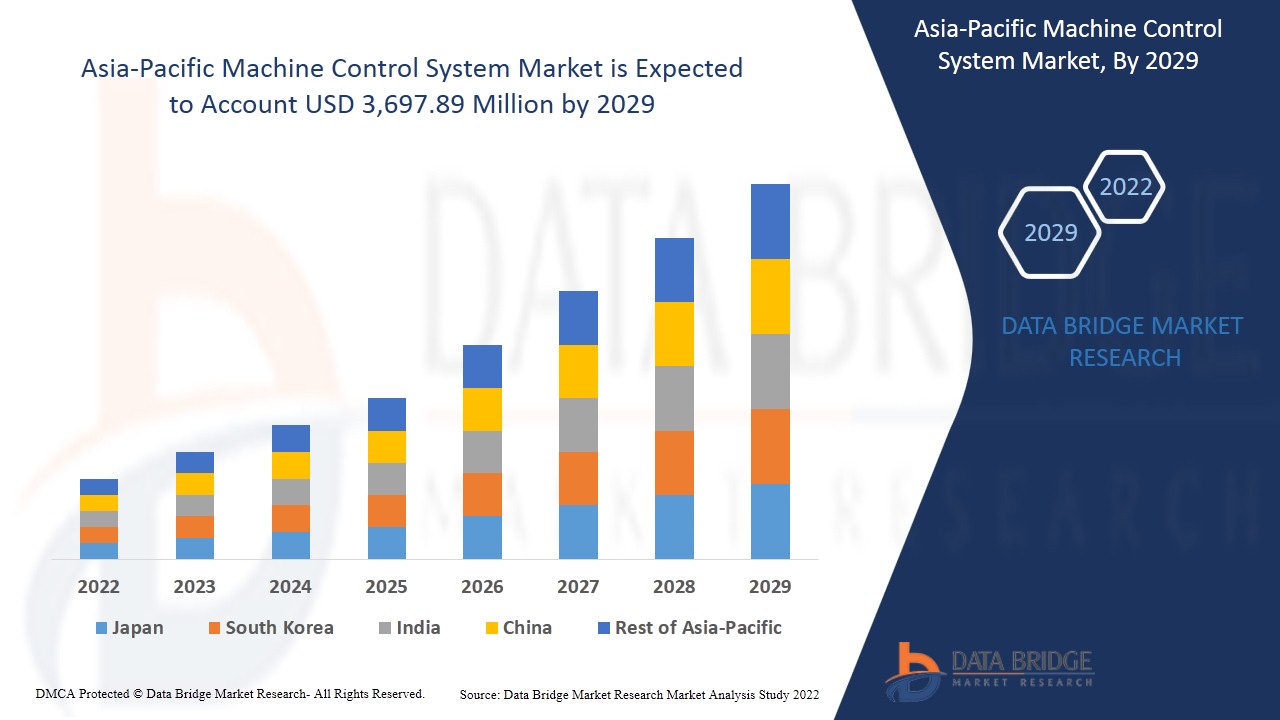

Data Bridge Market Research analyses that the Asia-Pacific machine control system market is expected to reach the value of USD 3,697.89 million by 2029, at a CAGR of 7.9% during the forecast period. "Global Navigation Satellite System (GNSS)" accounts for the largest technology segment in the machine control system market. The global navigation satellite system (GNSS) provides accurate timing information, which is utilized to develop a high-precision IoT network. The Asia-Pacific machine control system market report also covers pricing analysis, patent analysis, and technological advancements in depth.

Asia-Pacific Machine Control System Market Definition

Le système de contrôle des machines fait référence à la réalisation d'activités industrielles et commerciales avec une touche numérique. Il comprend diverses solutions et services développés pour optimiser et gérer les opérations industrielles, d'infrastructure et les activités de production. Il permet d'automatiser diverses activités basées sur des applications telles que la gestion des enregistrements, le stockage des données, la surveillance, la rationalisation des activités de production, la gestion de la chaîne d'approvisionnement, la gestion des actifs, la gestion des risques, etc. Il comprend également des technologies telles que les systèmes de contrôle des usines, les technologies GPS, le haut débit mobile, le transport automatisé, l'IA, la blockchain, le jumeau numérique, etc.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par technologie (système mondial de navigation par satellite (GNSS), scanners laser, collecteurs SIG, stations totales, systèmes aéroportés et autres), équipement de véhicule (excavatrices, chargeuses, bulldozers, grattoirs, niveleuses, rouleaux compresseurs, foreuses et piliers, finisseurs et raboteuses à froid et autres), type de contrôleur (commande numérique par ordinateur (CNC), contrôleur logique programmable (PLC), contrôleur d'automatisation programmable (PAC), ordinateur personnel (PC), contrôleurs de mouvement et autres), application (mouvement et contrôle, guidage et automatisation, excavation de masse, bulldozer par points et autres), industrie (bâtiment et construction, agriculture, exploitation minière, transport, aérospatiale et défense, automobile, marine, gestion des déchets, services publics et autres) |

|

Pays couverts |

Chine, Japon, Corée du Sud, Australie et Nouvelle-Zélande, Malaisie, Singapour, Inde, Thaïlande, Indonésie, Philippines et reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Parmi les autres sociétés figurent ABB, Topcon, Kobelco Construction Machinery Co. Ltd., SATEL, Trimble Inc., Hemisphere GNSS, Inc., MOBA MOBILE AUTOMATION AG, Belden Inc., RaptorTech.com, Hexagon, RIB Group, James Fisher and Sons plc, Carlson Software, LIEBHERR, Schneider Electric, MITSUI & CO., LTD., Rockwell Automation, Inc., Komatsu Ltd., Microverse Automation Pvt. Ltd., Coperion GmbH, Otto Bihler Maschinenfabrik GmbH & Co. KG, OMRON Corporation, ANDRITZ, Siemens, Honeywell International Inc. |

Dynamique du marché des systèmes de contrôle des machines en Asie-Pacifique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

- Besoin croissant d'exactitude et de précision dans les systèmes de contrôle

Les solutions de contrôle des machines augmentent la qualité du chantier en simplifiant, en automatisant et en intégrant des solutions, ce qui se traduit par moins d'erreurs et plus de temps de travail. Les solutions de contrôle des machines permettent aux opérateurs d'acquérir des connaissances numériques tout en réduisant le risque d'erreurs. Les interfaces graphiques 3D intuitives avec une conception centrée sur le client aident les opérateurs à se sentir plus sûrs de leur capacité à effectuer leur travail, ce qui améliore les performances.

- Augmentation de la croissance des systèmes de contrôle de machines sans fil

Il est bien connu que la population de la région Asie-Pacifique augmente à un rythme sans précédent. Les entreprises investissent massivement dans la technologie sans fil pour proposer des solutions optimales aux utilisateurs finaux et aux professionnels. À mesure que l'industrie évolue, l'accent sera mis davantage sur les équipements sans fil pour de meilleures performances et une meilleure flexibilité de travail. Le développement de ces batteries sans fil équipées de systèmes de contrôle de machines devrait stimuler le marché des systèmes de contrôle de machines en Asie-Pacifique.

- Demande croissante de technologies guidées par machine dans les pays émergents

L'automatisation et l'intelligence artificielle (IA) transforment les industries et stimuleront la productivité, ce qui entraînera un développement économique accru. Partout dans le monde, la numérisation contribue à améliorer la sécurité, la productivité, l'accessibilité et la durabilité des systèmes énergétiques. Le secteur du bâtiment est essentiel au développement économique des pays émergents. En conséquence, plusieurs agences spécialisées ont été créées dans de nombreux pays pour surveiller les activités de construction et professionnaliser le fonctionnement des chantiers de construction, tels que le Construction Industry Development Board (Malaisie), l'Institute of Construction Training and Development (Sri Lanka), le National Construction Council (Tanzanie) et la Building and Construction Authority (Singapour). Dans le secteur du bâtiment, des approches rentables et efficaces en termes de temps doivent être utilisées pour fournir un environnement de construction sûr, de haute qualité, durable et convivial. Par conséquent, les systèmes de contrôle des machines jouent un rôle essentiel pour garantir la sécurité et la qualité sur les chantiers de construction des pays en développement.

Les technologies guidées par machine se concentrent généralement sur l'exploitation et la maintenance d'une machine ou d'une partie d'une machine. De nos jours, les activités d'exploitation et de maintenance effectuées sur une machine sont entièrement surveillées à l'aide de diverses technologies telles que l'intelligence artificielle (IA), l'apprentissage automatique (ML), etc. L'adoption de ces technologies a réduit l'intervention humaine et augmenté le besoin de technologies guidées par machine sur le marché, constituant ainsi une opportunité pour le marché des systèmes de contrôle des machines de la région Asie-Pacifique.

- Exigence d'investissement initial élevé

Le système de contrôle des machines offre aux industries des mesures de sécurité et diverses méthodes telles que le GNSS, le SIG, le balayage laser et les robots, entre autres. Les entreprises qui opèrent avec des industries ont besoin de systèmes de contrôle des machines pour transférer les matières premières d'un endroit à un autre. La mise en œuvre efficace des équipements des systèmes de contrôle nécessite des coûts élevés, ce qui augmente finalement le coût total de l'installation, car cela est nécessaire pour garantir une usine sûre. Ces instruments impliquent la gestion de risques plus élevés et d'environnements opérationnels critiques. Cependant, le coût initial du système est considérablement élevé, tout comme les coûts indirects tels que les licences, la certification, l'installation, les coûts énergétiques de maintenance et les coûts liés à la main-d'œuvre technique.

- Conception de systèmes de contrôle de machines ergonomiques et légers

Les systèmes de commande des machines doivent être compacts et légers pour être facilement transportés et utilisés efficacement. La taille compacte permet aux travailleurs une grande liberté de mouvement et la précision des systèmes de commande des machines augmente. L'outil léger facilite le transport sur le chantier. Le défi de base est que les systèmes de commande des machines sont robustes ; même les outils électriques sans fil ont des emplacements pour batterie, ce qui les rend encombrants et difficiles à transporter.

Les systèmes de contrôle des machines peuvent entraîner divers problèmes de santé pour l'utilisateur. Les systèmes de contrôle de démolition provoquent de fortes vibrations pendant le fonctionnement, et un léger mouvement erroné de l'utilisateur peut briser la colonne vertébrale de l'utilisateur et provoquer de graves dommages. Les ponceuses et les fraises peuvent produire de la poussière et de petits morceaux qui pourraient blesser l'utilisateur. L'ergonomie des systèmes de contrôle des machines doit être particulièrement importante pour protéger l'utilisateur contre tout accident de ce type.

Les systèmes de contrôle des machines peuvent être à l'origine de graves accidents et de problèmes de santé, et le poids important des systèmes de contrôle des machines rend difficile leur fonctionnement avec une efficacité optimale. Ces facteurs peuvent constituer un défi majeur pour le marché des systèmes de contrôle des machines en Asie-Pacifique.

Impact de la pandémie de COVID-19 sur le marché des systèmes de contrôle des machines en Asie-Pacifique

La COVID-19 a eu un impact majeur sur le marché des systèmes de contrôle des machines en Asie-Pacifique, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent des biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises en activité dans cette situation de pandémie sont les services essentiels qui sont autorisés à ouvrir et à exécuter les processus.

La croissance du marché des systèmes de contrôle des machines en Asie-Pacifique est attribuée à l'augmentation des projets de construction et d'infrastructures commerciales et résidentielles, à l'adoption d'outils électriques dans les ménages à des fins résidentielles/de bricolage, à la croissance des installations de fabrication et à l'augmentation des opérations de réparation et de maintenance dans le monde entier. Cependant, des facteurs tels qu'une augmentation des risques de sécurité et des préoccupations liées à une mauvaise utilisation des systèmes de contrôle des machines freinent la croissance du marché. La fermeture des installations de production pendant la situation de pandémie a eu un impact significatif sur le marché.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de recherche et développement pour améliorer la technologie impliquée dans le système de contrôle des machines. Grâce à cela, les entreprises mettront sur le marché des contrôleurs avancés et précis. En outre, l'utilisation de systèmes de contrôle des machines par les autorités gouvernementales dans la gestion de l'eau, l'agriculture, l'océanographie, l'hydrologie, la défense et la sécurité a conduit à la croissance du marché

Développements récents

- En novembre 2021, Rockwell Automation a lancé une nouvelle solution d'accès à distance. Cette nouvelle solution conçue pour les OEM n'est que la dernière offre d'accès à distance de Rockwell Automation qui propose une large gamme de services d'accès à distance pour les fabricants, notamment une surveillance et une assistance à distance des applications 24h/24 et 7j/7 pour aider les clients à résoudre de manière proactive les problèmes de maintenance. Grâce à ce lancement, l'entreprise a amélioré ses produits et services sur le marché

- En décembre 2021, Honeywell International Inc. prévoyait d'acquérir US Digital Designs, Inc., élargissant ainsi ses capacités de communication en matière de sécurité publique. Cette acquisition a permis à l'entreprise d'élargir sa gamme de solutions. Cette acquisition a aidé l'entreprise à étendre son portefeuille de produits et à accroître ses revenus.

Portée du marché des systèmes de contrôle des machines en Asie-Pacifique

Le marché des systèmes de contrôle des machines en Asie-Pacifique est segmenté en fonction de la technologie, de l'équipement du véhicule, du type de contrôleur , de l'application et de l'industrie. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Technologie

- Système mondial de navigation par satellite (GNSS)

- Scanners laser

- Collecteurs SIG

- Stations totales

- Systèmes aéroportés

- Autres

Sur la base de la technologie, le marché des systèmes de contrôle des machines de la région Asie-Pacifique est segmenté en système mondial de navigation par satellite (GNSS), scanners laser, collecteurs SIG, stations totales, systèmes aéroportés et autres.

Équipement du véhicule

- Excavateurs

- Chargeurs

- Bulldozers

- Grattoirs

- Niveleuses

- Rouleaux

- Foreurs et piliers

- Pavés et fraiseuses à froid

- Autres

Sur la base de l'équipement des véhicules, le marché des systèmes de contrôle des machines de la région Asie-Pacifique a été segmenté en excavatrices, chargeuses, bulldozers, grattoirs, niveleuses, rouleaux, foreuses et piliers, finisseurs et fraiseuses à froid, et autres.

Type de contrôleur

- Commande numérique par ordinateur (CNC)

- Automate programmable industriel (API)

- Contrôleur d'automatisation programmable (PAC)

- Ordinateur personnel (PC)

- Contrôleurs de mouvement

- Autres

Sur la base du type de contrôleur, le marché des systèmes de contrôle des machines Asie-Pacifique a été segmenté en commande numérique par ordinateur (CNC), contrôleur logique programmable (PLC), contrôleur d'automatisation programmable (PAC), ordinateur personnel (PC), contrôleurs de mouvement et autres.

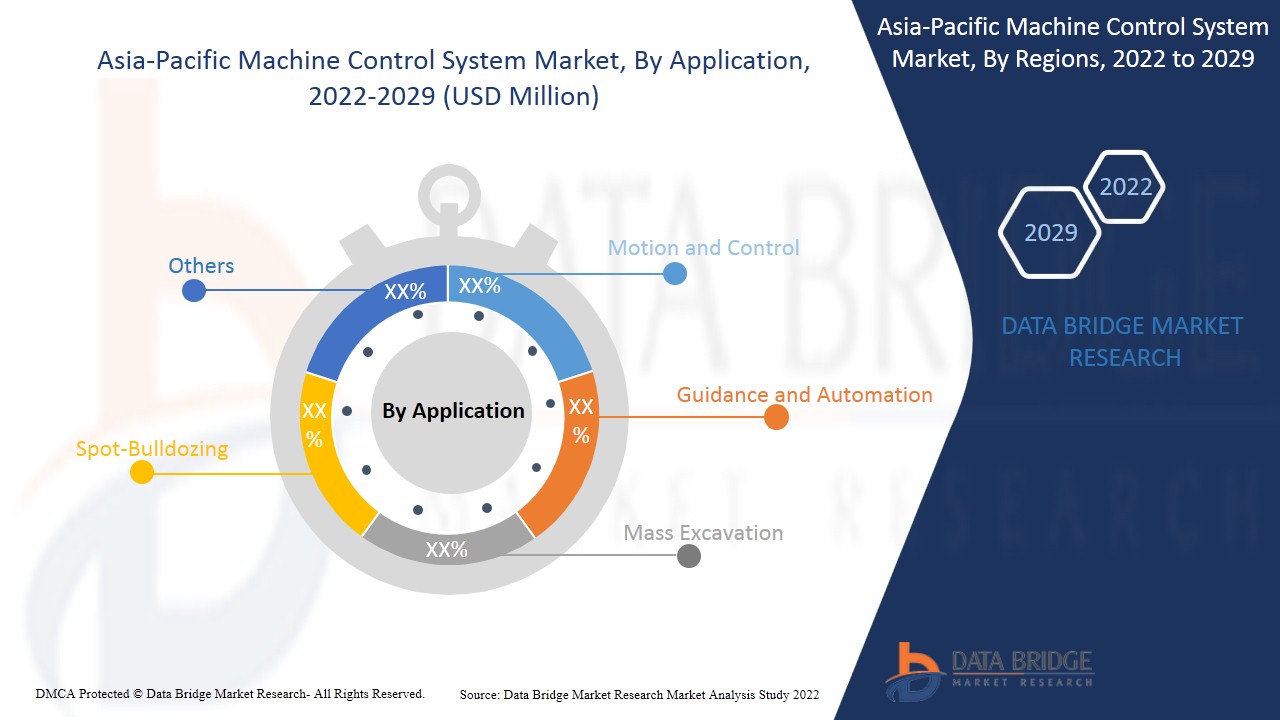

Application

- Mouvement et contrôle

- Guidage et automatisation

- Fouilles massives

- Bulldozer localisé

- Autres

Sur la base des applications, le marché des systèmes de contrôle des machines en Asie-Pacifique a été segmenté en mouvement et contrôle, guidage et automatisation, excavation de masse, bulldozer ponctuel et autres.

Industrie

- Bâtiment et construction

- Agriculture

- Exploitation minière

- Transport

- Aérospatiale et Défense

- Automobile

- Marin

- Gestion des déchets

- Utilitaires

- Autres

Sur la base de l'industrie, le marché des systèmes de contrôle des machines de la région Asie-Pacifique a été segmenté en bâtiment et construction, agriculture, exploitation minière, transport, aérospatiale et défense, automobile, marine, gestion des déchets, services publics et autres.

Analyse/perspectives régionales du marché des systèmes de contrôle des machines en Asie-Pacifique

Le marché des systèmes de contrôle des machines en Asie-Pacifique est analysé et des informations et tendances sur la taille du marché sont fournies par pays, technologie, équipement du véhicule, type de contrôleur, application et industrie, comme référencé ci-dessus.

Certains des pays couverts dans le rapport sur le marché des systèmes de contrôle des machines en Asie-Pacifique sont la Chine, le Japon, la Corée du Sud, l’Australie et la Nouvelle-Zélande, la Malaisie, Singapour, l’Inde, la Thaïlande, l’Indonésie, les Philippines et le reste de l’Asie-Pacifique.

La Chine domine le marché des systèmes de contrôle des machines en Asie-Pacifique. La Chine est susceptible d'être le marché des systèmes de contrôle des machines qui connaîtra la croissance la plus rapide en Asie-Pacifique. L'essor des infrastructures, du commerce et de l'industrie dans les pays émergents tels que le Japon, l'Inde et la Corée du Sud est à l'origine de la domination du marché. La Chine devrait dominer la région Asie-Pacifique, car les anciennes infrastructures des pays, telles que les ponts, les autoroutes, les réseaux d'égouts et les tunnels, sont continuellement réparées et améliorées à l'aide de divers équipements de contrôle des machines, tels que des excavatrices, des systèmes de pavage et des bulldozers.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des systèmes de contrôle des machines en Asie-Pacifique

Le paysage concurrentiel du marché des systèmes de contrôle des machines en Asie-Pacifique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus ne concernent que l'accent mis par les entreprises sur le marché des systèmes de contrôle des machines en Asie-Pacifique.

Certains des principaux acteurs opérant sur le marché des systèmes de contrôle des machines en Asie-Pacifique sont :

- ABB

- Topcon

- Maximatecc

- Kobelco Construction Machinery Co., Ltd.

- SATEL

- Trimble Inc.

- Hemisphere GNSS, Inc.

- MOBA MOBILE AUTOMATION AG

- Belden Inc.

- RaptorTech.com

- Hexagone

- Groupe RIB

- James Fisher et Fils plc

- Logiciel Carlson

- LIEBHERR

- Schneider Electric

- MITSUI & CO., LTD

- Rockwell Automation, Inc.

- Komatsu Ltd.

- Microverse Automation Pvt. Ltd.

- Coperion GmbH

- Otto Bihler Maschinenfabrik GmbH & Co. KG

- Société OMRON

- ANDRITZ

- Siemens

- Honeywell International Inc.

Méthodologie de recherche : Marché des systèmes de contrôle des machines en Asie-Pacifique

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes à partir de diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse de la part de marché Asie-Pacifique par rapport à la région et des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TECHNOLOGY TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 VALUE CHAIN ANALYSIS

4.1.1 OVERVIEW OF VALUE CHAIN ANALYSIS

4.1.2 VALUE CHAIN ANALYSIS FRAMEWORK

4.2 PESTLE ANALYSIS

4.3 PORTER’S FIVE FORCES MODEL

4.4 EVOLUTION OF MACHINE CONTROL SYSTEM WITH ARTIFICIAL INTELLIGENCE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING NEED FOR ACCURACY AND PRECISION IN CONTROL SYSTEMS

5.1.2 INCREASE IN GROWTH OF CORDLESS MACHINE CONTROL SYSTEMS

5.1.3 INCREASE IN GROWTH OF INFRASTRUCTURE PROJECTS ASIA PACIFICLY

5.1.4 EXPANSION OF MOTOR VEHICLE MAINTENANCE MARKET AS VEHICLE OWNERSHIP RATE INCREASES

5.2 RESTRAINTS

5.2.1 REQUIREMENT OF HIGH INITIAL INVESTMENT

5.2.2 FLUCTUATION IN PRICES OF RAW MATERIALS

5.2.3 LACK OF TECHNICAL EXPERTISE

5.3 OPPORTUNITIES

5.3.1 INCREASING DEMAND FOR MACHINE-GUIDED TECHNOLOGIES IN EMERGING NATIONS

5.3.2 SMART CONNECTIVITY IN MACHINE CONTROL SYSTEMS

5.3.3 TECHNOLOGICAL INNOVATIONS IN INDUSTRY 4.0

5.3.4 MACHINE CONTROL SYSTEMS MADE AVAILABLE ON E-COMMERCE PLATFORMS

5.4 CHALLENGES

5.4.1 DESIGNING ERGONOMIC AND LIGHTWEIGHT MACHINE CONTROL SYSTEMS

5.4.2 REGULATORY COMPLIANCE AND MACHINE CONTROL SYSTEM SAFETY

6 IMPACT OF COVID-19 ON THE ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 STRATEGIC DECISION BY MANUFACTURERS AFTER COVID-19

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND AND SUPPLY CHAIN

6.5 CONCLUSION

7 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ASIA PACIFIC NAVIGATION SATELLITE SYSTEM (GNSS)

7.3 LASER SCANNERS

7.4 GIS COLLECTORS

7.5 TOTAL STATIONS

7.6 AIRBORNE SYSTEM

7.7 OTHERS

8 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT

8.1 OVERVIEW

8.2 EXCAVATORS

8.3 LOADERS

8.4 DOZERS

8.5 SCRAPERS

8.6 GRADERS

8.7 ROLLERS

8.8 DRILLERS AND PILERS

8.9 PAVERS AND COLD PLANERS

8.1 OTHERS

9 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE

9.1 OVERVIEW

9.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

9.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

9.4 MOTION CONTROLLERS

9.5 COMPUTER NUMERICAL CONTROL (CNC)

9.6 PERSONAL COMPUTER (PC)

9.7 OTHERS

10 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 MONITORING AND CONTROL

10.3 GUIDANCE AND AUTOMATION

10.4 MASS EXCAVATION

10.5 SPOT-BULLDOZING

10.6 OTHERS

11 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 BUILDING AND CONSTRUCTION

11.2.1 MONITORING AND CONTROL

11.2.2 GUIDANCE AND AUTOMATION

11.2.3 MASS EXCAVATION

11.2.4 SPOT-BULLDOZING

11.2.5 OTHERS

11.3 AGRICULTURE

11.3.1 MONITORING AND CONTROL

11.3.2 GUIDANCE AND AUTOMATION

11.3.3 MASS EXCAVATION

11.3.4 SPOT-BULLDOZING

11.3.5 OTHERS

11.4 MINING

11.4.1 MONITORING AND CONTROL

11.4.2 GUIDANCE AND AUTOMATION

11.4.3 MASS EXCAVATION

11.4.4 SPOT-BULLDOZING

11.4.5 OTHERS

11.5 TRANSPORTATION

11.6 AEROSPACE AND DEFENSE

11.7 AUTOMOTIVE

11.8 MARINE

11.8.1 MONITORING AND CONTROL

11.8.2 GUIDANCE AND AUTOMATION

11.8.3 MASS EXCAVATION

11.8.4 SPOT-BULLDOZING

11.8.5 OTHERS

11.9 WASTE MANAGEMENT

11.9.1 MONITORING AND CONTROL

11.9.2 GUIDANCE AND AUTOMATION

11.9.3 MASS EXCAVATION

11.9.4 SPOT-BULLDOZING

11.9.5 OTHERS

11.1 UTILITIES

11.10.1 MONITORING AND CONTROL

11.10.2 GUIDANCE AND AUTOMATION

11.10.3 MASS EXCAVATION

11.10.4 SPOT-BULLDOZING

11.10.5 OTHERS

11.11 OTHERS

12 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 INDIA

12.1.3 JAPAN

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA AND NEW ZEALAND

12.1.6 THAILAND

12.1.7 INDONESIA

12.1.8 SINGAPORE

12.1.9 MALAYSIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 MITSUI & CO., LTD.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 TRIMBLE INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ROCKWELL AUTOMATION, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 TOPCON

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 BELDEN INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ABB

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ANDRITZ

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 CARLSON SOFTWARE

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CHALLENGER GEOMATICS LTD.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 COPERION GMBH

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 EOS POSITIONING SYSTEMS, INC. (EOS)

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 HEMISPHERE GNSS, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 HEXAGON

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 HONEYWELL INTERNATIONAL INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 JAMES FISHER AND SONS PLC

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 KOBELCO CONSTRUCTION MACHINERY CO., LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 KOMATSU LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 LIEBHERR

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 L5 NAVIGATION SYSTEMS AB

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 MAXIMATECC

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 MACHINE CONTROL SYSTEMS

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 MICROVERSE AUTOMATION PVT. LTD.

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 MOBA MOBILE AUTOMATION AG

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 OMRON CORPORATION

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENT

15.25 OTTO BIHLER MASCHINENFABRIK GMBH & CO. KG

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

15.26 RAPTORTECH.COM

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 RIB GROUP

15.27.1 COMPANY SNAPSHOT

15.27.2 REVENUE ANALYSIS

15.27.3 PRODUCT PORTFOLIO

15.27.4 RECENT DEVELOPMENT

15.28 SATEL

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENT

15.29 SCHNEIDER ELECTRIC

15.29.1 COMPANY SNAPSHOT

15.29.2 REVENUE ANALYSIS

15.29.3 PRODUCT PORTFOLIO

15.29.4 RECENT DEVELOPMENT

15.3 SIEMENS

15.30.1 COMPANY SNAPSHOT

15.30.2 REVENUE ANALYSIS

15.30.3 PRODUCT PORTFOLIO

15.30.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC NAVIGATION SATELLITE SYSTEM (GNSS) IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC LASER SCANNERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC GIS COLLECTORS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC TOTAL STATIONS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC AIRBORNE SYSTEM IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC OTHERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC EXCAVATORS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC LOADERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC DOZERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC SCRAPERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC GRADERS SYSTEM IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ROLLERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC DRILLERS AND PILERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC PAVERS AND COLD PLANERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC OTHERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC PROGRAMMABLE LOGIC CONTROLLER (PLC) IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC PROGRAMMABLE AUTOMATION CONTROLLER (PAC) IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC MOTION CONTROLLERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC COMPUTER NUMERICAL CONTROL (CNC) IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC PERSONAL COMPUTER (PC) IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC OTHERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC MONITORING AND CONTROL IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC GUIDANCE AND AUTOMATION IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC MASS EXCAVATION IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC SPOT-BULLDOZING IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC MINING IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC TRANSPORTATION IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC AEROSPACE AND DEFENSE IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC AUTOMOTIVE IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC MARINE IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC OTHERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 ASIA-PACIFIC AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 ASIA-PACIFIC MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 ASIA-PACIFIC UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 CHINA MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 61 CHINA MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 62 CHINA MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 63 CHINA MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CHINA MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 65 CHINA BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 CHINA AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 CHINA MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 CHINA MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CHINA WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 CHINA UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 INDIA MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 INDIA MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 73 INDIA MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 74 INDIA MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 INDIA MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 76 INDIA BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 INDIA AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 INDIA MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 INDIA MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 INDIA WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 INDIA UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 JAPAN MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 83 JAPAN MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 84 JAPAN MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 85 JAPAN MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 JAPAN MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 87 JAPAN BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 JAPAN AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 JAPAN MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 JAPAN MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 JAPAN WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 JAPAN UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 SOUTH KOREA MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 94 SOUTH KOREA MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 95 SOUTH KOREA MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 96 SOUTH KOREA MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 SOUTH KOREA MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 98 SOUTH KOREA BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 SOUTH KOREA AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 SOUTH KOREA MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 SOUTH KOREA MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 SOUTH KOREA WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SOUTH KOREA UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 AUSTRALIA AND NEW ZEALAND MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 105 AUSTRALIA AND NEW ZEALAND MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 106 AUSTRALIA AND NEW ZEALAND MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 107 AUSTRALIA AND NEW ZEALAND MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 AUSTRALIA AND NEW ZEALAND MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA AND NEW ZEALAND BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA AND NEW ZEALAND AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 AUSTRALIA AND NEW ZEALAND MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 AUSTRALIA AND NEW ZEALAND MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 AUSTRALIA AND NEW ZEALAND WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 AUSTRALIA AND NEW ZEALAND UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 THAILAND MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 116 THAILAND MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 117 THAILAND MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 118 THAILAND MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 THAILAND MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 120 THAILAND BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 THAILAND AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 THAILAND MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 THAILAND MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 THAILAND WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 THAILAND UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 INDONESIA MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 127 INDONESIA MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 128 INDONESIA MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 129 INDONESIA MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 INDONESIA MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 131 INDONESIA BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 INDONESIA AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 INDONESIA MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 INDONESIA WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 INDONESIA UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 SINGAPORE MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 138 SINGAPORE MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 139 SINGAPORE MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 140 SINGAPORE MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 141 SINGAPORE MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 142 SINGAPORE BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 SINGAPORE AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 SINGAPORE MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 SINGAPORE MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 SINGAPORE WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 SINGAPORE UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 149 MALAYSIA MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 150 MALAYSIA MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 151 MALAYSIA MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 152 MALAYSIA MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 153 MALAYSIA BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 MALAYSIA AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 MALAYSIA MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 MALAYSIA MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 MALAYSIA WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 MALAYSIA UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 PHILIPPINES MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 160 PHILIPPINES MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 161 PHILIPPINES MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 162 PHILIPPINES MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 163 PHILIPPINES MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 164 PHILIPPINES BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 PHILIPPINES AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 PHILIPPINES MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 PHILIPPINES MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 PHILIPPINES WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 PHILIPPINES UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 REST OF ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: SEGMENTATION

FIGURE 11 RISING NEED FOR ACCURACY AND PRECISION IN CONTROL SYSTEMS IS EXPECTED TO DRIVE ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET IN THE FORECAST PERIOD

FIGURE 12 TECHNOLOGY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND BE THE FASTEST-GROWING REGION IN THE ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET IN THE FORECAST PERIOD

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET

FIGURE 15 REGIONAL SHARE OF ASIA PACIFIC INFRASTRUCTURE INVESTMENT

FIGURE 16 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: BY TECHNOLOGY, 2021

FIGURE 17 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: BY VEHICLE EQUIPMENT, 2021

FIGURE 18 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: BY CONTROLLER TYPE, 2021

FIGURE 19 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: BY APPLICATION, 2021

FIGURE 20 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: BY INDUSTRY, 2021

FIGURE 21 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET: SNAPSHOT (2021)

FIGURE 22 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET: BY COUNTRY (2021)

FIGURE 23 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 ASIA-PACIFIC MACHINE CONTROL SYSTEM MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 26 ASIA PACIFIC MACHINE CONTROL SYSTEM MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.