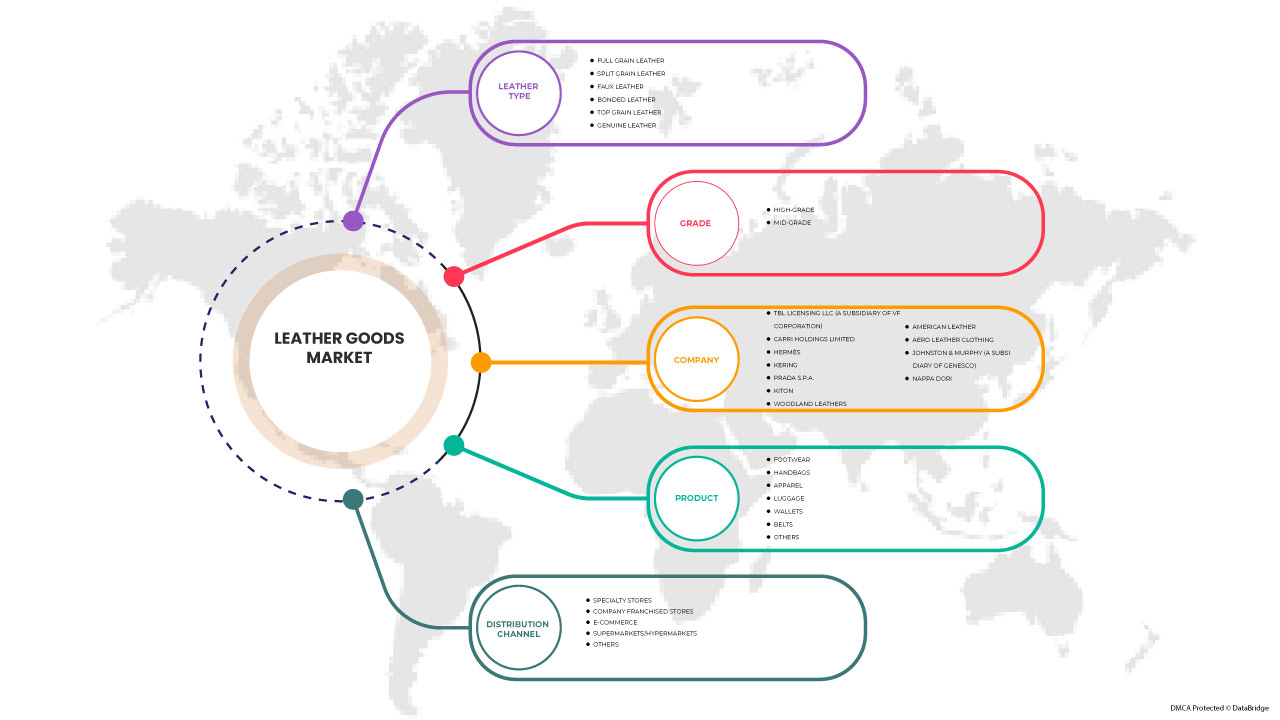

Marché des articles de maroquinerie en Asie-Pacifique, par type de cuir (cuir pleine fleur, cuir fendu, cuir pleine fleur, cuir véritable, similicuir et cuir reconstitué), produit ( chaussures , sacs à main, vêtements, bagages, portefeuilles, ceintures et autres), qualité (haute et moyenne qualité), canal de distribution (magasins spécialisés, magasins franchisés d'entreprise, commerce électronique, supermarchés/hypermarchés et autres) Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché de la maroquinerie en Asie-Pacifique

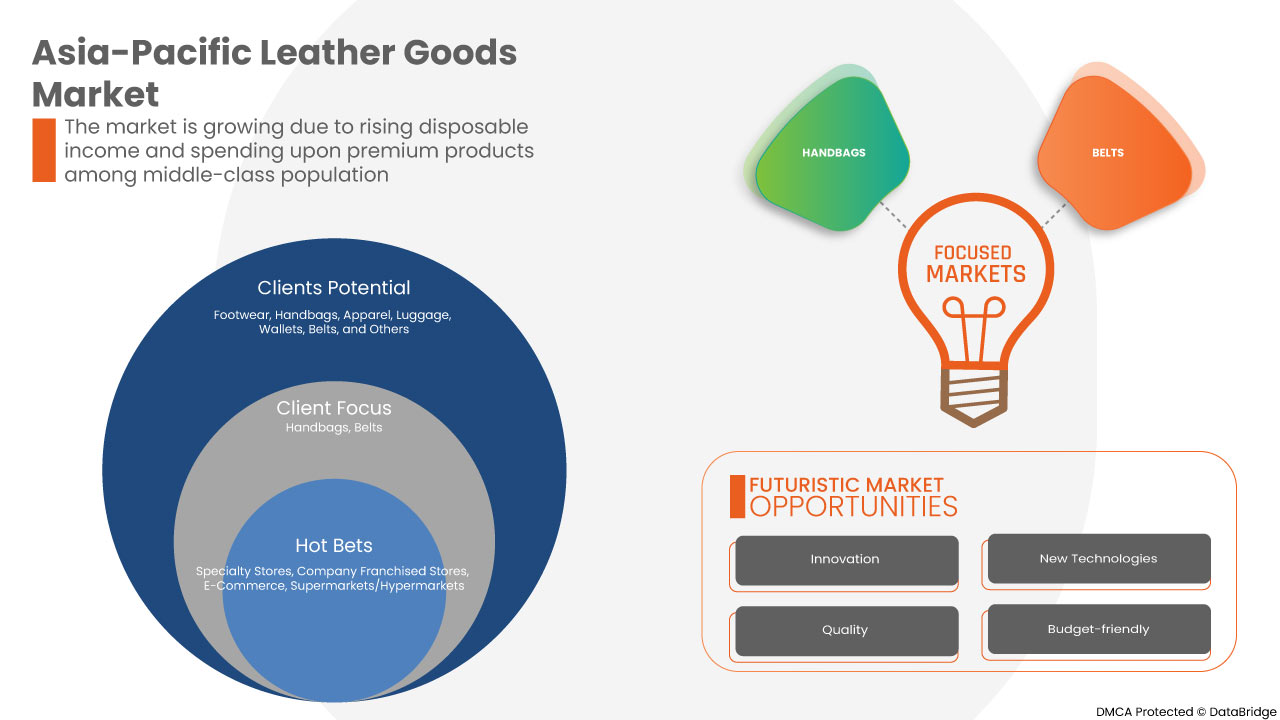

L'innovation croissante dans les articles de maroquinerie avec de nouvelles caractéristiques et de nouveaux designs et l'introduction de cuir biosourcé devraient offrir des opportunités sur le marché des articles de maroquinerie de la région Asie-Pacifique. Cependant, la prise de conscience croissante des effets néfastes des pratiques non éthiques dans la production d'articles de maroquinerie et le manque de compétences, de technologie, d'intrants intermédiaires et d'équipements de transformation devraient remettre en cause la croissance du marché. La faible disponibilité des matières premières, la disponibilité d'alternatives synthétiques telles que le cuir plastique et la disponibilité d'articles de maroquinerie à bas prix sont quelques-uns des facteurs qui freinent la croissance du marché.

Le rapport sur le marché de la maroquinerie en Asie-Pacifique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

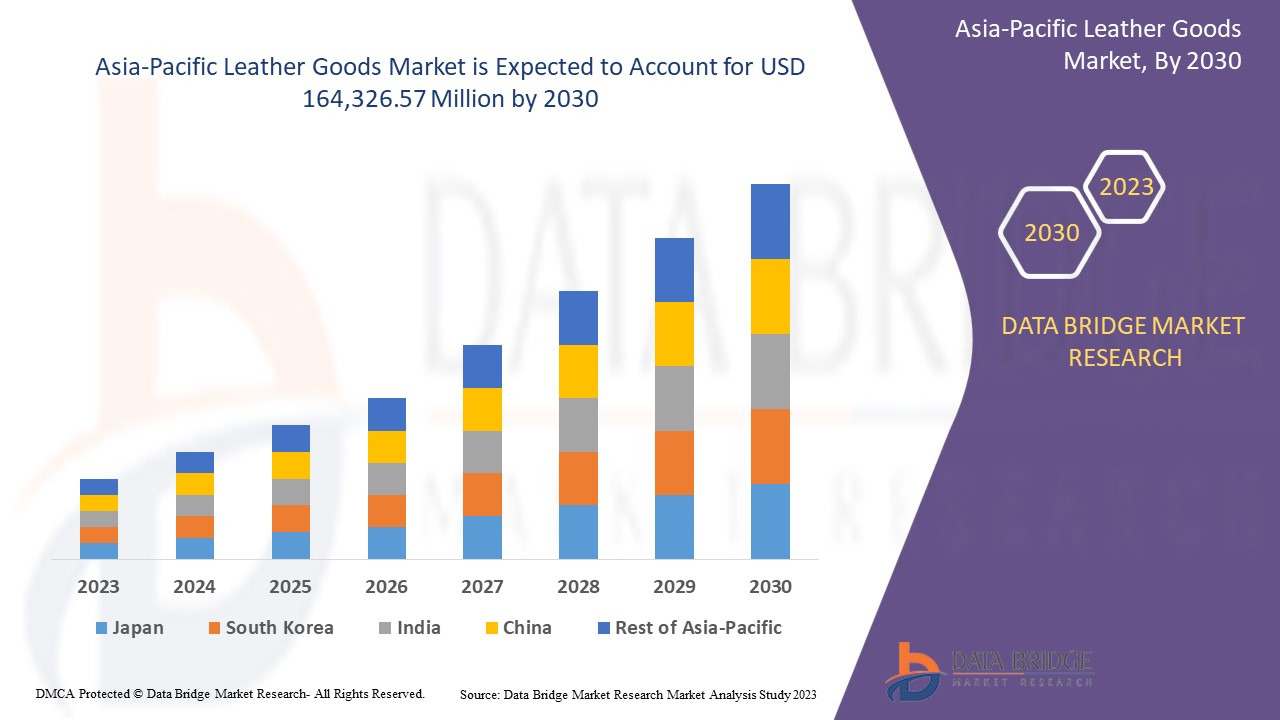

Le marché de la maroquinerie de la région Asie-Pacifique devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 7,3 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 164 326,57 millions USD d'ici 2030. Le principal facteur à l'origine de la croissance du marché est l'expansion rapide de l'industrie de la mode, qui a considérablement augmenté la demande des consommateurs pour des produits en cuir de haute qualité, haut de gamme et de luxe.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable pour 2020-2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type de cuir (cuir pleine fleur, cuir fendu, cuir pleine fleur, cuir véritable, similicuir et cuir reconstitué), produit (chaussures, sacs à main, vêtements, bagages, portefeuilles, ceintures et autres), qualité (haute et moyenne qualité), canal de distribution (magasins spécialisés, magasins franchisés d'entreprise, commerce électronique, supermarchés/hypermarchés et autres). |

|

Pays couverts |

Japon, Chine, Corée du Sud, Inde, Singapour, Thaïlande, Indonésie, Malaisie, Philippines, Australie et Nouvelle-Zélande, et reste de l'Asie-Pacifique. |

|

Acteurs du marché couverts |

TBL Licensing LLC (une filiale de VF Corporation), CAPRI HOLDINGS LIMITED, Hermès, KERING, PRADA SPA, Kiton, Woodland Leathers, American Leather, Aero Leather Clothing, JOHNSTON & MURPHY (une filiale de Genesco) et NAPPA DORI entre autres. |

Définition du marché

Les articles en cuir sont des articles fabriqués à partir de cuir. Ils peuvent être utilisés dans divers produits tels que des vêtements, des chaussures, des sacs, des gants et autres. En raison des caractéristiques du cuir telles que la résistance à la poussière, au feu et la durabilité, les articles en cuir sont préférés aux autres ressources. La demande croissante en cuir dans la production de vêtements stimule la croissance du marché.

Dynamique du marché de la maroquinerie en Asie-Pacifique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de la demande de produits en cuir de luxe haut de gamme et de haute qualité

L'industrie de la mode en pleine expansion a considérablement accru la demande des consommateurs pour des produits en cuir de haute qualité, haut de gamme et luxueux. Les clients apprécient l'esthétique et recherchent des produits haut de gamme pour créer une déclaration de mode. De plus, un nombre croissant de particuliers fortunés (HNWI), associé à la tendance croissante des vêtements de créateurs et de marque sur les principaux marchés, tels que les États-Unis, la France et la Chine, stimule la demande de produits en cuir de luxe. Les articles en cuir sont exclusifs et souvent vendus à des prix élevés.

- Construction économique et robuste de produits en cuir synthétique

Le cuir synthétique , également connu sous le nom de similicuir, est moins cher que le cuir véritable, respectueux des animaux, peut être produit dans pratiquement toutes les couleurs, peut être fabriqué pour présenter une finition brillante, peut être facilement nettoyé avec un chiffon humide, nécessite peu d'entretien, ne se fissure pas aussi facilement que le cuir véritable, résiste à la décoloration due aux UV et n'a pas l'odeur du cuir véritable, ce qui devrait attirer sa demande au cours de la période de prévision. Le similicuir est un produit synthétique et est très durable. De nos jours, le similicuir est généralement plus résistant que le cuir véritable. Des cuirs artificiels tels que le similicuir, le Naugahyde, le cuir végétalien, le tissu d'écorce, le liège, le coton glacé et le polyester PET recyclé sont disponibles sur le marché. Le similicuir est couramment utilisé pour fabriquer des vêtements en cuir artificiel. Il est fabriqué à partir de plastique et est moins coûteux et plus léger que le cuir véritable. Les produits en similicuir sont disponibles dans une variété de couleurs. Un autre matériau utilisé pour le cuir est le Naugahyde qui ressemble à la peau animale. Tous ces facteurs et avantages offerts par le cuir synthétique devraient stimuler la croissance du marché.

- L'augmentation de la demande de vêtements, chaussures et accessoires en cuir confortables, tendance et fantaisie

Les articles en cuir sont disponibles sous différentes formes, comme les gants, les sacs, les chaussures, les montres , les meubles et bien d'autres. L'augmentation de la demande de cuir dans la production de vêtements est l'un des principaux facteurs moteurs susceptibles d'influencer positivement la croissance du marché. De plus, les caractéristiques particulières du cuir, telles que la nature ignifuge, anti-poussière et anti-fissures et la durabilité des articles en cuir, sont souvent préférées aux autres ressources et matériaux, ce qui a contribué à accroître la demande et les ventes du marché.

Opportunités

- Augmentation de l'innovation dans la maroquinerie avec de nouvelles fonctionnalités et designs

Le comportement des consommateurs a considérablement changé au cours de la dernière décennie. Les anciennes technologies étant de plus en plus exploitées, notamment dans le développement et la commercialisation de produits de mode, les entreprises disposent de nouvelles possibilités pour répondre aux besoins des clients avec des produits variés. Le développement de nouvelles finitions de surface et d'embellissements avec des techniques viables est nécessaire pour développer des produits innovants et ajouter de la singularité et de la valeur aux produits.

Avec l'évolution rapide et les changements de mode de vie quotidiens, ainsi que l'augmentation du revenu disponible, les consommateurs sont de plus en plus enclins à se tourner vers les produits à la mode. Les consommateurs améliorent leur niveau de vie en fonction de leur revenu disponible et consomment davantage de produits à la mode. Ces types d'inclinations des consommateurs créeront donc une opportunité pour les acteurs du marché opérant sur le marché.

- Introduction du cuir bio-biaisé

Le processus de fabrication du cuir biosourcé n'a aucune conséquence néfaste sur l'écosystème. Le cuir synthétique fabriqué à partir de fibres naturelles comme le lin, le coton ou les fibres de coton associées au maïs, au palmier, au soja et à d'autres devrait être au centre des préoccupations des fabricants pour gagner une part de marché compétitive sur le marché de la maroquinerie de la région Asie-Pacifique avec l'avènement du cuir biosourcé. En outre, les feuilles d'ananas sont effectivement utilisées pour fabriquer le « Pinatex », un nouvel article en cuir synthétique. Ces feuilles d'ananas ont une fibre élastique et solide qui les rend excellentes pour une utilisation dans le processus de fabrication.

Contraintes/Défis

- La disponibilité d'articles de maroquinerie moins chers et la pénurie d'articles de maroquinerie dans le monde

Le coût élevé du cuir naturel est un facteur qui a entraîné la nécessité de remplacer le cuir naturel. La mauvaise qualité du cuir et la pénurie de cuir dans le monde entier constituent des goulots d'étranglement pour l'industrie de la maroquinerie. Certains types de produits en cuir disponibles sur le marché ont des coûts bas. Cela entrave également l'offre et la demande de produits en cuir de bonne qualité et leur prix. De plus, la pénurie mondiale de produits en cuir et de matières premières, comme le cuir véritable, fait grimper le prix de ces produits. En conséquence, les acheteurs européens recherchent des fournisseurs à bas prix capables de produire du cuir à partir d'animaux exotiques comme les pythons et les alligators. Ces facteurs freinent la croissance du marché. En outre, la faible disponibilité des matières premières, la disponibilité d'alternatives synthétiques telles que le cuir plastique et la disponibilité de produits en cuir à bas prix sont quelques-uns des facteurs qui freinent la croissance du marché.

- Réglementations gouvernementales strictes sur la production et l'utilisation du cuir naturel

Les réglementations gouvernementales strictes dans des régions comme l'Europe et les États-Unis, entre autres, entraînent la fermeture de plusieurs tanneries et unités de traitement du cuir. Ces gouvernements ont imposé des réglementations sur l'utilisation du cuir, ce qui constituera un frein à la croissance du marché dans les années à venir. Les politiques gouvernementales ont rendu disponibles sur le marché de nouvelles alternatives synthétiques, comme le cuir plastique.

- Manque de compétences, de technologie, d’intrants intermédiaires et d’équipements de transformation

La rareté des universités nationales qui proposent des diplômes en technologie du cuir contribue à cette situation. Cela a créé un déficit de compétences qui doit être la priorité dans le développement du secteur du cuir. Le manque de professionnels et l'insuffisance des centres de formation pour former les techniciens et les opérateurs nécessaires dans le secteur sont les causes de la situation actuelle. Le manque de technologie, de compétences et de formation intermédiaire constitue un défi pour le marché de la maroquinerie, car ces caractéristiques contribuent à produire des articles en cuir de haute qualité. La qualité des articles en cuir est la plus importante pour la croissance de l'industrie.

Développement récent

- En août 2017, la marque de luxe suisse Bally a inauguré son premier flagship store en Inde dans le cadre d'un partenariat avec Reliance Brands Limited. Ce magasin propose des chaussures pour femmes et hommes, des accessoires et des articles de maroquinerie haut de gamme.

Portée du marché des articles de maroquinerie en Asie-Pacifique

Le marché de la maroquinerie de la région Asie-Pacifique est divisé en quatre segments notables en fonction du type de cuir, du produit, de la qualité et du canal de distribution. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de cuir

- Cuir pleine fleur

- Cuir à fleur fendue

- faux cuir

- Cuir reconstitué

- Cuir pleine fleur

En fonction du type de cuir, le marché est segmenté en cuir pleine fleur, cuir fendu, cuir pleine fleur, cuir véritable, similicuir, cuir reconstitué et autres.

Produit

- Chaussure

- Sacs à main

- Vêtements

- Bagage

- Portefeuilles

- Ceintures

- Autres

En fonction du produit, le marché est segmenté en chaussures, sacs à main, vêtements, bagages, portefeuilles, ceintures et autres .

Grade

- De haute qualité

- Niveau intermédiaire

En fonction de la qualité, le marché est segmenté en qualité supérieure et qualité moyenne.

Canal de distribution

- Magasins spécialisés

- Magasins franchisés de l'entreprise

- Commerce électronique

- Supermarchés/Hypermarchés

- Autres

En fonction du canal de distribution, le marché est segmenté en magasins spécialisés, magasins franchisés d'entreprise, commerce électronique, supermarchés/hypermarchés et autres.

Analyse/perspectives régionales du marché de la maroquinerie en Asie-Pacifique

Le marché de la maroquinerie en Asie-Pacifique est segmenté en fonction du type de cuir, du produit, de la qualité et du canal de distribution.

Les pays du marché de la maroquinerie de la région Asie-Pacifique sont le Japon, la Chine, la Corée du Sud, l'Inde, Singapour, la Thaïlande, l'Indonésie, la Malaisie, les Philippines, l'Australie et la Nouvelle-Zélande, ainsi que le reste de la région Asie-Pacifique. La Chine domine le marché de la maroquinerie de la région Asie-Pacifique en termes de part de marché et de chiffre d'affaires en raison de la prise de conscience croissante des excellentes caractéristiques et propriétés des articles en cuir dans la région.

La section pays du rapport fournit également des facteurs individuels d'impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, l'analyse des tendances techniques des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des articles de maroquinerie en Asie-Pacifique

Le paysage concurrentiel du marché de la maroquinerie en Asie-Pacifique fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue des produits, la domination des applications et la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché de la maroquinerie en Asie-Pacifique.

Certains des principaux acteurs opérant sur le marché des articles de maroquinerie de la région Asie-Pacifique sont TBL Licensing LLC (une filiale de VF Corporation), CAPRI HOLDINGS LIMITED, Hermès, KERING, PRADA SPA, Kiton, American Leather, Aero Leather Clothing, JOHNSTON & MURPHY (une filiale de Genesco) et NAPPA DORI, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC LEATHER GOODS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE RISE IN THE DEMAND FOR COMFORTABLE, TRENDY, FANCY LEATHER APPAREL, FOOTWEAR, AND ACCESSORIES

5.1.2 INCREASE IN THE DEMAND FOR PREMIUM AND HIGH-QUALITY LUXURY LEATHER PRODUCTS

5.1.3 LOW-COST AND HEAVY-DUTY CONSTRUCTION OF SYNTHETIC LEATHER PRODUCTS

5.1.4 RISE IN THE EXPENDITURE ON HOME FURNISHING AND RENOVATION

5.2 RESTRAINTS

5.2.1 THE AVAILABILITY OF CHEAPER LEATHER GOODS AND THE SHORTAGE OF LEATHER GOODS WORLDWIDE

5.2.2 STRICT GOVERNMENTAL REGULATIONS ON THE PRODUCTION AND USE OF NATURAL LEATHER

5.3 OPPORTUNITIES

5.3.1 INCREASE IN INNOVATION IN LEATHER GOODS WITH NEW FEATURES AND DESIGNS

5.3.2 INTRODUCTION OF BIO-BIASED LEATHER

5.4 CHALLENGES

5.4.1 RISE IN THE AWARENESS REGARDING THE DETRIMENTAL EFFECTS OF UNETHICAL PRACTICES IN THE PRODUCTION OF LEATHER GOODS

5.4.2 LACK OF SKILLS, TECHNOLOGY, INTERMEDIATE INPUTS, AND PROCESSING EQUIPMENT

6 ASIA PACIFIC LEATHER GOODS MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 FOOTWEAR

6.2.1 FOOTWEAR, BY TYPE

6.2.1.1 BOOTS

6.2.1.2 FORMAL SHOES

6.2.1.3 LOAFERS

6.2.1.4 BALLERINAS

6.2.1.5 SANDALS

6.2.1.6 OTHERS

6.3 HANDBAGS

6.3.1 HANDBAGS, BY TYPE

6.3.1.1 SLING BAG

6.3.1.2 CLUTCHES

6.3.1.3 SATCHEL BAG

6.3.1.4 TOTE BAGS

6.3.1.5 WRISTLET BAG

6.3.1.6 OTHERS

6.4 APPAREL

6.4.1 APPAREL, BY TYPE

6.4.1.1 JACKET

6.4.1.2 CAPS

6.4.1.3 SUIT

6.4.1.4 WAISTCOAT

6.4.1.5 SHIRTS

6.4.1.6 OTHERS

6.5 LUGGAGE

6.5.1 LUGGAGE, BY TYPE

6.5.1.1 TRAVEL BAGS

6.5.1.2 BUSINESS BAGS

6.5.1.3 DUFFEL BAGS

6.5.1.4 SUITCASE & BRIEFCASE

6.5.1.5 ROLLABLE LUGGAGE

6.5.1.6 OTHERS

6.6 WALLETS

6.7 BELTS

6.8 OTHERS

7 ASIA PACIFIC LEATHER GOODS MARKET, BY LEATHER TYPE

7.1 OVERVIEW

7.2 FULL GRAIN LEATHER

7.3 SPLIT GRAIN LEATHER

7.4 TOP GRAIN LEATHER

7.5 GENUINE LEATHER

7.6 FAUX LEATHER

7.7 BONDED LEATHER

8 ASIA PACIFIC LEATHER GOODS MARKET, BY GRADE

8.1 OVERVIEW

8.2 HIGH-GRADE

8.3 MID-GRADE

9 ASIA PACIFIC LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 SPECIALTY STORES

9.3 COMPANY FRANCHISED STORES

9.4 E-COMMERCE

9.5 SUPERMARKETS/HYPERMARKETS

9.6 OTHERS

10 ASIA PACIFIC LEATHER GOODS MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 INDIA

10.1.3 JAPAN

10.1.4 SOUTH KOREA

10.1.5 AUSTRALIA & NEW ZEALAND

10.1.6 SINGAPORE

10.1.7 THAILAND

10.1.8 INDONESIA

10.1.9 MALAYSIA

10.1.10 PHILIPPINES

10.1.11 REST OF ASIA-PACIFIC

11 ASIA PACIFIC LEATHER GOODS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11.2 EVENT

11.3 ACQUISITION

11.4 AWARD

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 KERING

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 PRADA S.P.A.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 CAPRI HOLDINGS LIMITED

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 HERMÈS

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 TBL LICENSING LLC (A SUBSIDIARY OF VF CORPORATION)

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 AERO LEATHER CLOTHING

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 AMERICAN LEATHER

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 JOHNSTON & MURPHY (A SUBSIDIARY OF GENESCO)

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 KITON

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 NAPPA DORI

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 WOODLAND LEATHERS

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF TRUNKS, SUITCASES, VANITY CASES, EXECUTIVE CASES, BRIEFCASES, SCHOOL SATCHELS, SPECTACLE CASES, AND OTHER GOODS PRODUCED USING LEATHER AND SIMILAR MATERIALS; HS CODE – 4202 (USD THOUSAND)

TABLE 2 EXPORT DATA OF TRUNKS, SUITCASES, VANITY CASES, EXECUTIVE CASES, BRIEFCASES, SCHOOL SATCHELS, SPECTACLE CASES, AND OTHER GOODS PRODUCED USING LEATHER AND SIMILAR MATERIALS; HS CODE – 4202 (USD THOUSAND)

TABLE 3 ASIA PACIFIC LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 4 ASIA PACIFIC FOOTWEAR IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 ASIA PACIFIC FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 ASIA PACIFIC HANDBAGS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 ASIA PACIFIC HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 ASIA PACIFIC APPAREL IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 ASIA PACIFIC APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 ASIA PACIFIC LUGGAGE IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 ASIA PACIFIC LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 ASIA PACIFIC WALLETS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 ASIA PACIFIC BELTS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 ASIA PACIFIC OTHERS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 ASIA PACIFIC LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 16 ASIA PACIFIC FULL GRAIN LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 ASIA PACIFIC SPLIT GRAIN LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 ASIA PACIFIC TOP GRAIN LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 ASIA PACIFIC GENUINE LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 ASIA PACIFIC FAUX LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 ASIA PACIFIC BONDED LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 ASIA PACIFIC LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 23 ASIA PACIFIC HIGH-GRADE IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 ASIA PACIFIC MID-GRADE IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 ASIA PACIFIC LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 26 ASIA PACIFIC SPECIALTY STORES IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 ASIA PACIFIC COMPANY FRANCHISED STORES IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 ASIA PACIFIC E-COMMERCE IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 ASIA PACIFIC SUPERMARKETS/HYPERMARKETS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 ASIA-PACIFIC LEATHER GOODS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 32 ASIA-PACIFIC LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 33 ASIA-PACIFIC FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 ASIA-PACIFIC HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 ASIA-PACIFIC APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 ASIA-PACIFIC LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 ASIA-PACIFIC LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 38 ASIA-PACIFIC LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 39 ASIA-PACIFIC LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 40 CHINA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 41 CHINA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 CHINA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 CHINA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 CHINA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 CHINA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 46 CHINA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 47 CHINA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 48 INDIA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 49 INDIA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 INDIA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 INDIA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 INDIA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 INDIA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 54 INDIA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 55 INDIA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 56 JAPAN LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 57 JAPAN FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 JAPAN HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 JAPAN APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 JAPAN LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 JAPAN LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 62 JAPAN LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 63 JAPAN LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 64 SOUTH KOREA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 65 SOUTH KOREA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 SOUTH KOREA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 SOUTH KOREA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 SOUTH KOREA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 SOUTH KOREA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 70 SOUTH KOREA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 71 SOUTH KOREA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 72 AUSTRALIA & NEW ZEALAND LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 73 AUSTRALIA & NEW ZEALAND FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 AUSTRALIA & NEW ZEALAND HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 AUSTRALIA & NEW ZEALAND APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 AUSTRALIA & NEW ZEALAND LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 AUSTRALIA & NEW ZEALAND LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 78 AUSTRALIA & NEW ZEALAND LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 79 AUSTRALIA & NEW ZEALAND LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 80 SINGAPORE LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 81 SINGAPORE FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 SINGAPORE HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 SINGAPORE APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 SINGAPORE LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 SINGAPORE LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 86 SINGAPORE LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 87 SINGAPORE LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 88 THAILAND LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 89 THAILAND FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 THAILAND HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 THAILAND APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 THAILAND LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 THAILAND LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 94 THAILAND LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 95 THAILAND LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 96 INDONESIA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 97 INDONESIA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 INDONESIA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 INDONESIA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 INDONESIA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 INDONESIA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 102 INDONESIA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 103 INDONESIA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 104 MALAYSIA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 105 MALAYSIA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 MALAYSIA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 MALAYSIA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 MALAYSIA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 MALAYSIA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 110 MALAYSIA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 111 MALAYSIA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 112 PHILIPPINES LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 113 PHILIPPINES FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 PHILIPPINES HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 PHILIPPINES APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 PHILIPPINES LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 PHILIPPINES LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 118 PHILIPPINES LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 119 PHILIPPINES LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 120 REST OF ASIA-PACIFIC LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC LEATHER GOODS MARKET

FIGURE 2 ASIA PACIFIC LEATHER GOODS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC LEATHER GOODS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC LEATHER GOODS MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC LEATHER GOODS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC LEATHER GOODS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC LEATHER GOODS MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC LEATHER GOODS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC LEATHER GOODS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC LEATHER GOODS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 ASIA PACIFIC LEATHER GOODS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 ASIA PACIFIC LEATHER GOODS MARKET: SEGMENTATION

FIGURE 13 RISING DEMAND FOR COMFORTABLE, TRENDY, AND FANCY LEATHER APPAREL, FOOTWEAR, AND ACCESSORIES IS EXPECTED TO DRIVE THE ASIA PACIFIC LEATHER GOODS MARKET IN THE FORECAST PERIOD

FIGURE 14 FOOTWEAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC LEATHER GOODS MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC LEATHER GOODS MARKET

FIGURE 16 ASIA PACIFIC LEATHER GOODS MARKET: BY PRODUCT, 2022

FIGURE 17 ASIA PACIFIC LEATHER GOODS MARKET: BY LEATHER TYPE, 2022

FIGURE 18 ASIA PACIFIC LEATHER GOODS MARKET: BY GRADE, 2022

FIGURE 19 ASIA PACIFIC LEATHER GOODS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 20 ASIA-PACIFIC LEATHER GOODS MARKET: SNAPSHOT (2022)

FIGURE 21 ASIA-PACIFIC LEATHER GOODS MARKET: BY COUNTRY (2022)

FIGURE 22 ASIA-PACIFIC LEATHER GOODS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 ASIA-PACIFIC LEATHER GOODS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 ASIA-PACIFIC LEATHER GOODS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 25 ASIA PACIFIC LEATHER GOODS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.