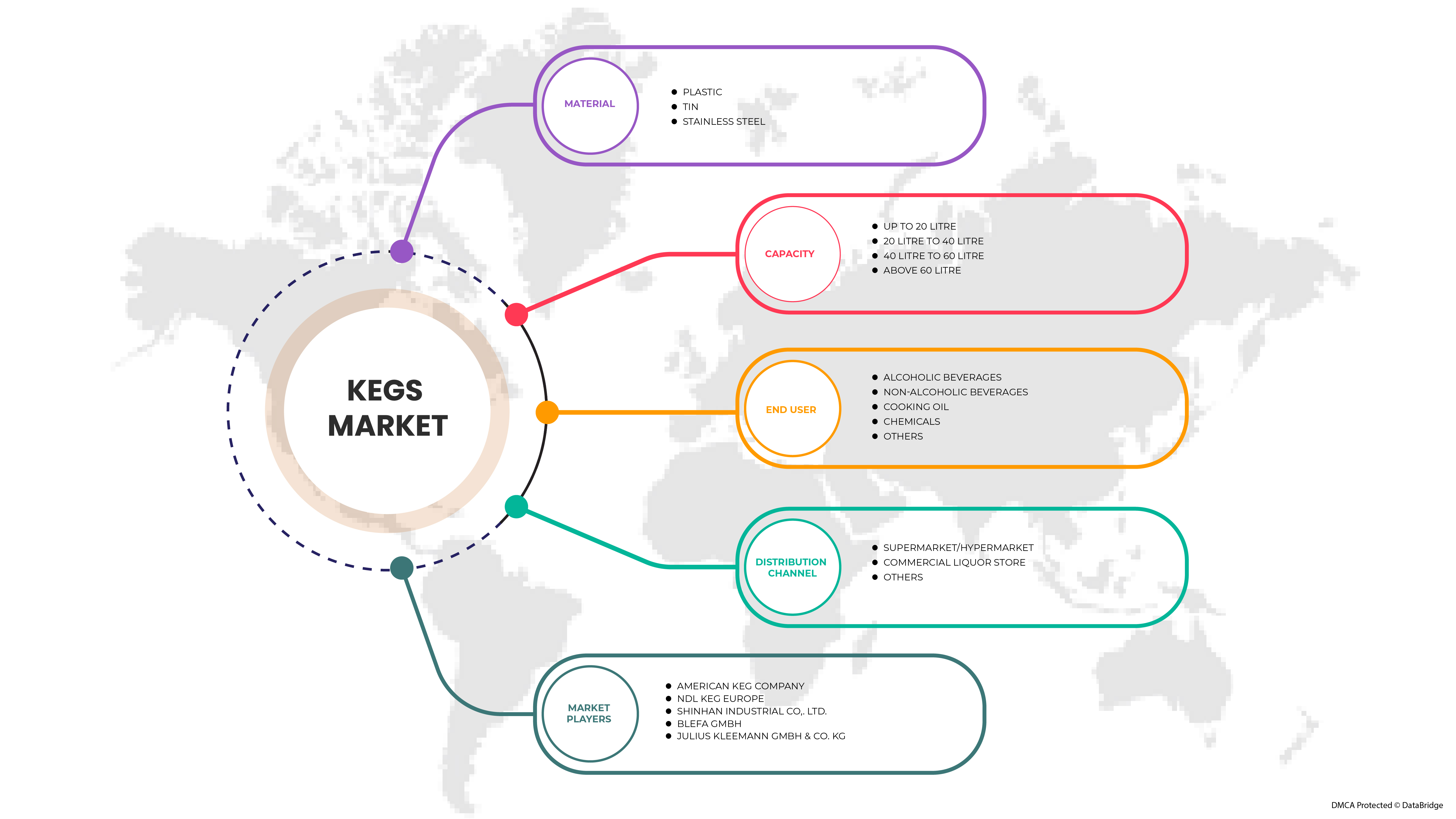

Asia-Pacific Kegs Market, By Material (Plastic, Tin, and Stainless Steel), Capacity (Up To 20 Litre, 20 Litre To 40 Litre, 40 Litre To 60 Litre, and Above 60 Litre), End User (Alcoholic Beverages, Non- Alcoholic Beverages, Cooking Oil, Chemicals, and Others), Distribution Channel (Supermarket/Hypermarket, Commercial Liquor Store, and Others) Industry Trends and Forecast to 2029.

Asia-Pacific Kegs Market Analysis and Size

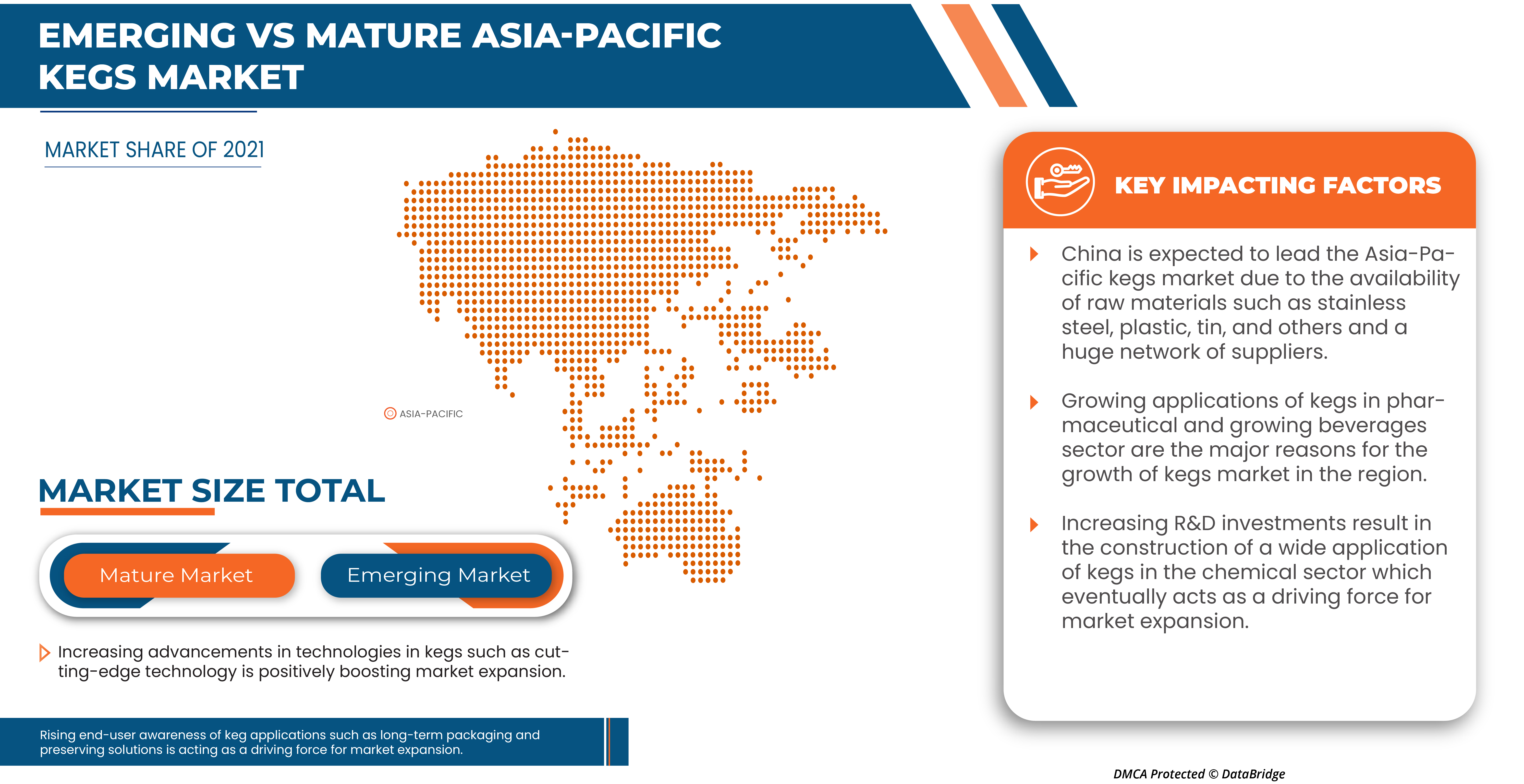

The Asia-Pacific kegs market is being driven by the increase in applications for kegs across industries. Additionally, the growth of the market is fueled by rising demand for alcoholic and non-alcoholic beverages. However, the primary factors limiting the market growth are the high costs associated with commercial kegs. As a result of the rising demand for kegs, manufacturers are putting more effort into launching new products with cut-edge technology and certified by authorized institutes. The market's expansion is ultimately aided by these choices.

Some of the factors driving the market growth are growing applications of kegs in chemical sector and food & beverages sector and increasing consumption of beverages due to gradual lifestyle changes. However, limitations in terms of slow replacement of kegs due to their prolonged lifespan are expected to hamper the market growth.

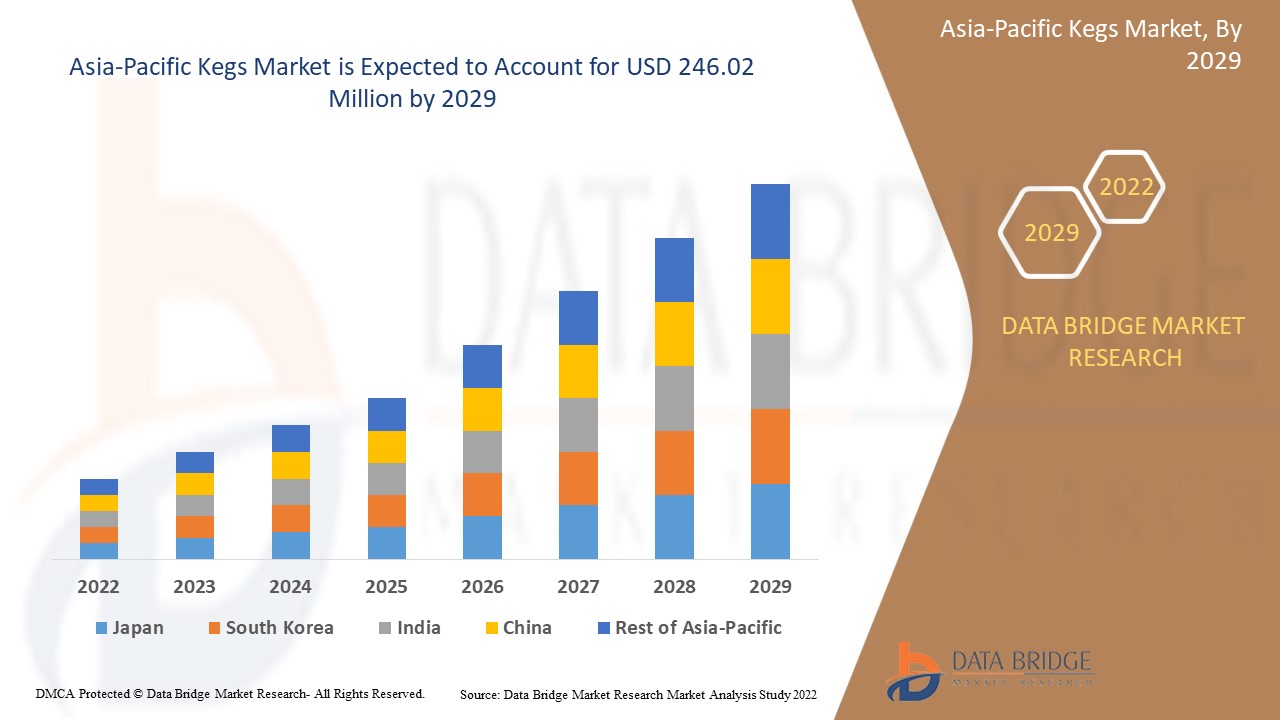

Data Bridge Market Research analyzes that the Asia-Pacific kegs market is expected to reach a value of USD 246.02 million by 2029 with a CAGR of 3.7% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volume in Million Units, and Pricing in USD |

|

Segments Covered |

By Material (Plastic, Tin, and Stainless Steel), Capacity (Up To 20 Litre, 20 Litre To 40 Litre, 40 Litre To 60 Litre, and Above 60 Litre), End User (Alcoholic Beverages, Non-Alcoholic Beverages, Cooking Oil, Chemicals, and Others), Distribution Channel (Supermarket/Hypermarket, Commercial Liquor Store, and Others). |

|

Countries Covered |

Japan, China, South Korea, India, Australia & New Zealand, Singapore, Thailand, Indonesia, Malaysia, Philippines, Taiwan, Hong Kong, and rest of Asia-Pacific. |

|

Market Players Covered |

SHINHAN INDUSTRIAL CO,. LTD., BLEFA GmbH, and Petainer Ltd. |

Market Definition

Kegs are little barrels. Beverages, chemicals, oils, and various liquids are transported and stored in kegs constructed with various raw materials. A keg is generally often made of stainless steel, however, aluminum can also be used if it has an interior plastic coating. Beer is frequently transported, served, and stored in it. A keg can also hold additional alcoholic and non-alcoholic beverages that are carbonated or not. It is common practice to maintain the pressure of carbonated beverages to keep carbon dioxide in the solution and prevent the beverage from going flat.

Asia-Pacific Kegs Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVERS

- Growing application of kegs in chemical sectors

A chemical storage keg is a high-quality storage container used by a wide range of industries to hold various types of chemical substances. They are available in a range of forms and sizes and have always been popular. An industrial chemical storage keg is a significant chemical storage system. Because chemicals are corrosive, they must be stored in a secure location. Chemical kegs are chemical storage containers that are frequently utilized in the chemical industry. They are available in a range of sizes and shapes and are used for static storage, processing, mixing, and transportation of both raw materials and finished chemical products.

Nowadays, most keg and chemical enterprises are investing in R&D, which leads to a surge in the applications of kegs in the chemical sector.

For instance,

- In November 2020, Indian Chemical New published an article titled “Role of R&D in Making Chemical Industry Aatma Nirbhar”. It said that according to the most recent statistics available, the Indian Chemical Industry spends roughly 2-3% of its total sales on R&D, compared to 9-10% for MNCs in other nations. According to Oxford Economics, the chemical industry spent USD 51.00 billion on R&D in 2017. China had the highest chemical R&D budget at USD 14.6 billion, followed by the U.S.and Japan at USD 12.10 billion and USD 6.90 billion, respectively. India was rated 7th with USD 1.80 billion investment in R&D in 2017. To compete with the international chemical sector, the industry must make significant investments in R&D. In addition, the Indian government provides numerous tax breaks to stimulate R&D investments.

Increasing R&D investments result in the construction of a wide application of kegs in the chemical sector, which eventually acts as a driving force for market expansion.

- Rising trend of long-term packaging and preserving solutions

The use of kegs as a packaging solution in the beverage industry is anticipated to have a promising future. Plastic kegs can be recycled and cost less to send back. On the other hand, keg adoption has expanded as a result of the popularity of kegs encouraging manufacturers to offer kegs for leasing. Single-use kegs are a more economical and effective alternative to traditional steel kegs, and it is anticipated that they will become widely used in near future. Additionally, the microbrew sector is expanding due to consumer enthusiasm for craft ales, which has bolstered the global keg industry. Keg use is anticipated to be encouraged by legislative constraints that favor lower package weight limits. Kegs are also used for preserving the solutions like beverages, oils, and chemicals to preserve the quality and flavor of the product.

For instance,

- In September 2021, Newsmatics Inc. published an article titled “Kegs have Become More Popular as a Promising, Long-term Packaging Solution” and tells that as a packaging option for beverages, kegs are anticipated to have a promising future

Rising end-user awareness of keg applications such as long-term packaging and preserving solutions is driving market growth.

RESTRAINTS

- Slow replacement of kegs due to their prolonged lifespan

Kegs have a longer lifespan, so customers purchase the product less frequently. Since it takes a lot of time to switch from old kegs to new ones, this time lag could act as a barrier to market expansion.

For instance,

- In March 2020, Keg Works published an article entitled “How Long Does a Keg Stay Fresh?”. It mentioned that a keg of pasteurized beer has a shelf life of around 90-120 days (or 3-4 months) and unpasteurized draught beer has a shelf life of about 45-60 days (or 6-8 weeks) when stored at the right temperature

Life span of various kegs is mentioned in the table given below:

|

Product name |

Life span |

|

Wine keg |

6-8 weeks |

|

Unpasteurized beer keg |

6-8 weeks |

|

Pasteurized keg |

3-4 weeks |

|

Cocktail keg |

Approx. 2 months |

|

Cider keg |

6-8 weeks |

Although kegs with a longer lifespan may assist end users, the slowdown replacement of kegs may function as a barrier to the growth of the buying market.

- High cost associated with commercial kegs

A price decline will almost certainly result in new consumers or keg sales. A high price, on the other hand, encourages buyers to buy less products, resulting in loss of sales for the company. The high cost of commercial kegs is a market barrier since end-users cannot afford to continue investing in these commercial kegs. It eventually acts as a barrier to market growth.

For instance,

|

Product name |

Price |

|

Commercial Beer Dispenser Kegerator - 4 Tap Store 4 Kegs |

INR 44,000 |

|

Ball Lock Corny Keg: Home Brew Fermenter |

INR 5,824 |

|

Stainless Steel Beer Barrel Commercial Keg 50 Litres Euro Standard |

USD 55-65/piece |

|

1 galloon, 30 Litres Commercial Brewing Beer Keg with CO2 Regulator |

USD 54.59-56.69/piece |

|

Empty Commercial Brew Customized Keg 30l Stainless Steel Beer Barrel 30l Beer Keg |

USD 44.48-57.65/piece |

The pricing of commercial kegs indicated above is higher, and they are beyond reach for end consumers. As a result, the market expansion will eventually slow down.

OPPORTUNITY

- Increasing advancements in technologies in kegs such as cutting-edge technology

Automation and technological developments have made keg manufacturing more efficient. These facilities may better manage their costs and key systems, thanks to smart keg tracking sensors linked to the Internet of Things (IoT) using both GPS and RFID technology, as well as temperature controls among other things. Keg automation technologies include smart sensors, mobile tablets and smartphones, software, APIs, and cloud databases. Technology-driven automation in kegs among other things enhances fulfillment and improves storage and transportation of alcoholic or non-alcoholic drinks, carbonated or non-carbonated, and other beverages.

The quick increase in R&D and technological progress in keg manufacturing will help in providing an opportunity for market growth and expansion.

As a result, opportunities in the market are anticipated to arise from ongoing technological developments in keg manufacturing.

CHALLENGE

- Growing stiff competition among players

Since there is intense competition among the current kegs industry players, this will result in lower prices and less overall profitability for the sector. Kegs is a highly competitive packaging and container market. The organization's total long-term profitability is affected by this competition. Due to the intense rivalry, businesses primarily concentrate on increasing the number of product releases, campaigns, and marketing to attract consumers. So, this competition among the players will be a challenge for the market.

Companies that produce and supply comparable goods are more competitive with one another, which could threaten the market due to large supply and low demand.

Post-COVID-19 Impact on Asia-Pacific Kegs Market

Post-pandemic, the demand for kegs increased as there were no restrictions on movement, hence, the supply of products was easy. The persistence of COVID-19 for a longer period affected the supply chain as it got disrupted, and it became difficult to supply the food products to the consumers, initially increasing the demand for products. However, post-COVID-19, the demand for kegs increased significantly owing to good nutrient content and other nutritional availability.

Recent Developments

- In May 2021, Lumiere Technologies became BLEFA's new India partner. Lumiere Technologies is based in Bangalore. It is a subsidiary of the SpectraA Group. SpectraA is well-known in the Indian brewery industry because it provides breweries with a complete solution. Similarly, the company provides a comprehensive solution to distilleries, food & beverage establishments, soft drink plants, and other businesses.

Asia-Pacific Kegs Market Scope

The Asia-Pacific kegs market is segmented into four notable segments based on material, capacity, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Material

- Plastic

- Tin

- Stainless Steel

Based on material, the market is segmented into plastic, tin, and stainless steel.

Capacity

- Up To 20 Litre

- 20 Litre To 40 Litre

- 40 Litre To 60 Litre

- Above 60 Litre

Based on capacity, the market is segmented into up to 20 litre, 20 litre to 40 litre, 40 litre to 60 litre, and above 60 litre.

End User

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Cooking Oil

- Chemicals

- Others

Based on end user, the market is segmented into alcoholic beverages, non-alcoholic beverages, cooking oil, chemicals, and others.

Distribution Channel

- Supermarket/Hypermarket

- Commercial Liquor Store

- Others

Based on distribution channel, the market is segmented into supermarket/hypermarket, commercial liquor store, and others.

Asia-Pacific Kegs Market Regional Analysis/Insights

The Asia-Pacific kegs market is analyzed and market size insights and trends are provided by country, material, capacity, end user, and distribution channel as referenced above.

The countries covered in this market report are Japan, China, South Korea, India, Australia & New Zealand, Singapore, Thailand, Indonesia, Malaysia, Philippines, Taiwan, Hong Kong, and Rest of Asia-Pacific.

China is dominating the kegs market in Asia-Pacific region. Growing demand for beverages is the major reason for market growth in Asia-Pacific. Moreover, the beverages market is growing progressively in the Asia-Pacific region. The growth of this market will directly impact the growth of the kegs market. However, high cost of commercial kegs is likely to restrict the market growth.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and the challenges faced due to large or scarce competition from local and domestic brands, and the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Kegs Market Share Analysis

The Asia-Pacific kegs market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major players operating in the market are SHINHAN INDUSTRIAL CO,. LTD., BLEFA GmbH, and Petainer Ltd. among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC KEGS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MATERIAL LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.3 IMPORT-EXPORT ANALYSIS

4.4 LIST OF KEY BUYERS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7 RAW MATERIAL PRODUCTION COVERAGE

5 REGULATION COVERAGE

6 CLIMATE CHANGE SCENARIO

7 SUPPLY CHAIN ANALYSIS

7.1 RAW MATERIAL

7.2 SUPPLYING/MANUFACTURING

7.3 DISTRIBUTION

7.4 END-USERS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING TREND OF LONG-TERM PACKAGING AND PRESERVING SOLUTIONS

8.1.2 INCREASING CONSUMPTION OF BEVERAGES DUE TO CHANGE IN GRADUAL LIFESTYLE

8.1.3 GROWING APPLICATION OF KEGS IN CHEMICAL SECTORS

8.2 RESTRAINTS

8.2.1 HIGH COST ASSOCIATED WITH COMMERCIAL KEGS

8.2.2 SLOW REPLACEMENT OF KEGS DUE TO THEIR PROLONGED LIFESPAN

8.3 OPPORTUNITIES

8.3.1 INCREASED DEMAND FOR ECO-FRIENDLY KEGS AS A RESULT OF THE SUSTAINABILITY TREND

8.3.2 INCREASING ADVANCEMENTS IN TECHNOLOGIES IN KEGS SUCH AS CUTTING-EDGE TECHNOLOGY

8.4 CHALLENGES

8.4.1 WIDE FLUCTUATIONS IN PRICE OF RAW MATERIAL

8.4.2 GROWING STIFF COMPETITION AMONG PLAYERS

9 ASIA PACIFIC KEGS MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 STAINLESS STEEL

9.3 PLASTIC

9.4 TIN

10 ASIA PACIFIC KEGS MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 40 LITRE TO 60 LITRE

10.3 20 LITRE TO 40 LITRE

10.4 ABOVE 60 LITRE

10.5 UP TO 20 LITRE

11 ASIA PACIFIC KEGS MARKET, BY END USER

11.1 OVERVIEW

11.2 ALCOHOLIC BEVERAGES

11.2.1 BEER

11.2.2 WINE

11.2.3 SPIRITS

11.2.4 CIDER

11.3 NON-ALCOHOLIC BEVERAGES

11.3.1 SOFT-DRINKS

11.3.2 RTD-BEVERAGES

11.3.3 JUICES

11.3.4 OTHERS

11.4 CHEMICALS

11.5 COOKING OIL

11.6 OTHERS

12 ASIA PACIFIC KEGS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 COMMERCIAL LIQUOR STORE

12.3 SUPERMARKET / HYPERMARKET

12.4 OTHERS

13 ASIA PACIFIC KEGS MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 AUSTRALIA & NEW ZEALAND

13.1.3 JAPAN

13.1.4 INDIA

13.1.5 SOUTH KOREA

13.1.6 THAILAND

13.1.7 PHILIPPINES

13.1.8 SINGAPORE

13.1.9 MALAYSIA

13.1.10 TAIWAN

13.1.11 INDONESIA

13.1.12 HONG KONG

13.1.13 REST OF ASIA-PACIFIC

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 BLEFA GMBH

16.1.1 COMPANY SNAPSHOT

16.1.2 COMPANY SHARE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 PETAINER LTD.

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 JULIUS KLEEMANN GMBH & CO. KG

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 NDL KEG EUROPE

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 NEW MAISONNEUVE KEG

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 AMERICAN KEG COMPANY

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 KEYKEG

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 SCHAEFER CONTAINER SYSTEMS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 SHINHAN INDUSTRIAL CO,. LTD.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 SUPERMONTE GROUP ITALY, INC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 THE METAL DRUM COMPANY

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT OF KEGS, 2020-2021, IN USD MILLION

TABLE 2 EXPORT OF KEGS (CASKS, BARRELS, VATS, TUBS AND OTHER COOPERS' PRODUCTS PARTS THEREOF, OF WOOD, INCL. STAVES), 2020-2021, IN USD MILLION

TABLE 3 ASIA PACIFIC KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 5 ASIA PACIFIC STAINLESS STEEL IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC STAINLESS STEEL IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 7 ASIA PACIFIC PLASTIC IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC PLASTIC IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 9 ASIA PACIFIC TIN IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC TIN IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 11 ASIA PACIFIC KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 13 ASIA PACIFIC 40 LITRE TO 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC 40 LITRE TO 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 15 ASIA PACIFIC 20 LITRE TO 40 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC 20 LITRE TO 40 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 17 ASIA PACIFIC ABOVE 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ABOVE 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 19 ASIA PACIFIC UP TO 20 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC UP TO 20 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 21 ASIA PACIFIC KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 23 ASIA PACIFIC ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 25 ASIA PACIFIC ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 27 ASIA PACIFIC NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 29 ASIA PACIFIC NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 31 ASIA PACIFIC CHEMICALS IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC CHEMICALS IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 33 ASIA PACIFIC COOKING OIL IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC COOKING OIL IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 35 ASIA PACIFIC OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 37 ASIA PACIFIC KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 39 ASIA PACIFIC COMMERCIAL LIQUOR STORE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC COMMERCIAL LIQUOR STORE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 41 ASIA PACIFIC SUPERMARKET / HYPERMARKET IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC SUPERMARKET / HYPERMARKET IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 43 ASIA PACIFIC OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 45 ASIA-PACIFIC KEGS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC KEGS MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 47 ASIA-PACIFIC KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 49 ASIA-PACIFIC KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 51 ASIA-PACIFIC KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 53 ASIA-PACIFIC ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 55 ASIA-PACIFIC NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 57 ASIA-PACIFIC KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 59 CHINA KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 60 CHINA KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 61 CHINA KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 62 CHINA KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 63 CHINA KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 CHINA KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 65 CHINA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 CHINA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 67 CHINA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 CHINA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 69 CHINA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 CHINA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 71 AUSTRALIA & NEW ZEALAND KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 72 AUSTRALIA & NEW ZEALAND KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 73 AUSTRALIA & NEW ZEALAND KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 74 AUSTRALIA & NEW ZEALAND KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 75 AUSTRALIA & NEW ZEALAND KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 76 AUSTRALIA & NEW ZEALAND KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 77 AUSTRALIA & NEW ZEALAND ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 AUSTRALIA & NEW ZEALAND ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 79 AUSTRALIA & NEW ZEALAND NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 AUSTRALIA & NEW ZEALAND NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 81 AUSTRALIA & NEW ZEALAND KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 AUSTRALIA & NEW ZEALAND KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 83 JAPAN KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 84 JAPAN KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 85 JAPAN KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 86 JAPAN KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 87 JAPAN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 88 JAPAN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 89 JAPAN ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 JAPAN ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 91 JAPAN NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 JAPAN NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 93 JAPAN KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 JAPAN KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 95 INDIA KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 96 INDIA KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 97 INDIA KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 98 INDIA KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 99 INDIA KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 INDIA KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 101 INDIA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 INDIA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 103 INDIA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 INDIA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 105 INDIA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 106 INDIA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 107 SOUTH KOREA KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 108 SOUTH KOREA KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 109 SOUTH KOREA KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 110 SOUTH KOREA KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 111 SOUTH KOREA KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 112 SOUTH KOREA KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 113 SOUTH KOREA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 114 SOUTH KOREA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 115 SOUTH KOREA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 116 SOUTH KOREA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 117 SOUTH KOREA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 118 SOUTH KOREA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 119 THAILAND KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 120 THAILAND KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 121 THAILAND KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 122 THAILAND KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 123 THAILAND KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 124 THAILAND KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 125 THAILAND ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 126 THAILAND ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 127 THAILAND NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 128 THAILAND NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 129 THAILAND KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 THAILAND KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 131 PHILIPPINES KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 132 PHILIPPINES KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 133 PHILIPPINES KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 134 PHILIPPINES KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 135 PHILIPPINES KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 136 PHILIPPINES KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 137 PHILIPPINES ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 PHILIPPINES ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 139 PHILIPPINES NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 PHILIPPINES NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 141 PHILIPPINES KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 PHILIPPINES KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 143 SINGAPORE KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 144 SINGAPORE KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 145 SINGAPORE KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 146 SINGAPORE KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 147 SINGAPORE KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 148 SINGAPORE KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 149 SINGAPORE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 150 SINGAPORE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 151 SINGAPORE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 152 SINGAPORE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 153 SINGAPORE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 154 SINGAPORE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 155 MALAYSIA KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 156 MALAYSIA KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 157 MALAYSIA KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 158 MALAYSIA KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 159 MALAYSIA KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 MALAYSIA KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 161 MALAYSIA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 162 MALAYSIA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 163 MALAYSIA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 164 MALAYSIA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 165 MALAYSIA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 166 MALAYSIA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 167 TAIWAN KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 168 TAIWAN KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 169 TAIWAN KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 170 TAIWAN KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 171 TAIWAN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 TAIWAN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 173 TAIWAN ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 174 TAIWAN ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 175 TAIWAN NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 176 TAIWAN NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 177 TAIWAN KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 178 TAIWAN KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 179 INDONESIA KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 180 INDONESIA KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 181 INDONESIA KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 182 INDONESIA KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 183 INDONESIA KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 184 INDONESIA KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 185 INDONESIA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 186 INDONESIA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 187 INDONESIA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 188 INDONESIA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 189 INDONESIA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 190 INDONESIA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 191 HONG KONG KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 192 HONG KONG KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 193 HONG KONG KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 194 HONG KONG KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 195 HONG KONG KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 196 HONG KONG KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 197 HONG KONG ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 198 HONG KONG ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 199 HONG KONG NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 200 HONG KONG NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 201 HONG KONG KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 202 HONG KONG KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 203 REST OF ASIA-PACIFIC KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC KEGS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC KEGS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC KEGS MARKET : DROC ANALYSIS

FIGURE 4 ASIA PACIFIC KEGS MARKET: ASIA PACIFIC VS REGIONAL ANALYSIS

FIGURE 5 ASIA PACIFIC KEGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC KEGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC KEGS MARKET: DBMR POSITION GRID

FIGURE 8 ASIA PACIFIC KEGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC KEGS MARKET: SEGMENTATION

FIGURE 10 RISING TREND OF LONG-TERM PAKAGING&PRESERVING SOLUTIONS IS EXPECTED TO DRIVE THE ASIA PACIFIC KEGS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 STAINLESS STEEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC KEGS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SUPPLY CHAIN OF ASIA PACIFIC KEGS MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA PACIFIC KEGS MARKET

FIGURE 14 ASIA PACIFIC KEGS MARKET, BY MATERIAL, 2021

FIGURE 15 ASIA PACIFIC KEGS MARKET, BY CAPACITY, 2021

FIGURE 16 ASIA PACIFIC KEGS MARKET, BY END USER, 2021

FIGURE 17 ASIA PACIFIC KEGS MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 18 ASIA-PACIFIC KEGS MARKET: SNAPSHOT (2021)

FIGURE 19 ASIA-PACIFIC KEGS MARKET: BY COUNTRY (2021)

FIGURE 20 ASIA-PACIFIC KEGS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 ASIA-PACIFIC KEGS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 ASIA-PACIFIC KEGS MARKET: BY MATERIAL (2022-2029)

FIGURE 23 ASIA PACIFIC KEGS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.