Marché du sucre industriel en Asie-Pacifique, par type (sucre blanc, sucre liquide, sucre brun et sucre glace), source (canne et betterave), forme (granulé, sirop et poudre), type d'emballage (sacs, sachets, boîtes, sacs fourre-tout et autres), application (aliments et boissons, produits pharmaceutiques, compléments alimentaires et autres), canal de distribution (direct et indirect) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché du sucre industriel en Asie-Pacifique

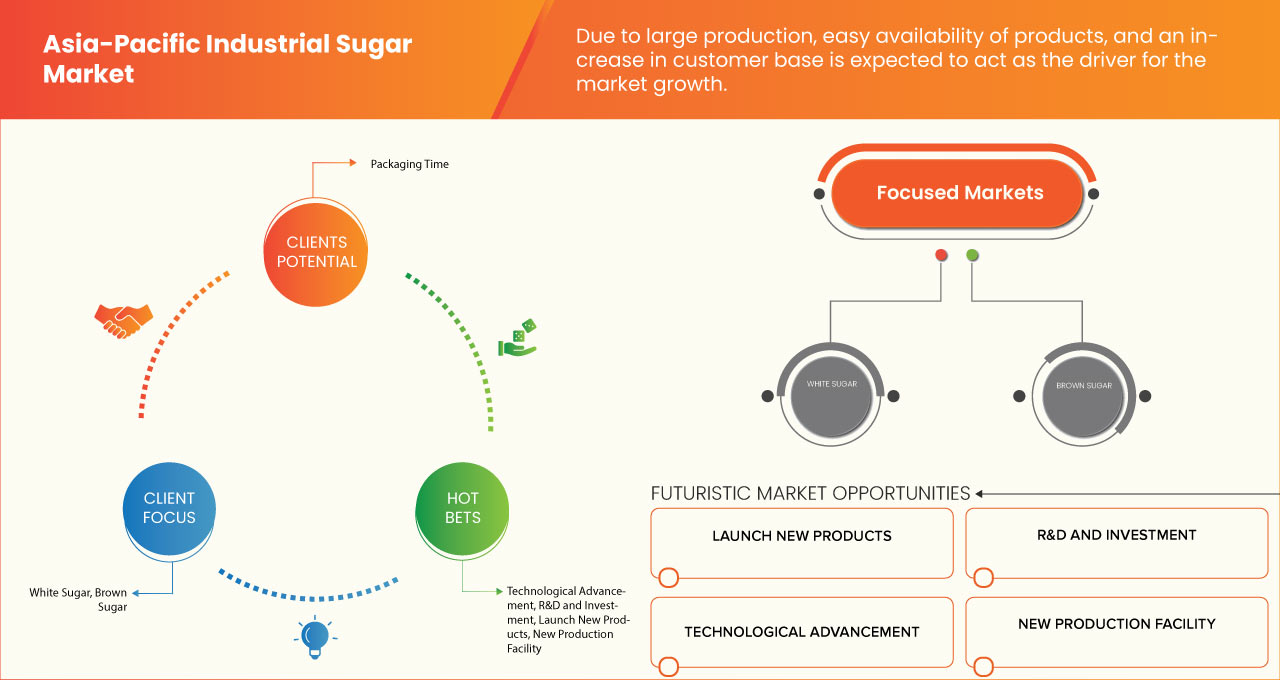

Le marché du sucre industriel de la région Asie-Pacifique est stimulé par l'utilisation croissante du sucre industriel dans les boissons à travers le monde ainsi que par l'expansion de l'industrie de transformation des aliments. En outre, la croissance rapide du secteur de la confiserie devrait alimenter la croissance du marché. En outre, l'adoption croissante de l'utilisation de biocarburants pour la production de sucre ouvrira davantage de potentiel commercial pour le marché du sucre industriel au cours de la période de prévision 2023-2030.

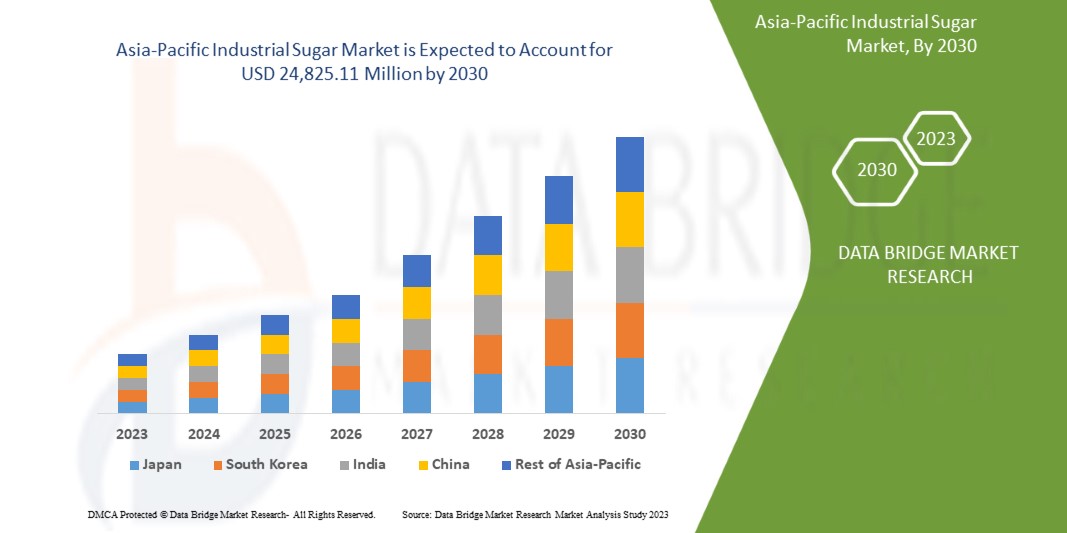

Data Bridge Market Research analyse que le marché du sucre industriel en Asie-Pacifique devrait atteindre la valeur de 24 825,11 millions USD d'ici 2030, à un TCAC de 3,6 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisé pour 2015-2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type (sucre blanc, sucre liquide, sucre roux et sucre glace), source (canne et betterave), forme (granulé, sirop et poudre), type d'emballage (sacs, sachets, boîtes, sacs fourre-tout et autres), application (aliments et boissons, produits pharmaceutiques, compléments alimentaires et autres), canal de distribution (direct et indirect) |

|

Pays couverts |

Inde, Chine, Thaïlande, Australie et Nouvelle-Zélande, Indonésie, Vietnam, Philippines, Malaisie, Japon, Corée du Sud, Singapour, Taïwan et reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Südzucker AG, Mitr Phol Group, Associated British Foods plc, Bajaj Hindusthan Sugar Ltd., Balrampur Chini Mills Limited, Shree Renuka Sugars Ltd, RANA GROUP, Rajshree Sugars & Chemicals Limited (RSCL), Ragus Sugars Manufacturing Ltd. et Upper Ganges Sugar & Industries Limited, entre autres |

Définition du marché

Le sucre industriel, également appelé sucre en vrac ou sucre commercial, est utilisé dans de nombreux secteurs et détient une part de marché importante. Ce sucre hautement raffiné est principalement utilisé à des fins industrielles plutôt que pour la consommation directe. Ses propriétés polyvalentes et sa large gamme d'applications en font un ingrédient essentiel dans de nombreuses industries, alimentant un marché du sucre industriel florissant.

L'industrie agroalimentaire est une des principales applications du sucre industriel. Il s'agit d'un ingrédient essentiel dans la fabrication d'aliments transformés, de confiseries, de boissons et de produits de boulangerie. La douceur, la texture et les propriétés conservatrices du sucre industriel améliorent le goût et la qualité globale de ces produits, ce qui les rend indispensables aux fabricants. Sa capacité à fonctionner comme agent de charge, stabilisateur et exhausteur de goût contribue également à son utilisation généralisée dans l'industrie alimentaire.

Dynamique du marché du sucre industriel en Asie-Pacifique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de la consommation de nourriture et de boissons

La consommation de boissons sucrées a augmenté en raison de l'urbanisation rapide, qui a augmenté la consommation mondiale d'aliments et de boissons. Bien que le sucre raffiné puisse être accepté dans le cadre d'une alimentation saine, les boissons sucrées sont largement annoncées, peu coûteuses et largement disponibles. Elles comprennent les boissons gazeuses, les boissons énergisantes , les boissons pour sportifs et l'eau minérale aromatisée. De plus, la taille standard des portions est passée de 375 ml à 600 ml, ce qui a augmenté la quantité de sucre industriel à mesure que la consommation de boissons a augmenté au cours de la période de prévision.

En outre, le marché mondial du sucre industriel a connu une croissance significative ces dernières années, principalement en raison de l'utilisation accrue de sucre industriel dans l'industrie des boissons. Le sucre industriel, dérivé de la canne à sucre ou de la betterave sucrière, est utilisé pour sucrer une variété de boissons, notamment les boissons gazeuses, les boissons énergisantes, les jus de fruits et les boissons prêtes à boire . Cependant, les économies émergentes, telles que la Chine, l'Inde et le Brésil, ont connu une forte augmentation de la consommation de boissons en raison de facteurs tels que l'augmentation des revenus disponibles et l'urbanisation. À mesure que ces marchés se développent, l'utilisation de sucre industriel dans les boissons augmente également pour répondre à la demande croissante des consommateurs. Ainsi, la consommation croissante d'aliments et de boissons devrait stimuler la croissance du marché.

- Adoption croissante des biocarburants pour la production de sucre industriel

L’utilisation de biocarburants dans le processus de fabrication connaît actuellement une évolution significative sur le marché. Les biocarburants constituent une alternative durable aux carburants fossiles car ils sont fabriqués à partir de ressources renouvelables telles que la bagasse de canne à sucre et la pulpe de betterave. L’expansion des industries de transformation des aliments, de confiserie et de boissons entraîne une augmentation de la demande de sucre industriel. Traditionnellement, les machines et équipements utilisés dans la production de sucre étaient alimentés par des combustibles fossiles. Mais l’industrie s’oriente vers l’utilisation de biocarburants à mesure que la durabilité et la réduction des émissions de carbone deviennent plus importantes.

Le mouvement mondial en faveur de la durabilité environnementale s’inscrit dans la lignée de l’adoption croissante des biocarburants. Les biocarburants sont considérés comme des sources d’énergie renouvelables car ils sont fabriqués à partir de biomasse, qui est constamment renouvelable. Le secteur sucrier industriel peut contribuer à réduire les émissions de gaz à effet de serre et à prévenir le changement climatique en réduisant sa dépendance aux combustibles fossiles. Pour atteindre leurs objectifs de durabilité, les gouvernements et les organismes dirigeants du monde entier encouragent l’utilisation des biocarburants. De nombreux pays ont mis en place des politiques de soutien pour promouvoir l’utilisation des biocarburants, notamment des objectifs en matière d’énergie renouvelable, des allègements fiscaux et des subventions. Grâce à ces initiatives, les producteurs de sucre industriel peuvent passer à des opérations alimentées par des biocarburants.

Par conséquent, on s’attend à ce que l’utilisation accrue de biocarburants dans la production de sucre industriel stimule la croissance du marché.

Opportunité

- Demande croissante d'édulcorants naturels et biologiques

L'industrie mondiale du sucre industriel connaît une croissance considérable en raison des progrès technologiques dans le traitement du sucre. La transformation du sucre repose traditionnellement sur des méthodes conventionnelles telles que le broyage, la purification et la cristallisation. Cependant, les progrès technologiques ont révolutionné l'industrie, en introduisant de nouvelles techniques et de nouveaux équipements qui rationalisent la production, optimisent l'utilisation des ressources et améliorent la qualité des produits. Ces avancées remodèlent le marché mondial du sucre industriel et créent des opportunités pour les fabricants de rester compétitifs dans un paysage en évolution rapide.

La demande d'une plus grande efficacité et de coûts réduits est l'une des principales forces à l'origine des développements technologiques dans l'industrie de transformation du sucre. Les fabricants peuvent optimiser les opérations, réduire les déchets et augmenter la productivité grâce à des systèmes d'automatisation sophistiqués, des contrôles informatisés et des analyses de données. Ces développements aident les producteurs de sucre à réduire les coûts de production et à augmenter la rentabilité. Les producteurs de sucre peuvent améliorer la qualité de leurs produits et se démarquer de leurs concurrents grâce aux améliorations technologiques. Les méthodes de traitement modernes, telles que les séparateurs centrifuges et les systèmes de bacs à vide continus, offrent un meilleur contrôle des variables telles que la taille des cristaux, la couleur et la teneur en humidité. Les fabricants sont en mesure de produire du sucre de haute qualité avec des qualités constantes pour satisfaire les demandes de nombreuses industries et les préférences des consommateurs.

Par conséquent, les principaux acteurs du marché explorent les opportunités de développer des avancées dans les technologies de production et de lancer de nouveaux produits innovants, offrant ainsi une large opportunité de croissance du marché.

Retenue/Défi

- Disponibilité de substituts et d'alternatives

Le marché mondial du sucre industriel adopte de plus en plus de substituts et d’alternatives. Cette évolution est motivée par divers facteurs, notamment l’évolution des préférences des consommateurs, les préoccupations en matière de santé, les préoccupations en matière de durabilité et les changements réglementaires. La canne à sucre et la betterave sucrière ont traditionnellement été les principales sources de sucre sur le marché du sucre industriel. Cependant, l’évolution de la dynamique du marché et des demandes des consommateurs a incité à explorer et à utiliser des substituts et des alternatives au sucre industriel traditionnel.

La reproduction de la saveur et de la texture du sucre traditionnel est l’un des principaux facteurs à prendre en compte lors de l’adoption de substituts et d’alternatives au sucre industriel. Il est difficile de fournir des substituts avec le même niveau de satisfaction, car les consommateurs ont développé une forte préférence pour les qualités sensorielles offertes par le sucre. Dans de nombreux cas, les substituts ont un profil de saveur différent et peuvent ne pas avoir la douceur ou la sensation en bouche souhaitées. L’adoption généralisée de substituts peut se heurter à des obstacles en raison des préférences et des attentes des consommateurs en matière de goût, de qualité et de familiarité.

Les édulcorants naturels tels que la stevia , l'extrait de fruit du moine et le sirop d'agave sont devenus populaires comme substituts du sucre. Ces édulcorants sont perçus comme des alternatives plus saines et plus naturelles, attrayantes pour les consommateurs à la recherche de produits aux étiquettes propres. Les fabricants intègrent ces édulcorants naturels dans leurs formulations pour répondre à la demande des consommateurs. Le sucralose , l'aspartame et la saccharine sont utilisés depuis longtemps comme substituts du sucre . Cependant, les inquiétudes des consommateurs concernant les risques potentiels pour la santé associés à ces édulcorants ont conduit à une surveillance et une prudence accrues. Les fabricants doivent répondre à ces préoccupations et garantir la sécurité et l'efficacité des édulcorants artificiels pour maintenir la confiance des consommateurs.

Développement récent

- En mai 2023, le groupe Mitr Phol a annoncé le lancement d'un nouveau matériau d'emballage durable et respectueux de l'environnement. Ils ont commencé à transformer l'emballage des produits à base de sucre en matériau durable en raison des préoccupations croissantes des consommateurs. Ce développement aidera l'entreprise à attirer une large base de consommateurs.

Portée du marché du sucre industriel en Asie-Pacifique

Le marché du sucre industriel de la région Asie-Pacifique est segmenté en six segments notables en fonction du type, de la source, de la forme, du type d'emballage, de l'application et du canal de distribution. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Sucre blanc

- Sucre liquide

- Sucre roux

- Sucre glace

Sur la base du type, le marché est segmenté en sucre blanc, sucre liquide, sucre brun et sucre glace.

Source

- Canne

- Betterave

Sur la base de la source, le marché est segmenté en canne et en betterave.

Formulaire

- Granulé

- Sirop

- En poudre

Sur la base de la forme, le marché est segmenté en granulés, sirop et poudre.

Type d'emballage

- Sacs

- Sac

- Boîte

- Sacs fourre-tout

- Autres

Sur la base du type d’emballage, le marché est segmenté en sacs, sacs, boîtes, sacs fourre-tout et autres.

Application

- Alimentation et boissons

- Pharmaceutique

- Compléments alimentaires

- Autres

Sur la base des applications, le marché du sucre industriel de la région Asie-Pacifique est segmenté en aliments et boissons, produits pharmaceutiques, compléments alimentaires et autres.

Canal de distribution

- Direct

- Indirect

Sur la base du canal de distribution, le marché du sucre industriel de la région Asie-Pacifique est segmenté en direct et indirect.

Analyse/perspectives régionales du marché du sucre industriel en Asie-Pacifique

Le marché du sucre industriel en Asie-Pacifique est analysé et des informations sur la taille du marché et les tendances sont fournies par type, source, forme, type d'emballage, application et canal de distribution, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché du sucre industriel en Asie-Pacifique sont l’Inde, la Chine, la Thaïlande, l’Australie et la Nouvelle-Zélande, l’Indonésie, le Vietnam, les Philippines, la Malaisie, le Japon, la Corée du Sud, Singapour, Taïwan et le reste de l’Asie-Pacifique.

L’Inde devrait dominer le marché en raison de sa production importante, de la disponibilité facile des produits et de l’augmentation de sa clientèle.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du sucre industriel en Asie-Pacifique

Le paysage concurrentiel du marché du sucre industriel en Asie-Pacifique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence régionale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché.

Certains des principaux acteurs opérant sur le marché du sucre industriel en Asie-Pacifique sont Südzucker AG, Mitr Phol Group, Associated British Foods plc, Bajaj Hindusthan Sugar Ltd., Balrampur Chini Mills Limited, Shree Renuka Sugars Ltd, RANA GROUP, Rajshree Sugars & Chemicals Limited (RSCL), Ragus Sugars Manufacturing Ltd. et Upper Ganges Sugar & Industries Limited, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC INDUSTRIAL SUGAR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELLING

2.9 TYPE LIFELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING FOOD AND BEVERAGES CONSUMPTION

5.1.2 EXPANSION OF THE FOOD PROCESSING INDUSTRY

5.1.3 GROWTH IN THE CONFECTIONERY SECTOR

5.1.4 INCREASING ADOPTION OF BIO-FUEL FOR THE PRODUCTION OF INDUSTRIAL SUGAR

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF SUBSTITUTES AND ALTERNATIVES

5.2.2 ENVIRONMENTAL CONCERNS ASSOCIATED WITH SUGAR PRODUCTION

5.2.3 WATER SCARCITY AND LAND MANAGEMENT ISSUES

5.3 OPPORTUNITIES

5.3.1 INCREASING DEMAND FOR NATURAL AND ORGANIC SWEETENERS

5.3.2 TECHNOLOGICAL ADVANCEMENTS IN INDUSTRIAL SUGAR PROCESSING

5.3.3 INTERNATIONAL TRADE EXPANSION

5.4 CHALLENGES

5.4.1 HEALTH CONCERNS RELATED TO INDUSTRIAL SUGAR CONSUMPTION

5.4.2 REGULATIONS ON INDUSTRIAL SUGAR PRODUCTION

5.4.3 FLUCTUATING RAW MATERIAL PRICES

6 ASIA PACIFIC INDUSTRIAL SUGAR MARKET, BY REGION

6.1 ASIA-PACIFIC

7 COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

8 SWOT ANALYSIS

9 COMPANY PROFILE

9.1 SÜDZUCKER AG

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT DEVELOPMENT

9.2 MITR PHOL GROUP

9.2.1 COMPANY SNAPSHOT

9.2.2 PRODUCT PORTFOLIO

9.2.3 RECENT DEVELOPMENT

9.3 ASSOCIATED BRITISH FOODS PLC

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENT

9.4 BAJAJ HINDUSTHAN SUGAR LTD. (2022)

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENT

9.5 BALRAMPUR CHINI MILLS LIMITED

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 RECENT DEVELOPMENT

9.6 RAGUS SUGARS MANUFACTURING LTD.

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENT

9.7 RAJSHREE SUGARS & CHEMICALS LIMITED (RSCL) (2022)

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 PRODUCT PORTFOLIO

9.7.4 RECENT DEVELOPMENT

9.8 RANA GROUP (2022)

9.8.1 COMPANY SNAPSHOT

9.8.2 REVENUE ANALYSIS

9.8.3 PRODUCT PORTFOLIO

9.8.4 RECENT DEVELOPMENT

9.9 SHREE RENUKA SUGARS LTD (2022)

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENT

9.1 UPPER GANGES SUGAR & INDUSTRIES LTD. (UGSIL)

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

Liste des figures

FIGURE 1 ASIA-PACIFIC INDUSTRIAL SUGAR MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC INDUSTRIAL SUGAR MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC INDUSTRIAL SUGAR MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC INDUSTRIAL SUGAR MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC INDUSTRIAL SUGAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC INDUSTRIAL SUGAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC INDUSTRIAL SUGAR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC INDUSTRIAL SUGAR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 ASIA-PACIFIC INDUSTRIAL SUGAR MARKET: SEGMENTATION

FIGURE 10 INCREASING ADOPTION OF BIO-FUEL FOR PRODUCTION OF SUGAR IS DRIVING THE GROWTH OF ASIA-PACIFIC INDUSTRIAL SUGAR MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 WHITE SUGAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC INDUSTRIAL SUGAR MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC INDUSTRIAL SUGAR MARKET

FIGURE 13 ASIA-PACIFIC INDUSTRIAL SUGAR MARKET: SNAPSHOT (2022)

FIGURE 14 ASIA-PACIFIC INDUSTRIAL SUGAR MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.