Marché des cellules souches pluripotentes induites (iPSC) en Asie-Pacifique, par source cellulaire (cellules cutanées et cellules sanguines), type (IPSC humaines et IPSC de souris), produit (instruments, consommables et kits et services), applications (recherche universitaire, médecine régénérative, thérapie cellulaire, criblage toxicologique, découverte et développement de médicaments, modélisation des maladies, banque de cellules souches, bio-impression 3D et autres), utilisateur final (sociétés de biotechnologie et pharmaceutiques, laboratoires de recherche, laboratoires de diagnostic et autres), canal de distribution (appel d'offres direct et vente au détail), pays (Japon, Chine, Corée du Sud, Inde, Australie, Singapour, Thaïlande, Malaisie, Indonésie, Philippines et reste de l'Asie-Pacifique) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché : marché des cellules souches pluripotentes induites (iPSC) en Asie-Pacifique

Analyse et perspectives du marché : marché des cellules souches pluripotentes induites (iPSC) en Asie-Pacifique

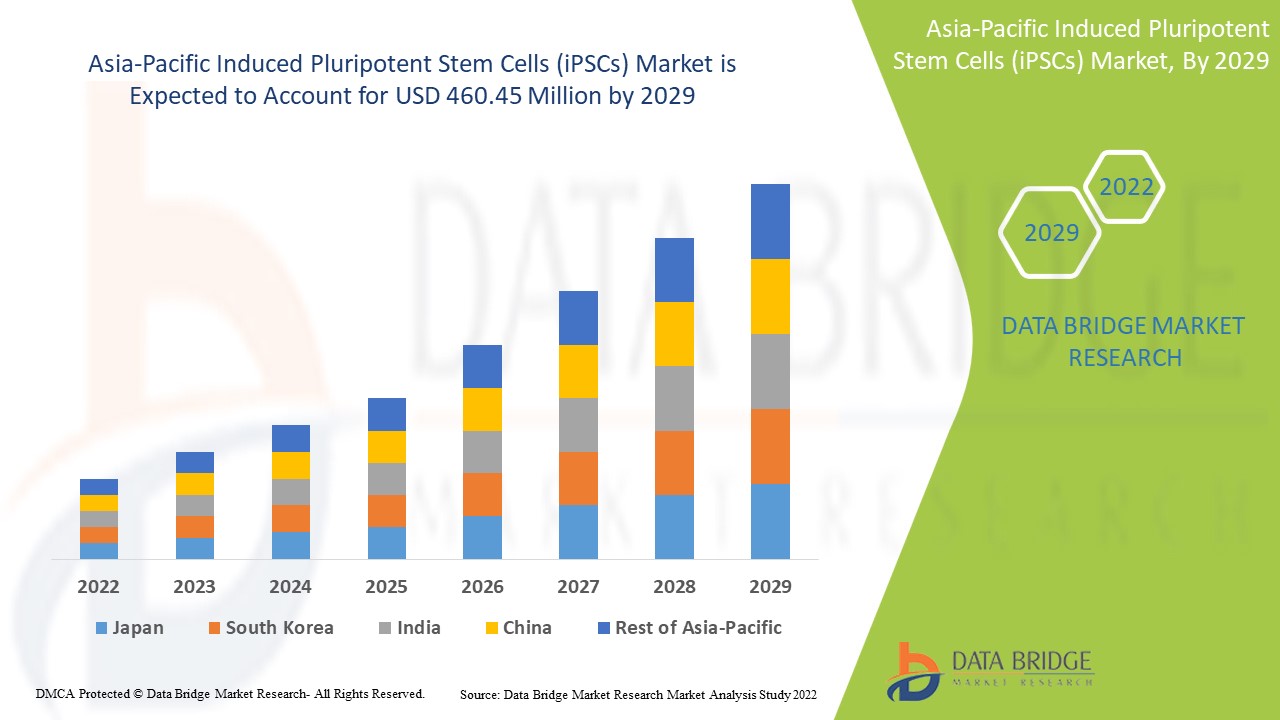

Le marché des cellules souches pluripotentes induites (iPSC) de la région Asie-Pacifique devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 12,2 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 460,45 millions USD d'ici 2029. L'augmentation des activités de recherche sur les thérapies par cellules souches agit comme moteur de la croissance du marché des cellules souches pluripotentes induites (iPSC).

Les cellules souches pluripotentes induites sont un type de cellules dérivées des tissus somatiques adultes et reprogrammées avec un ensemble de gènes et de facteurs pour obtenir une nature pluripotente. Certains gènes et éléments sont ajoutés pour obtenir des propriétés définies des cellules souches embryonnaires . Les cellules pluripotentes induites étant presque identiques au donneur de cellules, elles aident à la modélisation des maladies. Les rétrovirus sont couramment utilisés comme vecteurs pour reprogrammer les cellules souches pluripotentes induites. Les principales applications des cellules souches pluripotentes induites sont la modélisation des maladies, la découverte et le développement de médicaments, les études de toxicité et les thérapies géniques. Elles sont largement utilisées dans les traitements des maladies cardiovasculaires , du diabète sucré et de divers types de cancer. Les cellules souches pluripotentes induites humaines présentent les propriétés pertinentes de la maladie car elles portent le génotype spécifique de la maladie, ce qui permet de nouvelles options thérapeutiques adaptées au patient.

L’adoption croissante de la thérapie par cellules souches, la croissance du secteur des biotechnologies grâce à de meilleurs investissements et la prévalence croissante des maladies chroniques sont les moteurs du marché des cellules souches pluripotentes induites (iPSC). Les autres facteurs qui devraient propulser la croissance du marché des cellules souches pluripotentes induites (iPSC) en Asie-Pacifique comprennent la large gamme d’applications cliniques des cellules souches pluripotentes induites et les avancées technologiques émergentes des iPSC.

Cependant, des facteurs tels que le coût élevé associé aux thérapies à base de cellules souches et la disponibilité d'alternatives pour le traitement des tumeurs freinent la croissance du marché des cellules souches pluripotentes induites (iPSC) en Asie-Pacifique. D'autre part, le nombre croissant de produits en cours de développement, l'intérêt accru pour la médecine personnalisée et l'augmentation des dépenses de santé constituent une opportunité pour la croissance du marché des cellules souches pluripotentes induites (iPSC) en Asie-Pacifique. Les règles et réglementations strictes et l'instabilité génomique des IPSC constituent le principal défi du marché des cellules souches pluripotentes induites (iPSC) en Asie-Pacifique.

Le rapport sur le marché des cellules souches pluripotentes induites (iPSC) fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché des cellules souches pluripotentes induites (iPSC), contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des cellules souches pluripotentes induites (iPSC)

Portée et taille du marché des cellules souches pluripotentes induites (iPSC)

Le marché des cellules souches pluripotentes induites (iPSC) est segmenté en fonction de la source cellulaire, du type, du produit, des applications, des utilisateurs finaux et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence dans vos marchés cibles.

Le marché des cellules souches pluripotentes induites (iPSC) d'Asie-Pacifique est classé en six segments notables en fonction de la source cellulaire, du type, du produit, des applications, des utilisateurs finaux et du canal de distribution.

- En fonction de la source cellulaire, le marché des cellules souches pluripotentes induites (iPSC) de la région Asie-Pacifique est segmenté en cellules cutanées et en cellules sanguines. En 2022, le segment des cellules cutanées devrait dominer le marché en raison de la disponibilité facile des cellules cutanées.

- Sur la base du type, le marché des cellules souches pluripotentes induites (iPSC) de la région Asie-Pacifique est segmenté en IPSC humaines et en IPSC murines. En 2022, le segment des IPSC humaines devrait dominer le marché car elles sont principalement utilisées pour des applications thérapeutiques

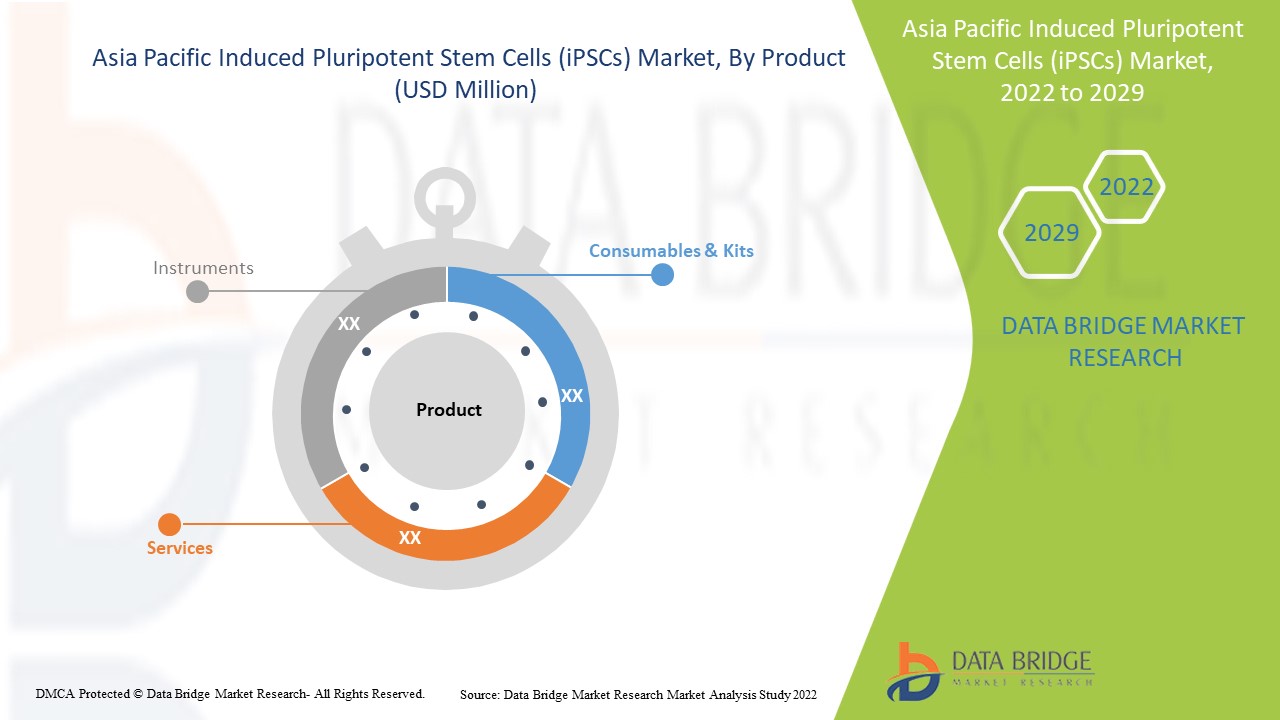

- Sur la base du produit, le marché des cellules souches pluripotentes induites (iPSC) de la région Asie-Pacifique est segmenté en instruments, consommables et kits et services. En 2022, le segment des consommables et des kits devrait dominer le marché car ils sont utilisés dans les tests de toxicité et les découvertes de médicaments.

- En fonction des applications, le marché des cellules souches pluripotentes induites (iPSC) de la région Asie-Pacifique est segmenté en recherche universitaire, médecine régénérative, thérapie cellulaire, dépistage toxicologique, découverte et développement de médicaments, modélisation de maladies, banque de cellules souches, bio-impression 3D, etc. En 2022, le segment de la découverte et du développement de médicaments devrait dominer le marché, car les cellules souches suscitent de plus en plus d'intérêt pour les inventions de nouveaux médicaments.

- Sur la base des utilisateurs finaux, le marché des cellules souches pluripotentes induites (iPSC) de la région Asie-Pacifique est segmenté en sociétés de biotechnologie et pharmaceutiques, laboratoires de recherche, laboratoires de diagnostic et autres. En 2022, le segment des sociétés de biotechnologie et pharmaceutiques devrait dominer le marché en raison des investissements importants des entreprises pour agrandir leurs installations.

- Sur la base du canal de distribution, le marché des cellules souches pluripotentes induites (iPSC) de la région Asie-Pacifique est segmenté en ventes directes et ventes au détail. En 2022, le segment des ventes directes devrait dominer le marché car il fournit des produits de haute qualité.

Analyse du marché des cellules souches pluripotentes induites (iPSC) au niveau des pays

Le marché des cellules souches pluripotentes induites (iPSC) est analysé et des informations sur la taille du marché sont fournies par pays, source de cellules, type, produit, applications, utilisateurs finaux et canal de distribution comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des cellules souches pluripotentes induites (iPSC) sont la Chine, la Corée du Sud, le Japon, l’Inde, l’Australie, Singapour, la Malaisie, l’Indonésie, la Thaïlande, les Philippines et le reste de l’Asie-Pacifique.

Le segment des consommables et des kits en Chine dans la région Asie-Pacifique devrait connaître le taux de croissance le plus élevé au cours de la période de prévision de 2022 à 2029 en raison de l'utilisation croissante de la technologie des cellules souches. Le segment des consommables et des kits au Japon est le deuxième à dominer le marché en raison de l'augmentation des cas de maladies chroniques et de l'adoption élevée de sources de cellules souches pour de meilleures thérapies. L'Inde est le troisième leader de la croissance du marché Asie-Pacifique, et le segment des consommables et des kits domine dans ce pays en raison du nombre croissant de centres de biotechnologie et d'activités de recherche.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Les activités stratégiques croissantes des principaux acteurs du marché pour accroître la sensibilisation au traitement par cellules souches pluripotentes induites (iPSC) stimulent la croissance du marché des cellules souches pluripotentes induites (iPSC).

Le marché des cellules souches pluripotentes induites (iPSC) vous fournit également une analyse de marché détaillée pour la croissance de chaque pays sur un marché particulier. En outre, il fournit des informations détaillées sur la stratégie des acteurs du marché et leur présence géographique. Les données sont disponibles pour la période historique de 2011 à 2020.

Analyse du paysage concurrentiel et des parts de marché des cellules souches pluripotentes induites (iPSC)

Le paysage concurrentiel du marché des cellules souches pluripotentes induites (iPSC) fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise liée au marché des cellules souches pluripotentes induites (iPSC).

Les principales entreprises qui commercialisent des cellules souches pluripotentes induites (iPSC) sont Thermo Fisher Scientific Inc., FUJIFILM Corporation, Hopstem Biotechnology LLC., Takara Bio Inc., Lonza., R & D Systems, Inc., Charles River Laboratories International, Inc., Corning Incorporated, REPROCELL Inc., Merck KGaA et d'autres acteurs nationaux. Les analystes de DBMR comprennent les atouts concurrentiels et fournissent une analyse concurrentielle pour chaque concurrent séparément.

De nombreux contrats et accords sont également initiés par des entreprises du monde entier qui accélèrent également le marché des cellules souches pluripotentes induites (iPSC).

Par exemple,

- En février 2021, Thermo Fisher Scientific Inc. a annoncé avoir remporté six prix lors des CMO Leadership Awards annuels. Ces prix, décernés par Life Science Leader et Outsourced Pharma, récompensent les meilleurs partenaires de fabrication sous contrat évalués par les sociétés biopharmaceutiques et biotechnologiques. On estime que cette reconnaissance devrait renforcer la présence de l'entreprise sur le marché de l'Asie-Pacifique et entraîner une augmentation de la croissance de l'entreprise dans les années à venir.

- En juin 2020, LumaCyte a collaboré avec Catalent, fournisseur de technologies avancées d'administration, de développement et de solutions de fabrication pour les médicaments, les produits biologiques, les thérapies cellulaires et géniques et les produits de santé grand public en Asie-Pacifique. Cette collaboration a contribué à étendre le produit de technologie de cellules souches Radiance de la société et son application.

La collaboration, le lancement de produits, l'expansion commerciale, les récompenses et la reconnaissance, les coentreprises et d'autres stratégies des acteurs du marché renforcent l'empreinte de l'entreprise sur le marché des pompes à perfusion vétérinaires, ce qui offre également l'avantage de la croissance des bénéfices de l'organisation.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CELL SOURCE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 ASIA PACIFIC MEDICAL CARTS MARKET: REGULATIONS

5.1 REGULATION IN U.S.

5.2 REGULATION IN CANADA

5.3 REGULATION IN EUROPE

5.4 REGULATION IN INDIA

5.5 REGUALTION IN JAPAN

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 WIDE RANGE OF CLINICAL APPLICATION OF INDUCED PLURIPOTENT STEM CELLS

6.1.2 EMERGING TECHNOLOGICAL ADVANTAGES OF IPSCS

6.1.3 RISING PREVALENCE OF SEVERAL CHRONIC DISEASES

6.1.4 INCREASING ADOPTION OF STEM CELL THERAPY

6.1.5 GROWING BIOTECHNOLOGY SECTOR WITH BETTER INVESTMENT

6.2 RESTRAINT

6.2.1 HIGH COST ASSOCIATED WITH STEM CELL THERAPIES AND LARGE-SCALE APPLICATIONS OF IPSCS

6.2.2 AVAILABILITY OF ALTERNATIVES FOR TUMOR TREATMENT

6.2.3 ADVERSE EFFECTS OF STEM CELL TRANSPLANTS

6.3 OPPORTUNITIES

6.3.1 INCREASING NUMBER OF PIPELINE PRODUCTS

6.3.2 INCREASING INTEREST OF PERSONALIZED MEDICINE

6.3.3 SURGE IN HEALTHCARE EXPENDITURE

6.3.4 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 GENOMIC INSTABILITY OF IPSCS IS THE KEY MARKET CHALLENGE

6.4.2 LACK OF SKILLED PROFESSIONALS

6.4.3 STRINGENT REGULATORY FRAMEWORK

7 IMPACT OF COVID-19 ON THE ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET

7.1 IMPACT ON PRICE

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS BY MANUFACTURERS

7.5 CONCLUSION

8 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE

8.1 OVERVIEW

8.2 SKIN CELLS

8.2.1 FIBROBLAST

8.2.2 KERATINOCYTES

8.2.3 ADIPOSE DERIVED STEM CELLS

8.2.4 HEPATOCYTES

8.2.5 MELANOCYTES

8.2.6 NEURAL STEM CELLS

8.2.7 OTHERS

8.3 BLOOD CELLS

8.3.1 PERIPHERAL BLOOD

8.3.2 CORD BLOOD ENDOTHELIAL CELLS

8.3.3 CORD BLOOD STEM CELLS

8.3.4 OTHERS

9 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE

9.1 OVERVIEW

9.2 HUMAN IPSCS

9.3 MOUSE IPSCS

10 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT

10.1 OVERVIEW

10.2 CONSUMABLES & KITS

10.2.1 REPROGRAMMING KITS

10.2.2 MEDIA

10.2.3 TRANSFECTION KITS

10.2.4 CELL IDENTIFICATION KITS

10.2.5 ACCESSORIES

10.2.6 OTHERS

10.3 SERVICES

10.4 INSTRUMENTS

10.4.1 IMAGING SYSTEMS

10.4.2 ELECTROPORATION DEVICE

10.4.3 INCUBATORS

10.4.4 OTHERS

11 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 DRUG DISCOVERY AND DEVELOPMENT

11.3 ACADEMIC RESEARCH

11.4 DISEASE MODELLING

11.5 CELLULAR THERAPY

11.6 REGENERATIVE MEDICINE

11.7 TOXICOLOGY SCREENING

11.8 STEM CELL BANKING

11.9 3D BIOPRINTING

11.1 OTHERS

12 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER

12.1 OVERVIEW

12.2 BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES

12.3 RESEARCH LABORATORIES

12.4 DIAGNOSTIC LABORATORIES

12.5 OTHERS

13 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 RETAIL SALES

14 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 JAPAN

14.1.3 INDIA

14.1.4 SOUTH KOREA

14.1.5 AUSTRALIA

14.1.6 SINGAPORE

14.1.7 THAILAND

14.1.8 MALAYSIA

14.1.9 INDONESIA

14.1.10 PHILIPPINES

14.1.11 REST OF ASIA-PACIFIC

15 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 FUJIFILM CORPORATION

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.1.5.1 ACQUISITION

17.2 THERMO FISHER SCIENTIFIC INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.2.5.1 EVENT

17.2.5.2 ACQUISITION

17.3 LONZA.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.3.5.1 EXPANSION

17.4 MERCK KGAA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.4.5.1 AGREEMENT

17.5 EVOTEC SE.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.5.5.1 AGREEMENT

17.5.5.2 COLLABORATION

17.6 APPLIED STEMCELL.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.6.3.1 PRODUCT LAUNCH

17.7 AXOL BIOSCIENCE LTD.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.7.3.1 MERGER

17.7.3.2 PRODUCT LAUNCH

17.8 CELL APPLICATIONS, INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.8.3.1 PARTNERSHIP

17.9 CHARLES RIVER LABORATORIES INTERNATIONAL, INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.9.4.1 ACQUISITION

17.1 CITIUS PHARMACEUTICALS, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.10.3.1 AGREEMENT

17.11 CORNING INCORPORATED

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.11.4.1 AGREEMENT

17.12 FATE THERAPEUTICS

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.12.3.1 CLINICAL TRIAL

17.13 GENECOPOEIA, INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 HOPSTEM BIOTECHNOLOGY LLC.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.14.3.1 PARTNERSHIP

17.15 HORIZON DISCOVERY LTD.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 LUMACYTE

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.16.3.1 COLLABORATION

17.17 R & D SYSTEMS, INC.

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 REPROCELL INC.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.18.3.1 COLLABORATION

17.18.3.2 FACILITY EXPANSION

17.18.3.3 SERVICE LAUNCH

17.19 TAKARA BIO INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.19.4.1 NEW FACILITY LAUNCH

17.2 UNIVERSAL CELLS INC. (AN ASTELLAS COMPANY)

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

17.20.4.1 ACQUISITION

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 NEW CANCER CASES, AGES 85+, IN THE U.S.

TABLE 2 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC HUMAN IPSCS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC MOUSE IPSCS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC SERVICES IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC DRUG DISCOVERY AND DEVELOPMENT IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ACADEMIC RESEARCH IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC DISEASE MODELLING IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC CELLULAR THERAPY IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC REGENERATIVE MEDICINE IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC TOXICOLOGY SCREENING IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC STEM CELL BANKING IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC 3D BIOPRINTING IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC OTHERS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC RESEARCH LABORATORIES IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC DIAGNOSTIC LABORATORIES IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC DIRECT TENDER IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC RETAIL SALES IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 CHINA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 46 CHINA SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 47 CHINA BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 48 CHINA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 CHINA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 50 CHINA INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 CHINA CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 52 CHINA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 CHINA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 CHINA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 JAPAN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 56 JAPAN SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 57 JAPAN BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 58 JAPAN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 JAPAN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 JAPAN INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 JAPAN CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 62 JAPAN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 JAPAN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 JAPAN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 INDIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 66 INDIA SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 67 INDIA BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 68 INDIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 INDIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 70 INDIA INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 71 INDIA CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 72 INDIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 INDIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 74 INDIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 81 SOUTH KOREA CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 SOUTH KOREA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 SOUTH KOREA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 AUSTRALIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 86 AUSTRALIA SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 87 AUSTRALIA BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 88 AUSTRALIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 AUSTRALIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 AUSTRALIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 95 SINGAPORE INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 96 SINGAPORE SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 97 SINGAPORE BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 98 SINGAPORE INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 SINGAPORE INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 100 SINGAPORE INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 101 SINGAPORE CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 102 SINGAPORE INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 SINGAPORE INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 SINGAPORE INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 105 THAILAND INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 106 THAILAND SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 107 THAILAND BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 108 THAILAND INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 THAILAND INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 110 THAILAND INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 111 THAILAND CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 112 THAILAND INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 THAILAND INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 114 THAILAND INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 115 MALAYSIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 116 MALAYSIA SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 117 MALAYSIA BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 118 MALAYSIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 MALAYSIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 120 MALAYSIA INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 121 MALAYSIA CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 122 MALAYSIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 MALAYSIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 124 MALAYSIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 125 INDONESIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 126 INDONESIA SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 127 INDONESIA BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 128 INDONESIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 INDONESIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 130 INDONESIA INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 131 INDONESIA CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 132 INDONESIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 INDONESIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 135 PHILIPPINES INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 136 PHILIPPINES SKIN CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 137 PHILIPPINES BLOOD CELLS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

TABLE 138 PHILIPPINES INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 PHILIPPINES INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 140 PHILIPPINES INSTRUMENTS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 141 PHILIPPINES CONSUMABLES & KITS IN INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 142 PHILIPPINES INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 143 PHILIPPINES INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 144 PHILIPPINES INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 145 REST OF ASIA-PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, BY CELL SOURCE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: SEGMENTATION

FIGURE 11 THE WIDE RANGE OF CLINICAL APPLICATION OF INDUCED PLURIPOTENT STEM CELLS (IPSC) ARE EXPECTED TO DRIVE THE ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SKIN CELLS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET

FIGURE 15 PREVALENCE OF CHRONIC DISEASES

FIGURE 16 NUMBER OF PEOPLE WITH DIABETES (MILLION) AMONG AGES 20–79 YEARS

FIGURE 17 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY CELL SOURCE, 2021

FIGURE 18 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY CELL SOURCE, 2020-2029 (USD MILLION)

FIGURE 19 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY CELL SOURCE, CAGR (2022-2029)

FIGURE 20 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY CELL SOURCE, LIFELINE CURVE

FIGURE 21 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY TYPE, 2021

FIGURE 22 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 23 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 24 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 25 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY PRODUCT, 2021

FIGURE 26 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY PRODUCT, 2020-2029 (USD MILLION)

FIGURE 27 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 28 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 29 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY APPLICATION, 2021

FIGURE 30 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 31 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 32 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 33 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY END USER, 2021

FIGURE 34 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 35 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY END USER, CAGR (2022-2029)

FIGURE 36 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY END USER, LIFELINE CURVE

FIGURE 37 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 38 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 39 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 40 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 41 ASIA-PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: SNAPSHOT (2021)

FIGURE 42 ASIA-PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY COUNTRY (2021)

FIGURE 43 ASIA-PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 44 ASIA-PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 45 ASIA-PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: BY CELL SOURCE (2022-2029)

FIGURE 46 ASIA PACIFIC INDUCED PLURIPOTENT STEM CELLS (IPSCS) MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.