Asia-Pacific Indoor Air Purification Market, By Product (Dust Collectors & Vacuums, Fume & Smoke Collectors, Mist Eliminators, Bad Odor & Harmful Gasses, Fire & Emergency Exhaust And Viruses & Fungus) Category (Small Room, Medium Room, Large Room) Technology (HEPA, Electrostatic Precipitators, Activated Carbon, Ionic Filters And Others) Function (Manual, Sensor And Others) Outer Material (Plastic And Metal) Price Range (Low, Mid, Premium) Distribution Channel (Direct Selling, E-Commerce, Supermarkets/Hypermarkets, Specialty Stores And Others) Application (Industrial, Commercial And Residential) Industry Trends and Forecast to 2029.

Asia-Pacific Indoor Air Purification Market Analysis and Size

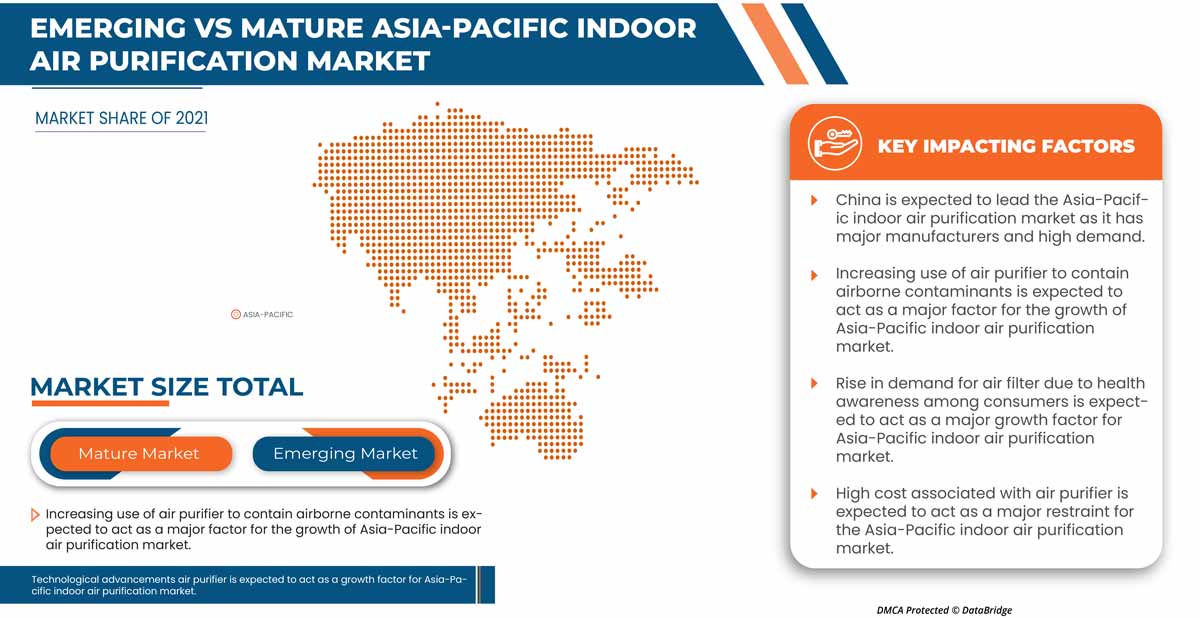

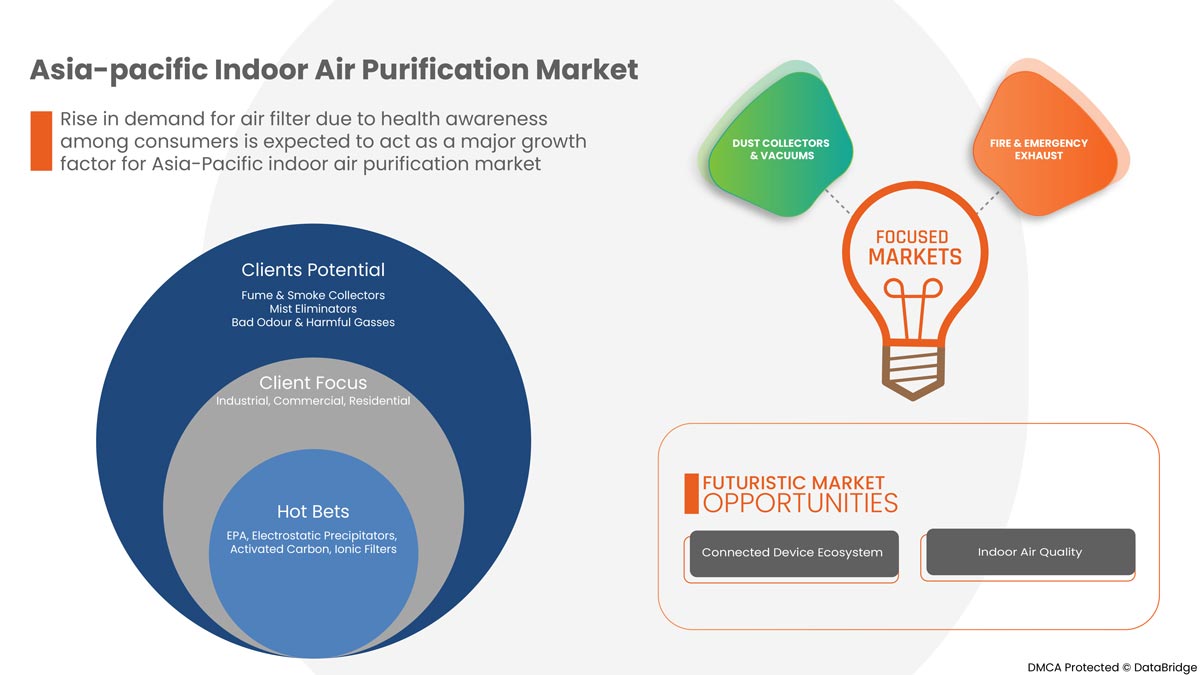

The increasing use of air purifier to contain airborne contaminants and advent of smart air purifier are driving the Asia-Pacific indoor air purification market. Additionally, growth in e-commerce sector has allowed higher penetration of air purifier across the globe and improvement in sensor technology has miniaturized the air purifier. However, high cost associated with air purifier and various concerns regarding air purifier is estimated to act as restraint for the market. Moreover, continuous fluctuations in the prices of raw materials and high Electricity consumption leading to high electricity cost because of air purifier are challenging the market growth. Additionally, low rate of upgradation in air filter technology has slowed down the market. However, rise in demand for air filter due to health awareness among consumers and increasing initiatives by governments for air filter adoption are estimated to provide opportunities for the growth of Asia-Pacific indoor air purification market.

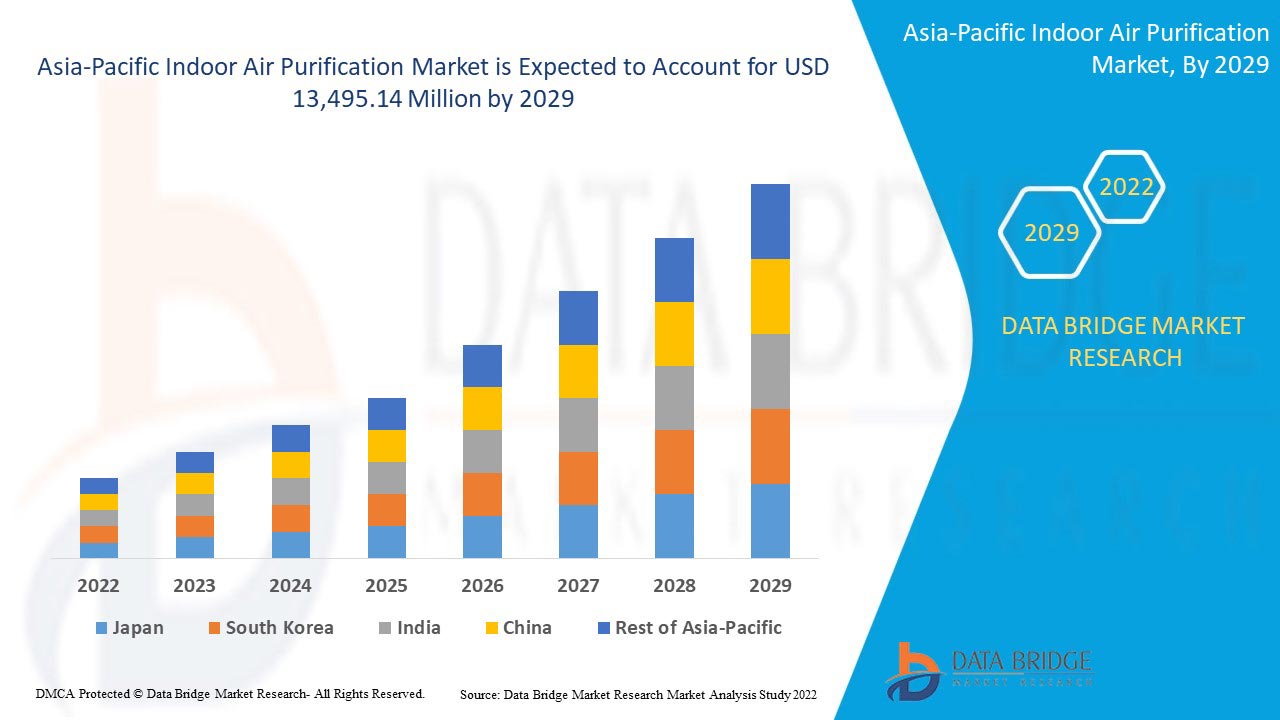

Data Bridge Market Research analyses that the indoor air purification market is expected to reach a value of USD 13,495.14 million by 2029, at a CAGR of 8.1% during the forecast period. The solution segment accounts for the largest offering segment in the air purification market. The indoor air purification market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Par produit (dépoussiéreurs et aspirateurs, collecteurs de fumée et de vapeur, éliminateurs de brouillard, mauvaises odeurs et gaz nocifs, échappement d'incendie et d'urgence et virus et champignons) Catégorie (petite pièce, pièce moyenne, grande pièce) Technologie (HEPA, précipitateurs électrostatiques, charbon actif, filtres ioniques et autres) Fonction (manuelle, capteur et autres) Matériau extérieur (plastique et métal) Gamme de prix (bas, moyen, haut de gamme) Canal de distribution (vente directe, commerce électronique, supermarchés/hypermarchés, magasins spécialisés et autres) Application (industrielle, commerciale et résidentielle), tendances de l'industrie et prévisions jusqu'en 2029 |

|

Pays couverts |

Chine, Japon, Inde, Corée du Sud, Singapour, Malaisie, Australie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique (APAC) dans la région Asie-Pacifique (APAC). |

|

Acteurs du marché couverts |

Royal Philips NV ; LG Electronics, Panasonic Corporation, DAIKIN INDUSTRIES ltd., Aerus LLC, Legend Brands, xpower, Abatement Technologies, Omnitech Design, B-AIR, Pulllman-Ermator ; Envirco, AEROSPACE AMERICA, INC. ; Camfil ; Carrier, Hamilton Beach Brands, Inc. ; Whirlpool, Lifa Air Ltd., NIKRO INDUSTRIES, INC. et COWAY CO. LTD. entre autres. |

Définition du marché

La purification intérieure est effectuée par des produits tels que des humidificateurs, des purificateurs d'air et des déshumidificateurs dans les secteurs industriel, commercial et résidentiel. Ces produits sont développés et fabriqués dans le but de modifier la qualité de l'air intérieur, dans une pièce individuelle ou dans une zone. Ces produits sont généralement de petite taille, ce qui permet de les déplacer efficacement et ne nécessite pas d'installation en cas d'application résidentielle. Les articles sur la qualité de l'air bénéficient d'une énorme traction et d'une demande de la part de la médecine complémentaire et alternative (MCA) d'influence orientale. La MCA est un spectre de thérapies, de traitements et de systèmes de santé, à la fois anciens et nouveaux, qui peuvent être normalement identifiés comme des pratiques de santé et de bien-être qui ne relèvent pas du spectre de la médecine occidentale normale et des habitudes de consommation occidentales. Avec la croissance des connaissances des consommateurs et leur intérêt pour une meilleure qualité de l'air, les fabricants et les entreprises ont une grande opportunité de positionner les articles sur la qualité de l'air comme des produits incontournables pour la maison, le bureau et les espaces commerciaux.

Dynamique du marché de la purification de l'air intérieur

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Utilisation croissante des purificateurs d'air pour contenir les contaminants en suspension dans l'air

Une maladie aéroportée est causée par un micro-organisme transmis par l'air. Ces organismes peuvent se propager par les éternuements, la toux, la pulvérisation de liquides, la propagation de poussière ou toute activité entraînant la production de particules aérosolisées. Il existe de nombreuses maladies aéroportées qui ont une importance clinique et comprennent des bactéries, des virus et des champignons. Les micro-organismes peuvent se propager par les éternuements, la toux, la pulvérisation de liquides, la propagation de poussière ou toute activité entraînant la production de particules aérosolisées. Les micro-organismes transmis par voie aérienne peuvent se propager par une fine brume, de la poussière, des aérosols ou des liquides. De plus, les particules aérosolisées peuvent être générées à partir d'une source d'infection, comme les sécrétions corporelles d'un patient infecté ou même d'un animal. Les particules aérosolisées infectées restent souvent en suspension dans les courants d'air et peuvent parcourir des distances considérables, bien que de nombreuses particules tombent à proximité. Plus la distance parcourue par la particule d'aérosol augmente, plus le risque d'infection augmente. Les précautions contre la transmission aérienne nécessitent la prévention des infections et l'utilisation des interventions disponibles dans les établissements de santé pour empêcher la transmission de particules en suspension dans l'air, telles que les filtres à air. Lorsqu'ils sont utilisés correctement, les purificateurs d'air et les filtres CVC peuvent aider à réduire les contaminants en suspension dans l'air, y compris les virus, dans un bâtiment ou un petit espace. Cette utilisation de purificateurs d'air pour contenir les contaminants et les infections en suspension dans l'air est la raison de la demande croissante de purificateurs d'air à l'échelle mondiale, agissant comme un moteur pour le marché de la purification de l'air intérieur en Asie-Pacifique.

- L'avènement du purificateur d'air intelligent

Les purificateurs d'air sont utilisés depuis le 20e siècle, initialement à des fins industrielles, mais avec l'augmentation des niveaux de pollution à travers le monde et l'avènement des solutions technologiques, leur utilisation a augmenté. Le niveau croissant de pollution de l'air dans les régions urbaines est une préoccupation majeure pour la santé d'une grande partie de la société. En parallèle, l'utilisation de la technologie afin d'augmenter l'efficacité et de faciliter l'utilisation du filtre à air a abouti au développement d'un purificateur d'air intelligent. Le purificateur d'air intelligent permet à l'utilisateur de surveiller et de contrôler la qualité de l'air intérieur via une application dédiée sur smartphone. Le produit permet également de suivre la qualité de l'air intérieur sur une période donnée, ce qui permet aux consommateurs d'observer l'heure de la journée avec la meilleure et la pire qualité de l'air. Cela augmente son impact sur l'utilisateur, ce qui entraîne une augmentation de la demande de purificateurs d'air intelligents dans tous les pays, ce qui stimule le marché.

- Croissance du secteur du commerce électronique

Le commerce électronique (ou commerce électronique) est l'achat et la vente de biens ou de services sur Internet. Il englobe une grande variété de données, de systèmes et d'outils pour les acheteurs et les vendeurs en ligne, y compris les achats mobiles et le cryptage des paiements en ligne. À l'heure actuelle, la plupart des entreprises ayant une présence en ligne utilisent une boutique et/ou une plateforme en ligne pour mener des activités de marketing et de vente en ligne et pour superviser la logistique et l'exécution, ce qui entraîne une croissance rapide des secteurs du commerce électronique. À mesure que le secteur du commerce électronique se développe, la capacité d'acheter des produits selon les besoins du client devient plus facile et les entreprises peuvent également répertorier les produits à des prix compétitifs sur plusieurs plateformes de commerce électronique pour élargir l'accessibilité du marché. La demande croissante de purificateurs d'air dans les régions urbaines en raison de ses avantages ; la fonction a stimulé ses ventes sur des sites de commerce électronique tels qu'Amazon, Shopify, Flipkart. La croissance du secteur du commerce électronique agit positivement pour le marché de la purification de l'air intérieur de la région Asie-Pacifique, car le client peut voir tous les purificateurs d'air disponibles pour un code PIN, les comparer et commander le mieux adapté à ses besoins et à son budget. Ainsi, la croissance du secteur du commerce électronique agit positivement sur la croissance du marché de la purification de l’air intérieur en Asie-Pacifique.

Opportunités

-

Augmentation de la demande de filtres à air en raison de la sensibilisation des consommateurs à la santé

Par rapport à l'air extérieur, les niveaux de pollution de l'air intérieur peuvent être jusqu'à cinq fois plus élevés. Que ce soit dans le confort de leur maison ou de leur lieu de travail, les gens passent plus de 90 % de leur temps à l'intérieur. La qualité de l'air intérieur (QAI), la santé et le bien-être sont étroitement liés. Respirer un air exempt de polluants améliore non seulement la qualité de vie, mais réduit également le risque d'infections respiratoires et minimise le risque de développer diverses maladies chroniques. Les organisations, notamment American Air Filter (AAF), disposent de plusieurs options pour se connecter au public cible et l'informer sur la QAI et son importance. La sensibilisation accrue des consommateurs aux impacts sur la santé tels que l'irritation des yeux, du nez et de la gorge, les maux de tête, les étourdissements et la fatigue, les maladies respiratoires, les maladies cardiaques et le cancer crée une perspective de croissance du marché des purificateurs d'air en Asie-Pacifique. Les filtres à air sont l'un des marchés en croissance à travers le monde. Les gens étant de plus en plus conscients de la nécessité de respirer un air pur, exempt d'allergènes et de micro-organismes pathogènes, la demande de purificateurs d'air a considérablement augmenté ces dernières années.

Contraintes/Défis

- Coûts élevés associés aux purificateurs d’air

L'importance des purificateurs d'air augmente à mesure que la qualité de l'air extérieur et intérieur se dégrade en raison de l'urbanisation rapide, augmentant les infections et maladies aéroportées à travers le monde. La pollution de l'air devient une préoccupation de plus en plus grave pour la santé, liée à environ 7 millions de décès en 2012 selon un récent rapport de l'Organisation mondiale de la santé (OMS). Les nouvelles données révèlent en outre un lien plus étroit entre l'exposition à la pollution de l'air intérieur et extérieur et les maladies cardiovasculaires, telles que les accidents vasculaires cérébraux et les maladies cardiaques ischémiques, ainsi qu'entre la pollution de l'air et le cancer. Comme la pollution intérieure et extérieure affecte la santé, les consommateurs se tournent vers les purificateurs d'air afin d'obtenir une bonne qualité de l'air intérieur. Cela a permis au fabricant d'augmenter le coût associé aux purificateurs d'air en augmentant ses caractéristiques technologiques ; afin de répondre à la demande mondiale. Ce coût élevé associé aux purificateurs d'air et aux purificateurs d'air intelligents ; limite la croissance de son marché car la classe moyenne ne peut pas se permettre de dépenser autant pour un équipement. Cela constitue en fin de compte un frein à la croissance du marché de la purification de l'air intérieur en Asie-Pacifique.

Développement récent

- En août 2022, Carrier a annoncé son intention de proposer un pack de démarrage pour un air sain aux universités, aux lieux de divertissement, aux écoles et aux organisations immobilières commerciales. Dans le cadre de ce plan, l'entreprise fournira un moyen simple, rapide et économique de surveiller, de visualiser et de réagir aux composants invisibles de la qualité de l'air intérieur (QAI), contribuant ainsi au bien-être des occupants. Grâce à cette étape, l'entreprise vise à accroître sa domination sur le marché de la purification de l'air intérieur en Asie-Pacifique.

- En juin 2021, Hamilton Beach Brands, Inc. a annoncé son partenariat avec The Clorox Company. En vertu de cet accord, Hamilton Beach Brands prévoit de lancer une gamme de purificateurs d'air haut de gamme sous la marque Clorox qui éliminera 99,97 % des allergènes et des particules du pollen, de la poussière et de la fumée. Cela devrait permettre à l'entreprise d'utiliser la licence de Clorox Company pour son produit proposé sur le marché de la purification de l'air intérieur.

Portée du marché de la purification de l'air intérieur

Le marché de la purification de l'air intérieur est segmenté sur la base du produit, de la catégorie, de la technologie, de la fonction, du matériau extérieur, de la gamme de prix, du canal de distribution et de l'application... La croissance parmi ces segments vous aidera à analyser les faibles segments de croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par produit

- Dépoussiéreurs et aspirateurs

- Collecteurs de fumée et de vapeurs

- Éliminateurs de brouillard

- Mauvaises odeurs et gaz nocifs

- Échappement d'incendie et d'urgence

- Virus et champignons

Sur la base du produit, le marché de la purification de l'air intérieur est segmenté en dépoussiéreurs et aspirateurs ; collecteurs de fumées et de fumées ; éliminateurs de brouillard ; mauvaises odeurs et gaz nocifs ; échappement d'incendie et d'urgence et virus et champignons.

Par catégorie

- Petite chambre

- Chambre moyenne

- Grande Chambre

Sur la base de la catégorie, le marché de la purification de l'air intérieur est segmenté en petites pièces, pièces moyennes et grandes pièces.

Par technologie

- HEPA

- Précipitateurs électrostatiques

- Charbon actif

- Filtres ioniques

- Autres

Sur la base de la technologie, le marché de la purification de l'air intérieur est segmenté en HEPA ; précipitateurs électrostatiques ; charbon actif ; filtres ioniques et autres.

Par fonction

- Manuel

- Capteur

- Autres

Sur la base de la fonction, le marché de la purification de l'air intérieur est segmenté en manuel, capteur et autres.

Par matériau extérieur

- Plastique

- Métal

Sur la base du matériau extérieur, le marché de la purification de l'air intérieur est segmenté en plastique et en métal.

Par gamme de prix

- Faible

- Milieu

- Prime

Sur la base de la gamme de prix, le marché de la purification de l'air intérieur est segmenté en bas de gamme, milieu de gamme et haut de gamme.

Par canal de distribution

- Vente directe

- Commerce électronique

- Supermarchés/Hypermarchés

- Magasins spécialisés

- Autres

Sur la base du canal de distribution, le marché de la purification de l'air intérieur est segmenté en vente directe ; commerce électronique ; supermarchés/hypermarchés ; magasins spécialisés et autres...

Par application

- Industriel

- Commercial

- Résidentiel

Sur la base des applications, le marché de la purification de l’air intérieur est segmenté en industriel, commercial et résidentiel.

Analyse/perspectives régionales du marché de la purification de l'air intérieur

Le marché de la purification de l’air intérieur est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, produit, catégorie, technologie, fonction, matériau extérieur, gamme de prix, canal de distribution et application, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché de la purification de l'air intérieur sont la Chine, le Japon, l'Inde, la Corée du Sud, Singapour, la Malaisie, l'Australie, la Thaïlande, l'Indonésie, les Philippines et le reste de l'Asie-Pacifique (APAC) dans l'Asie-Pacifique (APAC).

La Chine devrait dominer le marché en raison de la sensibilisation croissante des consommateurs aux purificateurs d'air et à leurs avantages, notamment la capacité à contenir les contaminants en suspension dans l'air.

La section pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, l'analyse des tendances techniques des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de la purification de l'air intérieur

Le paysage concurrentiel du marché de la purification de l'air intérieur fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché de la purification de l'air intérieur.

Certains des principaux acteurs opérant sur le marché sont Koninklijke Philips NV; LG Electronics, Panasonic Corporation, DAIKIN INDUSTRIES ltd., Aerus LLC, Legend Brands, xpower, Abatement Technologies, Omnitech Design, B-AIR, Pulllman-Ermator; Envirco, AEROSPACE AMERICA, INC.; Camfil; Carrier, Hamilton Beach Brands, Inc.; Whirlpool, Lifa Air Ltd., NIKRO INDUSTRIES, INC. et COWAY CO. LTD. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC INDOOR AIR PURIFICATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 PRODUCT CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTERS MODEL

4.3 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.3.1 PHOTOELECTROCHEMICAL OXIDATION

4.3.2 HIGH-EFFICIENCY PARTICULATE AIR PURIFIERS

4.3.3 ACTIVATED CARBON

4.3.4 ELECTROSTATIC PRECIPITATOR

4.3.5 IONIC FILTERS

4.3.6 AUTOMATED AIR PURIFICATION SYSTEM

4.4 VENDOR SELECTION CRITERIA

4.5 REGULATORY STANDARD

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING USAGE OF AIR PURIFIERS TO CONTAIN AIRBORNE CONTAMINANTS

6.1.2 ADVENT OF SMART AIR PURIFIER

6.1.3 GROWTH IN E- COMMERCE SECTOR

6.1.4 IMPROVEMENT IN SENSOR TECHNOLOGY

6.2 RESTRAINTS

6.2.1 HIGH COSTS ASSOCIATED WITH AIR PURIFIERS

6.2.2 RISING CONCERNS REGARDING AIR PURIFIER

6.3 OPPORTUNITIES

6.3.1 RISE IN DEMAND FOR AIR FILTER DUE TO HEALTH AWARENESS AMONG CONSUMERS

6.3.2 MORE OF PARTNERSHIP AND ACQUISITION AMONGST MARKET PLAYERS

6.3.3 INCREASING INITIATIVES BY GOVERNMENTS FOR AIR FILTER ADOPTION

6.4 CHALLENGES

6.4.1 CONTINUOUS FLUCTUATIONS IN THE PRICES OF RAW MATERIALS

6.4.2 HIGH ELECTRICITY CONSUMPTION LEADING TO HIGH ELECTRICITY COST

6.4.3 LOW RATE OF UPGRADATION IN AIR FILTER TECHNOLOGY

7 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 DUST COLLECTORS & VACCUMS

7.3 FUME & SMOKE COLLECTORS

7.4 VIRUSES & FUNGUS

7.5 BAD ODOUR & HARMFUL GASES

7.6 MIST ELIMINATORS

7.7 FIRE & EMERGENCY EXHAUST

8 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 LARGE ROOM

8.3 MEDIUM ROOM

8.4 SMALL ROOM

9 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET, BY FUNCTION

9.1 OVERVIEW

9.2 SENSOR

9.3 MANUAL

9.4 OTHERS

10 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 HEPA

10.3 ACTIVATED CARBON

10.4 ELECTROSTATIC PRECIPITATORS

10.5 IONIC FILTERS

10.6 OTHERS

11 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL

11.1 OVERVIEW

11.2 PLASTIC

11.2.1 POLYCARBONATE (PC)

11.2.2 ABS

11.2.3 POLYVINYL CHLORIDE (PVC)

11.2.4 HIGH-DENSITY POLYETHYLENE (PE)

11.2.5 OTHERS

11.3 METAL

11.3.1 STAINLESS STEEL

11.3.2 ALUMINIUM

11.3.3 OTHERS

12 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE

12.1 OVERVIEW

12.2 MID

12.3 LOW

12.4 PREMIUM

13 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 E-COMMERCE

13.3 SPECIALTY STORES

13.4 DIRECT SELLING

13.5 SUPERMARKETS/HYPERMARKETS

13.6 OTHERS

14 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 COMMERCIAL

14.3 RESIDENTIAL

14.4 INDUSTRIAL

15 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET, BY REGION

15.1 ASIA-PACIFIC

15.1.1 CHINA

15.1.2 JAPAN

15.1.3 SOUTH KOREA

15.1.4 INDIA

15.1.5 AUSTRALIA & NEW ZEALAND

15.1.6 SINGAPORE

15.1.7 THAILAND

15.1.8 MALAYSIA

15.1.9 INDONESIA

15.1.10 PHILIPPINES

15.1.11 REST OF ASIA-PACIFIC

16 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 PANASONIC CORPORATION

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 DAIKIN INDUSTRIES, LTD.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 LG ELECTRONICS

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 HONEYWELL INTERNATIONAL

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 KONINKLIJKE PHILIPS N.V

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 ABATEMENT TECHNOLOGIES

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 AEROSPACE AMERICA, INC.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 AERUS LLC

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 B-AIR

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 CAMFIL

18.10.3 COMPANY SNAPSHOT

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 CARRIER (2021)

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 COWAY CO. LTD. (2021)

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 ENVIRCO

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 HAMILTON BEACH BRANDS, INC. (2021)

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 LEGEND BRANDS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 LIFA AIR LTD. (2021)

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.17 NIKRO INDUSTRIES, INC.

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 OMNITEC DESIGN

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 PULLMAN-ERMATOR

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 WHIRLPOOL (2021)

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

18.21 XPOWER.COM

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 AIR PURIFIER AND COST ASSOCIATED WITH THEM IN USD

TABLE 2 COMPARISON OF THE ENERGY CONSUMPTION OF HOME APPLIANCES AND ELECTRONICS

TABLE 3 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC DUST COLLECTORS & VACCUMS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC FUME & SMOKE COLLECTORS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC VIRUSES & FUNGUS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC BAD ODOUR & HARMFUL GASES IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC MIST ELIMINATORS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC FIRE & EMERGENCY EXHAUST IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC LARGE ROOM IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC MEDIUM ROOM IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC SMALL ROOM IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC SENSOR IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC MANUAL IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC OTHERS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET , BY TECHNOLOGY 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC HEPA IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC ACTIVATED CARBON IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC ELECTROSTATIC PRECIPITATORS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC IONIC FILTERS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC OTHERS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC METAL IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC MID IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC LOW IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC PREMIUM IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC E-COMMERCE IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC SPECIALTY STORES IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC DIRECT SELLING IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC SUPERMARKETS/HYPERMARKETS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC OTHERS IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC COMMERCIAL IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC RESIDENTIAL IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC INDUSTRIAL IN INDOOR AIR PURIFICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC INDOOR AIR PURIFICATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC INDOOR AIR PURIFICATION MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 ASIA-PACIFIC INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 CHINA INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 55 CHINA INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 56 CHINA INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 57 CHINA INDOOR AIR PURIFICATION MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 58 CHINA INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 59 CHINA PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 CHINA METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CHINA INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 62 CHINA INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 63 CHINA INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 JAPAN INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 JAPAN INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 66 JAPAN INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 67 JAPAN INDOOR AIR PURIFICATION MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 68 JAPAN INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 69 JAPAN PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 JAPAN METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 JAPAN INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 72 JAPAN INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 73 JAPAN INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA INDOOR AIR PURIFICATION MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 SOUTH KOREA INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 83 SOUTH KOREA INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 INDIA INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 85 INDIA INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 86 INDIA INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 87 INDIA INDOOR AIR PURIFICATION MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 88 INDIA INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 89 INDIA PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 INDIA METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 INDIA INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 92 INDIA INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 93 INDIA INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA & NEW ZEALAND INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA & NEW ZEALAND INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA & NEW ZEALAND INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA & NEW ZEALAND INDOOR AIR PURIFICATION MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA & NEW ZEALAND INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 99 AUSTRALIA & NEW ZEALAND PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 AUSTRALIA & NEW ZEALAND METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 AUSTRALIA & NEW ZEALAND INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA & NEW ZEALAND INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 AUSTRALIA & NEW ZEALAND INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 104 SINGAPORE INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 105 SINGAPORE INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 106 SINGAPORE INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 107 SINGAPORE INDOOR AIR PURIFICATION MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 108 SINGAPORE INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 109 SINGAPORE PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 SINGAPORE METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 SINGAPORE INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 112 SINGAPORE INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 113 SINGAPORE INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 THAILAND INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 THAILAND INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 116 THAILAND INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 117 THAILAND INDOOR AIR PURIFICATION MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 118 THAILAND INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 119 THAILAND PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 THAILAND METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 THAILAND INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 122 THAILAND INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 123 THAILAND INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 MALAYSIA INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 125 MALAYSIA INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 126 MALAYSIA INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 127 MALAYSIA INDOOR AIR PURIFICATION MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 128 MALAYSIA INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 129 MALAYSIA PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 MALAYSIA METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 MALAYSIA INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 132 MALAYSIA INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 133 MALAYSIA INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 135 INDONESIA INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 136 INDONESIA INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 137 INDONESIA INDOOR AIR PURIFICATION MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 138 INDONESIA INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 139 INDONESIA PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 INDONESIA METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 INDONESIA INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 142 INDONESIA INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 143 INDONESIA INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 144 PHILIPPINES INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 145 PHILIPPINES INDOOR AIR PURIFICATION MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 146 PHILIPPINES INDOOR AIR PURIFICATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 147 PHILIPPINES INDOOR AIR PURIFICATION MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 148 PHILIPPINES INDOOR AIR PURIFICATION MARKET, BY OUTER MATERIAL, 2020-2029 (USD MILLION)

TABLE 149 PHILIPPINES PLASTIC IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 PHILIPPINES METAL IN INDOOR AIR PURIFICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 PHILIPPINES INDOOR AIR PURIFICATION MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 152 PHILIPPINES INDOOR AIR PURIFICATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 153 PHILIPPINES INDOOR AIR PURIFICATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 REST OF ASIA-PACIFIC INDOOR AIR PURIFICATION MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF AIR PURIFIER TO CONTAIN AIRBORNE CONTAMINANTS IS EXPECTED TO BE KEY DRIVERS FOR ASIA PACIFIC INDOOR AIR PURIFICATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 DUST COLLECTORS & VACUUMS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC INDOOR AIR PURIFICATION MARKET IN 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC INDOOR AIR PURIFICATION MARKET

FIGURE 14 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: BY PRODUCT, 2021

FIGURE 15 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: BY CATEGORY, 2021

FIGURE 16 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: BY FUNCTION, 2021

FIGURE 17 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: BY TECHNOLOGY, 2021

FIGURE 18 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: BY OUTER MATERIAL, 2021

FIGURE 19 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: BY PRICE RANGE, 2021

FIGURE 20 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 21 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: BY APPLICATION, 2021

FIGURE 22 ASIA-PACIFIC INDOOR AIR PURIFICATION MARKET: SNAPSHOT (2021)

FIGURE 23 ASIA-PACIFIC INDOOR AIR PURIFICATION MARKET: BY COUNTRY (2021)

FIGURE 24 ASIA-PACIFIC INDOOR AIR PURIFICATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 ASIA-PACIFIC INDOOR AIR PURIFICATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 ASIA-PACIFIC INDOOR AIR PURIFICATION MARKET: BY PRODUCT (2022-2029)

FIGURE 27 ASIA PACIFIC INDOOR AIR PURIFICATION MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.