Asia Pacific Hydrophobic Coatings Market

Taille du marché en milliards USD

TCAC :

%

USD

1.31 Billion

USD

2.09 Billion

2025

2033

USD

1.31 Billion

USD

2.09 Billion

2025

2033

| 2026 –2033 | |

| USD 1.31 Billion | |

| USD 2.09 Billion | |

|

|

|

|

Segmentation du marché des revêtements hydrophobes en Asie-Pacifique, par produit (polysiloxanes, fluoropolymères, fluoroalkylsilanes, dioxyde de titane et autres), type de substrat (métal, verre, polymère, céramique, béton et textiles), nombre de couches (monocouche et multicouches), méthode d'application (immersion, application au pinceau, application au rouleau, pulvérisation et autres), fonction (anticorrosion, antimicrobien, antisalissure, antigivre/anti-mouillage, autonettoyant et autres), qualité (qualité alimentaire, qualité industrielle et autres), canal de distribution (hors ligne et en ligne), utilisateur final (automobile, électronique, bâtiment et construction, secteur maritime, textile, santé, aérospatiale, pétrole et gaz, agroalimentaire et autres) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des revêtements hydrophobes en Asie-Pacifique

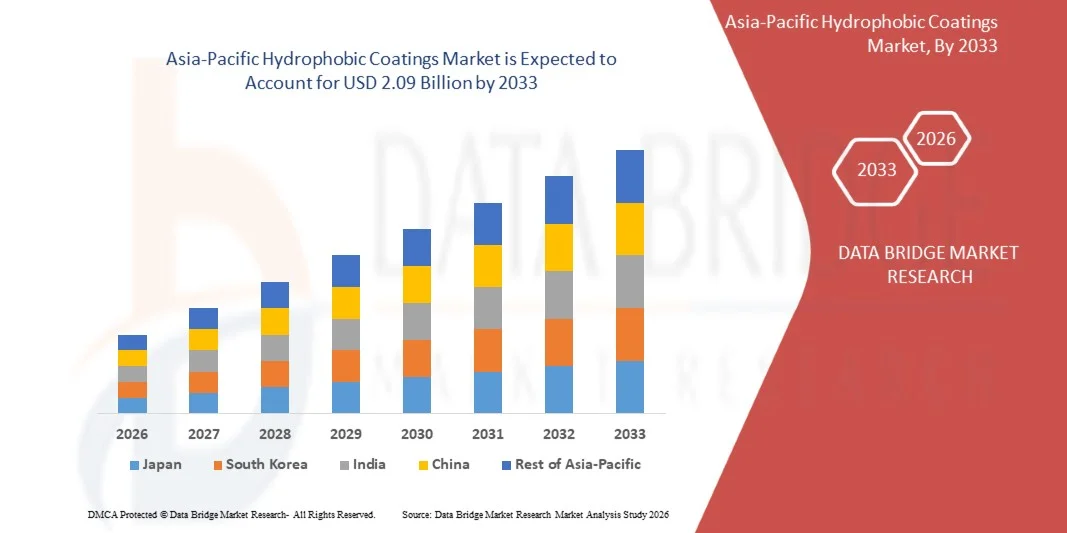

- Le marché des revêtements hydrophobes en Asie-Pacifique était évalué à 1,31 milliard de dollars américains en 2025 et devrait atteindre 2,09 milliards de dollars américains d'ici 2033 , avec un TCAC de 6,0 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de revêtements protecteurs dans des secteurs tels que l'automobile, l'électronique, la construction et l'aérospatiale, où les surfaces nécessitent des propriétés hydrofuges, une résistance à la corrosion et une durabilité accrue.

- De plus, l'intérêt croissant des consommateurs et des industriels pour la durabilité, l'hygiène et les surfaces nécessitant peu d'entretien favorise l'adoption de revêtements hydrophobes avancés, qui s'imposent comme des solutions essentielles pour les applications performantes et respectueuses de l'environnement. La convergence de ces facteurs accélère l'adoption des revêtements hydrophobes, stimulant ainsi significativement la croissance du marché.

Analyse du marché des revêtements hydrophobes en Asie-Pacifique

- Les revêtements hydrophobes, qui confèrent des propriétés d'hydrophobie, d'autonettoyage, d'anticorrosion et antimicrobiennes, sont de plus en plus essentiels pour améliorer la durée de vie, la sécurité et la fonctionnalité des surfaces dans de nombreuses applications industrielles et commerciales.

- La demande croissante de revêtements hydrophobes est principalement alimentée par les progrès technologiques dans le domaine des matériaux de revêtement, le renforcement des exigences réglementaires et environnementales, et le besoin accru de traitements de surface multifonctionnels, nécessitant peu d'entretien et offrant des performances élevées.

- La Chine a dominé le marché des revêtements hydrophobes en Asie-Pacifique en 2025, grâce à son vaste tissu industriel, au développement rapide de ses infrastructures et à l'adoption croissante de solutions de protection de surface avancées dans des secteurs clés tels que l'automobile, l'électronique et la construction.

- L'Inde devrait être le pays connaissant la croissance la plus rapide sur le marché des revêtements hydrophobes en Asie-Pacifique au cours de la période de prévision, en raison de son industrialisation rapide, de l'expansion de sa production automobile et électronique et de l'adoption croissante de revêtements protecteurs dans les projets de construction et d'infrastructure.

- Le segment des polysiloxanes a dominé le marché avec une part de plus de 40 % en 2025, grâce à leurs excellentes propriétés hydrofuges, leur résistance chimique et leur adaptabilité à divers substrats. Ces revêtements sont largement plébiscités dans les secteurs de l'automobile, de l'électronique et de la construction pour leur durabilité et leur capacité à préserver l'esthétique des surfaces. Les polysiloxanes offrent également une application facile et une compatibilité avec de nombreuses méthodes de revêtement, ce qui améliore l'efficacité opérationnelle. Leur polyvalence, permettant de former des couches minces et transparentes sans altérer l'aspect du substrat, renforce leur popularité. Les chaînes d'approvisionnement bien établies et la large adoption industrielle de ce segment consolident sa position dominante.

Portée du rapport et segmentation du marché des revêtements hydrophobes en Asie-Pacifique

|

Attributs |

Revêtements hydrophobes : principales perspectives du marché |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des revêtements hydrophobes en Asie-Pacifique

« Utilisation croissante des revêtements autonettoyants et multifonctionnels »

- Une tendance majeure du marché des revêtements hydrophobes en Asie-Pacifique est l'utilisation croissante de revêtements autonettoyants et multifonctionnels dans tous les secteurs industriels. Cette tendance est motivée par le besoin de surfaces résistantes à l'eau, à la poussière et aux contaminants, tout en améliorant la durabilité des produits. Ces revêtements optimisent les performances dans des secteurs tels que l'automobile, l'électronique et la construction en réduisant les besoins de maintenance et en prolongeant la durée de vie des équipements.

- Par exemple, des entreprises comme P2i et 3M proposent des revêtements hydrophobes avancés pour l'électronique grand public et les dispositifs médicaux, empêchant les infiltrations d'eau et l'encrassement des surfaces. Ces solutions améliorent la durée de vie des appareils et le confort d'utilisation dans les environnements exposés à l'humidité et aux particules.

- L'adoption des revêtements hydrophobes dans le secteur automobile s'accélère, car leur application sur les pare-brise, les capteurs et les panneaux de carrosserie améliore la visibilité, la sécurité et la résistance à la corrosion. Ces revêtements deviennent ainsi essentiels à la performance des véhicules modernes et à la protection des passagers.

- Dans le domaine de l'électronique et des objets connectés, les revêtements hydrophobes sont utilisés pour protéger les composants sensibles des dommages causés par l'eau et la transpiration. Cette tendance permet aux fabricants de proposer des produits fiables et durables, répondant aux attentes croissantes des consommateurs en matière de robustesse.

- Le secteur de la construction et des matériaux de construction intègre de plus en plus de revêtements hydrophobes sur les surfaces en verre, en béton et en métal afin de prévenir les dégâts d'eau et les taches. Cette tendance favorise les revêtements qui offrent une protection durable tout en préservant l'esthétique.

- Les industries des secteurs de l'énergie et des infrastructures appliquent des revêtements hydrophobes aux turbines, aux pipelines et aux panneaux solaires afin d'améliorer leur efficacité et de réduire les coûts de maintenance. L'utilisation croissante de ces revêtements stimule la croissance du marché et les positionne comme des facteurs clés de la longévité opérationnelle.

Dynamique du marché des revêtements hydrophobes en Asie-Pacifique

Conducteur

« La demande croissante de revêtements résistants à la corrosion et à l’eau dans les industries clés »

- Le besoin croissant de surfaces résistantes à la corrosion et à l'eau dans les secteurs de l'automobile, de l'électronique et des équipements industriels stimule le marché des revêtements hydrophobes en Asie-Pacifique. Ces revêtements protègent les actifs de grande valeur contre la dégradation environnementale, prolongeant ainsi leur durée de vie et réduisant les coûts de réparation.

- Par exemple, PPG Industries fournit des revêtements hydrophobes spécialisés pour les applications automobiles et aérospatiales, qui améliorent la résistance à la corrosion dans des conditions extrêmes. Ces revêtements permettent aux fabricants de proposer des produits plus sûrs et plus durables, tout en respectant les normes réglementaires les plus strictes.

- L'industrie électronique recourt de plus en plus aux revêtements hydrophobes pour prévenir les défaillances dues à l'humidité dans les appareils sensibles tels que les smartphones, les objets connectés et les équipements médicaux. Cette adoption favorise l'innovation dans le domaine des nanorevêtements et des traitements de surface protecteurs.

- Les machines industrielles et les équipements lourds bénéficient de revêtements hydrophobes qui réduisent la rouille et l'usure des surfaces, améliorant ainsi la disponibilité et la productivité des équipements. Cette technologie favorise son adoption dans tous les secteurs où la continuité des opérations est essentielle.

- Le secteur des énergies renouvelables utilise des revêtements hydrophobes pour les éoliennes, les panneaux solaires et les équipements hydrauliques afin d'améliorer leur efficacité et de minimiser les dommages liés à l'eau. La demande croissante pour ces revêtements résistants soutient la croissance du marché et les positionne comme des solutions essentielles pour la protection des actifs.

Retenue/Défi

« Coût élevé et application complexe des revêtements avancés »

- Le marché des revêtements hydrophobes en Asie-Pacifique est confronté à des défis liés au coût élevé des formulations avancées et à la complexité des procédés d'application nécessaires à une performance optimale. Ces facteurs limitent l'adoption de ces revêtements, notamment dans les segments sensibles aux prix et les petites industries.

- Par exemple, des entreprises comme P2i utilisent des techniques de dépôt en phase vapeur de précision pour appliquer des nanorevêtements sur des composants électroniques, ce qui nécessite un équipement spécialisé et un personnel qualifié. La complexité de ces procédés augmente les coûts de production et limite leur déploiement à grande échelle.

- L'obtention d'une épaisseur de revêtement uniforme et d'une bonne adhérence sur des surfaces diverses exige un contrôle rigoureux du processus, ce qui augmente encore les coûts opérationnels et allonge les délais de production.

- Le recours aux produits chimiques de haute pureté et aux nanomatériaux accroît la sensibilité de la chaîne d'approvisionnement et affecte la stabilité des coûts, ce qui complique le maintien de prix compétitifs.

- Le développement à grande échelle des revêtements hydrophobes pour les applications industrielles et grand public, tout en garantissant une qualité constante, demeure un enjeu majeur. Ces défis incitent les fabricants à investir dans l'optimisation des procédés et la réduction des coûts afin de répondre à la demande croissante tout en maintenant les normes de performance.

Portée du marché des revêtements hydrophobes en Asie-Pacifique

Le marché est segmenté en fonction du produit, du type de substrat, de la couche de revêtement, de la méthode d'application, de la fonction, de la qualité, du canal de distribution et de l'utilisateur final.

• Sous-produit

Le marché des revêtements hydrophobes en Asie-Pacifique est segmenté, selon le type de produit, en polysiloxanes, fluoropolymères, fluoroalkylsilanes, dioxyde de titane et autres. Le segment des polysiloxanes a dominé le marché en 2025, représentant plus de 40 % des revenus. Cette domination s'explique par leurs excellentes propriétés hydrofuges, leur résistance chimique et leur adaptabilité à divers substrats. Ces revêtements sont largement plébiscités dans les secteurs de l'automobile, de l'électronique et de la construction pour leur durabilité et leur capacité à préserver l'esthétique des surfaces. Les polysiloxanes offrent également une application facile et une compatibilité avec de nombreuses méthodes de revêtement, optimisant ainsi l'efficacité opérationnelle. Leur polyvalence, permettant de former des couches minces et transparentes sans altérer l'aspect du substrat, renforce leur popularité. Enfin, la solidité des chaînes d'approvisionnement et la large adoption industrielle de ce segment consolident sa position dominante.

Le segment des fluoropolymères devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par la demande croissante dans les secteurs de l'électronique de pointe, de l'aérospatiale et du nautisme. À titre d'exemple, Chemours a élargi sa gamme de revêtements hydrophobes à base de téflon afin de répondre aux exigences industrielles en matière de surfaces hautes performances et résistantes à la corrosion. Les fluoropolymères offrent une inertie chimique et une stabilité thermique supérieures, ce qui les rend idéaux pour les environnements difficiles. Leur faible énergie de surface leur confère des propriétés anti-salissures et autonettoyantes efficaces. L'augmentation des investissements en R&D pour les revêtements fluoropolymères de nouvelle génération contribue également à leur adoption rapide. Ce segment bénéficie d'une préférence croissante pour les revêtements protecteurs haut de gamme et durables dans de nombreux secteurs industriels.

• Par type de substrat

Le marché des revêtements hydrophobes en Asie-Pacifique est segmenté selon le type de substrat : métal, verre, polymère, céramique, béton et textile. Le segment des substrats métalliques dominait le marché en 2025, grâce à leur utilisation intensive dans les secteurs de l’automobile, de l’aérospatiale et de la construction, qui exigent des surfaces résistantes à la corrosion et hydrofuges. Les substrats métalliques bénéficient d’une durabilité et de performances accrues lorsqu’ils sont revêtus de couches hydrophobes, ce qui prolonge la durée de vie des composants critiques. Les normes et réglementations industrielles favorisent également les revêtements métalliques pour les applications de protection. Leur compatibilité avec diverses méthodes de revêtement et leur capacité à maintenir l’intégrité structurelle contribuent à leur adoption croissante. La forte présence industrielle de ce segment explique son leadership durable sur le marché.

Le segment des substrats en verre devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par l'adoption croissante des fenêtres intelligentes, des panneaux solaires et de l'électronique grand public. Par exemple, PPG Industries a développé des revêtements hydrophobes de pointe pour le verre architectural, améliorant ainsi son imperméabilité et ses propriétés autonettoyantes. Ces revêtements optimisent la visibilité et réduisent les coûts d'entretien des bâtiments résidentiels et commerciaux. Les substrats en verre revêtus de couches hydrophobes offrent également des propriétés anti-salissures pour les pare-brise automobiles. L'urbanisation croissante et le développement des bâtiments intelligents alimentent la demande de surfaces vitrées traitées. Ce segment connaît une croissance rapide grâce aux progrès technologiques et à la sensibilisation accrue aux solutions écoénergétiques.

• Par couche de revêtement

Le marché des revêtements hydrophobes en Asie-Pacifique est segmenté en deux catégories : monocouche et multicouche. Le segment monocouche dominait le marché en 2025, grâce à son rapport coût-efficacité, sa facilité d’application et son adéquation aux déploiements industriels à grande échelle. Les revêtements monocouches sont largement utilisés dans les secteurs de l’automobile, de l’électronique et du bâtiment pour la protection des surfaces sans modification significative des dimensions du substrat. Leur simplicité garantit des performances constantes et des temps d’arrêt de production minimaux. Ce segment bénéficie de pratiques de fabrication éprouvées et d’une compatibilité avec les méthodes de revêtement conventionnelles. Les solutions monocouches offrent également une hydrophobie fiable tout en réduisant le gaspillage de matériaux. Leur polyvalence contribue à leur position dominante sur le marché.

Le segment des revêtements multicouches devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par la demande croissante de revêtements multifonctionnels et haute performance. À titre d'exemple, AkzoNobel a lancé des revêtements hydrophobes multicouches pour applications marines, combinant des propriétés anticorrosion, antisalissure et autonettoyantes. Les systèmes multicouches améliorent la durabilité, la résistance thermique et les performances de surface dans des environnements difficiles. Ce segment gagne du terrain dans les secteurs de l'aérospatiale, de l'électronique et des machines industrielles, où une protection avancée est essentielle. L'augmentation des investissements en R&D pour les revêtements multifonctionnels accélère leur adoption. Les solutions multicouches répondent à la demande de traitements de surface techniques haut de gamme.

• Par méthode de candidature

Le marché des revêtements hydrophobes en Asie-Pacifique est segmenté, selon la méthode d'application, en trempage, application au pinceau, application au rouleau, pulvérisation et autres. Le segment de la pulvérisation dominait le marché en 2025, grâce à son efficacité pour revêtir uniformément des géométries complexes et de grandes surfaces. La pulvérisation offre un contrôle précis de l'épaisseur du revêtement et réduit le gaspillage de matériau, ce qui la rend idéale pour les applications automobiles et de construction. L'adoption à l'échelle industrielle et la mécanisation améliorent la productivité et garantissent une qualité constante. Les méthodes de pulvérisation permettent également une compatibilité avec de multiples substrats et formulations de revêtement. La présence établie de ce segment dans les processus commerciaux et industriels contribue à sa position de leader sur le marché.

Le segment du revêtement par immersion devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par son utilisation croissante dans la production à petite échelle et les applications industrielles spécialisées. Par exemple, DuPont a exploité les techniques de revêtement par immersion pour appliquer des couches hydrophobes sur les composants électroniques afin d'améliorer leur résistance à l'humidité. Ce procédé garantit une couverture uniforme et une forte adhérence sur les surfaces complexes ou de formes irrégulières. Il gagne en popularité dans les secteurs du textile, de l'électronique et de la santé pour sa précision et son efficacité. La demande croissante de procédés de revêtement économiques et adaptables à grande échelle soutient cette croissance. Le revêtement par immersion facilite également la création de revêtements multifonctionnels, ce qui accélère son adoption.

• Par fonction

Le marché des revêtements hydrophobes en Asie-Pacifique est segmenté, selon leur fonction, en revêtements anticorrosion, antimicrobiens, antisalissures, antigivrage/mouillage, autonettoyants et autres. Le segment anticorrosion a dominé le marché en 2025, porté par une utilisation industrielle généralisée dans les secteurs de l'automobile, du maritime, du pétrole et du gaz, et de la construction, qui exigent une protection durable contre la rouille et la dégradation. Les revêtements anticorrosion prolongent la durée de vie des composants et réduisent les coûts de maintenance, ce qui les rend essentiels pour les infrastructures et les machines industrielles. Ces revêtements sont privilégiés en raison de leurs performances éprouvées, de leur conformité réglementaire et de leur compatibilité avec divers substrats. Les solutions anticorrosion s'intègrent également bien avec d'autres couches fonctionnelles, améliorant ainsi la protection globale des surfaces. La pertinence industrielle établie de ce segment renforce sa position dominante sur le marché.

Le segment des revêtements autonettoyants devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par leur adoption croissante dans les secteurs du verre architectural, des panneaux solaires et de l'électronique grand public. Par exemple, Saint-Gobain a développé des revêtements hydrophobes autonettoyants pour les façades de bâtiments, permettant de réduire la maintenance et la consommation d'eau. Ces revêtements exploitent des propriétés superhydrophobes pour repousser naturellement la saleté et les contaminants. L'urbanisation rapide et le développement des bâtiments intelligents stimulent la demande de surfaces nécessitant peu d'entretien. Ce segment bénéficie également d'une sensibilisation accrue au développement durable et à l'efficacité des ressources. Les progrès technologiques dans le domaine des nanorevêtements accélèrent encore la croissance du marché.

• Par niveau scolaire

Le marché des revêtements hydrophobes en Asie-Pacifique est segmenté, selon leur qualité, en trois catégories : qualité alimentaire, qualité industrielle et autres. Le segment de la qualité industrielle a dominé le marché en 2025, grâce à ses nombreuses applications dans les secteurs de l’automobile, de l’aérospatiale, de la construction et de l’électronique, qui exigent des revêtements protecteurs haute performance. Les revêtements hydrophobes de qualité industrielle offrent durabilité, stabilité thermique et résistance chimique, même dans des conditions d’utilisation difficiles. Ils sont largement plébiscités pour leur conformité aux normes industrielles et leurs avantages opérationnels à long terme. La forte présence de ce segment dans les pôles de production et la robustesse de ses chaînes d’approvisionnement contribuent à sa position dominante. Les revêtements de qualité industrielle permettent également l’intégration de couches multifonctionnelles, ce qui en accroît l’utilité.

Le segment des revêtements de qualité alimentaire devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par la demande croissante de surfaces hygiéniques et hydrofuges dans l'industrie agroalimentaire. Par exemple, PPG a développé des revêtements hydrophobes de qualité alimentaire pour prévenir la prolifération bactérienne et faciliter le nettoyage des équipements de transformation. Ces revêtements sont conformes aux normes de sécurité et garantissent la qualité des produits. La sensibilisation accrue aux normes de contrôle de la contamination et d'hygiène dans l'industrie agroalimentaire favorise leur adoption. Ce segment se développe à mesure que les fabricants privilégient l'efficacité et la sécurité. Les revêtements de qualité alimentaire contribuent également à prolonger la durée de vie des équipements tout en minimisant les efforts de nettoyage.

• Par canal de distribution

Le marché des revêtements hydrophobes en Asie-Pacifique est segmenté en deux canaux de distribution : hors ligne et en ligne. En 2025, le segment hors ligne dominait le marché, grâce à des chaînes d'approvisionnement bien établies, des pratiques d'achat industrielles éprouvées et la disponibilité d'un support technique pour les produits de revêtement. Les acheteurs industriels privilégient souvent les canaux hors ligne pour les commandes en gros, les consultations et les solutions personnalisées. La distribution hors ligne permet une évaluation pratique des produits et garantit le respect des normes de qualité. Ce segment bénéficie de relations solides entre les fabricants, les distributeurs et les utilisateurs finaux des secteurs de l'automobile, de l'aérospatiale et de la construction. Les canaux hors ligne demeurent un moyen privilégié de distribution des revêtements hydrophobes en raison de la confiance qu'ils inspirent et de leur accessibilité.

Le segment en ligne devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par l'essor du e-commerce, des places de marché B2B et des plateformes d'approvisionnement numérique. Par exemple, Alibaba a facilité la vente en ligne de revêtements hydrophobes spéciaux pour des applications industrielles et à petite échelle. Les canaux en ligne offrent aux acheteurs praticité, une plus grande visibilité et des informations comparatives sur les produits. La digitalisation accrue et l'approvisionnement à distance stimulent l'adoption de ces solutions par les PME et les acheteurs internationaux. Ce segment se développe à mesure que les fabricants renforcent leur visibilité en ligne et multiplient les initiatives de vente directe aux consommateurs. La distribution en ligne permet une pénétration de marché plus rapide et un accès à des applications de niche.

• Par l'utilisateur final

Le marché des revêtements hydrophobes en Asie-Pacifique est segmenté, selon l'utilisateur final, en automobile, électronique, bâtiment et construction, secteur maritime, textile, santé, aérospatiale, pétrole et gaz, agroalimentaire et autres. Le segment automobile dominait le marché en 2025, porté par la demande croissante de revêtements protecteurs pour véhicules visant à améliorer la résistance à la corrosion, l'hydrophobie et la durabilité des surfaces. Les revêtements hydrophobes améliorent l'esthétique des véhicules, réduisent les coûts d'entretien et favorisent des pratiques de fabrication durables. Les constructeurs automobiles intègrent de plus en plus ces revêtements dans leurs processus de production pour les composants à forte valeur ajoutée. La base industrielle établie de ce segment et son adoption dans les véhicules particuliers, utilitaires et électriques renforcent sa position dominante. La forte préférence des consommateurs pour les véhicules nécessitant peu d'entretien soutient également ce segment.

Le secteur de l'électronique devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par l'adoption croissante des smartphones, des objets connectés et de l'électronique industrielle, qui nécessitent des surfaces résistantes à l'humidité et autonettoyantes. Par exemple, Samsung a intégré des revêtements hydrophobes à ses appareils mobiles afin d'améliorer leur résistance à l'eau et leur fiabilité. Ce secteur bénéficie de la miniaturisation croissante, de l'essor de l'Internet des objets (IoT) et de la demande accrue de composants électroniques de grande valeur, exigeant une durabilité à long terme. La sensibilisation accrue des consommateurs à la protection des appareils favorise une adoption rapide. Les revêtements électroniques contribuent également à la conception d'appareils économes en énergie et ne nécessitant aucun entretien. La croissance de ce secteur s'explique par l'accent mis par les fabricants sur l'innovation et la différenciation des produits.

Analyse régionale du marché des revêtements hydrophobes en Asie-Pacifique

- La Chine a dominé le marché des revêtements hydrophobes en Asie-Pacifique en 2025, générant la plus grande part de revenus grâce à son vaste tissu industriel, au développement rapide de ses infrastructures et à l'adoption croissante de solutions de protection de surface avancées dans des secteurs clés tels que l'automobile, l'électronique et la construction.

- Des initiatives gouvernementales robustes promouvant les matériaux haute performance et les technologies résistantes à la corrosion, combinées à l'expansion rapide de l'électronique intelligente et de la fabrication automobile, renforcent le leadership de la Chine sur le marché régional.

- La présence de grands fabricants nationaux tels que PPG Industries China et Sinopec, les collaborations avec les acteurs mondiaux du secteur des revêtements et l'introduction de revêtements hydrophobes à la fois technologiquement avancés et économiques continuent de consolider la position dominante de la Chine au cours de la période prévisionnelle. L'expansion des applications industrielles et la prise de conscience croissante de l'importance de la protection des actifs à long terme renforcent encore la pénétration du marché dans les zones industrielles urbaines et périurbaines.

Aperçu du marché des revêtements hydrophobes au Japon et en Asie-Pacifique

Le marché japonais devrait connaître une croissance soutenue entre 2026 et 2033, porté par son secteur manufacturier de pointe et son engagement fort envers la qualité et l'ingénierie de précision. Les industries japonaises adoptent de plus en plus les revêtements hydrophobes multifonctionnels pour l'électronique, les composants automobiles et les machines industrielles afin d'améliorer leur durabilité et leur efficacité opérationnelle. Des entreprises telles que 3M Japan et Nissin Chemical stimulent la croissance du marché grâce à leurs investissements en R&D et au lancement de revêtements innovants et performants. La demande de revêtements compacts, adaptés à des applications spécifiques et respectueux de l'environnement est en hausse en raison des réglementations strictes et des initiatives de développement durable. Les progrès technologiques constants, les collaborations entre les fabricants japonais et les fournisseurs mondiaux de revêtements, ainsi que l'accent mis sur une protection de surface de haute qualité, renforcent les perspectives de croissance soutenue du marché. L'engagement du Japon envers la précision, l'innovation et la fiabilité des produits consolide son positionnement régional fort.

Aperçu du marché des revêtements hydrophobes en Inde et en Asie-Pacifique

L'Inde devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide du marché des revêtements hydrophobes en Asie-Pacifique entre 2026 et 2033, portée par une industrialisation rapide, l'expansion de la production automobile et électronique et l'adoption croissante de revêtements protecteurs dans les projets de construction et d'infrastructures. La multiplication des campagnes de sensibilisation à la durabilité des produits, l'urbanisation et le développement des pôles de production accélèrent cette adoption. La demande de revêtements hydrophobes économiques et faciles à appliquer est particulièrement forte auprès des PME et des grandes entreprises industrielles. Le développement des chaînes d'approvisionnement industrielles, la croissance rapide des plateformes de commerce électronique pour les revêtements spéciaux et les partenariats avec des acteurs mondiaux tels que PPG Industries et Sherwin-Williams améliorent l'accessibilité des produits. Les initiatives gouvernementales promouvant les matériaux avancés et l'importance accrue accordée à la protection des actifs garantissent l'émergence de l'Inde comme marché à la croissance la plus rapide de la région.

Part de marché des revêtements hydrophobes en Asie-Pacifique

L'industrie des revêtements hydrophobes est principalement dominée par des entreprises bien établies, notamment :

- Nanofilm (États-Unis)

- BASF SE (Allemagne)

- AccuCoat Inc. (États-Unis)

- NeverWet, LLC (États-Unis)

- Arkema (France)

- COTEC GmbH (Allemagne)

- P2i Ltd. (Royaume-Uni)

- PPG Industries, Inc. (États-Unis)

- 3M (États-Unis)

- Artekya Teknoloji (Turquie)

- La société Sherwin-Williams (États-Unis)

- Laboratoire de nanotechnologie avancée (États-Unis)

- AkzoNobel NV (Pays-Bas)

- Aculon Inc. (États-Unis)

- UltraTech International, Inc. (États-Unis)

- Systèmes de revêtement Nukote International (États-Unis)

- Cytonix, LLC (États-Unis)

Dernières évolutions du marché des revêtements hydrophobes en Asie-Pacifique

- En juin 2024, NEI Corporation a lancé NANOMYTE AM-100EC, un revêtement antimicrobien de nouvelle génération conçu pour offrir une protection supérieure contre les micro-organismes pathogènes. Ce produit innovant allie propriétés antimicrobiennes et facilité de nettoyage, ce qui le rend particulièrement adapté aux applications dans les secteurs de la santé, de l'agroalimentaire et de l'hygiène publique. Le revêtement AM-100EC est conçu pour résister aux protocoles de nettoyage les plus rigoureux tout en conservant son efficacité, répondant ainsi à la demande croissante du marché pour des surfaces hygiéniques et sûres. Ce lancement renforce la position de NEI sur le marché des revêtements hydrophobes en Asie-Pacifique en élargissant son offre de revêtements antimicrobiens et multifonctionnels, témoignant de l'importance accrue accordée à la sécurité publique et à la conformité réglementaire.

- En mars 2024, Mitsui Chemicals, Inc., en collaboration avec la société allemande CADIS Engineering GmbH, a lancé, par l'intermédiaire de sa filiale COTEC GmbH, une imprimante numérique conçue pour optimiser les écrans automobiles à revêtement hydrophobe. Cette innovation permet un dépôt précis de revêtements hydrophobes sur les surfaces électroniques automobiles, améliorant ainsi l'hydrophobie, la résistance aux salissures et la durabilité. Ce développement devrait accélérer l'adoption des revêtements hydrophobes dans l'électronique automobile, un segment en forte croissance, en permettant des applications plus performantes et plus efficaces. Il renforce également la tendance du marché à intégrer les revêtements avancés aux technologies de fabrication numérique et de véhicules intelligents.

- En février 2024, l'Institut Leibniz pour la science et la technologie des plasmas (INP) de Greifswald, en Allemagne, a mis au point une nouvelle méthode de production de revêtements polymères organosiliciés ultra-hydrophobes. Cette approche offre une alternative écologique aux composés perfluorés et polyfluorés (PFAS), largement utilisés mais faisant l'objet d'une surveillance réglementaire accrue. En réduisant la dépendance aux PFAS, cette innovation répond aux enjeux de développement durable du marché des revêtements hydrophobes en Asie-Pacifique, en promouvant des solutions plus sûres et respectueuses de l'environnement. Ce développement soutient la croissance du marché dans les industries privilégiant les revêtements écologiques et positionne les polymères organosiliciés comme une solution clé, performante et conforme à la réglementation.

- En juillet 2023, BASF Automotive OEM Coatings a atteint 100 % d'utilisation d'énergie renouvelable sur ses sites chinois, une étape importante vers la neutralité carbone de l'entreprise. Grâce à une combinaison d'achats directs d'électricité renouvelable, de certificats internationaux d'énergie renouvelable et d'autres stratégies, cette initiative devrait réduire les émissions de carbone d'environ 19 000 tonnes d'ici fin 2023. Cette étape majeure souligne l'engagement de BASF en matière de développement durable et trouve un écho favorable auprès du marché des revêtements hydrophobes en Asie-Pacifique, mettant en lumière la demande croissante de solutions écoresponsables et à faible émission de carbone. Cette initiative renforce la position concurrentielle de BASF en alignant son offre de produits sur les tendances mondiales en matière de développement durable.

- En septembre 2022, BASF Coatings a inauguré à Münster-Hiltrup, en Allemagne, un centre de recherche de pointe dédié au revêtement par immersion électrophorétique, axé sur l'amélioration des technologies de revêtement hydrophobe. Ce centre privilégie la sécurité, l'efficacité et la simulation des procédés spécifiques aux clients, contribuant ainsi au développement de la technologie de revêtement électrophorétique CathoGuard 800. Reconnue pour sa protection des surfaces automobiles contre la corrosion grâce à une faible teneur en solvants et une réduction des eaux usées, cette innovation offre à la fois des performances élevées et des avantages environnementaux. Ce centre de recherche renforce le leadership de BASF sur le marché des revêtements hydrophobes pour l'automobile, permettant le développement de solutions avancées et écologiques répondant aux normes industrielles en constante évolution et aux attentes des clients.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.