Asia-Pacific Health and Wellness Food Market, By Type (Functional Food, Fortified and Healthy Bakery Products, Healthy Snacks, BFY Foods, Beverages, Chocolates and Others), Calorie Content (No-Calorie, Low Calories and Reduced-Calorie), Nature (Non-GMO and GMO), Fat Content (No Fat, Low Fat and Reduced-Fat), Category (Conventional and Organic), Free From Category (Gluten-Free, Dairy-Free, Soy-Free, Nut-Free, Lactose-Free, Artificial Flavor-Free, Artificial Color-Free and Others) and Distribution Channel (Store-Based Retailers and Non-Store Retailers) Industry Trends and Forecast to 2029

Market Analysis and Insights

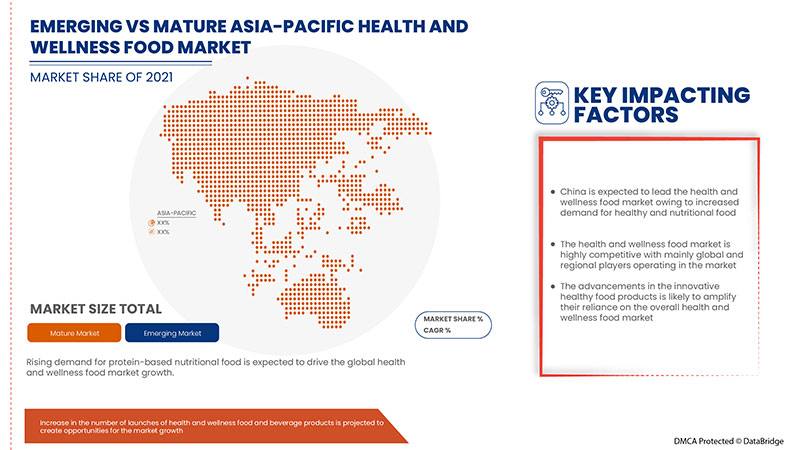

Asia-Pacific health and wellness food market is gaining significant growth due to the growing food & beverage industry and the rise in demand for healthy and nutritional food products. The increase in the number of health conscious people is also boosting the growth of Asia's Pacific health and wellness food market. However, stringent government regulations associated with food products are expected to restrain the market growth of the vanilla market during the forecast period.

For instance,

- In August 2019, according to Economics Times, Danone and Nestle, two European food titans, pushed up new product releases and developments, a formula for fighting off new competition in the health and nutrition industry. While Nestle is relaunched Milo, the world's largest malted food drinks brand, Danone said it is working on over a dozen new products, including low sugar variations, bar, and ready-to-drink versions of its health brand Protinex

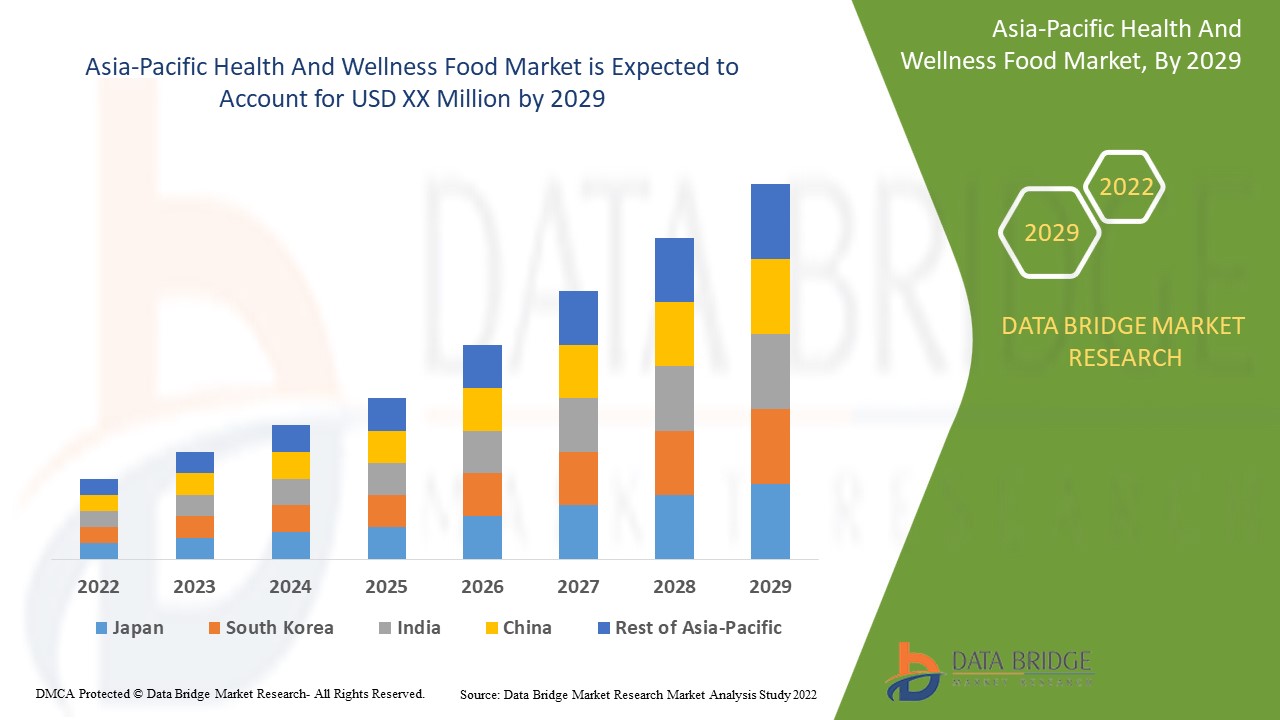

Data Bridge Market Research analyses that the Asia-Pacific health and wellness food market will grow at a CAGR of 9.9% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019- 2015) |

|

Quantitative Units |

Revenue in USD Billion |

|

Segments Covered |

By Type (Functional Food, Fortified and Healthy Bakery Products, Healthy Snacks, BFY Foods, Beverages, Chocolates and Others), Calorie Content (No-Calorie, Low Calories and Reduced-Calorie), Nature (Non-GMO and GMO), Fat Content (No Fat, Low Fat and Reduced-Fat), Category (Conventional and Organic), Free From Category (Gluten-Free, Dairy-Free, Soy-Free, Nut-Free, Lactose-Free, Artificial Flavor-Free, Artificial Color-Free and Others) and Distribution Channel (Store-Based Retailers and Non-Store Retailers) |

|

Regions Covered |

China, Japan, Australia, India, Philippines, Indonesia, Singapore, South Korea, Malaysia, Thailand and rest of Asia-Pacific |

|

Market Players Covered |

Alter Eco, Maspex, PepsiCo, General Mills Inc., Mars, Incorporated, Nestlé, Danone, Abbott, Huel Inc., Groupe de sociétés GSK, Clif Bar & Company, Green Valley Dairies, Chobani, LLC., SO DELICIOUS DAIRY FREE, Enjoy Life, The Simply Good Foods Company, Mondelez International., Kellogg Co., The Quaker Oats Company et Yakult Honsha Co., Ltd. |

Définition du marché

L’alimentation, la santé et le bien-être sont tous interconnectés. Les aliments que nous consommons et leur provenance ont un impact sur notre santé et notre forme physique. Le bien-être découle de l’alimentation équilibrée que nous intégrons dans notre vie quotidienne. La santé ne se résume pas seulement à manger de meilleurs aliments, mais aussi à réduire la tension et le stress et à faire régulièrement de l’exercice. Les aliments pour la santé et le bien-être peuvent aider à réduire le risque ou le traitement des maladies et à améliorer les performances physiques ou mentales en incluant un élément fonctionnel ou une modification du traitement.

Dynamique du marché des aliments de santé et de bien-être en Asie-Pacifique

Conducteurs

- Demande croissante d'aliments et de boissons sains et nutritifs à base de protéines

Il existe une demande rapide d’aliments et de boissons sains à base de protéines, car les consommateurs sont devenus plus soucieux de leur santé et préfèrent des aliments ayant une plus grande valeur nutritionnelle et des bienfaits pour la santé qui les aideront à maintenir une alimentation saine.

Les noix, les céréales, les graines, les fruits et les légumes sont d'importantes sources de protéines utilisées pour produire des produits alimentaires à base de protéines. Ainsi, les fabricants se concentrent sur le développement de nouveaux produits en proposant divers mélanges de noix, de fruits, de céréales, de snacks à base de céréales, de barres, de boissons et d'autres produits riches en protéines pour attirer la clientèle.

De plus, les protéines sont l’un des principaux macronutriments dont notre corps a besoin en grande quantité pour fonctionner correctement. Les protéines sont une substance importante dont chaque cellule du corps a besoin. Les protéines sont l’élément principal des ongles et des cheveux et jouent également un rôle important pour la peau et le corps, car elles construisent et réparent les tissus. Elles sont également essentielles pour les os, les muscles et le sang. Ainsi, les fabricants s’efforcent d’introduire sur le marché des aliments riches en protéines.

De plus, les boissons à base de protéines fournissent une meilleure nutrition car elles contiennent une grande quantité de protéines et d'autres nutriments bénéfiques. Ainsi, étant une source riche en protéines, elles stimulent l'énergie et nourrissent davantage le corps. De plus, les boissons à base de protéines offrent une meilleure santé, un goût supérieur et plus de fraîcheur. De plus, les protéines fournissent au corps des muscles, des organes, des cheveux, des tissus et de la peau. Les boissons nutritionnelles à base de protéines jouent également un rôle dans le métabolisme, la perte de poids et la gestion du poids, en aidant à favoriser la libération des graisses, en réduisant le stockage des graisses et en augmentant le taux métabolique du corps. Les consommateurs sont conscients de ce fait et demandent donc davantage de produits alimentaires et de boissons à base de protéines dans le monde entier.

- Augmentation du revenu disponible et des dépenses croissantes en produits alimentaires sains

Une augmentation du revenu disponible ou un revenu disponible élevé à travers le monde permet aux consommateurs de s’offrir davantage de nourriture et de boissons.

De plus, lorsque le revenu disponible augmente, les ménages ont plus d’argent à épargner ou à dépenser en nourriture, ce qui conduit naturellement à une augmentation de la consommation de produits alimentaires sains, créant ainsi une demande pour le marché mondial des aliments de santé et de bien-être. Ainsi, l’augmentation du revenu disponible des consommateurs leur permet d’acheter davantage de boissons nutritives pour vivre une vie saine, ce qui stimule la croissance du marché.

En outre, l’augmentation des dépenses consacrées à des aliments sains et nutritifs a stimulé la demande de produits alimentaires qui aident les gens à maintenir leur santé.

Ainsi, on peut constater qu’en raison de l’augmentation du revenu disponible, les consommateurs dépensent plus d’argent en produits sains tels que les boissons nutritionnelles pour rester en bonne santé, ce qui devrait stimuler la croissance du marché mondial des aliments de santé et de bien-être.

Opportunités

-

Augmentation du nombre de lancements de produits alimentaires et de boissons de santé et de bien-être

Le marché de la santé et du bien-être connaît une croissance rapide dans le monde entier en raison de la sensibilisation accrue à la santé et de la demande de produits sains et nutritionnels.

Une partie importante du plan de lancement consiste à valider rapidement le produit et ses avantages. Pour ce faire, le Net Promoter Score (NPS) et le Customer Satisfaction Score (CSAT) peuvent être corrompus lorsque vous recevez des commentaires négatifs de la part d'utilisateurs qui ne sont pas censés tester la première version de votre produit ou de votre fonctionnalité. De cette façon, les fabricants d'aliments de santé et de bien-être créent constamment de nouvelles stratégies de lancement, ce qui contribue à la croissance de l'entreprise.

Par exemple,

-

En juillet 2021, selon PR News Wire, Health-Ade, une marque américaine, a lancé « Pop », un soda prébiotique à faible teneur en sucre et aux bienfaits réels pour la santé intestinale, complétant ainsi une gamme de boissons saines pour l'intestin. Ce soda meilleur pour la santé est proposé dans de nouveaux emballages, saveurs et formules, pour un total de six options délicieuses : Grenade, Citron vert, Gingembre pétillant, Fraise vanille, Apple Snap et Raisin juteux sont quelques-unes des saveurs disponibles

Ainsi, de nouvelles stratégies de lancement sont mises en œuvre pour stimuler le marché. Il s'agit d'une opportunité exceptionnelle pour les fabricants car ces lancements expliquent le contenu et la qualité des produits, permettant ainsi aux consommateurs d'acheter des produits plus sains.

Contraintes/Défis

- Manque de sensibilisation et scepticisme des gens à l’égard des aliments et des boissons sains

Le manque de connaissances sur les bienfaits pour la santé et la valeur nutritionnelle des aliments et boissons nutritionnels crée un scepticisme à l'égard des produits. Les consommateurs hésitent à consommer des boissons nutritionnelles en raison de la contamination et de la falsification accrues des aliments et boissons. Ainsi, cela finit par créer un scepticisme chez les consommateurs, qui réfléchissent à deux fois avant d'acheter l'aliment ou la boisson pour éviter les effets secondaires. C'est le principal facteur de défi pour la croissance du marché. Le manque de compréhension de l'étiquetage nutritionnel sur les aliments et les boissons crée une confusion chez les consommateurs. Les étiquettes nutritionnelles peuvent être trompeuses et, dans certains cas, il s'agit de fausses allégations, ce qui crée une hésitation chez les consommateurs à choisir des aliments et des boissons sains et appropriés.

- Hausse des prix des aliments et boissons sains et nutritifs

Les fluctuations des prix des matières premières et la hausse des prix des nutriments de meilleure qualité ont entraîné une augmentation des coûts des aliments et boissons nutritifs. De plus, les taxes alimentaires plus élevées et la demande croissante d'aliments et de boissons nutritifs entraînent des prix élevés.

Les prix élevés de ces produits peuvent modifier les habitudes d’achat des consommateurs, comme les boissons à teneur moyenne en sucre, les shakes nutritionnels, les boissons pour sportifs, les boissons énergisantes et d’autres boissons qui empêchent les consommateurs sensibles au prix d’acheter ces produits.

Par exemple,

- Le prix moyen d'Altrajuice Apple est de 4,75 $/200 ml ; cependant, le prix moyen d'un Coca/Pepsi est de 2,50 $/330 ml

Ainsi, en raison des prix élevés des aliments et boissons sains et nutritifs, les consommateurs peuvent se tourner vers des substituts plus abordables pour la classe moyenne inférieure et la classe moyenne, ce qui freine la croissance du marché mondial des aliments de santé et de bien-être.

Impact de la pandémie de COVID-19 sur le marché des aliments de santé et de bien-être en Asie-Pacifique

Après la pandémie, la demande de produits alimentaires et de santé a augmenté, car il n'y aura plus de restrictions de mouvement ; par conséquent, l'approvisionnement en produits sera facile. En outre, la tendance croissante à une alimentation saine et le nombre croissant de personnes soucieuses de leur santé dans le monde après l'épidémie de coronavirus devraient stimuler la croissance du marché.

La demande croissante d'aliments et de boissons enrichis, sains, riches en protéines et nutritifs permet aux fabricants de lancer de nouvelles options de collations saines et innovantes, augmentant ainsi la demande d'aliments sains et de bien-être, ce qui a contribué à la croissance du marché.

Par exemple,

- En décembre 2020, DuPont a annoncé le développement d'une nouvelle gamme d'ingrédients appelée Virslik, un auxiliaire de fabrication doté d'une « texture désirable » et d'une « saveur propre ». Cet ingrédient aidera à formuler des yaourts aux saveurs et textures nouvelles.

Développements récents

- En octobre 2020, selon le Food Business, KIND Healthy Snacks a amélioré sa catégorie de barres énergétiques en lançant la barre KIND Energy, une barre qui offre une énergie durable à partir de grains entiers. La barre est fabriquée à partir d'avoine et contient 35 % de sucre en moins

- En mai 2022, selon Food Business, Oreo lancera une nouvelle gamme d'Oreos sans gluten aux États-Unis, Oreo Zero en Chine, Lacta Intense au Brésil et Caramilk, un produit à base de chocolat, en Australie. Ces produits sont le fruit de nouvelles formulations destinées aux consommateurs soucieux de leur santé, car la santé et le bien-être continuent d'être au cœur des innovations de l'entreprise

Portée du marché des aliments de santé et de bien-être en Asie-Pacifique

Le marché des aliments de santé et de bien-être de la région Asie-Pacifique est segmenté en sept segments notables en fonction du type, de la teneur en calories, de la nature, de la teneur en matières grasses, de la catégorie, de la catégorie de forme libre et du canal de distribution.

La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Aliments fonctionnels

- Collations saines

- Boissons

- Produits de boulangerie enrichis et sains

- Aliments pour les plus petits

- Chocolat

- Autres

Sur la base du type, le marché des aliments de santé et de bien-être de la région Asie-Pacifique est segmenté en aliments fonctionnels, collations saines, boissons, produits de boulangerie enrichis et sains, aliments pour les petits-enfants, chocolat et autres.

Teneur en calories

- Faible en calories

- Teneur réduite en calories

- Aucune calorie

Sur la base de la teneur en calories, le marché des aliments de santé et de bien-être de la région Asie-Pacifique est segmenté en aliments à faible teneur en calories, à teneur réduite en calories et sans calories.

Nature

- Sans OGM

- OGM

Sur la base de la nature, le marché des aliments de santé et de bien-être de la région Asie-Pacifique est segmenté en OGM et sans OGM.

Teneur en matières grasses

- Sans gras

- Faible en gras

- À teneur réduite en matières grasses

Sur la base de la teneur en matières grasses, le marché des aliments de santé et de bien-être de la région Asie-Pacifique est segmenté en sans matières grasses, à faible teneur en matières grasses et à teneur réduite en matières grasses.

Catégorie

- Conventionnel

- Organique

Sur la base de la catégorie, le marché des aliments de santé et de bien-être de la région Asie-Pacifique est segmenté en conventionnel et biologique.

Catégorie Sans

- Sans gluten

- Sans produits laitiers

- Sans soja

- Sans noix

- Sans lactose

- Sans arôme artificiel

- Sans colorant artificiel

- Autres

Sur la base de la catégorie sans, le marché des aliments de santé et de bien-être de la région Asie-Pacifique est segmenté en sans gluten, sans produits laitiers, sans soja, sans noix, sans lactose, sans arôme artificiel, sans colorant artificiel et autres.

Canal de distribution

- Détaillant en magasin

- Détaillants hors magasin

Sur la base du canal de distribution, le marché des aliments de santé et de bien-être de la région Asie-Pacifique est segmenté en détaillants en magasin et hors magasin.

Analyses/perspectives régionales des marchés des aliments de santé et de bien-être en Asie-Pacifique

Le marché des aliments de santé et de bien-être en Asie-Pacifique a été analysé, et des informations sur la taille du marché et les tendances sont fournies sur la base des références ci-dessus.

Les pays couverts par le rapport sur le marché des aliments de santé et de bien-être en Asie-Pacifique sont la Chine, le Japon, l'Australie, l'Inde, les Philippines, l'Indonésie, Singapour, la Corée du Sud, la Malaisie, la Thaïlande et le reste de l'Asie-Pacifique.

China dominates the Asia-Pacific health and wellness food marketing in terms of market share and revenue and will continue to flourish its dominance during the forecast period. This is due to the growing demand for healthy and nutrition-rich food. In addition, a rise in the number of health-conscious people in Asia-Pacific will add to the market's growth.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Europe brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing a forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Health and Wellness Food Market Share Analysis

Asia-Pacific health and wellness food market competitive landscape provides details about the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, and application dominance. The above data points only relate to the companies' focus on the Asia-Pacific health and wellness food market.

The major players operating in the market are Alter Eco, Maspex, PepsiCo, General Mills Inc., Mars, Incorporated, Nestlé, Danone, Abbott, Huel Inc., GSK Group of Companies, Clif Bar & Company, Green Valley Dairies, Chobani, LLC., SO DELICIOUS DAIRY FREE, Enjoy Life, The Simply Good Foods Company, Mondelez International., Kellogg Co., The Quaker Oats Company and Yakult Honsha Co., Ltd.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER DISPOSABLE INCOME DYNAMICS

4.3 CONSUMER LEVEL TRENDS OF ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET

4.3.1 OVERVIEW

4.3.2 HIGH NUTRITIONAL VALUE

4.3.3 PLANT-BASED AND ORGANIC PRODUCTS

4.3.4 ON-THE-GO FOOD PRODUCTS

4.3.5 HEALTHY SNACKING

4.4 FACTORS INFLUENCING PURCHASE DECISION

4.4.1 GROWING CONSUMERS' INTEREST IN PLANT-BASED DIETS

4.4.2 DEMAND FOR FREE-FROM FOODS PRODUCTS

4.4.3 HEALTHY AND SUSTAINABLE FOOD AVAILABILITY

4.4.4 PRICING OF HEALTH AND WELLNESS FOOD

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET

4.5.1 MANUFACTURERS LAUNCHING NATURAL INGREDIENT-BASED FOOD PRODUCTS

4.5.2 GROWING PRODUCTION OF A WIDE RANGE OF HEALTH AND WELLNESS FOOD BY MANUFACTURERS

4.5.3 MANUFACTURERS FOCUSING ON THE DEVELOPMENT OF NUTRACEUTICAL FOOD PRODUCTS

4.6 LIST OF KEY SOURCES OF MARKET INSIGHTS

4.7 MEETING CONSUMER REQUIREMENTS

4.8 NEW PRODUCT LAUNCH STRATEGY

4.8.1 NUMBER OF PRODUCT LAUNCHES

4.8.1.1 LINE EXTENSION

4.8.1.2 NEW PACKAGING

4.8.1.3 RELAUNCHED

4.8.1.4 NEW FORMULATION

4.9 PRIVATE LABEL VS BRAND LABEL

4.1 PROMOTIONAL ACTIVITIES

4.11 REGULATIONS, CERTIFICATION, AND LABELLING CLAIMS

4.11.1 REGULATIONS

4.11.2 LABELING AND CLAIM

4.11.3 CERTIFICATIONS

4.11.3.1 BRC FOOD SAFETY CERTIFICATION

4.11.3.2 AGMARK CERTIFICATION

4.11.3.3 PLANT AND PLANT PRODUCTS

4.12 SHOPPING BEHAVIOR AND DYNAMICS

4.12.1 RECOMMENDATIONS FROM FAMILY AND FRIENDS-

4.12.2 RESEARCH

4.12.3 IMPULSIVE

4.12.4 ADVERTISEMENT:

4.12.4.1 TELEVISION ADVERTISEMENT

4.12.4.2 ONLINE ADVERTISEMENT

4.12.4.3 IN-STORE ADVERTISEMENT

4.12.4.4 OUTDOOR ADVERTISEMENT

4.12.5 CONCLUSION

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 RAW MATERIAL PROCUREMENT

4.13.2 MANUFACTURING PROCESS

4.13.3 MARKETING AND DISTRIBUTION

4.13.4 END USERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR PROTEIN-BASED NUTRITIONAL AND HEALTHY FOOD & BEVERAGES

5.1.2 INCREASING DISPOSABLE INCOME AND GROWING EXPENDITURE ON HEALTHY FOOD PRODUCTS

5.1.3 INCREASING DEMAND FOR VEGAN/PLANT-BASED HEALTHY FOOD

5.1.4 GROWING DEMAND FOR CLEAN LABEL FOOD

5.2 RESTRAINTS

5.2.1 INCREASING REGULATION ON FORTIFIED FOOD & BEVERAGES

5.2.2 HIGHER PRICES OF HEALTHY NUTRITIONAL FOOD & BEVERAGES

5.3 OPPORTUNITIES

5.3.1 INCREASE IN NUMBER OF LAUNCHES OF HEALTH AND WELLNESS FOOD & BEVERAGE PRODUCTS

5.3.2 CHANGE IN EATING HABITS AND LIFESTYLE OF MILLENNIALS

5.3.3 GROWING DEMAND FOR NON-ALCOHOLIC DRINKS THAT PROVIDE HEALTH BENEFITS

5.4 CHALLENGES

5.4.1 DISRUPTED SUPPLY CHAIN DUE TO COVID-19

5.4.2 LACK OF AWARENESS AMONG PEOPLE AND SKEPTICISM TOWARDS HEALTHY FOOD & BEVERAGES

6 POST-COVID IMPACT ON THE ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET

6.1 AFTERMATH OF COVID-19

6.2 IMPACT ON DEMAND AND SUPPLY CHAIN

6.3 IMPACT ON PRICE

6.4 CONCLUSION

7 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET, BY TYPE

7.1 OVERVIEW

7.2 FUNCTIONAL FOOD

7.2.1 FUNCTIONAL FOOD, BY TYPE

7.2.1.1 BREAKFAST CEREAL PRODUCTS

7.2.1.1.1 BREAKFAST CEREAL FLAKES

7.2.1.1.2 BREAKFAST OATMEAL

7.2.1.1.3 BREAKFAST CEREAL PORRIDGE

7.2.1.1.4 BREAKFAST COOKIES

7.2.1.1.5 OTHERS

7.2.1.2 YOGURTS

7.2.1.2.1 YOGURT, BY TYPE

7.2.1.2.1.1 REGULAR YOGURTS

7.2.1.2.1.2 CONCENTRATED YOGURT

7.2.1.2.1.3 PROBIOTIC YOGURT

7.2.1.2.1.4 SET YOGURT

7.2.1.2.1.5 BIO LIVE YOGURT

7.2.1.2.1.6 STIRRED YOGURT

7.2.1.2.1.7 OTHERS

7.2.1.2.2 YOGURT, BY CATEGORY

7.2.1.2.2.1 FROZEN YOGURT

7.2.1.2.2.2 DRINKABLE YOGURT

7.2.1.2.2.3 SPOONABLE YOGURT

7.2.1.2.2.4 OTHERS

7.2.1.2.3 YOGURT, BY FLAVOR

7.2.1.2.3.1 PLAIN

7.2.1.2.3.2 FLAVORED

7.2.1.2.3.2.1 STRAWBERRY

7.2.1.2.3.2.2 VANILLA

7.2.1.2.3.2.3 BLUEBERRY

7.2.1.2.3.2.4 PEACH

7.2.1.2.3.2.5 BANANA

7.2.1.2.3.2.6 BLACKBERRY

7.2.1.2.3.2.7 CHERRY

7.2.1.2.3.2.8 BUTTERSCOTCH

7.2.1.2.3.2.9 CARAMEL

7.2.1.2.3.2.10 POMEGRANATE

7.2.1.2.3.2.11 CHOCOLATES

7.2.1.2.3.2.12 NUTS

7.2.1.2.3.2.13 COCONUT

7.2.1.2.3.2.14 ORCHARD CHERRY

7.2.1.2.3.2.15 COTTON CANDY

7.2.1.2.3.2.16 HONEY

7.2.1.2.3.2.17 MOCHA

7.2.1.2.3.2.18 AMARETTO

7.2.1.2.3.2.19 PUMPKIN

7.2.1.2.3.2.20 PEPPERMINT

7.2.1.2.3.2.21 OTHERS

7.2.1.3 NUTRITION BARS

7.2.1.3.1 NUTRITION BARS, BY TYPE

7.2.1.3.1.1 CEREALS BARS

7.2.1.3.1.1.1 GRANOLA BARS

7.2.1.3.1.1.2 OAT BARS

7.2.1.3.1.1.3 RICE BARS

7.2.1.3.1.1.4 MIXED CEREAL BARS

7.2.1.3.1.1.5 OTHERS

7.2.1.3.1.2 ENERGY BARS

7.2.1.3.1.2.1 PLANT-BASED PROTEIN BARS

7.2.1.3.1.2.2 ANIMAL-BASED PROTEIN BARS

7.2.1.3.1.2.2.1 WHEY PROTEIN BARS

7.2.1.3.1.2.2.2 CASEIN PROTEIN BARS

7.2.1.3.1.2.2.2.1 FIBER BARS

7.2.1.3.1.2.2.2.2 PROBIOTIC BARS

7.2.1.3.1.2.2.2.3 OMEGA-3 BARS

7.2.1.3.1.2.2.2.4 AMINO ACID BARS

7.2.1.3.1.2.2.2.5 OTHERS

7.2.1.3.1.3 FRUIT BARS

7.2.1.3.1.3.1 BANANA

7.2.1.3.1.3.2 APPLES

7.2.1.3.1.3.3 ORANGES

7.2.1.3.1.3.4 BERRIES

7.2.1.3.1.3.5 CHERRY

7.2.1.3.1.3.6 AVOCADO

7.2.1.3.1.3.7 OTHERS

7.2.1.3.1.4 NUT BARS

7.2.1.3.1.4.1 ALMOND

7.2.1.3.1.4.2 PEANUT

7.2.1.3.1.4.3 HAZELNUTS

7.2.1.3.1.4.4 CASHEW

7.2.1.3.1.4.5 DATES

7.2.1.3.1.4.6 OTHERS

7.2.1.3.1.5 OTHERS

7.2.1.3.2 NUTRITION BARS, BY CATEGORY

7.2.1.3.3 REGULAR

7.2.1.3.4 PRE WORK OUT BARS

7.2.1.3.5 MEAL REPLACEMENT BAR

7.2.1.3.6 POST WORK OUT BARS

7.2.1.3.7 YOGA BARS

7.2.1.3.8 OTHERS

7.2.2 FUNCTIONAL FOODS, BY CATEGORY

7.2.2.1 CONVENTIONAL

7.2.2.2 ORGANIC

7.2.3 FUNCTIONAL FOODS, BY CALORIE CONTENT

7.2.3.1 LOW CALORIES

7.2.3.2 REDUCED CALORIE

7.2.3.3 NO CALORIES

7.3 HEALTHY SNACKS

7.3.1 HEALTHY SNACKS, BY PRODUCT TYPE

7.3.1.1 VEGGIE SNACKS

7.3.1.2 MULTIGRAIN WAFERS, CRACKERS & CHIPS

7.3.1.3 TRAIL MIXES

7.3.1.4 DRY BERRIES SNACKS

7.3.1.5 OTHERS

7.3.2 HEALTHY SNACKS, BY CATEGORY

7.3.2.1 CONVENTIONAL

7.3.2.2 ORGANIC

7.3.3 HEALTHY SNACKS, BY CALORIE CONTENT

7.3.3.1 LOW CALORIES

7.3.3.2 REDUCED CALORIE

7.3.3.3 NO CALORIES

7.4 BEVERAGES

7.4.1 BEVERAGES, BY TYPE

7.4.1.1 FORTIFIED COFFEE

7.4.1.2 BFY BEVERAGES

7.4.1.2.1 HEALTHY SMOOTHIES

7.4.1.2.2 DIET SODA

7.4.1.2.3 PLANT-BASED MILK

7.4.1.2.3.1 PLANT-BASED MILK, BY TYPE

7.4.1.2.3.1.1 ALMOND MILK

7.4.1.2.3.1.2 SOY MILK

7.4.1.2.3.1.3 COCONUT MILK

7.4.1.2.3.1.4 OAT MILK

7.4.1.2.3.1.5 CASHEW MILK

7.4.1.2.3.1.6 OTHERS

7.4.1.2.4 PLANT-BASED MILK, BY FORMULATION

7.4.1.2.4.1.1 SWEETENED

7.4.1.2.4.1.2 UNSWEETENED

7.4.1.2.5 FLAVORED WATER

7.4.1.3 ENERGY DRINKS

7.4.1.4 KOMBUCHA DRINKS

7.4.1.5 HERBAL TEA

7.4.1.5.1 MIXED HERB

7.4.1.5.2 YERBA MATE

7.4.1.5.3 OOLONG

7.4.1.5.4 CHAMOMILE

7.4.1.5.5 MATCHA

7.4.1.5.6 MINT

7.4.1.5.7 ROSEMARY

7.4.1.5.8 PEPPERMINT

7.4.1.5.9 CONVENTIONAL TEA LEAVES

7.4.1.5.10 SINGLE HERB

7.4.1.5.11 CINNAMON

7.4.1.5.12 THYME

7.4.1.5.13 ROSE HIP

7.4.1.5.14 ECHINACEA

7.4.1.5.15 BUBBLE

7.4.1.5.16 OTHERS

7.4.1.6 FRUIT TEA

7.4.1.6.1 SINGLE FRUIT TEA

7.4.1.6.2 PEACH

7.4.1.6.3 ORANGE

7.4.1.6.4 POMEGRANATE

7.4.1.6.5 MANGO

7.4.1.6.6 STRAWBERRY

7.4.1.6.7 APPLE TEA

7.4.1.6.8 PINEAPPLE

7.4.1.6.9 KIWI

7.4.1.6.10 RASPBERRY

7.4.1.6.11 CRANBERRY

7.4.1.6.12 BLUEBERRY

7.4.1.6.13 GOJI BERRY

7.4.1.6.14 PASSION FRUIT

7.4.1.6.15 OTHERS

7.4.1.6.16 MIX FRUIT TEA

7.4.2 BEVERAGES, BY CATEGORY

7.4.2.1 CONVENTIONAL

7.4.2.2 ORGANIC

7.4.3 BEVERAGES, BY CALORIE CONTENT

7.4.3.1 LOW CALORIES

7.4.3.2 REDUCED CALORIES

7.4.3.3 NO CALORIES

7.5 FORTIFIED & HEALTHY BAKERY PRODUCTS

7.5.1 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY TYPE

7.5.1.1 BREAD & ROLLS

7.5.1.2 BISCUIT & COOKIES

7.5.1.3 PANCAKES & OTHER BAKERY MIXES

7.5.1.4 CAKES & PASTRIES

7.5.1.5 TORTILLA

7.5.1.6 CUPCAKES & MUFFINS

7.5.2 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY CATEGORY

7.5.2.1 CONVENTIONAL

7.5.2.2 ORGANIC

7.5.3 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY CALORIE CONTENT

7.5.3.1 LOW CALORIES

7.5.3.2 REDUCED CALORIE

7.5.3.3 NO CALORIES

7.6 BFY FOODS

7.6.1 BFY FOODS, BY TYPE

7.6.1.1 HEALTHY PIZZA & PASTA

7.6.1.2 HEALTHY CRISPS

7.6.1.3 HEALTHY CRISPS, BY TYPE

7.6.1.3.1 PROTEIN CRISPS

7.6.1.3.2 VEGGIES CRISPS

7.6.1.3.3 GREEN BEANS CRISPS

7.6.1.3.4 MIX VEGGIE CRISPS

7.6.1.3.5 BEETS CRISPS

7.6.1.3.6 CAULIFLOWER CRISPS

7.6.1.3.7 OTHERS

7.6.1.3.8 HEALTHY CRISPS, BY FLAVOR

7.6.1.3.9 BARBECUE

7.6.1.3.10 CHEESE

7.6.1.3.11 SEA SALT

7.6.1.3.12 SWEET CHILLI

7.6.1.3.13 BUFFALO WING

7.6.1.3.14 SWEET & SALT

7.6.1.3.15 OTHERS

7.6.1.4 SOUPS

7.6.1.5 SPREADS

7.6.1.6 SAUCES, MAYONNAISE & DRESSINGS

7.6.1.7 OTHERS

7.6.2 BFY FOODS, BY CATEGORY

7.6.2.1 CONVENTIONAL

7.6.2.2 ORGANIC

7.6.3 BFY FOODS, BY CALORIE CONTENT

7.6.3.1 LOW CALORIES

7.6.3.2 REDUCED CALORIES

7.6.3.3 NO CALORIES

7.7 CHOCOLATE

7.7.1 CHOCOLATES, BY TYPE

7.7.1.1 DARK CHOCOLATE BARS

7.7.1.2 NUT INFUSED CHOCOLATES

7.7.1.3 FRUIT & NUT INFUSED CHOCOLATE BRITTLES

7.7.1.4 FORTIFIED CHOCOLATE BARS

7.7.1.5 OTHERS

7.7.2 CHOCOLATES, BY FORMULATION

7.7.2.1 SWEET

7.7.2.2 SEMI-SWEET

7.7.2.3 SUGAR FREE

7.7.3 CHOCOLATES, BY CATEGORY

7.7.3.1 CONVENTIONAL

7.7.3.2 ORGANIC

7.7.4 CHOCOLATES, BY CALORIE CONTENT

7.7.4.1 LOW CALORIES

7.7.4.2 REDUCED CALORIE

7.7.4.3 NO CALORIES

7.8 OTHERS

8 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET, BY CALORIE CONTENT

8.1 OVERVIEW

8.2 LOW CALORIES

8.3 REDUCED CALORIES

8.4 NO CALORIES

9 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET, BY NATURE

9.1 OVERVIEW

9.2 NON-GMO

9.3 GMO

10 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET, BY FAT CONTENT

10.1 OVERVIEW

10.2 NO FAT

10.3 LOW FAT

10.4 REDUCED FAT

11 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET, BY CATEGORY

11.1 OVERVIEW

11.2 ORGANIC

11.3 CONVENTIONAL

12 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET, BY FREE FROM CATEGORY

12.1 OVERVIEW

12.2 GLUTEN FREE

12.3 DAIRY FREE

12.4 SOY FREE

12.5 NUT FREE

12.6 LACTOSE FREE

12.7 ARTIFICIAL FLAVOR FREE

12.8 ARTIFICIAL COLOR FREE

12.9 OTHERS

13 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 STORE BASED RETAILERS

13.2.1 SUPERMARKET/HYPERMARKET

13.2.2 CONVENIENCE STORES

13.2.3 SPECIALTY STORES

13.2.4 GROCERY STORES

13.2.5 OTHERS

13.3 NON-STORE RETAILERS

13.3.1 COMPANY WEBSITES

13.3.2 ONLINE

14 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 JAPAN

14.1.3 AUSTRALIA

14.1.4 INDIA

14.1.5 PHILIPPINES

14.1.6 INDONESIA

14.1.7 SINGAPORE

14.1.8 SOUTH KOREA

14.1.9 MALAYSIA

14.1.10 THAILAND

14.1.11 REST OF ASIA-PACIFIC

15 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 PEPSICO

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 DANONE

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 NESTLÉ

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 ABBOTT

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 GENERAL MILLS INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 YAKULT HONSHA CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 GSK GROUP OF COMPANIES

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 SIMPLY GOOD FOODS USA, INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 ALTER ECO

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BARREL. SITE BY BARREL

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 CHOBANI, LLC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 CLIF BAR & COMPANY

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 ENJOY LIFE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 FORAGER PROJECT

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 GREEN VALLEY DAIRIE

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 HUEL INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 KASHI

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 KELLOGG CO.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENT

17.19 KITE HILL

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 LAKE CHAMPLAIN CHOCOLATES

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 LAVVA

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 LIBERTE

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 MARS, INCORPORATED

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 MASPEX GROUP

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 MONDELĒZ INTERNATIONAL.

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENT

17.26 SO DELICIOUS DAIRY FREE

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 STONYFIELD FARM, INC.

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 THE QUAKER OATS COMPANY

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENTS

17.29 THE SIMPLY GOOD FOODS COMPANY

17.29.1 COMPANY SNAPSHOT

17.29.2 REVENUE ANALYSIS

17.29.3 PRODUCT PORTFOLIO

17.29.4 RECENT DEVELOPMENTS

17.3 YOPLAIT USA, INC.

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE:

19 RELATED REPORTS

Liste des figures

FIGURE 1 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 RISING DEMAND FOR PROTEIN-BASED NUTRITIONAL AND HEALTHY FOOD & BEVERAGES IS EXPECTED TO DRIVE THE ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET IN THE FORECAST PERIOD 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET

FIGURE 15 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY TYPE, 2021

FIGURE 16 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY CALORIE CONTENT, 2021

FIGURE 17 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY NATURE, 2021

FIGURE 18 ASIA PACIFIC GMO CROP REVENUE (2018)

FIGURE 19 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY FAT CONTENT, 2021

FIGURE 20 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY CATEGORY, 2021

FIGURE 21 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY FREE FROM CATEGORY, 2021

FIGURE 22 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 ASIA-PACIFIC HEALTH AND WELLNESS FOOD MARKET: SNAPSHOT (2021)

FIGURE 24 ASIA-PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2021)

FIGURE 25 ASIA-PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 ASIA-PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 ASIA-PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY TYPE (2022 & 2029)

FIGURE 28 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.