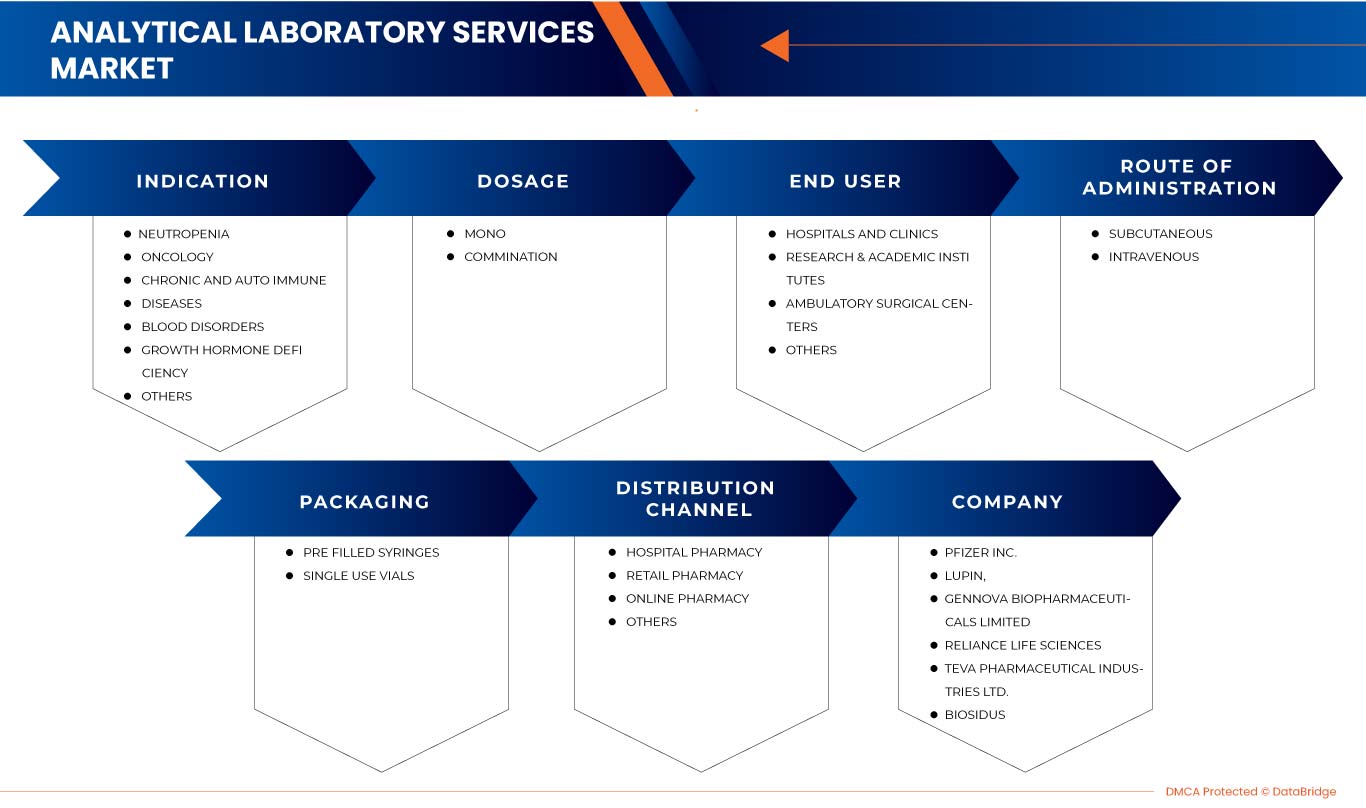

Marché Asie-Pacifique du G-CSF/PEG-G-CSF, par indication ( neutropénie , oncologie, maladies chroniques et auto-immunes, troubles sanguins, déficit de l'harmonie de croissance et autres), dosage (mono et combiné), voie d'administration (intraveineuse, sous-cutanée), emballage (flacons à usage unique et seringues préremplies), utilisateur final (hôpitaux et cliniques, instituts de recherche et universitaires, centres de chirurgie ambulatoire et autres), canal de distribution (pharmacie hospitalière, pharmacie en ligne, pharmacie de détail et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché du G-CSF/PEG-G-CSF en Asie-Pacifique

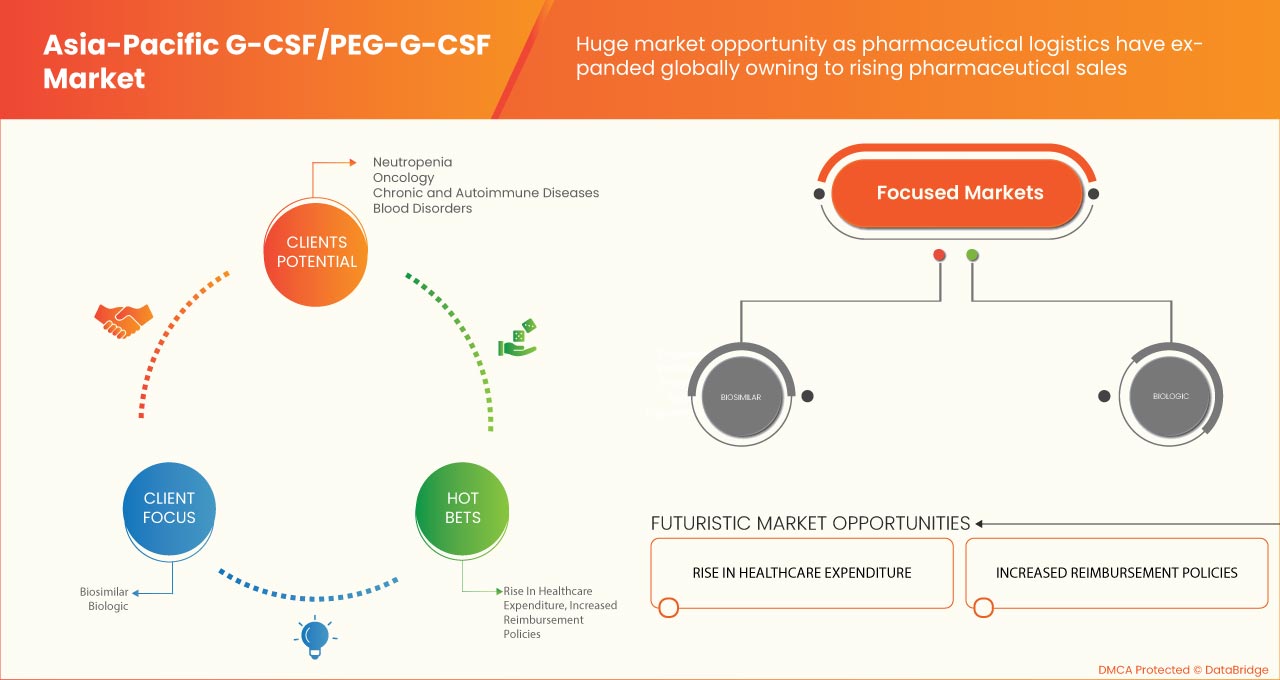

Français L'augmentation de la prévention du cancer dans les pays développés et les gouvernements ont lancé des initiatives conscientes pour éduquer au traitement précoce, favorisant le marché de vente Asie-Pacifique du G-CSF biosimilaire. Grafeel, Colstim, Neukine et Filcad, qui sont des biosimilaires approuvés et sont également rentables et facilement disponibles dans les pays en développement, entraîneront une croissance significative du marché. La Chine et l'Inde sont les pays où le nombre de patients atteints de cancer augmente, ce qui est susceptible de stimuler le marché Asie-Pacifique. Ainsi, l'utilisation de biosimilaires contribue à réduire les coûts de santé des patients par rapport à l'utilisation de produits biologiques originaux, ce qui augmente la demande sur le marché de vente des biosimilaires du G-CSF en Asie-Pacifique. En raison des processus de fabrication biologique complexes des biosimilaires individuels, les coûts des biosimilaires ne sont pas aussi bas que ceux des génériques. La prévalence croissante des maladies auto-immunes et chroniques rares devrait stimuler la croissance du marché segmentaire.

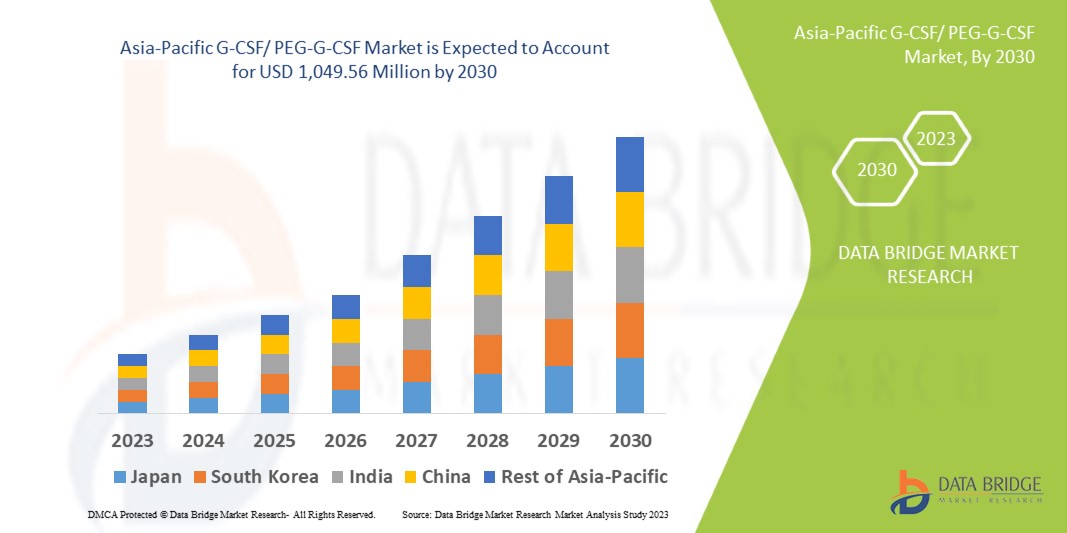

Data Bridge Market Research estime que le marché du G-CSF/PEG-G-CSF en Asie-Pacifique devrait atteindre la valeur de 1 049,56 millions USD d'ici 2030, à un TCAC de 6,3 % au cours de la période de prévision. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par indication (neutropénie, oncologie, maladies chroniques et auto-immunes, troubles sanguins, déficit de l'harmonie de croissance et autres), dosage (mono et combiné), voie d'administration (intraveineuse, sous-cutanée), conditionnement (flacons à usage unique et seringues préremplies), utilisateur final (hôpitaux et cliniques, instituts de recherche et universitaires, centres de chirurgie ambulatoire et autres), canal de distribution (pharmacie hospitalière, pharmacie en ligne, pharmacie de détail et autres) |

|

Pays couverts |

Chine, Japon, Inde, Australie, Nouvelle-Zélande, Indonésie, Thaïlande, Vietnam, Singapour, Philippines, Malaisie, Reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Français USV Private Limited, Viatris Inc., Biocon, Fresenius Kabi AG, Hangzhou Jiuyuan Gene Engineering Co., Ltd., Amgen Inc., Pfizer Inc., Sandoz International GmbH, Apotex Inc., Cadila Pharmaceuticals, Dr. Reddy's Laboratories Ltd., Amneal Pharmaceuticals LLC., Coherus BioSciences, Accord Healthcare, NAPP PHARMACEUTICALS LIMITED., Intas Pharmaceuticals Ltd., Mundipharma International, Teva Pharmaceutical Industries Ltd., Spectrum Pharmaceuticals, Inc., Kyowa Kirin Co., Ltd., Jiangsu Hengrui Pharmaceuticals Co., Ltd., entre autres. |

Définition du marché du G-CSF/PEG-G-CSF en Asie-Pacifique

Le facteur de stimulation des colonies de granulocytes (G-CSF) est un médicament utilisé pour traiter la neutropénie. Il s'agit d'une maladie dans laquelle le nombre de globules blancs est inférieur à la moyenne et qui est causée par certaines formes de chimiothérapie. Les principaux types de G-CSF sont le lénograstim (Granocyte), le filgrastim (Neupogen, Zarzio, Nivestim, Accofil), le filgrastim à action prolongée (pégylé) (pegfilgrastim, Neulasta, Pelmeg, Ziextenco) et le lipegfilgrastim (Lonquex). Le lénograstim est un agent thérapeutique recombinant glycosylé qui est chimiquement similaire ou identique au facteur de stimulation des colonies de granulocytes (G-CSF) humain naturel. Divers produits comprennent des comprimés et des gélules et traitent le cancer, les troubles sanguins, le déficit en hormone de croissance et les maladies chroniques et auto-immunes.

Dynamique du marché du G-CSF/PEG-G-CSF en Asie-Pacifique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de l'incidence des cancers du sang et des maladies cancéreuses

Le cancer est un terme générique qui désigne de nombreuses maladies pouvant affecter n'importe quelle partie du corps. On parle également de tumeurs malignes et de néoplasmes. L'une des caractéristiques du cancer est la formation rapide de cellules anormales qui se développent au-delà des limites normales et peuvent envahir les parties voisines du corps et se propager à d'autres organes ; ce dernier processus est appelé métastase. Les métastases étendues sont la principale cause de décès par cancer.

Le filgrastim est un facteur de stimulation des colonies de granulocytes (GCSF) qui contribue à augmenter le nombre de neutrophiles dans le sang. Le filgrastim et le pegfilgrastim sont très utilisés pour augmenter le nombre de globules blancs après une chimiothérapie ou une radiothérapie contre le cancer.

- Augmentation des cas de neutropénie fébrile

La neutropénie fébrile fait référence à la fièvre qui se manifeste lors d'une neutropénie importante. Si un patient est neutropénique, son risque d'infection peut être plus élevé que d'habitude et la gravité d'une infection particulière peut également être plus élevée. La neutropénie fébrile est la complication mortelle la plus courante du traitement du cancer ; son traitement est souvent une urgence oncologique.

La neutropénie fébrile est une neutropénie accompagnée de fièvre. La neutropénie fait référence à une diminution de la concentration de neutrophiles dans le sang. Les neutrophiles sont un type de globules blancs qui aident à combattre les infections dans le cadre du système immunitaire. L'Infectious Diseases Society of America définit la neutropénie comme un nombre absolu de neutrophiles (NAN) inférieur à 1 500 cellules/mm3. Le risque d'infection et de fièvre neutropénique augmente considérablement en cas de neutropénie sévère, définie comme un nombre absolu de neutrophiles (NAN) inférieur à 500 cellules/mm3. La fièvre est définie comme une température buccale unique supérieure ou égale à 38,3 °C (101 °F) ou une température persistante supérieure ou égale à 38,0 °C (100,4 °F) ou plus pendant une heure ou plus.

Retenue

- Réglementations gouvernementales strictes

Les sociétés pharmaceutiques qui développent des biosimilaires tels que le filgrastim sont confrontées à un défi majeur dans le processus d'approbation de leurs produits. Chaque pays dispose d'un processus d'approbation différent pour tous les médicaments, traitements, vaccins et dispositifs médicaux. Cependant, ces procédures d'approbation sont difficiles à suivre. Cela est dû aux différentes réglementations et preuves requises pour prouver l'efficacité et la sécurité du produit.

Les exigences réglementaires de l'Agence européenne des médicaments garantissent aux biosimilaires les mêmes normes élevées de qualité, de sécurité et d'efficacité que pour les produits biologiques d'origine. Elles comprennent également un exercice rigoureux de comparaison avec le produit de référence, mais ne sont pas universellement acceptées par les organismes de réglementation en dehors de l'Union européenne (UE). Il convient de noter que les « produits biologiques similaires » approuvés en Inde, les « biogénériques » approuvés en Iran, les « médicaments biologiques similaires » approuvés en Argentine et les produits biologiques non originaux approuvés en Afrique du Sud n'auraient peut-être pas été autorisés s'ils avaient été soumis aux processus réglementaires stricts requis pour l'approbation des biosimilaires dans l'UE.

Opportunité

- L’utilisation de biosimilaires contribue à réduire les coûts de santé pour les patients

Les biosimilaires ont le potentiel de changer fondamentalement les soins de santé en fournissant des traitements plus abordables et tout aussi efficaces aux patients et en offrant davantage d’options de traitement aux médecins. Le développement de biosimilaires nécessite une analyse rigoureuse pour démontrer leur équivalence avec le produit de référence et garantir l’absence de différences cliniquement significatives en termes de sécurité, d’efficacité et de pureté. En conséquence, les systèmes de santé peuvent orienter les économies à long terme vers des améliorations globales des soins aux patients. Pour contribuer à créer un marché des biosimilaires florissant et garantir l’accès des patients, les décideurs politiques peuvent prendre des mesures pour réduire ou éliminer le coût des biosimilaires et encourager les médecins à prescrire des biosimilaires par rapport à l’Europe.

Défi

- Effets secondaires multiples du G-CSF

Le facteur de stimulation des colonies de granulocytes (G-CSF) est un médicament utilisé pour traiter la neutropénie, un trouble dans lequel certaines formes de chimiothérapie entraînent un nombre de globules blancs inférieur à la moyenne. Le G-CSF est un type de facteur de croissance qui permet à la moelle osseuse de produire plus de globules blancs pour réduire le risque d'infection après certains types de traitement contre le cancer. Mais le G-CSF entraîne de nombreux effets secondaires, tels que des douleurs osseuses ou musculaires, des ecchymoses, des saignements des gencives ou du nez, de la diarrhée, une température élevée (fièvre), un essoufflement et une pâleur, des maux de bouche, de gorge, d'intestin et de rectum, entre autres. Ces effets secondaires peuvent être observés chez plus de 10 personnes sur 100 (plus de 10 %).

Selon une étude réalisée par le NCBI, la plupart des donneurs normaux recevant du G-CSF ressentent des effets secondaires, mais ceux-ci sont d'intensité légère à modérée. Quatre-vingt-dix pour cent des donneurs ont ressenti des effets secondaires du G-CSF. Les effets les plus fréquemment observés étaient des douleurs osseuses (83 %), des maux de tête (39 %), des courbatures (23 %), de la fatigue (14 %) et des nausées et vomissements (12 %), ce qui devrait constituer un défi pour la croissance du marché.

Impact post-COVID-19 sur le marché du G-CSF/PEG-G-CSF en Asie-Pacifique

La pandémie de COVID-19 a eu un impact quelque peu positif sur le marché du G-CSF/PEG-G-CSF. La pandémie a imposé de nouvelles normes et réglementations, telles que la distanciation sociale et le confinement, pour empêcher la propagation du virus. En conséquence, les gens du monde entier ont été contraints de rester chez eux, ce qui a donné lieu à de nouvelles tendances telles que le travail à domicile. Ce confinement a entraîné une diminution du diagnostic et du pronostic des maladies. L'accent accru mis sur les soins personnels, l'exercice physique et la santé a aidé les applications et plateformes de fitness à gagner du terrain à la suite de la pandémie.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de R&D, de lancement de produits et de partenariats stratégiques pour améliorer la technologie et les résultats des tests impliqués dans le marché du diagnostic de transplantation.

Développements récents

- En juillet 2018, Accord Healthcare, une filiale d'Intas Pharmaceuticals Ltd., a lancé un biosimilaire du pegfilgrastim en Europe après avoir reçu le feu vert du CHMP (Comité des médicaments à usage humain) pour Pelgraz® (pegfilgrastim). Ce lancement de produit a aidé l'entreprise à développer ses activités en Europe.

- En mars 2022, Kashiv Biosciences a annoncé l'approbation de sa demande de licence de produit biologique (BLA) pour le filgrastim-ayow, un biosimilaire référençant Neupogen par la Food and Drug Administration (FDA) des États-Unis. Le produit est commercialisé sous le nom exclusif RELEUKO.

Portée du marché Asie-Pacifique du G-CSF/PEG-G-CSF

Le marché du G-CSF/PEG-G-CSF en Asie-Pacifique est segmenté en indications, dosages, voies d'administration, conditionnement, utilisateurs finaux et canaux de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

MARCHÉ ASIE-PACIFIQUE DU G-CSF / PEG-G-CSF, PAR INDICATION

- Neutropénie

- Oncologie

- Maladies chroniques et auto-immunes

- Troubles sanguins

- Déficit en hormone de croissance

- Autres

Sur la base de l'indication, le G-CSF/PEG-G-CSF d'Asie-Pacifique est segmenté en neutropénie, oncologie, maladies chroniques et auto-immunes, troubles sanguins, déficit en hormone de croissance et autres.

MARCHÉ ASIE-PACIFIQUE DU G-CSF / PEG-G-CSF, PAR DOSAGE

- Mono

- Combinaison

Sur la base du dosage, le G-CSF/PEG-G-CSF Asie-Pacifique est segmenté en mono et en combinaison.

MARCHÉ ASIE-PACIFIQUE DU G-CSF / PEG-G-CSF, PAR VOIE D'ADMINISTRATION

- Intraveineux

- Sous-cutané

Sur la base de la voie d'administration, le G-CSF/PEG-G-CSF Asie-Pacifique est segmenté en intraveineux et sous-cutané.

MARCHÉ ASIE-PACIFIQUE DU G-CSF / PEG-G-CSF, PAR CONDITIONNEMENT

- Flacons à usage unique

- Seringues préremplies

Sur la base de l'emballage, le G-CSF/PEG-G-CSF Asie-Pacifique est segmenté en flacons à usage unique et en seringues préremplies.

MARCHÉ ASIE-PACIFIQUE DU G-CSF / PEG-G-CSF, PAR UTILISATEUR FINAL

- Hôpitaux et cliniques

- Instituts de recherche et d'enseignement

- Centres de chirurgie ambulatoire

- Autres

Sur la base de l'utilisateur final, le G-CSF/PEG-G-CSF Asie-Pacifique est ensuite segmenté en hôpitaux et cliniques, instituts de recherche et universitaires, centres de chirurgie ambulatoire et autres.

MARCHÉ ASIE-PACIFIQUE DU G-CSF / PEG-G-CSF, PAR CANAL DE DISTRIBUTION

- Pharmacie de l'hôpital

- Pharmacie en ligne

- Pharmacie de détail

- Autres

Sur la base du canal de distribution, le G-CSF/PEG-G-CSF Asie-Pacifique est en outre segmenté en pharmacie hospitalière, pharmacie en ligne, pharmacie de détail et autres.

Analyse/perspectives régionales du marché du G-CSF/PEG-G-CSF en Asie-Pacifique

Le marché Asie-Pacifique G-CSF/PEG-G-CSF est analysé et des informations sur la taille du marché sont fournies en fonction du pays, de l’indication, du dosage, de la voie d’administration, de l’emballage, de l’utilisateur final et du canal de distribution.

Le marché Asie-Pacifique G-CSF/PEG-G-CSF comprend les pays Chine, Japon, Inde, Australie, Nouvelle-Zélande, Indonésie, Thaïlande, Vietnam, Singapour, Philippines, Malaisie, reste de l'Asie-Pacifique.

La Chine domine le marché grâce à la présence d'acteurs clés sur le plus grand marché de consommation avec un PIB élevé. La Chine devrait connaître une croissance en raison de la prévalence croissante des maladies chroniques et auto-immunes.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du G-CSF/PEG-G-CSF en Asie-Pacifique

Le paysage concurrentiel du marché G-CSF/PEG-G-CSF en Asie-Pacifique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché G-CSF/PEG-G-CSF en Asie-Pacifique.

Français Certaines grandes entreprises présentes sur le marché sont USV Private Limited, Viatris Inc., Biocon, Fresenius Kabi AG, Hangzhou Jiuyuan Gene Engineering Co., Ltd., Amgen Inc., Pfizer Inc., Sandoz International GmbH, Apotex Inc., Cadila Pharmaceuticals, Dr. Reddy's Laboratories Ltd., Amneal Pharmaceuticals LLC., Coherus BioSciences, Accord Healthcare, NAPP PHARMACEUTICALS LIMITED., Intas Pharmaceuticals Ltd., Mundipharma International, Teva Pharmaceutical Industries Ltd., Spectrum Pharmaceuticals, Inc., Kyowa Kirin Co., Ltd., Jiangsu Hengrui Pharmaceuticals Co., Ltd., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC G-CSF / PEG-G-CSF MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 ASIA PACIFIC G-CSF/PEG-G-CSF MARKET: MERGERS AND ACQUISITION

4.4 ASIA PACIFIC G-CSF / PEG-G-CSF MARKET

4.5 STRATEGIES TO THE ENTER THE MARKET

4.5.1 JOINT VENTURE (PARTNERSHIPS):

4.5.2 ACQUISITION:

4.5.3 LINE EXPANSION VIA COLLABORATION:

4.5.4 PRODUCT APPROVAL:

4.5.5 PRODUCT LAUNCH:

4.5.6 GEOGRAPHIC EXPANSION:

4.5.7 COST LEADERSHIP:

4.5.8 PRODUCT DEVELOPMENT:

4.6 ASIA PACIFIC G-CSF / PEG-G-CSF MARKET, INDUSTRY INSIGHTS

4.6.1 PATENT ANALYSIS

4.6.2 DRUG TREATMENT RATE BY MATURED MARKETS

4.6.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.6.4 THERAPEUTIC ASSESSMENT

4.6.5 KEY PRICING STRATEGIES

4.6.6 KEY PATIENT ENROLLMENT STRATEGIES

4.6.7 CONCLUSION

4.7 PIPELINE ANALYSIS FOR ASIA PACIFIC G-CSF / PEG-G-CSF MARKET

5 EPIDEMIOLOGY

6 ASIA PACIFIC G-CSF / PEG-G-CSF MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING INCIDENCES OF BLOOD CANCERS AND CANCER DISEASES

7.1.2 RISING INCIDENCES OF AUTOIMMUNE DISORDERS

7.1.3 INCREASING CASES OF FEBRILE NEUTROPENIA

7.1.4 INCREASING AWARENESS ABOUT FILGRASTIM AND PEGFILGRASTIM

7.2 RESTRAIN

7.2.1 STRINGENT GOVERNMENTAL REGULATIONS

7.2.2 AVAILABILITY OF ALTERNATIVES FOR THE CHEMOTHERAPY

7.3 OPPORTUNITIES

7.3.1 THE USE OF BIOSIMILARS HELPS REDUCE HEALTHCARE COSTS FOR PATIENTS

7.3.2 COST-EFFECTIVENESS AND PATENT EXPIRY OF BIOLOGICAL PRODUCTS

7.4 CHALLENGES

7.4.1 THE HIGH COST ASSOCIATED WITH BRANDED BIOLOGICS AND IMPROVED CHEMOTHERAPY

7.4.2 THE MULTIPLE SIDE EFFECTS OF G-CSF

8 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET, BY INDICATION

8.1 OVERVIEW

8.2 NEUTROPENIA

8.2.1 CHEMOTHERAPY INDUCED FEBRILE NEUTROPENIA (MYELOSUPPRESSIVE CHEMOTHERAPY TREATMENT)

8.2.2 SEVERE CHRONIC NEUTROPENIA

8.2.3 RADIOTHERAPY INDUCED NEUTROPENIA

8.2.4 NEUTROPENIA IN HIV PATIENTS

8.2.5 CLOZAPINE INDUCED NEUTROPENIA

8.2.6 NEUTROPENIA IN HEPATITIS C PATIENTS

8.2.7 CONGENITAL NEUTROPENIA

8.3 ONCOLOGY

8.3.1 ACUTE MYELOID LEUKEMIA RECEIVING CONSOLIDATION CHEMOTHERAPY

8.3.2 OTHERS

8.4 CHRONIC AND AUTO IMMUNE DISEASES

8.5 BLOOD DISORDERS

8.6 GROWTH HORMONE DEFICIENCY

8.7 OTHERS

9 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET, BY DOSAGE

9.1 OVERVIEW

9.2 MONO

9.3 COMBINATION

10 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION

10.1 OVERVIEW

10.2 SUBCUTANEOUS

10.3 INTRAVENOUS

11 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET, BY PACKAGING

11.1 OVERVIEW

11.2 PRE FILLED SYRINGES

11.3 SINGLE USE VIALS

12 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS AND CLINICS

12.3 RESEARCH & ACADEMIC INSTITUTES

12.4 AMBULATORY SURGICAL CENTERS

12.5 OTHERS

13 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 HOSPITALS PHARMACY

13.3 RETAIL PHARMACY

13.4 ONLINE PHARMACY

13.5 OTHERS

14 ASIA PACIFIC G-CSF/PEG-G-CSF MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 INDIA

14.1.3 INDONESIA

14.1.4 THAILAND

14.1.5 VIETNAM

14.1.6 SINGAPORE

14.1.7 PHILIPPINES

14.1.8 MALAYSIA

15 ASIA PACIFIC G-CSF / PEG-G-CSF MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 PFIZER INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 VIATRIS INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 AMGEN INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 STADA ARZENEIMITTEL AG

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 TEVA PHARMACEUTICAL INDUSTRIES LTD.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 JIANGSU HENGRUI PHARMACEUTICALS CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 ACCORD HEALTHCARE

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 AMNEAL PHARMACEUTICALS LLC.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 APOTEX INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 BIOCON

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 BIO SIDUS

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 CADILA PHARMACEUTICALS

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 COHERUS BIOSCIENCES

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 DR. REDDY’S LABORATORIES LTD

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 FRESENIUS KABI AG

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 GENNOVA BIOPHARMACEUTICALS LIMITED

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 HANGZHOU JIUYUAN GENE ENGINEERING CO., LTD.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 INTAS PHARMACEUTICALS LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 KASHIV BIOSCIENCES, LLC.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 KYOWA KIRIN CO., LTD.

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

17.21 LUPIN

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENT

17.22 MUNDIPHARMA INTERNATIONAL.

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 NAPP PHARMACEUTICALS LIMITED

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 RELIANCE LIFE SCIENCES

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 SANDOZ INTERNATIONAL GMBH

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENTS

17.26 SPECTRUM PHARMACEUTICALS, INC.

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 USV PRIVATE LIMITED

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 BELOW ARE THE RULES AND REGULATIONS TO GET APPROVAL FOR USE IN THE MARKET:

TABLE 2 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET, BY INDICATION, 2021-2030 (USD MILLION)

TABLE 3 ASIA PACIFIC NEUTROPENIA IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC NEUTROPENIA IN G-CSF/ PEG-G-CSF MARKET, BY INDICATION, 2021-2030 (USD MILLION)

TABLE 5 ASIA PACIFIC ONCOLOGY IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC ONCOLOGY IN G-CSF/ PEG-G-CSF MARKET, BY INDICATION, 2021-2030 (USD MILLION)

TABLE 7 ASIA PACIFIC CHRONIC AND AUTO IMMUNE DISEASES IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC BLOOD DISORDERS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC GROWTH HORMONE DEFICIENCY IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC OTHERS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET, BY DOSAGE, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC MONO IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC COMBINATION IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC SUBCUTANEOUS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC INTRAVENOUS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC PRE FILLED SYRINGES IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC SINGLE USE VIALS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC HOSPITALS AND CLINICS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC RESEARCH & ACADEMIC INSTITUTES IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC AMBULATORY SURGICAL CENTERS IN G-CSF/ PEG-G-CSFMARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC OTHERS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC HOSPITALS PHARMACY IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC RETAIL PHARMACY IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC ONLINE PHARMACY IN G-CSF/ PEG-G-CSFMARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC OTHERS IN G-CSF/ PEG-G-CSF MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC G-CSF / PEG-G-CSF MARKET, 2020-2030 (USD MILLION)

TABLE 31 ASIA-PACIFIC G-CSF / PEG-G-CSF MARKET, 2020-2030 (USD MILLION)

TABLE 32 ASIA-PACIFIC G-CSF / PEG-G-CSF MARKET, BY COUNTRY, 2020-2030 (USD MILLION)

TABLE 33 ASIA-PACIFIC G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 34 ASIA-PACIFIC NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 35 ASIA-PACIFIC ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 36 ASIA-PACIFIC G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 37 ASIA-PACIFIC G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 38 ASIA-PACIFIC G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 39 ASIA-PACIFIC G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 40 ASIA-PACIFIC G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 41 CHINA G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 42 CHINA NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 43 CHINA ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 44 CHINA G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 45 CHINA MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 46 CHINA G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 47 CHINA SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 48 CHINA PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 49 CHINA G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 50 CHINA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 51 CHINA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 52 CHINA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 53 CHINA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 54 CHINA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 55 CHINA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 56 CHINA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 57 CHINA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 58 CHINA G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 59 CHINA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 60 CHINA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 61 CHINA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 62 CHINA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 63 CHINA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 64 CHINA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 65 CHINA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 66 CHINA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 67 CHINA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 68 INDIA G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 69 INDIA NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 70 INDIA ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 71 INDIA G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 72 INDIA MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 73 INDIA COMBINATION IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 74 INDIA G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 75 INDIA SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 76 INDIA G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 77 INDIA PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 78 INDIA G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 79 INDIA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 80 INDIA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 81 INDIA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 82 INDIA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 83 INDIA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 84 INDIA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 85 INDIA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 86 INDIA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 87 INDIA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 88 INDIA G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 89 INDIA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 90 INDIA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 91 INDIA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 92 INDIA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 93 INDIA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 94 INDIA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 95 INDIA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 96 INDIA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 97 INDIA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 98 INDONESIA G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 99 INDONESIA NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 100 INDONESIA ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 101 INDONESIA G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 102 INDONESIA MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 103 INDONESIA G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 104 INDONESIA SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 105 INDONESIA INTRAVENOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 106 INDONESIA G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 107 INDONESIA PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 108 INDONESIA SINGLE USE VIALS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 109 INDONESIA G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 110 INDONESIA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 111 INDONESIA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 112 INDONESIA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 113 INDONESIA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 114 INDONESIA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 115 INDONESIA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 116 INDONESIA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 117 INDONESIA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 118 INDONESIA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 119 INDONESIA G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 120 INDONESIA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 121 INDONESIA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 122 INDONESIA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 123 INDONESIA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 124 INDONESIA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 125 INDONESIA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 126 INDONESIA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 127 INDONESIA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 128 INDONESIA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 129 THAILAND G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 130 THAILAND NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 131 THAILAND ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 132 THAILAND G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 133 THAILAND MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 134 THAILAND G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 135 THAILAND SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 136 THAILAND G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 137 THAILAND PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 138 THAILAND G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 139 THAILAND HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 140 THAILAND HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 141 THAILAND HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 142 THAILAND RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 143 THAILAND RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 144 THAILAND RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 145 THAILAND AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 146 THAILAND AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 147 THAILAND AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 148 THAILAND G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 149 THAILAND HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 150 THAILAND HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 151 THAILAND HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 152 THAILAND RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 153 THAILAND RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 154 THAILAND RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 155 THAILAND ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 156 THAILAND ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 157 THAILAND ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 158 VIETNAM G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 159 VIETNAM NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 160 VIETNAM ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 161 VIETNAM G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 162 VIETNAM MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 163 VIETNAM G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 164 VIETNAM SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 165 VIETNAM G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 166 VIETNAM PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 167 VIETNAM G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 168 VIETNAM HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 169 VIETNAM HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 170 VIETNAM HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 171 VIETNAM RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 172 VIETNAM RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 173 VIETNAM RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 174 VIETNAM AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 175 VIETNAM AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 176 VIETNAM AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 177 VIETNAM G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 178 VIETNAM HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 179 VIETNAM HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 180 VIETNAM HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 181 VIETNAM RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 182 VIETNAM RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 183 VIETNAM RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 184 VIETNAM ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 185 VIETNAM ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 186 VIETNAM ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 187 SINGAPORE G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 188 SINGAPORE NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 189 SINGAPORE ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 190 SINGAPORE G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 191 SINGAPORE MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 192 SINGAPORE G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 193 SINGAPORE SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 194 SINGAPORE INTRAVENOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 195 SINGAPORE G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 196 SINGAPORE PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 197 SINGAPORE SINGLE USE VIALS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 198 SINGAPORE G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 199 SINGAPORE HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 200 SINGAPORE HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 201 SINGAPORE HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 202 SINGAPORE RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 203 SINGAPORE RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 204 SINGAPORE RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 205 SINGAPORE AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 206 SINGAPORE AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 207 SINGAPORE AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 208 SINGAPORE G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 209 SINGAPORE HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 210 SINGAPORE HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 211 SINGAPORE HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 212 SINGAPORE RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 213 SINGAPORE RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 214 SINGAPORE RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 215 SINGAPORE ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 216 SINGAPORE ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 217 SINGAPORE ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 218 PHILIPPINES G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 219 PHILIPPINES NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 220 PHILIPPINES ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 221 PHILIPPINES G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 222 PHILIPPINES MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 223 PHILIPPINES G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 224 PHILIPPINES SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 225 PHILIPPINES G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 226 PHILIPPINES PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 227 PHILIPPINES G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 228 PHILIPPINES HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 229 PHILIPPINES HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 230 PHILIPPINES HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 231 PHILIPPINES RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 232 PHILIPPINES RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 233 PHILIPPINES RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 234 PHILIPPINES AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 235 PHILIPPINES AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 236 PHILIPPINES AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 237 PHILIPPINES G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 238 PHILIPPINES HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 239 PHILIPPINES HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 240 PHILIPPINES HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 241 PHILIPPINES RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 242 PHILIPPINES RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 243 PHILIPPINES RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 244 PHILIPPINES ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 245 PHILIPPINES ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 246 PHILIPPINES ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 247 MALAYSIA G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 248 MALAYSIA NEUTROPENIA IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 249 MALAYSIA ONCOLOGY IN G-CSF / PEG-G-CSF MARKET, BY INDICATION, 2020-2030 (USD MILLION)

TABLE 250 MALAYSIA G-CSF / PEG-G-CSF MARKET, BY DOSAGE, 2020-2030 (USD MILLION)

TABLE 251 MALAYSIA MONO IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 252 MALAYSIA G-CSF / PEG-G-CSF MARKET, BY ROUTE OF ADMINISTRATION, 2020-2030 (USD MILLION)

TABLE 253 MALAYSIA SUBCUTANEOUS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 254 MALAYSIA G-CSF / PEG-G-CSF MARKET, BY PACKAGING, 2020-2030 (USD MILLION)

TABLE 255 MALAYSIA PRE FILLED SYRINGES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 256 MALAYSIA G-CSF / PEG-G-CSF MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 257 MALAYSIA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 258 MALAYSIA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 259 MALAYSIA HOSPITAL AND CLINICS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 260 MALAYSIA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 261 MALAYSIA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 262 MALAYSIA RESEARCH AND ACADEMIC INSTITUTES IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 263 MALAYSIA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 264 MALAYSIA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 265 MALAYSIA AMBULATORY SURGICAL CENTERS IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 266 MALAYSIA G-CSF / PEG-G-CSF MARKET, BY DISTRIBUTION CHANNEL, 2020-2030 (USD MILLION)

TABLE 267 MALAYSIA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 268 MALAYSIA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 269 MALAYSIA HOSPITAL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 270 MALAYSIA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 271 MALAYSIA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 272 MALAYSIA RETAIL PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

TABLE 273 MALAYSIA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 (USD MILLION)

TABLE 274 MALAYSIA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 ASP (USD)

TABLE 275 MALAYSIA ONLINE PHARMACY IN G-CSF / PEG-G-CSF MARKET, BY BRAND, 2020-2030 VOLUME (UNITS)

Liste des figures

FIGURE 1 ASIA PACIFIC G-CSF / PEG-G-CSF MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC G-CSF / PEG-G-CSF MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC G-CSF / PEG-G-CSF MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC G-CSF / PEG-G-CSF MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC G-CSF / PEG-G-CSF MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC G-CSF / PEG-G-CSF MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC G-CSF / PEG-G-CSF MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC G-CSF / PEG-G-CSF MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 ASIA PACIFIC G-CSF / PEG-G-CSF MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC G-CSF / PEG-G-CSF MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN CANCER PROPHYLAXIS IN DEVELOPED COUNTRIES AND INITIATIVES TAKEN BY GOVERNMENTS ARE TO DRIVE THE ASIA PACIFIC G-CSF / PEG-G-CSF MARKET FROM 2023 TO 2030

FIGURE 12 NEUTROPENIA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC G-CSF / PEG-G-CSF MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC G-CSF / PEG-G-CSF MARKET

FIGURE 14 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY INDICATION CATEGORY, 2022

FIGURE 15 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY INDICATION CATEGORY, 2021-2030 (USD MILLION)

FIGURE 16 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY INDICATION CATEGORY, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY INDICATION CATEGORY, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY DOSAGE, 2022

FIGURE 19 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY DOSAGE, 2021-2030 (USD MILLION)

FIGURE 20 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY DOSAGE, CAGR (2023-2030)

FIGURE 21 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY DOSAGE, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY ROUTE OF ADMINISTRATION, 2022

FIGURE 23 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

FIGURE 24 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2023-2030)

FIGURE 25 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY PACKAGING, 2022

FIGURE 27 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY PACKAGING, 2021-2030 (USD MILLION)

FIGURE 28 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY PACKAGING, CAGR (2023-2030)

FIGURE 29 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY PACKAGING, LIFELINE CURVE

FIGURE 30 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY END USER, 2022

FIGURE 31 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY END USER, 2021-2030 (USD MILLION)

FIGURE 32 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY END USER, CAGR (2023-2030)

FIGURE 33 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 35 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

FIGURE 36 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 37 ASIA PACIFIC G-CSF/ PEG-G-CSF MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 ASIA-PACIFIC G-CSF/PEG-G-CSF MARKET: SNAPSHOT (2022)

FIGURE 39 ASIA-PACIFIC G-CSF/PEG-G-CSF MARKET: BY COUNTRY (2022)

FIGURE 40 ASIA-PACIFIC G-CSF/PEG-G-CSF MARKET: BY COUNTRY (2022 & 2030)

FIGURE 41 ASIA-PACIFIC G-CSF/PEG-G-CSF MARKET: BY COUNTRY (2022 & 2030)

FIGURE 42 ASIA-PACIFIC G-CSF/PEG-G-CSF MARKET: BY INDICATION (2023-2030)

FIGURE 43 ASIA PACIFIC G-CSF / PEG-G-CSF MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.