Asia Pacific Flow Cytometry Market

Taille du marché en milliards USD

TCAC :

%

USD

1.29 Billion

USD

3.25 Billion

2024

2032

USD

1.29 Billion

USD

3.25 Billion

2024

2032

| 2025 –2032 | |

| USD 1.29 Billion | |

| USD 3.25 Billion | |

|

|

|

|

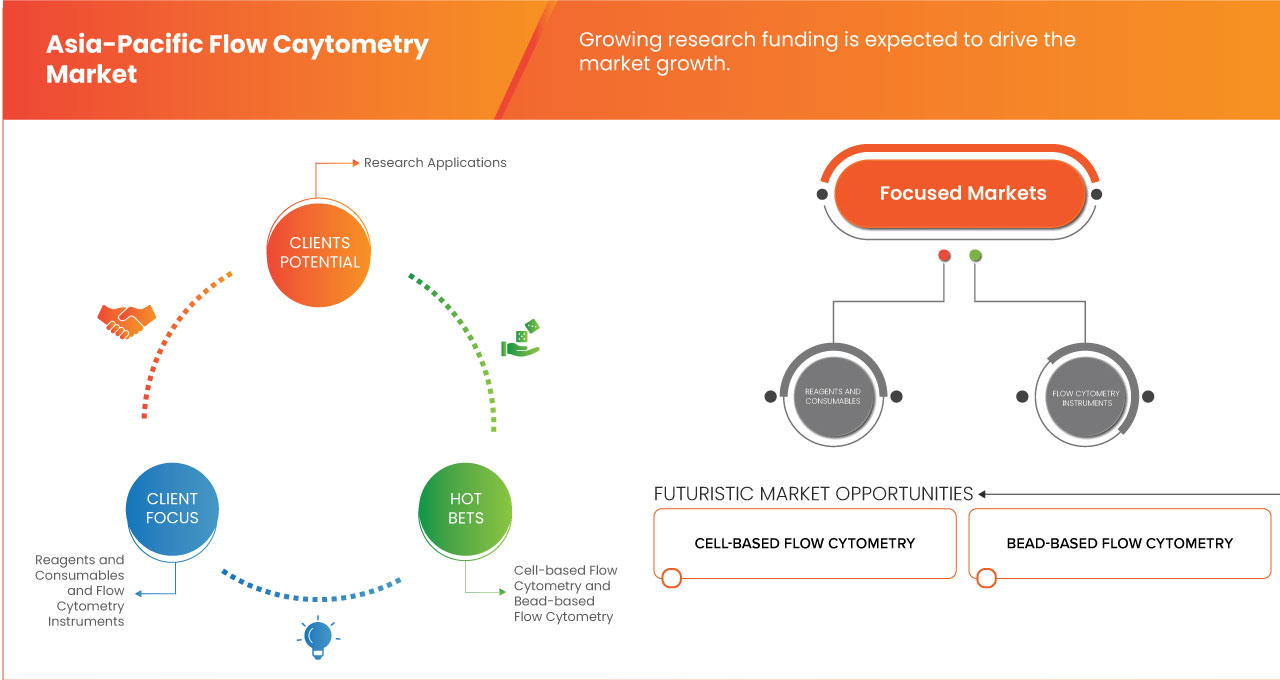

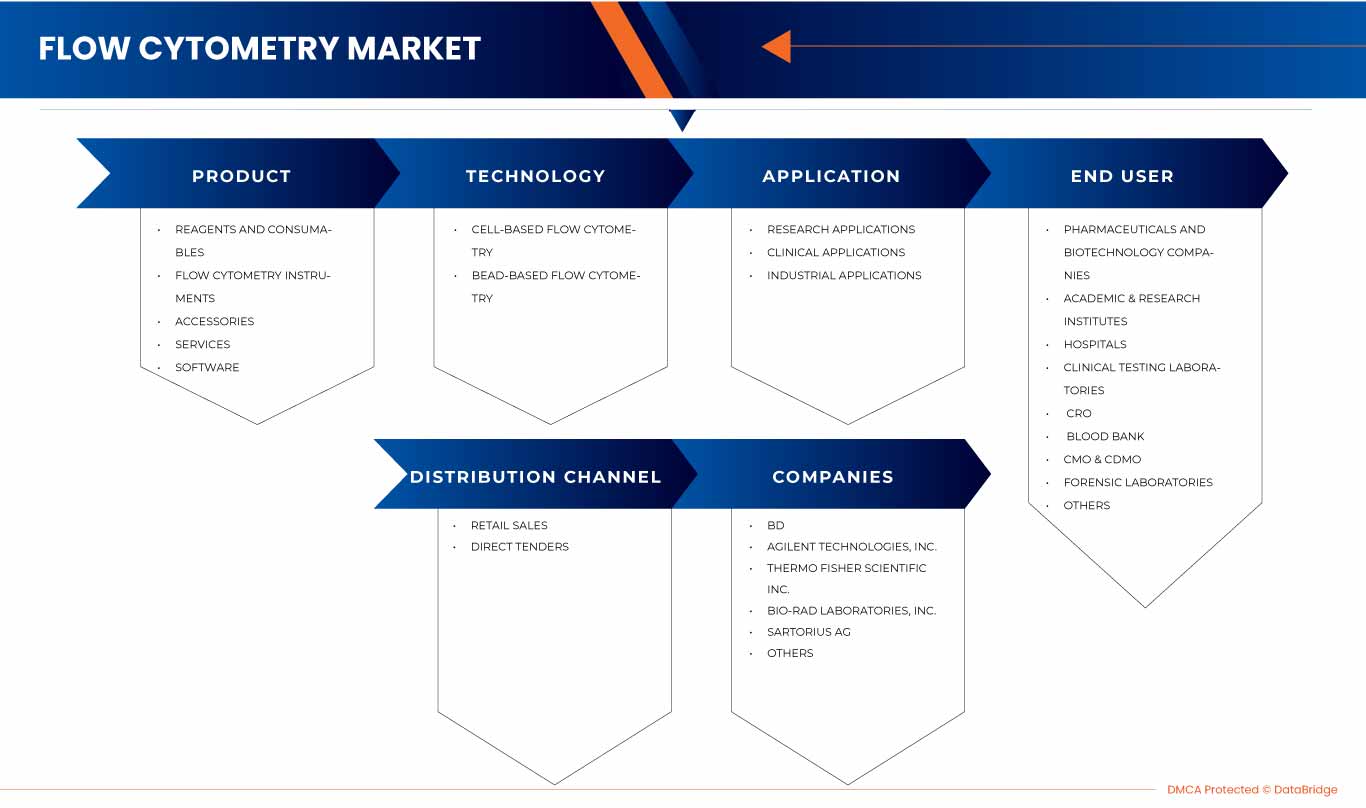

Segmentation du marché de la cytométrie en flux en Asie-Pacifique, par produit (réactifs et consommables, instruments de cytométrie en flux, accessoires, services et logiciels), technologie (cytométrie en flux cellulaire et cytométrie en flux à billes), application (applications de recherche, applications cliniques et applications industrielles), utilisateur final (sociétés pharmaceutiques et biotechnologiques, instituts universitaires et de recherche, hôpitaux, laboratoires d'essais cliniques, CRO, banques du sang, CMO et CDMO, laboratoires médico-légaux, etc.), canal de distribution (vente au détail et appels d'offres directs) - Tendances et prévisions du secteur jusqu'en 2032

Analyse du marché de la cytométrie de flux en Asie-Pacifique

La cytométrie de flux est une technique permettant de détecter et de quantifier les propriétés physiques et chimiques d'une population de cellules ou de particules. Un échantillon contenant des cellules ou des particules est mis en suspension dans un liquide puis injecté dans le cytomètre de flux. La cytométrie de flux est une technologie éprouvée pour l'identification des cellules en solution, généralement utilisée pour analyser le sang périphérique, la moelle osseuse et d'autres fluides corporels. Les cellules immunitaires sont identifiées et quantifiées par cytométrie de flux, également utilisée pour décrire les hémopathies malignes. L'évaluation des cellules par cette technique joue un rôle clé dans le diagnostic de nombreuses maladies chroniques. Elle analyse les activités biologiques intracellulaires, l'apoptose, la nécrose, le cycle cellulaire, la membrane cellulaire, la prolifération cellulaire et la mesure de l'ADN par cellule.

Les principales applications diagnostiques comprennent les hémopathies bénignes, le cancer, le sida, les déficits immunitaires, ainsi que la détection de ces maladies par fluorescence. Dans ce procédé, les cellules sont colorées avec des fluorophores pour détecter la lumière émise et produire l'intensité nécessaire au marquage de protéines spécifiques (immunophénotypage) pour le diagnostic de la leucémie et des lymphomes.

Taille du marché de la cytométrie de flux en Asie-Pacifique

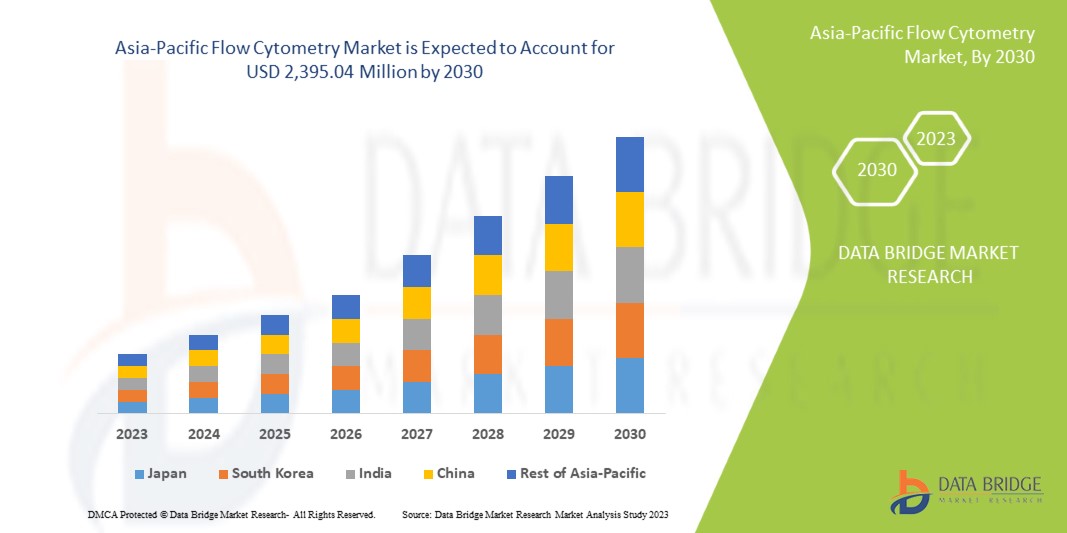

La taille du marché de la cytométrie de flux en Asie-Pacifique était évaluée à 1,29 milliard USD en 2024 et devrait atteindre 3,25 milliards USD d'ici 2032, avec un TCAC de 12,2 % au cours de la période de prévision de 2025 à 2032. Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire.

Tendances du marché de la cytométrie en flux en Asie-Pacifique

« Adoption croissante des capacités d'analyse multiparamétrique »

Une tendance majeure sur le marché de la cytométrie en flux en Asie-Pacifique est l'adoption croissante de capacités d'analyse multiparamétrique, portée par les avancées technologiques permettant la mesure simultanée de nombreux marqueurs cellulaires. Cette tendance est largement alimentée par la demande croissante de caractérisation cellulaire détaillée dans des domaines tels que la cancérologie, l'immunologie et la médecine personnalisée, où les interactions cellulaires complexes doivent être comprises. Les innovations en matière de systèmes laser, de détecteurs et de logiciels permettent d'analyser davantage de paramètres avec une sensibilité et une résolution accrues, permettant ainsi aux chercheurs et aux cliniciens d'approfondir leurs connaissances sur les processus biologiques et d'améliorer la précision des diagnostics. Cette évolution vers des systèmes de cytométrie en flux plus sophistiqués transforme les méthodologies de recherche et élargit les possibilités d'application de la cytométrie en flux à divers domaines.

Portée du rapport et segmentation du marché de la cytométrie en flux en Asie-Pacifique

|

Attributs |

Perspectives du marché de la cytométrie en flux en Asie-Pacifique |

|

Segments couverts |

|

|

Région couverte |

États-Unis, Canada, Mexique, Allemagne, France, Royaume-Uni, Italie, Espagne, Russie, Pays-Bas, Suisse, Turquie, Belgique, Autriche, Irlande, Norvège, Pologne, reste de l'Europe, Japon, Chine, Inde, Corée du Sud, Australie, Singapour, Thaïlande, Malaisie, Indonésie, Vietnam, Philippines, reste de l'Asie-Pacifique, Brésil, Argentine, Pérou, reste de l'Amérique du Sud, Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Koweït, Israël et reste du Moyen-Orient et de l'Afrique |

|

Acteurs clés du marché |

BD (États-Unis), Agilent Technologies, Inc. (États-Unis), Thermo Fisher Scientific Inc. (États-Unis), Bio-Rad Laboratories, Inc. (États-Unis), Sartorius AG (Allemagne), Bennubio Inc. (États-Unis), Enzo Biochem Inc. (États-Unis), Apogee Flow Systems Ltd. (Royaume-Uni), Beckman Coulter, Inc. (États-Unis), Coherent Corp. (États-Unis), Cell Signaling Technology, Inc. (États-Unis), Cytek Biosciences (États-Unis), Biomérieux (France) et Cytonome/ST LLC (États-Unis) |

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Définition du marché de la cytométrie de flux en Asie-Pacifique

Le marché de la cytométrie en flux en Asie-Pacifique englobe le développement, la production et la distribution d'équipements, de réactifs, de logiciels et de services de cytométrie en flux utilisés pour l'analyse et le tri des cellules et autres particules en suspension dans un flux fluide. La cytométrie en flux est une technique puissante qui permet de mesurer simultanément de multiples caractéristiques physiques et chimiques de cellules individuelles, telles que la taille, la complexité et l'expression protéique. Largement utilisée dans diverses applications, notamment l'immunologie, l'oncologie, la microbiologie et le développement de médicaments, cette technologie est un outil essentiel pour le diagnostic clinique et la recherche.

Dynamique du marché de la cytométrie de flux en Asie-Pacifique

Conducteurs

- Prévalence croissante des maladies chroniques

La cytométrie de flux est une technique permettant de détecter et de quantifier les propriétés physiques et chimiques d'une population de cellules ou de particules. Un échantillon contenant des cellules ou des particules est mis en suspension dans un liquide puis injecté dans le cytomètre de flux. La cytométrie de flux est une technologie éprouvée pour l'identification des cellules en solution, généralement utilisée pour analyser le sang périphérique, la moelle osseuse et d'autres fluides corporels. Les cellules immunitaires sont identifiées et quantifiées par cytométrie de flux, également utilisée pour décrire les hémopathies malignes. L'évaluation des cellules par cette technique joue un rôle clé dans le diagnostic de nombreuses maladies chroniques. Elle analyse les activités biologiques intracellulaires, l'apoptose, la nécrose, le cycle cellulaire, la membrane cellulaire, la prolifération cellulaire et la mesure de l'ADN par cellule.

Les principales applications diagnostiques comprennent les hémopathies bénignes, le cancer, le sida, les déficits immunitaires, ainsi que la détection de ces maladies par fluorescence. Dans ce procédé, les cellules sont colorées avec des fluorophores pour détecter la lumière émise et produire l'intensité nécessaire au marquage de protéines spécifiques (immunophénotypage) pour le diagnostic de la leucémie et des lymphomes.

La prévalence croissante des maladies chroniques a créé une demande croissante de techniques de cytométrie en flux qui peuvent aider les chercheurs et les cliniciens à mieux comprendre les mécanismes sous-jacents de ces maladies et à développer des traitements plus efficaces.

- Application croissante des instruments de cytométrie

La cytométrie de flux est un outil analytique puissant permettant d'analyser et de quantifier des cellules ou des particules individuelles dans un mélange hétérogène. Elle utilise des lasers et des optiques pour détecter et mesurer la taille, la forme et l'intensité de la fluorescence des cellules ou des particules. Cette technique consiste à marquer les cellules ou les particules avec des colorants fluorescents ou des anticorps qui se lient à des marqueurs spécifiques de la surface cellulaire ou à des molécules intracellulaires. Les cellules ou particules marquées passent ensuite dans un cytomètre de flux, qui détecte et mesure la fluorescence émise par chaque cellule ou particule. La cytométrie de flux est largement utilisée dans de nombreux domaines de recherche, notamment l'immunologie, la microbiologie, la recherche sur les cellules souches, la cancérologie, la découverte et le développement de médicaments, et le diagnostic clinique. Cette technique évolue constamment grâce à de nouvelles applications et à des améliorations matérielles et logicielles, ce qui en fait un outil essentiel pour l'étude des systèmes biologiques.

Par exemple,

- En juillet 2023, selon un article publié par le NCBI, l'application croissante de la cytométrie en flux dans divers domaines, notamment l'immunophénotypage, les tests de viabilité, l'analyse du cycle cellulaire et l'identification des cellules rares, stimule le marché de la cytométrie en flux en Asie-Pacifique. Sa capacité à analyser des cellules individuelles à l'échelle d'une seule cellule et à trier des populations spécifiques pour la recherche avancée stimule la demande. Cette polyvalence accélère la croissance de la recherche universitaire et clinique, propulsant ainsi l'expansion du marché.

- En juin 2020, selon un article publié par la bibliothèque en ligne Wiley, la cytométrie de flux permet d'identifier et de caractériser différents sous-ensembles de cellules immunitaires chez les patients atteints de maladies auto-immunes telles que le lupus érythémateux disséminé (LED). L'étude conclut que la cytométrie de flux pourrait apporter des informations précieuses sur la pathogenèse de ces maladies et contribuer au développement de thérapies plus ciblées. Cela accélère la croissance de la recherche universitaire et clinique, propulsant ainsi l'expansion du marché.

Utilisation croissante de la cytométrie de flux dans la découverte de médicaments

- L'expansion des activités de recherche devrait stimuler la croissance de la cytométrie de flux. Elle s'est imposée comme un outil clé pour explorer les processus de découverte et de développement de médicaments. Grâce à sa capacité exceptionnelle à analyser des populations cellulaires hétérogènes, la cytométrie de flux offre des perspectives prometteuses pour la découverte et le développement de médicaments. Elle fournit des informations à haute résolution sur les informations fonctionnelles et biologiques multiparamétriques d'une cellule unique. De plus, les progrès constants des approches de cytométrie de flux, telles que l'analyse multifactorielle à haut débit, l'amélioration du tri cellulaire et la détection et la résolution rapides des événements, garantissent une efficacité accrue dans la recherche et la caractérisation de nouveaux médicaments bioactifs.

- Par exemple;-

- En mars 2024, selon un article publié par le NCBI, l'utilisation croissante de la cytométrie de flux dans la découverte de médicaments, notamment pour la modulation des biomarqueurs dans les premiers essais cliniques, stimule le marché de la cytométrie de flux en Asie-Pacifique. Sa capacité à fournir des informations précieuses sur la progression des molécules et la traduction inverse des données des patients accélère les découvertes thérapeutiques. Cette application croissante dans la découverte de médicaments stimule la demande de technologies avancées de cytométrie de flux dans les secteurs de la santé et de l'industrie pharmaceutique.

- En novembre 2021, selon un article publié par News Medical Life Sciences, l'utilisation croissante de la cytométrie de flux dans la découverte de médicaments, de l'identification des cibles au développement de nouveaux médicaments, stimule le marché Asie-Pacifique. Elle permet l'analyse de diverses structures biomoléculaires, notamment les membranes cellulaires, les protéines, l'ADN et l'ARNm, permettant un ciblage précis dans le développement de médicaments. Cette large applicabilité à la compréhension des processus biologiques complexes accélère la demande de technologies de cytométrie de flux dans la recherche pharmaceutique.

Opportunités

- Augmentation de l'adoption des techniques de cytométrie de flux dans la recherche et le milieu universitaire

La cytométrie de flux est une technique sophistiquée permettant de mesurer des cellules individuelles et d'autres particules en suspension à un rythme de plusieurs milliers de cellules par seconde. La cytométrie de flux a été étendue aux études environnementales, à l'analyse des vésicules extracellulaires et permet d'utiliser plus de 30 paramètres différents pour des analyses plus approfondies. Elle est principalement utilisée en immunologie. Les cytomètres de flux offrent des capacités exceptionnelles, des données de haute qualité et une plateforme conviviale qui permet aux chercheurs de gagner du temps lors de la collecte et de l'analyse des données.

L’augmentation de la prévalence et de l’incidence des maladies chroniques et infectieuses a ouvert de vastes possibilités de recherche et de développement pour de nouvelles applications diagnostiques et thérapeutiques.

Par exemple,

En février 2021, selon une étude publiée dans PLOS ONE, des chercheurs ont utilisé la cytométrie de flux pour analyser la réponse immunitaire de patients atteints de la COVID-19. L'étude a révélé que la cytométrie de flux était un outil fiable et efficace pour caractériser la réponse immunitaire au virus, ce qui pourrait orienter les stratégies thérapeutiques.

En avril 2021, selon une étude publiée dans Frontiers in Immunology, des chercheurs ont utilisé la cytométrie de flux pour étudier la réponse immunitaire à l'infection par le VIH. L'étude a révélé que la cytométrie de flux était un outil efficace pour caractériser la réponse immunitaire au virus, ce qui pourrait conduire au développement de nouveaux traitements et vaccins.

- Développement croissant des industries pharmaceutiques et biotechnologiques

Les instruments de cytométrie en flux sont devenus essentiels à la découverte et au développement de médicaments dans les industries pharmaceutique et biotechnologique. Le développement de nouveaux équipements de cytométrie en flux a permis aux chercheurs d'analyser et de trier les cellules plus rapidement, plus précisément et plus efficacement, ce qui a contribué à accélérer le développement des médicaments. Par exemple, Beckman Coulter, l'un des principaux fabricants d'équipements de cytométrie en flux, a développé le cytomètre en flux CytoFLEX LX, offrant une détection rapide, une sensibilité accrue et un encombrement réduit. CytoFLEX LX est conçu pour aider les chercheurs à analyser les populations de cellules rares plus rapidement et plus efficacement.

Globalement, le développement de nouveaux dispositifs de cytométrie en flux aide les entreprises pharmaceutiques et biotechnologiques à accélérer le développement de médicaments en permettant une analyse plus rapide et plus précise de populations cellulaires complexes. Avec l'augmentation de la population âgée et des cas de maladies chroniques, la croissance des entreprises biotechnologiques et pharmaceutiques s'accélère également. Partout dans le monde, les activités de recherche et développement s'intensifient en raison des dépenses de santé publique et des performances économiques.

Par exemple,

- En octobre 2024, Ardena a annoncé une expansion substantielle de ses activités bioanalytiques aux Pays-Bas. De plus, l'entreprise s'est concentrée sur le développement de ses capacités en immunochimie, cytométrie de flux et plateformes qPCR, l'augmentation de ses capacités LC-MS/MS et l'ajout de nouveaux systèmes automatisés Hamilton pour améliorer son efficacité et répondre aux défis croissants de la bioanalyse.

- En avril 2021, selon les données du Congressional Budget Office (CBO), le secteur pharmaceutique a consacré 83 milliards de dollars à la recherche et au développement. Ces dépenses ont été engagées pour diverses opérations, notamment la découverte et les tests de nouveaux médicaments, le développement d'avancées technologiques telles que l'extension de gamme, et les essais cliniques pour le suivi de la sécurité et la commercialisation.

Contraintes/Défis

- Coût élevé des instruments de cytométrie en flux

L'investissement initial important requis pour les instruments de cytométrie en flux, associé aux coûts permanents des réactifs, des colorants et de la maintenance, crée des obstacles financiers, en particulier pour les petits laboratoires ou ceux dont les ressources sont limitées. De plus, la complexité technique de la cytométrie en flux exige un personnel qualifié pour son exploitation, avec une formation spécialisée nécessaire à son utilisation correcte. Cela limite son accessibilité dans les régions où l'expertise fait défaut, réduisant ainsi son taux d'adoption. De plus, les systèmes de cytométrie en flux nécessitent une maintenance, un étalonnage et un dépannage réguliers, ce qui augmente les coûts d'exploitation et peut entraîner des temps d'arrêt, impactant encore davantage l'efficacité des laboratoires. Les exigences réglementaires strictes pour l'approbation de ces dispositifs médicaux entraînent également des retards de mise sur le marché et des coûts de conformité supplémentaires. Ces facteurs, pris ensemble, freinent l'adoption généralisée de la cytométrie en flux, en particulier sur les marchés émergents où les contraintes financières, le manque de professionnels qualifiés et la lenteur des processus réglementaires constituent des obstacles importants à la croissance, freinant à terme le potentiel d'expansion du marché.

Par exemple -

- En janvier 2024, selon un article publié par Excedr, le coût élevé des instruments de cytométrie en flux, compris entre 100 000 et 1,5 million de dollars américains, constitue un frein important pour le marché Asie-Pacifique. Ces dépenses limitent l'accès des petits laboratoires et institutions, rendant difficile l'adoption de technologies de pointe. Par conséquent, les coûts élevés d'investissement initial et de maintenance freinent leur utilisation généralisée et ralentissent la croissance du marché, en particulier dans les pays aux ressources limitées.

- En novembre 2023, selon un article publié par le NCBI, le coût élevé des instruments de cytométrie en flux, compris entre 50 000 et 750 000 dollars américains, voire plus, constitue un frein important au marché de la région Asie-Pacifique. Cet investissement financier important, requis pour des fonctionnalités et des spécifications avancées, limite l'accessibilité, notamment pour les petits laboratoires de recherche et les institutions aux budgets limités. Par conséquent, ce coût élevé freine l'adoption et la croissance du marché, notamment dans les pays aux ressources limitées.

L'investissement initial dans les instruments et les dépenses courantes liées aux réactifs et à la maintenance représentent des défis financiers pour les petits laboratoires et ceux situés dans des régions aux ressources limitées. La complexité de la technologie nécessite également un personnel qualifié, ce qui limite son utilisation dans les régions manquant d'expertise. De plus, la nécessité d'une maintenance et d'un étalonnage réguliers augmente les coûts d'exploitation et peut entraîner des temps d'arrêt. Des exigences réglementaires strictes retardent encore davantage l'approbation des produits et leur mise sur le marché. Ces facteurs limitent l'adoption de la cytométrie en flux, notamment sur les marchés émergents, et freinent sa croissance globale.

- Limites de la cytométrie en flux

La cytométrie de flux présente des limites inhérentes, notamment son incapacité à analyser les tissus fixés au formol, ce qui restreint son utilisation dans certaines recherches et applications cliniques. Conçue pour des échantillons frais ou congelés, cette méthode peut altérer la structure cellulaire et l'expression des marqueurs, les rendant impropres à l'analyse. De plus, la cytométrie de flux peine à capturer pleinement les interactions cellulaires complexes ou les voies de signalisation multicouches. Ces restrictions limitent son champ d'application dans divers domaines et freinent le marché de la cytométrie de flux en Asie-Pacifique en limitant son applicabilité, notamment en milieu clinique et en pathologie.

Par exemple

- En juin 2021, selon un article publié par LearnHaem, la cytométrie en flux nécessite le traitement d'échantillons frais immédiatement après leur prélèvement, car un stockage inapproprié ou prolongé entraîne une apoptose naturelle, ce qui diminue la précision des résultats. De plus, la cytométrie en flux ne peut pas être utilisée sur des tissus fixés au formol, ce qui limite son application dans certains environnements cliniques et de recherche. Ces contraintes freinent le marché de la cytométrie en flux en Asie-Pacifique, réduisant sa polyvalence et son applicabilité dans certains domaines.

- En mars 2020, selon un article publié par le NCBI, la cytométrie de flux présentait des limites en raison du flou optique causé par un mouvement cellulaire important, ce qui affecte la clarté de l'image. De plus, la détection d'objets rares et atypiques, tels que les cellules tumorales circulantes (CTC), pose un défi malgré leur importance pronostique. Ces problèmes limitent la capacité à capturer et à analyser avec précision des biomarqueurs critiques, freinant ainsi le développement et l'application de la cytométrie de flux dans certains domaines du diagnostic et de la recherche.

La cytométrie de flux présente des limites, notamment son incapacité à analyser les tissus fixés au formol, couramment utilisés en pathologie et en diagnostic clinique. Ce procédé nécessite des échantillons frais ou congelés, et la fixation chimique altère les marqueurs cellulaires, les rendant incompatibles avec l'analyse par cytométrie de flux. De plus, la technique peine à capturer pleinement les interactions cellulaires complexes ou les voies de signalisation complexes. Ces limitations limitent l'application plus large de la technologie et freinent le marché de la cytométrie de flux en Asie-Pacifique en réduisant sa polyvalence en milieu clinique et de recherche.

Portée du marché de la cytométrie de flux en Asie-Pacifique

Le marché est segmenté en fonction du produit, de l'application, de la technologie, du canal de distribution et de l'utilisateur final. La croissance de ces segments vous permettra d'analyser les segments à faible croissance des secteurs et de fournir aux utilisateurs une vue d'ensemble et des informations précieuses sur le marché, facilitant ainsi la prise de décisions stratégiques pour identifier les applications clés du marché.

Produit

- Réactifs et consommables

- Colorant

- Anticorps

- Perles

- Autres

- Instruments de cytométrie de flux

- Analyseurs de cellules

- Par type

- Cytomètres de flux d'imagerie

- Cytomètres de flux sans imagerie

- Par gamme

- Analyseurs de cellules haut de gamme

- Analyseurs de cellules de milieu de gamme

- Analyseurs de cellules à faible portée

- Par modalité

- Paillasse

- Autonome

- Par type

- Trieurs de cellules

- Par modalité

- Paillasse

- Autonome

- Par gamme

- Analyseurs de cellules haut de gamme

- Analyseurs de cellules de milieu de gamme

- Analyseurs de cellules à faible portée

- Par modalité

- Analyseurs de cellules

- Accessoires

- Filtres

- Détecteurs

- Autres

- Services

- Logiciel

Technologie

- Cytométrie de flux cellulaire

- Instruments de cytométrie de flux

- Réaimants et consommables

- Accessoires

- Cytométrie de flux à base de billes

- Instruments de cytométrie de flux

- Réaimants et consommables

- Accessoires

Application

- Applications de recherche

- Analyse du cycle cellulaire

- Tri/Criblage cellulaire

- Transfection/viabilité cellulaire

- Pharmaceutique et biotechnologie

- Découverte de médicaments

- Recherche sur les cellules souches

- Tests de toxicité in vitro

- Immunologie

- Apoptose

- Comptage cellulaire

- Autres

- Applications cliniques

- Hématologie

- Cancer

- Maladies d'immunodéficience

- Transplantation d'organes

- Autre application clinique

- Applications industrielles

Utilisateur final

- Sociétés pharmaceutiques et biotechnologiques

- Instituts universitaires et de recherche

- Hôpitaux

- Laboratoires d'essais cliniques

- Cro

- Banque du sang

- CMO et CDM

- Laboratoires médico-légaux

- Autres

Canal de distribution

- Ventes au détail

- Hors ligne

- En ligne

- Appels d'offres directs

Analyse régionale du marché de la cytométrie en flux en Asie-Pacifique

Le marché est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, produit, application, technologie, canal de distribution et utilisateur final, comme référencé ci-dessus.

Les pays couverts par le marché sont la Chine, le Japon, l'Inde, la Corée du Sud, l'Australie, Singapour, la Thaïlande, la Malaisie, l'Indonésie, les Philippines et le reste de l'Asie-Pacifique.

Le Japon détient la plus grande part de marché, grâce à ses infrastructures de santé avancées, à ses industries biotechnologiques et pharmaceutiques performantes, à son adoption de technologies de pointe, à ses investissements importants en R&D et au soutien gouvernemental. Le vieillissement de sa population et la présence d'acteurs bien établis sur le marché stimulent encore davantage la demande en cytométrie de flux.

La section pays du rapport présente également les facteurs d'impact sur les marchés individuels et les évolutions réglementaires nationales qui influencent les tendances actuelles et futures du marché. Des données telles que l'analyse des chaînes de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. De plus, la présence et la disponibilité des marques d'Asie-Pacifique et les difficultés auxquelles elles sont confrontées en raison de la forte ou de la faible concurrence des marques locales et nationales, de l'impact des tarifs douaniers nationaux et des routes commerciales sont prises en compte lors de l'analyse prévisionnelle des données nationales.

Part de marché de la cytométrie de flux en Asie-Pacifique

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence en Asie-Pacifique, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les leaders du marché de la cytométrie de flux en Asie-Pacifique opérant sur le marché sont :

- BD (États-Unis)

- Agilent Technologies, Inc. (États-Unis)

- Thermo Fisher Scientific Inc. (États-Unis)

- Bio-Rad Laboratories, Inc. (États-Unis)

- Sartorius AG (Allemagne)

- Bennubio Inc. (États-Unis)

- Enzo Biochem Inc. (États-Unis)

- Apogee Flow Systems Ltd. (Royaume-Uni)

- Beckman Coulter, Inc. (États-Unis)

- Coherent Corp. (États-Unis)

- Cell Signaling Technology, Inc. (États-Unis)

- Cytek Biosciences (États-Unis)

- Biomérieux. (France)

- Cytonome/ST LLC (États-Unis)

Derniers développements sur le marché de la cytométrie en flux en Asie-Pacifique

- En juillet 2024, Agilent Technologies a annoncé l'acquisition de BioVectra, une société canadienne de services pharmaceutiques, pour 925 millions de dollars américains. Cette acquisition renforce les capacités d'Agilent en matière d'édition génomique, notamment dans la fabrication d'oligonucléotides et de peptides, et renforce son rôle dans les thérapies à base d'ARN et les technologies d'édition génomique comme CRISPR-Cas.

- En juin 2024, Thermo Fisher a inauguré un agrandissement de 6 700 m² sur son campus de Middleton, qui servira de laboratoire d'essais pharmaceutiques. Ce projet créera 350 emplois au cours des deux prochaines années, et bénéficiera de crédits d'impôt de l'État.

- En novembre 2024, Sartorius Stedim Biotech a inauguré un nouveau Centre d'innovation en bioprocédés à Marlborough, dans le Massachusetts, afin de promouvoir le développement de thérapies de nouvelle génération. Ce site de 63 000 pieds carrés offrira des services d'optimisation des procédés, de formation et des suites BPF pour la production clinique à partir de 2025.

- En mars 2024, Beckman Coulter Life Sciences a lancé le cytomètre en flux CytoFLEX nano, une avancée majeure dans l'analyse des nanoparticules, permettant une détection dès 40 nm. Ce système améliore la sensibilité et offre jusqu'à 50 % de données supplémentaires pour la recherche sur les vésicules extracellulaires et les cibles à faible abondance.

- En mars 2024, Beckman Coulter Life Sciences a reçu l'autorisation 510(k) de la FDA pour distribuer son cytomètre de flux clinique DxFLEX aux États-Unis. Cela simplifie les tests de haute complexité avec une sensibilité améliorée et une compensation automatisée, rendant la cytométrie de flux multicolore plus accessible et efficace pour les laboratoires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC FLOW CYTOMETRY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 ASIA-PACIFIC FLOW CYTOMETRY MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC DISEASES

6.1.2 INCREASING APPLICATION OF CYTOMETRY INSTRUMENTS

6.1.3 GROWING USE OF FLOW CYTOMETRY IN DRUG DISCOVERY

6.1.4 GROWING RESEARCH FUNDING

6.2 RESTRAINTS

6.2.1 HIGH COST OF FLOW CYTOMETRY INSTRUMENTS

6.2.2 LIMITATIONS OF FLOW CYTOMETRY

6.3 OPPORTUNITIES

6.3.1 INCREASE IN ADOPTION OF FLOW CYTOMETRY TECHNIQUES IN RESEARCH AND ACADEMIA

6.3.2 RISING DEVELOPMENT OF PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES

6.3.3 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 DIFFICULTY IN THE DEVELOPMENT AND VALIDATION OF FLOW CYTOMETRY ASSAYS

6.4.2 COMPLEXITIES RELATED TO REAGENT DEVELOPMENT

7 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 REAGENTS AND CONSUMABLES

7.2.1 DYE

7.2.2 ANTIBODIES

7.2.3 BEADS

7.2.4 OTHERS

7.3 FLOW CYTOMETRY INSTRUMENTS

7.3.1 CELL ANALYZERS

7.3.1.1 CELL ANALYZERS, BY TYPE

7.3.1.1.1 IMAGING FLOW CYTOMETERS

7.3.1.1.2 NON-IMAGING FLOW CYTOMETERS

7.3.1.2 CELL ANALYZERS, BY RANGE

7.3.1.2.1 HIGH-RANGE CELL ANALYZERS

7.3.1.2.2 MID-RANGE CELL ANALYZERS

7.3.1.2.3 LOW-RANGE CELL ANALYZERS

7.3.1.3 CELL ANALYZERS, BY MODALITY

7.3.1.3.1 BENCHTOP

7.3.1.3.2 STANDALONE

7.3.2 CELL SORTERS

7.3.2.1 BENCHTOP

7.3.2.2 STANDALONE

7.3.3 CELL SORTERS

7.3.3.1 HIGH-RANGE CELL ANALYZERS

7.3.3.2 MID-RANGE CELL ANALYZERS

7.3.3.3 LOW-RANGE CELL ANALYZERS

7.4 ACCESSORIES

7.4.1 FILTERS

7.4.2 DETECTORS

7.4.3 OTHERS

7.5 SERVICES

7.6 SOFTWARE

8 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 CELL-BASED FLOW CYTOMETRY

8.2.1 FLOW CYTOMETRY INSTRUMENTS

8.2.2 REAGENTS & CONSUMABLES

8.2.3 ACCESSORIES

8.3 BEAD-BASED FLOW CYTOMETRY

8.3.1 FLOW CYTOMETRY INSTRUMENTS

8.3.2 REAGENTS & CONSUMABLES

8.3.3 ACCESSORIES

9 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 RESEARCH APPLICATIONS

9.2.1 CELL CYCLE ANALYSIS

9.2.2 CELL SORTING/SCREENING

9.2.3 CELL TRANSFECTION/VIABILITY

9.2.4 PHARMACEUTICAL AND BIOTECHNOLOGY

9.2.4.1 DRUG DISCOVERY

9.2.4.2 STEM CELL RESEARCH

9.2.4.3 IN VITRO TOXICITY TESTING

9.2.5 IMMUNOLOGY

9.2.6 APOPTOSIS

9.2.7 CELL COUNTING

9.2.8 OTHERS

9.3 CLINICAL APPLICATIONS

9.3.1 HAEMATOLOGY

9.3.2 CANCER

9.3.3 IMMUNODEFICIENCY DISEASES

9.3.4 ORGAN TRANSPLANTATION

9.3.5 OTHER CLINICAL APPLICATION

9.4 INDUSTRIAL APPLICATIONS

10 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 RETAIL SALES

10.2.1 OFFLINE

10.2.2 ONLINE

10.3 DIRECT TENDERS

11 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICALS AND BIOTECHNOLOGY COMPANIES

11.3 ACADEMIC & RESEARCH INSTITUTES

11.4 HOSPITALS

11.5 CLINICAL TESTING LABORATORIES

11.6 CRO

11.7 BLOOD BANK

11.8 CMO & CDMO

11.9 FORENSIC LABORATORIES

11.1 OTHERS

12 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 JAPAN

12.1.2 CHINA

12.1.3 INDIA

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA-PACIFIC FLOW CYTOMETRY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 BD

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 AGILENT TECHNOLOGIES, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 THERMO FISHER SCIENTIFIC INC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 BIO-RAD LABORATORIES, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 SARTORIUS AG

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 APOGEE FLOW SYSTEMS LTD.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BECKMAN COULTER, INC. (A SUBSIDIARY OF DANAHER CORPORATION)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 BIOMÉRIEUX

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BIOLEGEND, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 BENNUBIO INC

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 COHERENT CORP.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 CYTONOME/ST, LLC

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 CYTOBUOY

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 CELL SIGNALING TECHNOLOGY, INC

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 CYTEK BIOSCIENCES

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 DIASORIN S.P.A.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 ELABSCIENCE BIONOVATION INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 ENZO BIOCHEM, INC

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 MILTENYI BIOTEC AND/OR ITS AFFILIATES

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 MERCK KGAA

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 NANOCELLECT BIOMEDICAL

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 NEOGENOMICS LABORATORIES

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENT

15.23 ON-CHIP BIOTECHNOLOGIES CO., LTD. CORPORATION

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 ORLFO TECHNOLOGIES

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 STRATEDIGM, INC

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 SONY BIOTECHNOLOGY INC

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 SYSMEX ASIA PACIFIC PTE LTD (PART OF SYSMEX CORPORATION)

15.27.1 COMPANY SNAPSHOT

15.27.2 REVENUE ANALYSIS

15.27.3 PRODUCT PORTFOLIO

15.27.4 RECENT DEVELOPMENT

15.28 TAKARA BIO INC.

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENT

15.29 UNION BIOMETRICA, INC.

15.29.1 COMPANY SNAPSHOT

15.29.2 PRODUCT PORTFOLIO

15.29.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 2 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 3 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 4 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 5 ASIA-PACIFIC FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 6 ASIA-PACIFIC FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 7 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 8 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 9 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 10 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 11 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 12 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 13 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 14 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 15 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 16 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 18 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 19 ASIA-PACIFIC SERVICES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 20 ASIA-PACIFIC SOFTWARE IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 21 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 22 ASIA-PACIFIC CELL-BASED FLOW CYTOMETRY IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 23 ASIA-PACIFIC CELL-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 24 ASIA-PACIFIC BEAD-BASED FLOW CYTOMETRY IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 25 ASIA-PACIFIC BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 26 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 27 ASIA-PACIFIC RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 28 ASIA-PACIFIC RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 29 ASIA-PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 30 ASIA-PACIFIC CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 31 ASIA-PACIFIC CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 32 ASIA-PACIFIC INDUSTRIAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 34 ASIA-PACIFIC RETAIL SALES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 35 ASIA-PACIFIC RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 36 ASIA-PACIFIC RETAIL SALES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 37 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 38 ASIA-PACIFIC PHARMACEUTICALS & BIOTECHNOLOGY COMPANIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 39 ASIA-PACIFIC ACADEMIC & RESEARCH INSTITUTES COMPANIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 40 ASIA-PACIFIC HOSPITALS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 41 ASIA-PACIFIC CLINICAL TESTING LABORATORIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 42 ASIA-PACIFIC CRO IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 43 ASIA-PACIFIC BLOOD BANK IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 44 ASIA-PACIFIC CMO&CDMO IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 45 ASIA-PACIFIC FORENSIC LABORATORIES IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 46 ASIA-PACIFIC OTHERS IN FLOW CYTOMETRY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 47 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 48 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 49 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 50 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 51 ASIA-PACIFIC REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 52 ASIA-PACIFIC FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 53 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 54 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 55 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 56 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 57 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 58 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 59 ASIA-PACIFIC CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 60 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 61 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 62 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 63 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 64 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 65 ASIA-PACIFIC CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 66 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 67 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 68 ASIA-PACIFIC ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 69 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 70 ASIA-PACIFIC CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 71 ASIA-PACIFIC BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 72 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 73 ASIA-PACIFIC RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 74 ASIA-PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 75 ASIA-PACIFIC CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 76 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 77 ASIA-PACIFIC FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 78 ASIA-PACIFIC RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 79 JAPAN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 80 JAPAN REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 81 JAPAN REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 82 JAPAN REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 83 JAPAN FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 84 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 85 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 86 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 87 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 88 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 89 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 90 JAPAN CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 91 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 92 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 93 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 94 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 95 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 96 JAPAN CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 97 JAPAN ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 98 JAPAN ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 99 JAPAN ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 100 JAPAN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 101 JAPAN CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 102 JAPAN BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 103 JAPAN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 104 JAPAN RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 105 JAPAN PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 106 JAPAN CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 107 JAPAN FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 108 JAPAN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 109 JAPAN RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 110 CHINA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 111 CHINA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 112 CHINA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 113 CHINA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 114 CHINA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 115 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 116 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 117 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 118 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 119 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 120 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 121 CHINA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 122 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 123 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 124 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 125 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 126 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 127 CHINA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 128 CHINA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 129 CHINA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 130 CHINA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 131 CHINA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 132 CHINA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 133 CHINA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 134 CHINA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 135 CHINA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 136 CHINA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 137 CHINA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 138 CHINA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 139 CHINA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 140 CHINA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 141 INDIA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 142 INDIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 143 INDIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 144 INDIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 145 INDIA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 146 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 147 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 148 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 149 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 150 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 151 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 152 INDIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 153 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 154 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 155 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 156 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 157 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 158 INDIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 159 INDIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 160 INDIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 161 INDIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 162 INDIA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 163 INDIA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 164 INDIA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 165 INDIA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 166 INDIA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 167 INDIA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 168 INDIA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 169 INDIA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 170 INDIA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 171 INDIA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 172 SOUTH KOREA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 173 SOUTH KOREA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 174 SOUTH KOREA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 175 SOUTH KOREA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 176 SOUTH KOREA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 177 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 178 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 179 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 180 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 181 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 182 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 183 SOUTH KOREA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 184 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 185 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 186 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 187 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 188 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 189 SOUTH KOREA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 190 SOUTH KOREA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 191 SOUTH KOREA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 192 SOUTH KOREA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 193 SOUTH KOREA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 194 SOUTH KOREA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 195 SOUTH KOREA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 196 SOUTH KOREA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 197 SOUTH KOREA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 198 SOUTH KOREA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 199 SOUTH KOREA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 200 SOUTH KOREA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 201 SOUTH KOREA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 202 SOUTH KOREA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 203 AUSTRALIA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 204 AUSTRALIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 205 AUSTRALIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 206 AUSTRALIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 207 AUSTRALIA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 208 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 209 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 210 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 211 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 212 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 213 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 214 AUSTRALIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 215 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 216 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 217 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 218 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 219 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 220 AUSTRALIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 221 AUSTRALIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 222 AUSTRALIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 223 AUSTRALIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 224 AUSTRALIA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 225 AUSTRALIA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 226 AUSTRALIA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 227 AUSTRALIA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 228 AUSTRALIA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 229 AUSTRALIA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 230 AUSTRALIA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 231 AUSTRALIA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 232 AUSTRALIA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 233 AUSTRALIA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 234 SINGAPORE FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 235 SINGAPORE REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 236 SINGAPORE REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 237 SINGAPORE REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 238 SINGAPORE FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 239 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 240 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 241 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 242 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 243 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 244 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 245 SINGAPORE CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 246 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 247 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 248 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 249 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 250 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 251 SINGAPORE CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 252 SINGAPORE ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 253 SINGAPORE ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 254 SINGAPORE ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 255 SINGAPORE FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 256 SINGAPORE CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 257 SINGAPORE BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 258 SINGAPORE FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 259 SINGAPORE RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 260 SINGAPORE PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 261 SINGAPORE CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 262 SINGAPORE FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 263 SINGAPORE FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 264 SINGAPORE RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 265 THAILAND FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 266 THAILAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 267 THAILAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 268 THAILAND REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 269 THAILAND FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 270 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 271 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 272 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 273 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 274 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 275 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 276 THAILAND CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 277 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 278 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 279 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 280 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 281 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 282 THAILAND CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 283 THAILAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 284 THAILAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 285 THAILAND ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 286 THAILAND FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 287 THAILAND CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 288 THAILAND BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 289 THAILAND FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 290 THAILAND RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 291 THAILAND PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 292 THAILAND CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 293 THAILAND FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 294 THAILAND FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 295 THAILAND RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 296 MALAYSIA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 297 MALAYSIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 298 MALAYSIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 299 MALAYSIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 300 MALAYSIA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 301 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 302 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 303 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 304 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 305 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 306 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 307 MALAYSIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 308 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 309 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 310 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 311 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 312 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 313 MALAYSIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 314 MALAYSIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 315 MALAYSIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 316 MALAYSIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 317 MALAYSIA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 318 MALAYSIA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 319 MALAYSIA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 320 MALAYSIA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 321 MALAYSIA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 322 MALAYSIA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 323 MALAYSIA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 324 MALAYSIA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 325 MALAYSIA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 326 MALAYSIA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 327 INDONESIA FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 328 INDONESIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 329 INDONESIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 330 INDONESIA REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 331 INDONESIA FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 332 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 333 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 334 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 335 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 336 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 337 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 338 INDONESIA CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 339 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 340 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 341 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 342 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 343 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 344 INDONESIA CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 345 INDONESIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 346 INDONESIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 347 INDONESIA ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 348 INDONESIA FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 349 INDONESIA CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 350 INDONESIA BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 351 INDONESIA FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 352 INDONESIA RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 353 INDONESIA PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 354 INDONESIA CLINICAL APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 355 INDONESIA FLOW CYTOMETRY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 356 INDONESIA FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 357 INDONESIA RETAIL SALES IN FLOW CYTOMETRY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 358 PHILIPPINES FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 359 PHILIPPINES REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 360 PHILIPPINES REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 361 PHILIPPINES REAGENTS AND CONSUMABLES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 362 PHILIPPINES FLOW CYTOMETRY INSTRUMENTS IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 363 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 364 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (VOLUME)

TABLE 365 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY TYPE, 2018-2032 (ASP)

TABLE 366 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 367 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 368 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 369 PHILIPPINES CELL ANALYZERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 370 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (USD MILLION)

TABLE 371 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (VOLUME)

TABLE 372 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY MODALITY, 2018-2032 (ASP)

TABLE 373 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (USD MILLION)

TABLE 374 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (VOLUME)

TABLE 375 PHILIPPINES CELL SORTERS IN FLOW CYTOMETRY MARKET, BY RANGE, 2018-2032 (ASP)

TABLE 376 PHILIPPINES ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 377 PHILIPPINES ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (VOLUME)

TABLE 378 PHILIPPINES ACCESSORIES IN FLOW CYTOMETRY MARKET, BY PRODUCT, 2018-2032 (ASP)

TABLE 379 PHILIPPINES FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 380 PHILIPPINES CELL-BASED FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 381 PHILIPPINES BEAD-BASED IN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 382 PHILIPPINES FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 383 PHILIPPINES RESEARCH APPLICATIONS IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 384 PHILIPPINES PHARMACEUTICAL AND BIOTECHNOLOGY IN FLOW CYTOMETRY MARKET, BY APPLICATION, 2018-2032 (USD MILLION)