Asia Pacific Exosome Therapeutic Market

Taille du marché en milliards USD

TCAC :

%

USD

122.59 Thousand

USD

404.38 Thousand

2021

2029

USD

122.59 Thousand

USD

404.38 Thousand

2021

2029

| 2022 –2029 | |

| USD 122.59 Thousand | |

| USD 404.38 Thousand | |

|

|

|

Marché des thérapies par exosomes en Asie-Pacifique, par type (exosome naturel, exosome hybride), source (cellules souches mésenchymateuses, sang, fluides corporels, urine, cellules dendritiques, salive, lait et autres), thérapie (immunothérapie, chimiothérapie et thérapie génique), capacité de transport (biomacromolécules et petites molécules), application (troubles métaboliques, oncologie, troubles cardiaques, neurologie, troubles inflammatoires, transplantation d'organes , troubles gynécologiques, troubles sanguins et autres), voie d'administration (parentérale et orale), utilisateur final (instituts de recherche et universitaires, hôpitaux et centres de diagnostic), pays (Corée du Sud, Australie, Hong Kong, reste de l'Asie-Pacifique) Tendances de l'industrie et prévisions jusqu'en 2029

Analyse et perspectives du marché : marché des thérapies par exosomes en Asie-Pacifique

Analyse et perspectives du marché : marché des thérapies par exosomes en Asie-Pacifique

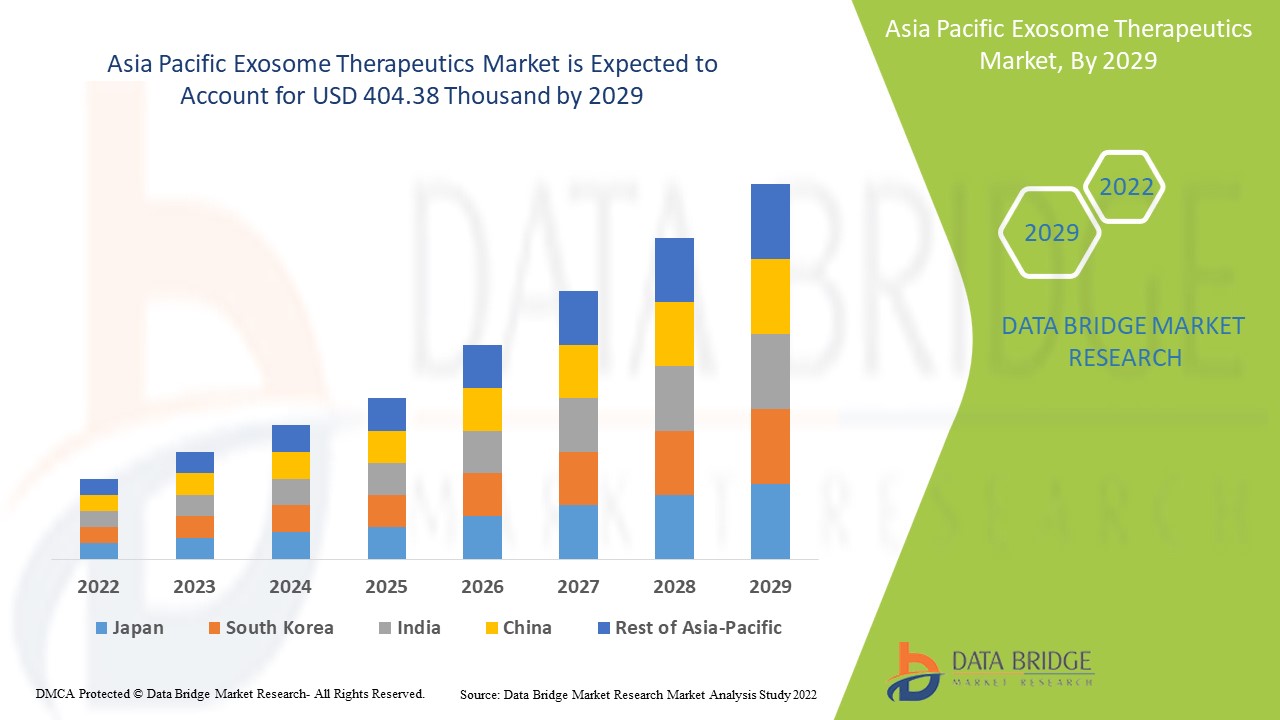

Le marché des thérapies par exosomes en Asie-Pacifique devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 16,4 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 404,38 milliers USD d'ici 2029 contre 122,59 milliers USD en 2021. La prévalence croissante des maladies auto-immunes inflammatoires chroniques et les développements technologiques dans le domaine des thérapies par exosomes sont susceptibles d'agir comme les principaux moteurs de la demande du marché au cours de la période de prévision.

Les exosomes sont une classe spécifique de vésicules extracellulaires dérivées de cellules composées d'endosomes et ont généralement un diamètre de 30 à 150 nm – le plus petit type de vésicule extracellulaire. Protégés par une bicouche lipidique, les exosomes sont poussés dans l'environnement extracellulaire, qui contient une cargaison complexe de contenus dérivés de la cellule d'origine. Les contenus présents dans la cargaison sont des protéines, des lipides, de l'acide ribonucléique messager (ARNm), de l'acide ribonucléique microsomal (miARN) et de l'acide désoxyribonucléique (ADN). Les exosomes se distinguent par la façon dont ils sont formés – par la fusion et l'exocytose de corps multivésiculaires dans l'espace extracellulaire. Les exosomes ont été associés au traitement de diverses maladies chroniques telles que les maladies auto-immunes. La nanotechnologie a montré de nouvelles perspectives pour la détection préalable du cancer à partir de nanotransporteurs tels que les exosomes. Étant donné que les exosomes offrent un fort potentiel d’applicabilité dans les interventions thérapeutiques, ils ont été considérés comme des vecteurs potentiels de médicaments.

Les exosomes sont de deux types : les exosomes naturels et les exosomes hybrides. Les exosomes naturels sont subdivisés en exosomes exogènes et en exosomes autologues. Les exosomes autologues sont des véhicules sûrs et efficaces pour l'administration ciblée de médicaments destinés au traitement du cancer, des maladies auto-immunes et des maladies inflammatoires chroniques. Les exosomes exogènes sont de minuscules vésicules membranaires extracellulaires libérées par les endosomes de diverses cellules et peuvent être trouvées dans la plupart des liquides corporels, tels que le liquide synovial, le liquide amniotique et le sperme. Dans le cancer, les exosomes jouent un rôle essentiel dans la propagation métastatique, la résistance aux médicaments et la formation de nouveaux vaisseaux sanguins.

Les facteurs responsables de la croissance du marché des thérapies à base d'exosomes en Asie-Pacifique sont l'incidence accrue des maladies inflammatoires chroniques, l'augmentation des activités de recherche et développement pour les thérapies à base d'exosomes et le financement gouvernemental pour le développement et la production de thérapies à base d'exosomes. De plus, le potentiel de croissance des thérapies à base d'exosomes dans les économies émergentes et l'utilisation accrue de thérapies anti-âge soutiennent la croissance du marché des thérapies à base d'exosomes. Cependant, l'augmentation des coûts, les réglementations strictes imposées et les risques observés lors de l'utilisation des thérapies à base d'exosomes sont les contraintes qui peuvent entraver la croissance du marché. Une augmentation des dépenses de santé devrait offrir une opportunité lucrative de croissance du marché. D'autre part, l'augmentation des investissements, associée à un manque de procédures standardisées pour l'isolement des exosomes ainsi qu'à la non-disponibilité de l'expertise requise, sont quelques-uns des défis importants qui devraient affecter la croissance du marché.

Le rapport sur le marché des thérapies par exosomes en Asie-Pacifique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des thérapies par exosomes en Asie-Pacifique

Portée et taille du marché des thérapies par exosomes en Asie-Pacifique

Le marché des thérapies par exosomes en Asie-Pacifique est classé en sept segments notables qui sont basés sur le type, la source, la thérapie, la capacité de transport, l'application, la voie d'administration et l'utilisateur final.

- Sur la base du type, le marché des exosomes thérapeutiques en Asie-Pacifique est segmenté en exosomes naturels et en exosomes hybrides. En 2022, le segment des exosomes naturels devrait dominer le marché des exosomes thérapeutiques en Asie-Pacifique en raison de la présence de matière naturelle des exosomes et des avantages en matière d'administration de médicaments.

- Sur la base de la source, le marché des thérapies par exosomes en Asie-Pacifique est segmenté en cellules souches mésenchymateuses, sang, fluides corporels, urine, cellules dendritiques, salive, lait et autres. En 2022, le segment des cellules souches mésenchymateuses devrait dominer le marché des thérapies par exosomes en Asie-Pacifique en raison des applications émergentes des cellules souches mésenchymateuses et de l'expansion du pipeline, de la disponibilité et de la facilité de récolte.

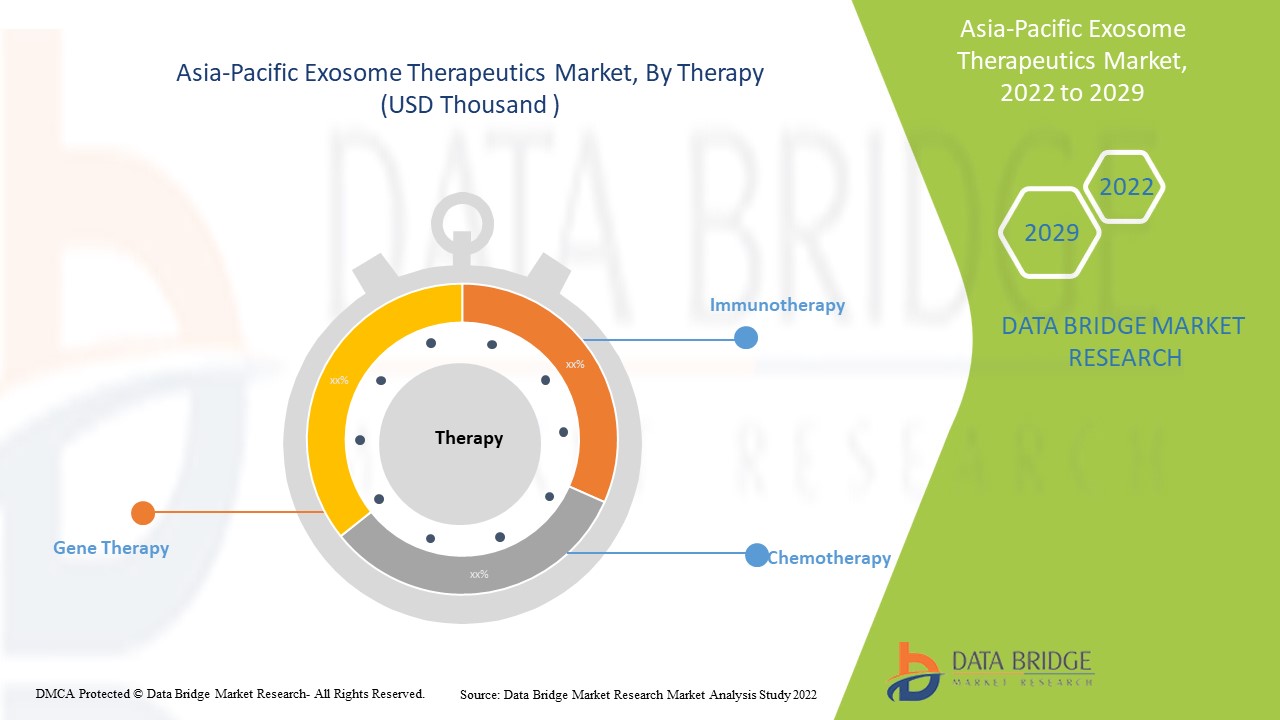

- Sur la base de la thérapie, le marché des thérapies par exosomes en Asie-Pacifique est segmenté en immunothérapie, thérapie génique et chimiothérapie. En 2022, le segment de l'immunothérapie devrait dominer le marché des thérapies par exosomes en Asie-Pacifique en raison de sa facilité d'utilisation, de sa grande précision et de l'amélioration du taux de survie à long terme.

- Sur la base de la capacité de transport, le marché des exosomes thérapeutiques de la région Asie-Pacifique est segmenté en bio-macromolécules et en petites molécules. En 2022, le segment des bio-macromolécules devrait dominer le marché des exosomes thérapeutiques de la région Asie-Pacifique en raison de la présence d'une sensibilité élevée, de l'utilisation accrue de protéines thérapeutiques pour soigner les troubles inflammatoires et du renforcement des défenses naturelles de l'organisme pour lutter contre les maladies inflammatoires.

- Sur la base des applications, le marché des thérapies par exosomes en Asie-Pacifique est segmenté en troubles métaboliques, oncologie, troubles cardiaques, neurologie, troubles inflammatoires, transplantation d'organes, troubles gynécologiques, troubles sanguins, etc. En 2022, le segment des troubles métaboliques devrait dominer le marché des thérapies par exosomes en Asie-Pacifique en raison de l'augmentation des cas de troubles métaboliques en Chine et en Inde et de la disponibilité des thérapies par exosomes dans les laboratoires de diagnostic.

- En fonction de la voie d'administration, le marché des exosomes thérapeutiques en Asie-Pacifique est segmenté en deux catégories : parentéral et oral. En 2022, le segment parentéral devrait dominer le marché des exosomes thérapeutiques en Asie-Pacifique en raison de sa biodisponibilité améliorée et de son début d'action immédiat.

- Sur la base de l'utilisateur final, le marché des thérapies par exosomes de la région Asie-Pacifique est segmenté en instituts de recherche et universitaires, hôpitaux et centres de diagnostic. En 2022, le segment des instituts de recherche et universitaires devrait dominer le marché des thérapies par exosomes de la région Asie-Pacifique en raison de l'augmentation de la recherche et du développement des exosomes au Japon et du soutien financier du gouvernement.

Analyse du marché des thérapies par exosomes en Asie-Pacifique au niveau des pays

Le marché des thérapies par exosomes en Asie-Pacifique est analysé et des informations sur la taille du marché sont fournies par type, source, thérapie, capacité de transport, application, voie d'administration et utilisateur final.

Les pays couverts par le rapport sur le marché des thérapies par exosomes sont le Japon, la Chine, l’Inde, la Corée du Sud, l’Australie, Singapour, l’Indonésie, les Philippines et le reste de l’Asie-Pacifique.

L'Asie-Pacifique devrait connaître le taux de croissance annuel composé le plus élevé au cours des périodes de prévision, car dans les pays de l'Asie-Pacifique, la demande de produits thérapeutiques à base d'exosomes augmente très rapidement avec l'urbanisation et l'automatisation des laboratoires. La Chine devrait dominer le marché de l'Asie-Pacifique, car elle est l'un des principaux pays à inculquer le marché des thérapies à base d'exosomes.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Le potentiel de croissance des thérapies à base d'exosomes dans les économies émergentes et les initiatives stratégiques des acteurs du marché créent de nouvelles opportunités sur le marché des thérapies à base d'exosomes en Asie-Pacifique

Le marché des thérapies par exosomes en Asie-Pacifique vous fournit également une analyse de marché détaillée pour la croissance de chaque pays dans un secteur particulier avec les ventes de thérapies par exosomes, l'impact des progrès dans la thérapie par exosomes et les changements dans les scénarios réglementaires avec leur soutien au marché des thérapies par exosomes. Les données sont disponibles pour la période historique de 2011 à 2020.

Analyse du paysage concurrentiel et des parts de marché des thérapies par exosomes en Asie-Pacifique

Le paysage concurrentiel du marché des thérapies par exosomes en Asie-Pacifique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise liée au marché des thérapies par exosomes.

La principale société fournissant des thérapies à base d'exosomes en Asie-Pacifique est Exopharm.

Les analystes DBMR comprennent les atouts concurrentiels et fournissent une analyse concurrentielle pour chaque concurrent séparément.

Les initiatives stratégiques des acteurs du marché ainsi que les nouvelles avancées technologiques en matière de thérapies à base d’exosomes comblent le fossé dans le traitement des maladies auto-immunes chroniques.

Par exemple,

- En septembre 2021, Exopharm a collaboré avec la société japonaise Showa Denko Materials pour l'utilisation de la technologie LEAP dans les thérapies par exosomes. La technologie LEAP réduit le problème majeur rencontré lors de la production d'exosomes, qui sont utilisés comme médecine régénérative pour des maladies telles que le cancer. Cette collaboration évaluerait la plateforme technologique LEAP (Ligand-based Exosome Affinity Purification) d'Exopharm au sein de son unité commerciale de médecine régénérative de Yokohama. Showa Denko Materials tirerait parti de la technologie des exosomes d'Exopharm

La collaboration, les coentreprises et d’autres stratégies des acteurs du marché améliorent le marché de l’entreprise sur le marché des thérapies par exosomes, ce qui offre également l’avantage à l’organisation d’améliorer son offre pour le marché des thérapies par exosomes.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC EXOSOME THERAPEUTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 TYPE SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 PIPELINE ANALYSIS

6 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING PREVALENCE OF CHRONIC INFLAMMATION, AUTOIMMUNE DISEASE, LYME DISEASE, AND OTHER CHRONIC DEGENERATIVE DISEASES

7.1.2 RISE IN INCIDENCE OF ONCOLOGY DISEASES

7.1.3 TECHNOLOGICAL ADVANCEMENTS IN EXOSOME THERAPEUTICS

7.1.4 RISE IN RESEARCH AND DEVELOPMENT ACTIVITIES, INVOLVED IN EXOSOME THERAPEUTICS

7.1.5 GOVERNMENT FUNDING FOR THE DEVELOPMENT AND PRODUCTION OF EXOSOME THERAPEUTICS

7.2 RESTRAINTS

7.2.1 HIGH COST ASSOCIATED WITH THE EXOSOME THERAPEUTICS

7.2.2 LACK OF AUTHENTICATION REQUIREMENTS FOR ISOLATION OF EXOSOMES

7.2.3 RISKS OBSERVED WHILE USING EXOSOME THERAPEUTICS

7.2.4 UNMET MEDICAL NEEDS

7.3 OPPORTUNITIES

7.3.1 INCREASE USE OF ANTI-AGING THERAPY

7.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

7.3.3 RISE IN HEALTHCARE EXPENDITURE

7.3.4 AVAILABILITY OF VARIOUS EXOSOME ISOLATION AND PURIFICATION TECHNIQUES

7.3.5 PROGRESSING THERAPEUTIC VALUE OF EXOSOME

7.4 CHALLENGES

7.4.1 THE SHORTAGE OF SKILLED PROFESSIONALS REQUIRED FOR THE ISOLATION OF EXOSOME

7.4.2 LATE APPROVAL ASSOCIATED WITH PRODUCT LAUNCHES

8 IMPACT OF COVID-19 ON ASIA PACIFIC EXOSOME THERAPEUTICS MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON DEMAND

8.3 IMPACT ON SUPPLY CHAIN

8.4 STRATEGIC DECISIONS BY MANUFACTURERS

8.5 CONCLUSION

9 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY TYPE

9.1 OVERVIEW

9.2 NATURAL EXOSOMES

9.2.1 AUTOLOGOUS EXOSOMES

9.2.2 EXOGENOUS EXOSOMES

9.3 HYBRID EXOSOMES

10 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY SOURCE

10.1 OVERVIEW

10.2 MESENCHYMAL STEM CELLS

10.3 BLOOD

10.3.1 T-LYMPHOCYTES

10.3.2 OTHERS

10.4 BODY FLUIDS

10.4.1 AMNIOTIC FLUID

10.4.2 SEMEN

10.4.3 SYNOVIAL FLUID

10.4.4 OTHERS

10.5 URINE

10.6 DENDRITIC CELLS

10.7 SALIVA

10.8 MILK

10.9 OTHERS

11 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY THERAPY

11.1 OVERVIEW

11.2 IMMUNOTHERAPY

11.3 GENE THERAPY

11.4 CHEMOTHERAPY

12 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY

12.1 OVERVIEW

12.2 BIO MACROMOLECULES

12.2.1 NUCLEIC ACIDS

12.2.2 PROTEINS

12.2.3 PEPTIDES

12.3 SMALL MOLECULES

13 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 METABOLIC DISORDERS

13.3 ONCOLOGY

13.3.1 NON-SMALL CELL LUNG CANCER

13.3.2 BREAST CANCER

13.3.3 GASTRIC CANCER

13.3.4 HEAD AND NECK CANCER

13.3.5 OTHERS

13.4 CARDIAC DISORDERS

13.5 NEUROLOGY

13.5.1 ALZHEIMER'S DISEASE

13.5.2 PARKINSON'S DISEASE

13.5.3 OTHERS

13.6 INFLAMMATORY DISORDERS

13.7 ORGAN TRANSPLANTATION

13.8 GYNECOLOGY DISORDERS

13.9 BLOOD DISORDERS

13.1 OTHERS

14 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION

14.1 OVERVIEW

14.2 PARENTERAL

14.3 ORAL

15 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY END USER

15.1 OVERVIEW

15.2 RESEARCH AND ACADEMIC INSTITUTES

15.3 HOSPITALS

15.4 DIAGNOSTIC CENTERS

16 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY REGION

16.1 ASIA-PACIFIC

16.1.1 SOUTH KOREA

16.1.2 AUSTRALIA

16.1.3 HONG-KONG

16.1.4 REST OF ASIA-PACIFIC

17 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

18 COMPANY PROFILE

18.1 KIMERA LABS

18.1.1 COMPANY SNAPSHOT

18.1.2 COMPANY SHARE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENTS

18.2 STEM CELLS GROUP

18.2.1 COMPANY SNAPSHOT

18.2.2 COMPANY SHARE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.3 AEGLE THERAPEUTICS

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 RECENT DEVELOPMENTS

18.4 AVALON GLOBOCARE CORP.(2021)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 CAPRICOR THERAPEUTICS (2021)

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 CODIAK (2021)

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 EXOSOME SCIENCES (A SUBSIDIARY OF AETHLON MEDICAL) (2021)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS NO RECENT DEVELOPMENTS

18.8 EXOPHARM

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 EVOX THERAPEUTICS

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 EV THERAPEUTICS

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 JAZZ PHARMACEUTICALS, INC

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 RENEURON GROUP PLC

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 STEM CELL MEDICINE

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA PACIFIC EXOSOME THERAPEUTICSMARKET, PIPELINE ANALYSIS

TABLE 2 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 3 ASIA PACIFIC NATURAL EXOSOMES IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 ASIA PACIFIC NATURAL EXOSOMES IN EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 ASIA PACIFIC HYBRID EXOSOMES IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 7 ASIA PACIFIC MESENCHYMAL STEM CELLS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 ASIA PACIFIC BLOOD IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC BLOOD IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 10 ASIA PACIFIC BODY FLUIDS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC BLOOD IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC URINE IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC DENDRITIC CELLS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC SALIVA IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC MILK IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC OTHERS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY THERAPY, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC IMMUNOTHERAPY IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC GENE THERAPY IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC CHEMOTHERAPY IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC BIO MACROMOLECULES IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC BIO MACROMOLECULES IN EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC SMALL MOLECULES IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC METABOLIC DISORDERS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC ONCOLOGY IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC ONCOLOGY IN ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC CARDIAC DISORDERS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA PACIFIC NEUROLOGY IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC NEUROLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 32 ASIA PACIFIC INFLAMMATORY DISORDERS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA PACIFIC ORGAN TRANSPLANTATION IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 ASIA PACIFIC GYNECOLOGY DISORDERS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA PACIFIC BLOOD DISORDERS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 ASIA PACIFIC OTHERS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA PACIFIC PARENTERAL IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 ASIA PACIFIC ORAL IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 41 ASIA PACIFIC RESEARCH AND ACADEMIC INSTITUTES IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 ASIA PACIFIC HOSPITALS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 ASIA PACIFIC DIAGNOSTIC CENTERS IN EXOSOME THERAPEUTICS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY COUNTRY, 2019-2029 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC NATURAL EXOSOME IN EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC BLOOD IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC BODY FLUIDS IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY THERAPY, 2020-2029 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC BIO MACROMOLECULES IN EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC ONCOLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC NEUROLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 58 SOUTH KOREA EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 SOUTH KOREA NATURAL EXOSOME IN EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 SOUTH KOREA EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 61 SOUTH KOREA BLOOD IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 62 SOUTH KOREA BODY FLUIDS IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 63 SOUTH KOREA EXOSOME THERAPEUTICS MARKET, BY THERAPY, 2020-2029 (USD THOUSAND)

TABLE 64 SOUTH KOREA EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 65 SOUTH KOREA BIO MACROMOLECULES IN EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 66 SOUTH KOREA EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 67 SOUTH KOREA ONCOLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 SOUTH KOREA NEUROLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 SOUTH KOREA EXOSOME THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD THOUSAND)

TABLE 70 SOUTH KOREA EXOSOME THERAPEUTICS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 71 AUSTRALIA EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 72 AUSTRALIA NATURAL EXOSOME IN EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 AUSTRALIA EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 74 AUSTRALIA BLOOD IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 75 AUSTRALIA BODY FLUIDS IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 76 AUSTRALIA EXOSOME THERAPEUTICS MARKET, BY THERAPY, 2020-2029 (USD THOUSAND)

TABLE 77 AUSTRALIA EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 78 AUSTRALIA BIO MACROMOLECULES IN EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 79 AUSTRALIA EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 80 AUSTRALIA ONCOLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 AUSTRALIA NEUROLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 82 AUSTRALIA EXOSOME THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD THOUSAND)

TABLE 83 AUSTRALIA EXOSOME THERAPEUTICS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 84 HONG-KONG EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 HONG-KONG NATURAL EXOSOME IN EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 HONG-KONG EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 87 HONG-KONG BLOOD IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 88 HONG-KONG BODY FLUIDS IN EXOSOME THERAPEUTICS MARKET, BY SOURCE, 2020-2029 (USD THOUSAND)

TABLE 89 HONG-KONG EXOSOME THERAPEUTICS MARKET, BY THERAPY, 2020-2029 (USD THOUSAND)

TABLE 90 HONG-KONG EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 91 HONG-KONG BIO MACROMOLECULES IN EXOSOME THERAPEUTICS MARKET, BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 92 HONG-KONG EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 93 HONG-KONG ONCOLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 94 HONG-KONG NEUROLOGY IN EXOSOME THERAPEUTICS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 95 HONG-KONG EXOSOME THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD THOUSAND)

TABLE 96 HONG-KONG EXOSOME THERAPEUTICS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 97 REST OF ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: DBMR POSITION GRID

FIGURE 8 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: END USER COVERAGE GRID

FIGURE 10 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: SEGMENTATION

FIGURE 11 THE INCREASED PREVALENCE OF AUTOIMMUNE DISORDERS, LYME DISEASES, INCIDENCE OF CANCER AND RISE IN TECHNOLOGICAL ADVANCEMENTS IS EXPECTED TO DRIVE THE ASIA PACIFIC EXOSOME THERAPEUTICS MARKET FROM 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE ASIA PACIFIC EXOSOME THERAPEUTICS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC EXOSOME THERAPEUTICS MARKET

FIGURE 14 THE PREVALENCE OF MULTIPLE SCLEROSIS IN WORLD HEALTH ORGANISATION (WHO) REGIONS IN 2020.

FIGURE 15 INCIDENCE RATE OF CANCER IN AUSTRALIA AND OTHER COUNTRIES (2020)

FIGURE 16 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY TYPE, 2021

FIGURE 17 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY TYPE, 2020-2029 (USD THOUSAND)

FIGURE 18 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 19 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 20 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY SOURCE, 2021

FIGURE 21 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY SOURCE, 2020-2029 (USD THOUSAND)

FIGURE 22 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY SOURCE, CAGR (2022-2029)

FIGURE 23 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 24 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY THERAPY, 2021

FIGURE 25 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY THERAPY, 2020-2029 (USD THOUSAND)

FIGURE 26 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY THERAPY, CAGR (2022-2029)

FIGURE 27 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY THERAPY, LIFELINE CURVE

FIGURE 28 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY TRANSPORTING CAPACITY, 2021

FIGURE 29 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY TRANSPORTING CAPACITY, 2020-2029 (USD THOUSAND)

FIGURE 30 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY TRANSPORTING CAPACITY, CAGR (2022-2029)

FIGURE 31 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY TRANSPORTING CAPACITY, LIFELINE CURVE

FIGURE 32 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY APPLICATION, 2021

FIGURE 33 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY APPLICATION, 2020-2029 (USD THOUSAND)

FIGURE 34 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 35 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 36 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 37 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY ROUTE OF ADMINISTRATION, 2020-2029 (USD THOUSAND)

FIGURE 38 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 39 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 40 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY END USER, 2021

FIGURE 41 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY END USER, 2020-2029 (USD THOUSAND)

FIGURE 42 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 43 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 44 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET: SNAPSHOT (2021)

FIGURE 45 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET: BY COUNTRY (2021)

FIGURE 46 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 47 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 ASIA-PACIFIC EXOSOME THERAPEUTICS MARKET: BY TYPE (2022-2029)

FIGURE 49 ASIA PACIFIC EXOSOME THERAPEUTICS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.