Asia Pacific Digital Therapeutics Market

Taille du marché en milliards USD

TCAC :

%

USD

4.66 Billion

USD

25.08 Billion

2024

2032

USD

4.66 Billion

USD

25.08 Billion

2024

2032

| 2025 –2032 | |

| USD 4.66 Billion | |

| USD 25.08 Billion | |

|

|

|

|

Segmentation du marché des thérapies numériques (DTx) en Asie-Pacifique, par type de produit et de service (produits matériels, solutions/logiciels et services), application (applications de traitement/soins et applications préventives), mode d'achat (organisation d'achat groupé et individuel), canal de vente (B2B et B2C) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des thérapies numériques (DTx) en Asie-Pacifique

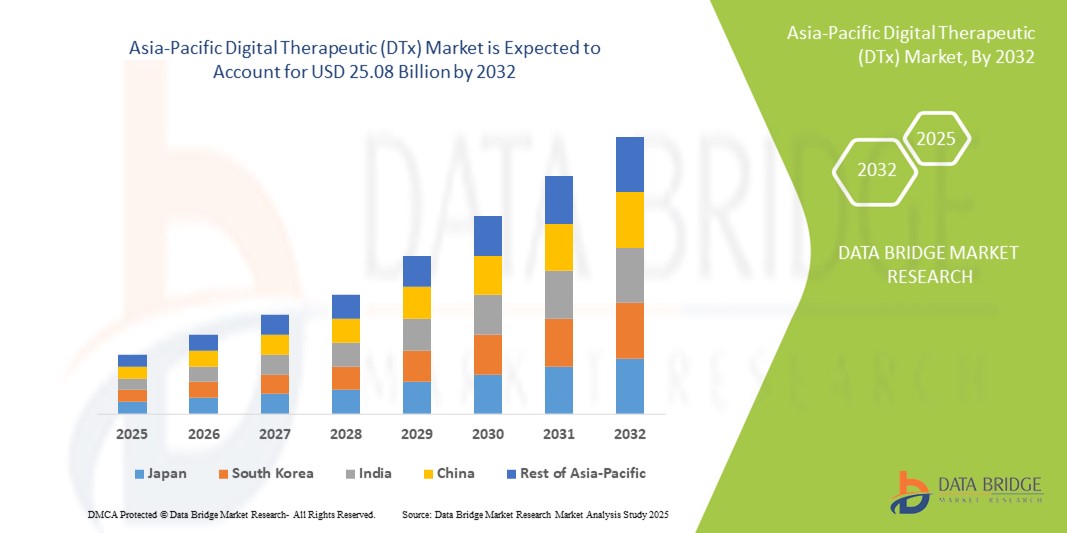

- La taille du marché des thérapies numériques (DTx) en Asie-Pacifique était évaluée à 4,66 milliards USD en 2024 et devrait atteindre 25,08 milliards USD d'ici 2032 , à un TCAC de 23,40 % au cours de la période de prévision.

- La croissance du marché est principalement tirée par la prévalence croissante des maladies chroniques, la numérisation croissante des soins de santé et l'accent croissant mis sur une prestation de soins rentable et centrée sur le patient dans toute la région.

- De plus, la pénétration croissante des smartphones, une meilleure accessibilité à Internet et des cadres réglementaires favorables renforcent l'engagement des patients et encouragent l'adoption généralisée des solutions DTx. Cette dynamique propulse le marché DTx en Asie-Pacifique, consolidant son rôle dans l'écosystème de santé numérique en pleine évolution de la région.

Analyse du marché des thérapies numériques (DTx) en Asie-Pacifique

- Les thérapies numériques (DTx), qui fournissent des interventions thérapeutiques fondées sur des preuves via des logiciels pour prévenir, gérer ou traiter des conditions médicales, deviennent une composante à part entière du paysage des soins de santé dans la région Asie-Pacifique en raison de leur évolutivité, de leurs capacités d'accès à distance et de leur capacité à soutenir la gestion des maladies chroniques et les soins de santé mentale.

- La demande croissante de DTx en Asie-Pacifique est principalement due à l'incidence croissante des maladies chroniques liées au mode de vie, à l'accent croissant mis sur les soins de santé préventifs et à la sensibilisation accrue aux solutions de santé numériques parmi les patients et les prestataires de soins de santé.

- Le Japon a dominé le marché des thérapies numériques (DTx) en Asie-Pacifique avec la plus grande part de revenus de 37,3 % en 2024, soutenu par son infrastructure de soins de santé avancée, le vieillissement de sa population et ses voies réglementaires favorables, avec des progrès notables dans l'adoption de plateformes numériques pour la santé mentale et la gestion des maladies chroniques.

- L'Inde devrait être le pays qui connaîtra la croissance la plus rapide sur le marché des thérapies numériques (DTx) en Asie-Pacifique au cours de la période de prévision, en raison de la pénétration croissante des smartphones, de l'amélioration de la connectivité Internet, du fardeau croissant des maladies chroniques et de l'accent croissant mis sur les solutions de santé numériques abordables.

- Le segment des organisations d'achat groupé a dominé le marché des thérapies numériques (DTx) en Asie-Pacifique avec une part de marché de 54,6 % en 2024, grâce à sa capacité à rationaliser les achats, à réduire les coûts et à permettre une adoption à grande échelle par le biais des établissements de santé et des réseaux d'employeurs.

Portée du rapport et segmentation du marché des thérapies numériques (DTx) en Asie-Pacifique

|

Attributs |

Informations clés sur le marché des thérapies numériques (DTx) en Asie-Pacifique |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des thérapies numériques (DTx) en Asie-Pacifique

« Plateformes thérapeutiques personnalisées et pilotées par l'IA »

- Une tendance importante et croissante sur le marché des thérapies digitales en Asie-Pacifique est l'intégration de l'intelligence artificielle (IA) et d'algorithmes de soins personnalisés pour proposer des thérapies numériques sur mesure, adaptées aux comportements, aux besoins cliniques et au niveau d'engagement des patients. Cette innovation améliore considérablement l'observance thérapeutique et les résultats des patients atteints de maladies chroniques et de santé mentale.

- Par exemple, CureApp (Japon) propose des thérapies de réadaptation basées sur l'IA pour des pathologies telles que la dépendance à la nicotine et l'hypertension, en fournissant un retour d'information personnalisé et des plans thérapeutiques. De même, JOGO Health, basé en Inde, utilise le biofeedback basé sur l'IA pour les troubles neurologiques, permettant ainsi une rééducation à distance.

- L'intégration de l'IA aux plateformes DTx permet une surveillance continue et une analyse des données en temps réel pour ajuster dynamiquement les protocoles de traitement, émettre des alertes prédictives et permettre des interventions de santé proactives. Ce niveau de personnalisation favorise un engagement accru et des bénéfices cliniques mesurables.

- De plus, l'intégration avec les dispositifs portables et les applications mobiles facilite la fluidité des flux de données et la connectivité patient-soignant. Les interfaces multilingues et culturellement adaptables favorisent l'adoption de la DTx dans divers segments démographiques de la région.

- Cette tendance vers des interventions de santé numériques intelligentes, en temps réel et spécifiques au patient transforme rapidement l'approche de la région en matière de soins chroniques, les entreprises innovant pour répondre à la demande croissante de thérapies numériques holistiques et accessibles.

Dynamique du marché des thérapies numériques (DTx) en Asie-Pacifique

Conducteur

« Fardeau croissant des maladies chroniques et expansion de l'écosystème de la santé numérique »

- La prévalence croissante des maladies chroniques telles que le diabète , l’hypertension , les troubles cardiovasculaires et de santé mentale, ainsi qu’un écosystème de santé numérique en pleine expansion, constituent un facteur clé qui accélère l’adoption des thérapies numériques en Asie-Pacifique.

- Par exemple, en août 2024, Wellthy Therapeutics s'est associé à un important réseau de santé indien pour lancer une plateforme DTx destinée à la prise en charge des maladies chroniques, élargissant ainsi l'accès aux soins aux populations isolées et mal desservies. Ces partenariats renforcent l'utilité des DTx pour des prestations de soins évolutives et abordables.

- L'utilisation généralisée des smartphones, l'expansion de la connectivité Internet et les initiatives gouvernementales de soutien telles que la vision de la Société 5.0 au Japon et la mission numérique Ayushman Bharat en Inde permettent également de mettre en place une infrastructure pour le déploiement du DTx.

- Alors que les prestataires de soins de santé intègrent de plus en plus les outils numériques dans les soins aux patients, les plateformes DTx deviennent essentielles pour soutenir la gestion des maladies à long terme, améliorer l'accès et réduire les coûts globaux des soins.

Retenue/Défi

« Préoccupations liées à la confidentialité des données et incertitude réglementaire »

- Les préoccupations en matière de confidentialité et les incohérences réglementaires demeurent un défi important qui entrave l'adoption plus large des solutions DTx en Asie-Pacifique, en particulier dans les marchés émergents où les lois sur la protection des données sont encore en évolution.

- Par exemple, les différences de niveau d' application de la cybersécurité et de pratiques de traitement des données selon les pays suscitent des inquiétudes quant à l'accès non autorisé aux données, en particulier pour les plateformes collectant des informations médicales sensibles sur les patients. Ces inquiétudes peuvent saper la confiance des utilisateurs et freiner l'adoption de la DTx.

- Pour y remédier, les entreprises doivent garantir le respect des lois sur la confidentialité spécifiques à chaque pays, telles que l'APPI du Japon et la loi DPDP de l'Inde, mettre en œuvre un cryptage fort et maintenir des pratiques de données transparentes.

- De plus, l'absence de cadres réglementaires normalisés pour les DTx dans de nombreux pays d'Asie-Pacifique rend les procédures de validation clinique, d'approbation des produits et de remboursement floues. Cette incertitude réglementaire crée des barrières à l'entrée pour les startups locales et les entreprises internationales en quête de croissance.

- La création d’un écosystème réglementaire cohérent, transparent et centré sur le patient, parallèlement à des campagnes de sensibilisation du public et à des initiatives d’alphabétisation numérique, sera essentielle pour surmonter ces obstacles et libérer tout le potentiel du DTx dans la région.

Portée du marché des thérapies numériques (DTx) en Asie-Pacifique

Le marché est segmenté en fonction du type de produit et de service, de l’application, du mode d’achat et du canal de vente.

- Par type de produit et de service

En fonction du type de produits et de services, le marché des thérapies numériques (DTx) en Asie-Pacifique est segmenté en produits matériels, solutions/logiciels et services. Le segment des solutions/logiciels a dominé le marché avec la plus grande part de chiffre d'affaires (61,3 %) en 2024, grâce à son évolutivité, sa rentabilité et sa capacité à proposer des thérapies personnalisées et interactives pour diverses pathologies chroniques et comportementales. Ces solutions logicielles sont fréquemment intégrées aux smartphones, aux objets connectés et aux plateformes cloud, permettant ainsi l'engagement des patients et le suivi de leur progression en temps réel.

Le segment des produits matériels devrait connaître la croissance la plus rapide, soit 19,4 % entre 2025 et 2032, grâce à l'intégration croissante des biocapteurs portables et des dispositifs de surveillance intelligents dans les écosystèmes thérapeutiques. Ces outils permettent la collecte et le retour d'information continus des données des patients, améliorant ainsi la précision et la personnalisation des thérapies numériques dans toute la région.

- Par application

En termes d'applications, le marché des thérapies numériques (DTx) en Asie-Pacifique est segmenté en applications thérapeutiques et de soins et en applications préventives. Ce segment a dominé le marché avec une part de chiffre d'affaires de 57,4 % en 2024, principalement en raison de la demande croissante d'outils numériques pour la prise en charge des maladies chroniques telles que le diabète, l'hypertension et les troubles mentaux. Ces solutions contribuent à améliorer l'observance thérapeutique et favorisent la surveillance à distance pour de meilleurs résultats cliniques.

Le segment des applications préventives devrait connaître le TCAC le plus rapide de 20,8 % entre 2025 et 2032, grâce à une sensibilisation croissante aux soins de santé préventifs, à l'utilisation croissante de programmes de modification du mode de vie et au rôle croissant des plateformes numériques pour encourager les stratégies d'intervention précoce pour les populations à risque.

- En déverrouillant le mécanisme

En fonction du mode d'achat, le marché des thérapies numériques (DTx) en Asie-Pacifique est segmenté en organisations d'achat groupé (GPO) et en organisations individuelles. Le segment des organisations d'achat groupé a dominé le marché avec une part de marché de 54,6 % en 2024, soutenu par les établissements de santé et les employeurs qui achètent des solutions DTx en gros afin de réduire les coûts et d'élargir l'accès aux patients et aux travailleurs. Ces modèles garantissent une mise en œuvre plus large et réduisent les coûts d'acquisition de patients pour les développeurs de DTx.

Le segment individuel devrait connaître le TCAC le plus rapide, soit 21,2 %, entre 2025 et 2032, grâce à la sensibilisation croissante des consommateurs, à l'autogestion des maladies chroniques et à l'adoption croissante d'applications de santé mobiles achetées directement via les magasins d'applications ou les sites Web des entreprises.

- Par canal de vente

En fonction des canaux de vente, le marché des thérapies numériques (DTx) en Asie-Pacifique est segmenté en B2B et B2C. Le segment B2B a dominé le marché avec une part de chiffre d'affaires de 63,6 % en 2024, grâce à des collaborations stratégiques entre les fournisseurs de thérapies numériques et les hôpitaux, les organismes payeurs et les entreprises. Ces partenariats incluent souvent l'intégration aux plateformes de soins et aux modèles d'assurance existants, permettant un déploiement structuré et à grande échelle.

Le segment B2C devrait connaître le taux de croissance le plus rapide, soit 22,5 %, entre 2025 et 2032, grâce à l’augmentation des connaissances en matière de santé numérique, à la pénétration croissante d’Internet et des smartphones et à la préférence croissante pour les outils de santé numériques autoguidés parmi les consommateurs plus jeunes et férus de technologie dans les régions urbaines et semi-urbaines.

Analyse régionale du marché des thérapies numériques (DTx) en Asie-Pacifique

- Le Japon a dominé le marché des thérapies numériques (DTx) en Asie-Pacifique avec la plus grande part de revenus de 37,3 % en 2024, soutenu par son infrastructure de soins de santé avancée, le vieillissement de sa population et ses voies réglementaires favorables, avec des progrès notables dans l'adoption de plateformes numériques pour la santé mentale et la gestion des maladies chroniques.

- Les consommateurs et les prestataires de soins de santé au Japon apprécient grandement les fonctionnalités de validation clinique, de personnalisation et de soins à distance offertes par les plateformes DTx, ce qui conduit à une intégration généralisée dans le système de santé du pays.

- Cette forte position sur le marché est en outre soutenue par des cadres réglementaires favorables, une grande culture numérique et des collaborations actives entre les développeurs DTx et les institutions de santé publique, positionnant le Japon comme un leader dans la conduite de la transformation numérique au sein du paysage thérapeutique de la région.

Aperçu du marché des thérapies numériques (DTx) en Asie-Pacifique

Le marché des thérapies numériques (DTx) en Asie-Pacifique devrait connaître une croissance annuelle composée (TCAC) record de 23,2 % entre 2025 et 2032, portée par la prévalence croissante des maladies chroniques, l'essor de l'utilisation des smartphones et le développement des infrastructures de santé numérique. Les initiatives gouvernementales de numérisation des soins de santé et la forte demande de solutions de soins à distance accélèrent l'adoption des DTx dans des pays comme l'Inde, le Japon, la Chine et la Corée du Sud. Par ailleurs, l'intérêt croissant pour les soins préventifs et les solutions numériques personnalisées renforce l'engagement des patients et améliore les résultats thérapeutiques dans toute la région.

Aperçu du marché japonais des thérapies numériques (DTx)

Le marché japonais des thérapies numériques (DTx) a représenté la plus grande part de chiffre d'affaires en Asie-Pacifique en 2024, grâce à l'infrastructure de santé avancée du pays, au vieillissement de sa population et à un environnement réglementaire favorable. Le Japon s'est imposé comme un leader dans l'adoption de solutions DTx cliniquement validées pour la prise en charge de l'hypertension, du diabète et de la santé mentale. L'intégration des plateformes DTx aux dossiers médicaux électroniques et aux systèmes nationaux d'assurance maladie favorise leur utilisation. De plus, les partenariats entre hôpitaux, assureurs et développeurs de DTx élargissent l'accessibilité et accélèrent leur adoption en zones urbaines et rurales.

Aperçu du marché indien des thérapies numériques (DTx)

Le marché indien des thérapies numériques (DTx) devrait connaître son plus fort taux de croissance annuel composé (TCAC) au cours de la période de prévision, porté par l'urbanisation rapide, l'amélioration de la maîtrise du numérique et la charge croissante des maladies non transmissibles. L'importante population indienne, la pénétration croissante des smartphones et l'engagement du gouvernement en faveur de la santé numérique, notamment grâce à des programmes comme la Mission numérique Ayushman Bharat, sont des facteurs clés de la croissance du DTx. Les startups locales développent activement des plateformes multilingues rentables pour la gestion du diabète, des maladies cardiovasculaires et de la santé comportementale, favorisant ainsi l'adoption du DTx dans les métropoles et les régions de niveau 2 et 3.

Aperçu du marché chinois des thérapies numériques (DTx)

Le marché chinois des thérapies numériques (DTx) connaît une forte croissance, soutenue par des politiques gouvernementales encourageant l'innovation en santé numérique et par une population férue de technologie. Les plateformes DTx sont de plus en plus intégrées aux programmes de télémédecine et de prise en charge des maladies chroniques. Avec une part importante de patients atteints de maladies chroniques, la Chine adopte les DTx basées sur l'IA pour un traitement personnalisé et un suivi en temps réel. Les collaborations entre entreprises technologiques et prestataires de soins de santé favorisent l'évolutivité des plateformes, notamment dans les parcours de soins du diabète et des troubles mentaux.

Aperçu du marché sud-coréen des thérapies numériques (DTx)

Le marché sud-coréen des thérapies numériques (DTx) progresse rapidement, soutenu par une infrastructure TIC robuste, une forte culture numérique et des efforts réglementaires visant à accélérer leur commercialisation. Le ministère de la Sécurité alimentaire et pharmaceutique (MFDS) a pris des mesures proactives pour élaborer un cadre réglementaire pour les thérapies logicielles, permettant ainsi une approbation plus rapide des produits. L'engagement fort des consommateurs sud-coréens envers les technologies de la santé et les applications mobiles de bien-être stimule la demande de DTx, notamment dans des domaines tels que les troubles du sommeil, la santé mentale et les maladies métaboliques.

Part de marché des thérapies numériques (DTx) en Asie-Pacifique

L'industrie de la thérapie numérique (DTx) en Asie-Pacifique est principalement dirigée par des entreprises bien établies, notamment :

- CureApp, Inc. (Japon)

- Wellthy Therapeutics Pvt. Ltd. (Inde)

- JOGOHEALTH (Inde)

- Samsung Electronics Co., Ltd. (Corée du Sud)

- Tunstall Australasia Pty Ltd (Australie)

- Biofourmis, Inc. (Singapour)

- Health2Sync Inc. (Taïwan)

- M3, Inc. (Japon)

- Smartfuture Pte. Ltd. (Singapour)

- AinOne Inc. (Corée du Sud)

- Neurowyzr Pte. (Singapour)

- Biorithm Pte. (Singapour)

- Ubie, Inc. (Japon)

- RoundGlass LLC (Inde)

- Olive Union Inc. (Japon)

- Onsurity Technologies Pvt. Ltd. (Inde)

- Zoi Health Co., Ltd. (Corée du Sud)

- MediHub Co., Ltd. (Corée du Sud)

- CareVoice Digital Health Co. Ltd. (Chine)

Quels sont les développements récents sur le marché de la thérapie numérique (DTx) en Asie-Pacifique ?

- En mai 2024, CureApp, Inc. (Japon), pionnier des thérapies numériques, a lancé CureApp SC, une plateforme innovante de thérapies digitales pour le sevrage tabagique, en collaboration avec le ministère japonais de la Santé. Cette application, approuvée cliniquement, intègre des conseils comportementaux et des données issues de l'IA, améliorant ainsi les résultats pour les patients grâce à un retour d'information en temps réel et un accompagnement personnalisé. Ce lancement renforce le leadership du Japon en matière d'acceptation réglementaire et de déploiement clinique des solutions de thérapies digitales.

- En mars 2024, Wellthy Therapeutics (Inde) s'est associé à un important prestataire de soins de santé pour déployer sa plateforme de gestion des maladies chroniques dans plusieurs villes indiennes. Cette plateforme DTx multilingue, optimisée par l'IA, cible le diabète et les maladies cardiovasculaires, permettant des plans de soins personnalisés et un suivi à distance. Cette initiative stratégique élargit l'accès à la santé numérique aux régions de niveaux 2 et 3, démontrant ainsi l'évolutivité des solutions DTx localisées.

- En février 2024, JOGO Health (Inde) a lancé en Corée du Sud sa thérapie numérique basée sur la neuroplasticité, destinée au traitement des accidents vasculaires cérébraux (AVC) et de l'incontinence grâce à des dispositifs portables de biofeedback. Cette expansion sur un nouveau marché témoigne de l'intérêt croissant des pays pour les thérapies non invasives basées sur des logiciels et illustre l'influence de l'Inde en matière d'innovation dans le paysage mondial des thérapies numériques.

- En janvier 2024, le Samsung Medical Center (Corée du Sud) a lancé un projet pilote intégrant les thérapies numériques pour les troubles du sommeil et la thérapie cognitivo-comportementale (TCC) grâce à une plateforme d'applications hospitalières. Ce projet s'inscrit dans une initiative plus vaste visant à intégrer la TCx aux soins traditionnels, avec un suivi et une supervision clinique en temps réel, favorisant ainsi les modèles hybrides de santé numérique dans le pays.

- En décembre 2023, Tunstall Healthcare (Australie) a collaboré avec les autorités locales de santé publique pour mettre en œuvre un programme d'intervention en santé numérique destiné aux patients âgés atteints de maladies chroniques. Ce programme associe des dispositifs portables et un logiciel DTx pour suivre à distance l'évolution des patients, prévenir les réadmissions à l'hôpital et favoriser l'autonomie. Cette initiative témoigne de l'engagement croissant de l'Australie en faveur des solutions numériques pour le vieillissement et des modèles de soins axés sur la valeur.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT AND SERVICE TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 ASIA-PACIFIC DIGITAL THERAPEUTICS (DTX) MARKET: REGULATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN PREVALENCE OF CHRONIC DISEASES

5.1.2 INCREASE IN AWARENESS BY GOVERNMENT AGENCIES

5.1.3 TECHNOLOGICAL ADVANCEMENT IN HEALTHCARE

5.1.4 INCREASED NUMBER OF PEOPLE USING SMARTPHONES

5.1.5 IMPROVED QUALITY OF LIFE

5.2 RESTRAINTS

5.2.1 PATIENT INFORMATION PRIVACY POLICIES

5.2.2 DIGITAL PAYMENT ASSOCIATED WITH DIGITAL THERAPEUTICS

5.2.3 UNDER DEVELOPING COUNTIRES LACKING SMARTPHONES AND INTERNET FACILITIES

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND OF DIGITAL THERAPEUTICS

5.3.2 COLLABORATION BETWEEN COMPANIES TO PROVIDE BETTER PRODUCTS/SERVICES

5.3.3 PARTNERSHIP BETWEEN COMPANIES

5.3.4 EXPANSION AND LAUNCH OF PRODUCTS

5.3.5 EVENTS AND EXHIBITION

5.3.6 PHYSICIAN ADOPTION

5.4 CHALLENGES

5.4.1 CLINICAL VALIDATION

5.4.2 REGULATORY APPROVAL

5.4.3 PAYER REIMBURSEMENT

6 IMPACT OF COVID-19 ON ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET

6.1 IMPACT ON DEMAND

6.2 IMPACT ON SUPPLY

6.3 KEY INITIATIVES TAKEN BY PLAYERS DURING COVID-19

6.4 CONCLUSION

7 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE

7.1 OVERVIEW

7.2 SOLUTION/SOFTWARE

7.3 HARDWARE PRODUCTS

7.4 SERVICE

8 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 TREATMENT/CARE-RELATED APPLIACTIONS

8.2.1 DIABETES

8.2.2 CENTRAL NERVOUS SYSTEM DISORDERS

8.2.3 SMOKING CESSATION

8.2.4 CHRONIC RESPIRATORY DISEASES

8.2.5 MUSCULOSKELETAL DISORDER

8.2.6 CARDIOVASCULAR DISEASES

8.2.7 MEDICATION ADHERENCE

8.2.8 GASTROINTESTINAL DISORDERS

8.2.9 REHABILITATION AND PATIENT CARE

8.2.10 SUBSTANCE USE DISORDER AND ADDICTION MANAGEMENT

8.2.11 OTHER TREATMENT/ CARE RELATED APPLICATIONS

8.3 PREVENTIVE APPLICATIONS

8.3.1 PREDIABETES

8.3.2 OBESITY

8.3.3 NUTRITION

8.3.4 LIFESTYLE MANAGEMENT

8.3.5 OTHER PREVENTIVE APPLICATIONS

9 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE

9.1 OVERVIEW

9.2 GROUP PURCHASE ORGANIZATION

9.2.1 SOLUTIONS/ SOFTWARE

9.2.2 HARDWARE PRODUCT

9.2.3 SERVICE

9.3 INDIVIDUAL

9.3.1 SOLUTIONS/ SOFTWARE

9.3.2 HARDWARE PRODUCT

9.3.3 SERVICE

10 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 B2B

10.2.1 PAYERS

10.2.2 EMPLOYERS

10.2.3 PHARMA COMPANIES

10.2.4 PROVIDERS

10.2.5 OTHER BUYERS

10.3 B2C

10.3.1 CAREGIVERS

10.3.2 PATIENTS

11 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY GEOGRAPHY

11.1 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY COUNTRY

11.1.1 JAPAN

11.1.2 CHINA

11.1.3 AUSTRALIA

11.1.4 SOUTH KOREA

11.1.5 INDIA

11.1.6 SINGAPORE

11.1.7 THAILAND

11.1.8 MALAYSIA

11.1.9 INDONESIA

11.1.10 PHILIPPINES

11.1.11 REST OF ASIA-PACIFIC

12 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT

14 COMPANY PROFILE

14.1 FITBIT,INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 LIVONGO

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 RESMED

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 OMADA HEALTH, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 GINGER

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 SAMSUNG

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 MINDSTRONG HEALTH

14.7.1 COMPANY SNAPSHOT

14.7.2 SERVICE PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 2MORROW INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 AKILI INTERACTIVE LABS, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 ATENTIV

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 AYOGO HEALTH INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 BETTER THERAPEUTICS, INC

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 CANARY HEALTH

14.13.1 COMPANY SNAPSHOT

14.13.2 SOLUTION PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 CLICK THERAPEUTICS, INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 COGNIFIT

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 COGNOA

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 GAIA AG

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 HAPPIFY, INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 KAIA HEALTH

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 MANGO HEALTH

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 NATURAL CYCLES USA CORP

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 NOOM, INC.

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENT

14.23 PEAR THERAPEUTICS, INC.

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

14.24 SMARTPATIENT GMBH

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENT

14.25 VOLUNTIS

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 PRODUCT PORTFOLIO

14.25.4 RECENT DEVELOPMENTS

14.26 WELLDOC, INC.

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT DEVELOPMENTS

14.27 WELLTHY THERAPEUTICS PVT LTD

14.27.1 COMPANY SNAPSHOT

14.27.2 PRODUCT PORTFOLIO

14.27.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

LIST OF TABLES

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2020-2028 (USD MILLION)

TABLE 3 ASIA-PACIFIC SOLUTIONS/SOFTWARE IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION))

TABLE 4 ASIA-PACIFIC HARDWARE PRODUCTS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 5 ASIA-PACIFIC SERVICE IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 6 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

TABLE 7 ASIA-PACIFIC TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 ASIA-PACIFIC TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 9 ASIA-PACIFIC PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 ASIA-PACIFIC PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 11 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2020-2028 (USD MILLION)

TABLE 12 ASIA-PACIFIC GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 ASIA-PACIFIC GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 14 ASIA-PACIFIC INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 ASIA-PACIFIC INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 16 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2020-2028 (USD MILLION)

TABLE 17 ASIA-PACIFIC B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 ASIA-PACIFIC B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 19 ASIA-PACIFIC B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 ASIA-PACIFIC B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 21 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 22 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 23 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 24 ASIA-PACIFIC TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 25 ASIA-PACIFIC PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 26 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 27 ASIA-PACIFIC GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 28 ASIA-PACIFIC INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 29 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 30 ASIA-PACIFIC B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 31 ASIA-PACIFIC B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 32 JAPAN DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 33 JAPAN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 34 JAPAN TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 35 JAPAN PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 36 JAPAN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 37 JAPAN GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 38 JAPAN INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 39 JAPAN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 40 JAPAN B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 41 JAPAN B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 42 CHINA DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 43 CHINA DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 44 CHINA TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 45 CHINA PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 46 CHINA DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 47 CHINA GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 48 CHINA INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 49 CHINA DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 50 CHINA B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 51 CHINA B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 52 AUSTRALIA DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 53 AUSTRALIA DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 54 AUSTRALIA TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 55 AUSTRALIA PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 56 AUSTRALIA DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 57 AUSTRALIA GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 58 AUSTRALIA INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 59 AUSTRALIA DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 60 AUSTRALIA B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 61 AUSTRALIA B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 62 SOUTH KOREA DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 63 SOUTH KOREA DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 64 SOUTH KOREA TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 65 SOUTH KOREA PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 66 SOUTH KOREA DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 67 SOUTH KOREA GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 68 SOUTH KOREA INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 69 SOUTH KOREA DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 70 SOUTH KOREA B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 71 SOUTH KOREA B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 72 INDIA DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 73 INDIA DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 74 INDIA TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 75 INDIA PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 76 INDIA DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 77 INDIA GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 78 INDIA INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 79 INDIA DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 80 INDIA B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 81 INDIA B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 82 SINGAPORE DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 83 SINGAPORE DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 84 SINGAPORE TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 85 SINGAPORE PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 86 SINGAPORE DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 87 SINGAPORE GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 88 SINGAPORE INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 89 SINGAPORE DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 90 SINGAPORE B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 91 SINGAPORE B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 92 THAILAND DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 93 THAILAND DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 94 THAILAND TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 95 THAILAND PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 96 THAILAND DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 97 THAILAND GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 98 THAILAND INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 99 THAILAND DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 100 THAILAND B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 101 THAILAND B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 102 MALAYSIA DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 103 MALAYSIA DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 104 MALAYSIA TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 105 MALAYSIA PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 106 MALAYSIA DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 107 MALAYSIA GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 108 MALAYSIA INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 109 MALAYSIA DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 110 MALAYSIA B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 111 MALAYSIA B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 112 INDONESIA DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 113 INDONESIA DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 114 INDONESIA TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 115 INDONESIA PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 116 INDONESIA DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 117 INDONESIA GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 118 INDONESIA INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 119 INDONESIA DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 120 INDONESIA B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 121 INDONESIA B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 122 PHILIPPINES DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

TABLE 123 PHILIPPINES DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 124 PHILIPPINES TREATMENT/CARE-RELATED APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 125 PHILIPPINES PREVENTIVE APPLICATIONS IN DIGITAL THERAPEUTIC (DTX) MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 126 PHILIPPINES DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 127 PHILIPPINES GROUP PURCHASE ORGANIZATION IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 128 PHILIPPINES INDIVIDUAL IN DIGITAL THERAPEUTIC (DTX) MARKET, BY PURCHASE MODE, 2019-2028 (USD MILLION)

TABLE 129 PHILIPPINES DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 130 PHILIPPINES B2B IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 131 PHILIPPINES B2C IN DIGITAL THERAPEUTIC (DTX) MARKET, BY SALES CHANNEL, 2019-2028 (USD MILLION)

TABLE 132 REST OF ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET, BY PRODUCT AND SERVICE TYPE, 2019-2028 (USD MILLION)

Liste des figures

LIST OF FIGURES

FIGURE 1 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET : DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBA DIGITAL THERAPEUTIC (DTX) MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 INCREASING DEMAND OF DIGITAL THERAPEUTICS WORLDWIDE DUE TO PREVALENCE OF CHRONIC DISEASES IS EXPECTED TO DRIVE THE MARKET GROWTH IN THE FORECAST PERIOD OF 2021 TO 2028.

FIGURE 13 SOLUTIONS/SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET IN 2021 & 2028

FIGURE 14 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR DIGITAL THERAPEUTICS (DTX) MANUFACTURERS IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET

FIGURE 16 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PRODUCT AND SERVICE TYPE, 2020

FIGURE 17 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PRODUCT AND SERVICE TYPE, 2020-2028 (USD MILLION)

FIGURE 18 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PRODUCT AND SERVICE TYPE, CAGR (2021-2028)

FIGURE 19 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PRODUCT AND SERVICE TYPE, LIFELINE CURVE

FIGURE 20 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY APPLICATION, 2020

FIGURE 21 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY APPLICATION, 2020-2028 (USD MILLION)

FIGURE 22 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY APPLICATION, CAGR (2021-2028)

FIGURE 23 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 24 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PURCHASE MODE, 2020

FIGURE 25 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PURCHASE MODE, 2020-2028 (USD MILLION)

FIGURE 26 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PURCHASE MODE, CAGR (2021-2028)

FIGURE 27 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PURCHASE MODE, LIFELINE CURVE

FIGURE 28 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY SALES CHANNEL, 2020

FIGURE 29 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY SALES CHANNEL, 2020-2028 (USD MILLION)

FIGURE 30 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY SALES CHANNEL, CAGR (2021-2028)

FIGURE 31 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY SALES CHANNEL, LIFELINE CURVE

FIGURE 32 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: SNAPSHOT (2020)

FIGURE 33 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY COUNTRY (2020)

FIGURE 34 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY COUNTRY (2021 & 2028)

FIGURE 35 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY COUNTRY (2020 & 2028)

FIGURE 36 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: BY PRODUCT AND SERVICE (2021-2028)

FIGURE 37 ASIA-PACIFIC DIGITAL THERAPEUTIC (DTX) MARKET: COMPANY SHARE 2020 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.