Asia Pacific Departmental Pacs Market

Taille du marché en milliards USD

TCAC :

%

USD

3.39 Billion

USD

5.52 Billion

2024

2032

USD

3.39 Billion

USD

5.52 Billion

2024

2032

| 2025 –2032 | |

| USD 3.39 Billion | |

| USD 5.52 Billion | |

|

|

|

|

Segmentation du marché des PACS départementaux en Asie-Pacifique, par type de produit (PACS traditionnels et spécialisés), composant (logiciels, services et matériel), application (IRM, tomodensitométrie, radiographie numérique, échographie, imagerie nucléaire, arceaux de sécurité, etc.), niveau d'intégration (PACS intégrés et autonomes), utilisateur final (hôpitaux, chaînes/centres de radiologie, centres de chirurgie ambulatoire, etc.), canal de distribution (appels d'offres directs, administrateurs tiers, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des PACS départementaux de la région APAC

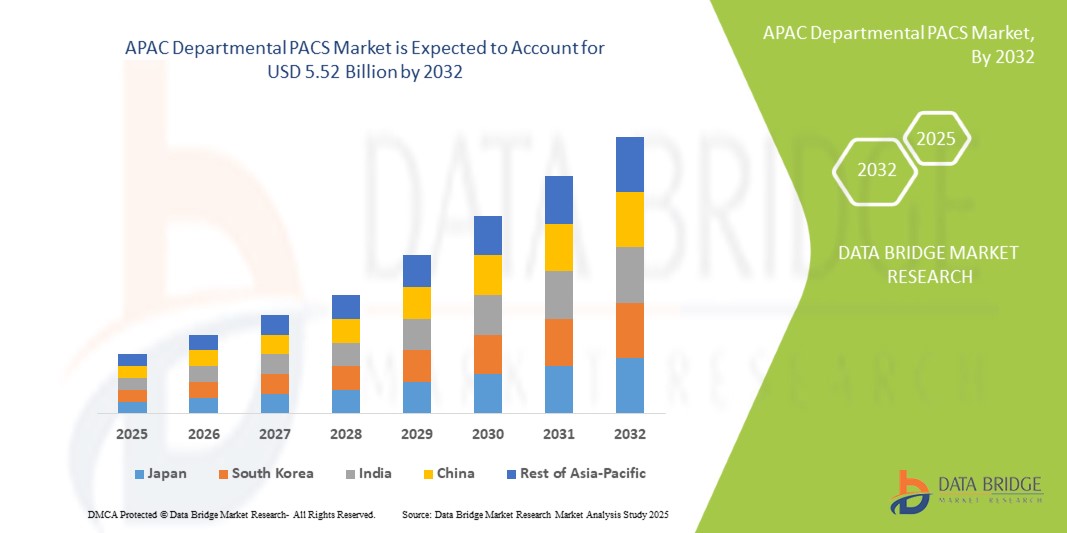

- La taille du marché des PACS départementaux de l'APAC a été évaluée à3,39 milliards USD en 2024et devrait atteindre5,52 milliards de dollars d'ici 2032, à unTCAC de 6,30 %pendant la période de prévision

- Cette croissance est tirée par des facteurs tels que la numérisation croissante des soins de santé, la prévalence croissante des maladies chroniques, les progrès technologiques, les initiatives gouvernementales, l'amélioration des infrastructures et l'adoption dans les économies émergentes.

Analyse du marché des PACS départementaux de la région APAC

- Le marché des PACS départementaux connaît une expansion constante, portée par l'adoption croissante de technologies de santé avancées dans les établissements médicaux. Les hôpitaux et les centres de diagnostic intègrent de plus en plus ces systèmes pour optimiser les flux de travail et la prise en charge des patients.

- La demande de solutions PACS départementales est également influencée par le besoin croissant de systèmes performants de stockage et de récupération de données en imagerie médicale. Ces systèmes offrent un accès centralisé aux images des patients, améliorant ainsi la précision du diagnostic et réduisant les coûts opérationnels.

- La Chine devrait dominer le marché des PACS départementaux de la région APAC en raison de son infrastructure de soins de santé avancée, de son adoption élevée des technologies d'imagerie numérique et de la forte présence des principaux fournisseurs de PACS.

- L'Inde devrait être la région connaissant la croissance la plus rapide sur le marché des PACS départementaux de la région APAC au cours de la période de prévision en raison de la numérisation rapide des soins de santé, de l'augmentation des investissements dans l'imagerie médicale et de la demande croissante de solutions de diagnostic efficaces.

- Le segment des PACS spécialisés devrait dominer le marché avec une part de marché de 28 % en 2025 en raison de ses fonctionnalités adaptées à des spécialités médicales spécifiques, améliorant la précision du diagnostic et l'efficacité du flux de travail.

Portée du rapport et segmentation du marché des PACS départementaux de la région APAC

|

Attributs |

Informations clés sur le marché des PACS départementaux de l'APAC |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research incluent également une analyse approfondie des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire. |

Tendances du marché des PACS départementaux de la région Asie-Pacifique

« Intégration croissante desIntelligence artificielledans les systèmes d'imagerie »

- L'IA révolutionne les industries, améliorant l'efficacité, la précision et la fonctionnalité des systèmes d'imagerie

- Par exemple, DeepMind de Google a développé un système d’IA qui surpasse les experts humains dans le diagnostic des maladies oculaires à partir d’analyses rétiniennes.

- Dans le domaine de la santé, les algorithmes d'IA analysent les images médicales (radiographies, IRM, scanners, échographies) avec une grande précision

- Par exemple, le logiciel d'IA d'Aidoc aide les radiologues en identifiant rapidement les cas critiques dans les scanners, réduisant ainsi le temps de réponse aux urgences.

- L'IA permet de détecter plus tôt et avec plus de précision des pathologies telles que le cancer, les maladies cardiovasculaires et les troubles neurologiques

- Par exemple, les modèles d’apprentissage profond de PathAI aident les pathologistes à diagnostiquer les tissus cancéreux avec une plus grande précision, réduisant ainsi les erreurs de diagnostic.

- L'IA peut identifier des modèles dans les images que les experts humains pourraient manquer, ce qui conduit à des diagnostics plus rapides et plus fiables.

- Par exemple, le système d’IA développé par Enlitic a montré qu’il pouvait repérer des fractures subtiles dans les rayons X qui sont souvent négligées par les radiologues.

- Dans le domaine de la sécurité, les systèmes d'imagerie basés sur l'IA sont utilisés pour la reconnaissance faciale et la surveillance afin de surveiller les activités et d'identifier les individus.

Dynamique du marché des PACS départementaux de l'APAC

Conducteur

« Demande croissante de détection précoce des maladies »

- La demande croissante de détection précoce des maladies stimule le marché des PACS départementaux de la région APAC

- Les prestataires de soins de santé se concentrent sur les soins préventifs, qui nécessitent des technologies d'imagerie avancées pour l'identification précoce des maladies

- Les systèmes PACS permettent un stockage, une récupération et un partage efficaces desimages médicales, conduisant à des diagnostics rapides et précis

- La détection précoce de maladies telles que le cancer, les maladies cardiovasculaires et les troubles neurologiques permet d'obtenir de meilleurs résultats pour les patients

- L'intégration de l'IA et de l'apprentissage automatique avec le PACS améliore la précision du diagnostic et l'efficacité du flux de travail, stimulant ainsi la croissance du marché

Par exemple,

- La solution PACS basée sur l'IA d'Aidoc aide les radiologues à identifier plus rapidement les cas critiques dans les scanners CT, améliorant ainsi la vitesse de diagnostic dans les situations d'urgence.

- L'IA DeepMind de Google a montré sa capacité à surpasser les experts humains dans le diagnostic des maladies oculaires à partir d'analyses rétiniennes, illustrant la puissance de l'intégration de l'IA dans les PACS pour la détection précoce des maladies.

Opportunité

« Demande croissante de solutions PACS basées sur le cloud »

- La demande croissante de solutions PACS basées sur le cloud représente une opportunité significative sur le marché PACS départemental de la région APAC.

- Les organisations de soins de santé cherchent de plus en plus à réduire les coûts d’infrastructure et à améliorer l’évolutivité

- Les PACS basés sur le cloud offrent une flexibilité, un investissement initial en capital inférieur et une maintenance simplifiée par rapport aux systèmes traditionnels sur site

- Ces systèmes permettent aux prestataires de soins de santé de stocker et d'accéder aux données d'imagerie médicale à distance, ce qui est particulièrement bénéfique dans les régions dotées d'infrastructures physiques limitées ou pour les établissements de santé opérant sur plusieurs sites.

- L'évolutivité du cloud permet de gérer le volume croissant de données d'imagerie médicale sans nécessiter de mises à niveau matérielles constantes.

Par exemple,

- Ambra Health propose des solutions PACS basées sur le cloud qui permettent aux prestataires de soins de santé d'accéder et de partager des données d'imagerie à distance, réduisant ainsi les coûts d'infrastructure et améliorant la flexibilité opérationnelle.

- Everlight Radiology utilise un PACS basé sur le cloud pour fournir des rapports radiologiques en temps réel, permettant l'accès aux avis d'experts dans les zones mal desservies, améliorant ainsi les soins aux patients et l'efficacité du diagnostic.

Retenue/Défi

« Coûts élevés associés à la mise en œuvre »

- Les coûts élevés associés à la mise en œuvre de systèmes de gestion d'imagerie médicale, tels que les PACS, constituent un frein important pour le marché des PACS départementaux de la région APAC.

- Les coûts comprennent non seulement l’investissement initial en matériel et en logiciels, mais également les dépenses courantes liées à la maintenance du système, aux mises à niveau et à la formation du personnel.

- Les établissements de santé de petite taille et ceux des régions en développement sont souvent confrontés à des contraintes budgétaires, ce qui rend difficile l'allocation de fonds pour des solutions d'imagerie avancées.

- Le fardeau financier que représentent l’intégration du PACS aux systèmes d’information hospitaliers existants, la garantie de la sécurité des données et le respect des réglementations en matière de santé augmente encore les coûts.

- Ces défis économiques peuvent dissuader les prestataires de soins de santé d’adopter la technologie PACS malgré ses avantages en termes d’amélioration de la précision du diagnostic et de l’efficacité opérationnelle.

Par exemple,

- Dans de nombreux hôpitaux ruraux en Inde, les coûts élevés de mise en œuvre des systèmes PACS ont retardé l’adoption de ces technologies, limitant l’accès aux outils de diagnostic avancés.

- Une étude de l'Organisation mondiale de la santé (OMS) a souligné que les petites cliniques d'Asie du Sud-Est ont du mal à faire face aux coûts de mise en place et de maintenance des systèmes PACS, ce qui entrave leur capacité à fournir des services d'imagerie de haute qualité.

Portée du marché des PACS départementaux de l'APAC

Le marché est segmenté en fonction du type de produit, du composant, de l’application, du niveau d’intégration, de l’utilisateur final et du canal de distribution.

|

Segmentation |

Sous-segmentation |

|

Par type de produit |

|

|

Par composant |

|

|

Par application |

|

|

Par niveau d'intégration |

|

|

Par utilisateur final |

|

|

Par canal de distribution |

|

En 2025, les solutions PACS spécialisées devraient dominer le marché avec une part de marché plus importante dans le segment des types de produits.

Le segment des PACS spécialisés devrait dominer le marché des PACS départementaux de la région APAC avec la plus grande part de 28 % en 2025. Grâce à ses solutions sur mesure adaptées à des spécialités médicales spécifiques telles que l'oncologie, la cardiologie, l'orthopédie et l'ophtalmologie, ces systèmes sont conçus pour traiter des données d'imagerie complexes, améliorant ainsi la précision du diagnostic et l'efficacité des flux de travail.

L'IRM devrait représenter la plus grande part du marché technologique au cours de la période de prévision.

En 2025, le segment de l'IRM devrait dominer le marché avec une part de marché de 30 à 35 %, grâce à son rôle essentiel dans le diagnostic non invasif et à sa capacité à fournir une imagerie haute résolution des tissus mous. L'IRM est largement utilisée pour diagnostiquer les troubles neurologiques, les troubles musculo-squelettiques, les cancers et d'autres pathologies complexes.

Analyse régionale du marché des PACS départementaux de la région APAC

« La Chine détient la plus grande part du marché des PACS départementaux de la région Asie-Pacifique »

- La Chine devrait détenir la plus grande part de marché en raison de sa solide infrastructure de soins de santé et de l'adoption généralisée de technologies d'imagerie avancées.

- Les investissements substantiels du pays dans la numérisation des soins de santé et l'expansion du réseau hospitalier contribuent à sa position de leader sur le marché des PACS.

- Avec la croissance de l’industrie des dispositifs médicaux, la Chine est bien placée pour maintenir sa domination dans le secteur des PACS

- Les initiatives gouvernementales soutenant les outils de santé numériques renforcent davantage l'intégration des systèmes PACS dans les établissements de santé en Chine

« L'Inde devrait enregistrer le TCAC le plus élevé sur le marché des PACS départementaux de la région Asie-Pacifique »

- L'Inde devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé du marché APAC des PACS, grâce à l'expansion de son secteur de la santé.

- La demande croissante de solutions d'imagerie avancées dans les secteurs des dispositifs médicaux et des hôpitaux en plein essor en Inde alimente la croissance rapide du marché.

- Le secteur de la santé en Inde est un moteur clé, représentant une part importante du secteur médical global, stimulant l'adoption du PACS

- Le nombre croissant d'hôpitaux et de centres de diagnostic en Inde souligne la nécessité de systèmes d'imagerie efficaces, accélérant la croissance du PACS dans la région.

Part de marché des PACS départementaux de la région APAC

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence mondiale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les principaux leaders du marché opérant sur le marché sont :

- FUJIFILM Corporation(Japon)

- Mach 7 Technologies Limited (Australie)

- Reyence (Japon)

- SinoVision (Chine)

- TeleRAD Reporting Services Private Limited (Inde)

- Canon Medical Systems Corporation(Japon)

- Konica Minolta, Inc.(Japon)

- INFINITT Santé(Corée du Sud)

- Samsung Medison(Corée du Sud)

Derniers développements sur le marché des PACS départementaux en Asie-Pacifique

- En janvier 2024, FUJIFILM Diosynth Biotechnologies (États-Unis) et SHL Medical (Suisse) ont conclu un partenariat stratégique afin de répondre à la demande croissante du marché en médicaments auto-injectables. Cette collaboration renforcera la capacité de production de FUJIFILM au Danemark, atteignant jusqu'à 30 millions d'unités par an d'ici début 2025. En intégrant la plateforme d'auto-injection Molly de SHL, le partenariat vise à rationaliser les processus de production et à réduire les risques liés à la chaîne d'approvisionnement. Ce développement bénéficiera aux entreprises pharmaceutiques et biotechnologiques en accélérant la mise sur le marché et en améliorant l'accès des patients aux médicaments auto-injectables.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.