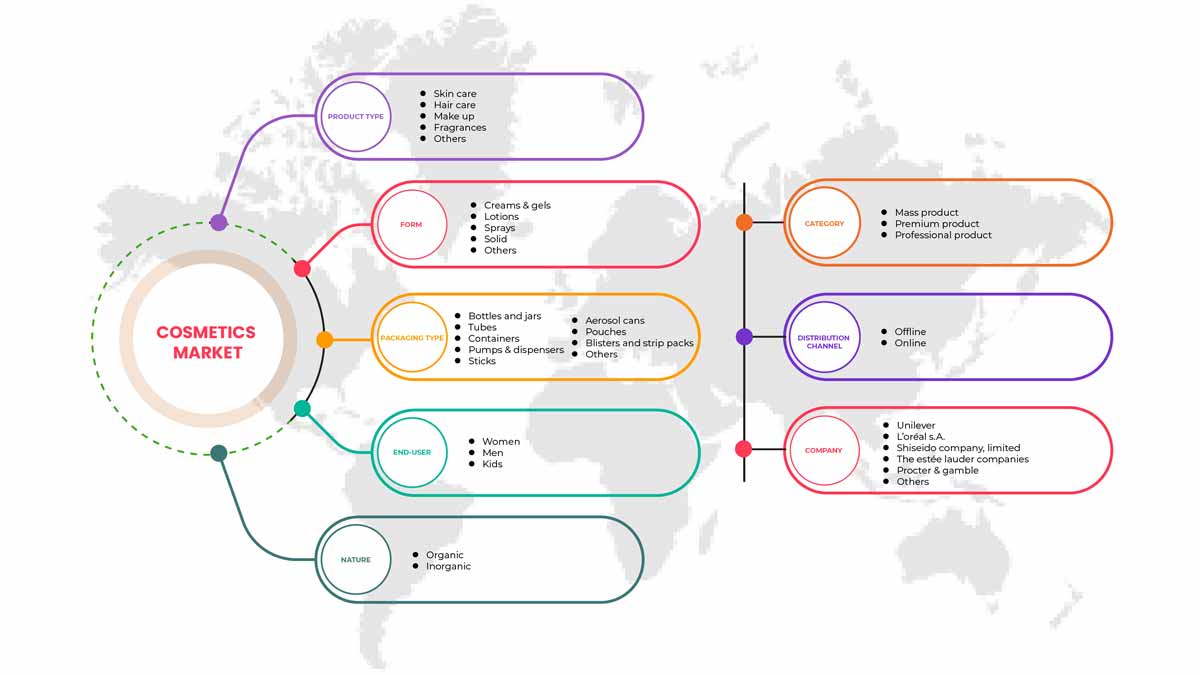

Asia-Pacific Cosmetics Market, By Product Type (Skin Care, Hair Care, Make Up, Fragrances, Others), Nature (Inorganic, Organic), Form (Creams & Gels, Lotions, Sprays, Solid and Others), Category (Mass Product, Premium Product, Professional Product), Packaging Type (Bottles and Jars, Tubes, Containers, Pumps & Dispensers, Sticks, Aerosol Cans, Pouches, Blisters and Strip Packs and Others), Distribution Channel (Offline and Online), End-User (Women, Men and Kids) - Industry Trends and Forecast to 2029.

Market Analysis and Insights: Asia-Pacific Cosmetics Market

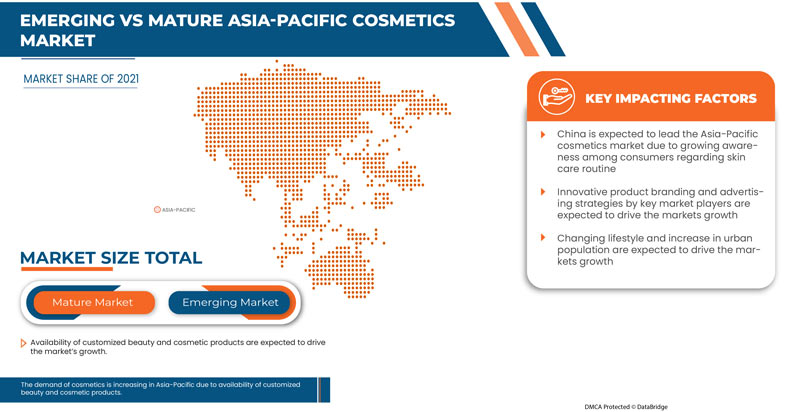

The cosmetic industry has a very important role in every developed and developing economy. Accelerated urbanization and increasing urban population with changing lifestyle demands are important drivers for the increasing demand for cosmetic skin care beauty products in the market. The growing global economy has increased disposable income with the global population in urban areas. This has increased the spending capacity of the urban population.

A busy lifestyle in urban areas is a major factor driving the growth of the cosmetic skin care products market across the region. People often lead hectic and fast-paced lives, so they face much stress. Hence, people want face creams to offer a fresh appearance and hide the signs of exhaustion on their faces. Millennials form a major part of the urban population and consumer spending. They are at the forefront of the beauty athleisure trend. It constitutes a major significant factor in spending on beauty products and cosmetics. Increasing social media trends and the need to look good are expected to boost market demand.

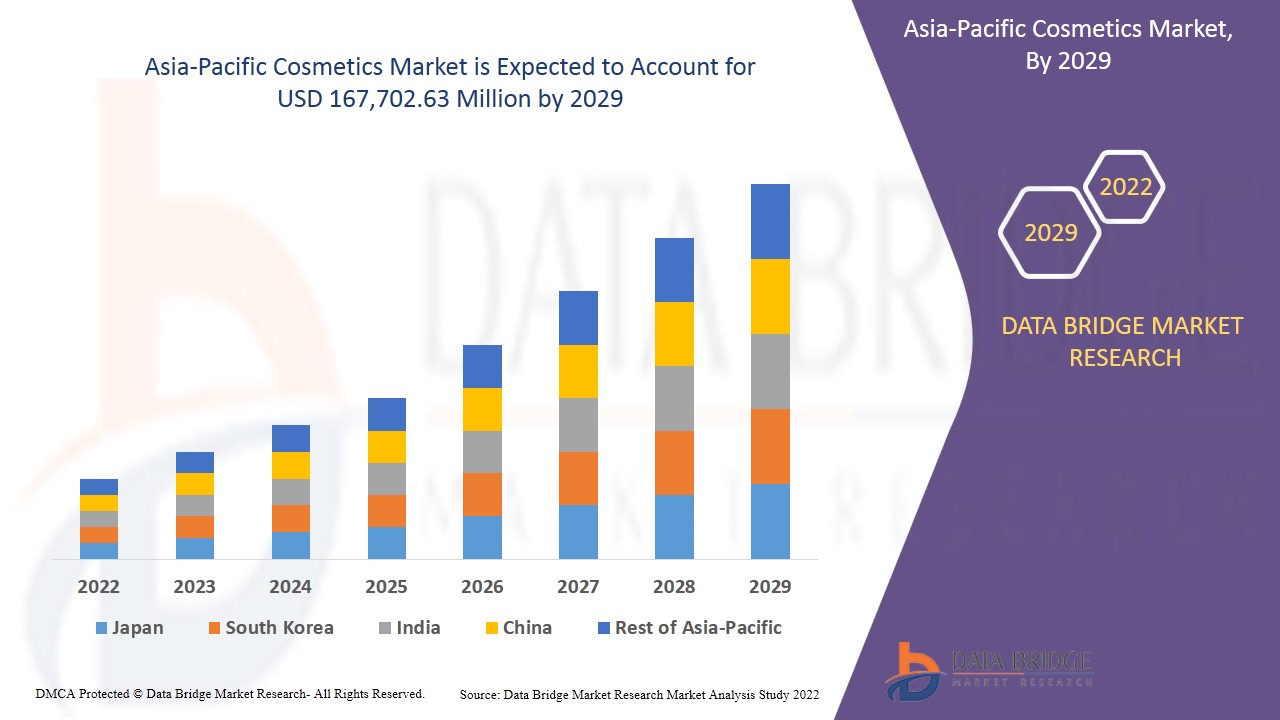

Asia-Pacific cosmetics market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.5% in the forecast period of 2022 to 2029 and is expected to reach USD 167,702.63 million by 2029. The major factor driving the growth of the cosmetics market is the increasing demand for self-care products to combat stress & anxiety and the tendency of consumers to increase their engagement in self-care routines as a means for feeling good and looking better by using natural and organic ingredients.

Asia-Pacific cosmetics market report provides details of market share, new developments and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type de produit (soins de la peau, soins capillaires, maquillage, parfums, autres), nature (inorganique, biologique), forme (crèmes et gels, lotions, sprays, solides et autres), catégorie (produit de masse, produit haut de gamme, produit professionnel), type d'emballage (bouteilles et pots, tubes, contenants, pompes et distributeurs, bâtons, bombes aérosols , sachets, blisters et bandes et autres), canal de distribution (hors ligne et en ligne), utilisateur final (femmes, hommes et enfants) |

|

Régions couvertes |

Chine, Japon, Australie et Nouvelle-Zélande, Inde, Philippines, Indonésie, Singapour, Corée du Sud, Malaisie, Thaïlande et le reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Unilever, L'Oréal SA, Shiseido Company, Limited, The Estée Lauder Companies, Procter & Gamble, Kao Corporation, Colgate-Palmolive Company, Oriflame Cosmetics Global SA, Beiersdorf AG, Johnson & Johnson Services, Inc., Amorepacific, Coty Inc., AVON PRODUCTS, Revlon, Inc. et The Body Shop International Limited, entre autres |

Définition du marché

Les cosmétiques sont en grande partie conçus pour être utilisés ou appliqués afin d'améliorer la beauté et l'apparence physique d'une personne. Ces produits cosmétiques sont principalement fabriqués à partir de sources artificielles. Le but des produits cosmétiques est principalement destiné au nettoyage externe, aux parfums , au changement d'apparence, à la correction des odeurs corporelles, à la protection de la peau et au conditionnement, entre autres. Des anti-transpirants, parfums, maquillage et shampooings , aux savons, crèmes solaires et dentifrices, les cosmétiques et les produits de soins personnels jouent un rôle essentiel à toutes les étapes de la vie d'un consommateur.

Les cosmétiques sont fabriqués à partir de mélanges de composés chimiques. Ces composés sont soit dérivés de sources naturelles, soit de nature artificielle. Les cosmétiques peuvent être utilisés à des fins personnelles pour les acheteurs au détail ou à des fins professionnelles dans l'industrie de la beauté et du divertissement. Dans l'industrie du divertissement, les cosmétiques sont largement utilisés pour mettre en valeur les traits naturels d'une personne, ajouter de la couleur au visage d'une personne et peuvent être utilisés pour changer complètement l'apparence du visage pour ressembler à une personne, une créature ou un objet différent.

Dynamique du marché des cosmétiques en Asie-Pacifique

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

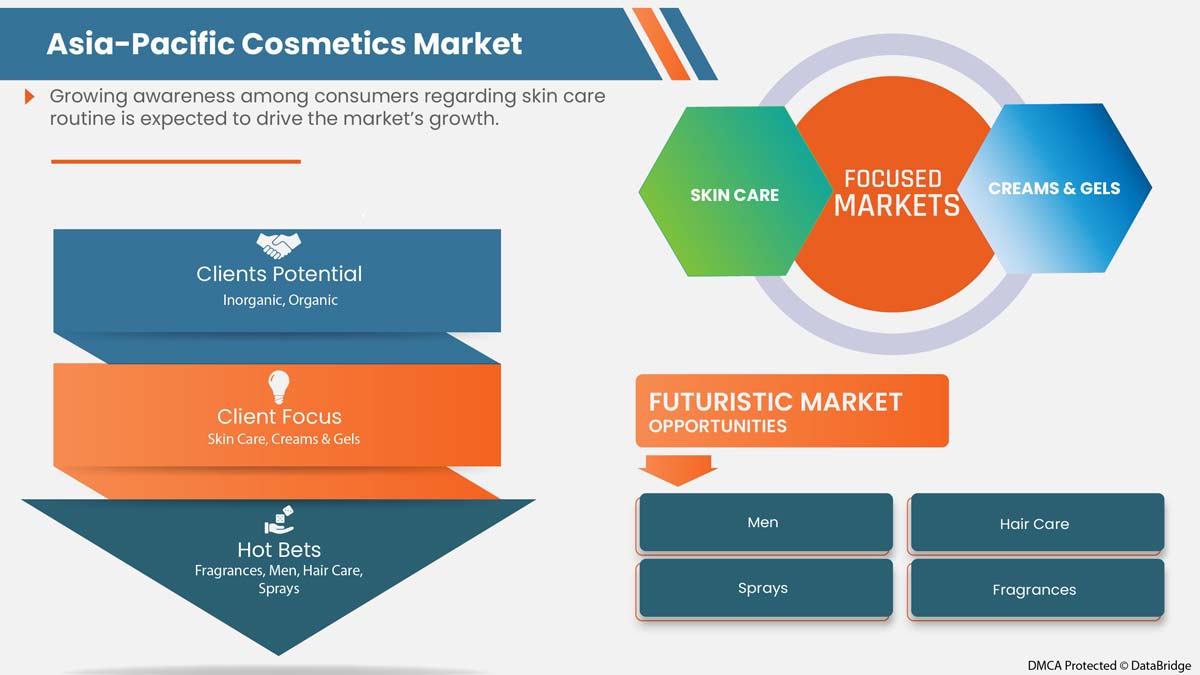

- Sensibilisation croissante des consommateurs à la routine de soins de la peau

Ces dernières années, le marché des cosmétiques a bénéficié d'un regain d'intérêt pour les routines d'hygiène et de soins personnels. La demande croissante de produits de soins personnels pour lutter contre le stress et l'anxiété et la tendance des consommateurs à s'engager davantage dans des routines de soins personnels pour se sentir bien et avoir une meilleure apparence ont été les principaux moteurs du marché des cosmétiques. L'intérêt pour les ingrédients naturels et biologiques a encore accru la notoriété et la demande de produits de soins de la peau tels que les masques pour le visage, les gommages corporels , les toniques et les sérums parmi les utilisateurs, car il met l'accent sur le changement de leurs soins de la peau existants.

- Stratégies de marque et de publicité de produits innovantes par les principaux acteurs du marché

L'avènement des technologies numériques a influencé le comportement d'achat des consommateurs sur le marché des cosmétiques à travers le monde. Les principales marques de cosmétiques du marché exploitent les technologies numériques pour permettre aux consommateurs de découvrir les marques d'une toute nouvelle manière, car le consommateur moderne s'attend à une conversation à double sens pour se connecter davantage avec la marque. Les avancées technologiques, les stratégies de marque et de publicité innovantes ont permis aux amateurs de beauté d'accéder facilement aux tendances, aux looks, au contenu et aux expériences.

Les grandes entreprises et marques de beauté s'efforcent en permanence d'innover dans leurs stratégies de marque et de publicité pour atteindre un public plus large et accroître l'engagement des clients. De nombreuses marques utilisent les plateformes de médias sociaux pour améliorer leur portée, ce qui a été la principale stratégie de ces dernières années. Cela a permis aux marques d'augmenter leur base d'utilisateurs et leur popularité sur le marché des cosmétiques, ce qui devrait stimuler la croissance du marché.

- Disponibilité de produits de beauté et cosmétiques personnalisés

Les entreprises et les fabricants de produits de beauté introduisent en permanence la personnalisation et la numérisation dans les produits cosmétiques, en raison de la demande croissante de soins de la peau personnalisés. Les consommateurs sont de plus en plus conscients des produits de beauté et de soins de la peau disponibles sur le marché. Les avancées technologiques du secteur éloignent les consommateurs des produits cosmétiques conçus uniquement pour le type de peau générique. Les consommateurs sont de plus en plus attentifs au choix du produit en fonction de leur type de peau. En conséquence, les entreprises de beauté se concentrent sur la satisfaction de ces consommateurs avec des produits idéaux pour leur utilisation, leur permettant d'accroître l'engagement des consommateurs sur le marché.

Opportunités

-

Focus sur la recherche et le développement dans la production de cosmétiques durables

La durabilité devient une priorité clé pour de nombreuses marques dans l'industrie de la beauté en constante évolution. Les entreprises s'efforcent constamment de mettre en œuvre des initiatives plus écologiques sans compromettre la qualité et la portée du produit pour attirer une population croissante de consommateurs soucieux de l'environnement. De nombreux acteurs majeurs déploient des efforts et fixent des objectifs pour atteindre la neutralité carbone. Les entreprises participent activement à la réduction de l'impact environnemental de leurs processus d'emballage tout au long du cycle de vie. L'industrie de la beauté connaît de précieuses collaborations et partenariats pour explorer des matériaux alternatifs et des concepts plus responsables dans la conception des emballages.

-

Demande croissante de produits de beauté végétaliens

Ces dernières années, l'adoption d'un mode de vie alternatif végétalien au sein de la population mondiale a augmenté. Les gens adoptent ce mode de vie pour améliorer leur santé générale tout en bénéficiant à leur corps à l'intérieur comme à l'extérieur. Ces développements influencent également l'industrie cosmétique. Les consommateurs essaient activement de rechercher et d'adopter des produits cosmétiques végétaliens à mesure que la sensibilisation à ce sujet augmente. Cela peut être attribué à la facilité d'accès aux informations en ligne sur les avantages et l'impact environnemental.

Les consommateurs sont de plus en plus sensibilisés aux produits d’origine animale tels que les cheveux, la fourrure et autres présents dans les marques de cosmétiques. Ils trouvent la cruauté envers les animaux contraire à l’éthique et sensibilisent les gens à cet égard. Cela a créé une tendance sur le marché mondial des cosmétiques à adopter des produits de soins personnels à base de plantes. Les grandes entreprises de fabrication de cosmétiques du monde entier se rendent compte de l’importance de fabriquer des produits qui utilisent des ingrédients d’origine minérale ou végétale plutôt que de fabriquer des produits infusés d’ingrédients extraits d’animaux.

Contraintes/Défis

- Tendances croissantes en matière de rappel de produits

Le retrait des produits cosmétiques et de beauté d'un marché est une méthode rapide et efficace pour retirer les produits qui enfreignent les normes et les réglementations, en particulier ceux qui présentent un danger pour la santé. Le retrait d'un tel produit peut être initié pour plusieurs raisons, telles que de nombreuses plaintes de consommateurs, la violation des normes fixées par les organismes de réglementation concernant l'utilisation des ingrédients, les rappels volontaires des entreprises et autres.

Par exemple,

- En novembre 2021, Procter & Gamble a rappelé plus de 15 déodorants et aérosols différents fabriqués sous ses marques Old Spice et Secret. Le rappel a été lancé après que l'entreprise a découvert que l'échantillonnage de ses produits aérosols détectait du benzène, un cancérigène connu, dans une gamme de déodorants. De tels rappels ont un impact sur les poches de l'entreprise et peuvent avoir un impact sur ses revenus. Ils ont également un impact sur la valeur de la marque de l'entreprise et affectent donc sa réputation sur le marché, ce qui peut freiner sa croissance sur le marché

- Sensibilisation accrue aux effets secondaires causés par l'utilisation de produits chimiques et d'ingrédients synthétiques

Il existe de nombreux exemples dans le secteur de la beauté où les utilisateurs ont affirmé ne pas avoir obtenu le résultat escompté par la marque. Une qualité et un grade inférieurs aux normes et des compositions nocives peuvent entraîner des allergies, une décoloration, une altération de la texture ou des dommages permanents à la peau ou aux cheveux. L'utilisation accrue et la production non réglementée ont entraîné une forte augmentation des effets secondaires subis par les consommateurs.

Il est important que le consommateur inspecte et étudie minutieusement le produit cosmétique avant de l'utiliser, car il peut contenir des ingrédients qui ne conviennent pas à la peau ou auxquels il est allergique. Les produits chimiques du produit peuvent être absorbés par la peau et provoquer des irritations et d'autres effets secondaires. La sensibilisation croissante à ces cas peut freiner la croissance du marché.

Impact post-COVID-19 sur le marché des cosmétiques en Asie-Pacifique

L'industrie cosmétique a été directement impactée par les changements radicaux de comportement des consommateurs provoqués par la pandémie de coronavirus (COVID-19). La pandémie de COVID-19 a accru les préoccupations des clients en matière de durabilité et de santé. L'industrie a réagi positivement à la crise, les marques ayant réorienté leur production vers la production de désinfectants pour les mains et d'agents nettoyants et offrant des services de beauté gratuits aux travailleurs de première ligne.

Développements récents

- En août 2021, Unilever a annoncé l'acquisition de Paula's Choice, la marque de soins de la peau axée sur le numérique. La marque est célèbre pour son innovation de pointe, sa science accessible sans jargon, ses ingrédients hautement performants et ses produits sans cruauté. Avec cette acquisition, l'entreprise a intégré le groupe dans son portefeuille de produits et a ainsi accru la visibilité de la marque auprès d'une base de consommateurs plus large. Cela répond aux priorités stratégiques de l'entreprise visant à élargir son portefeuille de produits de soins de la peau haut de gamme sur le marché des cosmétiques

- En mars 2021, Coty Inc. a annoncé un partenariat avec LanzaTech, un producteur d'ingrédients verts et durables de nouvelle génération. En conséquence, les entreprises investiront dans l'introduction d'éthanol durable fabriqué à partir d'émissions de carbone capturées dans leurs produits de parfumerie. Cette initiative a soutenu les objectifs de l'entreprise de développer des produits propres et verts sur le marché

Portée du marché des cosmétiques en Asie-Pacifique

Le marché des cosmétiques de la région Asie-Pacifique est segmenté en fonction du type de produit, de la nature, de la forme, de la catégorie, du type d'emballage, du canal de distribution et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de produit

- Soins de la peau

- Soins capillaires

- Parfums

- Se maquiller

- Autres

Sur la base du type, le marché des cosmétiques de la région Asie-Pacifique est segmenté en soins de la peau, soins capillaires, parfums, maquillage et autres.

Nature

- Organique

- Inorganique

Sur la base de la nature, le marché des cosmétiques de la région Asie-Pacifique est segmenté en produits biologiques et inorganiques.

Formulaire

- Crèmes et gels

- Lotions

- Sprays

- Solide

- Autres

Sur la base de la forme, le marché des cosmétiques de l'Asie-Pacifique est segmenté en crèmes et gels, lotions, sprays, solides et autres.

Catégorie

- Produit de masse

- Produit Premium

- Produit professionnel

Sur la base des applications, le marché des cosmétiques Asie-Pacifique est segmenté en produits de masse, produits haut de gamme et produits professionnels.

Type d'emballage

- Bouteilles et bocaux

- Tubes

- Conteneurs

- Pochettes

- Bâtons

- Pompes et distributeurs

- Plaquettes et plaquettes

- Bombes aérosols

- Autres

Sur la base des applications, le marché des cosmétiques de la région Asie-Pacifique est segmenté en bouteilles et pots, tubes, conteneurs, sachets, bâtonnets, pompes et distributeurs, blisters et bandelettes, bombes aérosols et autres.

Canal de distribution

- Hors ligne

- En ligne

Sur la base du canal de distribution, le marché des cosmétiques Asie-Pacifique est segmenté en hors ligne et en ligne.

Utilisateur final

- Femmes

- Hommes

- Enfants

Sur la base de l’utilisateur final, le marché des cosmétiques Asie-Pacifique est classé en femmes, hommes et enfants.

Analyse/perspectives régionales du marché des cosmétiques en Asie-Pacifique

Le marché des cosmétiques de la région Asie-Pacifique est segmenté en fonction du type de produit, de la nature, de la forme, de la catégorie, du type d'emballage, du canal de distribution et de l'utilisateur final.

Les pays du marché des cosmétiques de la région Asie-Pacifique sont le Japon, la Chine, la Corée du Sud, l’Inde, Singapour, la Thaïlande, l’Indonésie, la Malaisie, les Philippines, l’Australie et le reste de la région Asie-Pacifique.

- En 2022, la Chine devrait dominer le marché des cosmétiques de la région Asie-Pacifique en termes de part de marché et de revenus du marché en raison de la forte présence d'acteurs clés du marché dans la région.

La section par pays du rapport fournit également des facteurs individuels d'impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques européennes et les défis rencontrés en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des cosmétiques en Asie-Pacifique

Le marché concurrentiel des cosmétiques en Asie-Pacifique fournit des détails sur les concurrents. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que les entreprises qui se concentrent sur le marché des cosmétiques en Asie-Pacifique.

Certains des principaux acteurs opérant sur le marché des cosmétiques en Asie-Pacifique sont Unilever, L'Oréal SA, Shiseido Company, Limited, The Estée Lauder Companies, Procter & Gamble, Kao Corporation, Colgate-Palmolive Company, Oriflame Cosmetics Global SA, Beiersdorf AG, Johnson & Johnson Services, Inc., Amorepacific, Coty Inc., AVON PRODUCTS, Revlon, Inc. et The Body Shop International Limited, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent des grilles de positionnement des fournisseurs, une analyse de la chronologie du marché, un aperçu et un guide du marché, une grille de positionnement de l'entreprise, une analyse des parts de marché de l'entreprise, des normes de mesure, une analyse de la part de marché Asie-Pacifique par rapport à la région et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC COSMETICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 BMR TRIPOD DATA VALIDATION MODEL

2.6 FORM LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING AWARENESS AMONG CONSUMERS REGARDING SKINCARE ROUTINE

5.1.2 INNOVATIVE PRODUCT BRANDING AND ADVERTISING STRATEGIES BY KEY MARKET PLAYERS

5.1.3 AVAILABILITY OF CUSTOMIZED BEAUTY & COSMETIC PRODUCTS

5.1.4 CHANGING LIFESTYLES AND INCREASE IN URBAN POPULATION

5.2 RESTRAINTS

5.2.1 RISE IN AWARENESS REGARDING SIDE EFFECTS CAUSED DUE TO USE OF SYNTHETIC CHEMICALS AND INGREDIENTS

5.2.2 INCREASING TRENDS IN PRODUCT RECALLS

5.3 OPPORTUNITIES

5.3.1 FOCUS ON RESEARCH AND DEVELOPMENTS IN THE PRODUCTION OF SUSTAINABLE COSMETICS

5.3.2 RISING DEMAND FOR VEGAN BEAUTY PRODUCTS

5.4 CHALLENGE

5.4.1 NECESSITY OF TRANSPARENCY FOR INGREDIENTS USED IN COSMETIC PRODUCTS

6 ASIA-PACIFIC COSMETICS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 SKIN CARE

6.2.1 MASKS

6.2.2 MOISTURIZERS

6.2.3 BODY LOTIONS

6.2.4 TONER

6.2.5 CLEANSING CREAM

6.2.6 FACIAL REMOVER

6.2.7 SUNSCREENS

6.2.8 BODY WASH

6.2.9 NIGHT SERUM

6.2.10 DAY CREAM

6.2.11 HAND & FOOT CREAM

6.2.12 OTHERS

6.3 HAIR CARE

6.3.1 SHAMPOO

6.3.2 CONDITIONERS

6.3.3 HAIR COLOR

6.3.3.1 HAIR DYES AND COLORS

6.3.3.2 HAIR BLEACHES

6.3.3.3 HAIR TINTS

6.3.3.4 OTHERS

6.3.3.4.1 NORMAL

6.3.3.4.2 OILY

6.3.3.4.3 DRY

6.4 SERUMS

6.5 OIL

6.6 SPRAYS

6.7 OTHERS

6.8 MAKE UP

6.8.1 LIPSTICK

6.8.2 EYE SHADOWS

6.8.3 MASCARA

6.9 FOUNDATION

6.9.1 BRONZER

6.9.2 BLUSH

6.9.3 OTHERS

6.1 FRAGRANCES

6.11 OTHERS

7 ASIA-PACIFIC COSMETICS MARKET, BY NATURE

7.1 OVERVIEW

7.2 INORGANIC

7.3 ORGANIC

8 ASIA-PACIFIC COSMETICS MARKET, BY FORM

8.1 OVERVIEW

8.2 CREAMS & GELS

8.3 LOTIONS

8.4 SPRAYS

8.5 SOLID

8.6 OTHERS

9 ASIA-PACIFIC COSMETICS MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 MASS PRODUCT

9.3 PREMIUM PRODUCT

9.4 PROFESSIONAL PRODUCT

10 ASIA-PACIFIC COSMETICS MARKET, BY PACKAGING TYPE

10.1 OVERVIEW

10.2 BOTTLES AND JARS

10.3 TUBES

10.4 CONTAINERS

10.5 PUMPS & DISPENSERS

10.6 STICKS

10.7 AEROSOL CANS

10.8 POUCHES

10.9 BLISTERS AND STRIP PACKS

10.1 OTHERS

11 ASIA-PACIFIC COSMETICS MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 OFFLINE

11.2.1 SPECIALTY STORES

11.2.2 SUPERMARKETS/HYPERMARKETS

11.2.3 PHARMACIES

11.2.4 SALONS

11.2.5 OTHERS

11.3 ONLINE

12 ASIA-PACIFIC COSMETICS MARKET, BY END USER

12.1 OVERVIEW

12.2 WOMEN

12.2.1 SKIN CARE

12.2.2 HAIR CARE

12.2.3 MAKE UP

12.2.4 FRAGRANCES

12.2.5 OTHERS

12.3 MEN

12.3.1 SKIN CARE

12.3.2 HAIR CARE

12.3.3 FRAGRANCES

12.3.4 MAKE UP

12.3.5 OTHERS

12.4 KIDS

12.4.1 SKIN CARE

12.4.2 HAIR CARE

12.4.3 FRAGRANCES

12.4.4 MAKE UP

12.4.5 OTHERS

13 ASIA-PACIFIC COSMETICS MARKET, BY COUNTRY

13.1 CHINA

13.2 JAPAN

13.3 INDIA

13.4 SOUTH KOREA

13.5 AUSTRALIA & NEW ZEALAND

13.6 INDONESIA

13.7 PHILIPPINES

13.8 THAILAND

13.9 MALAYSIA

13.1 SINGAPORE

13.11 REST OF ASIA-PACIFIC

14 ASIA-PACIFIC COSMETICS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.2 COLLABORATION

14.3 EXPANSION

14.4 PRODUCT LAUNCH

14.5 ACQUISITION

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 UNILEVER

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT UPDATES

16.2 L’ORÉAL S.A.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT UPDATES

16.3 SHISEIDO COMPANY, LIMITED

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT UPDATES

16.4 THE ESTÉE LAUDER COMPANIES

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 PROCTER & GAMBLE

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT UPDATES

16.6 AMOREPACIFIC

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 AVON PRODUCTS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT UPDATES

16.8 BEIERSDORF GROUP

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT UPDATES

16.9 COLGATE-PALMOLIVE COMPANY

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATES

16.1 COTY INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT UPDATES

16.11 JOHNSON & JOHNSON SERVICES, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT UPDATES

16.12 KAO CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT UPDATES

16.13 ORIFLAME COSMETICS GLOBAL SA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT UPDATES

16.14 REVLON, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 THE BODY SHOP INTERNATIONAL LIMITED

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT UPDATES

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF BEAUTY OR MAKE-UP PREPARATIONS AND PREPARATIONS FOR THE CARE OF THE SKIN; HS CODE – 3304 (USD THOUSAND)

TABLE 2 EXPORT DATA OF BEAUTY OR MAKE-UP PREPARATIONS AND PREPARATIONS FOR THE CARE OF THE SKIN; HS CODE – 3304 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA-PACIFIC SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA-PACIFIC HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA-PACIFIC HAIR COLOR COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA-PACIFIC HAIR COLOR COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA-PACIFIC MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 ASIA-PACIFIC COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 10 ASIA-PACIFIC COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 11 ASIA-PACIFIC COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 12 ASIA-PACIFIC COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA-PACIFIC COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 14 ASIA-PACIFIC OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 ASIA-PACIFIC COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 16 ASIA-PACIFIC WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 17 ASIA-PACIFIC MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 ASIA-PACIFIC KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 19 ASIA-PACIFIC COSMETICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 20 CHINA COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 21 CHINA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 CHINA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 CHINA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 CHINA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 25 CHINA MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 CHINA COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 27 CHINA COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 28 CHINA COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 29 CHINA COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 30 CHINA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 CHINA OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 CHINA COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 33 CHINA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 CHINA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 35 CHINA KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 JAPAN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 37 JAPAN SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 JAPAN HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 JAPAN HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 JAPAN HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 41 JAPAN MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 JAPAN COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 43 JAPAN COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 44 JAPAN COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 45 JAPAN COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 46 JAPAN COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 47 JAPAN OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 JAPAN COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 49 JAPAN WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 JAPAN MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 JAPAN KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 INDIA COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 INDIA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 INDIA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 INDIA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 INDIA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 57 INDIA MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 INDIA COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 59 INDIA COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 60 INDIA COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 61 INDIA COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 62 INDIA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 63 INDIA OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 INDIA COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 65 INDIA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 INDIA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 INDIA KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 SOUTH KOREA COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH KOREA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 SOUTH KOREA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH KOREA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH KOREA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH KOREA MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 81 SOUTH KOREA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 SOUTH KOREA KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 AUSTRALIA & NEW ZEALAND COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 AUSTRALIA & NEW ZEALAND SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 AUSTRALIA & NEW ZEALAND HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 AUSTRALIA & NEW ZEALAND HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 AUSTRALIA & NEW ZEALAND HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 89 AUSTRALIA & NEW ZEALAND MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA & NEW ZEALAND COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA & NEW ZEALAND COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA & NEW ZEALAND COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 93 AUSTRALIA & NEW ZEALAND COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA & NEW ZEALAND COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA & NEW ZEALAND OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA & NEW ZEALAND COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA & NEW ZEALAND WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA & NEW ZEALAND MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 99 AUSTRALIA & NEW ZEALAND KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 INDONESIA COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 INDONESIA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 INDONESIA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 INDONESIA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 INDONESIA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 105 INDONESIA MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 INDONESIA COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 107 INDONESIA COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 108 INDONESIA COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 109 INDONESIA COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 110 INDONESIA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 111 INDONESIA OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 INDONESIA COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 113 INDONESIA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 INDONESIA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 INDONESIA KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 PHILIPPINES COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 117 PHILIPPINES SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 PHILIPPINES HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 PHILIPPINES HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 PHILIPPINES HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 121 PHILIPPINES MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 PHILIPPINES COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 123 PHILIPPINES COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 124 PHILIPPINES COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 125 PHILIPPINES COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 126 PHILIPPINES COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 127 PHILIPPINES OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 PHILIPPINES COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 129 PHILIPPINES WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 PHILIPPINES MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 PHILIPPINES KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 THAILAND COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 THAILAND SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 THAILAND HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 THAILAND HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 THAILAND HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 137 THAILAND MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 THAILAND COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 139 THAILAND COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 140 THAILAND COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 141 THAILAND COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 142 THAILAND COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 143 THAILAND OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 THAILAND COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 145 THAILAND WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 THAILAND MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 147 THAILAND KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 149 MALAYSIA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 MALAYSIA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 MALAYSIA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 MALAYSIA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 153 MALAYSIA MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 MALAYSIA COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 155 MALAYSIA COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 156 MALAYSIA COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 157 MALAYSIA COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 158 MALAYSIA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 159 MALAYSIA OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 MALAYSIA COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 161 MALAYSIA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 162 MALAYSIA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 163 MALAYSIA KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 164 SINGAPORE COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 165 SINGAPORE SKIN CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 SINGAPORE HAIR CARE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 SINGAPORE HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 SINGAPORE HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2020-2029 (USD MILLION)

TABLE 169 SINGAPORE MAKE UP IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 SINGAPORE COSMETICS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 171 SINGAPORE COSMETICS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 172 SINGAPORE COSMETICS MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 173 SINGAPORE COSMETICS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 174 SINGAPORE COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 175 SINGAPORE OFFLINE IN COSMETICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 SINGAPORE COSMETICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 177 SINGAPORE WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 178 SINGAPORE MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 179 SINGAPORE KIDS IN COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 180 REST OF ASIA-PACIFIC COSMETICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA-PACIFIC COSMETICS MARKET

FIGURE 2 ASIA-PACIFIC COSMETICS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC COSMETICS MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC COSMETICS MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC COSMETICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC COSMETICS MARKET: THE FORM LINE CURVE

FIGURE 7 ASIA-PACIFIC COSMETICS MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA-PACIFIC COSMETICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA-PACIFIC COSMETICS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA-PACIFIC COSMETICS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 ASIA-PACIFIC COSMETICS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA-PACIFIC COSMETICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA-PACIFIC COSMETICS MARKET: SEGMENTATION

FIGURE 14 GROWING AWARENESS AMONG CONSUMERS REGARDING SKINCARE ROUTINES IS EXPECTED TO DRIVE THE ASIA-PACIFIC COSMETICS MARKET GROWTH IN THE FORECAST PERIOD OF 2022-2029

FIGURE 15 SKIN CARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC COSMETICS MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC COSMETICS MARKET

FIGURE 17 ASIA-PACIFIC COSMETICS MARKET, BY PRODUCT TYPE, 2021

FIGURE 18 ASIA-PACIFIC COSMETICS MARKET, BY NATURE, 2021

FIGURE 19 ASIA-PACIFIC COSMETICS MARKET: BY FORM, 2021

FIGURE 20 ASIA-PACIFIC COSMETICS MARKET: BY CATEGORY, 2021

FIGURE 21 ASIA-PACIFIC COSMETICS MARKET: BY PACKAGING TYPE, 2021

FIGURE 22 ASIA-PACIFIC COSMETICS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 ASIA-PACIFIC COSMETICS MARKET: BY END-USER, 2021

FIGURE 24 ASIA-PACIFIC COSMETICS MARKET: SNAPSHOT (2021)

FIGURE 25 ASIA-PACIFIC COSMETICS MARKET: BY COUNTRY (2021)

FIGURE 26 ASIA-PACIFIC COSMETICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 ASIA-PACIFIC COSMETICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 ASIA-PACIFIC COSMETICS MARKET: BY PRODUCT TYPE (2022 - 2029)

FIGURE 29 ASIA-PACIFIC COSMETICS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.