Asia Pacific Cooling System For Edge Computing Market

Taille du marché en milliards USD

TCAC :

%

USD

361.33 Million

USD

814.87 Million

2024

2032

USD

361.33 Million

USD

814.87 Million

2024

2032

| 2025 –2032 | |

| USD 361.33 Million | |

| USD 814.87 Million | |

|

|

|

|

Segmentation du marché des systèmes de refroidissement pour l'informatique de pointe en Asie-Pacifique, par type de système (à air, à liquide et hybride), capacité de refroidissement (systèmes de refroidissement de moyenne, petite et grande taille (plus de 200 kW)), type de déploiement (unités de refroidissement en salle, unités de refroidissement en rack, unités de refroidissement extérieures, unités de refroidissement liquide à immersion directe, unités de refroidissement portables et unités de refroidissement par immersion), système de gestion du refroidissement (systèmes de gestion du refroidissement intégrés et autonomes), méthode de refroidissement (refroidissement par eau glacée, refroidissement à détente directe (DX), refroidissement liquide et autres), secteur vertical (informatique et télécommunications, fabrication, administration et secteurs publics, santé, transport et logistique, commerce de détail et biens de consommation, et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des systèmes de refroidissement pour l'informatique de pointe en Asie-Pacifique

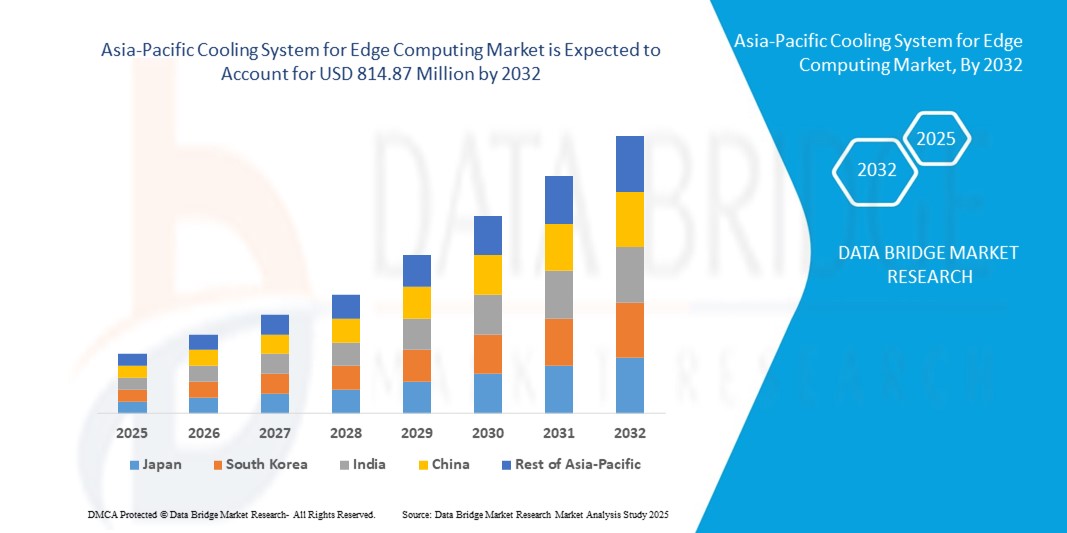

- La taille du marché des systèmes de refroidissement pour l'informatique de pointe en Asie-Pacifique était évaluée à 361,33 millions USD en 2024 et devrait atteindre 814,87 millions USD d'ici 2032 , à un TCAC de 10,70 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'adoption croissante de l'informatique de pointe dans tous les secteurs, la demande croissante de technologies de refroidissement efficaces et durables et le besoin croissant de gérer la chaleur dans les environnements informatiques à haute densité.

- Les progrès réalisés dans les solutions de refroidissement liquide et de refroidissement par immersion, ainsi que l’augmentation des investissements dans les centres de données plus proches des utilisateurs finaux, contribuent davantage à l’expansion du marché.

Analyse du marché des systèmes de refroidissement pour l'informatique de pointe en Asie-Pacifique

- Le marché des systèmes de refroidissement pour l'informatique de pointe en Asie-Pacifique connaît une dynamique significative à mesure que les entreprises accélèrent leur transformation numérique et déploient une infrastructure de pointe pour un traitement plus rapide des données.

- L'accent croissant mis sur la réduction de la latence et la garantie de performances système ininterrompues a accru le besoin de technologies de refroidissement innovantes qui minimisent la consommation d'énergie tout en maintenant une efficacité opérationnelle élevée.

- La Chine a dominé le marché des systèmes de refroidissement pour l'informatique de pointe en Asie-Pacifique avec la plus grande part de revenus en 2024, soutenue par des investissements massifs dans le déploiement de la 5G, l'adoption de l'IoT et les initiatives de villes intelligentes.

- Le Japon devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé sur le marché des systèmes de refroidissement pour l'informatique de pointe en Asie-Pacifique en raison de la demande croissante en informatique haute performance, de l'adoption précoce des technologies de refroidissement liquide et de l'augmentation des investissements dans les applications de pointe pilotées par l'IA et l'IoT.

- Le segment des systèmes à air a détenu la plus grande part de marché en 2024, grâce à sa rentabilité, sa large disponibilité et sa facilité d'intégration aux infrastructures existantes. Le refroidissement par air reste une option privilégiée pour les déploiements périphériques de petite et moyenne envergure, où les exigences d'efficacité sont modérées.

Portée du rapport et segmentation du marché des systèmes de refroidissement pour l'informatique de pointe en Asie-Pacifique

|

Attributs |

Systèmes de refroidissement pour l'informatique de pointe en Asie-Pacifique : informations clés sur le marché |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande. |

Tendances du marché des systèmes de refroidissement pour l'informatique de pointe en Asie-Pacifique

Adoption des technologies de refroidissement liquide et de refroidissement par immersion

- L'évolution vers des systèmes avancés de refroidissement liquide et par immersion transforme le marché de l'edge computing en gérant les fortes densités thermiques dans les infrastructures compactes. Ces technologies permettent une gestion efficace de la chaleur en périphérie, garantissant une disponibilité et des performances système constantes, même sous des charges de travail importantes.

- La demande croissante de méthodes de refroidissement durables accélère l'adoption de systèmes à liquide, plus économes en énergie et en eau que le refroidissement à air traditionnel. Cette tendance est particulièrement marquée dans les régions ayant des objectifs stricts de réduction des émissions de carbone, où l'efficacité énergétique est une priorité.

- L'évolutivité et la conception modulaire des systèmes de refroidissement par immersion les rendent adaptés aux déploiements edge de petite et moyenne taille, contribuant ainsi à réduire les coûts d'exploitation tout en prolongeant la durée de vie des équipements. Leur adaptabilité constitue un atout majeur pour les entreprises qui développent leurs réseaux edge en zones urbaines et isolées.

- Par exemple, en 2023, plusieurs opérateurs télécoms ont déployé des unités de refroidissement liquide modulaires dans leurs centres de données périphériques, ce qui a permis de réduire considérablement la consommation d'énergie et d'améliorer la fiabilité des services réseau. Cela améliore non seulement les performances, mais contribue également à la réalisation des objectifs de développement durable à long terme.

- Si le refroidissement liquide et par immersion permet une meilleure efficacité et de meilleurs avantages environnementaux, son impact à grande échelle dépend de la réduction des coûts initiaux, du développement de normes industrielles et de la formation des opérateurs. Les fournisseurs doivent privilégier des stratégies de déploiement localisées pour maximiser l'adoption dans divers environnements edge.

Dynamique du marché des systèmes de refroidissement pour l'informatique de pointe en Asie-Pacifique

Conducteur

Augmentation du trafic de données et demande croissante de traitement à faible latence

- L'augmentation exponentielle du trafic de données, induite par les objets connectés, les réseaux 5G et les applications temps réel, exerce une pression considérable sur les infrastructures informatiques de pointe. Pour maintenir les performances et éviter les interruptions de service, un refroidissement efficace est devenu un facteur essentiel du déploiement en périphérie.

- Les entreprises sont de plus en plus conscientes des risques financiers et opérationnels liés à la surchauffe, notamment les dommages matériels, l'inefficacité énergétique et les interruptions de service. Cette prise de conscience s'est traduite par une adoption accrue de systèmes de refroidissement de nouvelle génération garantissant un fonctionnement fluide.

- Les gouvernements et les régulateurs industriels soutiennent le développement des infrastructures de pointe par des initiatives d'efficacité énergétique et des politiques informatiques vertes. Ces cadres encouragent les entreprises à investir dans des solutions de refroidissement modernes qui réduisent l'empreinte carbone et respectent les exigences de développement durable.

- Par exemple, en 2022, plusieurs opérateurs de centres de données adoptent de plus en plus des systèmes de refroidissement par immersion avancés pour se conformer aux directives en matière d'efficacité énergétique, stimulant ainsi la demande du marché pour des technologies de refroidissement hautes performances.

- Bien que la demande de traitement à faible latence soit un facteur clé, il sera essentiel de prendre en compte la consommation d'énergie, l'intégration des systèmes et la formation opérationnelle pour garantir l'adoption durable de systèmes de refroidissement avancés à la périphérie.

Retenue/Défi

Coûts de déploiement élevés et obstacles techniques dans les environnements Edge

- Les investissements importants requis pour les solutions de refroidissement avancées, telles que l'immersion liquide et le refroidissement direct sur puce, demeurent un obstacle majeur à leur adoption, notamment pour les petites entreprises et les marchés émergents. De nombreuses organisations continuent de recourir aux systèmes conventionnels en raison de contraintes budgétaires.

- Le manque de techniciens qualifiés et l'expertise limitée dans la gestion des technologies de refroidissement spécialisées sur des sites distants ou distribués limitent encore davantage le déploiement. Ce défi est aggravé par l'absence de pratiques normalisées et de directives techniques dans l'ensemble du secteur.

- La pénétration du marché est également freinée par des problèmes d'infrastructure, notamment la disponibilité de l'énergie et les problèmes de maintenance dans certains environnements périphériques. Ces contraintes peuvent retarder le déploiement de systèmes de refroidissement performants, contraignant à recourir à des alternatives moins performantes.

- Par exemple, en 2023, de nombreux centres de données périphériques à petite échelle continuent d'utiliser des systèmes de refroidissement par air hérités en raison des coûts élevés et de la disponibilité limitée des technologies avancées de refroidissement liquide.

- Alors que l'innovation continue d'améliorer l'efficacité des systèmes de refroidissement, il est essentiel de surmonter les obstacles liés aux coûts, aux infrastructures et aux compétences. Les acteurs du marché doivent investir dans des solutions modulaires, rentables et facilement déployables pour favoriser une adoption plus large dans l'écosystème edge.

Systèmes de refroidissement pour le marché de l'informatique de pointe en Asie-Pacifique

Le marché est segmenté en fonction du type de systèmes de refroidissement, de la capacité de refroidissement, du type de déploiement, du système de gestion du refroidissement, de la méthode de refroidissement et de la verticale.

- Par type de systèmes de refroidissement

En fonction du type de système de refroidissement, le marché Asie-Pacifique des systèmes de refroidissement pour l'edge computing est segmenté en systèmes à air, à liquide et hybrides. Le segment à air a représenté la plus grande part de chiffre d'affaires en 2024, grâce à sa rentabilité, sa large disponibilité et sa facilité d'intégration aux infrastructures existantes. Le refroidissement par air reste une option privilégiée pour les déploiements edge de petite et moyenne envergure, où les exigences d'efficacité sont modérées.

Le segment des systèmes de refroidissement liquide devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à sa capacité supérieure de dissipation thermique et à son adoption croissante dans les centres de données périphériques haute densité. Les solutions de refroidissement liquide gagnent en popularité grâce à leur capacité à réduire la consommation d'énergie et à soutenir les objectifs de développement durable, ce qui les rend idéales pour les environnements informatiques de nouvelle génération.

- Par capacité de refroidissement

En fonction de la capacité de refroidissement, le marché est divisé en systèmes de refroidissement de moyenne, petite et grande taille (plus de 200 kW). Le segment des systèmes de refroidissement de moyenne taille a représenté la plus grande part de chiffre d'affaires en 2024, principalement en raison de leur adoption dans les installations régionales et périphériques nécessitant des charges de refroidissement modérées.

Le segment des systèmes de refroidissement à grande échelle devrait connaître la croissance la plus rapide entre 2025 et 2032, avec l'expansion de l'informatique de pointe dans les grands hubs de télécommunications et les installations d'entreprise. Leur capacité à gérer des charges de travail intensives et à maintenir une fiabilité système élevée en fait un choix essentiel pour les réseaux de pointe à grande échelle.

- Par type de déploiement

Selon le type de déploiement, le marché est segmenté en unités de refroidissement en salle, en rack, en extérieur, en liquide directement sur puce, portables et par immersion. Le segment des unités de refroidissement en salle a dominé le marché en 2024, grâce à son utilisation établie dans les installations edge et les centres de données traditionnels.

Le segment des unités de refroidissement liquide directement sur puce devrait connaître la croissance la plus rapide entre 2025 et 2032, alimenté par la demande croissante de solutions de refroidissement économes en énergie et peu encombrantes. Ces systèmes offrent une gestion thermique ciblée et sont de plus en plus déployés dans les environnements edge hautes performances.

- Par système de gestion du refroidissement

En termes de systèmes de gestion du refroidissement, le marché se divise en deux catégories : les systèmes intégrés et les systèmes autonomes. En 2024, le segment des systèmes intégrés détenait la plus grande part de marché, les entreprises privilégiant de plus en plus les systèmes centralisés qui améliorent la surveillance, l'automatisation et l'optimisation énergétique.

Le segment des systèmes de gestion du refroidissement autonomes devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, en particulier parmi les installations à petite échelle et les opérateurs sensibles aux coûts qui préfèrent des configurations flexibles et indépendantes.

- Par méthode de refroidissement

En fonction de la méthode de refroidissement, le marché Asie-Pacifique des systèmes de refroidissement pour l'edge computing est segmenté en refroidissement par eau glacée, refroidissement à détente directe (DX), refroidissement liquide, etc. Le segment du refroidissement par eau glacée a représenté la plus grande part de chiffre d'affaires en 2024, grâce à sa fiabilité, son évolutivité et son adoption généralisée dans les installations edge de moyenne et grande taille.

Le segment du refroidissement liquide devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, grâce à l'augmentation des densités de puissance à la périphérie et au besoin de technologies de refroidissement hautement efficaces et durables.

- Par Vertical

Sur le plan vertical, le marché est segmenté en technologies de l'information et des télécommunications, industrie manufacturière, administration publique, santé, transport et logistique, commerce de détail et biens de consommation, entre autres. Le segment des technologies de l'information et des télécommunications a dominé le marché en 2024, porté par le déploiement à grande échelle des réseaux 5G et la demande croissante de centres de données en périphérie.

Le secteur des soins de santé devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, car l’adoption de l’informatique de pointe dans la télémédecine, l’imagerie médicale et la surveillance des patients en temps réel entraîne le besoin de systèmes de refroidissement fiables et économes en énergie.

Analyse régionale du marché des systèmes de refroidissement pour l'informatique de pointe en Asie-Pacifique

- La Chine a dominé le marché des systèmes de refroidissement pour l'informatique de pointe en Asie-Pacifique avec la plus grande part de revenus en 2024, soutenue par des investissements massifs dans le déploiement de la 5G, l'adoption de l'IoT et les initiatives de villes intelligentes.

- La croissance rapide des infrastructures numériques du pays stimule la demande de solutions de refroidissement avancées qui garantissent efficacité et durabilité

- Un soutien gouvernemental fort, une base de fabrication à grande échelle et une demande croissante d'applications basées sur l'IA renforcent encore le leadership de la Chine sur le marché

Système de refroidissement japonais pour le marché de l'informatique de pointe

Le marché japonais des systèmes de refroidissement pour l'edge computing devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à l'adoption croissante de l'edge computing dans les secteurs de l'automobile, de la robotique et des télécommunications. La hausse des coûts de l'énergie et l'accent mis par le pays sur la neutralité carbone incitent les entreprises à adopter des systèmes de refroidissement innovants, à base de liquide et par immersion. De plus, les collaborations entre les fournisseurs mondiaux de technologies de refroidissement et les opérateurs locaux accélèrent l'adoption de solutions de nouvelle génération.

Part de marché des systèmes de refroidissement pour l'informatique de pointe en Asie-Pacifique

Le système de refroidissement de l'industrie de l'informatique de pointe en Asie-Pacifique est principalement dirigé par des entreprises bien établies, notamment :

- Daikin Industries, Ltd. (Japon)

- Mitsubishi Electric Corporation (Japon)

- Huawei Technologies (Chine)

- Fujitsu Limited (Japon)

- Hitachi Cooling & Heating (Japon)

- Johnson Controls-Hitachi Air Conditioning (Japon)

- Delta Electronics (Taïwan)

- NEC Corporation (Japon)

- OMRON Corporation (Japon)

- Sungrow Power Supply Co., Ltd. (Chine)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.