Marché des fournitures d'essais cliniques en Asie-Pacifique, par services (stockage, fabrication, emballage, étiquetage et distribution), phase clinique (phase III, phase II, phase IV, phase I), utilisations thérapeutiques (oncologie, maladies cardiovasculaires, dermatologie, troubles métaboliques, maladies infectieuses, maladies respiratoires, troubles du SNC et mentaux, troubles sanguins , autres), utilisateur final (organismes de recherche sous contrat, sociétés pharmaceutiques et biotechnologiques), tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et perspectives du marché : marché des fournitures pour essais cliniques en Asie-Pacifique

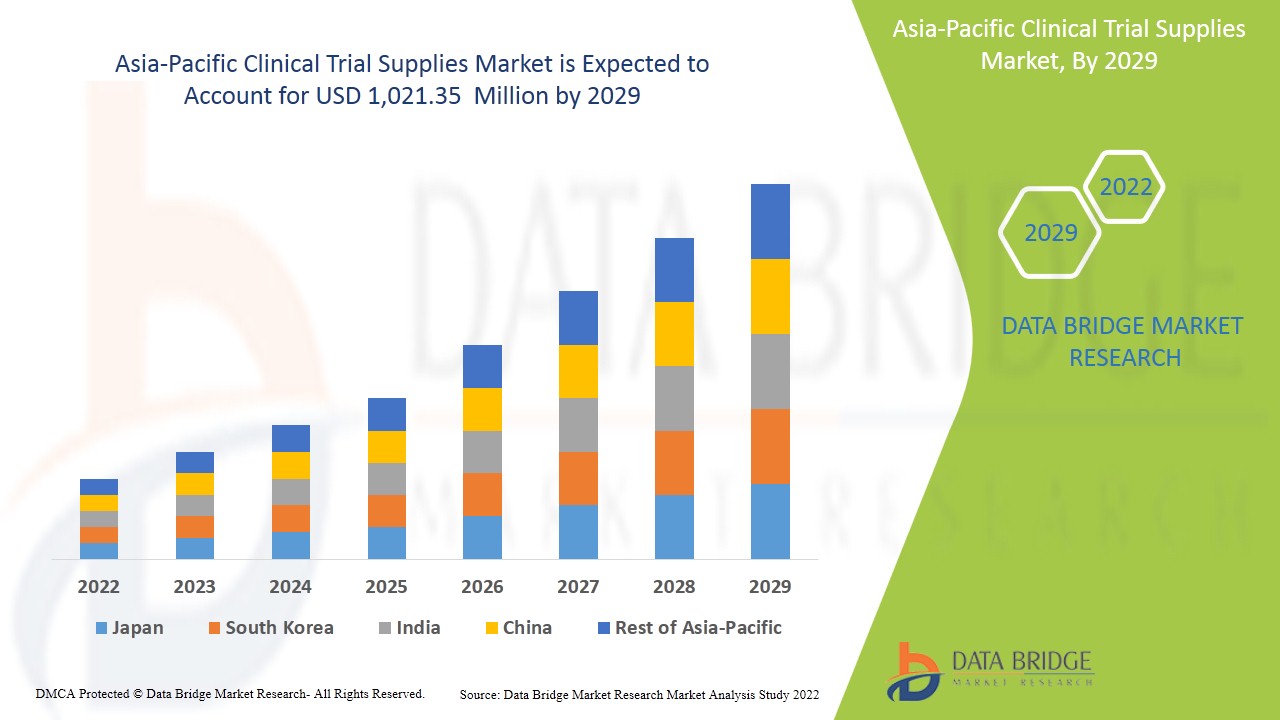

Le marché des fournitures pour essais cliniques en Asie-Pacifique devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 9,2 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 1 021,35 millions USD d'ici 2029. Les principaux facteurs à l'origine de la croissance du marché des fournitures pour essais cliniques sont l'augmentation de la demande d'essais cliniques dans le monde entier, l'augmentation de l'incidence des maladies, les fonds gouvernementaux pour les investissements en R&D et le développement de nouveaux traitements tels que la médecine personnalisée, ce qui conduit le marché des fournitures pour essais cliniques à croître à l'avenir.

L' essai clinique est une étude de recherche qui détermine si une stratégie, un traitement ou un dispositif médical est sûr, efficace et utile pour l'homme. Ces études aident à déterminer quelles approches médicales sont les plus adaptées à certaines maladies. Un essai clinique fournit les meilleures données pour la prise de décision en matière de soins de santé.

L'objectif des essais cliniques est d'étudier des normes scientifiques strictes. Ces normes protègent les patients et contribuent à produire des résultats d'étude fiables.

Les essais cliniques constituent la dernière étape du développement d'un médicament dans le cadre d'un processus de recherche long et minutieux mené par des scientifiques ou des chercheurs sur une maladie particulière, qu'il s'agisse d'un médicament ou d'un dispositif médical. Le processus de développement d'un médicament commence souvent dans un laboratoire, où les scientifiques développent et testent d'abord de nouvelles idées liées au traitement de la maladie.

Le rapport sur le marché des fournitures d'essais cliniques en Asie-Pacifique fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits , de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par services (stockage, fabrication, emballage, étiquetage et distribution), phase clinique (phase III, phase II, phase IV, phase I), utilisations thérapeutiques (oncologie, maladies cardiovasculaires, dermatologie, troubles métaboliques, maladies infectieuses, maladies respiratoires, troubles du système nerveux central et troubles mentaux, troubles sanguins, autres), par utilisateur final (organismes de recherche sous contrat, sociétés pharmaceutiques et biotechnologiques) |

|

Pays couverts |

États-Unis, Canada et Mexique en Amérique du Nord, Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Turquie, Reste de l'Europe en Europe, Chine, Japon, Inde, Corée du Sud, Singapour, Malaisie, Australie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), Afrique du Sud, Reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA), Brésil, Argentine et Reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud. |

|

Acteurs du marché couverts |

Movianto (États-Unis), Sharp (États-Unis), Thermo Fisher Scientific Inc. (États-Unis), Catalent, Inc (États-Unis), PCI Pharma Services (États-Unis), Almac Group (Royaume-Uni), PAREXEL International Corporation (États-Unis), Bionical Ltd. (Royaume-Uni), Alium Medical Limited (Royaume-Uni), Myonex (Royaume-Uni), Clinigen Group plc (Royaume-Uni), Ancillare, LP (États-Unis), SIRO Clinpharm (Inde) CLINICAL SUPPLIES MANAGEMENT HOLDINGS, INC. (États-Unis) Biocair (Royaume-Uni) et entre autres. |

Dynamique du marché des fournitures pour essais cliniques

Conducteurs

- Demande croissante d'essais cliniques dans le monde entier

La demande croissante d'essais cliniques a atteint 82 % dans les seuls pays en développement tels que l'Amérique du Nord, l'Europe et l'Asie. Ces médicaments sont disponibles sur le marché après un essai clinique, de sorte que toutes les entreprises effectuent généralement des essais cliniques en fonction du type de médicament ou de dispositif. et agissent donc comme un moteur majeur qui entraînera l'expansion du taux de croissance du marché des traitements.

- Incidence croissante des maladies chroniques

La prévalence élevée des maladies chroniques due à la croissance rapide de la population et aux infections parmi les personnes est observée dans le monde entier. Ces maladies jouent un rôle majeur dans le domaine des essais cliniques pour le développement de médicaments. Le médicament doit passer toutes les phases cliniques standard pour être disponible avant la consommation humaine. Ainsi, pour traiter ces maladies chroniques chez l'homme, le médicament doit être sûr.

- Les fonds publics investis dans la R&D

Les instruments, le personnel, la gestion médicale en cas de préjudice pour les chercheurs, les assurances, le transport, les frais du comité d'éthique, le traitement des données et autres consommables entraînent des coûts importants dans les essais cliniques. Les essais cliniques sont l'évaluation des idées de prévention et de traitement des maladies qui favoriseront encore la croissance du marché des traitements.

Opportunités

- Augmentation des essais de développement de nouveaux médicaments dans les pays émergents

Les essais cliniques visant à évaluer l'efficacité des médicaments sont essentiels au développement de nouveaux médicaments destinés au traitement des maladies avant leur mise sur le marché pour la consommation humaine. De plus, les nouveaux médicaments doivent satisfaire aux exigences de licence et aux normes internationales avant d'être vendus et distribués. L'augmentation de la prévalence et de l'incidence des maladies et l'augmentation du nombre de patients sont les facteurs qui ont conduit à l'émergence de nouvelles tendances en matière d'essais cliniques pour le développement de médicaments dans les pays en développement au cours de la période écoulée.

En outre, les gouvernements des pays émergents (Chine, Brésil, Russie, Inde et Afrique du Sud) réforment les soins de santé publics et facilitent l’accès aux médicaments. Ces deux facteurs, qui agissent de concert, se traduisent par une plus grande liberté de développement du marché et une innovation accrue dans la recherche clinique sur les marchés émergents.

Contraintes/Défis

Les effets indésirables d'un médicament sont les effets indésirables ou nocifs qui peuvent survenir après l'administration d'un médicament dans des conditions normales d'utilisation chez l'homme. Les réactions médicamenteuses se manifestent généralement par une jaunisse, une anémie, des éruptions cutanées et entraînent une diminution du nombre de globules blancs, des lésions rénales et des lésions nerveuses entraînant une altération de la vision ou de l'audition.

De nombreux effets indésirables peuvent être constatés à partir d'examens physiques au cours de la phase clinique des tests. Ainsi, la déclaration des effets indésirables au cours des essais cliniques constitue le principal facteur de restriction du marché des fournitures. Malgré les investissements importants en temps et en argent pour le développement de produits biologiques et de nouveaux médicaments, on estime que la réduction des délais et des taux d'approbation des médicaments constitue le plus grand défi pour le marché, ce qui peut entraver la croissance du marché.

Ce rapport sur le marché des fournitures d'essais cliniques fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des fournitures d'essais cliniques, contactez Data Bridge Market Research pour un briefing d'analyste , notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Développement récent

- En février 2022, Catalent Inc. a annoncé que la société avait augmenté sa capacité de stockage à température contrôlée et de distribution de fournitures cliniques à travers la Chine. Cela a conduit à une augmentation de l'approvisionnement clinique pour optimiser le développement, le lancement et de meilleurs traitements dans différentes morbidités ainsi que des capacités d'emballage secondaire

Portée du marché des fournitures pour essais cliniques en Asie-Pacifique

Le marché des fournitures d'essais cliniques en Asie-Pacifique est classé en fonction des services, de la phase clinique, des utilisations thérapeutiques et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Service

- Fabrication

- Distribution

- Stockage

- Emballage et étiquetage

Sur la base des services, le marché des fournitures d’essais cliniques de la région Asie-Pacifique est segmenté en fabrication, distribution, stockage, emballage et étiquetage.

Phase clinique

- Phase I

- Phase II

- Phase III

- Phase IV

Sur la base de la phase clinique, le marché des fournitures d'essais cliniques de la région Asie-Pacifique est segmenté en phase I, phase II, phase III et phase IV.

Utilisations thérapeutiques

- Oncologie

- Système nerveux central (SNC)

- Troubles mentaux

- Maladies cardiovasculaires

- Maladies infectieuses

- Maladies respiratoires

- Trouble sanguin

- Dermatologie

- Autres

Sur la base des utilisations thérapeutiques, le marché des fournitures d'essais cliniques de la région Asie-Pacifique est segmenté en oncologie, troubles du SNC et mentaux, maladies cardiovasculaires, maladies infectieuses, maladies respiratoires, troubles métaboliques, troubles sanguins, dermatologie et autres.

Utilisateur final

- Organisation de recherche contractuelle

- Sociétés pharmaceutiques et biotechnologiques

Sur la base de l’utilisateur final, le marché des fournitures d’essais cliniques de la région Asie-Pacifique est segmenté en organisations de recherche contractuelle et sociétés pharmaceutiques et biotechnologiques.

Analyse/perspectives régionales du marché des fournitures pour essais cliniques

Le marché des fournitures d'essais cliniques de l'Asie-Pacifique est en outre segmenté en principaux pays tels que le Japon, la Chine, la Corée du Sud, l'Inde, l'Australie, Singapour, l'Indonésie, la Thaïlande, la Malaisie, les Philippines et le reste de l'Asie-Pacifique.

L'Inde domine le marché des fournitures d'essais cliniques en Asie-Pacifique en termes de part de marché et de chiffre d'affaires et continuera de renforcer sa domination au cours de la période de prévision 2022-2029. Cela est dû à l'augmentation du nombre de patients, à la hausse des investissements dans le secteur de la santé et au soutien croissant du gouvernement dans cette région

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des fournitures pour essais cliniques en Asie-Pacifique

Le paysage concurrentiel du marché des fournitures pour essais cliniques en Asie-Pacifique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des fournitures pour essais cliniques.

Français Les principaux acteurs de premier plan opérant sur le marché des fournitures d'essais cliniques en Asie-Pacifique sont Movianto (États-Unis), Sharp (États-Unis), Thermo Fisher Scientific Inc. (États-Unis), Catalent, Inc (États-Unis), PCI Pharma Services (États-Unis), Almac Group (Royaume-Uni), PAREXEL International Corporation (États-Unis), Bionical Ltd. (Royaume-Uni), Alium Medical Limited (Royaume-Uni), MYODERM (Royaume-Uni), Clinigen Group plc (Royaume-Uni), Ancillare, LP (États-Unis), SIRO Clinpharm (Inde) CLINICAL SUPPLIES MANAGEMENT HOLDINGS, INC. (États-Unis) Biocair (Royaume-Uni) et entre autres.

Méthodologie de recherche : Marché des fournitures pour essais cliniques en Asie-Pacifique

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse mondiale par rapport aux régions et la part des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SERVICES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS FIVE FORCES

5 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: REGULATORY SCENARIO

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR CLINICAL TRIALS WORLDWIDE

6.1.2 INCREASING INCIDENCE OF CHRONIC DISEASES

6.1.3 GOVERNMENT FUNDS IN R&D INVESTMENTS

6.1.4 ADVANCEMENT OF TECHNOLOGY IN CLINICAL TRIALS SUPPLIES

6.2 RESTRAINTS

6.2.1 ADVERSE EFFECTS OF CLINICAL TRIALS

6.2.2 TRANSPORTATION ISSUE IN CLINICAL TRIAL SUPPLIES

6.2.3 HIGH COST ASSOCIATED WITH THE CLINICAL TRIALS

6.3 OPPORTUNITIES

6.3.1 INCREASING NEW DRUG DEVELOPMENT TRIALS IN EMERGING COUNTRIES

6.3.2 INCREASING DEMAND FOR INNOVATIVE SOLUTIONS IN CLINICAL TRIALS SERVICES

6.3.3 EVOLUTION IN SUPPLY CHAIN MANAGEMENT FOR CLINICAL TRIALS

6.4 CHALLENGES

6.4.1 LOWER PROCEDURE TIME OF CLINICAL TRIALS APPROVAL

6.4.2 LACK OF SKILLED PERSON TO OPERATE DEVICES DURING CLINICAL TRIALS

7 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES

7.1 OVERVIEW

7.2 STORAGE

7.3 MANUFACTURING

7.4 PACKAGING AND LABELLING

7.5 DISTRIBUTION

8 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASES

8.1 OVERVIEW

8.2 PHASE III

8.3 PHASE II

8.4 PHASE IV

8.5 PHASE I

9 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE

9.1 OVERVIEW

9.2 ONCOLOGY

9.3 CARDIOVASCULAR DISEASES

9.4 DERMATOLOGY

9.5 METABOLIC DISORDERS

9.6 INFECTIOUS DISEASES

9.7 RESPIRATORY DISEASES

9.8 CNS AND MENTAL DISORDERS

9.9 BLOOD DISORDERS

9.1 OTHERS

10 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY END USER

10.1 OVERVIEW

10.2 CONTRACT RESEARCH ORGANIZATIONS

10.3 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

11 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 SOUTH KOREA

11.1.5 AUSTRALIA

11.1.6 THAILAND

11.1.7 MALAYSIA

11.1.8 SINGAPORE

11.1.9 INDONESIA

11.1.10 PHILIPPINES

11.1.11 REST OF ASIA-PACIFIC

12 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.1.5.1 PARTNERSHIP

14.2 ALMAC GROUP

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 CATALENT INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SERVICE PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.3.5.1 SERVICE EXPANSION

14.4 CLINIGEN GROUP PLC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.4.5.1 PARTNERSHIP

14.5 MOVIANTO

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 SERVICE PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.5.4.1 ACQUISITION

14.6 PCI PHARMA SERVICES

14.6.1 COMPANY SNAPSHOT

14.6.2 SERVICE PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 SHARP

14.7.1 COMPANY SNAPSHOT

14.7.2 SERVICE PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 ALIUM MEDICAL LIMITED

14.8.1 COMPANY SNAPSHOT

14.8.2 SERVICE PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 ANCILLARE, LP

14.9.1 COMPANY SNAPSHOT

14.9.2 SERVICE PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 BIOCAIR

14.10.1 COMPANY SNAPSHOT

14.10.2 SERVICE PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 BIONICAL LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 SERVICE PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.11.3.1 SERVICE LAUNCH

14.12 CLINICAL SUPPLIES MANAGEMENT HOLDINGS,INC

14.12.1 COMPANY SNAPSHOT

14.12.2 SERVICE PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 KLIFO

14.13.1 COMPANY SNAPSHOT

14.13.2 SERVICE PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.13.3.1 ACQUISTION

14.14 MYONEX

14.14.1 COMPANY SNAPSHOT

14.14.2 SERVICE PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 PAREXEL INTERNATIONAL CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 SERVICE PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.15.3.1 COLLABORATION

14.16 SIRO CLINPHARM PRIVATE LIMITED

14.16.1 COMPANY SNAPSHOT

14.16.2 SERVICE PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 LOCATIONS OF REGISTERED STUDIES

TABLE 2 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC STORAGE IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC MANUFACTURING IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC PACKAGING AND LABELLING IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC DISTRIBUTION IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC PHASE III IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC PHASE II IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC PHASE IV IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC PHASE I IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC ONCOLOGY IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC CARDIOVASCULAR DISEASES IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC DERMATOLOGY IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC METABOLIC DISORDERS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC INFECTIOUS DISEASES IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC RESPIRATORY DISEASES IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC CNS AND MENTAL DISORDERS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC BLOOD DISORDERS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC OTHERS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 CHINA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 31 CHINA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 32 CHINA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 33 CHINA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 JAPAN CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 35 JAPAN CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 36 JAPAN CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 37 JAPAN CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 INDIA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 39 INDIA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 40 INDIA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 41 INDIA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 SOUTH KOREA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 43 SOUTH KOREA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 44 SOUTH KOREA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 45 SOUTH KOREA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 AUSTRALIA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 47 AUSTRALIA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 48 AUSTRALIA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 49 AUSTRALIA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 THAILAND CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 51 THAILAND CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 52 THAILAND CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 53 THAILAND CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 MALAYSIA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 55 MALAYSIA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 56 MALAYSIA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 57 MALAYSIA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 58 SINGAPORE CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 59 SINGAPORE CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 60 SINGAPORE CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 61 SINGAPORE CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 INDONESIA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 63 INDONESIA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 64 INDONESIA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 65 INDONESIA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 PHILIPPINES CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 67 PHILIPPINES CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 68 PHILIPPINES CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 69 PHILIPPINES CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 REST OF ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC CLINICAL TRIAL SUPLLIES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC CLINICAL TRIAL SUPLLIES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 RISING DEMAND FOR CLINICAL TRIALS WORLDWIDE AND INCREASING INCIDENCES OF DISEASES IS DRIVING THE ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 STORAGE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET

FIGURE 14 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES, 2021

FIGURE 15 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY CLINICAL PHASE, 2021

FIGURE 19 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY CLINICAL PHASE, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY CLINICAL PHASE, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY CLINICAL PHASE, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY THERAPEUTIC USE, 2021

FIGURE 23 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY THERAPEUTIC USE, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY THERAPEUTIC USE, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY THERAPEUTIC USE, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY END USER, 2021

FIGURE 27 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 28 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET: SNAPSHOT (2021)

FIGURE 31 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY COUNTRY (2021)

FIGURE 32 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 ASIA-PACIFIC CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES (2022-2029)

FIGURE 35 ASIA PACIFIC CLINICAL TRIAL SUPPLIES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.