Asia Pacific Biopesticides Market

Taille du marché en milliards USD

TCAC :

%

USD

2.11 Billion

USD

7.07 Billion

2025

2033

USD

2.11 Billion

USD

7.07 Billion

2025

2033

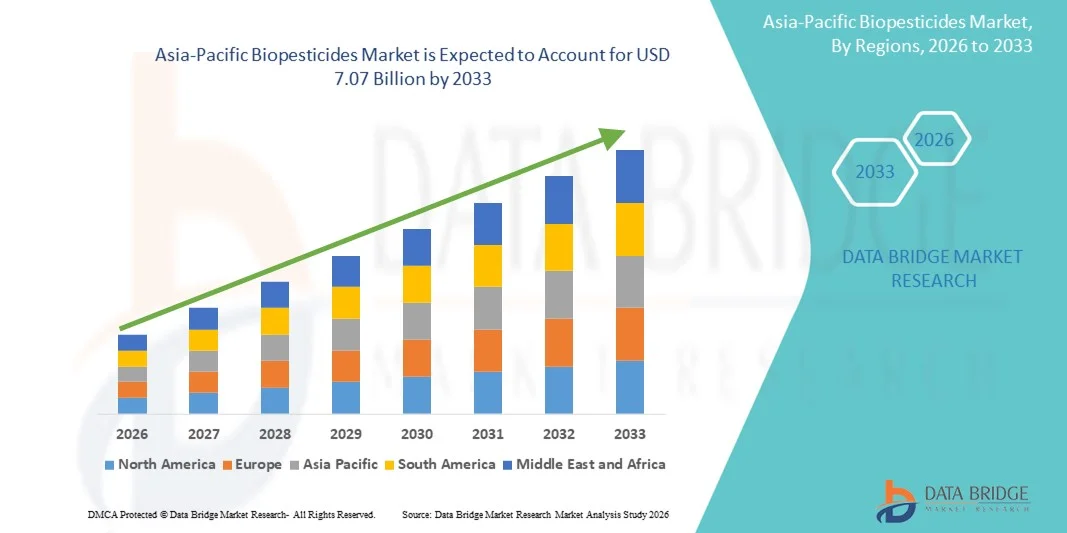

| 2026 –2033 | |

| USD 2.11 Billion | |

| USD 7.07 Billion | |

|

|

|

|

Segmentation du marché des biopesticides en Asie-Pacifique, par type (bioinsecticides, biofongicides, bionématicides, bioherbicides et autres), source (microbienne, biochimique et insectes), forme (sèche et liquide), application (application foliaire, fertirrigation, traitement du sol, traitement des semences et autres), catégorie (agriculture et horticulture), cultures (fruits et légumes, céréales, oléagineux et légumineuses, gazon et plantes ornementales et autres cultures) - Tendances du secteur et prévisions jusqu'en 2033

Quelle est la taille et le taux de croissance du marché des biopesticides en Asie-Pacifique ?

- Le marché des biopesticides en Asie-Pacifique était évalué à 2,11 milliards de dollars en 2025 et devrait atteindre 7,07 milliards de dollars d'ici 2033 , avec un TCAC de 5,1 % au cours de la période de prévision.

- La demande en biopesticides est en hausse en raison de leurs applications potentielles. Les biopesticides offrent divers avantages, notamment la réduction de la pollution environnementale et de la contamination des sols, ainsi que la diminution des traces toxiques dans la chaîne alimentaire.

- Les biopesticides se décomposent plus facilement que les pesticides chimiques et contribuent à augmenter le rendement des cultures. Ils sont souvent utilisés dans le cadre de programmes de lutte intégrée (IPM) pour une efficacité optimale.

Quels sont les principaux enseignements du marché des biopesticides ?

- L'augmentation des financements alloués aux biopesticides pour soutenir une agriculture durable devrait stimuler le marché des biopesticides. Cependant, une réglementation stricte de ces produits devrait freiner la croissance de ce marché.

- L'augmentation de la pollution environnementale causée par les pesticides chimiques devrait créer des opportunités de croissance pour le marché des biopesticides. Cependant, le prix élevé de ces derniers pourrait freiner la croissance de ce marché.

- En Chine, le marché des biopesticides a dominé la région Asie-Pacifique avec une part de revenus estimée à 38,7 % en 2025, grâce à une industrialisation rapide, à la production automobile et mécanique à grande échelle et à une adoption croissante dans les secteurs de la construction, des énergies renouvelables et des équipements lourds.

- En Inde, le marché devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, soit 8,1 %, entre 2026 et 2033, soutenu par une adoption croissante dans les secteurs de l'automobile, de la construction, des énergies renouvelables et des machines industrielles.

- Le segment des biofongicides a dominé le marché avec une part de 38,7 % en 2025, grâce à son utilisation intensive pour lutter contre les maladies fongiques des fruits, légumes, céréales et cultures à haute valeur ajoutée.

Portée du rapport et segmentation du marché des biopesticides

|

Attributs |

Aperçu du marché des biopesticides |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché des biopesticides ?

Adoption croissante de biopesticides durables, écologiques et ciblés

- Le marché des biopesticides connaît une demande accrue de solutions de lutte antiparasitaire respectueuses de l'environnement, biodégradables et adaptées aux cultures dans les secteurs de l'agriculture, de l'horticulture et des serres.

- Les fabricants développent des formulations à base de micro-organismes, de plantes et de produits biochimiques afin d'améliorer l'efficacité, de réduire les résidus chimiques et d'améliorer la santé des sols et des plantes.

- L'accent mis sur la conformité réglementaire, la réduction de l'impact environnemental et les certifications en agriculture biologique favorise l'adoption de ces pratiques par les agriculteurs, qu'ils soient à grande échelle ou de petite taille.

- Par exemple, des entreprises telles que Syngenta, Koppert, Andermatt Biocontrol, Bayer et Marrone Bio Innovations élargissent leurs gammes de produits avec des biofongicides microbiens, des bioinsecticides et des produits de lutte antiparasitaire à base d'ARN interférent.

- L'utilisation croissante de biopesticides dans les cultures de fruits, de légumes, de céréales et de cultures spécialisées soutient l'expansion du marché.

- Alors que l'agriculture se concentre de plus en plus sur la durabilité, la réduction de la dépendance aux produits chimiques et la protection précise des cultures, les biopesticides devraient rester essentiels pour les solutions agricoles de nouvelle génération.

Quels sont les principaux moteurs du marché des biopesticides ?

- La demande croissante de solutions de gestion des ravageurs sans résidus, respectueuses de l'environnement et efficaces stimule considérablement l'adoption des biopesticides dans l'agriculture mondiale.

- Par exemple, entre 2024 et 2025, Bayer, Syngenta, Koppert, Andermatt Biocontrol et Marrone Bio Innovations ont lancé des produits microbiens, botaniques et à base d'ARN interférent conçus pour une efficacité élevée, une spécificité de culture et un impact environnemental réduit.

- L'adoption croissante de l'agriculture biologique, des initiatives d'agriculture durable et des stratégies de lutte intégrée contre les ravageurs (LIR) stimule la demande

- Les progrès réalisés dans le développement des souches microbiennes, les technologies de formulation et les mécanismes d'administration améliorent l'efficacité, la durée de conservation et la facilité d'application.

- Les incitations gouvernementales, les subventions et les réglementations favorables aux solutions de protection des cultures respectueuses de l'environnement encouragent l'utilisation des biopesticides par rapport aux pesticides chimiques.

- Soutenu par une prise de conscience mondiale croissante des enjeux liés à l'agriculture durable et à la sécurité alimentaire, le marché des biopesticides devrait connaître une croissance soutenue à long terme.

Quel facteur freine la croissance du marché des biopesticides ?

- Le coût plus élevé des formulations microbiennes ou botaniques par rapport aux pesticides de synthèse limite leur adoption sur les marchés sensibles aux prix.

- Le manque de sensibilisation, d'expertise technique et de disponibilité des biopesticides dans les régions en développement ralentit la pénétration du marché.

- La variabilité des performances en cas de conditions météorologiques extrêmes, de pression parasitaire ou de conditions spécifiques aux cultures peut limiter l'application dans certains contextes agricoles.

- Les obstacles réglementaires, les processus d'enregistrement complexes et les exigences de conformité peuvent retarder le lancement et l'adoption des produits.

- La concurrence des pesticides chimiques à bas coût et des méthodes conventionnelles de protection des cultures exerce une pression sur les prix et réduit les parts de marché.

- Pour surmonter ces difficultés, les entreprises se concentrent sur des formulations rentables, la formation des agriculteurs, les essais de démonstration et les produits adaptés aux spécificités régionales afin de favoriser une adoption plus large des biopesticides.

Comment le marché des biopesticides est-il segmenté ?

Le marché est segmenté en fonction du type, de la source, de la forme, de l'application, de la catégorie et des cultures.

- Par type

Le marché est segmenté en bioinsecticides, biofongicides, bionématicides, bioherbicides et autres. Le segment des biofongicides dominait le marché en 2025 avec une part de 38,7 %, grâce à son utilisation intensive pour lutter contre les maladies fongiques des fruits, légumes, céréales et cultures à haute valeur ajoutée. Les biofongicides améliorent les rendements, réduisent les résidus chimiques et favorisent la santé des sols, ce qui en fait un choix privilégié pour une agriculture durable et biologique.

Le segment des bioinsecticides devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, soutenu par la demande croissante de solutions efficaces de gestion des ravageurs pour les fruits, les légumes et les cultures de rente, ainsi que par l'adoption croissante de stratégies de lutte intégrée contre les ravageurs (LIR) dans le monde entier.

- Par source

Le marché est segmenté en trois catégories : produits microbiens, produits biochimiques et insectes. Le segment des produits microbiens dominait le marché en 2025 avec une part de 42,1 %, grâce à leur grande efficacité contre les agents pathogènes et les ravageurs, leur polyvalence pour différentes cultures et leur compatibilité avec l’agriculture biologique.

Le segment biochimique devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, grâce aux progrès réalisés dans le domaine des phéromones, des extraits de plantes et des biostimulants qui offrent une lutte antiparasitaire ciblée avec un impact environnemental minimal.

- Par formulaire

Selon leur forme, le marché est segmenté en deux catégories : les produits secs et les produits liquides. Le segment des produits liquides dominait le marché en 2025 avec une part de 55,4 %, grâce à sa facilité d’application, sa couverture uniforme et sa compatibilité avec les systèmes modernes de pulvérisation et de fertirrigation.

Le segment des produits secs devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, grâce à l'adoption croissante des granulés et des poudres pour le traitement des sols, l'enrobage des semences et la stabilité à long terme en rayon dans diverses conditions climatiques.

- Sur demande

Le marché est segmenté en application foliaire, fertirrigation, traitement du sol, traitement des semences et autres. L'application foliaire dominait le marché avec une part de 37,6 % en 2025 grâce à son efficacité pour lutter rapidement contre les maladies et les ravageurs des cultures, légumes et fruits à haute valeur ajoutée.

Le traitement des semences devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, soutenu par l'intérêt croissant porté à la protection préventive des cultures, à la lutte précoce contre les ravageurs et les agents pathogènes, et à l'amélioration des taux de germination.

- Par catégorie

Le marché est segmenté, selon la catégorie, en agriculture et horticulture. Le segment agricole dominait le marché en 2025 avec une part de 63,2 %, grâce à une utilisation intensive dans la culture des céréales, des oléagineux et des grandes cultures.

Le segment de l'horticulture devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, grâce à l'adoption croissante des biopesticides dans les cultures de fruits, de légumes, de plantes ornementales et dans les exploitations en serre qui recherchent une production durable et de haute qualité.

- Par cultures

Le marché est segmenté en fruits et légumes, céréales, oléagineux et légumineuses, gazon et plantes ornementales, et autres cultures. Les fruits et légumes dominaient le marché avec une part de 40,8 % en 2025, en raison de la forte pression des ravageurs, des restrictions réglementaires sur les pesticides chimiques et de la nécessité de produire des produits sans résidus.

Le secteur des oléagineux et des légumineuses devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, alimenté par la demande mondiale croissante, l'adoption de pratiques agricoles durables et la prise de conscience accrue du rôle des biopesticides dans l'amélioration des rendements agricoles et de la santé des sols.

Quelle région détient la plus grande part du marché des biopesticides ?

- En Chine, le marché des biopesticides a dominé la région Asie-Pacifique avec une part de revenus estimée à 38,7 % en 2025, grâce à une industrialisation rapide, à la production automobile et mécanique à grande échelle et à une adoption croissante dans les secteurs de la construction, des énergies renouvelables et des équipements lourds.

- La demande croissante de biopesticides légers, durables et sans entretien pour les applications à forte charge renforce la position de leader du pays sur le marché.

- Des collaborations solides avec les équipementiers, des capacités de fabrication avancées et des investissements continus en R&D renforcent la croissance à long terme du marché, faisant de la Chine une plaque tournante pour l'adoption des biopesticides en Asie-Pacifique.

Analyse du marché japonais des biopesticides

Au Japon, la croissance est portée par les secteurs de pointe de l'automobile, de l'aérospatiale et des machines industrielles. Les biopesticides sont largement utilisés en robotique, dans les éoliennes et les équipements de précision grâce à leur faible friction, leur haute résistance à l'usure et leur fonctionnement sans entretien. L'accent mis sur des solutions écoénergétiques et légères, ainsi que sur une solide production nationale et des partenariats avec des équipementiers, garantissent une adoption progressive et une expansion durable du marché dans les applications industrielles de haute précision.

Analyse du marché indien des biopesticides

En Inde, le marché devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, à 8,1 %, entre 2026 et 2033, porté par l'adoption croissante de ces biopesticides dans les secteurs de l'automobile, de la construction, des énergies renouvelables et des machines industrielles. Le développement des pôles de production, l'essor des véhicules électriques et les programmes de modernisation industrielle soutenus par le gouvernement stimulent la demande de biopesticides composites à base de fibres et de matrices métalliques. L'accent mis sur l'efficacité énergétique, la fonderie de précision et la production durable accélère la pénétration du marché régional.

Aperçu du marché des biopesticides en Corée du Sud

En Corée du Sud, la croissance est soutenue par les secteurs de l'automobile, de l'électronique et des équipements industriels, où les biopesticides sont privilégiés pour les opérations à forte charge, nécessitant peu d'entretien et une grande résistance à l'usure. Leur déploiement croissant dans les composants de véhicules électriques, la robotique et les installations d'énergies renouvelables accélère leur adoption. Des partenariats solides avec les constructeurs automobiles, l'innovation technologique et les investissements en R&D renforcent la position concurrentielle du pays sur le marché Asie-Pacifique.

Aperçu du marché australien des biopesticides

En Australie, la croissance soutenue est portée par les secteurs de la construction, des mines et des énergies renouvelables. Les biopesticides sont de plus en plus utilisés dans les machines lourdes, les équipements industriels et les éoliennes afin d'améliorer leur durabilité, leurs performances et leur durée de vie. Les modernisations industrielles, le développement des infrastructures et les initiatives en matière d'énergies renouvelables, soutenus par le gouvernement, encouragent leur adoption, tandis que l'expansion de la production locale et des exportations industrielles favorise la croissance du marché à long terme dans la région.

Quelles sont les principales entreprises du marché des biopesticides ?

L'industrie des biopesticides est principalement dominée par des entreprises bien établies, notamment :

- Syngenta Crop Protection AG (Suisse)

- Bionema (Royaume-Uni)

- Vegalab SA (Suisse)

- STK bio-ag technologies (Inde)

- Andermatt Biocontrol AG (Suisse)

- Koppert Biological Systems (Pays-Bas)

- Corteva (États-Unis)

- Bayer AG (Allemagne)

- Biobest Group NV (Belgique)

- Certis USA LLC (États-Unis)

- Valent BioSciences LLC (États-Unis)

- Novozymes (Danemark)

- BASF SE (Allemagne)

- IPL Biologicals Limited (Inde)

- Terramera Inc. (Canada)

- Engrais bio Khandelwal (Inde)

- Isagro (Italie)

- Gowan Company (États-Unis)

- Parry America, Inc. (États-Unis)

- Barrix Agro Sciences Pvt Ltd (Inde)

- BioWorks Inc. (États-Unis)

- Marrone Bio Innovations (États-Unis)

- FMC Corporation (États-Unis)

- UPL (Inde)

- Nufarm (Australie)

- Bioline AgriSciences Ltd (Canada)

- Biofa GmbH (Allemagne)

- BioConsortia, Inc. (États-Unis)

- McLaughlin Gormley King Company (États-Unis)

- W. Neudorff GmbH KG (Allemagne)

Quels sont les développements récents sur le marché mondial des biopesticides ?

- En mai 2024, Bioceres Crop Solutions Corp a annoncé que le ministère brésilien de l'Agriculture et de l'Élevage (MAPA) avait approuvé trois nouvelles solutions bio-insecticides et bio-nématicides dérivées de cellules inactivées de sa plateforme Burkholderia exclusive, renforçant ainsi son offre de protection des cultures durable et favorisant son adoption à travers le Brésil.

- En mai 2024, FMC Corporation a signé un accord avec Optibrium afin d'accélérer la découverte de nouvelles technologies de protection des cultures, notamment des biopesticides exploitant l'apprentissage automatique et l'intelligence artificielle, dans le but d'améliorer l'efficacité de la recherche et l'innovation en agriculture durable.

- En avril 2024, Bayer a signé un accord avec la société britannique AlphaBio Control concernant un nouvel insecticide biologique, une première pour les cultures arables telles que les oléagineux, le colza et les céréales. Cet accord renforce le portefeuille de produits de Bayer et favorise des solutions durables pour la protection des cultures.

- En mars 2024, BASF a investi dans une nouvelle usine de fermentation sur son site de Ludwigshafen pour produire des produits phytosanitaires biologiques et biotechnologiques, notamment des fongicides et des traitements de semences. L'usine devrait entrer en service au second semestre 2025, offrant ainsi aux agriculteurs des solutions biopesticides avancées.

- En décembre 2023, Syngenta a lancé CERTANO, son premier produit biologique pour la production de canne à sucre. Ce bionématicide et biofongicide microbiologique agit immédiatement et durablement, favorisant la croissance des plants et assurant une protection durable des cultures de canne à sucre.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.