Asia Pacific Aseptic Sampling Market

Taille du marché en milliards USD

TCAC :

%

USD

143.60 Million

USD

343.05 Million

2024

2032

USD

143.60 Million

USD

343.05 Million

2024

2032

| 2025 –2032 | |

| USD 143.60 Million | |

| USD 343.05 Million | |

|

|

|

|

Segmentation du marché de l'échantillonnage aseptique en Asie-Pacifique, par type (échantillonnage aseptique manuel et automatisé), technique (échantillonnage hors ligne, échantillonnage en ligne et échantillonnage aseptique en ligne), application (processus en amont et en aval), utilisateur final (fabricants de biotechnologie et de produits pharmaceutiques, organisations de fabrication sous contrat, organismes de recherche sous contrat, départements universitaires et de R&D, etc.), canal de distribution (appel d'offres direct, distributeur tiers, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché de l'échantillonnage aseptique en Asie-Pacifique

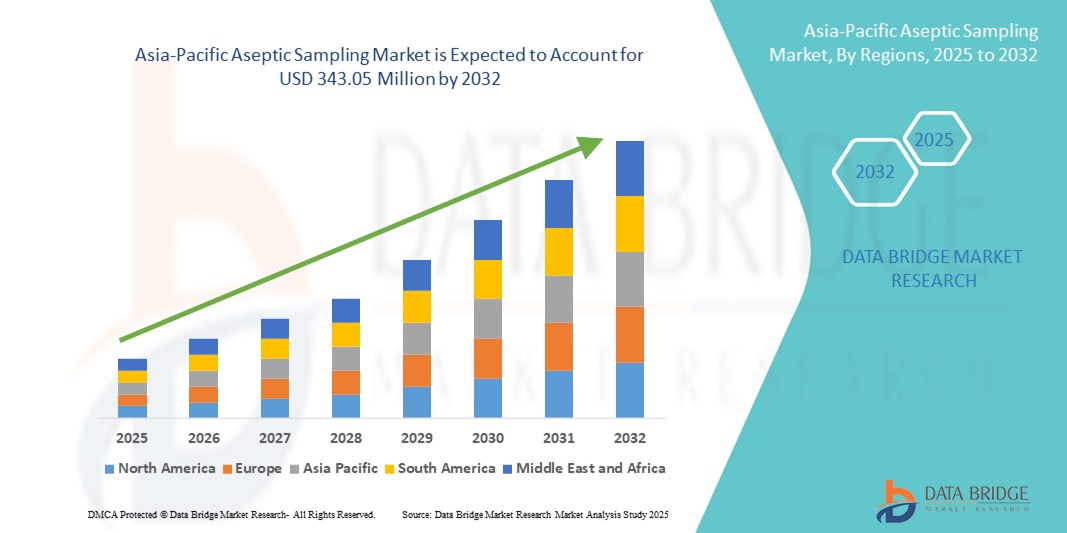

- La taille du marché de l'échantillonnage aseptique en Asie-Pacifique était évaluée à 143,60 millions USD en 2024 et devrait atteindre 343,05 millions USD d'ici 2032 , à un TCAC de 11,50 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par une sensibilisation accrue au contrôle de la contamination, l'essor des activités de fabrication biopharmaceutique et les avancées des technologies de traitement aseptique en Asie-Pacifique, permettant un échantillonnage efficace et stérile en milieu de production. La région connaît une forte croissance de la fabrication de produits biologiques, de vaccins et de thérapies innovantes, notamment dans les pays en pleine industrialisation comme l'Inde, la Chine et la Corée du Sud, contribuant à l'adoption croissante des solutions d'échantillonnage aseptique.

- Par ailleurs, l'augmentation des investissements dans les infrastructures pharmaceutiques et biotechnologiques, l'expansion des installations de production en zones rurales et semi-urbaines, et la multiplication des partenariats public-privé stimulent l'innovation et la disponibilité de systèmes d'échantillonnage aseptique avancés. Les initiatives gouvernementales favorisant le respect de la qualité, associées à la présence croissante d'entreprises internationales du secteur des sciences de la vie et à l'essor des capacités de production locales, stimulent considérablement la croissance du marché de l'échantillonnage aseptique en Asie-Pacifique.

Analyse du marché de l'échantillonnage aseptique en Asie-Pacifique

- Les solutions d'échantillonnage aseptique, qui garantissent un prélèvement d'échantillons sans contamination dans les secteurs pharmaceutique, biotechnologique et agroalimentaire, connaissent une adoption croissante dans la région Asie-Pacifique, portée par l'expansion de la production de produits biologiques, le renforcement des exigences réglementaires et l'augmentation des investissements dans les infrastructures de salles blanches. Des pays comme la Chine, l'Inde, le Japon et la Corée du Sud renforcent considérablement leurs capacités de traitement aseptique afin de répondre à la demande du marché intérieur et de l'exportation.

- La transition croissante vers des systèmes d'échantillonnage aseptiques à usage unique, par rapport aux méthodes traditionnelles réutilisables, est favorisée par leur faible risque de contamination, leur efficacité opérationnelle et leur rentabilité dans des environnements à forte conformité. De plus, la croissance du secteur industriel biopharmaceutique de la région, notamment dans la production de vaccins et d'anticorps monoclonaux, accélère la demande de solutions d'échantillonnage aseptiques innovantes et pré-validées.

- La Chine a dominé le marché de l'échantillonnage aseptique en Asie-Pacifique, représentant la plus grande part de chiffre d'affaires (38,5 %) en 2024, grâce à ses capacités de production pharmaceutique à grande échelle, à l'expansion rapide de ses installations de production de produits biologiques et de vaccins, et aux initiatives gouvernementales visant à améliorer la conformité aux BPF. La forte présence des fabricants d'équipements nationaux et les collaborations technologiques avec des entreprises occidentales stimulent encore davantage l'adoption de ces technologies.

- L'Inde devrait enregistrer le TCAC le plus rapide, soit 12,85 %, sur le marché de l'échantillonnage aseptique en Asie-Pacifique entre 2025 et 2032, grâce à la croissance rapide des exportations biopharmaceutiques , aux mesures gouvernementales incitatives liées à la production (PLI) et à l'augmentation des investissements dans les salles blanches et les infrastructures de traitement stérile. L'essor du secteur de la fabrication sous contrat et des services de recherche crée également de nouvelles opportunités pour les systèmes d'échantillonnage aseptique avancés.

- Le segment des procédés en amont a dominé le marché de l'échantillonnage aseptique en Asie-Pacifique avec une part de marché de 62,5 % en 2024. L'échantillonnage aseptique est essentiel aux étapes de culture cellulaire et de fermentation pour garantir la détection précoce des contaminations et maintenir la qualité des produits. Ce segment bénéficie des investissements croissants en R&D biopharmaceutique et de la production croissante de produits biologiques en Chine, en Inde et en Corée du Sud.

Portée du rapport et segmentation du marché de l'échantillonnage aseptique en Asie-Pacifique

|

Attributs |

Informations clés sur le marché de l'échantillonnage aseptique en Asie-Pacifique |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché de l'échantillonnage aseptique en Asie-Pacifique

Progrès technologiques croissants et expansion de la recherche biopharmaceutique

- Une tendance majeure et croissante sur le marché de l'échantillonnage aseptique en Asie-Pacifique est l'adoption rapide de technologies avancées d'échantillonnage stérile pour soutenir l'expansion des activités de fabrication biopharmaceutique et de recherche clinique dans la région. La transition vers les produits biologiques à haute valeur ajoutée, les vaccins et les thérapies cellulaires et géniques stimule la demande de méthodes d'échantillonnage précises, exemptes de contamination et conformes aux exigences réglementaires strictes.

- Par exemple, les principaux fabricants de produits pharmaceutiques et les instituts de recherche de la région investissent dans des solutions d'échantillonnage aseptique en système fermé, notamment des assemblages à usage unique, des dispositifs d'échantillonnage automatisés et des systèmes de surveillance intégrés, afin d'améliorer la fiabilité des processus et de réduire le risque de pénétration microbienne.

- L'adoption croissante des technologies d'analyse des procédés (PAT) dans les installations de fabrication permet un suivi qualité en temps réel, une amélioration de l'efficacité de la production et la conformité aux Bonnes Pratiques de Fabrication (BPF). Ces avancées sont particulièrement vitales pour les environnements à haut niveau de confinement, tels que les laboratoires de biosécurité (BSL) et les unités de production de vaccins.

- Les collaborations entre fabricants d'équipements, entreprises de biotechnologie et centres de recherche universitaires accélèrent le déploiement de solutions d'échantillonnage innovantes. Les initiatives soutenues par les gouvernements et les réformes réglementaires favorables dans des pays comme la Chine, l'Inde, le Japon et la Corée du Sud améliorent également l'accès au marché et soutiennent le transfert de technologie pour les procédés aseptiques avancés.

- Alors que l'Asie-Pacifique continue de s'imposer comme une plaque tournante mondiale de la production biopharmaceutique, le marché de l'échantillonnage aseptique devrait connaître une croissance soutenue, tirée par l'innovation technologique, l'amélioration des capacités de fabrication et le rôle croissant de la région dans l'activité mondiale des essais cliniques.

Dynamique du marché de l'échantillonnage aseptique en Asie-Pacifique

Conducteur

Besoin croissant dû à l'augmentation de la production biopharmaceutique et aux progrès dans la surveillance des bioprocédés

- L'adoption croissante de la fabrication de produits biologiques et biosimilaires en Asie-Pacifique, soutenue par des investissements croissants dans les infrastructures pharmaceutiques et l'amélioration des mesures de contrôle qualité, stimule considérablement la croissance du marché. Des pays comme la Chine, l'Inde, la Corée du Sud et Singapour renforcent leurs capacités de biotraitement et leurs cadres réglementaires, permettant ainsi des normes de stérilité plus strictes et une qualité de produit fiable pour la production à grande échelle.

- Par exemple, en mars 2024, Sartorius AG (Allemagne) a annoncé l'élargissement de son portefeuille de solutions de bioprocédés en Asie-Pacifique, incluant des systèmes d'échantillonnage aseptique avancés pour répondre à la demande croissante dans le secteur de la fabrication biotechnologique. Ces innovations devraient catalyser l'adoption de méthodes d'échantillonnage hautes performances, accélérant ainsi le développement du marché de l'échantillonnage aseptique en Asie-Pacifique sur la période de prévision.

- L'intérêt croissant pour le biotraitement continu et la disponibilité de technologies d'échantillonnage aseptique de nouvelle génération, telles que les systèmes automatisés à usage unique, incitent à passer de l'échantillonnage manuel conventionnel à des solutions de surveillance plus précises, sans contamination et en temps réel.

- Les organismes de réglementation de la région Asie-Pacifique, tels que la Therapeutic Goods Administration (TGA) en Australie et la National Medical Products Administration (NMPA) en Chine, soutiennent de plus en plus l'innovation en matière de fabrication aseptique par le biais d'approbations simplifiées, d'incitations à la conformité aux bonnes pratiques de fabrication (BPF) et de programmes de formation pour les opérateurs de processus.

- Les collaborations entre entreprises régionales de biotechnologie, organisations de fabrication sous contrat (CMO) et centres de recherche universitaires renforcent l'écosystème d'innovation en Asie-Pacifique. Ces partenariats jouent un rôle essentiel dans l'élargissement de l'accès aux systèmes d'échantillonnage avancés, le déploiement à grande échelle des initiatives d'optimisation des procédés et la sensibilisation aux pratiques de fabrication stérile dans divers sites de production.

Retenue/Défi

Infrastructures limitées et variabilité dans l'adoption des technologies

- Le coût élevé associé aux systèmes d’échantillonnage aseptique avancés, y compris les unités automatisées, les consommables à usage unique et les dispositifs intégrés de surveillance des processus, constitue un obstacle important à une adoption généralisée, en particulier en Asie du Sud-Est et dans les zones de fabrication rurales disposant de budgets d’investissement limités.

- Même lorsque les cadres réglementaires encouragent la conformité aux BPF, la mise en œuvre de systèmes aseptiques de pointe nécessite généralement des mises à niveau sophistiquées des installations, une formation des opérateurs et des processus de validation, ce qui les rend moins réalisables pour les fabricants à petite échelle.

- De plus, les ingénieurs procédés et les experts en validation spécialisés sont souvent concentrés dans les pôles industriels urbains. Cette disparité géographique contraint les petites unités de production à externaliser l'échantillonnage aseptique ou à recourir à des méthodes manuelles sous-optimales.

- Un autre défi réside dans l'absence de protocoles normalisés pour l'échantillonnage aseptique dans la production de produits biologiques et de thérapies cellulaires/géniques. En raison du manque de données de terrain et de la familiarité des opérateurs, notamment dans les installations novices en matière de technologies à usage unique, l'adoption de systèmes d'échantillonnage innovants reste inégale.

- Pour surmonter ces défis, des réformes politiques, des subventions gouvernementales renforcées, des programmes de formation à l'échelle de l'industrie et la création de centres d'excellence régionaux en biotraitement seront essentiels pour élargir l'accès et parvenir à une croissance durable sur le marché de l'échantillonnage aseptique en Asie-Pacifique.

Portée du marché de l'échantillonnage aseptique en Asie-Pacifique

Le marché est segmenté en fonction du type, de la technique, de l’application, de l’utilisateur final et du canal de distribution.

- Par type

En fonction du type, le marché est segmenté en échantillonnage aseptique manuel et échantillonnage aseptique automatisé/instruments. Le type d'échantillonnage aseptique manuel représentait la plus grande part de marché, soit 57,8 % en 2024, grâce à sa large application dans les lignes de production pharmaceutiques et biotechnologiques traditionnelles. Son attrait réside dans son faible investissement initial, sa flexibilité opérationnelle et sa facilité de déploiement, ce qui en fait le choix privilégié des petits acteurs biopharmaceutiques, des laboratoires universitaires et des instituts de recherche de la région Asie-Pacifique. Ce segment reste une solution rentable, en particulier dans les pays où les industries biopharmaceutiques sont en phase de croissance et où les infrastructures d'automatisation avancée restent limitées.

Le type d'échantillonnage/d'instruments aseptiques automatisés devrait atteindre le TCAC le plus élevé de 10,3 % entre 2025 et 2032, les fabricants s'orientant vers l'automatisation et la biofabrication numérique pour améliorer la reproductibilité, l'efficacité et la stérilité des flux de production. L'échantillonnage automatisé permet une surveillance continue, des processus à haut débit et un contrôle qualité en temps réel, minimisant ainsi les erreurs humaines tout en respectant les exigences réglementaires mondiales. L'augmentation des investissements dans les produits biologiques de nouvelle génération, les biosimilaires et les thérapies innovantes stimule encore la demande, en particulier dans les principaux pôles biopharmaceutiques de la région Asie-Pacifique (APAC) tels que Singapour, l'Inde et l'Australie, où les installations à grande échelle adoptent les modèles de l'Industrie 4.0 et des usines intelligentes.

- Par technique

En fonction de la technique, le marché est segmenté en techniques d'échantillonnage hors ligne, en ligne et aseptique. En 2024, la technique d'échantillonnage hors ligne représentait la part la plus importante (46,8 %), car elle est largement utilisée dans les processus de contrôle qualité de routine où les échantillons sont prélevés physiquement et analysés séparément en laboratoire. Cette méthode offre une certaine flexibilité dans les paramètres de test et est couramment utilisée dans les petites installations en Inde, en Chine et en Asie du Sud-Est.

Le segment de l'échantillonnage aseptique en ligne devrait connaître le TCAC le plus rapide, soit 9,8 %, grâce à la progression vers la surveillance continue des bioprocédés, l'automatisation et la réduction des risques de contamination. Son adoption est significative dans la fabrication de produits biologiques à haute valeur ajoutée et de produits injectables stériles sur les marchés avancés de la région Asie-Pacifique.

- Par application

En fonction des applications, le marché est divisé en deux catégories : les procédés en amont et les procédés en aval. Le segment des procédés en amont a dominé le marché avec une part de marché de 62,5 % en 2024, car l'échantillonnage aseptique est essentiel pendant les étapes de culture cellulaire et de fermentation pour garantir la détection précoce des contaminations et maintenir la qualité des produits. Ce segment bénéficie des investissements croissants en R&D biopharmaceutique et de la production croissante de produits biologiques en Chine, en Inde et en Corée du Sud.

Le segment des procédés en aval devrait connaître la croissance la plus rapide, soit 8,9 % entre 2025 et 2032, sous l'effet de la complexité croissante des procédés de purification, de filtration et de formulation, qui exigent des contrôles qualité fréquents en conditions stériles. L'expansion de la production de biosimilaires en Asie-Pacifique stimule également la demande dans ce segment.

- Par utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en fabricants de produits biotechnologiques et pharmaceutiques, organisations de fabrication sous contrat (CMO), organisations de recherche sous contrat (CRO), départements universitaires et de R&D, entre autres. Le segment des fabricants de produits biotechnologiques et pharmaceutiques détenait la plus grande part de marché, soit 51,3 % en 2024, en raison du recours important à l'échantillonnage aseptique dans les installations de production à grande échelle de produits biologiques, de vaccins et de médicaments stériles. L'augmentation des investissements dans les usines de fabrication de produits biologiques en Inde, en Chine et à Singapour devrait maintenir la domination du segment.

Le segment des organisations de fabrication sous contrat (CMO) devrait connaître le TCAC le plus rapide de 9,5 % entre 2025 et 2032, soutenu par la tendance à l'externalisation dans la fabrication biopharmaceutique, où les partenaires contractuels doivent se conformer à des normes de traitement aseptique rigoureuses.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en appels d'offres directs, distributeurs tiers et autres. Le segment des appels d'offres directs dominait avec 47,1 % de part de marché en 2024, l'approvisionnement en gros par les grandes sociétés pharmaceutiques, les CMO et les instituts de recherche gouvernementaux étant une pratique courante dans la région Asie-Pacifique. Ce canal garantit la rentabilité et le respect des politiques d'approvisionnement institutionnelles.

Le segment des distributeurs tiers devrait connaître le TCAC le plus rapide de 10,1 % entre 2025 et 2032, grâce à l'essor des distributeurs spécialisés dans les sciences de la vie offrant un support technique localisé, des délais de livraison plus rapides et des solutions de gestion des stocks sur mesure.

Analyse régionale du marché de l'échantillonnage aseptique en Asie-Pacifique

- L'Asie-Pacifique détenait une part de marché de 22,6 % du marché mondial de l'échantillonnage aseptique en 2024, grâce à l'expansion rapide de la fabrication biopharmaceutique dans la région, à l'adoption croissante de systèmes avancés de surveillance des processus et à l'accent croissant mis sur le maintien de la stérilité dans la production de produits biologiques à grande échelle.

- Des cadres réglementaires rigoureux, tels que les obligations de conformité aux BPF et aux PIC/S, ainsi que des investissements croissants dans les installations de production de vaccins et de biosimilaires, favorisent la croissance des entreprises pharmaceutiques nationales et multinationales. Les partenariats public-privé et les mesures gouvernementales incitatives pour le développement des capacités biotechnologiques accélèrent encore l'adoption des technologies d'échantillonnage aseptique dans la région.

- En outre, la région Asie-Pacifique abrite plusieurs fabricants d'équipements de traitement aseptique et centres de R&D de premier plan, facilitant l'innovation continue des produits, l'amélioration de la validation des processus et des programmes de formation améliorés pour les opérateurs.

Aperçu du marché de l'échantillonnage aseptique en Chine et en Asie-Pacifique

Le marché chinois de l'échantillonnage aseptique a dominé le marché Asie-Pacifique, représentant la plus grande part de chiffre d'affaires (38,5 %) en 2024, grâce à une capacité de production pharmaceutique à grande échelle, à l'expansion rapide des installations de production de produits biologiques et de vaccins, et aux initiatives gouvernementales visant à améliorer la conformité aux BPF. La forte présence des fabricants nationaux d'équipements aseptiques et le renforcement des collaborations technologiques avec des entreprises occidentales stimulent encore les taux d'adoption. De plus, la volonté de la Chine d'atteindre son autonomie en matière d'équipements de biotraitement à haute valeur ajoutée stimule l'innovation locale dans les systèmes d'échantillonnage aseptique automatisés et à usage unique.

Aperçu du marché de l'échantillonnage aseptique au Japon et en Asie-Pacifique

En 2024, le marché japonais de l'échantillonnage aseptique détenait 19,2 % de parts de marché en Asie-Pacifique, grâce à son secteur pharmaceutique très avancé, à ses normes rigoureuses de validation des bioprocédés et à l'adoption précoce de systèmes d'échantillonnage automatisés dans la production de thérapies cellulaires et géniques. L'accent mis par le pays sur l'assurance qualité, ses importants investissements en R&D dans les produits biologiques et son financement public stratégique en faveur de la médecine régénérative renforcent encore sa position sur le marché.

Aperçu du marché de l'échantillonnage aseptique en Inde et en Asie-Pacifique

Le marché indien de l'échantillonnage aseptique devrait enregistrer le TCAC le plus rapide de la région Asie-Pacifique, soit 12,85 %, entre 2025 et 2032. Ce TCAC est porté par la croissance rapide des exportations de produits biopharmaceutiques, les mesures d'incitation gouvernementales dans le cadre du programme d'incitation à la production (PLI) et l'augmentation des investissements dans les salles blanches et les infrastructures de traitement stérile. L'expansion des secteurs de la fabrication sous contrat et des organisations de recherche sous contrat (CRO) du pays crée également de nouvelles opportunités pour le déploiement de systèmes d'échantillonnage aseptique avancés, notamment des plateformes automatisées à usage unique qui soutiennent la production de produits biologiques à grande échelle.

Part de marché de l'échantillonnage aseptique en Asie-Pacifique

L'industrie de l'échantillonnage aseptique en Asie-Pacifique est principalement dirigée par des entreprises bien établies, notamment :

- Sartorius AG (Allemagne)

- KEOFITT A/S (Danemark)

- KIESELMANN GmbH (Allemagne)

- Thermo Fisher Scientific Inc. (États-Unis)

- Groupe GEMU (Allemagne)

- Flownamics (États-Unis)

- Merck KGaA (Allemagne)

- Advanced Microdevices Pvt. Ltd. (MDI) (Inde)

- Saint-Gobain (France)

- Groupe GEA Aktiengesellschaft (Allemagne)

- Avantor, Inc. (États-Unis)

- ALFA LAVAL (Suède)

- WL Gore & Associates, Inc. (États-Unis)

- Systèmes d'échantillonnage QualiTru (États-Unis)

- Aerre Inox Srl (Italie)

- Shanghai LePure Biotech Co., Ltd. (Chine)

- Joneng Valves Co., Limited (Chine)

- Burkle GmbH (Allemagne)

- Dietrich Engineering Consultants (Suisse)

Derniers développements sur le marché de l'échantillonnage aseptique en Asie-Pacifique

- En mars 2023, Sartorius AG a annoncé une expansion stratégique de ses capacités de production et de service client en biotraitement en Corée du Sud et dans toute la région Asie-Pacifique, visant à répondre à la demande croissante en biopharmacie et en échantillonnage aseptique.

- En juin 2022, Merck kGaA a annoncé une collaboration avec Agilent Technologies afin de combler le manque de technologies d'analyse de procédés pour le traitement en aval. Cette collaboration contribuera à une nouvelle augmentation du chiffre d'affaires.

- En novembre 2021, Sartorius AG, partenaire international de premier plan de la recherche en sciences de la vie et de l'industrie biopharmaceutique, a annoncé avoir remporté le prix du « Meilleur fournisseur de bioprocédés » lors des Europe Bioprocessing Excellence Awards 2021. Ce prix a aidé l'entreprise à faire reconnaître son travail.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.