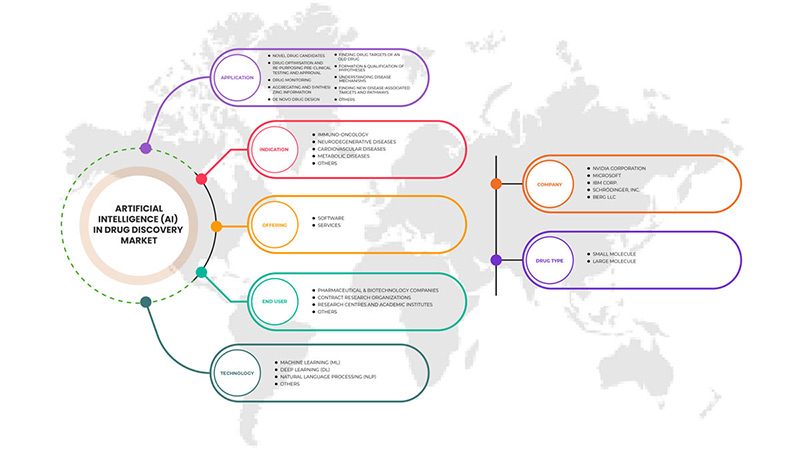

Intelligence artificielle (IA) sur le marché de la découverte de médicaments en Asie-Pacifique, par application (nouveaux candidats médicaments, optimisation et réorientation des médicaments, tests et approbations précliniques, surveillance des médicaments, recherche de nouvelles cibles et voies associées aux maladies, compréhension des mécanismes des maladies, agrégation et synthèse d'informations, formation et qualification d'hypothèses, conception de nouveaux médicaments, recherche de cibles médicamenteuses d'un ancien médicament et autres), technologie (apprentissage automatique, apprentissage profond, traitement du langage naturel et autres), type de médicament (petite et grande molécule), offre (logiciels et services), indication (immuno-oncologie, maladies neurodégénératives, maladies cardiovasculaires, maladies métaboliques et autres), utilisation finale (organismes de recherche sous contrat (CRO), sociétés pharmaceutiques et biotechnologiques, centres de recherche et instituts universitaires et autres) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché de l'intelligence artificielle (IA) dans la découverte de médicaments en Asie-Pacifique

L’intelligence artificielle (IA) devrait devenir une technologie lucrative dans le secteur de la santé. La mise en œuvre de l’IA réduit le déficit de R&D dans le processus de fabrication des médicaments et contribue à la fabrication ciblée de médicaments. Par conséquent, les sociétés biopharmaceutiques se tournent vers l’IA pour accroître leur part de marché. L’IA pour la découverte de médicaments est une technologie qui utilise des machines pour simuler l’intelligence humaine afin de résoudre des problèmes complexes dans la procédure de développement de médicaments.

L'adoption de solutions d'IA dans le processus d'essais cliniques élimine les obstacles possibles, réduit la durée du cycle des essais cliniques et augmente la productivité et la précision du processus d'essais cliniques. Les avancées technologiques de l'IA pour la découverte de médicaments et la réduction du temps total nécessaire au processus de découverte de médicaments sont d'autres facteurs qui stimulent la croissance du marché au cours de la période de prévision. Cependant, la faible qualité et l'incohérence des données disponibles entraveront la croissance du marché. De plus, les coûts élevés associés à la technologie et les limitations techniques freineront la croissance du marché.

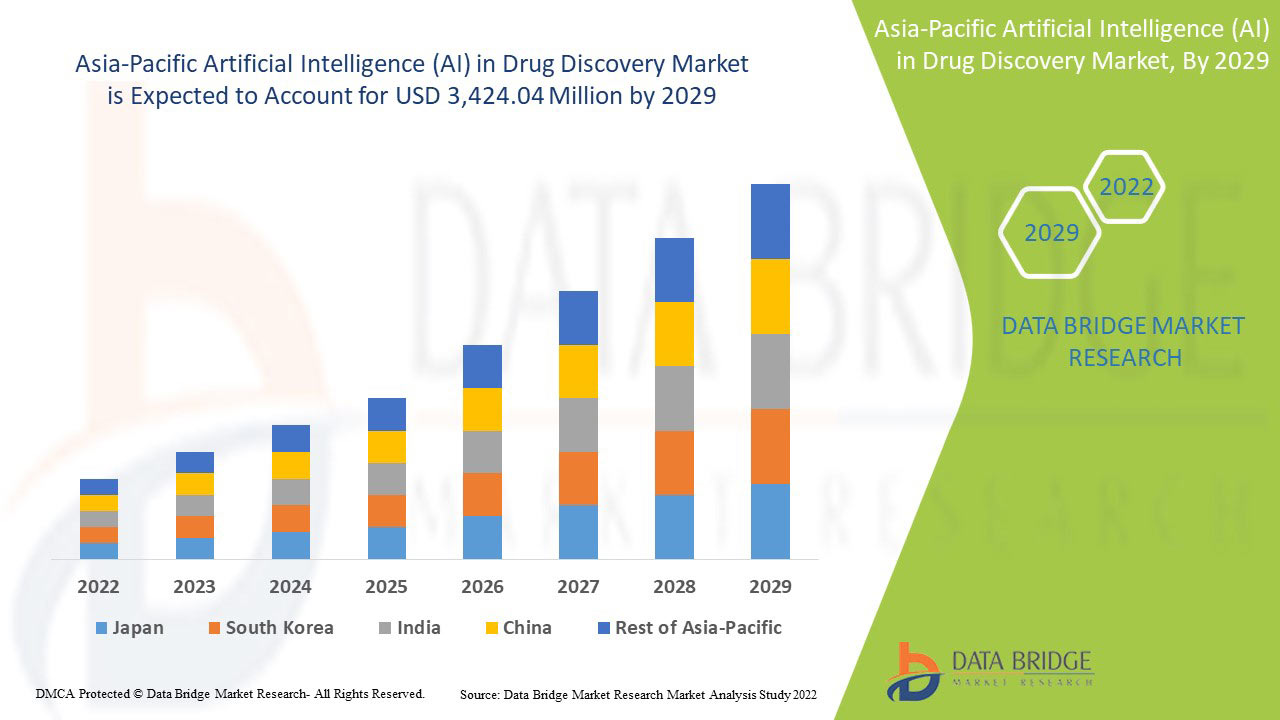

Data Bridge Market Research analyse que le marché de l'intelligence artificielle (IA) dans la découverte de médicaments en Asie-Pacifique devrait atteindre la valeur de 3 424,04 millions USD d'ici 2029, à un TCAC de 50,9 % au cours de la période de prévision. Les logiciels représentent le segment technologique le plus important du marché en raison de l'évolution rapide des avancées technologiques pour commercialiser l'utilisation de l'IA dans le marché de la découverte de médicaments. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par application (nouveaux candidats médicaments, optimisation et réorientation des médicaments, tests et approbations précliniques, surveillance des médicaments, recherche de nouvelles cibles et voies associées aux maladies, compréhension des mécanismes des maladies, agrégation et synthèse des informations, formation et qualification d'hypothèses, conception de nouveaux médicaments, recherche de cibles médicamenteuses d'un ancien médicament et autres), technologie (apprentissage automatique, apprentissage profond, traitement du langage naturel et autres), type de médicament (petite et grande molécule), offre (logiciels et services), indication ( immuno-oncologie , maladies neurodégénératives, maladies cardiovasculaires, maladies métaboliques et autres), utilisation finale (organismes de recherche sous contrat (CRO), sociétés pharmaceutiques et biotechnologiques, centres de recherche et instituts universitaires et autres) |

|

Pays couverts |

Chine, Japon, Inde, Corée du Sud, Singapour, Thaïlande, Malaisie, Australie et Nouvelle-Zélande, Philippines, Indonésie, reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Certains des principaux acteurs opérant sur le marché sont NVIDIA Corporation, IBM Corp., Atomwise Inc., Microsoft, Benevolent AI, Aria Pharmaceuticals, Inc., DEEP GENOMICS, Exscientia, Cloud, Insilico Medicine, Cyclica, NuMedii, Inc., Envisagenics, Owkin Inc., BERG LLC, Schrödinger, Inc., XtalPi Inc. et BIOAGE Inc. entre autres. |

Définition du marché de l'intelligence artificielle (IA) dans la découverte de médicaments en Asie-Pacifique

L’IA a attiré l’attention et l’esprit des praticiens de la technologie médicale au cours des dernières années, alors que plusieurs entreprises et grands laboratoires de recherche ont travaillé pour perfectionner ces technologies pour une utilisation clinique. Les premières démonstrations commercialisées de la manière dont l’IA (également connue sous le nom de Deep Learning (DL), Machine Learning (ML) ou Artificial Neural Networks (ANN)) pourrait aider les cliniciens sont désormais disponibles. Ces systèmes pourraient conduire à un changement de paradigme dans le flux de travail des cliniciens et augmenter la productivité tout en améliorant simultanément le traitement et le débit des patients. L’IA pour la découverte de médicaments est une technologie qui utilise des machines pour simuler l’intelligence humaine afin de résoudre des défis complexes dans la procédure de développement de médicaments. L’adoption de solutions d’IA dans le processus d’essais cliniques élimine les obstacles possibles, réduit la durée du cycle des essais cliniques et augmente la productivité et la précision du processus d’essais cliniques. Par conséquent, l’adoption de ces solutions d’IA avancées dans les processus de découverte de médicaments gagne en popularité parmi les acteurs de l’industrie des sciences de la vie. Dans le secteur pharmaceutique, elle aide à la découverte de nouveaux composés, à l’identification de cibles thérapeutiques et au développement de médicaments personnalisés. Les plateformes d’IA utilisées pour la découverte de médicaments peuvent s’avérer être une option envisageable pour obtenir des informations sur la découverte de médicaments permettant de traiter et de minimiser la gravité de diverses maladies chroniques.

Dynamique du marché de l'intelligence artificielle (IA) dans la découverte de médicaments en Asie-Pacifique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- L'augmentation de l'incidence des maladies chroniques renforce le besoin d'IA dans la découverte de médicaments

L’incidence des maladies chroniques augmente à un rythme rapide dans le monde entier. Selon les Centres pour le contrôle et la prévention des maladies (CDC), six adultes sur dix aux États-Unis souffrent d’une maladie chronique. En outre, le CDC souligne également que les maladies chroniques telles que les maladies cardiaques et le diabète sont les principales causes de décès aux États-Unis. Ces statistiques mettent en lumière la prévalence croissante des maladies chroniques et la nécessité de réduire le taux de mortalité dû à ces maladies.

Les plateformes d’IA utilisées pour la découverte de médicaments peuvent s’avérer être une option viable pour obtenir des informations sur la découverte de médicaments destinés à traiter et à minimiser la gravité de diverses maladies chroniques. Ainsi, ces facteurs devraient agir comme un moteur de la croissance du marché au cours de la période de prévision.

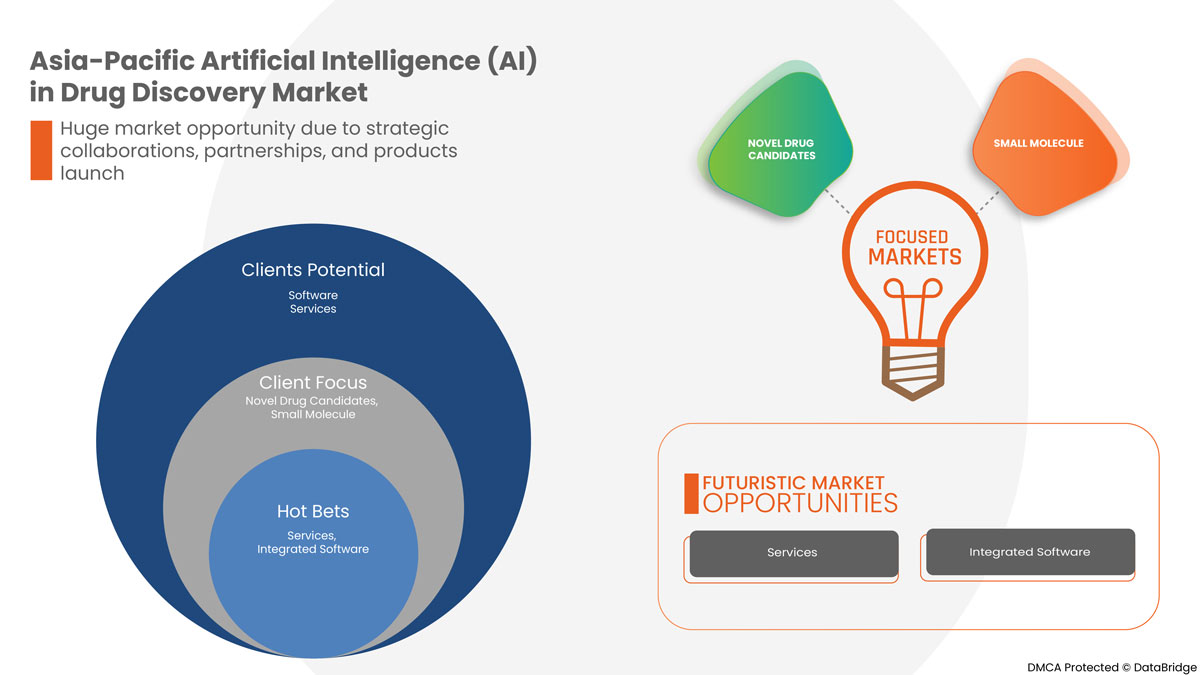

- Collaborations stratégiques, partenariats et lancement de produits

L’IA a le potentiel de transformer la découverte de médicaments en accélérant rapidement le calendrier de recherche et développement, en rendant le développement de médicaments moins coûteux et plus rapide et en améliorant la probabilité d’approbation. L’IA peut également accroître l’efficacité de la recherche sur le réemploi des médicaments.

L'augmentation des alliances et des collaborations intersectorielles stimule le marché. L'importance croissante de l'IA dans la découverte et le développement de médicaments et l'augmentation du financement des activités de R&D, y compris la technologie de l'IA dans le domaine de la recherche sur les médicaments, devraient propulser la croissance du marché mondial. Par conséquent, l'augmentation des collaborations et des partenariats intersectoriels stimule le marché.

Retenue

- Coût élevé associé à la technologie et aux limitations techniques

Le secteur de la santé est aujourd’hui confronté à plusieurs défis complexes, comme l’augmentation du coût des médicaments et des thérapies, et la société a besoin de changements spécifiques et significatifs dans ce domaine. Le succès de l’IA dépend entièrement de la disponibilité d’une quantité substantielle de données, car ces données sont utilisées pour la formation ultérieure fournie au système. L’accès aux données de divers fournisseurs de bases de données peut entraîner des coûts supplémentaires pour une entreprise. Les essais cliniques visent à établir la sécurité et l’efficacité d’un médicament chez l’homme pour une maladie particulière et nécessitent six à sept ans ainsi qu’un investissement financier substantiel. Cependant, seule une molécule sur dix entrant dans ces essais obtient une autorisation de mise sur le marché, ce qui représente une perte massive pour l’industrie. Ces échecs peuvent résulter d’une sélection inappropriée des patients, d’un manque d’exigences techniques et d’une mauvaise infrastructure. Ainsi, l’augmentation des coûts liés à la technologie constitue un frein à la croissance du marché.

Opportunité

-

Hausse des investissements en R&D

L’augmentation des activités de R&D et l’adoption croissante de services et d’applications basés sur le cloud offriront des opportunités bénéfiques pour la croissance du marché.

L'industrie de l'IA dans le secteur biopharmaceutique continue de croître après une longue période de septicémie. Cela se reflète dans le flux continu d'investissements et l'augmentation du nombre de collaborations entre les sociétés pharmaceutiques et les entreprises d'IA en 2021 par rapport aux années précédentes. La croissance du secteur biopharmaceutique est largement influencée par l'engagement actif des principales sociétés pharmaceutiques dans les investissements liés à l'IA. Le nombre de publications scientifiques dans le domaine de l'IA dans le secteur biopharmaceutique et les collaborations de recherche entre les sociétés pharmaceutiques et les fournisseurs d'expertise en IA augmentent rapidement, mais certaines sociétés pharmaceutiques restent critiques à l'égard des applications de l'IA. Les applications de ML et d'IA dans les secteurs pharmaceutique et de la santé conduisent à la formation d'un nouveau domaine interdisciplinaire de découverte de médicaments basée sur les données dans le domaine de la santé. Ainsi, l'augmentation des investissements dans les activités de R&D constitue une opportunité de croissance du marché.

Défi

- Manque de professionnels qualifiés

La pénurie de professionnels qualifiés devrait freiner la croissance du marché. Les employés doivent se recycler ou acquérir de nouvelles compétences pour travailler efficacement sur les machines d'IA complexes afin d'obtenir les résultats souhaités pour le médicament. Ce défi qui empêche l'adoption à grande échelle de l'IA dans l'industrie pharmaceutique comprend le manque de personnel qualifié pour exploiter les plateformes basées sur l'IA, le budget limité des petites organisations, l'appréhension du remplacement des humains entraînant des pertes d'emploi, le scepticisme à l'égard des données générées par l'IA et le phénomène de la boîte noire (c'est-à-dire la manière dont les conclusions sont tirées par la plateforme d'IA). Le manque de compétences constitue un obstacle majeur à la découverte de médicaments par l'IA, décourageant les entreprises d'adopter des machines basées sur l'IA pour la découverte de médicaments.

Les exigences en matière de compétences étant trop élevées, il est devenu difficile de retenir et de gérer les professionnels possédant les compétences requises. De plus, les progrès technologiques sont un autre aspect qui entraîne une demande accrue de professionnels qualifiés. Il est urgent de former les professionnels aux technologies basées sur l'IA. Le manque de professionnels formés et expérimentés et les lacunes persistantes en matière de compétences limitent les perspectives d'employabilité et l'accès à des emplois de qualité. Il est donc évident que la disponibilité de professionnels dotés de compétences adéquates constitue un défi pour la croissance du marché.

Impact de la pandémie de COVID-19 sur le marché de l'intelligence artificielle (IA) dans la découverte de médicaments en Asie-Pacifique

L'épidémie de COVID-19 a eu un impact bénéfique sur l'expansion de l'IA dans le secteur de la découverte de médicaments en raison de son utilisation généralisée par diverses organisations pour l'identification et le dépistage des médicaments existants utilisés dans le traitement de la COVID-19. L'IA est utile pour détecter les produits chimiques actifs pour la prévention du SRAS-CoV, du VIH, du SRAS-CoV-2, du virus de la grippe et d'autres. Pendant la pandémie, les économies du monde entier se sont appuyées sur la découverte de médicaments basée sur l'IA plutôt que sur les processus traditionnels de détection de vaccins, qui prennent des années à créer et sont tout aussi coûteux, contribuant à la croissance du marché.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de R&D pour améliorer la technologie impliquée dans le microphone sans fil. Grâce à cela, les entreprises apporteront au marché des logiciels d'IA avancés et précis.

Développements récents

- En mars 2022, NVIDIA Corporation a lancé Clara Holoscan MGX pour développer et déployer des applications d'IA en temps réel. Clara Holoscan MGX étend la plateforme Clara Holoscan pour fournir une architecture de référence de qualité médicale tout-en-un, ainsi qu'un support logiciel à long terme, afin d'accélérer l'innovation dans le secteur des dispositifs médicaux. Cela aidera l'entreprise à améliorer les performances de l'IA dans le secteur de la santé pour la chirurgie, le diagnostic et la découverte de médicaments.

- En mai 2022, Benevolent AI, une société leader dans la découverte de médicaments au stade clinique utilisant l'IA, a annoncé qu'AstraZeneca avait sélectionné une nouvelle cible supplémentaire pour la fibrose pulmonaire idiopathique (FPI) pour son portefeuille de développement de médicaments, ce qui a donné lieu à un paiement d'étape à Benevolent AI. Il s'agit de la troisième nouvelle cible issue de la collaboration qui a été identifiée à l'aide de la plateforme Benevolent dans deux domaines thérapeutiques, la FPI et l'insuffisance rénale chronique, puis validée et sélectionnée pour l'entrée dans le portefeuille d'AstraZeneca. Cela s'appuie sur la récente extension de la collaboration avec AstraZeneca pour inclure deux nouveaux domaines thérapeutiques, le lupus érythémateux disséminé et l'insuffisance cardiaque, signée en janvier 2022. Cela a aidé l'entreprise à renforcer sa collaboration.

Portée du marché de l'intelligence artificielle (IA) dans la découverte de médicaments en Asie-Pacifique

Le marché de l'intelligence artificielle (IA) dans la découverte de médicaments en Asie-Pacifique est segmenté en application, technologie, type de médicament, offre, indication et utilisation finale. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

APPLICATION

- Nouveaux candidats médicaments

- Optimisation et réutilisation des médicaments, tests précliniques et approbation

- Surveillance des médicaments

- Découvrir de nouvelles cibles et voies associées aux maladies

- Comprendre les mécanismes des maladies

- Agrégation et synthèse des informations

- Formation et qualification des hypothèses

- Conception de nouveaux médicaments

- Recherche des cibles d'un ancien médicament

- Autres

Based on application, the market is segmented into novel drug candidates, drug optimization and repurposing preclinical testing and approval, drug monitoring, finding new diseases associated targets and pathways, understanding disease mechanisms, aggregating and synthesizing information, formation & qualification of hypotheses, de novo drug design, finding drug targets of an old drug, and others.

TECHNOLOGY

- Machine Learning (ML)

- Deep Learning (DL)

- Natural Language Processing (NLP)

- Others

Based on technology, the market is segmented into Machine Learning (ML), Deep Learning (DL), Natural Language Processing (NLP), and others.

DRUG TYPE

- Small Molecule

- Large Molecule

Based on drug type, the market is segmented into small molecule and large molecule.

OFFERING

- Software

- Services

Based on offering, the market is segmented into software and services.

INDICATION

- Immuno-Oncology

- Neurodegenerative Diseases

- Cardiovascular Diseases

- Metabolic Diseases

- Others

Based on indication, the market is segmented into immuno-oncology, neurodegenerative diseases, cardiovascular diseases, metabolic diseases, and others.

END USE

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Research Centres And Academic Institutes

- Others

Based on end use, the market is segmented into pharmaceutical & biotechnology companies, Contract Research Organizations (CROs), research centers and academic institutes, and others.

Asia-Pacific Artificial Intelligence (AI) in Drug Discovery Market Regional Analysis/Insights

The Asia-Pacific Artificial Intelligence (AI) in drug discovery market is analyzed and market size information is provided by application, technology, drug type, offering, indication, and end use.

The countries covered in this market report are China, Japan, India, South Korea, Singapore, Thailand, Malaysia, Australia & New Zealand, Philippines, Indonesia, rest of Asia-Pacific.

- In 2022, Asia-Pacific is the third most dominating region due to the higher demand for infectious diseases diagnostic kits due to increasing patient pool and rising awareness among people. China is expected to grow due to rise in technological advancements in AI for drug discovery.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Artificial Intelligence (AI) in Drug Discovery Market Share Analysis

Le paysage concurrentiel du marché de l'intelligence artificielle (IA) dans la découverte de médicaments en Asie-Pacifique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché de l'intelligence artificielle (IA) dans la découverte de médicaments en Asie-Pacifique.

Certains des principaux acteurs opérant sur le marché sont NVIDIA Corporation, IBM Corp., Atomwise Inc., Microsoft, Benevolent AI, Aria Pharmaceuticals, Inc., DEEP GENOMICS, Exscientia, Cloud, Insilico Medicine, Cyclica, NuMedii, Inc., Envisagenics, Owkin Inc., BERG LLC, Schrödinger, Inc., XtalPi Inc. et BIOAGE Inc. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORETSR’S FIVE FORCES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE RISE IN INCIDENCE OF CHRONIC DISEASES PROPELS NEED FOR ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY

5.1.2 STRATEGIC COLLABORATIONS, PARTNERSHIPS, AND PRODUCTS LAUNCH

5.1.3 REDUCTION IN TOTAL TIME INVOLVED IN DRUG DISCOVERY PROCESS

5.1.4 ADVANCEMENT OF ARTIFICIAL INTELLIGENCE IN THE HEALTHCARE INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH TECHNOLOGY AND TECHNICAL LIMITATIONS

5.2.2 DISADVANTAGES AND RISKS ASSOCIATED WITH AI IN DRUG DISCOVERY

5.2.3 LACK OF AVAILABLE QUALITY DATA

5.3 OPPORTUNITIES

5.3.1 RISE IN THE INVESTMENTS FOR R&D

5.3.2 RISING HEALTHCARE INFRASTRUCTURE

5.3.3 DEVELOPMENT OF NOVEL TOOLS

5.4 CHALLENGES

5.4.1 THE ASIA PACIFIC SHORTAGE OF AI TALENT

5.4.2 ETHICAL, LEGAL, AND REGULATORY ISSUES FOR AI ADOPTION IN THE PHARMACEUTICAL SCIENCES

6 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 INTEGRATED

6.2.2 STANDALONE

6.3 SERVICES

7 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 MACHINE LEARNING (ML)

7.2.1 SUPERVISED LEARNING

7.2.2 UNSUPERVISED LEARNING

7.2.3 REINFORCEMENT LEARNING

7.3 DEEP LEARNING

7.4 NATURAL LANGUAGE PROCESSING (NLP)

7.5 OTHERS

8 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET , BY DRUG TYPE

8.1 OVERVIEW

8.2 SMALL MOLECULE

8.3 LARGE MOLECULE

9 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 NOVEL DRUG CANDIDATES

9.2.1 PREDICT BIOACTIVITY OF SMALL MOLECULE

9.2.2 IDENTIFY BIOLOGICS TARGET

9.2.3 OTHERS

9.3 DRUG OPTIMISATION AND RE-PURPOSING PRE-CLINICAL TESTING AND APPROVAL

9.4 DRUG MONITORING

9.5 AGGREGATING AND SYNTHESIZING INFORMATION

9.6 DE NOVO DRUG DESIGN

9.7 FINDING DRUG TARGETS OF AN OLD DRUG

9.8 FORMATION & QUALIFICATION OF HYPOTHESES

9.9 UNDERSTANDING DISEASE MECHANISMS

9.1 FINDING NEW DISEASE-ASSOCIATED TARGETS AND PATHWAYS

9.11 OTHERS

10 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION

10.1 OVERVIEW

10.2 IMMUNE-ONCOLOGY

10.2.1 BREAST CANCER

10.2.2 LUNG CANCER

10.2.3 COLORECTAL CANCER

10.2.4 PROSTATE CANCER

10.2.5 PANCREATIC CANCER

10.2.6 BRAIN CANCER

10.2.7 LEUKEMIA

10.2.8 OTHERS

10.3 NEURODEGENERATIVE DISEASES

10.4 CARDIOVASCULAR DISEASES

10.5 METABOLIC DISEASES

10.6 OTHERS

11 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET , BY END USE

11.1 OVERVIEW

11.2 CONTRACT RESEARCH ORGANIZATIONS

11.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

11.4 RESEARCH CENTERS AND ACADEMIC INSTITUTES

11.5 OTHERS

12 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 SOUTH KOREA

12.1.4 INDIA

12.1.5 AUSTRALIA & NEW ZEALAND

12.1.6 SINGAPORE

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 INDONESIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 NVIDIA CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 MICROSOFT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 IBM CORP

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 SCHRÖDINGER, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 BERG LLC

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ARDIGEN

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 EXSCIENTIA

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 ARIA PHARMACEUTICALS, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ATOMWISE INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 BENEVOLENT AI

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 BIOAGE INC.,

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 CLOUD

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 CYCLICA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 DEEP GENOMICS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 ENVISAGENICS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 INSILICO MEDICINE

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 NUMEDII, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 OWKIN INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 XTALPI INC.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC SERVICES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC DEEP LEARNING IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC NATURAL LANGUAGE PROCESSING (NLP) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC SMALL MOLECULE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC LARGE MOLECULE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC DRUG OPTIMISATION AND RE-PURPOSING PRE-CLINICAL TESTING AND APPROVAL IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC DRUG MONITORING IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC AGGREGATING AND SYNTHESIZING INFORMATION IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC DE NOVO DRUG DESIGN IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC FINDING DRUG TARGETS OF AN OLD DRUG IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC FORMATION & QUALIFICATION OF HYPOTHESES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC UNDERSTANDING DISEASE MECHANISMS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC FINDING NEW DISEASE-ASSOCIATED TARGETS AND PATHWAYS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC NEURODEGENERATIVE DISEASES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC CARDIOVASCULAR DISEASES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC METABOLIC DISEASES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 GLOB ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC CONTRACT RESEARCH ORGANIZATIONS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC RESEARCH CENTRES AND ACADEMIC INSTITUTES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC OTHERS IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 49 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 50 CHINA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 52 CHINA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 54 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 CHINA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 57 CHINA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 58 CHINA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 59 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 60 JAPAN SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 62 JAPAN MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 63 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 64 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 JAPAN NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 67 JAPAN IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 68 JAPAN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 70 SOUTH KOREA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 SOUTH KOREA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 73 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 79 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 80 INDIA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 82 INDIA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 83 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 84 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 INDIA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 87 INDIA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 88 INDIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 89 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA & NEW ZEALAND SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA & NEW ZEALAND MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 93 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA & NEW ZEALAND NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA & NEW ZEALAND IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA & NEW ZEALAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 99 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 100 SINGAPORE SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 102 SINGAPORE MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 103 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 104 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 SINGAPORE NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 SINGAPORE ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 107 SINGAPORE IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 108 SINGAPORE AARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 109 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 110 THAILAND SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 THAILAND MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 113 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 114 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 THAILAND NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 117 THAILAND IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 118 THAILAND ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 119 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 120 MALAYSIA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 122 MALAYSIA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 123 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 124 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 MALAYSIA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 127 MALAYSIA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 128 MALAYSIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 129 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 130 INDONESIA SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 132 INDONESIA MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 133 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 INDONESIA NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 137 INDONESIA IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 138 INDONESIA ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 139 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 140 PHILIPPINES SOFTWARE IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 142 PHILIPPINES MACHINE LEARNING (ML) IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 143 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 144 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 PHILIPPINES NOVEL DRUG CANDIDATES IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 147 PHILIPPINES IMMUNO-ONCOLOGY IN ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 148 PHILIPPINES ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 149 REST OF ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 11 THE GROWING NEED TO CURB DRUG DISCOVERY COSTS AND REDUCE TIME INVOLVED IN THE DRUG DEVELOPMENT PROCESS, THE RISING ADOPTION OF CLOUD-BASED APPLICATIONS AND SERVICES, AND THE IMPENDING PATENT EXPIRY OF BLOCKBUSTER DRUGS ARE EXPECTED TO DRIVE THE GROWTH OF THE ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SOFTWARE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET IN 2022 AND 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET

FIGURE 14 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, 2021

FIGURE 15 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, 2021

FIGURE 19 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, 2021

FIGURE 23 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY DRUG TYPE, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, 2021

FIGURE 27 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 28 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 29 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, 2021

FIGURE 31 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, 2020-2029 (USD MILLION)

FIGURE 32 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 33 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 34 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY END USE, 2021

FIGURE 35 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY END USE, 2022-2029 (USD MILLION)

FIGURE 36 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY END USE, CAGR (2022-2029)

FIGURE 37 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET : BY END USE, LIFELINE CURVE

FIGURE 38 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: SNAPSHOT (2021)

FIGURE 39 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY COUNTRY (2021)

FIGURE 40 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: BY OFFERING (2022-2029)

FIGURE 43 ASIA PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN DRUG DISCOVERY MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.