Asia Pacific And Us Warehouse Management System Market

Taille du marché en milliards USD

TCAC :

%

USD

1.06 Billion

USD

3.79 Billion

2024

2032

USD

1.06 Billion

USD

3.79 Billion

2024

2032

| 2025 –2032 | |

| USD 1.06 Billion | |

| USD 3.79 Billion | |

|

|

|

|

Segmentation du marché des systèmes de gestion d'entrepôt en Asie-Pacifique et aux États-Unis, par composants (grues, systèmes automatisés de stockage et de récupération, robots, convoyeurs et systèmes de tri, véhicules à guidage automatique, etc.), fonctions (réception et rangement, contrôle des stocks, gestion des quais et des parcs, placement, prélèvement, gestion des effectifs et des tâches, expédition, etc.), offre (logiciels et services), déploiement (Cloud/SaaS et sur site), type de niveau (WMS avancé, WMS intermédiaire et WMS de base), utilisateur final (e-commerce, agroalimentaire, logistique tierce partie, électricité et électronique, automobile, métaux et machines, santé, produits chimiques, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des systèmes de gestion d'entrepôt en Asie-Pacifique

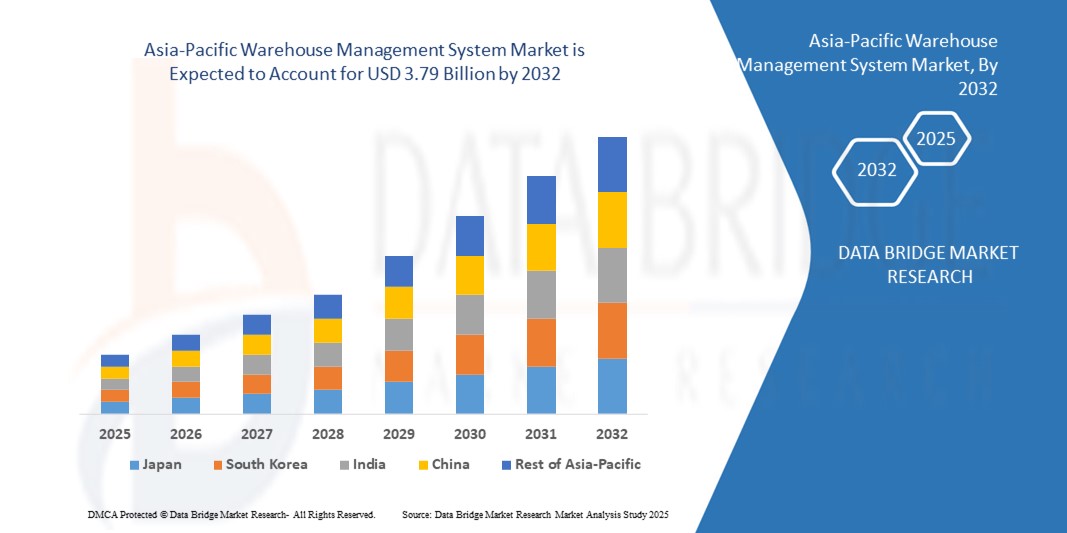

- La taille du marché des systèmes de gestion d'entrepôt en Asie-Pacifique était évaluée à 1,06 milliard USD en 2024 et devrait atteindre 3,79 milliards USD d'ici 2032 , à un TCAC de 17,30 % au cours de la période de prévision et la taille du marché des systèmes de gestion d'entrepôt aux États-Unis était évaluée à 991,8 millions USD en 2024 et devrait atteindre 3 506,54 millions USD d'ici 2032 , à un TCAC de 17,1 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'adoption croissante de l'automatisation, de la robotique et des technologies de la chaîne d'approvisionnement numérique dans les entrepôts et les centres de distribution, ce qui conduit à une efficacité opérationnelle améliorée, à une réduction des coûts de main-d'œuvre et à une meilleure gestion des stocks.

- Par ailleurs, la demande croissante des secteurs du e-commerce, de la vente au détail, de l'industrie manufacturière et de la logistique tierce pour une visibilité en temps réel, un suivi précis des stocks et une rationalisation des opérations d'entrepôt fait des systèmes de gestion d'entrepôt une solution essentielle pour les chaînes d'approvisionnement modernes. Ces facteurs convergents accélèrent l'adoption de ces systèmes, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des systèmes de gestion d'entrepôt en Asie-Pacifique

- Les systèmes de gestion d'entrepôt (SGE) sont des solutions logicielles permettant aux entreprises de gérer et d'optimiser leurs opérations d'entrepôt, notamment la gestion des stocks, l'exécution des commandes, la réception et le rangement, la préparation de commandes, l'expédition et la gestion des effectifs. Ces systèmes s'intègrent aux plateformes d'automatisation, de robotique et de planification des ressources de l'entreprise (ERP) pour améliorer l'efficacité et la précision des opérations d'entrepôt.

- La demande croissante de systèmes de gestion d'entrepôt est principalement alimentée par la croissance du e-commerce et de la distribution omnicanale, la complexité croissante des chaînes d'approvisionnement, la hausse des coûts de main-d'œuvre et le besoin d'une exécution des commandes plus rapide et plus précise. Les entreprises adoptent de plus en plus des solutions WMS cloud, optimisées par l'IA et accessibles sur mobile pour gagner en agilité opérationnelle et en compétitivité.

- La Chine a dominé le marché des systèmes de gestion d'entrepôt en 2024, en raison de son secteur du commerce électronique en pleine croissance, de l'expansion de sa base de fabrication et de l'adoption croissante de solutions d'automatisation et de chaîne d'approvisionnement numérique.

- L'Asie-Pacifique devrait être le pays qui connaîtra la croissance la plus rapide sur le marché des systèmes de gestion d'entrepôt au cours de la période de prévision en raison de

- Le segment des services a dominé le marché avec une part de marché de 81,41 % en 2024, en raison de la demande croissante de solutions de mise en œuvre, de personnalisation, de formation et de maintenance garantissant une intégration transparente et des performances optimales des systèmes de gestion d'entrepôt. Les entreprises privilégient les services professionnels pour réduire les risques de déploiement, améliorer l'efficacité opérationnelle et exploiter pleinement le potentiel des logiciels avancés. De plus, la complexité croissante des opérations d'entrepôt et le besoin constant de support et de mises à jour contribuent à la domination du segment des services sur le marché.

Portée du rapport et segmentation du marché des systèmes de gestion d'entrepôt

|

Attributs |

Informations clés sur le marché des systèmes de gestion d'entrepôt |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

NOUS |

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon. |

Tendances du marché des systèmes de gestion d'entrepôt en Asie-Pacifique

Intégration de l'IA et de la robotique pour automatiser les opérations d'entrepôt

- L'intégration de l'intelligence artificielle et de la robotique aux systèmes de gestion d'entrepôt améliore rapidement l'efficacité opérationnelle et l'évolutivité. Ces technologies permettent aux entrepôts d'accroître leur rapidité, leur précision et leur productivité, tout en minimisant les tâches fastidieuses et les erreurs humaines dans les environnements logistiques complexes.

- Par exemple, GreyOrange a déployé des robots avancés pilotés par l'IA pour automatiser les opérations de tri et de préparation de commandes dans les entrepôts de marques telles que Flipkart. Cela illustre comment la robotique et l'IA transforment les fonctions des entrepôts et redéfinissent les normes de précision des commandes et d'efficacité du rendement.

- Les systèmes de gestion d'entrepôt basés sur l'IA sont de plus en plus utilisés pour l'analyse prédictive, qui permet de prévoir la demande, d'optimiser le placement des stocks et de rationaliser le traitement des commandes. Ces fonctionnalités offrent une valeur inestimable aux entreprises qui cherchent à concilier l'évolution rapide des marchés avec la maîtrise des coûts et la qualité de service.

- L'intégration robotique optimise les flux de travail grâce à des systèmes de prélèvement automatisés, des bras robotisés pour la palettisation et des véhicules à guidage autonome pour la manutention. Ensemble, ces solutions réduisent considérablement les temps de cycle et améliorent la flexibilité pour gérer la demande saisonnière ou fluctuante.

- Cette tendance s'étend également aux PME, où l'intégration de l'IA et de la robotique dans le cloud est adoptée pour optimiser l'efficacité opérationnelle de la grande distribution. Cette démocratisation de l'automatisation avancée des entrepôts ouvre de nouvelles perspectives pour une pénétration plus large du marché.

- En conclusion, la fusion de l'IA et de la robotique au sein des systèmes de gestion d'entrepôt transforme le fonctionnement des entrepôts. En favorisant l'automatisation, la précision et l'intelligence en temps réel, ces avancées propulsent le secteur vers des infrastructures de chaîne d'approvisionnement plus intelligentes et évolutives.

Dynamique du marché des systèmes de gestion d'entrepôt en Asie-Pacifique

Conducteur

Demande croissante de visibilité des stocks en temps réel et d'exécution plus rapide des commandes

- La demande croissante de visibilité des stocks en temps réel, combinée à la pression pour traiter les commandes rapidement, est un facteur clé de l'adoption des systèmes de gestion d'entrepôt. Les entreprises recherchent des systèmes leur permettant de suivre, de gérer et d'optimiser leurs stocks avec précision, tout en assurant un traitement fluide des commandes.

- Par exemple, Manhattan Associates a développé des solutions WMS avancées permettant aux détaillants d'obtenir une visibilité en temps réel sur leurs stocks, tant dans leurs centres de distribution que dans leurs magasins. Leur déploiement auprès de grandes marques de distribution illustre l'importance cruciale des WMS pour garantir des expériences client plus rapides et plus efficaces.

- La visibilité en temps réel garantit la minimisation des écarts de stock et l'optimisation de la précision des commandes. Cela permet aux entreprises de réduire les commandes en souffrance, d'éviter les ruptures de stock coûteuses et d'améliorer la satisfaction client grâce à une disponibilité fiable des produits.

- L'essor du commerce omnicanal accroît la demande de systèmes de gestion d'entrepôt. Les clients s'attendant à une livraison le lendemain, voire le jour même, les entreprises ont besoin de systèmes capables de coordonner les stocks sur plusieurs canaux afin d'assurer une gestion unifiée des commandes.

- En résumé, l'importance croissante de la rapidité et de la précision dans l'exécution des commandes fait de la visibilité en temps réel une nécessité stratégique pour les entreprises modernes. Les systèmes de gestion d'entrepôt sont ainsi devenus des outils essentiels pour obtenir un avantage concurrentiel sur les marchés à forte demande.

Retenue/Défi

Coûts élevés et complexité de la mise en œuvre du système

- L'investissement initial élevé et la complexité liés à la mise en œuvre de systèmes de gestion d'entrepôt demeurent un défi majeur pour les organisations. Les coûts liés aux licences logicielles, à l'infrastructure matérielle, à la personnalisation et à l'intégration peuvent être conséquents pour de nombreuses entreprises.

- Par exemple, les entreprises qui adoptent SAP Extended Warehouse Management font souvent état de délais de mise en œuvre longs et de coûts de conseil et de formation élevés. Cela démontre l'ampleur des ressources nécessaires pour passer des processus d'entrepôt traditionnels à des plateformes WMS entièrement optimisées.

- Les difficultés d'intégration ajoutent à la complexité, car le WMS doit s'intégrer harmonieusement aux systèmes ERP, aux plateformes de gestion des commandes et aux systèmes de gestion des transports. Assurer la compatibilité et la fluidité des flux de données entre plusieurs plateformes rallonge souvent les délais des projets et augmente les coûts.

- De plus, former le personnel d'entrepôt à l'utilisation et à la gestion efficaces des solutions WMS avancées exige du temps et des investissements, ce qui engendre des ralentissements temporaires de la productivité pendant les phases de transition. Cela devient particulièrement difficile pour les entreprises gérant quotidiennement des volumes importants.

- En fin de compte, les obstacles combinés du coût et de la complexité freinent l'adoption à grande échelle, en particulier pour les PME. Le développement de solutions cloud plus rentables, d'interfaces conviviales et de stratégies de mise en œuvre modulaires sera essentiel pour réduire ces contraintes et élargir les opportunités d'adoption mondiale.

Portée du marché des systèmes de gestion d'entrepôt en Asie-Pacifique

Le marché est segmenté en fonction des composants, des fonctions, de l’offre, du déploiement, du type de niveau et de l’utilisateur final.

- Par composants

Sur la base des composants, le marché des systèmes de gestion d'entrepôt est segmenté en grues, systèmes automatisés de stockage et de récupération, robots, convoyeurs et systèmes de tri, véhicules à guidage automatique, etc. En 2024, le segment des systèmes automatisés de stockage et de récupération a dominé la plus grande part de chiffre d'affaires du marché, grâce à son efficacité à automatiser les processus de stockage et de récupération tout en minimisant les coûts de main-d'œuvre et les erreurs humaines. Les entrepôts s'appuient de plus en plus sur les systèmes automatisés de stockage et de récupération pour un stockage haute densité, une exécution plus rapide des commandes et une intégration transparente avec l'infrastructure existante. Leur capacité à gérer divers types de produits et à optimiser l'utilisation de l'espace renforce leur préférence auprès des entrepôts de grande taille et du e-commerce.

Le segment des véhicules à guidage automatique (VGA) devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à leur adoption croissante dans la manutention automatisée et l'intralogistique. Les VGA offrent des solutions de transport flexibles et autonomes au sein des entrepôts, réduisant la dépendance au travail manuel et rationalisant les flux de travail. Leur compatibilité avec la robotique et les logiciels de gestion d'entrepôt (WMS) les rend particulièrement adaptés aux opérations à volume élevé et aux configurations d'entrepôt dynamiques, stimulant ainsi la demande dans les secteurs de la logistique et de la fabrication.

- Par fonctions

Le marché des systèmes de gestion d'entrepôt (SGE) est segmenté en fonction des fonctions : réception et rangement, contrôle des stocks, gestion des parcs et des quais, placement, préparation de commandes, gestion des effectifs et des tâches, expédition, etc. En 2024, le segment du contrôle des stocks détenait la plus grande part de chiffre d'affaires du marché, grâce à son rôle essentiel pour garantir des niveaux de stock précis, réduire les surstocks ou les ruptures de stock et assurer une visibilité en temps réel sur l'entrepôt. Des fonctionnalités avancées de gestion des stocks, telles que les codes-barres, le suivi par radiofréquence et l'intégration aux systèmes de planification des ressources de l'entreprise, ont rendu cette fonction indispensable aux entrepôts modernes en quête d'efficacité opérationnelle et de réduction des coûts.

Le segment de la préparation de commandes devrait connaître le taux de croissance annuel composé le plus rapide entre 2025 et 2032, porté par le besoin croissant d'une exécution des commandes plus rapide et plus précise dans les secteurs du e-commerce et de la vente au détail. Les solutions de préparation de commandes automatisées et semi-automatisées, souvent intégrées à la robotique et à l'intelligence artificielle, réduisent les erreurs de prélèvement, optimisent la répartition de la main-d'œuvre et améliorent le rendement, ce qui en fait un secteur fonctionnel à forte croissance dans les opérations d'entrepôt.

- En offrant

Sur la base de l'offre, le marché des systèmes de gestion d'entrepôt (SGE) est segmenté en logiciels et services. En 2024, le segment des services a dominé le marché avec 81,41 % de chiffre d'affaires, soutenu par la demande croissante de solutions de mise en œuvre, de personnalisation, de formation et de maintenance garantissant une intégration fluide et des performances optimales des SGE. Les entreprises privilégient les services professionnels pour réduire les risques de déploiement, améliorer l'efficacité opérationnelle et exploiter pleinement le potentiel des logiciels avancés. De plus, la complexité croissante des opérations d'entrepôt et le besoin constant de support et de mises à jour contribuent à la domination du segment des services sur le marché.

Le secteur des logiciels devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par le besoin croissant de visibilité en temps réel, d'automatisation et de prise de décision basée sur les données dans les entrepôts. Les logiciels de gestion d'entrepôt (WMS) permettent un contrôle centralisé des stocks, de la gestion des commandes et de l'optimisation des flux de travail, fournissant des informations exploitables qui améliorent l'efficacité opérationnelle et réduisent les coûts d'exploitation.

- Par déploiement

En fonction du déploiement, le marché des systèmes de gestion d'entrepôt (SGE) est segmenté en deux catégories : cloud, SaaS (logiciel en tant que service) et sur site. En 2024, le segment sur site détenait la plus grande part de chiffre d'affaires, les grandes entreprises souhaitant un meilleur contrôle de la sécurité des données, de la personnalisation et des exigences de conformité. Les solutions de SGE sur site offrent aux entreprises la flexibilité nécessaire pour s'intégrer à leur infrastructure informatique existante et se conformer aux normes réglementaires strictes de secteurs sensibles tels que la santé et la chimie.

Le segment du cloud, ou SaaS (logiciel en tant que service), devrait connaître le taux de croissance annuel composé le plus rapide entre 2025 et 2032, grâce à l'adoption croissante de solutions flexibles, évolutives et rentables. Les systèmes de gestion d'entrepôt cloud permettent un accès en temps réel depuis plusieurs sites, réduisent les coûts d'infrastructure initiaux et permettent un déploiement rapide, ce qui les rend particulièrement attractifs pour les PME et les e-commerces multisites en quête d'agilité et de transformation numérique.

- Par type de niveau

Selon le type de niveau, le marché des systèmes de gestion d'entrepôt est segmenté en systèmes de gestion d'entrepôt avancés, systèmes de gestion d'entrepôt intermédiaires et systèmes de gestion d'entrepôt de base. Le segment des systèmes de gestion d'entrepôt avancés a dominé la plus grande part de marché en 2024, grâce à ses fonctionnalités complètes, notamment l'analyse basée sur l'intelligence artificielle, l'intégration de l'automatisation et le suivi des performances en temps réel. Les grands entrepôts et les entreprises de e-commerce privilégient les systèmes de gestion d'entrepôt avancés pour optimiser les flux de travail complexes, améliorer la précision et renforcer la visibilité de la chaîne d'approvisionnement sur plusieurs nœuds.

Le segment des systèmes de gestion d'entrepôt intermédiaires devrait connaître la croissance la plus rapide entre 2025 et 2032, soutenu par une adoption croissante par les entreprises de taille moyenne en quête d'un équilibre entre coût et sophistication fonctionnelle. Les systèmes de gestion d'entrepôt intermédiaires offrent des fonctionnalités modulaires, une intégration aisée et une automatisation suffisante, permettant aux entreprises en croissance d'améliorer l'efficacité de leurs entrepôts sans investissements initiaux importants.

- Par utilisateur final

En fonction de l'utilisateur final, le marché des systèmes de gestion d'entrepôt est segmenté en e-commerce, agroalimentaire, logistique tierce partie, électricité et électronique, automobile, métaux et machines, santé, produits chimiques, etc. En 2024, le e-commerce a représenté la plus grande part de chiffre d'affaires, porté par la croissance exponentielle du commerce en ligne et la nécessité d'une exécution des commandes plus rapide et sans erreur. Un système de gestion d'entrepôt performant permet aux acteurs du e-commerce de gérer des commandes importantes et de petites séries, d'optimiser la rotation des stocks et de répondre aux attentes des consommateurs en matière de livraisons le jour même ou le lendemain.

Le secteur de la logistique tierce partie devrait connaître le taux de croissance annuel composé le plus rapide entre 2025 et 2032, porté par l'externalisation croissante des services d'entreposage et de distribution. Les prestataires de services logistiques tiers s'appuient de plus en plus sur les systèmes de gestion d'entrepôt (WMS) pour proposer des solutions logistiques évolutives, intégrées et technologiques, leur permettant de gérer plusieurs clients, d'assurer des livraisons ponctuelles et d'améliorer l'efficacité opérationnelle de leurs réseaux.

Analyse régionale du marché des systèmes de gestion d'entrepôt en Asie-Pacifique

- La Chine a dominé le marché des systèmes de gestion d'entrepôt avec la plus grande part de revenus en 2024, grâce à son secteur du commerce électronique en pleine croissance, à l'expansion de sa base de fabrication et à l'adoption croissante de solutions d'automatisation et de chaîne d'approvisionnement numérique.

- Des investissements importants dans les infrastructures d'entreposage, associés à la volonté du gouvernement de promouvoir une logistique intelligente et des initiatives de l'Industrie 4.0, renforcent le leadership de la Chine sur le marché régional.

- La présence de fournisseurs nationaux de technologies d'entrepôt de premier plan, les collaborations avec des fournisseurs de solutions mondiaux et l'introduction de systèmes de gestion d'entrepôt rentables mais technologiquement avancés continuent de se consolider

Aperçu du marché des systèmes de gestion d'entrepôt au Japon

Le marché japonais des systèmes de gestion d'entrepôt (SGE) devrait connaître une croissance soutenue de 2025 à 2032, porté par des secteurs manufacturier et logistique de pointe et par l'importance accordée à l'efficacité opérationnelle et à la transformation numérique. Les entreprises japonaises adoptent de plus en plus de solutions de stockage automatisées, de robotique et de logiciels intégrés pour optimiser leurs opérations d'entrepôt. La demande de SGE compacts, multifonctionnels et hautement performants est en hausse en raison de l'espace limité et des coûts de main-d'œuvre élevés. Les investissements continus en recherche et développement et les partenariats entre les fournisseurs de solutions japonais et les entreprises technologiques mondiales renforcent les perspectives de croissance soutenue du marché. L'accent mis par le Japon sur l'innovation, la fiabilité et l'optimisation de la chaîne d'approvisionnement renforce son fort positionnement régional.

Aperçu du marché indien des systèmes de gestion d'entrepôt

Le marché indien des systèmes de gestion d'entrepôt devrait enregistrer le taux de croissance annuel composé le plus rapide de la région Asie-Pacifique entre 2025 et 2032, porté par l'essor du e-commerce, l'essor des activités manufacturières et l'adoption croissante de solutions d'automatisation et de gestion d'entrepôts basées sur le cloud. La prise de conscience croissante de l'efficacité opérationnelle, de l'optimisation des coûts et de la gestion numérique de la chaîne d'approvisionnement accélère l'adoption de ces solutions par les PME. La demande de systèmes de gestion d'entrepôt abordables, évolutifs et faciles à déployer est particulièrement forte parmi les entreprises émergentes. L'expansion des réseaux de distribution et de logistique, la croissance rapide du e-commerce et les initiatives gouvernementales favorisant les infrastructures numériques améliorent l'accessibilité des produits. L'accent croissant mis par l'Inde sur la modernisation des entrepôts lui permet de devenir le marché à la croissance la plus rapide de la région.

Aperçu du marché des systèmes de gestion d'entrepôt aux États-Unis

Le marché américain des systèmes de gestion d'entrepôts devrait connaître une croissance soutenue entre 2025 et 2032, portée par les avancées technologiques continues, l'augmentation des investissements dans les entrepôts automatisés et une forte concentration sur la transformation numérique. Les entreprises privilégient les solutions logicielles permettant l'analyse prédictive, la prévision de la demande et la gestion intelligente des stocks. La collaboration continue entre les fournisseurs de technologies américains et les fournisseurs mondiaux, ainsi que les politiques de soutien à la logistique intelligente, renforcent ces perspectives de croissance soutenue. L'accent mis par le pays sur l'innovation, l'efficacité opérationnelle et la résilience de la chaîne d'approvisionnement renforce son fort positionnement régional sur le marché des systèmes de gestion d'entrepôts.

Part de marché des systèmes de gestion d'entrepôt en Asie-Pacifique

L’industrie des systèmes de gestion d’entrepôt est principalement dirigée par des entreprises bien établies, notamment :

- Blue Yonder Group, Inc. (États-Unis)

- Oracle Corporation (États-Unis)

- SAP SE (Allemagne)

- Infor (États-Unis)

- Manhattan Associates (États-Unis)

- Tecsys Inc. (Canada)

- SENKO Co., Ltd. (Japon)

- Softeon (États-Unis)

- Accelogix LLC (États-Unis)

- Datex Corporation (États-Unis)

- Made4net (États-Unis)

- CAMELOT 3PL SOFTWARE (Allemagne)

- ShipBob, Inc. (États-Unis)

- JAPAN LOGISTIC SYSTEMS CORP. (Japon)

- Synergy Logistics Ltd (Royaume-Uni)

- Honeywell International Inc. (États-Unis)

- IBM Corporation (États-Unis)

- NEC Corporation (Japon)

- Cisco Systems, Inc. (États-Unis)

- Extensiv (États-Unis)

- La Raymond Corporation (États-Unis)

Derniers développements sur le marché des systèmes de gestion d'entrepôt en Asie-Pacifique et aux États-Unis

- En mars 2024, Made4net a présenté son système de gestion d'entrepôt WarehouseExpert et ses solutions d'exécution de bout en bout de la chaîne logistique au salon MODEX 2024. Cette démonstration a mis en avant l'intégration du système aux technologies de robotique et d'automatisation, soulignant sa capacité à améliorer la rapidité et l'efficacité des chaînes logistiques. Ce développement illustre la tendance croissante à intégrer l'automatisation aux systèmes de gestion d'entrepôt pour optimiser l'efficacité opérationnelle et répondre aux exigences des chaînes logistiques modernes.

- En novembre 2023, Blue Yonder, fournisseur leader de solutions pour la chaîne d'approvisionnement, a annoncé l'acquisition de Doddle, une entreprise technologique spécialisée dans la logistique du premier et du dernier kilomètre. Cette acquisition permet à Blue Yonder de proposer une suite logistique plus complète, répondant aux défis d'optimisation de la logistique du premier et du dernier kilomètre, historiquement complexes à gérer. En intégrant la technologie de Doddle à ses solutions existantes de commerce et de retours, Blue Yonder vise à bâtir des chaînes d'approvisionnement de bout en bout plus durables et plus rentables.

- En novembre 2023, Epicor, leader mondial des logiciels d'entreprise sectoriels, a annoncé l'acquisition d'Elite EXTRA, fournisseur leader de solutions cloud de livraison du dernier kilomètre. Cette acquisition renforce la capacité d'Epicor à aider ses clients de divers secteurs à simplifier la logistique du dernier kilomètre et à accroître leur compétitivité sur un marché ultra-concurrentiel. En intégrant les solutions d'Elite EXTRA, Epicor vise à enrichir son offre dans les secteurs de la fabrication, du transport et de la vente, en offrant à ses clients des capacités avancées de livraison du dernier kilomètre.

- En février 2021, The Raymond Corporation a annoncé le lancement d'un nouveau transpalette automatisé, qui vient compléter son offre de solutions intralogistiques. Équipé d'un logiciel de gestion des commandes, ce transpalette automatisé s'intègre parfaitement aux systèmes de gestion d'entrepôt pour optimiser les performances et éliminer les erreurs. Ce développement offre aux entreprises une solution flexible pour les installations de stockage à haute densité et haute sélectivité, diversifiant ainsi leur portefeuille d'automatisation avec de nouveaux produits.

- En mars 2021, Extensiv a lancé une suite optimisée pour les petits colis, dotée de fonctionnalités étendues pour une efficacité accrue et un entrepôt dématérialisé pour les prestataires logistiques tiers proposant des solutions e-commerce et omnicanal. Cette solution permet aux entreprises de rationaliser et de gérer efficacement les petits colis, réduisant ainsi les délais d'emballage et augmentant la rentabilité. En intégrant cette suite à leurs systèmes de gestion d'entrepôt, les entreprises peuvent optimiser leurs processus d'emballage et d'expédition, ce qui améliore leur efficacité opérationnelle.

- En mai 2025, Körber Supply Chain a annoncé le lancement d'un module avancé de gestion d'entrepôt intégrant des analyses prédictives basées sur l'IA. Ce nouveau module permet aux entrepôts de prévoir la demande, d'optimiser l'allocation des stocks et de gérer proactivement les goulots d'étranglement opérationnels. Ce développement renforce la position de Körber sur le marché en permettant à ses clients d'améliorer la productivité de leurs entrepôts, de réduire leurs coûts opérationnels et d'améliorer leurs niveaux de service dans des chaînes d'approvisionnement de plus en plus complexes.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.