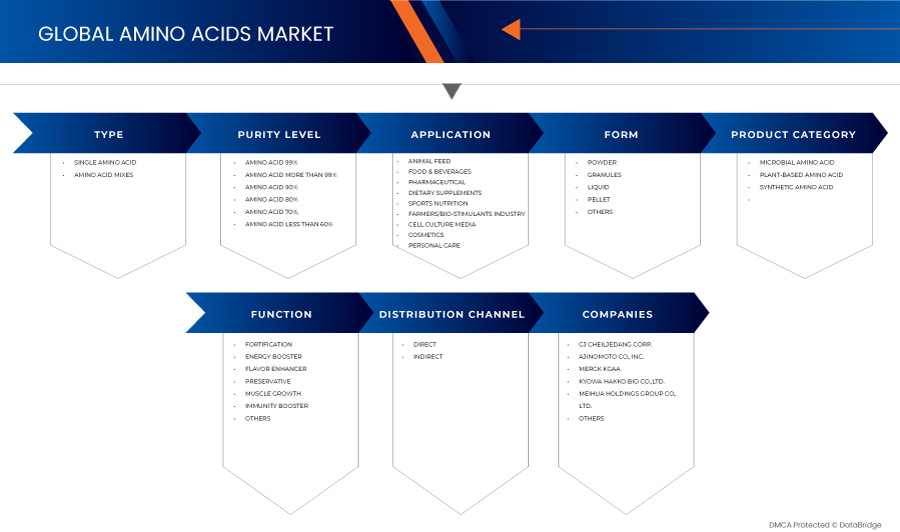

Asia-Pacific Amino Acids Market, By Type of Amino Acid (Glutamic Acid, Methionine, Cysteine, Lysine, Arginine, Tyrosine, Alanine, Leucine, Histidine, Phenylalanine, Valine, Proline, Tryptophan, Glycine, Serine, Isoleucine Threonine, Glutamine, Aspartic Acid, Asparagine, and Others), Purity Level (Amino Acid 99%, Amino Acid More Than 99%, Amino Acid 90%, Amino Acid 80%, Amino Acid 70%, and Amino Acid Less Than 60%), Form (Powder, Granules, Liquid, Pellet, and Others), Product Category (Microbial Amino Acid, Plant-Based Amino Acid, and Synthetic Amino Acid), Function (Fortification, Energy Booster, Flavor Enhancer, Preservative, Muscle Growth, Immunity Booster, and Others), Application (Animal Feed, Food & Beverages, Pharmaceutical, Dietary Supplements, Sports Nutrition, Cell Culture Media, Cosmetic, and Personal Care), Distribution Channel (Direct and Indirect) Industry Trends and Forecast to 2029

Market Analysis and Insights

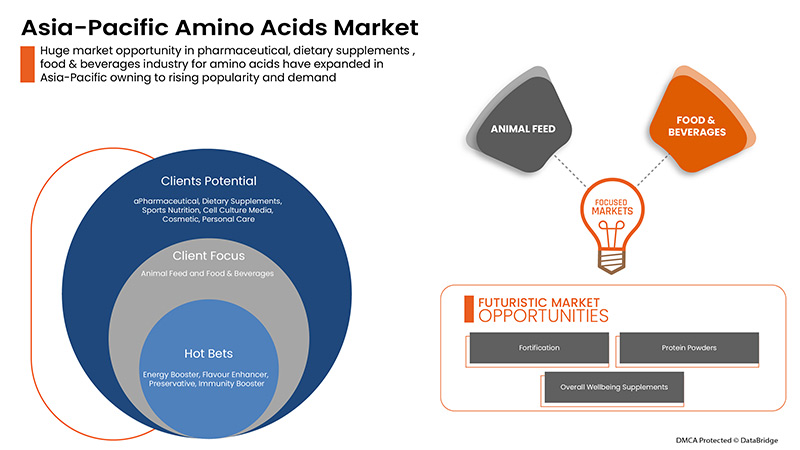

Increasing demand for Amino Acid in various industries such as food and beverages, dietary supplements, cosmetics, and animal feed is driving the global amino acids market growth. In addition, advancement in biotechnology used for amino acid production further enhances market growth. Furthermore, increasing the acceptability of amino acids for medicinal properties is boosting the sales and profit of the players operating in the market, which is expected further to drive the market growth for the amino acids market.

The major restraint impacting the market growth is the complicated manufacturing process. Further, the high logistic cost of amino acid production will also restrain the market growth. On the other hand, the availability of different types of amino acids is expected to act as an opportunity to grow the global amino acids market. In comparison, the challenge for the market growth is the implementation of strict regulations for the commercialization of amino acid products.

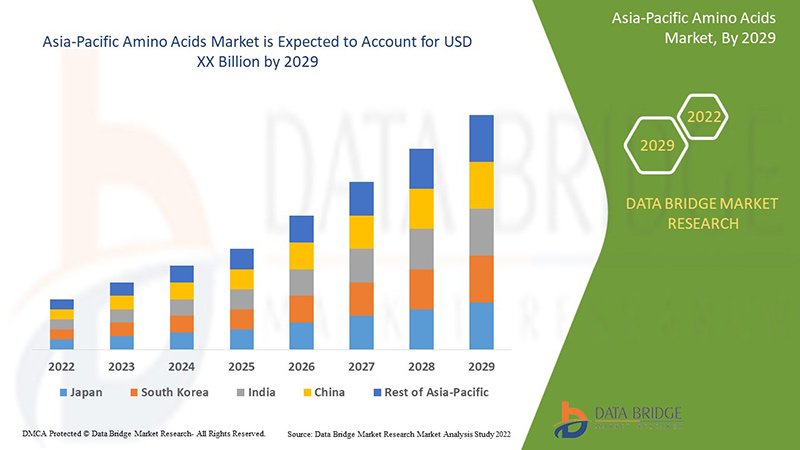

Data Bridge Market Research analyses that the Asia-Pacific amino acids market will grow at a CAGR of 7.2% from 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019- 2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Par type d'acide aminé (acide glutamique, méthionine, cystéine, lysine, arginine, tyrosine, alanine, leucine, histidine, phénylalanine, valine, proline, tryptophane, glycine, sérine, isoleucine, thréonine, glutamine, acide aspartique, asparagine et autres), niveau de pureté (acide aminé 99 %, acide aminé plus de 99 %, acide aminé 90 %, acide aminé 80 %, acide aminé 70 % et acide aminé moins de 60 %), forme (poudre, granulés, liquide, granulés et autres), catégorie de produit (acide aminé microbien, acide aminé d'origine végétale et acide aminé synthétique), fonction (fortification, booster d'énergie, exhausteur de goût, conservateur, croissance musculaire, booster d'immunité et autres), application (alimentation animale, aliments et boissons, produits pharmaceutiques, diététique Suppléments, nutrition sportive, milieux de culture cellulaire, cosmétiques et soins personnels), canal de distribution (direct et indirect) |

|

Pays couverts |

Chine, Inde, Japon, Australie, Corée du Sud, Indonésie, Philippines, Thaïlande, Malaisie, Singapour et reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Français : Merck KGaA, Ajinomoto Co., Inc., KYOWA HAKKO BIO CO., LTD., Evonik Industries AG, ADM, Prinova Group LLC., NOVUS INTERNATIONAL, Qingdao Samin Chemical Co., Ltd., PACIFIC RAINBOW INTERNATIONAL, INC., Daesang, Adisseo, CJ CheilJedang Corp., Global Bio-chem Technology Group Company Limited., Sunrise Nutrachem Group Co., LTD, Kingchem Life Science LLC, NIPPON RIKA Co., LTD., Sichuan Tongsheng Amino acid Co., Ltd, FUFENG GROUP, Asiamerica Group, Inc., Sumitomo Chemical Co., Ltd. |

Définition du marché

Les acides aminés sont des molécules qui se combinent pour former des protéines. Les acides aminés et les protéines sont les éléments constitutifs de la vie. Les acides aminés constituent une part importante de l'alimentation animale et humaine. Dans le corps humain, ils sont nécessaires à des processus vitaux tels que la synthèse des neurotransmetteurs et des hormones. Ils sont bénéfiques pour nourrir le système immunitaire, lutter contre l'arthrite et le cancer, et traiter les maladies rectales et les acouphènes. De nos jours, la demande en acides aminés augmente car ils contribuent à améliorer des conditions telles que la dépression, les troubles du sommeil, le trouble dysphorique prémenstruel (TDPM), le sevrage tabagique, le bruxisme et le trouble déficitaire de l'attention avec hyperactivité (TDAH). Les acides aminés sont également abondants dans la viande rouge, les fruits de mer, les œufs, les produits laitiers et le soja.

Dynamique du marché des acides aminés en Asie-Pacifique

Conducteurs

- Une chaîne d’approvisionnement solide

La disponibilité de matières premières de qualité est essentielle à la fabrication d'acides aminés. Pour assurer un approvisionnement continu en matières premières, les principaux acteurs du marché utilisent des techniques d'intégration en amont et en aval pour garantir un approvisionnement fiable et de haute qualité en matières premières. De tels processus d'intégration verticale garantissent la fiabilité de l'approvisionnement en matières premières et des possibilités de développement de produits nouveaux et créatifs à partir des matières premières actuelles. Par conséquent, une chaîne d'approvisionnement robuste est établie pour la production réalisable d'acides aminés.

En outre, les canaux de distribution directs et indirects solides et rapides mis en place par les fabricants garantissent la livraison rapide des produits, ce qui entraîne une demande accrue d'acides aminés. Par conséquent, la solide chaîne d'approvisionnement stimule la demande d'acides aminés sur le marché car elle garantit la disponibilité rapide des acides aminés.

- Disponibilité de différents types d'acides aminés sur le marché

Les acides aminés peuvent être classés en trois groupes : les acides aminés non essentiels, les acides aminés essentiels et les acides aminés conditionnels. Ces groupes se composent de différents types d'acides aminés en fonction de leurs besoins. Comme chaque acide aminé essentiel a une fonction distincte dans l'organisme, les symptômes de pénurie varient en conséquence. Par conséquent, la disponibilité de différents acides aminés et leurs besoins variables ont conduit à la production de produits contenant différents acides aminés.

Par conséquent, la demande de différents types d’acides aminés a conduit à la production de différents produits avec des compositions et des avantages différents, conduisant finalement à la croissance du marché des acides aminés.

Opportunités

-

Augmentation du nombre d'initiatives prises par les fabricants d'acides aminés

L'augmentation du nombre d'initiatives prises par les fabricants d'acides aminés, telles que le lancement de nouveaux produits, l'expansion, les investissements et autres, créera une excellente opportunité pour la croissance du marché mondial des acides aminés. La demande d'acides aminés augmente dans diverses industries, notamment l'alimentation et les boissons, les cosmétiques, les compléments alimentaires, les produits pharmaceutiques et autres, en raison de ses divers avantages pour la santé, tels que le renforcement du système immunitaire, le développement musculaire, l'aide à la réparation des tissus corporels, le maintien d'une peau, d'ongles et de cheveux sains, et d'autres avantages.

Par exemple,

-

En octobre 2020, Evonik a annoncé le regroupement de sa production de MetAMINO (DL-méthionine) dans trois centres internationaux (Amériques, Europe et Asie). L'entreprise prend cette mesure pour maximiser les économies d'échelle et utiliser des processus robustes. L'entreprise vise à renforcer sa position en améliorant sa position en matière de coûts

Ainsi, l’augmentation du nombre de lancements d’acides aminés, l’expansion, les investissements pour augmenter la production et d’autres initiatives des fabricants, associés à la demande croissante d’acides aminés dans différentes industries, devraient créer une opportunité massive pour les acides aminés sur le marché mondial.

Retenue/Défi

- Forte concurrence entre les acteurs du marché

La forte concurrence entre les acteurs du marché déjà existants constitue un défi de taille pour les nouveaux acteurs qui souhaitent entrer sur le marché, car plusieurs d'entre eux proposent des produits à base d'acides aminés de haute qualité pour différents utilisateurs finaux, notamment les fabricants de produits alimentaires et de boissons, l'industrie pharmaceutique, les fabricants de compléments alimentaires et autres. De plus, certains acteurs locaux et fabricants à petite échelle proposent des produits de mauvaise qualité ou des produits contrefaits à des prix moins chers, ce qui affecte le marché mondial des acides aminés. En outre, l'augmentation du nombre de fabricants proposant une large gamme d'acides aminés pour différentes applications entraînera une concurrence féroce pour les autres acteurs du marché.

L’augmentation du nombre d’acteurs proposant des acides aminés de haute qualité pour différentes applications crée un défi majeur sur le marché mondial des acides aminés.

Impact post-COVID-19 sur le marché des acides aminés en Asie-Pacifique

Après la pandémie, la demande de compléments alimentaires et de produits alimentaires sains a augmenté, car il n'y aura plus de restrictions de mouvement ; par conséquent, l'approvisionnement en produits serait facile. La persistance du COVID-19 pendant une période plus longue a affecté la chaîne d'approvisionnement car elle a été perturbée, et il est devenu difficile de fournir les produits alimentaires aux consommateurs, ce qui a initialement diminué la demande de produits. Cependant, après le COVID, la demande de produits alimentaires de santé et de bien-être a considérablement augmenté en raison d'une sensibilisation accrue aux avantages des acides aminés dans les aliments sains et nutritifs à long terme, augmentant la demande de produits à base d'acides aminés. Les consommateurs essaient de mener une vie saine. Ils sont plus enclins à se tourner vers les produits alimentaires les plus bénéfiques, tels que les aliments et boissons à base de plantes, végétaliens et nutritionnels, car ils sont enrichis en acides aminés.

Développements récents

- En décembre 2021, Bayer a lancé Ambition, le premier biostimulant à base d'acides aminés, sur le marché chinois. Le produit étudie le potentiel de développement agricole, de sorte que les cultures poussent de manière énergique avec une grande résistance au stress pour un rendement élevé et une qualité élevée, ce qui profite à la récolte des agriculteurs, à la protection des sols et à la sécurité des consommateurs. Ambition est adapté à l'agriculture biologique

- En octobre 2017, Daesang, une entreprise sud-coréenne de fabrication de produits alimentaires, a affirmé avoir réussi à créer pour la première fois dans le pays de la L-histidine, un acide aminé à haute valeur ajoutée. La L-histidine est abondante dans les poissons à chair rouge et à peau bleue. Elle est fréquemment utilisée dans les produits pharmaceutiques, les compléments alimentaires et les aliments pour animaux.

Portée du marché des acides aminés en Asie-Pacifique

Le marché des acides aminés de la région Asie-Pacifique est segmenté en sept segments notables : types d’acides aminés, niveau de pureté, forme, catégorie de produit, fonction, application et canal de distribution.

La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Types d'acides aminés

- Acide glutamique

- Méthionine

- Cystéine

- Lysine

- Arginine

- Tyrosine

- Alanine

- Leucine

- Histidine

- Phénylalanine

- Valine

- Proline

- Tryptophane

- Glycine

- Sérine

- Isoleucine

- Thréonine

- Glutamine

- Acide aspartique

- Asparagine

- Autres

Sur la base des types d'acides aminés, le marché des acides aminés Asie-Pacifique est segmenté en alanine, arginine, acide aspartique, cystéine, acide glutamique, glutamine, glycine, histidine, isoleucine, leucine, lysine, méthionine, phénylalanine, proline, sérine, asparagine, thréonine, tyrosine, tryptophane, valine et autres.

Niveau de pureté

- Acide aminé 99%

- Acide aminé à plus de 99 %

- Acide aminé 90%

- Acide aminé 80%

- Acide aminé 70%

- Acide aminé inférieur à 60 %

Sur la base du niveau de pureté, le marché des acides aminés de la région Asie-Pacifique est segmenté en acides aminés inférieurs à 60 %, acides aminés à 70 %, acides aminés à 80 %, acides aminés à 90 %, acides aminés à 99 % et acides aminés à plus de 99 %.

Formulaire

- Poudre

- Granulés

- Liquide

- Pastille

- Autres

Sur la base de la forme, le marché des acides aminés Asie-Pacifique est segmenté en liquide, cristal, poudre, granulés et autres.

Teneur en matières grasses

- Sans gras

- Faible en gras

- À teneur réduite en matières grasses

Sur la base de la teneur en matières grasses, le marché des acides aminés de la région Asie-Pacifique est segmenté en sans matières grasses, à faible teneur en matières grasses et à teneur réduite en matières grasses.

Catégorie de produit

- Acide aminé microbien

- Acide aminé d'origine végétale

- Acide aminé synthétique

Sur la base de la catégorie de produits, le marché des acides aminés d'Asie-Pacifique est segmenté en acides aminés d'origine végétale, acides aminés d'origine microbienne et acides aminés synthétiques.

Fonction

- Fortification

- Booster d'énergie

- Exhausteur de goût

- Conservateur

- Croissance musculaire

- Renforcement de l'immunité

- Autres

Sur la base de la fonction, le marché des acides aminés est divisé en booster d'immunité, conservateur, exhausteur de goût, fortification, croissance musculaire, booster d'énergie et autres.

Application

- Alimentation animale

- Alimentation et boissons

- Pharmaceutique

- Compléments alimentaires

- Nutrition sportive

- Milieux de culture cellulaire

- Cosmétique

- Soins personnels

Sur la base des applications, le marché des acides aminés de la région Asie-Pacifique est segmenté en aliments et boissons, compléments alimentaires, produits pharmaceutiques, nutrition sportive, aliments pour animaux, soins personnels, cosmétiques et milieux de culture cellulaire.

Canal de distribution

- Direct

- Indirect

Sur la base du canal de distribution, le marché des acides aminés d’Asie-Pacifique est segmenté en direct et indirect.

Analyse/perspectives régionales des marchés des acides aminés en Asie-Pacifique

Le marché des acides aminés en Asie-Pacifique est analysé et des informations sur la taille et les tendances du marché sont fournies sur la base des références ci-dessus.

Les pays couverts par le rapport sur les marchés des aliments de santé et de bien-être en Asie-Pacifique sont la Chine, l'Inde, le Japon, l'Australie, la Corée du Sud, l'Indonésie, les Philippines, la Thaïlande, la Malaisie, Singapour et le reste de l'Asie-Pacifique.

The China dominates the Asia-Pacific amino acids market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the livestock industry's industrialization and the country's economic growth. The Asia-Pacific region's demand for meat-based food items is increasing, boosting the region's amino acid market.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Asia-Pacific brands, their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Amino Acids Market Share Analysis

The competitive Asia-Pacific amino acids market details the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, and application dominance. The above data points only relate to the companies' focus on the Asia-Pacific amino acids market.

Some of the major players operating in the Asia-Pacific amino acids market are Merck KGaA, Ajinomoto Co., Inc., KYOWA HAKKO BIO CO., LTD., Evonik Industries AG, ADM, Prinova Group LLC., NOVUS INTERNATIONAL, Qingdao Samin Chemical Co.,Ltd., PACIFIC RAINBOW INTERNATIONAL, INC., Daesang, Adisseo, CJ CheilJedang Corp., Global Bio-chem Technology Group Company Limited., Sunrise Nutrachem Group Co.,LTD, Kingchem Life Science LLC, NIPPON RIKA Co., LTD., Sichuan Tongsheng Amino acid Co., Ltd, FUFENG GROUP, Asiamerica Group, Inc. and Sumitomo Chemical Co., Ltd. among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC AMINO ACIDS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN ANALYSIS

4.1.1 RAW MATERIAL PROCUREMENT

4.1.2 MANUFACTURING PROCESS

4.1.3 MARKETING AND DISTRIBUTION

4.1.4 END USERS

4.2 SUPPLY SHORTAGE

4.3 TECHNOLOGICAL ADVANCEMENT

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.5.1 MANUFACTURERS ARE DOING EXPANSIONS TO CATER TO THE DEMAND

4.5.2 LAUNCH OF DIFFERENT AMINO ACIDS BY MANUFACTURERS

4.5.3 MANUFACTURERS LAUNCHING NATURAL INGREDIENT BASED/PLANT-BASED AMINO ACIDS

4.5.4 FUTURE PERSPECTIVE

4.6 FACTOR INFLUENCING PURCHASE DECISION (B2B)

4.6.1 HIGH NUTRITIONAL VALUE

4.6.2 PRICING OF THE AMINO ACIDS

4.6.3 HIGH QUALITY

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR AMINO ACIDS IN VARIOUS INDUSTRIES

6.1.2 ADVANCEMENTS IN BIOTECHNOLOGY USED FOR THE PRODUCTION OF AMINO ACIDS

6.1.3 AVAILABILITY OF DIFFERENT TYPES OF AMINO ACIDS IN THE MARKET

6.1.4 STRONG SUPPLY CHAIN

6.2 RESTRAINTS

6.2.1 COMPLICATED MANUFACTURING PROCESS

6.2.2 STRICT GOVERNMENT REGULATIONS

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR AMINO ACIDS FOR DIETARY SUPPLEMENTS

6.3.2 RISING DEMAND FOR NUTRITIOUS AND HEALTHY PRODUCTS

6.3.3 INCREASING NUMBER OF INITIATIVES TAKEN BY AMINO ACID MANUFACTURERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG THE MARKET PLAYERS

6.4.2 RISING AWARENESS REGARDING THE SIDE EFFECTS OF AMINO ACIDS

7 ASIA PACIFIC AMINO ACIDS MARKET, BY TYPE OF AMINO ACID

7.1 OVERVIEW

7.2 GLUTAMIC ACID

7.3 METHIONINE

7.4 CYSTEINE

7.5 LYSINE

7.6 ARGININE

7.7 TYROSINE

7.8 ALANINE

7.9 LEUCINE

7.1 HISTIDINE

7.11 PHENYLALANINE

7.12 VALINE

7.13 PROLINE

7.14 TRYPTOPHAN

7.15 GLYCINE

7.16 SERINE

7.17 ISOLEUCINE

7.18 THREONINE

7.19 GLUTAMINE

7.2 ASPARTIC ACID

7.21 ASPARAGINE

7.22 OTHERS

8 ASIA PACIFIC AMINO ACIDS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ANIMAL FEED

8.2.1 ANIMAL FEED, BY ANIMAL TYPE

8.2.1.1 POULTRY FEED

8.2.1.1.1 BROILERS

8.2.1.1.2 BREEDERS

8.2.1.1.3 LAYERS

8.2.1.2 RUMINANT FEED

8.2.1.2.1 CALVES

8.2.1.2.2 DAIRY CATTLE

8.2.1.2.3 BEEF CATTLE

8.2.1.2.4 OTHERS

8.2.1.3 SWINE FEED

8.2.1.3.1 STARTER

8.2.1.3.2 GROWER

8.2.1.3.3 SOW

8.2.1.4 PET FOOD

8.2.1.4.1 DOGS

8.2.1.4.2 CATS

8.2.1.4.3 BIRDS

8.2.1.4.4 RABBIT

8.2.1.4.5 OTHERS

8.2.1.5 AQUACULTURE

8.2.1.5.1 FISH

8.2.1.5.2 CRUSTACEANS

8.2.1.5.3 MOLLUSKS

8.2.1.5.4 OTHERS

8.2.1.6 OTHERS

8.2.2 ANIMAL FEED, BY PRODUCT CATEGORY

8.2.2.1 PLANT-BASED AMINO ACID

8.2.2.2 MICROBIAL AMINO ACID

8.2.2.3 SYNTHETIC AMINO ACID

8.3 FOOD & BEVERAGES

8.3.1 FOOD & BEVERAGES, BY TYPE

8.3.1.1 BEVERAGES

8.3.1.1.1 BEVERAGES, BY TYPE

8.3.1.1.1.1 JUICES

8.3.1.1.1.2 SPORTS DRINKS

8.3.1.1.1.3 ENERGY DRINKS

8.3.1.1.1.4 DAIRY BASED DRINKS

8.3.1.1.1.4.1 REGULAR PROCESSED MILK

8.3.1.1.1.4.2 FLAVOURED MILK

8.3.1.1.1.4.3 MILK SHAKES

8.3.1.1.1.5 PLANT-BASED BEVERAGES

8.3.1.1.1.5.1 SOY MILK

8.3.1.1.1.5.2 ALMOND MILK

8.3.1.1.1.5.3 OAT MILK

8.3.1.1.1.5.4 CASHEW MILK

8.3.1.1.1.5.5 COCONUT MILK

8.3.1.1.1.5.6 OTHERS

8.3.1.1.1.6 SMOOTHIES

8.3.1.2 PROCESSED FOOD

8.3.1.2.1 PROCESSED FOOD, BY TYPE

8.3.1.2.1.1 SAUCES, DRESSINGS AND CONDIMENTS

8.3.1.2.1.2 JAMS, PRESERVES & MARMALADES

8.3.1.2.1.3 READY MEALS

8.3.1.2.1.4 SOUPS

8.3.1.2.1.5 OTHERS

8.3.1.3 BAKERY

8.3.1.3.1 BAKERY, BY TYPE

8.3.1.3.1.1 BREAD & ROLLS

8.3.1.3.1.2 BISCUIT, COOKIES & CRACKERS

8.3.1.3.1.3 CAKES, PASTRIES & TRUFFLE

8.3.1.3.1.4 TART & PIES

8.3.1.3.1.5 BROWNIES

8.3.1.3.1.6 OTHER

8.3.1.4 DAIRY PRODUCTS

8.3.1.4.1 DAIRY PRODUCTS, BY TYPE

8.3.1.4.1.1 ICE CREAM

8.3.1.4.1.2 CHEESE

8.3.1.4.1.3 YOGURT

8.3.1.4.1.4 OTHERS

8.3.1.5 CONVENIENCE FOOD

8.3.1.5.1 CONVENIENCE FOOD, BY TYPE

8.3.1.5.1.1 SNACKS & EXTRUDED SNACKS

8.3.1.5.1.2 PIZZA & PASTA

8.3.1.5.1.3 INSTANT NOODLES

8.3.1.5.1.4 OTHERS

8.3.1.6 FUNCTIONAL FOOD

8.3.1.7 FROZEN DESSERTS

8.3.1.7.1 FROZEN DESSERTS, BY TYPE

8.3.1.7.1.1 GELATO

8.3.1.7.1.2 CUSTARD

8.3.1.7.1.3 OTHERS

8.3.1.8 CONFECTIONERY

8.3.1.8.1 CONFECTIONARY, BY TYPE

8.3.1.8.1.1 GUMS & JELLIES

8.3.1.8.1.2 HARD-BOILED SWEETS

8.3.1.8.1.3 CHOCOLATE

8.3.1.8.1.4 CHOCOLATE SYRUPS

8.3.1.8.1.5 CARAMELS & TOFFEES

8.3.1.8.1.6 MINTS

8.3.1.8.1.7 OTHERS

8.3.1.9 INFANT FORMULA

8.3.1.9.1 INFANT FORMULA, BY TYPE

8.3.1.9.1.1 FIRST INFANT FORMULA

8.3.1.9.1.2 ANTI-REFLUX (STAY DOWN) FORMULA

8.3.1.9.1.3 COMFORT FORMULA

8.3.1.9.1.4 HYPOALLERGENIC FORMULA

8.3.1.9.1.5 FOLLOW-ON FORMULA

8.3.1.9.1.6 OTHERS

8.3.2 FOOD AND BEVERAGES, BY PRODUCT CATEGORY

8.3.2.1 PLANT-BASED AMINO ACID

8.3.2.2 MICROBIAL AMINO ACID

8.3.2.3 SYNTHETIC AMINO ACID

8.4 PHARMACEUTICAL

8.4.1 PHARMACEUTICAL, BY PRODUCT CATEGORY

8.4.1.1 PLANT-BASED AMINO ACID

8.4.1.2 MICROBIAL AMINO ACID

8.4.1.3 SYNTHETIC AMINO ACID

8.4.2 PHARMACEUTICAL, BY TYPE OF AMINO ACID

8.4.2.1 GLUTAMIC ACID

8.4.2.2 METHIONINE

8.4.2.3 CYSTEINE

8.4.2.4 LYSINE

8.4.2.5 ARGININE

8.4.2.6 TYROSINE

8.4.2.7 ALANINE

8.4.2.8 LEUCINE

8.4.2.9 HISTIDINE

8.4.2.10 PHENYLALANINE

8.4.2.11 VALINE

8.4.2.12 PROLINE

8.4.2.13 TRYPTOPHAN

8.4.2.14 GLYCINE

8.4.2.15 SERINE

8.4.2.16 ISOLEUCINE

8.4.2.17 THREONINE

8.4.2.18 GLUTAMINE

8.4.2.19 ASPARTIC ACID

8.4.2.20 ASPARAGINE

8.4.2.21 OTHERS

8.5 DIETARY SUPPLEMENTS

8.5.1 DIETARY SUPPLEMENTS, BY TYPE

8.5.1.1 IMMUNITY SUPPLEMENTS

8.5.1.2 BONE AND JOINT HEALTH SUPPLEMENTS

8.5.1.3 OVERALL WELLBEING SUPPLEMENTS

8.5.1.4 BRAIN HEALTH SUPPLEMENTS

8.5.1.5 SKIN HEALTH SUPPLEMENTS

8.5.1.6 OTHERS

8.5.2 DIETARY SUPPLEMENTS, BY PRODUCT CATEGORY

8.5.2.1 PLANT-BASED AMINO ACID

8.5.2.2 MICROBIAL AMINO ACID

8.5.2.3 SYNTHETIC AMINO ACID

8.5.3 DIETARY SUPPLEMENTS, BY TYPE OF AMINO ACID

8.5.3.1 GLUTAMIC ACID

8.5.3.2 METHIONINE

8.5.3.3 CYSTEINE

8.5.3.4 LYSINE

8.5.3.5 ARGININE

8.5.3.6 TYROSINE

8.5.3.7 ALANINE

8.5.3.8 LEUCINE

8.5.3.9 HISTIDINE

8.5.3.10 PHENYLALANINE

8.5.3.11 VALINE

8.5.3.12 PROLINE

8.5.3.13 TRYPTOPHAN

8.5.3.14 GLYCINE

8.5.3.15 SERINE

8.5.3.16 ISOLEUCINE

8.5.3.17 THREONINE

8.5.3.18 GLUTAMINE

8.5.3.19 ASPARTIC ACID

8.5.3.20 ASPARAGINE

8.5.3.21 OTHERS

8.6 SPORTS NUTRITION

8.6.1 SPORTS NUTRITION, BY TYPE

8.6.1.1 SPORT DRINK MIXES

8.6.1.2 ENERGY GELS

8.6.1.3 SPORTS NUTRITION BARS

8.6.1.4 PROTEIN POWDERS

8.6.1.5 OTHERS

8.6.2 SPORTS NUTRITION, BY PRODUCT CATEGORY

8.6.2.1 PLANT-BASED AMINO ACID

8.6.2.2 MICROBIAL AMINO ACID

8.6.2.3 SYNTHETIC AMINO ACID

8.6.3 SPORTS NUTRITION, BY TYPE OF AMINO ACID

8.6.3.1 GLUTAMIC ACID

8.6.3.2 METHIONINE

8.6.3.3 CYSTEINE

8.6.3.4 LYSINE

8.6.3.5 ARGININE

8.6.3.6 TYROSINE

8.6.3.7 ALANINE

8.6.3.8 LEUCINE

8.6.3.9 HISTIDINE

8.6.3.10 PHENYLALANINE

8.6.3.11 VALINE

8.6.3.12 PROLINE

8.6.3.13 TRYPTOPHAN

8.6.3.14 GLYCINE

8.6.3.15 SERINE

8.6.3.16 ISOLEUCINE

8.6.3.17 THREONINE

8.6.3.18 GLUTAMINE

8.6.3.19 ASPARTIC ACID

8.6.3.20 ASPARAGINE

8.6.3.21 OTHERS

8.7 CELL CULTURE MEDIA

8.7.1 CELL CULTURE MEDIA, BY PRODUCT CATEGORY

8.7.1.1 PLANT-BASED AMINO ACID

8.7.1.2 MICROBIAL AMINO ACID

8.7.1.3 SYNTHETIC AMINO ACID

8.7.2 CELL CULTURE MEDIA, BY TYPE OF AMINO ACID

8.7.2.1 GLUTAMIC ACID

8.7.2.2 METHIONINE

8.7.2.3 CYSTEINE

8.7.2.4 LYSINE

8.7.2.5 ARGININE

8.7.2.6 TYROSINE

8.7.2.7 ALANINE

8.7.2.8 LEUCINE

8.7.2.9 HISTIDINE

8.7.2.10 PHENYLALANINE

8.7.2.11 VALINE

8.7.2.12 PROLINE

8.7.2.13 TRYPTOPHAN

8.7.2.14 GLYCINE

8.7.2.15 SERINE

8.7.2.16 ISOLEUCINE

8.7.2.17 THREONINE

8.7.2.18 GLUTAMINE

8.7.2.19 ASPARTIC ACID

8.7.2.20 ASPARAGINE

8.7.2.21 OTHERS

8.8 COSMETIC

8.8.1 COSMETIC, BY TYPE

8.8.1.1 FACE SERUMS

8.8.1.2 FACE CREAM

8.8.1.3 LIP CARE AND LIPSTICK PRODUCTS

8.8.1.4 OTHERS

8.8.2 COSMETIC, BY PRODUCT CATEGORY

8.8.2.1 PLANT-BASED AMINO ACID

8.8.2.2 MICROBIAL AMINO ACID

8.8.2.3 SYNTHETIC AMINO ACID

8.8.3 COSMETIC, BY TYPE OF AMINO ACID

8.8.3.1 GLUTAMIC ACID

8.8.3.2 METHIONINE

8.8.3.3 CYSTEINE

8.8.3.4 LYSINE

8.8.3.5 ARGININE

8.8.3.6 TYROSINE

8.8.3.7 ALANINE

8.8.3.8 LEUCINE

8.8.3.9 HISTIDINE

8.8.3.10 PHENYLALANINE

8.8.3.11 VALINE

8.8.3.12 PROLINE

8.8.3.13 TRYPTOPHAN

8.8.3.14 GLYCINE

8.8.3.15 SERINE

8.8.3.16 ISOLEUCINE

8.8.3.17 THREONINE

8.8.3.18 GLUTAMINE

8.8.3.19 ASPARTIC ACID

8.8.3.20 ASPARAGINE

8.8.3.21 OTHERS

8.9 PERSONAL CARE

8.9.1 PERSONAL CARE, BY TYPE

8.9.1.1 SKIN CARE

8.9.1.2 HAIR CARE

8.9.2 PERSONAL CARE, BY PRODUCT CATEGORY

8.9.2.1 PLANT-BASED AMINO ACID

8.9.2.2 MICROBIAL AMINO ACID

8.9.2.3 SYNTHETIC AMINO ACID

9 ASIA PACIFIC AMINO ACIDS MARKET, BY PURITY LEVEL

9.1 OVERVIEW

9.2 AMINO ACID 99%

9.3 AMINO ACID MORE THAN 99%

9.4 AMINO ACID 90%

9.5 AMINO ACID 80%

9.6 AMINO ACID 70%

9.7 AMINO ACID LESS THAN 60%

10 ASIA PACIFIC AMINO ACIDS MARKET, BY FORM

10.1 OVERVIEW

10.2 POWDER

10.2.1 POWDER, BY TYPE

10.2.1.1 FINE POWDER

10.2.1.2 CRYSTALLINE POWDER

10.2.1.3 GRANULAR POWDER

10.3 GRANULES

10.4 LIQUID

10.5 PELLET

10.6 OTHERS

11 ASIA PACIFIC AMINO ACIDS MARKET, BY PRODUCT CATEGORY

11.1 OVERVIEW

11.2 MICROBIAL AMINO ACID

11.2.1 MICROBIAL AMINO ACID, BY TYPE

11.2.1.1 BACTERIA

11.2.1.2 FUNGI

11.2.1.3 YEAST

11.3 PLANT-BASED AMINO ACID

11.4 SYNTHETIC AMINO ACID

12 ASIA PACIFIC AMINO ACIDS MARKET, BY FUNCTION

12.1 OVERVIEW

12.2 FORTIFICATION

12.3 ENERGY BOOSTER

12.4 FLAVOR ENHANCER

12.5 PRESERVATIVE

12.6 MUSCLE GROWTH

12.7 IMMUNITY BOOSTER

12.8 OTHERS

13 ASIA PACIFIC AMINO ACIDS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT

13.3 INDIRECT

14 ASIA PACIFIC AMINO ACIDS MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 INDIA

14.1.3 JAPAN

14.1.4 AUSTRALIA

14.1.5 SOUTH KOREA

14.1.6 INDONESIA

14.1.7 PHILIPPINES

14.1.8 THAILAND

14.1.9 MALAYSIA

14.1.10 SINGAPORE

14.1.11 REST OF ASIA-PACIFIC

15 COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 AJINOMOTO CO., INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 CJ CHEILJEDANG CORP.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 MERCK KGAA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 FUFENG GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 DAESANG

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 KYOWA HAKKO BIO CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 COMPANY SHARE ANALYSIS

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 ADISSEO

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 ADM

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 AMINO GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ASIAMERICA GROUP, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 EVONIK INDUSTRIES AG

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 ASIA PACIFIC BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 KINGCHEM LIFE SCIENCE LLC

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 NIPPON RIKA CO., LTD.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 NOVUS INTERNATIONAL

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 PANGAEA SCIENCES.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 PACIFIC RAINBOW INTERNATIONAL, INC.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 PRINOVA GROUP LLC.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 QINGDAO SAMIN CHEMICAL CO., LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 SICHUAN TONGSHENG AMINO ACID CO., LTD

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 SUMITOMO CHEMICAL.

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 SUNRISE NUTRACHEM GROUP CO.,LTD

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des figures

FIGURE 1 ASIA PACIFIC AMINO ACIDS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC AMINO ACIDS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC AMINO ACIDS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC AMINO ACIDS MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC AMINO ACIDS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC AMINO ACIDS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC AMINO ACIDS MARKET : DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC AMINO ACIDS MARKET : VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC AMINO ACIDS MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC AMINO ACIDS MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCREASING USE OF AMINO ACIDS IN FOOD AND BEVERAGES, PERSONAL CARE, COSMETIC PRODUCTS, ANIMAL FEED AND PHARMACEUTICAL DRUGS IS LEADING THE GROWTH OF THE ASIA PACIFIC AMINO ACIDS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TYPE OF AMINO ACID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC AMINO ACIDS MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC AMINO ACIDS MARKET

FIGURE 15 ASIA PACIFIC AMINO ACIDS MARKET: BY TYPE OF AMINO ACID, 2021

FIGURE 16 ASIA PACIFIC AMINO ACIDS MARKET, BY APPLICATION

FIGURE 17 ASIA PACIFIC AMINO ACIDS MARKET: BY PURITY LEVEL, 2021

FIGURE 18 ASIA PACIFIC AMINO ACIDS MARKET: BY FORM, 2021

FIGURE 19 ASIA PACIFIC AMINO ACIDS MARKET: BY PRODUCT CATEGORY, 2021

FIGURE 20 ASIA PACIFIC AMINO ACIDS MARKET: BY FUNCTION, 2021

FIGURE 21 ASIA PACIFIC AMINO ACIDS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 ASIA-PACIFIC AMINO ACIDS MARKET: SNAPSHOT (2021)

FIGURE 23 ASIA-PACIFIC AMINO ACIDS MARKET: BY COUNTRY (2021)

FIGURE 24 ASIA-PACIFIC AMINO ACIDS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 ASIA-PACIFIC AMINO ACIDS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 ASIA-PACIFIC AMINO ACIDS MARKET: BY TYPE OF AMINO ACID (2022 & 2029)

FIGURE 27 ASIA PACIFIC AMINO ACIDS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.