Asia Pacific Aluminum Foil Market

Taille du marché en milliards USD

TCAC :

%

USD

37.73 Billion

USD

97.50 Billion

2024

2032

USD

37.73 Billion

USD

97.50 Billion

2024

2032

| 2025 –2032 | |

| USD 37.73 Billion | |

| USD 97.50 Billion | |

|

|

|

Segmentation du marché de la feuille d'aluminium en Asie-Pacifique, par produit (emballages en aluminium, sachets, blisters, tubes pliables, plateaux/conteneurs, capsules, couvercles laminés, sacs doublés d'aluminium, feuilles de chocolat, joints ronds en aluminium, autres), type (imprimé, non imprimé), épaisseur (0,07 MM, 0,09 MM, 0,2 MM, 0,4 MM), utilisateur final (aliments, produits pharmaceutiques, cosmétiques, isolation, électronique, échantillonnage géochimique, composants automobiles, autres) - Tendances et prévisions de l'industrie jusqu'en 2032

Analyse du marché du papier d'aluminium

Le papier aluminium est utilisé dans une large gamme de produits dans le monde entier. En raison d'une prise de conscience croissante de la pollution générée par les plastiques dans l'environnement, les clients peuvent utiliser le papier aluminium dans les fours traditionnels et à convection, ce qui leur donne le choix de l'utiliser dans les deux cas. Ils protègent également les échantillons de roche des solvants organiques en formant un joint.

Taille du marché du papier d'aluminium

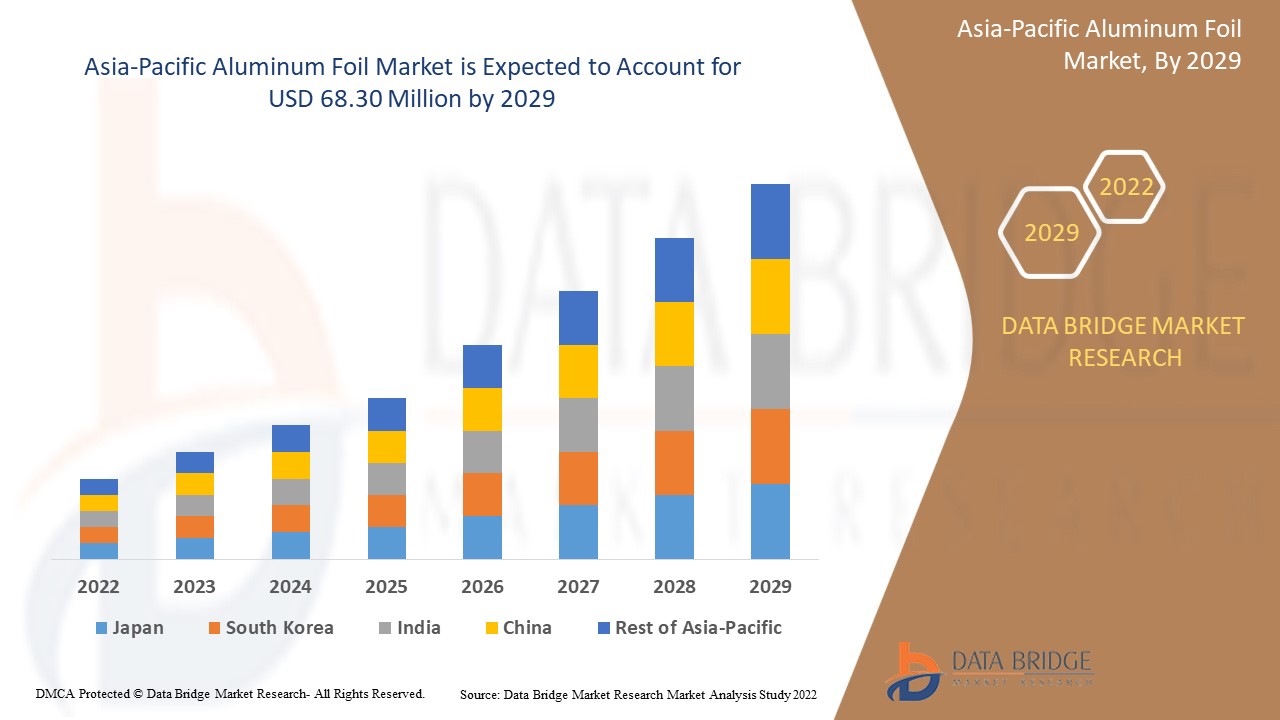

La taille du marché des feuilles d'aluminium en Asie-Pacifique était évaluée à 37,73 milliards USD en 2024 et devrait atteindre 97,50 milliards USD d'ici 2032, avec un TCAC de 12,6 % au cours de la période de prévision de 2025 à 2032.

Portée du rapport et segmentation du marché

|

Attributs |

Informations clés sur le marché du papier d'aluminium |

|

Segmentation |

|

|

Pays couverts |

Japon, Chine, Inde, Corée du Sud, Australie et Nouvelle-Zélande, Singapour, Malaisie, Thaïlande, Indonésie, Philippines, reste de l'Asie-Pacifique. |

|

Principaux acteurs du marché |

Amcor PLC (Suisse), Constantia Flexibles (Autriche), Coppice Alupack Limited (Royaume-Uni), Aditya Birla management corporation Pvt ltd (Bombay), Eurofoil (Luxembourg), Hulamin Limited (Afrique du Sud), Novelis Aluminum (États-Unis), Tetra Pak SA (Suisse), RUSAL (Russie), Wyda Packaging (Pty) LTD (Afrique du Sud), Alufoil Products Pvt Ltd (Inde), Assan Aluminyum Sanavi ve Ticaret AS (Istanbul), Constellium SE (France), Norsk Hydro ASA (Norvège), Reynolds Consumer Products (États-Unis), Raviraj Foils Ltd (Inde), Zhangjiagang Goldshine Aluminum Foil Co. (Chine), Aliberico (Espagne) |

|

Opportunités de marché |

|

Définition du marché du papier d'aluminium

Le papier aluminium est un composant essentiel des stratifiés et est couramment utilisé dans les emballages alimentaires. Il offre une fonction barrière plus élevée contre l'humidité, l'oxygène et d'autres gaz, ainsi que contre les odeurs volatiles et la lumière, que tout autre matériau stratifié en plastique. Le papier aluminium est également utilisé pour fabriquer des emballages stérilisés. Les feuilles d'aluminium offrent de nombreux avantages aux industries de l'emballage et de l'alimentation ainsi qu'au consommateur, notamment la convivialité et la recyclabilité.

Dynamique du marché du papier d'aluminium

Conducteurs

- Initiatives gouvernementales croissantes pour sensibiliser les consommateurs

En raison de l’augmentation des activités gouvernementales visant à sensibiliser à la sécurité alimentaire, le marché est poussé par une demande accrue de papier d’aluminium de la part des utilisateurs finaux tels que les industries alimentaires, pharmaceutiques et cosmétiques.

- Des règles et réglementations strictes en matière de sécurité alimentaire

Le progrès de l’industrie du papier d’aluminium domestique est dû aux réglementations gouvernementales concernant les normes de sécurité et de qualité alimentaires, qui encouragent les fabricants à créer des solutions d’emballage efficaces qui empêchent la contamination des aliments.

- Augmenter la demande de vente au détail en ligne

L'évolution de la dynamique du secteur de la vente au détail devrait stimuler la demande de différents produits de vente au détail, ce qui favorisera la croissance des produits d'emballage prêts à l'emploi. En outre, le développement du segment de la vente au détail en ligne a déplacé les consommateurs des magasins de détail vers les magasins en ligne. L'industrie alimentaire en ligne restera probablement un marché de consommation clé pour les produits en aluminium.

- Demande croissante de produits biologiques

Le développement de la biotechnologie et la demande croissante de produits biologiques devraient stimuler la demande de feuilles d’aluminium dans les produits, tels que les poudres, les liquides et les comprimés dans le pays.

Opportunités

- Augmentation des innovations de produits

Pour assurer la croissance du marché, le nombre croissant d'innovations de produits devrait ouvrir de nouvelles perspectives de marché. L'aluminium est un matériau recyclable qui représente une opportunité lucrative pour les fabricants, car l'augmentation des taux de collecte et de récupération du produit se traduit par une baisse du prix de production et une amélioration de la rentabilité.

- Demande de production d'emballages légers

L'utilisation de feuilles d'aluminium accompagnées de films souples pour produire des emballages légers a augmenté de manière raisonnable. Cela devrait offrir de nouvelles opportunités aux vendeurs du marché à court terme. Ces emballages peuvent être utilisés dans les emballages alimentaires, de café et de poisson.

Contraintes/Défis

Le marché mondial connaît une croissance fulgurante. Cependant, il existe des obstacles sur la voie de la croissance. Parmi ces obstacles, on peut citer le manque de techniques d'emballage appropriées ; certains pays s'en tiennent encore aux méthodes traditionnelles. En raison de l'évolution des modes de vie, une grande partie de la population mondiale n'a toujours pas assez d'argent pour acheter des aliments emballés. Ce sont là les principales contraintes du marché qui entraveront le taux de croissance du marché.

Ce rapport sur le marché de la feuille d'aluminium fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché de la feuille d'aluminium, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Portée du marché de la feuille d'aluminium en Asie-Pacifique

Le marché des feuilles d'aluminium est segmenté en fonction des produits, des types, de l'épaisseur et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produits

- Emballages en aluminium

- Pochettes

- Blisters

- Tubes pliables

- Plateaux/Conteneurs

- Gélules

- Couvercles laminés

- Sacs doublés d'aluminium

- Feuilles de chocolat

- Joints ronds en aluminium

- Autres

Taper

- Imprimé

- Non imprimé

Épaisseur

- 0,07 mm

- 0,09 mm

- 0,2 mm

- 0,4 MM

Utilisateur final

- Nourriture

- Médicaments

- Produits de beauté

- Isolation

- Électronique

- Échantillonnage géochimique

- Composants automobiles

- Autres

Analyse régionale du marché du papier d'aluminium

Le marché du papier d’aluminium est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, produits, types, épaisseur et utilisateur final comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché du papier d'aluminium sont le Japon, la Chine, l'Inde, la Corée du Sud, l'Australie et la Nouvelle-Zélande, Singapour, la Malaisie, la Thaïlande, l'Indonésie, les Philippines, le reste de l'Asie-Pacifique,

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Part de marché du papier d'aluminium

Le paysage concurrentiel du marché de la feuille d'aluminium fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché de la feuille d'aluminium.

Les leaders du marché du papier d'aluminium opérant sur le marché sont :

- Amcor PLC (Suisse)

- Constantia Flexibles (Autriche)

- Coppice Alupack Ltd. (Royaume-Uni)

- Aditya Birla Management Corporation Pvt Ltd (Inde)

- Eurofoil (Luxembourg)

- Hulamin Limited (Afrique du Sud)

- Novelis Aluminium (États-Unis)

- Tetra Pak International SA (Suisse)

- RUSAL (Russie)

- Wyda Packaging (Pty) LTD (Afrique du Sud)

- Alufoil Products Pvt Ltd (Inde)

- Assan Aluminyum Sanavi ve Ticaret AS (Istanbul)

- Constellium SE (France)

- Norsk Hydro ASA (Norvège)

- Produits de consommation Reynolds (États-Unis)

- Raviraj Foils Ltd (Inde)

- Zhangjiagang Goldshine Aluminium Foil Co. (Chine)

- Alibérico (Espagne)

Dernières évolutions sur le marché du papier d'aluminium

- En novembre 2021, ProAmpac a déclaré que sa société mère, IFP Investments Limited, avait développé Irish Flexible Packaging et Fispak. Il s'agit de producteurs et fournisseurs irlandais d'emballages durables et flexibles destinés aux marchés du poisson, des produits laitiers, de la boulangerie, de la viande et du fromage en Irlande et dans le monde entier.

- En septembre 2021, Flex Films, la branche de fabrication de films de la société d'emballages flexibles Uflex, a lancé son film haute barrière BOPET F-UHB-M. Le film est prévu pour remplacer la feuille d'aluminium dans les applications d'emballage flexible afin de résoudre les tâches de l'industrie qui ont une faible intégrité, une disponibilité des matériaux, un prix élevé des matériaux, entre autres. Ces alternatives sur le marché peuvent conduire la production alimentaire à remplacer la feuille d'aluminium pour emballer les produits, ce qui devrait remettre en cause la croissance du marché

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.