Affichage 2D Asie-Pacifique pour le marché de la défense et de l'aérospatiale, par technologie d'affichage (écrans à cristaux liquides (LCD), diode électroluminescente (LED), LED organique (OLED), micro-LED et autres), type (tactile et non tactile), résolution (Full HD, HD, 4K et autres), taille du panneau (5 pouces à 10 pouces, supérieur à 10 pouces et inférieur à 5 pouces), type d'affichage (écran conventionnel et écran intelligent), canal de vente (OEM et détaillant), application (aérospatiale et défense) Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché de l'affichage 2D pour la défense et l'aérospatiale en Asie-Pacifique

Le marché des écrans 2D pour l'aérospatiale et la défense est un marché spécialisé qui fournit des écrans pour les applications aérospatiales militaires et commerciales. Les écrans utilisés sur ce marché doivent répondre à des exigences strictes en matière de fiabilité, de performances et de durabilité et être conformes à diverses normes réglementaires. Le marché des écrans 2D pour l'aérospatiale et la défense devrait connaître une croissance régulière dans les années à venir, tirée par la demande croissante de technologies d'affichage avancées, la croissance de l'industrie aérospatiale et de défense et le besoin d'améliorer la connaissance de la situation et les capacités de communication dans l'aviation militaire et commerciale. L'émergence de nouvelles technologies, telles que les écrans haute résolution, les écrans tactiles et les écrans de réalité augmentée, devrait également stimuler la croissance de ce marché.

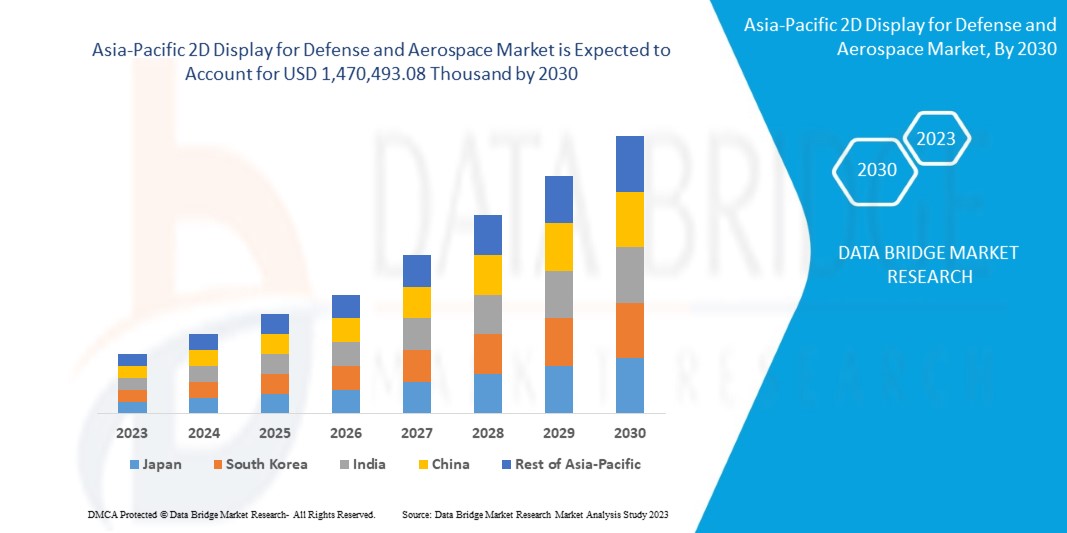

Selon les analyses de Data Bridge Market Research, le marché de l'affichage 2D pour la défense et l'aérospatiale en Asie-Pacifique devrait atteindre une valeur de 1 470 493,08 milliers de dollars d'ici 2030, à un TCAC de 5,9 % au cours de la période de prévision. Le rapport sur le marché de l'affichage 2D pour la défense et l'aérospatiale en Asie-Pacifique couvre également de manière exhaustive l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, prix en dollars américains |

|

Segments couverts |

Par technologie d'affichage (écrans à cristaux liquides (LCD), diodes électroluminescentes (LED), LED organiques (OLED), micro-LED, autres), type (tactile, non tactile), résolution (Full HD, HD, 4K, autres), taille du panneau (5 pouces à 10 pouces, supérieur à 10 pouces, inférieur à 5 pouces), type d'affichage (écran conventionnel, écran intelligent), canal de vente (OEM, détaillant), application (aérospatiale, défense) |

|

Régions couvertes |

Chine, Japon, Corée du Sud, Inde, Australie, Nouvelle-Zélande, Singapour, Taïwan, Malaisie, Thaïlande, Indonésie, Philippines, Vietnam et reste de l'Asie-Pacifique |

|

Acteurs du marché couverts |

Astronautics Corporation of America, FDS Avionics Corp., ScioTeq, Excelitas Technologies Corp., DIEHL STIFTUNG & CO. KG, US Micro Products, Honeywell International Inc., Barco, BAE Systems, Thales, Garmin Ltd., WINMATE INC, Collins Aerospace, D&T Inc et Elbit Systems Ltd., entre autres. |

Définition du marché

Un dispositif d'affichage est un périphérique de sortie permettant de présenter des informations sous forme visuelle ou tactile. Lorsque les informations d'entrée fournies comportent un signal électrique, l'affichage est appelé affichage électronique. Un visiocasque 2D (HMD) est un dispositif d'affichage porté sur la tête ou dans le cadre d'un casque doté d'une petite optique d'affichage devant un œil (HMD monoculaire) ou chaque œil (HMD binoculaire). Un HMD a de nombreuses utilisations, notamment dans les jeux, l'aviation, l'ingénierie et la médecine. Les casques de réalité virtuelle sont des HMD combinés à des IMU. Il existe également un visiocasque optique (OHMD), un écran portable qui peut refléter des images projetées et permettre à un utilisateur de voir à travers.

Affichage 2D de la dynamique du marché de la défense et de l'aérospatiale en Asie-Pacifique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

CONDUCTEURS

- CROISSANCE DES PROGRAMMES DE MODERNISATION MILITAIRE DANS LE MONDE

La modernisation militaire consiste à mettre à jour et à améliorer les capacités et les équipements militaires d'une nation afin de mieux répondre aux défis de sécurité actuels et futurs. Elle implique l'acquisition de nouveaux systèmes d'armes, de nouvelles technologies et de nouvelles infrastructures, ainsi que le développement de nouvelles stratégies et doctrines. La modernisation militaire est importante pour une nation car elle permet de maintenir une capacité de dissuasion crédible contre des adversaires potentiels, d'améliorer la préparation et l'efficacité militaires et de garantir que l'armée peut s'acquitter des rôles et des missions qui lui sont assignés. Alors que les nations du monde entier augmentent leurs budgets de défense respectifs, le nombre de programmes de modernisation militaire augmente également.

- CROISSANCE DE LA DEMANDE EN TECHNOLOGIES D'AFFICHAGE AVANCÉES

La défense des gouvernements du monde entier et l'industrie aérospatiale nécessitent des écrans avancés capables de fournir des images haute résolution, des informations en temps réel et une meilleure connaissance de la situation aux pilotes et aux soldats. Il existe donc une demande croissante d'écrans 2D capables de répondre à ces exigences.

OPPORTUNITÉ

- AUGMENTATION DE LA DEMANDE DE SYSTÈMES DE SIMULATION ET DE FORMATION

Les systèmes de simulation et de formation dans le secteur de la défense et de l'aérospatiale sont des outils et des technologies utilisés pour simuler des scénarios réels et former le personnel militaire et les pilotes. Ces systèmes peuvent simuler divers scénarios, des opérations de routine aux scénarios complexes du champ de bataille, et permettent au personnel militaire de s'entraîner et de perfectionner ses compétences dans un environnement sûr et contrôlé. L'importance des systèmes de simulation et de formation dans le secteur de la défense et de l'aérospatiale ne peut être surestimée. Ces systèmes permettent de garantir que le personnel militaire est bien formé et préparé à toute situation qu'il peut rencontrer. En outre, ils contribuent à réduire le risque d'accidents ou de mésaventures lors d'exercices d'entraînement ou de missions.

RESTRICTIONS/DÉFIS

- RÉGLEMENTATIONS GOUVERNEMENTALES STRICTES

Des réglementations gouvernementales strictes devraient restreindre le marché de l'affichage 2D de la défense et de l'aérospatiale en Asie-Pacifique en créant des obstacles à l'achat et à l'utilisation de certaines technologies d'affichage 2D. Ces réglementations sont mises en place pour garantir que les technologies utilisées dans l'industrie de la défense et de l'aérospatiale répondent à certaines normes de sécurité et de sûreté.

- OBSOLESCENCE TECHNOLOGIQUE ÉLEVÉE DANS LE SECTEUR DE LA DÉFENSE ET DE L'AÉROSPATIAL

L'obsolescence technologique fait référence à l'état d'obsolescence dû aux progrès technologiques. Cela signifie qu'une technologie, un produit ou un service autrefois populaire et très demandé peut devenir obsolète et inutilisable à mesure que des technologies plus récentes et plus avancées sont développées et largement disponibles. Dans le contexte du marché, l'obsolescence technologique peut se produire lorsque la technologie d'affichage 2D utilisée dans la défense et l'aérospatiale devient obsolète et est remplacée par des technologies plus récentes et plus avancées, ce qui entraîne une baisse de la demande pour l'ancienne technologie. Il s'agit d'un défi dans l'industrie de la défense et de l'aérospatiale, où la technologie doit être constamment mise à jour et améliorée pour s'adapter aux besoins et aux exigences changeants de l'armée. Dans le cas des écrans 2D pour la défense et l'aérospatiale, l'obsolescence technologique peut limiter la croissance du marché de plusieurs manières.

Impact post-COVID-19 sur le marché de l'affichage 2D pour la défense et l'aérospatiale en Asie-Pacifique

La pandémie de COVID-19 a eu un impact considérable sur le secteur de l’aérospatiale et de la défense, notamment sur le marché des écrans 2D. La pandémie a entraîné une baisse du trafic aérien et une réduction des dépenses de défense, ce qui a eu un impact sur la demande d’écrans 2D utilisés dans les avions et les applications de défense. L’un des principaux impacts de la pandémie a été la perturbation de la chaîne d’approvisionnement de la région Asie-Pacifique, qui a entraîné des pénuries de matières premières et de composants utilisés dans la fabrication d’écrans 2D. Cela a entraîné des retards dans la production et la livraison des écrans, ce qui a eu un impact sur la capacité des entreprises de l’aérospatiale et de la défense à terminer leurs projets à temps. La pandémie a également entraîné une baisse de la demande d’avions commerciaux, ce qui a eu un impact sur la demande d’écrans 2D utilisés dans les écrans de cockpit et d’autres applications. En outre, la réduction des dépenses de défense a entraîné un ralentissement des achats militaires, ce qui a eu un impact sur la demande d’écrans utilisés dans les applications militaires.

Développements récents

- En mars 2022, Nighthawk Flight Systems, Inc. a annoncé que la société avait obtenu la certification AS9100/ISO9001. Cette certification a permis à l'entreprise de concevoir et de fabriquer des systèmes d'affichage intégrés compacts. Qui est utilisé pour l'aviation générale, l'aviation d'affaires, l'armée, le transport aérien et les avions régionaux dans le cadre de l'affichage 2D Asie-Pacifique pour le marché de la défense et de l'aérospatiale

- En août 2020, Aspen Avionics, Inc. a annoncé que la société avait conclu un accord avec le groupe de sociétés aérospatiales AIRO. Cette étape a permis d'élargir les investissements et les ressources de l'entreprise et d'accroître ses technologies non seulement dans le domaine de l'avionique pour l'aviation générale, mais également pour proposer des produits avioniques pour les plates-formes de vol habitées et sans pilote pour les avions commerciaux, militaires, robotiques et multimodaux sous l'affichage 2D Asie-Pacifique pour le marché de la défense et de l'aérospatiale

Affichage 2D pour le marché de la défense et de l'aérospatiale en Asie-Pacifique

Le marché de l'affichage 2D pour la défense et l'aérospatiale en Asie-Pacifique est segmenté en fonction de la technologie d'affichage, du type, de la résolution, de la taille du panneau, du type d'affichage, du canal de vente et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu et des informations précieuses sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par technologie d'affichage

- Écrans à cristaux liquides (LCD)

- Diode électroluminescente (DEL)

- LED organique (OLED)

- Micro-LED

- Autres

Sur la base de la technologie d'affichage, le marché de l'affichage 2D Asie-Pacifique pour la défense et l'aérospatiale est segmenté en écrans à cristaux liquides (LCD) , diodes électroluminescentes (LED), LED organiques (OLED), micro-LED et autres.

Par type

- Touche

- Sans contact

Sur la base du type, le marché de l'affichage 2D Asie-Pacifique pour la défense et l'aérospatiale est segmenté en tactile et non tactile.

Par résolution

- Full HD

- Haute définition

- 4K

- Autres

Sur la base de la résolution, le marché de l'affichage 2D Asie-Pacifique pour la défense et l'aérospatiale est segmenté en Full HD, HD, 4K et autres.

Par taille de panneau

- 5 pouces à 10 pouces

- Plus de 10 pouces

- Moins de 5 pouces

Sur la base de la taille du panneau, le marché des écrans 2D de la zone Asie-Pacifique pour la défense et l'aérospatiale est segmenté en 5 à 10 pouces, plus de 10 pouces et moins de 5 pouces.

Par type d'affichage

- Affichage conventionnel

- Affichage intelligent

Sur la base du type d'affichage, le marché de l'affichage 2D Asie-Pacifique pour la défense et l'aérospatiale est segmenté en affichage conventionnel et affichage intelligent.

Par canal de vente

- OEM

- Détaillant

Sur la base du canal de vente, le marché de l'affichage 2D Asie-Pacifique pour la défense et l'aérospatiale est segmenté en OEM et détaillants.

Par application

- Aérospatial

- Défense

Sur la base de l'application, le marché de l'affichage 2D Asie-Pacifique pour la défense et l'aérospatiale est segmenté en aérospatiale et défense

Analyse/perspectives régionales du marché de l'affichage 2D pour la défense et l'aérospatiale en Asie-Pacifique

L'analyse du marché de l'affichage 2D pour la défense et l'aérospatiale en Asie-Pacifique est réalisée. Comme indiqué ci-dessus, des informations sur la taille et les tendances du marché sont fournies par région, technologie d'affichage, type, résolution, taille du panneau, type d'affichage, canal de vente et application.

Les pays couverts dans le rapport sur le marché de l'affichage 2D pour la défense et l'aérospatiale en Asie-Pacifique sont la Chine, le Japon, la Corée du Sud, l'Inde, l'Australie, la Nouvelle-Zélande, Singapour, Taïwan, la Malaisie, la Thaïlande, l'Indonésie, les Philippines, le Vietnam et le reste de l'Asie-Pacifique.

La Chine domine la région Asie-Pacifique, car elle a connu une augmentation de ses budgets de défense et de ses investissements dans les technologies aérospatiales et de défense.

La section régionale du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques d'Asie-Pacifique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données de la région.

Analyse du paysage concurrentiel et des parts de marché de l'affichage 2D pour la défense et l'aérospatiale en Asie-Pacifique

Le paysage concurrentiel du marché de l'affichage 2D pour la défense et l'aérospatiale en Asie-Pacifique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Asie-Pacifique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'accent mis par les entreprises sur le marché de l'affichage 2D pour la défense et l'aérospatiale en Asie-Pacifique.

Certains des principaux acteurs opérant sur le marché de l'affichage 2D pour la défense et l'aérospatiale en Asie-Pacifique sont Astronautics Corporation of America, FDS Avionics Corp., ScioTeq, Excelitas Technologies Corp., DIEHL STIFTUNG & CO. KG, US Micro Products, Honeywell International Inc., Barco, BAE Systems, Thales, Garmin Ltd., WINMATE INC, Collins Aerospace, D&T Inc et Elbit Systems Ltd., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 COMPONENT CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 TECHNOLOGICAL TRENDS

4.3 COMPANY COMPARATIVE ANALYSIS

4.4 VALUE CHAIN ANALYSIS

4.5 PATENT ANALYSIS

4.6 CASE STUDY

4.7 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING MILITARY MODERNIZATION PROGRAMS ACROSS THE GLOBE

5.1.2 GROWING DEMAND FOR ADVANCED DISPLAY TECHNOLOGIES

5.1.3 EMERGING REQUIREMENTS OF ENHANCED COMMUNICATION SYSTEMS

5.1.4 INCREASE IN TECHNOLOGICAL ADVANCEMENTS IN DISPLAY TECHNOLOGY

5.2 RESTRAINTS

5.2.1 HIGH DEVELOPMENT AND MANUFACTURING COSTS ASSOCIATED WITH ADVANCED 2D DISPLAYS

5.2.2 STRINGENT GOVERNMENT REGULATIONS

5.3 OPPORTUNITIES

5.3.1 INCREASE IN DEMAND FOR SIMULATION AND TRAINING SYSTEMS

5.3.2 INCREASING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.3.3 RISE IN DEMAND FOR HEAD-MOUNTED DISPLAYS (HMDS)

5.3.4 EXPANSION OF THE DEFENSE AND AEROSPACE INDUSTRY ACROSS THE GLOBE

5.4 CHALLENGES

5.4.1 INTEGRATION CHALLENGES ASSOCIATED WITH ADVANCED 2D DISPLAYS

5.4.2 HIGH TECHNOLOGICAL OBSOLESCENCE IN DEFENCE AND AEROSPACE SECTOR

6 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY TYPE

6.1 OVERVIEW

6.2 LIQUID CRYSTAL DISPLAYS (LCD)

6.3 LIGHT EMITTING DIODE (LED)

6.4 ORGANIC LED (OLED)

6.4.1 RIGID

6.4.2 FLEXIBLE

6.4.3 FOLDABLE

6.5 MICRO-LED

6.6 OTHERS

7 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY TYPE

7.1 OVERVIEW

7.2 TOUCH

7.3 NON-TOUCH

8 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY RESOLUTION

8.1 OVERVIEW

8.2 FULL HD

8.3 HD

8.4 4K

8.5 OTHERS

9 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY PANEL SIZE

9.1 OVERVIEW

9.2 5 INCHES TO 10 INCHES

9.3 GREATER THAN 10 INCHES

9.4 LESS THAN 5 INCHES

10 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY DISPLAY TYPE

10.1 OVERVIEW

10.2 CONVENTIONAL DISPLAY

10.3 SMART DISPLAY

11 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY SALES CHANNEL

11.1 OVERVIEW

11.2 OEMS

11.3 RETAIL

12 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 AEROSPACE

12.2.1 BY TYPE

12.2.1.1 PRIMARY FLIGHT DISPLAY

12.2.1.2 MULTI-FUNCTIONAL DISPLAY

12.2.1.3 BACKUP DISPLAY

12.2.1.4 MISSION DISPLAY

12.2.2 BY TYPE

12.2.2.1 AIRCRAFT

12.2.2.2 HELICOPTERS

12.2.2.3 OTHERS

12.3 DEFENCE

12.3.1 BY TYPE

12.3.1.1 LAND

12.3.1.2 AIRBORNE

12.3.1.3 NAVAL

13 ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 INDIA

13.1.3 JAPAN

13.1.4 SOUTH KOREA

13.1.5 AUSTRALIA

13.1.6 SINGAPORE

13.1.7 TAIWAN

13.1.8 MALAYSIA

13.1.9 THAILAND

13.1.10 INDONESIA

13.1.11 PHILIPPINES

13.1.12 NEW ZEALAND

13.1.13 VIETNAM

13.1.14 REST OF ASIA-PACIFIC

14 ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 HONEYWELL INTERNATIONAL INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCTS PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 THALES

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SOLUTION PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 COLLINS AEROSPACE

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 SOLUTION PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 EXCELITAS TECHNOLOGIES CORP.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCTS PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 BAE SYSTEMS

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCTS PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ASPEN AVIONICS, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ASTRONAUTICS CORPORATION OF AMERICA

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCTS PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 AVMAP SRL

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCTS PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BARCO

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 SOLUTION PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 DIEHL STIFTUNG & CO. KG

16.10.1 COMPANY SNAPSHOT

16.10.2 SOLUTION PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 D&T INC

16.11.1 COMPANY SNAPSHOT

16.11.2 SOLUTION PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 ELBIT SYSTEMS LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 BUSINESS PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 FDS AVIONICS CORP.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCTS PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 GARMIN LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KORRY

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCTS PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 MEGGIT PLC

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCTS PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NIGHTHAWK FLIGHT SYSTEMS, INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 ROSEN AVIATION.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 SCIOTEQ

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 US MICRO PRODUCTS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 WINMATE INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 PATENT ANALYSIS

TABLE 2 REGULATORY STANDARDS

TABLE 3 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 4 ASIA PACIFIC LIQUID CRYSTAL DISPLAYS (LCD) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 ASIA PACIFIC LIGHT EMITTING DIODE (LED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 ASIA PACIFIC ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 ASIA PACIFIC ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 ASIA PACIFIC MICRO-LED IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 ASIA PACIFIC OTHERS IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA PACIFIC TOUCH IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA PACIFIC NON-TOUCH IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA PACIFIC FULL HD IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 ASIA PACIFIC HD IN 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA PACIFIC 4K IN 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA PACIFIC OTHERS IN 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 19 ASIA PACIFIC 5 INCHES TO 10 INCHES IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 ASIA PACIFIC GREATER THAN 10 INCHES IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 ASIA PACIFIC LESS THAN 5 INCHES IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 ASIA PACIFIC CONVENTIONAL DISPLAY IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 ASIA PACIFIC SMART DISPLAY IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 26 ASIA PACIFIC OEMS IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 ASIA PACIFIC RETAIL IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 29 ASIA PACIFIC AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 ASIA PACIFIC AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 ASIA PACIFIC AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 ASIA PACIFIC DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 ASIA PACIFIC DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 CHINA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 47 CHINA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 CHINA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 CHINA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 50 CHINA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 51 CHINA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 CHINA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 53 CHINA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 54 CHINA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 CHINA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 CHINA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 INDIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 58 INDIA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 INDIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 INDIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 61 INDIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 62 INDIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 INDIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 64 INDIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 65 INDIA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 INDIA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 INDIA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 JAPAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 69 JAPAN ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 JAPAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 JAPAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 72 JAPAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 73 JAPAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 JAPAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 75 JAPAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 76 JAPAN AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 JAPAN AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 JAPAN DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 SOUTH KOREA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 80 SOUTH KOREA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 SOUTH KOREA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 SOUTH KOREA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 83 SOUTH KOREA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 84 SOUTH KOREA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 SOUTH KOREA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 86 SOUTH KOREA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 87 SOUTH KOREA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 SOUTH KOREA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 SOUTH KOREA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 AUSTRALIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 91 AUSTRALIA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 AUSTRALIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 AUSTRALIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 94 AUSTRALIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 95 AUSTRALIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 AUSTRALIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 97 AUSTRALIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 98 AUSTRALIA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 AUSTRALIA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 AUSTRALIA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 SINGAPORE 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 102 SINGAPORE ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 SINGAPORE 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 SINGAPORE 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 105 SINGAPORE 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 106 SINGAPORE 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 SINGAPORE 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 108 SINGAPORE 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 109 SINGAPORE AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 SINGAPORE AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 SINGAPORE DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 TAIWAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 113 TAIWAN ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 TAIWAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 TAIWAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 116 TAIWAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 117 TAIWAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 118 TAIWAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 119 TAIWAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 120 TAIWAN AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 TAIWAN AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 TAIWAN DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 MALAYSIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 124 MALAYSIA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 MALAYSIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 MALAYSIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 127 MALAYSIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 128 MALAYSIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 MALAYSIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 130 MALAYSIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 131 MALAYSIA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 132 MALAYSIA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 133 MALAYSIA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 THAILAND 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 135 THAILAND ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 THAILAND 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 137 THAILAND 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 138 THAILAND 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 139 THAILAND 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 THAILAND 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 141 THAILAND 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 142 THAILAND AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 THAILAND AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 THAILAND DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 145 INDONESIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 146 INDONESIA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 INDONESIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 INDONESIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 149 INDONESIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 150 INDONESIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 151 INDONESIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 152 INDONESIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 153 INDONESIA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 154 INDONESIA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 155 INDONESIA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 156 PHILIPPINES 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 157 PHILIPPINES ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 158 PHILIPPINES 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 PHILIPPINES 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 160 PHILIPPINES 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 161 PHILIPPINES 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 162 PHILIPPINES 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 163 PHILIPPINES 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 164 PHILIPPINES AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 165 PHILIPPINES AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 166 PHILIPPINES DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 167 NEW ZEALAND 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 168 NEW ZEALAND ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 169 NEW ZEALAND 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 170 NEW ZEALAND 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 171 NEW ZEALAND 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 172 NEW ZEALAND 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 173 NEW ZEALAND 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 174 NEW ZEALAND 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 175 NEW ZEALAND AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 176 NEW ZEALAND AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 177 NEW ZEALAND DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 178 VIETNAM 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 179 VIETNAM ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 180 VIETNAM 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 181 VIETNAM 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 182 VIETNAM 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 183 VIETNAM 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 VIETNAM 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 185 VIETNAM 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 186 VIETNAM AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 187 VIETNAM AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 188 VIETNAM DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 189 REST OF ASIA-PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC 2D DIPLAY FOR DEFENSE AND AEROSPACE MARKET: DBMR TRIPOD DATA VALIDATION MODEL

FIGURE 3 ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: MULTIVARIATE MODELLING

FIGURE 10 ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: DISPLAY TECHNOLOGY CURVE

FIGURE 11 THE MARKET CHALLENGE MATRIX BY DISPLAY TECHNOLOGY

FIGURE 12 ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 13 ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: SEGMENTATION

FIGURE 14 EMERGING REQUIREMENTS OF ENHANCED COMMUNICATION SYSTEMS IS EXPECTED TO BE A KEY DRIVER FOR ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 LIQUID CRYSTAL DISPLAYS (LCD) IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET IN 2023 TO 2030

FIGURE 16 TECHNOLOGY TRENDS IN 2D DISPLAY FOR AEROSPACE AND DEFENSE

FIGURE 17 COMPANY COMPARISON

FIGURE 18 VALUE CHAIN FOR THE ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET

FIGURE 20 TOP 7 DEFENSE BUDGET OF NATION ACROSS THE GLOBE OF 2023 (IN USD)

FIGURE 21 MILITARY EXPENDITURE (% OF GDP) OF U.S., U.K., INDIA, CHINA, AND RUSSIA (2013-2021)

FIGURE 22 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY DISPLAY TECHNOLOGY, 2022

FIGURE 23 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY TYPE, 2022

FIGURE 24 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY RESOLUTION, 2022

FIGURE 25 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY PANEL SIZE, 2022

FIGURE 26 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY DISPLAY TYPE, 2022

FIGURE 27 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY SALES CHANNEL, 2022

FIGURE 28 ASIA PACIFIC 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY APPLICATION, 2022

FIGURE 29 ASIA-PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: SNAPSHOT (2022)

FIGURE 30 ASIA-PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY COUNTRY (2022)

FIGURE 31 ASIA-PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 32 ASIA-PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 33 ASIA-PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY DISPLAY TECHNOLOGY (2023-2030)

FIGURE 34 ASIA PACIFIC 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.