Marché des services de tests bioanalytiques en Afrique, par type (services bioanalytiques pour études précliniques et cliniques, services bioanalytiques de petites molécules et services bioanalytiques de grandes molécules), utilisateur final (organismes de recherche clinique, sociétés pharmaceutiques et biotechnologiques, laboratoires hospitaliers, instituts universitaires et de recherche et autres), tendances de l'industrie et prévisions jusqu'en 2029

Analyse et perspectives du marché

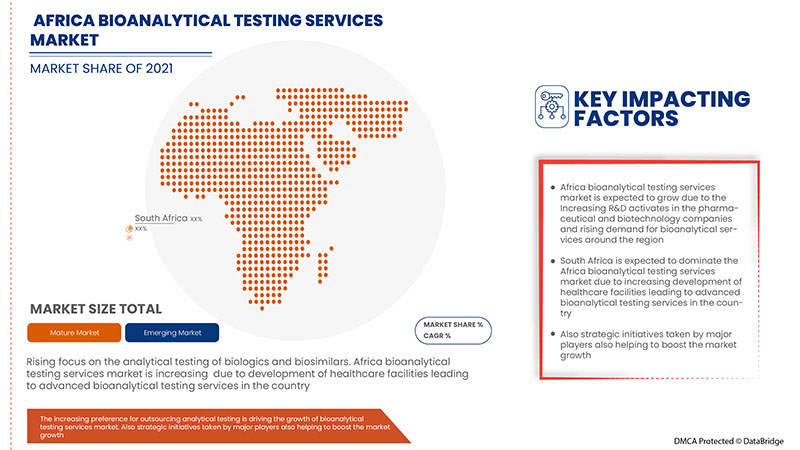

L'importance croissante accordée aux tests analytiques des produits biologiques et biosimilaires a renforcé la demande du marché. L'augmentation des dépenses de santé pour de meilleurs services de santé contribue également à la croissance du marché. Les principaux acteurs du marché se concentrent sur le lancement et l'approbation de divers services au cours de cette période cruciale. En outre, la préférence croissante pour l'externalisation des tests analytiques contribue également à la demande croissante de services de tests bioanalytiques dans la région.

Le marché africain des services de tests bioanalytiques connaît une croissance au cours de l'année de prévision en raison de l'augmentation du nombre d'acteurs du marché et de la disponibilité de services avancés. Parallèlement à cela, les fabricants sont engagés dans des activités de R&D pour lancer de nouveaux services sur le marché. La demande croissante de services de tests bioanalytiques spécialisés stimule encore la croissance du marché. Cependant, la pénurie de professionnels qualifiés et la pression sur les prix à laquelle sont confrontés les principaux acteurs pourraient entraver le développement du marché africain des services de tests bioanalytiques au cours de la période de prévision.

L'augmentation des dépenses de santé et les initiatives stratégiques des acteurs du marché offrent des opportunités de croissance au marché. Cependant, les formulations innovantes exigeant une approche de test bioanalytique unique et le besoin croissant d'améliorer la sensibilité des méthodes bioanalytiques constituent des défis majeurs pour la croissance du marché.

L'étude de marché Data Bridge montre que le marché africain des services de tests bioanalytiques connaîtra un TCAC de 6,8 % entre 2022 et 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, prix en dollars américains |

|

Segments couverts |

Par type (services bioanalytiques pour études précliniques et cliniques, services bioanalytiques de petites molécules et services bioanalytiques de grandes molécules), utilisateur final (organismes de recherche clinique, sociétés pharmaceutiques et biotechnologiques, laboratoires hospitaliers, instituts universitaires et de recherche et autres) |

|

Pays couverts |

Afrique du Sud, Angola, Éthiopie, Nigéria et le reste de l'Afrique |

|

Acteurs du marché couverts |

FARMOVS (PTY) LTD (Afrique du Sud), SGS SA (Suisse), Labcorp Drug Development (États-Unis), Synexa Life Sciences BV (Pays-Bas), Q2 Solutions. (États-Unis), Medpace (États-Unis), BARC SOUTH AFRICA (Afrique du Sud) et Merieux NutriSciences Corporation (France) |

Définition du marché

Les tests bioanalytiques sont la détermination quantitative de médicaments et/ou de métabolites dans des matrices biologiques telles que le sang, le sérum , le plasma ou les échantillons d'urine, de tissus et de peau, spécifiquement appliquée aux études de toxicologie, de pharmacologie, de bioéquivalence, de pharmacocinétique et de biodisponibilité chez l'animal ou l'homme. Les services bioanalytiques sont fournis aux chercheurs par des organismes de recherche sous contrat disposant des ressources, de l'expertise, de l'instrumentation et de la technologie nécessaires pour s'attaquer aux programmes les plus complexes dans de multiples modalités et domaines thérapeutiques pour la bioanalyse clinique et préclinique.

Dynamique du marché des services de tests bioanalytiques

Conducteurs

- L’accent est mis de plus en plus sur les tests analytiques des produits biologiques et biosimilaires

Les produits biologiques représentent l'un des domaines thérapeutiques les plus prometteurs et prennent une place de plus en plus importante sur le marché pharmaceutique. Environ 800 produits sont en cours de développement. L'une des principales raisons de cette évolution est la prévalence croissante des maladies chroniques.

Selon l’article de Biomed Central de mai 2020, l’Afrique est confrontée à un double fardeau de maladies infectieuses et chroniques. Les taux de mortalité par âge dus aux maladies chroniques sont plus élevés en Afrique subsaharienne que dans pratiquement toutes les autres régions, tant chez les hommes que chez les femmes. Au cours des dix prochaines années, le continent devrait connaître la plus forte augmentation des taux de mortalité dus aux maladies cardiovasculaires, au cancer, aux maladies respiratoires et au diabète.

L’augmentation attendue de la recherche et du développement dans le domaine des biosimilaires entraînera une demande croissante de services de tests bioanalytiques associés (études de compatibilité des biosimilaires, tests de stabilité, tests de mise sur le marché des produits et analyse des protéines des biosimilaires) afin de réduire les risques associés au développement de médicaments. De plus, l’introduction des biosimilaires et l’évolution vers un traitement en continu créent le besoin de techniques d’analyse plus rapides et plus sensibles.

- Augmentation de la préférence pour l'externalisation des tests analytiques

L'externalisation des services de tests bioanalytiques permet aux entreprises pharmaceutiques de réduire les risques en évitant de consacrer des sommes importantes à l'achat d'équipements analytiques et au maintien de la main-d'œuvre, notamment lorsque les efforts de développement en sont aux premiers stades. L'accessibilité de prestataires de services de tests analytiques spécialisés dotés de capacités essentielles pour fournir rapidement des résultats optimaux a conduit les entreprises pharmaceutiques à envisager de plus en plus d'externaliser les services de tests à des prestataires de services tiers.

Par conséquent, la préférence croissante pour l’externalisation des tests analytiques devrait stimuler le marché au cours de la période prévue.

Opportunité

-

Adoption croissante de l'approche de la qualité par la conception

Un nombre croissant de conférences, de colloques, d’ateliers et de cours de formation, en particulier dans les pays émergents, ont joué un rôle crucial dans la sensibilisation aux avantages de l’adoption de l’approche QbD parmi les fabricants de produits pharmaceutiques et biopharmaceutiques et les organismes de recherche.

L’acceptation et l’adoption croissantes de l’approche QbD parmi les sociétés pharmaceutiques et biopharmaceutiques de la région devraient jouer un rôle clé dans la croissance du marché des services de tests bioanalytiques dans les années à venir.

Retenue/Défi

- Pénurie de professionnels qualifiés

La pénurie de professionnels qualifiés pour manipuler les équipements de pointe nécessaires aux tests bioanalytiques est un facteur important qui devrait freiner la croissance de ce marché. Dans les pays africains, les gens sont moins sensibilisés à travailler dans ce secteur et à acquérir des compétences spécifiques liées à ce domaine.

Par exemple,

Selon l’article du Forum économique mondial de septembre 2019, le manque actuel de compétences a de réelles conséquences. Parmi les PDG très préoccupés par la disponibilité des compétences clés, 65 % des PDG africains ont déclaré que la pénurie de compétences les empêchait d’innover efficacement. En comparaison, 59 % ont admis que leurs normes de qualité et l’expérience client étaient compromises. En outre, 54 % ont confirmé qu’ils n’atteignaient pas leurs objectifs de croissance en raison de compétences inadéquates.

Cela pourrait entraver l’adoption de nouvelles technologies et méthodologies, limitant ainsi la croissance du marché des services de tests bioanalytiques dans les années à venir.

Impact post-COVID-19 sur le marché des services de tests bioanalytiques en Afrique

La COVID-19 a eu un impact négatif sur le marché. Les confinements et les isolements pendant les pandémies compliquent les essais cliniques . Le manque d'accès aux établissements de santé pour les traitements de routine et l'administration de médicaments aura un impact supplémentaire sur le marché.

Développement récent

- En janvier 2022, SGS SA a annoncé que la société avait collaboré avec Microsoft. Cette collaboration a intégré l'expertise intersectorielle de Microsoft, ses solutions de données avancées et ses plateformes de productivité, ainsi que son réseau mondial et ses compétences de pointe dans le secteur pour développer des solutions innovantes pour les clients du secteur des tests, de l'inspection et de la certification (TIC). Cela aidera l'entreprise à accroître sa présence mondiale et à s'implanter solidement sur le marché

Portée du marché des services de tests bioanalytiques en Afrique

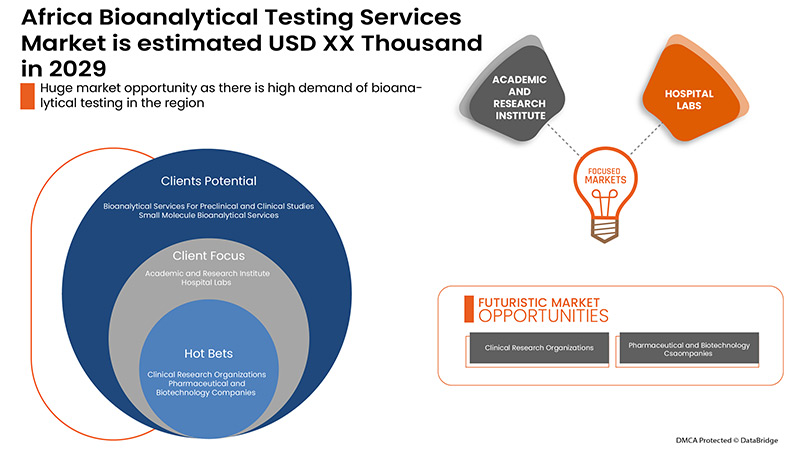

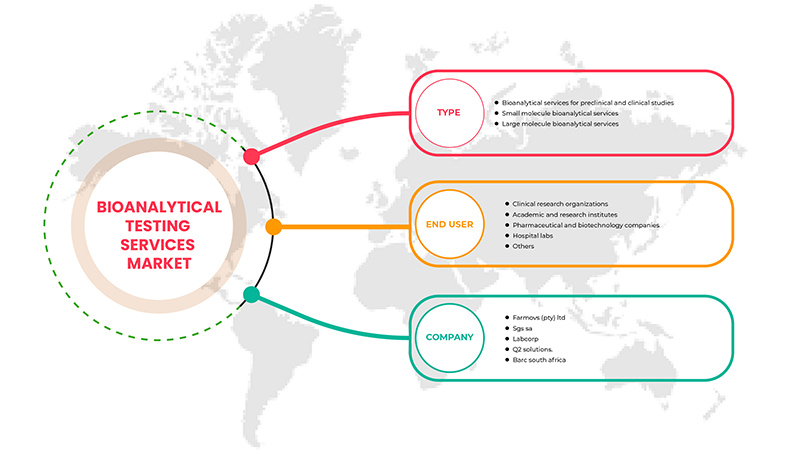

Le marché africain des services de tests bioanalytiques est classé en deux segments notables, tels que le type et l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Services bioanalytiques pour études précliniques et cliniques

- Services bioanalytiques de petites molécules

- Services bioanalytiques de grandes molécules

En fonction du type, le marché africain des services de tests bioanalytiques est segmenté en services bioanalytiques pour les études précliniques et cliniques, services bioanalytiques de petites molécules et services bioanalytiques de grandes molécules.

Utilisateur final

- Organisation de recherche clinique

- Sociétés pharmaceutiques et biotechnologiques

- Hôpitaux Laboratoires

- Instituts universitaires et de recherche

- Autres

En fonction de l’utilisateur final, le marché africain des services de tests bioanalytiques est segmenté en organisations de recherche clinique, sociétés pharmaceutiques et biotechnologiques, laboratoires hospitaliers, instituts universitaires et de recherche et autres.

Analyse/perspectives régionales du marché des services de tests bioanalytiques

Le marché des services de tests bioanalytiques est analysé et des informations sur la taille du marché et les tendances sont fournies par type et utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des services de tests bioanalytiques sont l’Afrique du Sud, le Nigéria, l’Angola, l’Éthiopie et le reste de l’Afrique.

Le marché des services de tests bioanalytiques en Afrique devrait croître en raison des dépenses croissantes en R&D dans l'industrie pharmaceutique et biopharmaceutique. En outre, une préférence accrue pour l'externalisation des tests analytiques dans la région stimulera davantage la croissance du marché au cours de la période de prévision.

L'Afrique du Sud devrait dominer le marché africain des services de tests bioanalytiques en termes de part de marché et de chiffre d'affaires. Elle continuera à accroître sa domination au cours de la période de prévision. Cela est dû à la forte demande de services bioanalytiques.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays et les tarifs d'importation et d'exportation, sont quelques-uns des indicateurs importants utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques africaines, les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des services de tests bioanalytiques

Le paysage concurrentiel du marché des services de tests bioanalytiques fournit des détails par concurrent. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence européenne, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des services de tests bioanalytiques.

Certains acteurs majeurs du marché des services de tests bioanalytiques en Afrique sont FARMOVS (PTY) LTD, SGS SA, Labcorp, Synexa Life Sciences BV, Q2 Solutions., Medpace, BARC SOUTH AFRICA, Merieux NutriSciences Corporation, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse de la part de marché Afrique VS. Région et fournisseur. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF AFRICA BIOANALYTICAL TESTING SERVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES

4.2 PESTEL ANALYSIS

5 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: REGULATIONS

5.1 REGULATION IN AFRICA:

5.1.1 GUIDELINES FOR BIOANALYTICAL TESTING SERVICES BY SAHPRA:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN FOCUS ON THE ANALYTICAL TESTING OF BIOLOGICS AND BIOSMILARS

6.1.2 INCREASE IN PREFERENCE FOR OUTSOURCING ANALYTICAL TESTING

6.1.3 GROWING R&D EXPENDITURE IN THE PHARMACEUTICAL AND BIOPHARMACEUTICAL INDUSTRY

6.2 RESTRAINTS

6.2.1 DEARTH OF SKILLED PROFESSIONALS

6.2.2 PRICING PRESSURE FACED BY MAJOR PLAYERS

6.3 OPPORTUNITIES

6.3.1 RISE IN ADOPTION OF THE QUALITY BY DESIGN APPROACH

6.3.2 RISE IN DEMAND FOR SPECIALIZED BIOANALYTICAL TESTING SERVICES

6.3.3 STRATEGIC INITIATIVES OF KEY PLAYERS

6.4 CHALLENGES

6.4.1 INNOVATIVE FORMULATIONS DEMANDING A UNIQUE BIOANALYTICAL TESTING APPROACH

6.4.2 GROWING NEED TO IMPROVE THE SENSITIVITY OF BIOANALYTICAL METHODS

7 AFRICA BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE

7.1 OVERVIEW

7.2 BIOANALYTICAL SERVICES FOR PRECLINICAL AND CLINICAL STUDIES

7.2.1 PHARMACOKINETIC (PK) ANALYSIS

7.2.2 BIOEQUIVALENCE STUDIES

7.2.3 BIOAVAILABILITY STUDIES

7.2.4 METHOD DEVELOPMENT & VALIDATION

7.2.5 LEAD OPTIMIZATION STUDIES

7.2.6 DOSE FORMULATION ANALYSIS

7.2.7 BIOANALYTICAL TECHNOLOGIES

7.2.8 OTHERS

7.3 SMALL MOLECULE BIOANALYTICAL SERVICES

7.3.1 METHOD DEVELOPMENT & VALIDATION

7.3.2 METABOLITE IDENTIFYING & SCREENING

7.3.3 SUPPORT FOR PRE-CLINICAL ANIMAL STUDIES

7.3.4 DRIED BLOOD SPOT ANALYSIS

7.3.5 TISSUE BIOANALYSIS

7.3.6 HAZARDOUS SAMPLE LABORATORY FOR HIV & HEPATITIS-B

7.3.7 BIOMARKERS ASSAY

7.3.8 OTHERS

7.4 LARGE MOLECULE BIOANALYTICAL SERVICES

7.4.1 IMMUNOCHEMISTRY SERVICES

7.4.2 BIOMARKER ASSAYS

7.4.3 METABOLITE IDENTIFYING & SCREENING

7.4.4 QUANTITATIVE IMMUNOASSAYS

7.4.5 IMMUNOGENICITY ASSAYS

7.4.6 PHARMACOKINETICS (PK) ANALYSIS

7.4.7 LIGAND-BINDING ASSAYS

7.4.8 OTHERS

8 AFRICA BIOANALYTICAL TESTING SERVICES MARKET, BY END USER

8.1 OVERVIEW

8.2 CLINICAL RESEARCH ORGANIZATIONS

8.3 ACADEMIC AND RESEARCH INSTITUTES

8.4 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

8.5 HOSPITALS LABS

8.6 OTHERS

9 AFRICA BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY

9.1 SOUTH AFRICA

9.2 NIGERIA

9.3 ETHIOPIA

9.4 ANGOLA

9.5 REST OF AFRICA

10 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: AFRICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 LABCORP

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENTS

12.2 FARMOVS (PTY) LTD

12.2.1 COMPANY SNAPSHOT

12.2.2 PRODUCT PORTFOLIO

12.2.3 RECENT DEVELOPMENTS

12.3 SGS SA

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 BARC SOUTH AFRICA

12.4.1 COMPANY SNAPSHOT

12.4.2 PRODUCT PORTFOLIO

12.4.3 RECENT DEVELOPMENTS

12.5 Q2 SOLUTIONS.

12.5.1 COMPANY SNAPSHOT

12.5.2 PRODUCT PORTFOLIO

12.5.3 RECENT DEVELOPMENTS

12.6 MEDPACE

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENTS

12.7 MERIEUX NUTRISCIENCES CORPORATION

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 SYNEXA LIFE SCIENCES BV

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 AFRICA BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 2 AFRICA BIOANALYTICAL SERVICES FOR PRECLINICAL AND CLINICAL STUDIES IN BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 3 AFRICA SMALL MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 AFRICA LARGE MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 AFRICA BIOANALYTICAL TESTING SERVICES MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 6 AFRICA BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND )

TABLE 7 SOUTH AFRICA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 SOUTH AFRICA BIOANALYTICAL SERVICES FOR PRECLINICAL AND CLINICAL STUDIES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 SOUTH AFRICA SMALL MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 SOUTH AFRICA LARGE MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 SOUTH AFRICA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 12 NIGERIA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 NIGERIA BIOANALYTICAL SERVICES FOR PRECLINICAL AND CLINICAL STUDIES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 NIGERIA SMALL MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 15 NIGERIA LARGE MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 NIGERIA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 17 ETHIOPIA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 ETHIOPIA BIOANALYTICAL SERVICES FOR PRECLINICAL AND CLINICAL STUDIES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 ETHIOPIA SMALL MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 ETHIOPIA LARGE MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 ETHIOPIA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 22 ANGOLA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 ANGOLA BIOANALYTICAL SERVICES FOR PRECLINICAL AND CLINICAL STUDIES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 24 ANGOLA SMALL MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 ANGOLA LARGE MOLECULE BIOANALYTICAL SERVICES IN BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 ANGOLA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 27 REST OF AFRICA BIOANALYTICAL TESTING SERVICES MARKETS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 AFRICA BIOANALYTICAL TESTING SERVICESMARKET: SEGMENTATION

FIGURE 2 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: DROC ANALYSIS

FIGURE 4 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: SEGMENTATION

FIGURE 11 THE RISING FOCUS ON THE ANALYTICAL TESTING OF BIOLOGICS AND BIOSIMILARS AND RISE IN DEMAND FOR SPECIALIZED BIOANALYTICAL TESTING SERVICES ARE EXPECTED TO DRIVE THE AFRICA BIOANALYTICAL TESTING SERVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 BIOANALYTICAL SERVICES FOR PRECLINICAL AND CLINICAL STUDIES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AFRICA BIOANALYTICAL TESTING SERVICES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE AFRICA BIOANALYTICAL TESTING SERVICES MARKET

FIGURE 14 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY TYPE, 2021

FIGURE 15 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY TYPE, 2022-2029 (USD THOUSAND)

FIGURE 16 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 17 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY END USER, 2021

FIGURE 19 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY END USER, 2022-2029 (USD THOUSAND)

FIGURE 20 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 21 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 22 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: SNAPSHOT (2021)

FIGURE 23 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY COUNTRY (2021)

FIGURE 24 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: BY TYPE (2022-2029)

FIGURE 27 AFRICA BIOANALYTICAL TESTING SERVICES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.