Marché des services informatiques en Irak, par système ( système intelligent , système de sécurité , contrôle et automatisation), type ( services gérés et services professionnels), taille de l'organisation (grandes entreprises et petites et moyennes entreprises (PME)), utilisateur final ( commercial , industriel, résidentiel, gouvernemental et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché des services informatiques en Irak

Les services informatiques sont essentiellement décrits comme la combinaison d'expertise technique et commerciale afin de fournir aux organisations la gestion, la création et l'optimisation des processus commerciaux. Ils aident à guider les organisations dans la stratégie informatique globale, qui comprend le cloud, le centre de données et le type de technologie et de fonctionnalité nécessaires dans le contexte des environnements informatiques et commerciaux de l'entreprise.

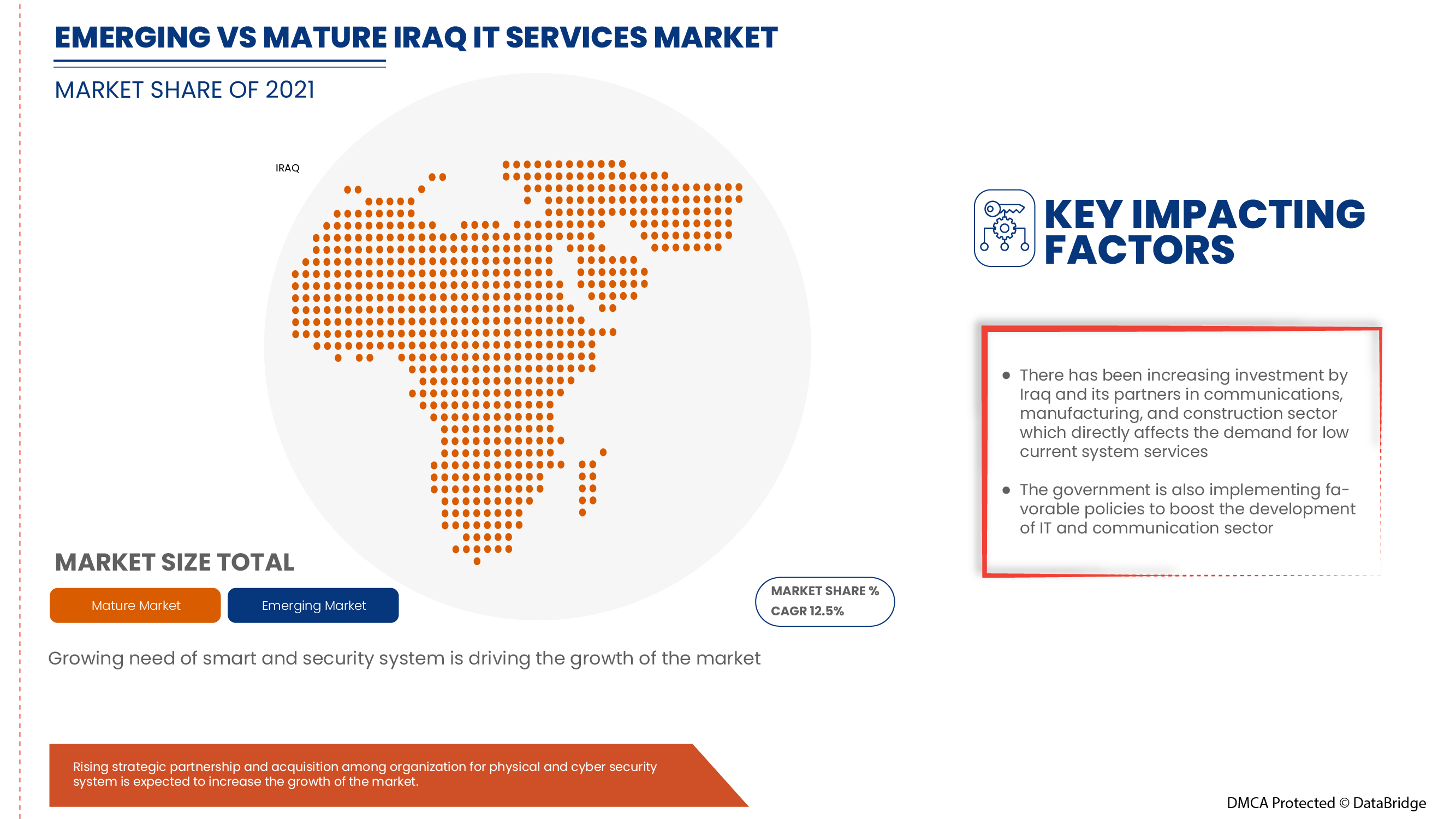

Selon les analyses de Data Bridge Market Research, le marché irakien des services informatiques devrait atteindre une valeur de 40,28 millions USD d'ici 2029, à un TCAC de 9,9 % au cours de la période de prévision. Les « systèmes intelligents » représentent le segment de composants le plus important sur le marché des services informatiques et fournissent des installations de base et une large gamme de fonctionnalités avec différentes plates-formes.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable jusqu'en 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par système (système intelligent, système de sécurité et contrôle et automatisation), type (services professionnels et services gérés), taille de l'organisation (grandes entreprises et petites et moyennes entreprises), utilisateur final (commercial, industriel, résidentiel, gouvernemental et autres) |

|

Pays couverts |

Irak |

|

Acteurs du marché couverts |

Intercom Enterprises, TECO Middle East, Advanced Micro Technologies Co., Emirates Dawn., AL Sadara UAE, Energy Pillars, Mobi EGYPT, Industrial Dimensions Contracting Co., EMergy Consultancy, infrastructure informatique sécurisée BITS., Guqa IT Team, Zegtech Inc., BTC NETWORKS, Skies ltd., ADS, entre autres |

Définition du marché

Les services informatiques sont une installation de pointe qui gère les systèmes et équipements informatiques liés à l'informatique. Les services informatiques relient les normes d'infrastructure aux exigences de l'environnement opérationnel de divers secteurs d'utilisateurs finaux. Les services informatiques sont externalisés auprès de nombreuses entreprises du monde entier qui fournissent l'installation en fonction des besoins des utilisateurs finaux et des clients. L'avancement des opérations informatiques sur la plate-forme basée sur le cloud a permis aux services informatiques d'être davantage axés sur les données et de fonctionner en temps réel. Cela crée une plus grande valeur pour l'entreprise et augmente la découverte des opportunités commerciales, l'efficacité opérationnelle et offre une optimisation de l'accès à distance.

Les services informatiques peuvent être classés en deux types : les services gérés et les services professionnels. Les services gérés sont un support continu pour ses clients, et l'utilisation de ces services est fréquente car des opérations telles que la correction de bogues et la maintenance du serveur ont lieu régulièrement. Les services professionnels sont des services informatiques occasionnels avec des offres telles que l'intégration d'infrastructure, le conseil et la formation. Dans ce cas, les services sont limités à une période de temps particulière, en fonction du type de projet.

Dynamique du marché des services informatiques en Irak

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

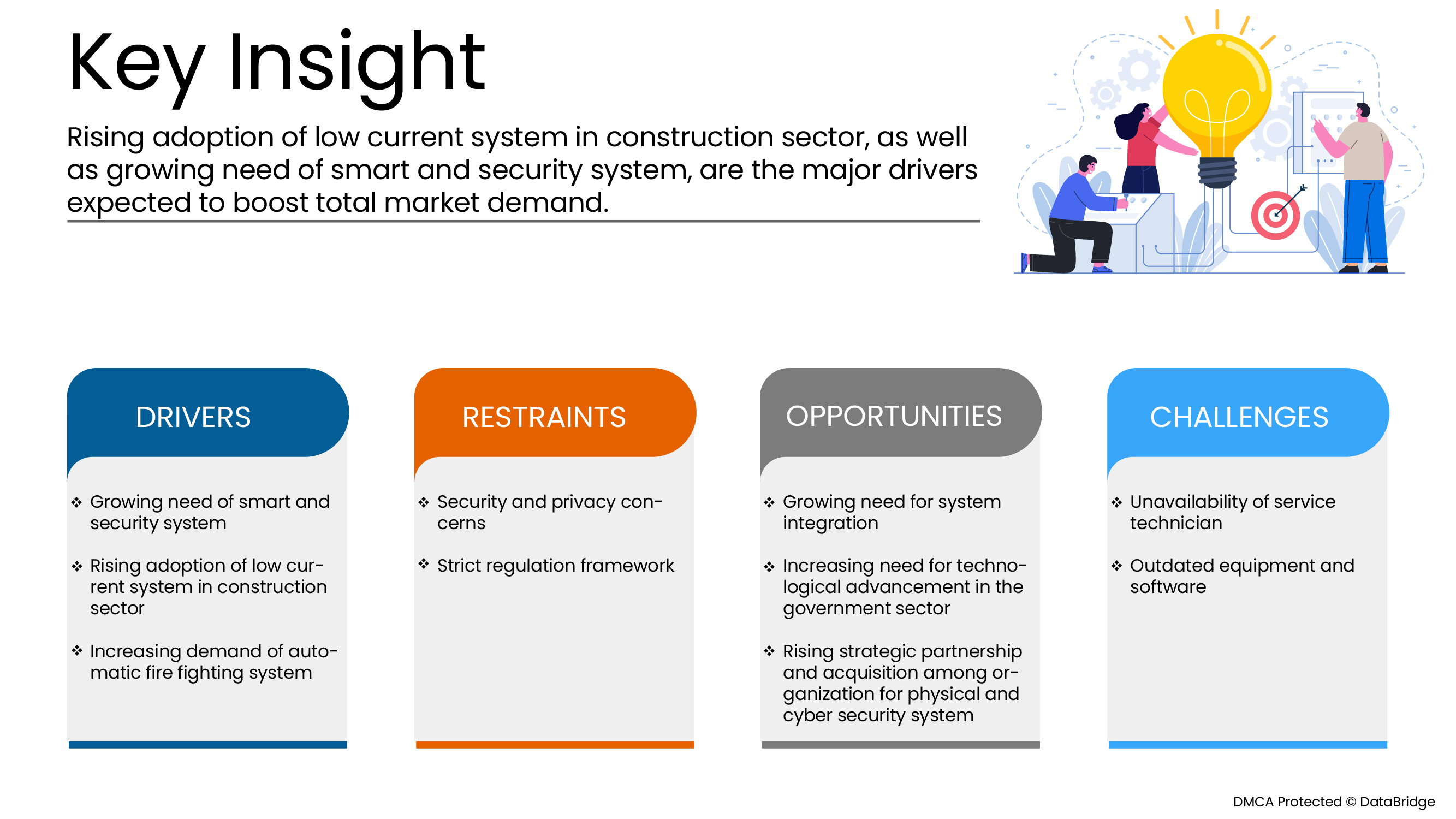

Conducteurs

- Besoin croissant de systèmes intelligents et sécurisés

Les systèmes intelligents et de sécurité fonctionnent aujourd'hui avec des signaux à faible courant et à très basse tension. L'infrastructure des systèmes à faible courant est la partie centrale de toute nouvelle construction de bâtiment, qu'il s'agisse de complexes résidentiels, hôteliers, commerciaux ou de campus universitaires intelligents.

Un certain nombre de systèmes de sécurité comprennent les systèmes de vidéosurveillance, les systèmes domotiques, le contrôle de l'éclairage, les systèmes d'alarme anti-intrusion, les systèmes d'horloge principale, la télévision intelligente et l'IPTV, les systèmes audiovisuels, le système de sonorisation, le système d'appel infirmier, le réseau et la téléphonie IP sont contrôlés par des composants à faible courant.

- Adoption croissante du système à faible courant dans le secteur de la construction

Les petites et moyennes entreprises s’orientent vers la numérisation et la construction d’infrastructures informatiques. Cela est rendu possible grâce aux services à faible courant offerts par les fournisseurs de services. Il est devenu plus pratique pour les entreprises irakiennes d’opter pour des services à faible courant en sous-traitant les services à un tiers sans étendre l’infrastructure, réduisant ainsi le coût global. Les PME irakiennes optent pour des services à faible courant pour optimiser et transformer leurs activités, ce qui devrait constituer un facteur moteur majeur pour le marché.

- Demande croissante de systèmes automatiques de lutte contre les incendies

Les systèmes de lutte contre l'incendie sont utilisés de manière exceptionnelle pour éviter les risques liés aux incendies. On distingue les systèmes actionnés automatiquement et les systèmes actionnés par un opérateur. La demande de systèmes automatiques de lutte contre l'incendie augmente car le système automatique comprend des capteurs capables de détecter la combustion, des dispositifs de signalisation d'alarme, des équipements d'extinction d'incendie, des dispositifs de démarrage et d'arrêt et des alimentations en substances extinctrices.

- Demande croissante de moyens de travail et d'apprentissage à distance

La pandémie a perturbé l’enseignement dans plus de 150 pays et a touché 1,6 milliard d’étudiants. En conséquence, de nombreux pays ont mis en place une forme d’apprentissage à distance. La réponse éducative au début de la COVID-19 s’est concentrée sur la mise en œuvre de modalités d’apprentissage à distance en réponse à la crise. Cependant, elles n’ont pas toujours été efficaces, mais à mesure que la pandémie s’est développée, les réponses éducatives ont également évolué.

Contraintes/Défis

- Problèmes de sécurité et de confidentialité

Les services et solutions à faible courant tels que le câblage structurel, les solutions de vidéosurveillance, les solutions de contrôle d'accès avancées, les solutions de mise en réseau, les systèmes de téléphonie IP et les solutions PABX, les systèmes de sonorisation et de VA, l'horloge maître et les solutions sans fil ont des structures complexes. Le risque de sécurité lié aux appareils à faible courant est qu'une défaillance d'un composant peut détruire l'ensemble du système. Les données stockées dans les systèmes de vidéosurveillance peuvent être corrompues. Ainsi, ces problèmes de sécurité peuvent constituer un frein à la croissance du marché.

- Indisponibilité des techniciens de service

Les entreprises peuvent être confrontées à des temps d'arrêt si les techniciens ne sont pas disponibles pour résoudre les problèmes immédiatement. Il peut être difficile de conserver un personnel expérimenté et qualifié en raison de la diminution de la disponibilité des techniciens de service sur le terrain. Le service de maintenance et de réparation est une affaire collective, et les opérations de service sur le terrain sont étroitement interconnectées avec plusieurs tâches consécutives impliquant de multiples intervenants qui doivent être gérées d'une manière particulière. Les techniciens sont un point de contact crucial entre le bureau et le terrain.

Impact de la pandémie de COVID-19 sur le marché des services informatiques en Irak

La COVID-19 a eu un impact majeur sur le marché des services informatiques, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent des biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises qui ont fait face à cette situation de pandémie étaient les services essentiels qui ont été autorisés à ouvrir et à exécuter leurs processus.

La COVID-19 a eu un impact sur le marché irakien des services informatiques. Les coûts d'investissement limités et le manque d'employés ont entravé les ventes et la production de services informatiques. Cependant, le gouvernement et les principaux acteurs du marché ont adopté de nouvelles mesures de sécurité pour développer les pratiques. Les progrès technologiques ont accéléré le taux de croissance du marché des services informatiques, car ils ciblaient le bon public. Le marché de la construction de services informatiques devrait reprendre son rythme après la pandémie en raison de l'assouplissement des restrictions.

Développements récents

- En mars 2019, TECO Middle East a lancé une solution pour les applications d'entreprise sur les systèmes Android et Apple. L'application aide ses clients à suivre leurs projets à venir et en cours et à prendre des décisions rapides. Cette application a aidé l'entreprise à rationaliser l'ensemble de son processus

- En juin 2022, Energy Pillars a achevé le projet ITT n° 2107-717 de travaux de modernisation électrique des installations du port de Mina Zayed. Ce projet achevé aidera l'entreprise à attirer de nouveaux clients et améliorera la valeur de la marque sur le marché

Portée du marché des services informatiques en Irak

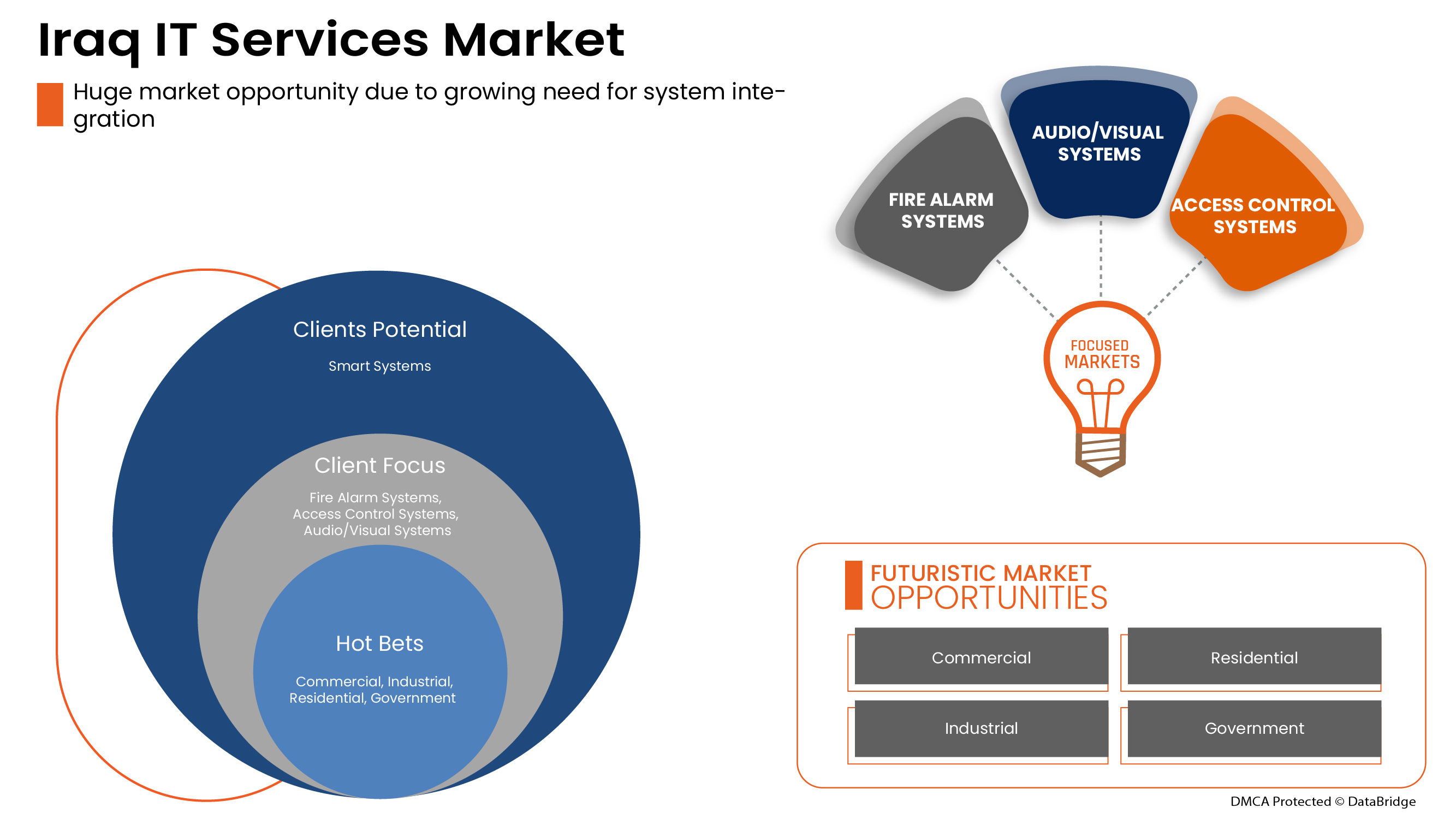

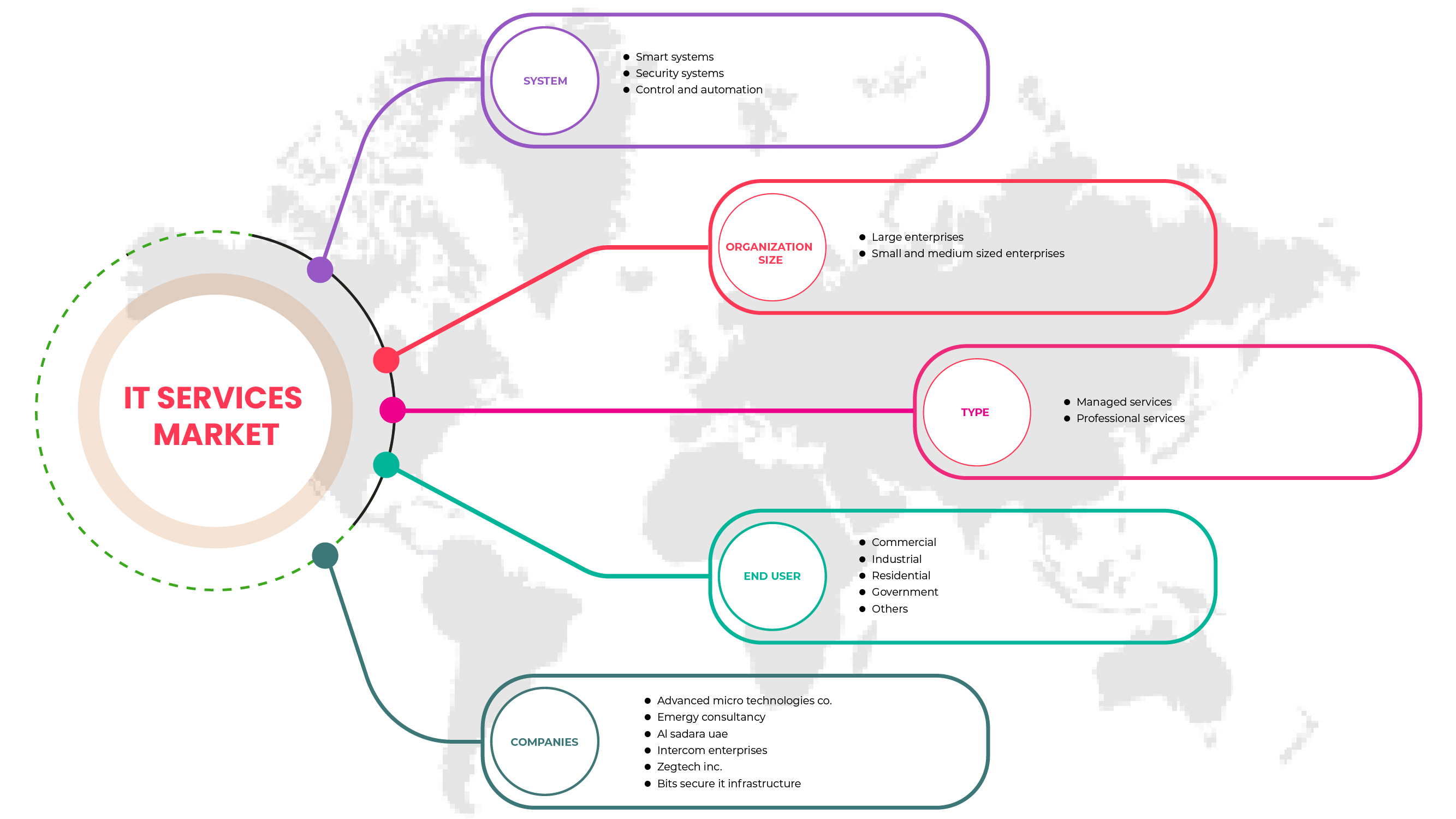

Le marché des services informatiques irakiens est segmenté en fonction des offres, du type, du type de niveau, de la taille, de la technologie et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Système

- Système intelligent

- Système de sécurité

- Contrôle et automatisation

Sur la base du système, le marché des services informatiques irakiens est segmenté en système intelligent, système de sécurité, contrôle et automatisation.

Taper

- Services professionnels

- Services gérés

Sur la base du type, le marché irakien des services informatiques est segmenté en services professionnels et services gérés.

Taille de l'organisation

- Grandes entreprises

- Petites et moyennes entreprises

Sur la base de la taille de l'organisation, le marché irakien des services informatiques est segmenté en grandes entreprises et en petites et moyennes entreprises.

Utilisateur final

- Commercial

- Industriel

- Résidentiel

- Gouvernement

- Autres

Sur la base de l'utilisateur final, le marché des services informatiques irakiens est segmenté en commercial, industriel, résidentiel, gouvernemental et autres.

Analyse/perspectives régionales du marché des services informatiques en Irak

Le marché des services informatiques irakiens est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type, type, taille de l'organisation, système et utilisateur final comme référencé ci-dessus.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des services informatiques

Le paysage concurrentiel du marché des services informatiques en Irak fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence régionale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des services informatiques en Irak.

Certains des principaux acteurs opérant sur le marché des services informatiques en Irak sont Intercom Enterprises, TECO Middle. East, Advanced Micro Technologies Co., Emirates Dawn., AL Sadara UAE, Energy Pillars, Mobi EGYPT, Industrial Dimensions Contracting Co., EMergy Consultancy, BITS secure IT infrastructure., Guqa IT Team, Zegtech Inc., BTC NETWORKS, Skies ltd., ADS, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF IRAQ IT SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 SYSTEM CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 LEGAL FACTORS

4.2.5 TECHNOLOGICAL FACTORS

4.2.6 ENVIRONMENTAL FACTORS

4.3 BRAND COMPARATIVE ANALYSIS

4.4 REGULATORY STANDARD:

5 REGIONAL SUMMARY

6 MARKET OVERVIEW

6.1 DRIVER

6.1.1 GROWING NEED OF SMART AND SECURITY SYSTEMS

6.1.2 INCREASING DEMAND FOR AUTOMATIC FIRE FIGHTING SYSTEM

6.2 RESTRAINTS

6.2.1 RISING SECURITY AND PRIVACY CONCERNS

6.2.2 STRICT REGULATORY FRAMEWORK

6.3 OPPORTUNITIES

6.3.1 GROWING NEED FOR SYSTEM INTEGRATION

6.3.2 INCREASING NEED FOR TECHNOLOGICAL ADVANCEMENT IN LOW CURRENT DEVICES

6.3.3 RISING STRATEGIC PARTNERSHIP AND ACQUISITION AMONG ORGANIZATIONS FOR PHYSICAL AND CYBER SECURITY SYSTEM

6.4 CHALLENGES

6.4.1 UNAVAILABILITY OF SERVICE TECHNICIANS

6.4.2 OUTDATED EQUIPMENT AND SOFTWARE

7 IRAQ IT SERVICES MARKET, BY SYSTEM

7.1 OVERVIEW

7.2 SMART SYSTEM

7.2.1 FIRE ALARM SYSTEMS

7.2.2 PUBLIC ADDRESS SYSTEMS

7.2.3 AUDIO/VISUAL SYSTEMS

7.2.4 MASTER CLOCK SYSTEMS

7.2.5 SMATV & IPTV, OTT SYSTEMS

7.2.6 LIGHTING CONTROL

7.2.7 NETWORK AND IP TELEPHONY

7.2.8 HOME AUTOMATION SYSTEMS

7.2.9 INTRUDER ALARM SYSTEMS

7.2.10 NURSE CALL SYSTEM

7.2.11 OTHERS

7.3 SECURITY SYSTEM

7.3.1 CCTV, SECURITY AND SURVEILLANCE SYSTEMS

7.3.2 ACCESS CONTROL SYSTEMS

7.3.2.1 ACCESS DEVICES

7.3.2.1.1 BIOMETRIC AUTHENTICATION

7.3.2.1.2 SMART CARD AND MOBILE ID AUTHENTICATION

7.3.2.2 READERS

7.3.2.3 MAGNETIC AND ELECTRIC LOCKS

7.3.3 INTRUSION DETECTION SYSTEMS

7.3.4 GATES & BARRIERS

7.3.5 OTHERS

7.4 CONTROL AND AUTOMATION

7.4.1 BUILDING MANAGEMENT SYSTEMS (BMS)

7.4.2 FIBER OPTICS CABLE INSTALLATION AND TESTING

7.4.3 SCADA AND AUTOMATION

7.4.4 ACTIVE COMPONENTS

7.4.5 INSTRUMENT EQUIPMENT AND CONTROL

7.4.6 OTHERS

8 IRAQ IT SERVICES MARKET, BY TYPE

8.1 OVERVIEW

8.2 PROFESSIONAL SERVICES

8.2.1 INSTALLATION AND IMPLEMENTATION

8.2.2 DESIGNING

8.2.3 SUPPORT AND MAINTENANCE

8.2.4 UPGRADATION

8.3 MANAGES SERVICES

9 TURKEY IT SERVICES MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM ENTERPRISES

10 IRAQ IT SERVICES MARKET, BY END USER

10.1 OVERVIEW

10.2 COMMERCIAL

10.2.1 BY APPLICATION

10.2.1.1 AIRPORTS

10.2.1.2 RETAIL AND MALLS

10.2.1.3 HOSPITALITY

10.2.1.4 HEALTHCARE

10.2.1.5 BANKING AND FINANCIAL INSTITUTIONS

10.2.1.6 OTHERS

10.2.2 BY SYSTEM

10.2.2.1 SMART SYSTEM

10.2.2.2 SECURITY SYSTEM

10.2.2.3 CONTROL AND AUTOMATION

10.2.3 BY TYPE

10.2.3.1 PROFESSIONAL SERVICES

10.2.3.1.1 INSTALLATION AND IMPLEMENTATION

10.2.3.1.2 DESIGNING

10.2.3.1.3 SUPPORT AND MAINTENANCE

10.2.3.1.4 UPGRADATION

10.2.3.2 MANAGES SERVICES

10.3 INDUSTRIAL

10.3.1 BY APPLICATION

10.3.1.1 OIL & GAS

10.3.1.2 SECURITY

10.3.1.3 TELECOMMUNICATION

10.3.1.4 DATA CENTER

10.3.1.5 MANUFACTURING

10.3.1.6 OTHERS

10.3.2 BY SYSTEM

10.3.2.1 SMART SYSTEM

10.3.2.2 SECURITY SYSTEM

10.3.2.3 CONTROL AND AUTOMATION

10.3.3 BY SYSTEM

10.3.3.1 PROFESSIONAL SERVICES

10.3.3.1.1 INSTALLATION AND IMPLEMENTATION

10.3.3.1.2 DESIGNING

10.3.3.1.3 SUPPORT AND MAINTENANCE

10.3.3.1.4 UPGRADATION

10.3.3.2 MANAGES SERVICES

10.4 RESIDENTIAL

10.4.1 BY APPLICATION

10.4.1.1 MULTI FAMILY HOME

10.4.1.2 SINGLE FAMILY HOME

10.4.1.3 APARTMENTS

10.4.1.4 OTHERS

10.4.2 BY SYSTEM

10.4.2.1 SMART SYSTEM

10.4.2.2 SECURITY SYSTEM

10.4.2.3 CONTROL AND AUTOMATION

10.4.3 BY TYPE

10.4.3.1 PROFESSIONAL SERVICES

10.4.3.1.1 INSTALLATION AND IMPLEMENTATION

10.4.3.1.2 DESIGNING

10.4.3.1.3 SUPPORT AND MAINTENANCE

10.4.3.1.4 UPGRADATION

10.4.3.2 MANAGES SERVICES

10.5 GOVERNMENT

10.5.1 BY SYSTEM

10.5.1.1 SECURITY SYSTEM

10.5.1.2 SMART SYSTEM

10.5.1.3 CONTROL AND AUTOMATION

10.5.2 BY TYPE

10.5.2.1 PROFESSIONAL SERVICES

10.5.2.1.1 INSTALLATION AND IMPLEMENTATION

10.5.2.1.2 DESIGNING

10.5.2.1.3 SUPPORT AND MAINTENANCE

10.5.2.1.4 UPGRADATION

10.5.2.2 MANAGES SERVICES

10.6 OTHERS

11 IRAQ IT SERVICES MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: IRAQ

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 MOBI EGYPT

13.1.1 COMPANY PROFILE

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 INTERCOM ENTERPRISES

13.2.1 COMPANY PROFILE

13.2.2 SOLUTION PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 ADVANCED MICRO TECHNOLOGIES CO.

13.3.1 COMPANY PROFILE

13.3.2 SOLUTION PORTFOLIO

13.3.3 RECENT DEVELOPMENT

13.4 EMERGY CONSULTANCY

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENTS

13.5 BITS SECURE IT INFRASTRUCTURE

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENTS

13.6 ADS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 AL SADARA UAE

13.7.1 COMPANY PROFILE

13.7.2 SERVICES PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 BTC NETWORKS

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 EMIRATES DAWN

13.9.1 COMPANY PROFILE

13.9.2 SERVICES PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 ENERGY PILLARS

13.10.1 COMPANY PROFILE

13.10.2 SERVICES PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 GUQA IT TEAM

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 INDUSTRIAL DIMENSIONS CONTRACTING CO.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 SKIES LTD.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.14 TECO MIDDLE. EAST

13.14.1 COMPANY PROFILE

13.14.2 SERVICE PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 ZEGTECH INC.

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 IRAQ IT SERVICES MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 2 IRAQ SMART SYSTEM IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 IRAQ SECURITY SYSTEM IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 IRAQ ACCESS CONTROL SYSTEMS IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 IRAQ ACCESS DEVICE IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 IRAQ CONTROL AND AUTOMATION IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 IRAQ IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 IRAQ PROFESSIONAL SERVICES IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 IRAQ IT SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 10 IRAQ IT SERVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 11 IRAQ COMMERCIAL IN IT SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 12 IRAQ COMMERCIAL IN IT SERVICES MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 13 IRAQ COMMERCIAL IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 IRAQ PROFESSIONAL SERVICES IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 IRAQ INDUSTRIAL IN IT SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 IRAQ INDUSTRIAL IN IT SERVICES MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 17 IRAQ INDUSTRIAL IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 IRAQ PROFESSIONAL SERVICES IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 IRAQ RESIDENTIAL IN IT SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 IRAQ RESIDENTIAL IN IT SERVICES MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 21 IRAQ RESIDENTIAL IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 IRAQ PROFESSIONAL SERVICES IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 IRAQ GOVERNMENT IN IT SERVICES MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 24 IRAQ GOVERNMENT IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 IRAQ PROFESSIONAL SERVICES IN IT SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 IRAQ IT SERVICES MARKET: SEGMENTATION

FIGURE 2 IRAQ IT SERVICES MARKET : DATA TRIANGULATION

FIGURE 3 IRAQ IT SERVICES MARKET: DROC ANALYSIS

FIGURE 4 IRAQ IT SERVICES MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 IRAQ IT SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 IRAQ IT SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 IRAQ IT SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 IRAQ IT SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 IRAQ IT SERVICES MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 IRAQ IT SERVICES MARKET: SEGMENTATION

FIGURE 11 GROWING NEED OF SMART AND SECURITY SYSTEM IS EXPECTED TO BE A KEY DRIVER FOR THE IRAQ IT SERVICES MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SMART SYSTEM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE IRAQ IT SERVICES MARKET IN 2022 & 2029

FIGURE 13 DRIVER, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF IRAQ IT SERVICES MARKET

FIGURE 14 IRAQ IT SERVICES MARKET: BY SYSTEM, 2021

FIGURE 15 IRAQ IT SERVICES MARKET: BY TYPE, 2021

FIGURE 16 IRAQ IT SERVICES MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 17 IRAQ IT SERVICES MARKET: BY END USER, 2021

FIGURE 18 IRAQ IT SERVICES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.