Un produit d'éclairage désigne tout appareil ou système conçu pour produire de la lumière pour diverses applications, notamment résidentielles, commerciales, industrielles et extérieures. Ces produits vont des ampoules à incandescence traditionnelles aux solutions modernes à faible consommation d'énergie telles que les LED (diodes électroluminescentes) et les LFC (lampes fluorescentes compactes). Les produits d'éclairage peuvent être des unités autonomes, comme des lampes et des luminaires, ou des systèmes intégrés associés à des technologies intelligentes pour un contrôle et une automatisation améliorés. Ils remplissent de multiples fonctions, notamment l'éclairage, la création d'ambiance et l'éclairage spécifique à une tâche, jouant un rôle crucial en matière de sécurité, d'esthétique et d'efficacité énergétique.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/us-lighting-market

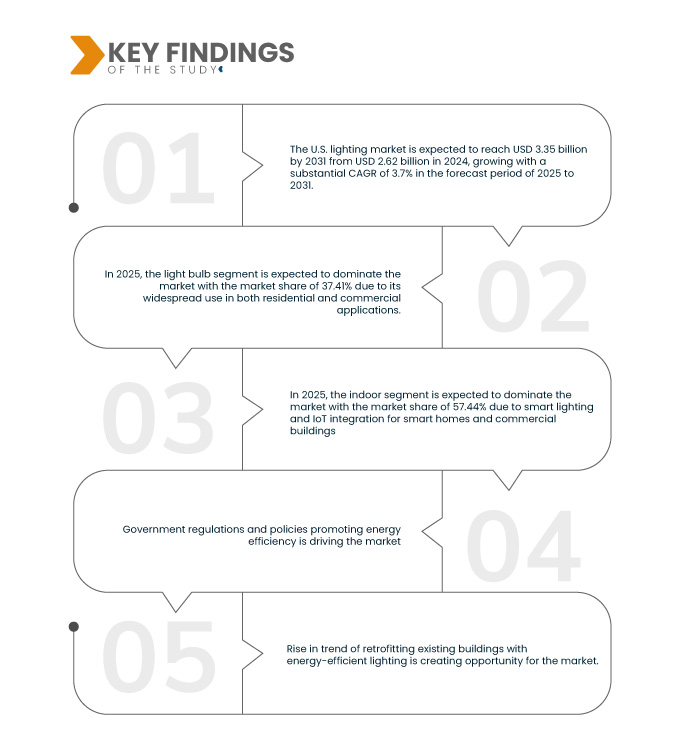

Data Bridge Market Research analyse que le marché américain de l'éclairage devrait atteindre 3,35 milliards d'ici 2031, contre 2,62 milliards USD en 2024, avec un TCAC substantiel de 3,7 % au cours de la période de prévision de 2025 à 2031.

Principales conclusions de l'étude

Réglementations et politiques gouvernementales favorisant l'efficacité énergétique

Les réglementations et politiques gouvernementales favorisant l'efficacité énergétique sont des moteurs clés de la croissance du marché américain de l'éclairage. La loi EISA (Energy Independence and Security Act) de 2007, qui a progressivement supprimé les ampoules à incandescence inefficaces et promu des alternatives économes en énergie comme les LED, a considérablement influencé la dynamique du marché. De plus, les mesures incitatives fédérales et étatiques, telles que les rabais et les crédits d'impôt, encouragent l'adoption de solutions d'éclairage économes en énergie en réduisant les coûts initiaux pour les consommateurs et les entreprises. Des programmes comme l'initiative Better Buildings du Département de l'Énergie des États-Unis soutiennent également cette transition en offrant des incitations financières pour la modernisation de l'éclairage. Ces réglementations et incitations façonnent le marché en favorisant l'innovation, la réduction de la consommation d'énergie et la diminution des émissions de gaz à effet de serre. L'efficacité énergétique restant une priorité, la demande de solutions d'éclairage économes en énergie devrait continuer à augmenter, stimulant ainsi la croissance du marché dans les années à venir.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2025 à 2031

|

Année de base

|

2024

|

Années historiques

|

2023 (personnalisable de 2017 à 2022)

|

Unités quantitatives

|

Chiffre d'affaires en milliards USD

|

Segments couverts

|

Type d'éclairage (ampoules, plafonniers, lampes et luminaires), emplacement (intérieur et extérieur), connectivité (filaire et sans fil), type d'installation (nouvelle installation et rénovation), canal de distribution (hors ligne et en ligne), utilisateur final ( commercial et résidentiel)

|

Pays couvert

|

POU

|

Acteurs du marché couverts

|

Signify Holding (Pays-Bas), ams-OSRAM AG (Autriche), Inter IKEA Systems BV9 (Pays-Bas), Havells India Ltd. (Inde), Lutron Electronics Co., Inc. (États-Unis), Artemide SpA (Italie), Herman Miller, Inc. (États-Unis), Flos SpA (Italie), Wipro Lighting (Inde), OttLite (États-Unis), Pablo Design (États-Unis) et Koncept Inc. (États-Unis), entre autres

|

Points de données couverts dans le rapport

|

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande.

|

Analyse des segments

Le marché de l’éclairage américain est segmenté en six segments notables basés sur le type d’éclairage, l’emplacement, la connectivité, le type d’installation, le canal de distribution et l’utilisateur final.

Sur la base du type d'éclairage, le marché est segmenté en ampoules, plafonniers, lampes et luminaires

En 2025, le segment des ampoules devrait dominer le marché de l’éclairage aux États-Unis

En 2025, le segment des ampoules devrait dominer le marché avec une part de marché de 37,41 %, grâce à son utilisation répandue dans les applications résidentielles et commerciales. Les ampoules, en particulier les LED, sont très adaptables, économes en énergie et économiques, ce qui en fait un choix privilégié des consommateurs.

- En fonction de l'emplacement, le marché est segmenté en intérieur et extérieur.

En 2025, le segment de l’éclairage intérieur devrait dominer le marché de l’éclairage aux États-Unis

En 2025, le segment de l'éclairage intérieur devrait dominer le marché avec une part de marché de 57,44 % en raison de la demande continue de solutions d'éclairage écoénergétiques dans les applications résidentielles, commerciales et industrielles.

- En termes de connectivité, le marché est segmenté en filaire et sans fil. En 2025, le segment filaire devrait dominer le marché avec une part de marché de 62,58 %.

- Selon le type d'installation, le marché est segmenté en nouvelles installations et en rénovation. En 2025, le segment des nouvelles installations devrait dominer le marché avec une part de marché de 53,69 %.

- En fonction des canaux de distribution, le marché est segmenté en deux segments : hors ligne et en ligne. En 2025, le segment hors ligne devrait dominer le marché avec une part de marché de 66,70 %.

- En fonction de l'utilisateur final, le marché est segmenté en deux segments : commercial et résidentiel. En 2025, le segment commercial devrait dominer le marché avec une part de marché de 60,44 %.

Acteurs majeurs

Data Bridge Market Research analyse Signify Holding (Pays-Bas), ams-OSRAM AG (Autriche), Inter IKEA Systems BV (Pays-Bas), Lutron Electronics Co., Inc (États-Unis) et Herman Miller, Inc. (États-Unis) comme les principaux acteurs opérant sur le marché.

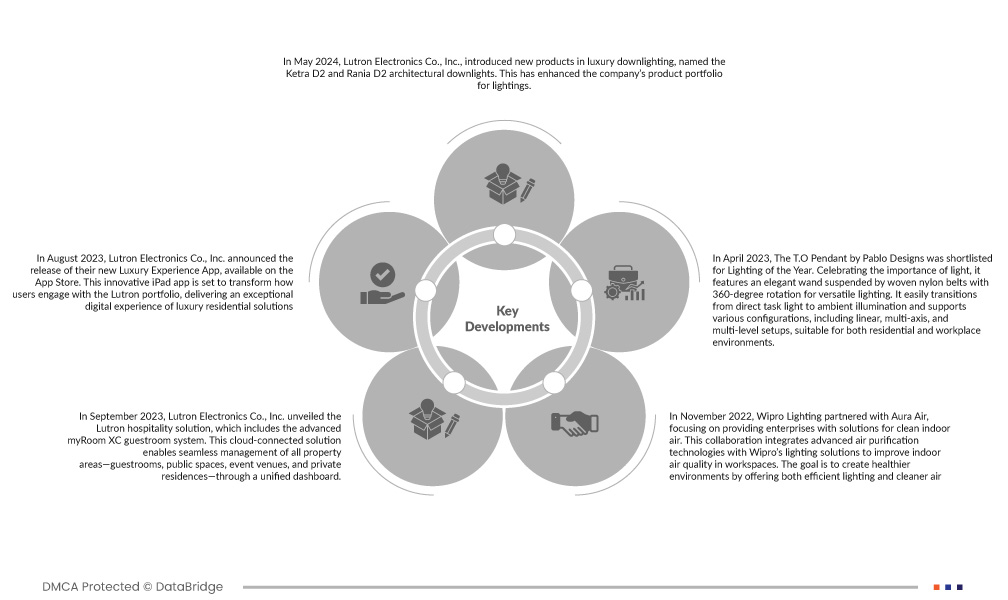

Évolution du marché

- En mai 2024, Lutron Electronics Co., Inc. a lancé de nouveaux produits d'éclairage encastré de luxe : les downlights architecturaux Ketra D2 et Rania D2. Ces nouveautés viennent enrichir la gamme de produits d'éclairage de l'entreprise.

- En août 2023, Lutron Electronics Co., Inc. a annoncé le lancement de sa nouvelle application Luxury Experience, disponible sur l'App Store. Cette application iPad innovante révolutionnera l'interaction avec la gamme Lutron, offrant une expérience numérique exceptionnelle autour des solutions résidentielles de luxe.

- En septembre 2023, Lutron Electronics Co., Inc. a dévoilé sa solution hôtelière, qui inclut le système avancé de gestion des chambres myRoom XC. Connectée au cloud, cette solution permet une gestion fluide de tous les espaces de l'établissement (chambres, espaces publics, salles d'événements et résidences privées) via un tableau de bord unifié.

- En novembre 2022, Wipro Lighting s'est associé à Aura Air pour fournir aux entreprises des solutions pour un air intérieur pur. Cette collaboration intègre des technologies avancées de purification de l'air aux solutions d'éclairage Wipro afin d'améliorer la qualité de l'air intérieur dans les espaces de travail. L'objectif est de créer des environnements plus sains en offrant à la fois un éclairage efficace et un air plus pur.

- En avril 2023, la suspension TO de Pablo Designs a été nominée pour le prix de l'Éclairage de l'Année. Célébrant l'importance de la lumière, elle est dotée d'une élégante tige suspendue par des sangles en nylon tressé et pivotante à 360 degrés pour un éclairage polyvalent. Elle passe facilement d'un éclairage direct à un éclairage d'ambiance et offre diverses configurations, notamment linéaires, multi-axes et multi-niveaux, convenant aussi bien aux environnements résidentiels qu'aux espaces de travail.

Selon l'analyse de Data Bridge Market Research :

Pour plus d'informations sur le marché de l'éclairage aux États-Unis, cliquez ici : https://www.databridgemarketresearch.com/reports/us-lighting-market