Les produits de diagnostic in vitro sont des réactifs, instruments et systèmes destinés au diagnostic de maladies ou d'autres affections, y compris la détermination de l'état de santé, afin de guérir, d'atténuer, de traiter ou de prévenir une maladie ou ses séquelles. Ces produits sont destinés à la collecte, à la préparation et à l'examen d'échantillons prélevés sur le corps humain.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/saudi-arabia-turkey-and-egypt-in-vitro-diagnostics-ivd-quality-control-market

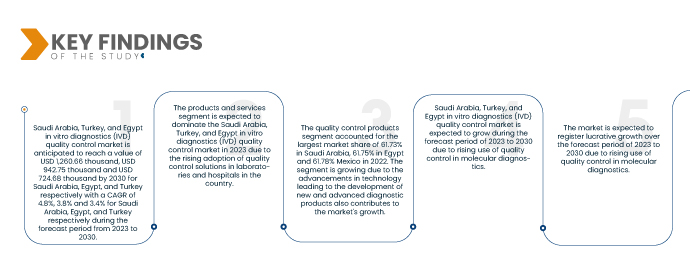

Le marché du contrôle de la qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte devrait atteindre 1 260,66 milliers USD, 724,68 milliers USD et 942,75 milliers USD d'ici 2030, contre 867,09 milliers USD, 555,84 milliers USD et 700,21 milliers USD en 2022, avec un TCAC de 4,8 %, 3,4 % et 3,8 % en Arabie saoudite, en Turquie et en Égypte au cours de la période de prévision de 2023 à 2030.

Les contrôles qualité des DIV sont des échantillons/matériaux utilisés pour valider la fiabilité du système de test DIV, garantir l'exactitude des résultats et évaluer l'impact de facteurs tels que les conditions environnementales et les performances de l'opérateur sur les résultats. De plus, ils peuvent également servir à surveiller l'état de santé d'un patient, à soigner des maladies et à permettre aux professionnels de santé d'identifier la procédure ou la thérapie la plus efficace pour le patient.

Data Bridge Market Research estime que le marché du contrôle qualité des diagnostics in vitro (DIV) devrait croître à un TCAC de 4,8 %, 3,8 % et 3,4 % respectivement en Arabie saoudite, en Égypte et en Turquie sur la période 2023-2030, et devrait atteindre 1 260,66 milliers USD, 942,75 milliers USD et 724,68 milliers USD d'ici 2030 pour ces deux pays. Le segment des produits de contrôle qualité devrait propulser la croissance du marché face à la prévalence croissante des maladies chroniques en Arabie saoudite, en Turquie et en Égypte.

Principales conclusions de l'étude

Augmentation des acquisitions stratégiques et des partenariats entre organisations

Les acteurs du marché du contrôle qualité des diagnostics in vitro (DIV) multiplient les acquisitions stratégiques et les partenariats. Ces entreprises obtiennent également des financements de tiers, ce qui dynamise leurs activités. Plusieurs types d'investissements accélèrent la recherche et le développement de produits de contrôle qualité des diagnostics in vitro (DIV), et de nouveaux produits viennent régulièrement enrichir le marché existant. Les investissements réalisés par plusieurs entreprises ont permis le développement et l'introduction de nouveaux produits innovants. Ces produits ont amélioré l'efficacité des produits et renforcé la crédibilité du fabricant sur le marché. Cela signifie donc que l'augmentation des acquisitions stratégiques et des partenariats représente une opportunité de croissance pour le marché du contrôle qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2023 à 2030

|

Année de base

|

2022

|

Années historiques

|

2021 (personnalisable de 2015 à 2020)

|

Unités quantitatives

|

Chiffre d'affaires en milliers de dollars américains

|

Segments couverts

|

Produits et services (produits et services de contrôle qualité), application (chimie clinique, immunochimie, hématologie, diagnostic moléculaire, coagulation/hémostase, microbiologie et autres), secteur (clinique et non clinique), utilisateur final (laboratoires cliniques, instituts universitaires et de recherche, banques du sang, industrie biotechnologique, industrie pharmaceutique et autres)

|

Pays couverts

|

Arabie saoudite, Turquie et Égypte

|

Acteurs du marché couverts

|

Thermo Fisher Scientific Inc., Siemens Healthcare Private Limited, Bio-Rad Laboratories, Inc., Beckman Coulter, Inc., Sysmex Europe SE, Randox Laboratories Ltd., Agappe Diagnostics Ltd, Spectrum Diagnostics., DiaSorin SpA, Sera Care et Technopath Clinical Diagnostics, entre autres.

|

Points de données couverts dans le rapport

|

En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire.

|

Analyse des segments :

Le marché du contrôle qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte est classé en quatre segments notables, basés sur les produits et services, l'application, le secteur et l'utilisateur final.

- En termes de produits et de services, le marché du contrôle qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte est segmenté en produits et services de contrôle qualité. En 2023, le segment des produits de contrôle qualité devrait dominer le marché du contrôle qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte, avec des parts de marché respectives de 61,73 %, 61,75 % et 61,78 %.

En 2023, le segment des produits de contrôle qualité domine le marché du contrôle qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte en raison de la prévalence croissante des maladies chroniques en Arabie saoudite, en Turquie et en Égypte.

- En fonction des applications, le marché du contrôle qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte est segmenté en chimie clinique, immunochimie, hématologie, diagnostic moléculaire, coagulation/hémostase, microbiologie, etc. En 2023, le segment de la chimie clinique devrait dominer le marché du contrôle qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte avec une part de marché de 25,75 %, 25,93 % et 26,11 %. Il devrait atteindre 357,83 milliers USD, 269,13 milliers USD et 208,09 milliers USD d'ici 2030, avec un TCAC de 4,8 %, 3,8 % et 3,4 % pour l'Arabie saoudite, l'Égypte et la Turquie sur la période de prévision 2023-2030.

- Sur la base du secteur, le marché du contrôle qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte est segmenté en clinique et non clinique. En 2023, le segment clinique devrait dominer le marché du contrôle qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte avec une part de marché de 54,98 %, 55,01 % et 55,03 %. Il devrait atteindre 710,53 milliers USD, 531,27 milliers USD et 409,08 milliers USD d'ici 2030, avec un TCAC de 5,1 %, 4,1 % et 3,7 % pour l'Arabie saoudite, l'Égypte et la Turquie respectivement sur la période de prévision de 2023 à 2030.

- En Arabie saoudite, en Turquie et en Égypte, le marché du contrôle qualité des diagnostics in vitro (DIV) est segmenté en fonction de l'utilisateur final : laboratoires cliniques, instituts universitaires et de recherche, industrie pharmaceutique, industrie biotechnologique, banques de sang, etc. En 2023, le segment des laboratoires cliniques devrait dominer le marché du contrôle qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte avec 34,67 %, 34,62 % et 34,58 % de parts de marché. Il devrait atteindre 493 820 USD, 368 870 USD et 283 220 USD d'ici 2030, avec un TCAC de 6,4 %, 5,4 % et 4,9 % respectivement pour l'Arabie saoudite, l'Égypte et la Turquie sur la période de prévision 2023-2030.

Acteurs majeurs

Data Bridge Market Research reconnaît les entreprises suivantes comme les acteurs du marché du contrôle de la qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte, notamment Thermo Fisher Scientific Inc., Siemens Healthcare Private Limited, Bio-Rad Laboratories, Inc., Beckman Coulter, Inc., Sysmex Europe SE, Randox Laboratories Ltd., Agappe Diagnostics Ltd, Spectrum Diagnostics., DiaSorin SpA, Sera Care et Technopath Clinical Diagnostics, entre autres.

Développement du marché

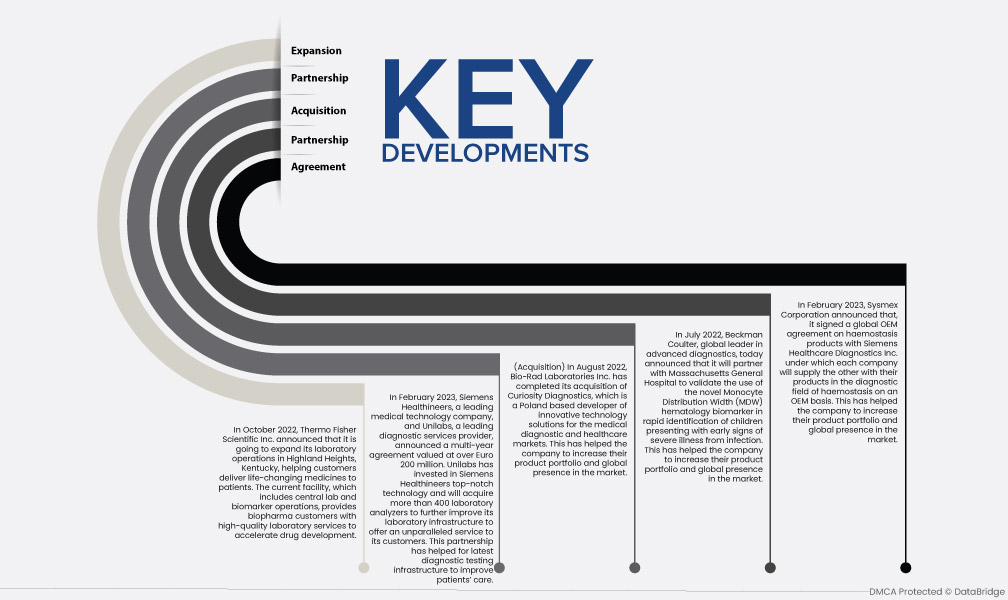

- En octobre 2022, Thermo Fisher Scientific Inc. a annoncé l'extension de ses activités de laboratoire à Highland Heights, dans le Kentucky, afin d'aider ses clients à fournir des médicaments révolutionnaires aux patients. L'installation actuelle, qui comprend un laboratoire central et des activités de biomarqueurs, offre aux clients biopharmaceutiques des services de laboratoire de haute qualité pour accélérer le développement de médicaments.

- En février 2023, Siemens Healthineers, leader des technologies médicales, et Unilabs, fournisseur majeur de services de diagnostic, ont annoncé un accord pluriannuel d'une valeur de plus de 200 millions d'euros. Unilabs a investi dans la technologie de pointe de Siemens Healthineers et va acquérir plus de 400 analyseurs de laboratoire afin d'améliorer son infrastructure et d'offrir un service inégalé à ses clients. Ce partenariat a permis de mettre en place une infrastructure de tests diagnostiques de pointe pour améliorer la prise en charge des patients.

- En août 2022, Bio-Rad Laboratories Inc. a finalisé l'acquisition de Curiosity Diagnostics, un développeur polonais de solutions technologiques innovantes pour les marchés du diagnostic médical et de la santé. Cette acquisition a permis à l'entreprise d'élargir son portefeuille de produits et de renforcer sa présence mondiale sur le marché.

- En juillet 2022, Beckman Coulter, leader mondial du diagnostic avancé, a annoncé aujourd'hui un partenariat avec le Massachusetts General Hospital pour valider l'utilisation du nouveau biomarqueur hématologique MDW (Monocyte Distribution Width) pour l'identification rapide des enfants présentant des signes précoces de maladie grave due à une infection. Ce partenariat a permis à l'entreprise d'élargir son portefeuille de produits et de renforcer sa présence mondiale sur le marché.

- En février 2023, Sysmex Corporation a annoncé la signature d'un accord OEM mondial avec Siemens Healthcare Diagnostics Inc. portant sur des produits d'hémostase. Aux termes de cet accord, chaque entreprise fournira à l'autre ses produits de diagnostic de l'hémostase en tant qu'équipementier. Cet accord a permis à l'entreprise d'élargir son portefeuille de produits et d'accroître sa présence mondiale sur le marché.

Analyse régionale

Géographiquement, les pays couverts par le rapport sur le marché du contrôle qualité des diagnostics in vitro (DIV) sont l’Arabie saoudite, l’Égypte et la Turquie.

Selon l'analyse de Data Bridge Market Research :

Analyse d'impact de la COVID-19

La demande de produits de diagnostic in vitro devrait augmenter en raison de la pandémie de COVID-19, principalement en raison de facteurs tels que la forte hausse de la demande pour les tests rapides PCR, NGS et sérologiques, le contexte réglementaire favorable au développement et à la commercialisation de ces produits, et la forte augmentation de la population cible. Ces facteurs ont incité les acteurs du marché à améliorer et à renforcer leurs capacités actuelles de fabrication et de distribution, ainsi qu'à se concentrer sur la commercialisation et la modernisation de leurs produits.

L'Arabie saoudite est la région dominante du marché du contrôle de la qualité des diagnostics in vitro (DIV) au cours de la période de prévision 2023-2030

En 2023, l'Arabie saoudite a dominé le marché du contrôle qualité des diagnostics in vitro (DIV) grâce à l'adoption croissante de solutions de contrôle qualité dans les laboratoires et les hôpitaux du pays. L'Arabie saoudite continuera de dominer ce marché en termes de parts de marché et de chiffre d'affaires, et continuera de consolider sa domination au cours de la période de prévision. Cela est dû aux avancées technologiques qui ont permis le développement de produits de diagnostic nouveaux et avancés. De plus, la prévalence croissante des maladies chroniques en Arabie saoudite, en Turquie et en Égypte devrait encore accélérer la croissance du marché dans cette région.

Pour plus d'informations sur le rapport sur le marché du contrôle qualité des diagnostics in vitro (DIV), cliquez ici : https://www.databridgemarketresearch.com/reports/saudi-arabia-turkey-and-egypt-in-vitro-diagnostics-ivd-quality-control-market