Saudi Arabia Turkey And Egypt In Vitro Diagnostics Ivd Quality Control Market

Taille du marché en milliards USD

TCAC :

%

USD

867.09 Thousand

USD

1,260.66 Thousand

2022

2030

USD

867.09 Thousand

USD

1,260.66 Thousand

2022

2030

| 2023 –2030 | |

| USD 867.09 Thousand | |

| USD 1,260.66 Thousand | |

|

|

|

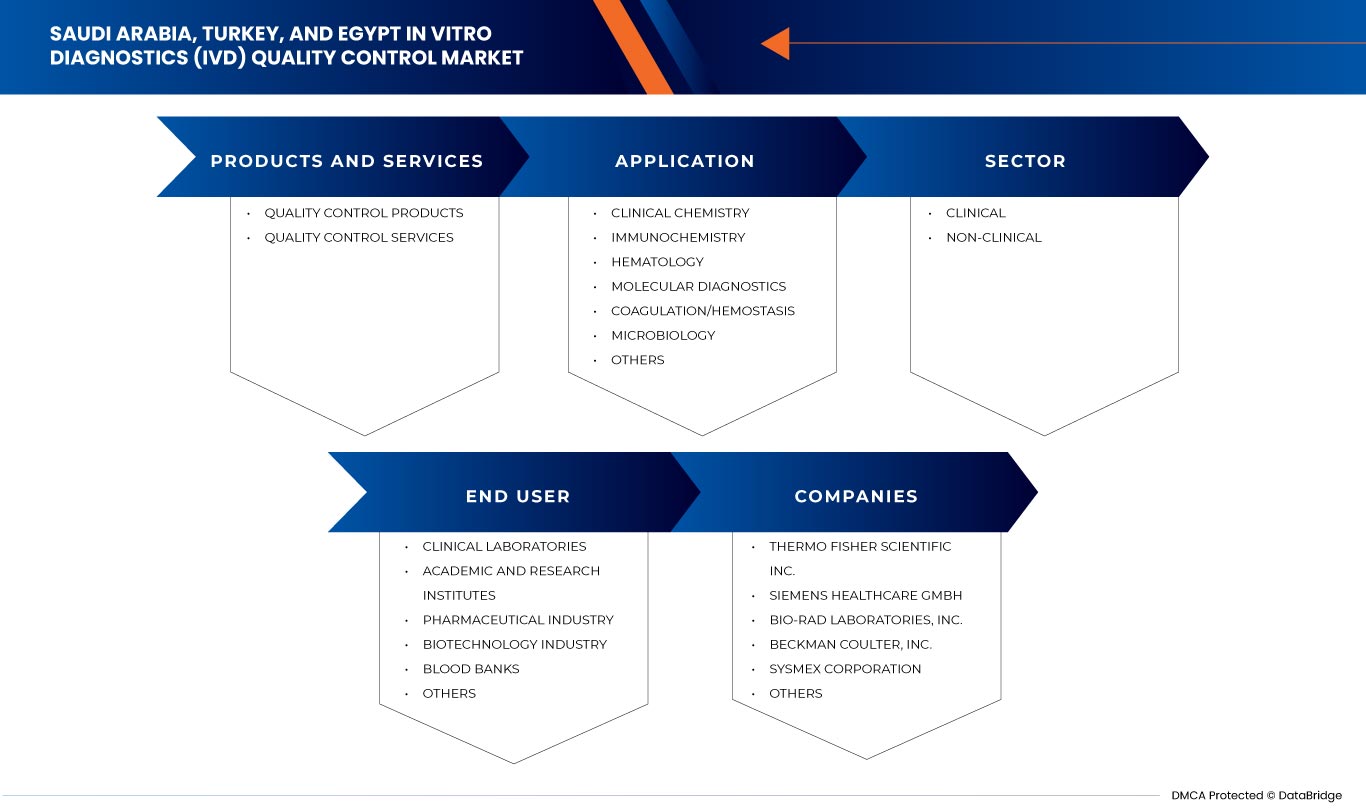

Marché du contrôle de la qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte, par produit et services (produits de contrôle de la qualité et services de contrôle de la qualité), application ( chimie clinique , immunochimie, hématologie, diagnostic moléculaire, coagulation/hémostase, microbiologie et autres), secteur (clinique et non clinique), utilisateur final (laboratoires cliniques, instituts universitaires et de recherche, banques du sang, industrie biotechnologique, industrie pharmaceutique et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché du contrôle de la qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte

La prévalence croissante des maladies chroniques en Arabie saoudite, en Turquie et en Égypte a accru la demande du marché. L'augmentation des dépenses de santé pour de meilleurs services de santé contribue également à la croissance du marché. Les principaux acteurs du marché se concentrent sur le lancement et l'approbation de divers produits au cours de cette période cruciale. En outre, l'augmentation des services de contrôle qualité améliorés contribue également à la demande croissante du marché du contrôle qualité des DIV.

Le marché du contrôle de la qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte devrait connaître une croissance du marché au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,8 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 1 260,66 milliers USD d'ici 2030 contre 867,09 milliers USD en 2022.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Produits et services (produits de contrôle qualité et services de contrôle qualité), application (chimie clinique, immunochimie, hématologie, diagnostic moléculaire, coagulation/hémostase, microbiologie et autres), secteur (clinique et non clinique), utilisateur final (laboratoires cliniques, instituts universitaires et de recherche, banques du sang, industrie biotechnologique, industrie pharmaceutique et autres) |

|

Pays couverts |

Arabie saoudite, Turquie et Égypte |

|

Acteurs du marché couverts |

Les principales entreprises présentes sur le marché sont Bio-Rad Laboratories, Inc, Siemens Healthcare Private Limited, Sysmex Europe SE, Randox Laboratories Ltd., Sera Care, Thermo Fisher Scientific Inc., Beckman Coulter, Inc., Technopath Clinical Diagnostics, DiaSorin SpA, Agappe Diagnostics Ltd et Spectrum Diagnostics. |

Définition du marché

Les produits de diagnostic in vitro sont des réactifs, instruments et systèmes destinés à être utilisés pour diagnostiquer une maladie ou d'autres conditions, y compris pour déterminer l'état de santé, afin de guérir, d'atténuer, de traiter ou de prévenir une maladie ou ses séquelles. Ces produits sont destinés à être utilisés pour la collecte, la préparation et l'examen d'échantillons prélevés sur le corps humain.

Les contrôles de qualité des dispositifs de diagnostic in vitro (DIV) sont des échantillons/matériaux utilisés pour valider la fiabilité du système de test du DIV afin de garantir l'exactitude des résultats des tests et d'évaluer l'impact de facteurs tels que les conditions environnementales et les performances de l'opérateur sur les résultats des tests. En outre, ils peuvent également être utilisés pour surveiller la santé d'un patient, soigner des maladies et permettre aux professionnels de la santé d'identifier la procédure de traitement ou la thérapie la plus efficace pour le patient.

Dynamique du marché du contrôle de la qualité des diagnostics in vitro (DIV)

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de la prévalence des maladies chroniques en Arabie saoudite, en Turquie et en Égypte

Les maladies et affections chroniques sont en augmentation dans le monde entier. Le vieillissement de la population et la sédentarité contribuent à une augmentation constante des problèmes de santé à long terme. La prévalence croissante des maladies chroniques et infectieuses a conduit au lancement d'outils de diagnostic et de test rapides par les principaux acteurs du marché. En outre, l'adoption croissante des dispositifs d'autotest et de point de service accélère encore la croissance des dispositifs de diagnostic in vitro dans le monde entier.

Ainsi, le nombre croissant de maladies chroniques devrait accélérer considérablement la croissance du marché du contrôle qualité des DIV dans un avenir proche.

- Adoption croissante de solutions de contrôle de la qualité dans les laboratoires et les hôpitaux

Les tests en laboratoire sur des échantillons de patients peuvent être une procédure complexe, en fonction des analyses cliniques, des études microbiologiques ou des analyses de banques de sang, entre autres aspects du laboratoire clinique. Le contrôle qualité (CQ) est l'un des impacts les plus importants des tests en laboratoire : il garantit à la fois la précision et l'exactitude des résultats des échantillons de patients. L'intégrité des échantillons de contrôle qualité est importante à la fois pour la gestion de la qualité globale et pour répondre aux exigences des tests d'aptitude.

Ainsi, l’adoption croissante de solutions de contrôle qualité dans les laboratoires et les hôpitaux devrait stimuler la croissance du marché.

Opportunités

-

Augmentation des acquisitions stratégiques et des partenariats entre organisations

Récemment, différentes organisations ont fait des démarches de partenariat et de collaboration pour développer des dispositifs de diagnostic in vitro (DIV) essentiels à la détection des maladies. Grâce à ces partenariats et accords, les deux entreprises peuvent non seulement développer une nouvelle gamme de technologies et de plateformes qui aideront à détecter les maladies.

Grâce à un accord à long terme, les deux entreprises peuvent proposer des dispositifs de diagnostic in vitro à prix dimensionnels en réponse à la demande des consommateurs sur le marché. Un tel partenariat et un tel accord mutuel profitent non seulement aux deux entreprises, mais créent également de nombreuses opportunités de croissance pour le marché.

-

Augmentation des activités de recherche et développement

Partout dans le monde, les dépenses consacrées aux activités de recherche et développement augmentent en raison des dépenses de santé publique et des performances économiques. Or, le secteur de la santé se classe au deuxième rang parmi tous les secteurs en ce qui concerne le montant consacré à la recherche et au développement. L'augmentation des dépenses de santé a en outre permis d'améliorer les opportunités de recherche et de développement. Par conséquent, elle a accru la demande de services d'externalisation des affaires réglementaires en matière de DIV dans toute la région.

Contraintes/Défis

- Coûts élevés liés au contrôle de la qualité et à la maintenance des dispositifs de diagnostic in vitro

Les diagnostics in vitro (DIV) sont des tests effectués sur des échantillons tels que du sang ou des tissus prélevés sur le corps humain. Les diagnostics in vitro peuvent détecter des maladies ou d'autres affections et peuvent être utilisés pour surveiller l'état de santé général d'une personne afin de contribuer à guérir, traiter ou prévenir des maladies.

Le DIV des analytes provenant d'échantillons corporels, y compris les biopsies de sang et de tissus, est utilisé seul ou en combinaison avec des investigations cliniques et est perçu comme un outil important pour des résultats médicaux de haute qualité, d'où le coût élevé du maintien du DIV et du contrôle qualité des dispositifs de DIV pour effectuer des tests précis.

Par conséquent, le coût croissant de la maintenance des DIV est devenu un facteur décisif pour les entreprises dans le processus de service, ce qui freine encore davantage la croissance du marché dans une certaine mesure.

- Réglementations strictes concernant les dispositifs de diagnostic in vitro en Arabie saoudite, en Turquie et en Égypte

L'utilisation des dispositifs de diagnostic in vitro (DIV) augmente rapidement dans le monde entier, en raison de la croissance de la population âgée et de plusieurs maladies chroniques qui peuvent être évitées grâce à un diagnostic précoce et à des traitements opportuns. Dans le même temps, les acteurs du marché des dispositifs de diagnostic in vitro (DIV) doivent suivre certaines réglementations pour obtenir l'approbation des autorités supérieures pour le lancement du produit dans une région. Ces directives strictes doivent être respectées, et c'est l'une des tâches les plus difficiles parmi toutes les étapes. L'approbation préalable à la mise sur le marché de divers dispositifs médicaux varie d'un pays à l'autre.

Par conséquent, les règles et réglementations strictes en matière d’approbation des produits constituent des freins à la croissance du marché.

Développement récent

- En février 2023, Siemens Healthineers, une société leader dans le domaine des technologies médicales, et Unilabs, un important fournisseur de services de diagnostic, ont annoncé un accord pluriannuel d'une valeur de plus de 200 000 €. Unilabs a investi dans la technologie de pointe de Siemens Healthineers et va acquérir plus de 400 analyseurs de laboratoire pour améliorer encore son infrastructure de laboratoire afin d'offrir un service inégalé à ses clients. Ce partenariat a contribué à la mise en place d'une infrastructure de tests de diagnostic de pointe pour améliorer les soins aux patients.

- En juillet 2021, Thermo Fisher Scientific, leader mondial au service de la science, a annoncé une collaboration avec Ortho Clinical Diagnostics pour promouvoir et distribuer les contrôles qualité Thermo Scientific MAS et le logiciel d'assurance qualité LabLink xL à utiliser avec les analyseurs VITROS d'Ortho Clinical Diagnostics. Cela a aidé l'entreprise à accroître sa présence mondiale sur le marché.

Portée du marché du contrôle de la qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte

Le marché du contrôle qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte est segmenté en quatre segments notables tels que les produits et services, l'application, le type, le secteur et l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Produits et services

- Contrôle de la qualité des produits

- Services de contrôle de la qualité

Sur la base des produits et services, le marché du contrôle qualité des diagnostics in vitro (IVD) d'Arabie saoudite, de Turquie et d'Égypte est segmenté en produits de contrôle qualité et services de contrôle qualité.

Applications

- Chimie clinique

- Immunochimie

- Hématologie

- Diagnostic moléculaire

- Coagulation/Hémostase

- Microbiologie

- Autres

Sur la base des applications, le marché du contrôle qualité des diagnostics in vitro (IVD) d'Arabie saoudite, de Turquie et d'Égypte est segmenté en chimie clinique, immunochimie, hématologie, diagnostics moléculaires, coagulation/hémostase, microbiologie et autres.

Secteur

- Clinique

- Non clinique

Sur la base du secteur, le marché du contrôle qualité des diagnostics in vitro (DIV) en Arabie saoudite, en Turquie et en Égypte est segmenté en clinique et non clinique.

Utilisateur final

- Laboratoires cliniques

- Instituts universitaires et de recherche

- Banques de sang

- Industrie de la biotechnologie

- Industrie pharmaceutique

- Autres

Sur la base des utilisateurs finaux, le marché du contrôle qualité des diagnostics in vitro (IVD) d'Arabie saoudite, de Turquie et d'Égypte est segmenté en laboratoires cliniques, instituts universitaires et de recherche, banques du sang, industrie biotechnologique, industrie pharmaceutique et autres.

Analyse du paysage concurrentiel et des parts de marché du contrôle de la qualité des diagnostics in vitro (DIV)

Le paysage concurrentiel du marché du contrôle qualité des diagnostics in vitro (DIV) fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché de l'ataxie.

Certains des principaux acteurs opérant sur le marché du contrôle qualité des diagnostics in vitro (IVD) sont Bio-Rad Laboratories, Inc, Siemens Healthcare Private Limited, Sysmex Europe SE, Randox Laboratories Ltd., Sera Care, Thermo Fisher Scientific Inc., Beckman Coulter, Inc., Technopath Clinical Diagnostics, DiaSorin SpA, Agappe Diagnostics Ltd et Spectrum Diagnostics. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SAUDI ARABIA PRODUCTS AND SERVICES, LIFELINE CURVE

2.8 EGYPT PRODUCTS AND SERVICES, LIFELINE CURVE

2.9 TURKEY PRODUCTS AND SERVICES, LIFELINE CURVE

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET TESTING TYPE COVERAGE GRID

2.13 VENDOR SHARE ANALYSIS

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL'S MODEL

4.2 PORTER'S 5 FORCES

4.3 INDUSTRY INSIGHTS

5 REGULATORY GUIDELINES FOR IN VITRO DIAGNOSTICS QUALITY CONTROL

5.1 REGULATIONS IN SAUDI ARABIA

5.2 REGULATIONS IN TURKEY

5.3 REGULATIONS IN EGYPT

5.3.1 MEDICAL DEVICE REGISTRATION IN EGYPT, THE PROCESS IN BRIEF:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC DISEASES ACROSS SAUDI ARABIA, TURKEY, AND EGYPT

6.1.2 RISING ADOPTION OF QUALITY CONTROL SOLUTIONS IN LABORATORIES AND HOSPITALS

6.1.3 ADVANCEMENTS IN TECHNOLOGY LEADING TO THE DEVELOPMENT OF NEW AND ADVANCED DIAGNOSTIC PRODUCTS

6.1.4 RISING USE OF QUALITY CONTROL IN MOLECULAR DIAGNOSTICS

6.2 RESTRAINTS

6.2.1 HIGH COST RELATED TO QUALITY CONTROL AND MAINTENANCE OF IVD

6.2.2 STRINGENT REGULATIONS REGARDING IVD IN SAUDI ARABIA, TURKEY, AND EGYPT

6.3 OPPORTUNITIES

6.3.1 RISE IN STRATEGIC ACQUISITION AND PARTNERSHIP AMONG ORGANIZATIONS

6.3.2 RISING RESEARCH AND DEVELOPMENT ACTIVITIES

6.4 CHALLENGES

6.4.1 LACK OF INFRASTRUCTURE IN HEALTHCARE SERVICE

6.4.2 SHORTAGE OF SKILLED PERSONNEL FOR HANDLING QUALITY CONTROL OF IN VITRO DIAGNOSTIC DEVICES.

7 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCT AND SERVICES

7.1 OVERVIEW

7.2 QUALITY CONTROL PRODUCTS

7.2.1 SERUM/PLASMA-BASED CONTROL

7.2.2 WHOLE BLOOD-BASED CONTROLS

7.2.3 URINE-BASED CONTROLS

7.2.4 OTHER CONTROLS

7.2.5 INTERNAL QUALITY CONTROL

7.2.6 EXTERNAL QUALITY CONTROL

7.3 QUALITY CONTROL SERVICES

8 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 CLINICAL CHEMISTRY

8.3 IMMUNOCHEMISTRY

8.4 HEMATOLOGY

8.5 MOLECULAR DIAGNOSTICS

8.5.1 QUALITY CONTROL PRODUCTS

8.5.1.1 INTERNAL QUALITY CONTROL

8.5.1.2 EXTERNAL QUALITY CONTROL

8.5.2 QUALITY CONTROL SERVICES

8.6 COAGULATION/HEMOSTASIS

8.7 MICROBIOLOGY

8.8 OTHERS

9 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR

9.1 OVERVIEW

9.2 CLINICAL

9.3 NON-CLINICAL

10 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER

10.1 OVERVIEW

10.2 CLINICAL LABORATORIES

10.3 ACADEMIC AND RESEARCH INSTITUTES

10.4 PHARMACEUTICAL INDUSTRY

10.5 BIOTECHNOLOGY INDUSTRY

10.6 BLOOD BANKS

10.7 OTHERS

11 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

11.2 COMPANY SHARE ANALYSIS: EGYPT

11.3 COMPANY SHARE ANALYSIS: TURKEY

12 SWOT ANALYSIS

13 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, COMPANY PROFILES

13.1 THERMO FISHER SCIENTIFIC INC.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 SIEMENS HEALTHCARE GMBH

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 BIO-RAD LABORATORIES, INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 BECKMAN COULTER, INC.

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENT

13.5 SYSMEX CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 AGAPPE DIAGNOSTICS LTD

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 DIASORIN MOLECULAR LLC.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 RANDOX LABORATORIES LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 SERA CARE

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 SPECTRUM DIAGNOSTICS

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 TECHNOPATH CLINICAL DIAGNOSTICS

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des figures

FIGURE 1 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COUNTRY MARKET ANALYSIS

FIGURE 6 TURKEYS IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COUNTRY MARKET ANALYSIS

FIGURE 7 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 8 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: MARKET TESTING TYPE COVERAGE GRID

FIGURE 11 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: SEGMENTATION

FIGURE 13 RISING PREVALENCE OF CHRONIC DISEASES ACROSS SAUDI ARABIA IS EXPECTED TO DRIVE THE SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN THE FORECAST PERIOD

FIGURE 14 RISING ADOPTION OF QUALITY CONTROL SOLUTIONS IN LABORATORIES AND HOSPITALS IS EXPECTED TO DRIVE THE TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN THE FORECAST PERIOD IN THE FORECAST PERIOD

FIGURE 15 ADVANCEMENTS IN TECHNOLOGY LEADING TO THE DEVELOPMENT OF NEW AND ADVANCED DIAGNOSTIC PRODUCTS ARE EXPECTED TO DRIVE THE EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN THE FORECAST PERIOD IN THE FORECAST PERIOD

FIGURE 16 THE PRODUCT AND SERVICES TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN 2023 & 2030

FIGURE 17 THE PRODUCT AND SERVICES TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN 2023 & 2030

FIGURE 18 THE PRODUCT AND SERVICES TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN 2023 & 2030

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET

FIGURE 20 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2022

FIGURE 21 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2022

FIGURE 22 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2022

FIGURE 23 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2023-2030 (USD THOUSAND)

FIGURE 24 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2023-2030 (USD THOUSAND)

FIGURE 25 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2023-2030 (USD THOUSAND)

FIGURE 26 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, CAGR (2023-2030)

FIGURE 27 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, CAGR (2023-2030)

FIGURE 28 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, CAGR (2023-2030)

FIGURE 29 SAUDI ARABIA, TURKEY AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 30 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 31 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 32 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2022

FIGURE 33 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2022

FIGURE 34 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2022

FIGURE 35 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 36 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 37 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 38 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, CAGR (2023-2030)

FIGURE 39 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, CAGR (2023-2030)

FIGURE 40 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, CAGR (2023-2030)

FIGURE 41 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, LIFELINE CURVE

FIGURE 42 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, LIFELINE CURVE

FIGURE 43 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, LIFELINE CURVE

FIGURE 44 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2022

FIGURE 45 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2022

FIGURE 46 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2022

FIGURE 47 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2023-2030 (USD THOUSAND)

FIGURE 48 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2023-2030 (USD THOUSAND)

FIGURE 49 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2023-2030 (USD THOUSAND)

FIGURE 50 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, CAGR (2023-2030)

FIGURE 51 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, CAGR (2023-2030)

FIGURE 52 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, CAGR (2023-2030)

FIGURE 53 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, LIFELINE CURVE

FIGURE 54 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, LIFELINE CURVE

FIGURE 55 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, LIFELINE CURVE

FIGURE 56 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2022

FIGURE 57 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2022

FIGURE 58 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2022

FIGURE 59 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 60 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 61 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 62 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, CAGR (2023-2030)

FIGURE 63 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, CAGR (2023-2030)

FIGURE 64 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, CAGR (2023-2030)

FIGURE 65 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, LIFELINE CURVE

FIGURE 66 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, LIFELINE CURVE

FIGURE 67 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, LIFELINE CURVE

FIGURE 68 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COMPANY SHARE 2022 (%)

FIGURE 69 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COMPANY SHARE 2022 (%)

FIGURE 70 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.