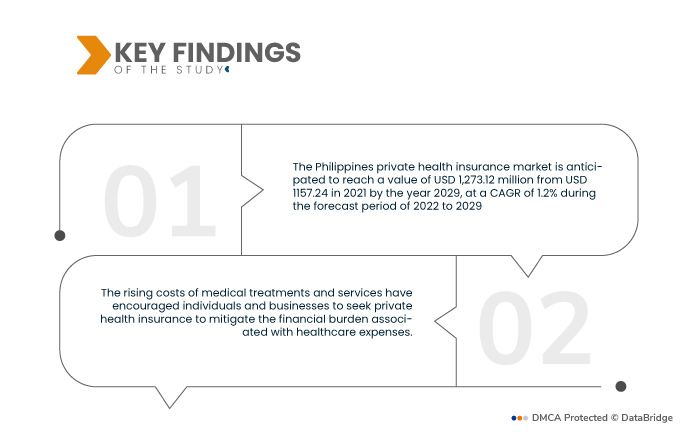

Le Le marché privé de l'assurance maladie aux Philippines connaît une croissance significative, tirée par la hausse des coûts des soins de santé et la demande croissante de services médicaux de qualité. Les assureurs proposent une large gamme de plans et d’avantages, adaptant leurs forfaits pour répondre à divers besoins. Ce marché en plein essor offre aux Philippins une sécurité financière et un meilleur accès aux soins de santé, faisant de l’assurance maladie privée un aspect crucial de leur bien-être général.

Accéder au rapport complet @ https://www.databridgemarketresearch.com/reports/philippines-private-health-insurance-market

Data Bridge Market Research analyse que le marché de l'assurance maladie privée aux Philippines devrait atteindre 1 273,12 millions de dollars d'ici 2029, contre 1 157,24 dollars en 2021, avec un TCAC de 1,2 % au cours de la période de prévision de 2022 à 2029. La prise de conscience croissante de la population La santé et le bien-être ont conduit à une demande accrue de couverture d’assurance maladie complète pour accéder à de meilleurs établissements et services de santé.

Principales conclusions de l'étude

L’expansion de la classe moyenne devrait stimuler le taux de croissance du marché

Alors que la population de la classe moyenne aux Philippines continue de croître, de plus en plus de personnes ont la capacité financière de rechercher de meilleures options de soins de santé. Avec un revenu disponible plus élevé et un désir de bénéficier d’un meilleur accès et de meilleurs services de santé, ce segment de la population se tourne de plus en plus vers l’assurance maladie privée pour bénéficier d’une couverture complète et accéder à des installations médicales de meilleure qualité. La croissance démographique de la classe moyenne est devenue un moteur important de la demande croissante de produits d’assurance maladie privée dans le pays.

Portée du rapport et segmentation du marché

|

Mesure du rapport

|

Détails

|

|

Période de prévision

|

2022 à 2029

|

|

Année de référence

|

2021

|

|

Années historiques

|

2020 (personnalisable jusqu'en 2014-2019)

|

|

Unités quantitatives

|

Chiffre d'affaires en millions USD, volumes en unités, prix en USD

|

|

Segments couverts

|

Taper (Assurance maladies graves, assurance maladie individuelle, assurance maladie familiale, assurance maladie spécifique et autres), catégorie de régime de santé/niveaux de métal (Bronze, Argent, Or Platine et autres), type de fournisseur (organismes de maintenance de la santé (HMOS), organismes de prestataires privilégiés ( PPOS), organisations de fournisseurs exclusifs (EPOS), plans de point de service (POS), plans de santé à franchise élevée (HDHPS) et autres), tranche d'âge (jeunes adultes (19-44 ans), adultes d'âge moyen (45- 64 ans) et personnes âgées (65 ans et plus)), canal de distribution (compagnies d'assurance directes, agrégateurs d'assurance et autres)

|

|

Acteurs du marché couverts

|

Etna Inc. (Filiale de CVS Health) (États-Unis), AIA Group Limited (Hong Kong), Allianz (Allemagne), HSBC Group (Hong Kong), Pacific Cross (Philippines), ASSICURAZIONI GENERALI SPA (Italie)

|

|

Points de données couverts dans le rapport

|

En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie d'experts, l'épidémiologie des patients, une analyse du pipeline, une analyse des prix, et le cadre réglementaire.

|

Analyse sectorielle :

Le marché de l’assurance maladie privée aux Philippines est segmenté en fonction du type, de la catégorie de plan de santé/niveaux de métal, du type de fournisseur, de la tranche d’âge et du canal de distribution.

- Sur la base du type, le marché de l'assurance maladie privée aux Philippines est segmenté en assurance maladies graves, assurance maladie individuelle, assurance maladie familiale, assurance maladie spécifique et autres.

- Sur la base des catégories de régimes de santé et des niveaux de métaux, le marché de l'assurance maladie privée aux Philippines est segmenté en Bronze, argent, or platine et autres.

- Sur la base du type de fournisseur, le marché de l'assurance maladie privée des Philippines est segmenté en organismes de maintenance de la santé (HMOS), organismes de prestataires privilégiés (PPOS), organismes de prestataires exclusifs (EPOS), plans de point de service (POS), plans de santé à franchise élevée. (HDHPS) et autres.

- Sur la base du groupe d'âge, le marché de l'assurance maladie privée aux Philippines est segmenté en jeunes adultes (19-44 ans), adultes d'âge moyen (45-64 ans) et adultes plus âgés (65 ans et plus).

- Sur la base du canal de distribution, le marché privé de l’assurance maladie aux Philippines est segmenté par les compagnies d’assurance directes, les agrégateurs d’assurance et autres.

Acteurs majeurs

Data Bridge Market Research reconnaît les sociétés suivantes comme les principales assurances maladie privées des Philippines les acteurs du marché de l'assurance maladie privée aux Philippines sont AIA Group Limited (Hong Kong), Allianz (Allemagne), HSBC Group (Hong Kong), Pacific Cross (Philippines), ASSICURAZIONI GENERALI SPA (Italie)

Développements du marché

- En 2022, Assicuranzioni Generali SPA a signé un accord pour l'acquisition de La Médicale, qui est une compagnie d'assurance pour les professionnels de la santé. Ce développement prévoit également la cession du portefeuille de couverture décès de Predica1, commercialisé et géré par La Médicale.

- En 2022, Allianz Real Estate, l'un des plus grands gestionnaires d'investissements immobiliers au monde, a conclu un accord pour acquérir un portefeuille d'actifs résidentiels multifamiliaux de premier ordre à Tokyo pour environ 90 millions de dollars, au nom d'Allianz Real Estate Asia-Pacific. Fonds multifamilial japonais.

Pour des informations plus détaillées sur le marché de l’assurance maladie privée aux Philippines rapport, cliquez sur https://www.databridgemarketresearch.com/reports/philippines-private-health-insurance-market