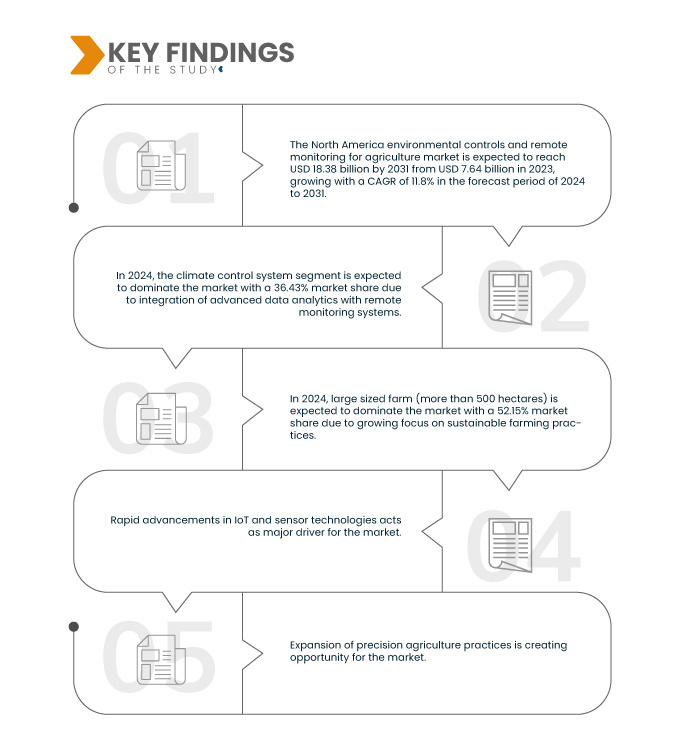

L'intégration croissante de l'Internet des objets (IoT) et des technologies de capteurs avancées transforme le contrôle environnemental et la surveillance à distance en agriculture. L'IoT permet la collecte de données en temps réel sur divers paramètres environnementaux tels que la température, l'humidité, l'humidité du sol et l'intensité lumineuse, aidant ainsi les agriculteurs à prendre des décisions éclairées. Des capteurs déployés sur les champs et les équipements agricoles assurent une surveillance précise et continue des cultures et des conditions environnementales, garantissant une utilisation optimale des ressources et améliorant l'efficacité. Ces technologies améliorent non seulement la productivité, mais contribuent également à atténuer les effets des changements climatiques, rendant l'agriculture plus résiliente et adaptative. De plus, la combinaison de l'IoT et des technologies de capteurs favorise le développement de l'agriculture de précision, où les agriculteurs peuvent adapter leurs intrants comme l'eau, les engrais et les pesticides en fonction des données de terrain en temps réel. Cela réduit le gaspillage, diminue les coûts et favorise des pratiques agricoles durables. L'intégration transparente des réseaux IoT aux plateformes cloud permet une prise de décision et une automatisation basées sur les données, améliorant ainsi l'efficacité opérationnelle. À mesure que ces technologies continuent de progresser, elles joueront un rôle essentiel dans l’adoption de contrôles environnementaux sophistiqués et de solutions de surveillance à distance dans l’agriculture, répondant aux défis liés aux pénuries de main-d’œuvre, à la variabilité climatique et à la gestion des ressources.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/north-america-environmental-controls-and-remote-monitoring-for-agriculture-market

Selon une étude de marché de Data Bridge, le marché nord-américain des contrôles environnementaux et de la télésurveillance pour l'agriculture devrait atteindre 18,38 milliards USD d'ici 2031, contre 7,64 milliards USD en 2023, avec un TCAC de 11,8 % sur la période 2024-2031. Les avancées rapides de l'IoT et des technologies de capteurs révolutionnent le contrôle environnemental et la télésurveillance en agriculture. Ces innovations permettent aux agriculteurs de disposer de données en temps réel et d'un contrôle précis de leurs opérations agricoles, améliorant ainsi l'efficacité, la productivité et la durabilité. À mesure que l'adoption de ces technologies se généralise, elles joueront un rôle crucial pour relever les défis de l'agriculture moderne, garantir une meilleure gestion des ressources et soutenir la tendance mondiale vers des pratiques agricoles plus résilientes et durables.

Principales conclusions de l'étude

Demande croissante d'une gestion efficace des ressources

La demande croissante d'une gestion efficace des ressources en agriculture influence considérablement le marché des contrôles environnementaux et de la télésurveillance. Face à l'augmentation des besoins mondiaux en production alimentaire et à l'intensification des préoccupations environnementales, les agriculteurs recherchent des technologies permettant d'optimiser l'utilisation des ressources et de minimiser le gaspillage. Les solutions IoT avancées, telles que les systèmes d'irrigation intelligents et les capteurs d'humidité du sol en temps réel, deviennent cruciales. Ces technologies permettent une surveillance précise des conditions environnementales, permettant une utilisation ciblée de l'eau, une application précise des engrais et une lutte antiparasitaire rapide. Cette efficacité améliore non seulement le rendement des cultures et réduit les coûts, mais favorise également des pratiques agricoles durables.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2024 à 2031

|

Année de base

|

2023

|

Années historiques

|

2022 (personnalisable pour 2016-2021)

|

Unités quantitatives

|

Chiffre d'affaires en millions USD

|

Segments couverts

|

Offre (système de contrôle climatique, système de contrôle d'éclairage , système de contrôle d'irrigation, surveillance à distance, système de contrôle de fertirrigation, logiciels et services), taille de l'exploitation (grande exploitation (plus de 500 hectares), petite exploitation (moins de 100 hectares), exploitation de taille moyenne (100 à 500 hectares), connectivité (Wi-Fi, Bluetooth, technologie RF, Zigbee et autres), application (agriculture de précision, surveillance du bétail et serre intelligente), canal de distribution (vente directe et ventes en direct)

|

Pays couverts

|

États-Unis, Canada, Mexique

|

Acteurs du marché couverts

|

Monnit Corporation (États-Unis), Ingersoll Rand (États-Unis), AGCO Corporation (États-Unis), Climate Control Systems (Canada), Rain Bird Corporation (États-Unis), Valmont Industries, Inc. (États-Unis), Netafim (Israël), Lindsay Corporation (États-Unis), The Toro Company (États-Unis), Hunter Industries Inc. (États-Unis), Galcon (États-Unis), Weathermatic (États-Unis), WeatherTRAK (États-Unis), Signify Holding (Pays-Bas), Topcon (Japon), Trimble Inc. (États-Unis), Controlled Environments Limited (Canada), Bayer AG (Allemagne), Ag Leader Technology (États-Unis), EOS Data Analytics, Inc. (États-Unis), CropX Inc. (Israël), AgEagle Aerial Systems Inc (États-Unis), Wadsworth Controls (États-Unis), Bartlett Instrument Company (États-Unis), Link4 Corporation (États-Unis), Priva (États-Unis), Hydrotek Hydroponics (Canada), Argus Control Systems Limited (Canada), Cropking Incorporated (États-Unis), Ridder (Canada), Agrowtek Inc. (États-Unis), Growlink, Inc. (États-Unis), Blue Lab (Nouvelle-Zélande), Grow Director (Israël), Maximus Solutions (Canada), Hoogendoorn (Pays-Bas), Sensaphone (États-Unis), Autogrow Systems Ltd (Nouvelle-Zélande) et Orisha (Canada) entre autres

|

Points de données couverts dans le rapport

|

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande.

|

Analyse des segments

Le marché nord-américain des contrôles environnementaux et de la surveillance à distance pour l'agriculture est segmenté en cinq segments notables, basés sur l'offre, la taille de l'exploitation, la connectivité, l'application et le canal de distribution.

- Sur la base de l'offre, le marché nord-américain des contrôles environnementaux et de la surveillance à distance pour l'agriculture est segmenté en système de contrôle climatique , système de contrôle d'éclairage, système de contrôle d'irrigation, surveillance à distance, système de contrôle de fertirrigation, logiciels et services.

En 2024, le segment des systèmes de contrôle climatique devrait dominer le marché des contrôles environnementaux et de la surveillance à distance pour l'agriculture

En 2024, le segment des systèmes de contrôle climatique devrait dominer le marché avec une part de 36,43 % en raison de leur capacité à atténuer les impacts des conditions météorologiques imprévisibles et du changement climatique sur la production agricole.

- Sur la base de la taille des exploitations, le marché nord-américain des contrôles environnementaux et de la surveillance à distance pour l'agriculture est segmenté en grandes exploitations (plus de 500 hectares), petites exploitations (moins de 100 hectares) et exploitations de taille moyenne (100 hectares à 500 hectares). En 2024, le segment des grandes exploitations (plus de 500 hectares) devrait dominer le marché avec une part de marché de 52,15 %.

- En Amérique du Nord, le marché des contrôles environnementaux et de la télésurveillance pour l'agriculture est segmenté en fonction de la connectivité : Wi-Fi, Bluetooth, technologie RF, Zigbee, etc. En 2024, le segment Wi-Fi devrait dominer le marché avec une part de marché de 36,08 %.

- En fonction des applications, le marché nord-américain des contrôles environnementaux et de la télésurveillance pour l'agriculture est segmenté en agriculture de précision, surveillance du bétail et serres intelligentes . En 2024, l'agriculture de précision devrait dominer le marché avec une part de marché de 50,22 %.

- Sur la base du canal de distribution, le marché nord-américain des contrôles environnementaux et de la surveillance à distance pour l'agriculture est segmenté en ventes directes et ventes indirectes.

En 2024, les ventes directes devraient dominer le marché des contrôles environnementaux et de la surveillance à distance pour l'agriculture

En 2024, le segment des ventes directes devrait dominer le marché avec une part de marché de 63,25 %, les entreprises se concentrant de plus en plus sur l'établissement de relations directes avec les exploitations agricoles et les entreprises agroalimentaires à grande échelle.

Acteurs majeurs

Data Bridge Market Research analyse Valmont Industries, Inc. (États-Unis), Ingersoll Rand (États-Unis), AGCO Corporation (États-Unis), Bayer AG (Allemagne), Lindsay Corporation (États-Unis) comme les principaux acteurs opérant sur le marché.

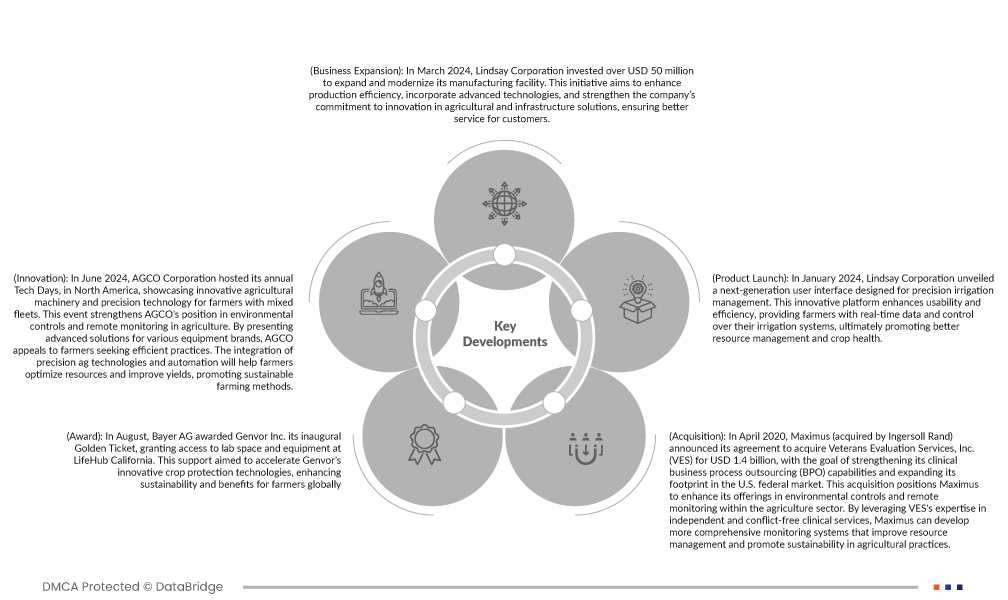

Développement du marché

- En juillet 2024, Trimble et Esri renforcent leur partenariat stratégique pour faire progresser les solutions SIG, l'intelligence de localisation et la gestion du cycle de vie des actifs. Leur collaboration, mise en avant lors de la Conférence des utilisateurs Esri 2024, se concentre sur l'optimisation des processus et l'automatisation des flux de travail pour une planification d'infrastructures plus écologiques. En tant que partenaire Platinum du réseau de partenaires Esri, Trimble vise à intégrer des technologies géospatiales avancées au logiciel ArcGIS d'Esri, permettant ainsi à ses clients d'améliorer la précision et la durabilité de leurs projets. Ce partenariat met également l'accent sur les actions humanitaires, illustrées par leur collaboration avec le HALO Trust pour améliorer la détection des mines terrestres.

- En mai 2024, Topcon Positioning Systems a ouvert un nouveau magasin Topcon Solutions à Spokane, dans l'État de Washington, portant ainsi sa présence commerciale à 14 points de vente dans tout le pays. Ce magasin proposera des produits et services de pointe pour les secteurs de la construction et de la géolocalisation, et comprendra un centre de formation agréé Autodesk pour améliorer l'expérience client et soutenir les professionnels locaux.

- En janvier 2024, le Transpiram de Toro a été élu Nouveau Produit de l'Année 2023. Cette solution innovante optimise l'efficacité de l'irrigation grâce à une technologie de pointe, améliorant ainsi la gestion de l'eau et la santé des cultures. Cette distinction souligne l'engagement de Toro en faveur de solutions de pointe dans le secteur de l'irrigation.

- En septembre 2020, Signify Holding s'est associé à GoodLeaf Farms, une entreprise canadienne d'agriculture verticale, pour fournir l'éclairage LED Philips Horticulture. Cette technologie améliore la production de légumes verts frais et sans pesticides tout au long de l'année. Cette collaboration renforce la position de Signify dans le domaine du contrôle environnemental et de la surveillance à distance en présentant des systèmes LED précis qui optimisent les conditions de croissance, augmentent le rendement et réduisent le gaspillage, consolidant ainsi son expertise en matière de solutions agricoles intelligentes et durables.

- En avril 2023, Sensaphone a lancé de nouveaux systèmes de télésurveillance – Sentinel, WSG30 et IMS-1000E – qui améliorent la gestion et la sécurité des laboratoires grâce à des alertes en temps réel et un enregistrement détaillé des données. Cette avancée renforce la présence de Sensaphone sur le marché du contrôle environnemental et de la télésurveillance en démontrant son expertise pour garantir des conditions de laboratoire optimales et prévenir les problèmes d'équipement.

Analyse régionale

Géographiquement, les pays couverts par le rapport sur le marché des contrôles environnementaux et de la surveillance à distance pour l'agriculture en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Selon l'analyse de Data Bridge Market Research :

Les États-Unis devraient être le pays dominant et celui qui connaît la croissance la plus rapide en Amérique du Nord en matière de contrôles environnementaux et de surveillance à distance pour le marché agricole.

Les États-Unis dominent le marché nord-américain des contrôles environnementaux et de la télésurveillance pour l'agriculture grâce à leurs vastes terres agricoles, à l'adoption de technologies agricoles avancées et à leurs investissements importants dans l'agriculture de précision. La diversité de la production agricole de la région, conjuguée à la demande croissante d'agriculture durable, renforce le besoin de contrôles environnementaux. De plus, le soutien et les incitations gouvernementales en faveur de pratiques agricoles intelligentes accélèrent encore la croissance de ce secteur.

Pour plus d'informations sur le rapport sur le marché nord-américain des contrôles environnementaux et de la surveillance à distance pour l'agriculture, cliquez ici : https://www.databridgemarketresearch.com/reports/north-america-environmental-controls-and-remote-monitoring-for-agriculture-market