Les thérapies numériques (DTx) permettent d'administrer des interventions thérapeutiques directement aux patients grâce à des logiciels d'évaluation à distance fondés sur des données probantes, afin de traiter, gérer et prévenir un large éventail de troubles comportementaux, mentaux et physiques. Elles sont utilisées seules ou en association avec des médicaments, des dispositifs ou d'autres thérapies afin d'optimiser les soins et les résultats de santé des patients. L'accès à distance croissant à des thérapies cliniquement prouvées comme sûres et efficaces est l'une des caractéristiques des thérapies numériques (DTx) pendant le traitement. Elles permettent un traitement facile, adapté à l'emploi du temps du patient, dans l'intimité et la sécurité de son domicile. Elles sont facilement accessibles et souvent via les appareils personnels du patient (smartphones, tablettes). La demande croissante de thérapies numériques s'accroît dans le monde entier en raison de la prévalence de maladies chroniques telles que le diabète et l'hypertension, qui devrait stimuler la croissance du marché. De plus, les avancées technologiques ont également contribué à la forte croissance du marché.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/north-america-and-europe-digital-therapeutics-market

Selon le rapport de l'OMS « Prévention et contrôle intégrés des maladies chroniques », en 2022, la contribution des principales maladies chroniques devrait atteindre 86 % de tous les décès et 74 % de la charge mondiale de morbidité.

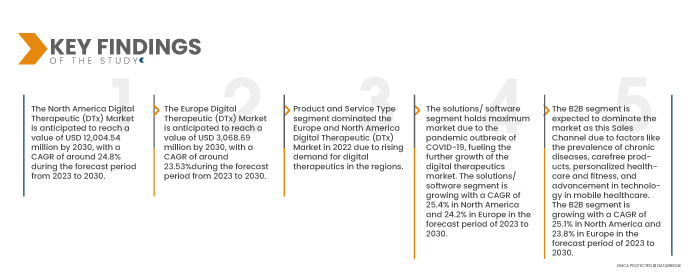

Data Bridge Market Research analyse que le marché des thérapies numériques (DTx) en Europe et en Amérique du Nord devrait croître à un TCAC de 24,8 % en Amérique du Nord et de 23,53 % en Europe au cours de la période de prévision de 2023 à 2030 et devrait atteindre 12 004,54 millions USD en Amérique du Nord et 3 068,69 millions en Europe d'ici 2030. En 2023, le segment des types de produits et de services devrait dominer le marché en raison de la demande croissante de thérapies numériques dans les régions.

AUGMENTATION DU NOMBRE DE PERSONNES UTILISANT DES SMARTPHONES

Aujourd'hui, les gens ont besoin d'un smartphone pour communiquer, faire leurs courses et consulter un médecin. Nombreux sont ceux qui ne peuvent imaginer leur vie sans smartphone. Ils préfèrent se faire soigner à domicile, confortablement, plutôt que d'être suivis à l'hôpital. La thérapie numérique permet donc aux patients de recevoir des soins simplement en restant chez eux. Grâce aux progrès technologiques et au développement des pays, l'utilisation des smartphones au quotidien est en constante augmentation.

La thérapie numérique repose sur des logiciels facilement accessibles sur smartphone, faciles à utiliser. Certaines applications sont disponibles sur téléphone, comme Mindstrong Health, Happify et Bluestar, entre autres.

Par exemple,

- Les smartphones, qui disposent d'une connexion à Internet et exécutent des applications, sont le type de téléphones portables le plus répandu dans 9 des 11 pays étudiés : de nombreux adultes (médiane de 53 %) utilisent un smartphone

- Alors que les ventes commerciales mobiles devraient atteindre 2,92 billions de dollars en 2020, les propriétaires de magasins de navigation ne peuvent pas se permettre de négliger l'importance d'avoir un magasin en réseau optimisé pour le mobile pour attirer plus de clients et développer leur activité.

- Ce chiffre augmente également rapidement au fil du temps, comme en témoigne le fait qu'il y avait un milliard d'utilisateurs mobiles de moins seulement quatre ans plus tôt, en 2021. Ce chiffre devrait atteindre 3,8 milliards en 2023, soit une amélioration de 52 % sur une très courte période de cinq ans.

Les progrès technologiques ont entraîné une augmentation du nombre de personnes utilisant des smartphones. La croissance rapide du e-commerce devrait stimuler le marché.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2023 à 2030

|

Année de base

|

2022

|

Années historiques

|

2021 (personnalisable de 2015 à 2020)

|

Unités quantitatives

|

Chiffre d'affaires en millions USD, volumes en tonnes, prix en USD

|

Segments couverts

|

Marché de la thérapie numérique (DTx) en Europe et en Amérique du Nord, par type de produit et de service (produit matériel, solutions/logiciels et services), application (applications de traitement/soins et applications préventives), mode d'achat (organisation d'achat groupé et individuel), canal de vente (B2B et B2C), pays (États-Unis, Canada, Mexique, Allemagne, Royaume-Uni, France, Italie, Espagne, Pays-Bas, Russie, Suisse, Turquie, Belgique et reste de l'Europe)

|

Pays couverts

|

États-Unis, Canada, Mexique, Allemagne, Royaume-Uni, France, Italie, Espagne, Pays-Bas, Russie, Suisse, Turquie, Belgique et reste de l'Europe

|

Acteurs du marché couverts

|

Noom (États-Unis), Atentiv (États-Unis), Cognoa (États-Unis), Kaia Health (États-Unis), Ginger (États-Unis), Livongo Health (États-Unis), Mango Health (États-Unis), Natural Cycles (Suède), Cognifit (États-Unis), Fitbit, Inc. (États-Unis), Omada Health Propeller Health (États-Unis), Welldoc, Inc. (États-Unis), Smart Patient GMBH (Allemagne), Mindstrong Health (États-Unis), Ayogo Health (Canada), Better Therapeutics (États-Unis), 2morrow (États-Unis), Canary Health (États-Unis), Click Therapeutics (États-Unis), Pear Therapeutics (États-Unis), Voluntis (États-Unis), Akili Interactive Labs (États-Unis), Samsung (Corée), Resmed (États-Unis) et GAIA AG (Allemagne), entre autres.

|

Points de données couverts dans le rapport

|

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research incluent également une analyse approfondie des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire.

|

Analyse des segments :

Le marché européen et nord-américain de la thérapie numérique (DTx) est classé en neuf segments notables en fonction du type de produit, de la solution commerciale, du type d'assistance/service, du niveau de couverture, du type de plans d'assurance, de la démographie, du type de couverture, de l'utilisateur final et du canal de distribution.

- Sur la base du type de produit et de service, le marché thérapeutique numérique (DTx) d'Europe et d'Amérique du Nord est segmenté en produits matériels, solutions/logiciels et services.

En 2023, le segment des solutions/logiciels devrait dominer le marché nord-américain de la thérapie numérique (DTx).

Français En 2023, le segment des solutions/logiciels devrait dominer le marché nord-américain des thérapies numériques (DTx) avec 71,5 % de parts de marché et devrait atteindre 8 856,67 millions USD d'ici 2030, contre 1 469,36 millions USD en 2022, avec un TCAC de 25,4 % au cours de la période de prévision de 2023 à 2030. En 2023, le segment des solutions/logiciels devrait dominer le marché européen des thérapies numériques (DTx) avec 58,8 % de parts de marché et devrait atteindre 1 871,63 millions USD d'ici 2030, contre 336,04 millions USD en 2022, avec un TCAC de 24,2 % au cours de la période de prévision de 2023 à 2030.

- En fonction des applications, le marché européen et nord-américain des thérapies numériques (DTx) est segmenté en applications thérapeutiques et préventives. En 2023, le segment des thérapies numériques devrait dominer le marché nord-américain avec 82,7 % de parts de marché et atteindre 10 102,18 millions USD d'ici 2030, contre 1 703,40 millions USD en 2022, avec un taux de croissance annuel composé (TCAC) de 25,1 % sur la période 2023-2030. En 2023, le segment des thérapies numériques devrait dominer le marché européen avec 83,7 % de parts de marché et atteindre 2 608,99 millions USD d'ici 2030, contre 479,34 millions USD en 2022, avec un taux de croissance annuel composé (TCAC) de 23,8 % sur la période 2023-2030.

- En fonction du mode d'achat, le marché des thérapies numériques (DTx) en Europe et en Amérique du Nord est segmenté en organisations d'achat groupé et en organisations individuelles. En 2023, le segment des organisations d'achat groupé devrait dominer le marché nord-américain des thérapies numériques (DTx) avec 74,9 % de parts de marché et atteindre 8 818,37 millions USD d'ici 2030, contre 1 552,65 millions USD en 2022, avec un taux de croissance annuel composé (TCAC) de 24,5 % sur la période 2023-2030. En 2023, le segment des organisations d'achat groupé devrait dominer le marché européen des thérapies numériques (DTx) avec 75,8 % de parts de marché et atteindre 2 284,59 millions USD d'ici 2030, contre 436,31 millions USD en 2022, avec un taux de croissance annuel composé (TCAC) de 23,2 % sur la période 2023-2030.

- En fonction des canaux de vente, le marché des thérapies numériques (DTx) en Europe et en Amérique du Nord est segmenté en B2B et B2C. En 2023, le segment B2B devrait dominer le marché nord-américain des thérapies numériques (DTx) avec 75,4 % de parts de marché et atteindre 9 205,50 millions USD d'ici 2030, contre 1 553,44 millions USD en 2022, avec un taux de croissance annuel composé (TCAC) de 25,1 % sur la période 2023-2030. En 2023, le segment B2B devrait dominer le marché européen des thérapies numériques (DTx) avec 76,2 % de parts de marché et atteindre 2 379,24 millions USD d'ici 2030, contre 436,33 millions USD en 2022, avec un taux de croissance annuel composé (TCAC) de 23,8 % sur la période 2023-2030.

Acteurs majeurs

Data Bridge Market Research reconnaît les entreprises suivantes comme les principaux acteurs du marché de la thérapie numérique (DTx) en Europe et en Amérique du Nord : Noom (États-Unis), Atentiv (États-Unis), Cognoa (États-Unis), Kaia Health (États-Unis), Ginger (États-Unis), Livongo Health (États-Unis), Mango Health (États-Unis), Natural Cycles (Suède), Cognifit (États-Unis), Fitbit, Inc. (États-Unis), Omada Health Propeller Health (États-Unis), Welldoc, Inc. (États-Unis), Smart Patient GMBH (Allemagne), Mindstrong Health (États-Unis), Ayogo Health (Canada), Better Therapeutics (États-Unis), 2morrow (États-Unis), Canary Health (États-Unis), Click Therapeutics (États-Unis), Pear Therapeutics (États-Unis), Voluntis (États-Unis), Akili Interactive Labs (États-Unis), Samsung (Corée), Resmed (États-Unis) et GAIA AG (Allemagne), entre autres.

Développement du marché

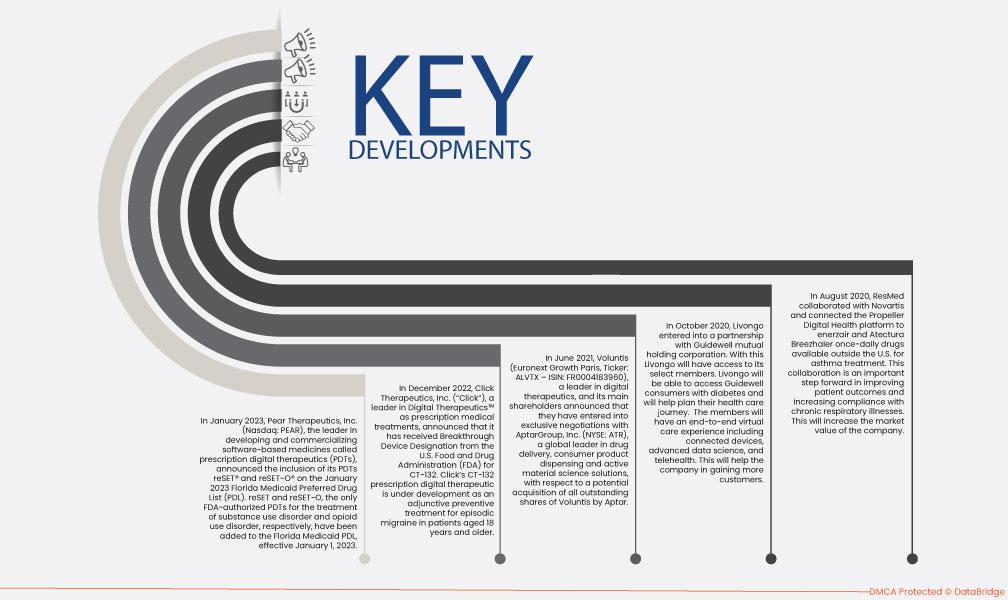

- En janvier 2023, Pear Therapeutics, Inc. (Nasdaq : PEAR), leader dans le développement et la commercialisation de médicaments basés sur des logiciels appelés thérapies numériques sur ordonnance (PDT), a annoncé l'inclusion de ses PDT reSET® et reSET-O® sur la liste des médicaments préférés (PDL) de Medicaid de Floride de janvier 2023. reSET et reSET-O, les seuls PDT autorisés par la FDA pour le traitement des troubles liés à l'usage de substances et des troubles liés à l'usage d'opioïdes, respectivement, ont été ajoutés à la PDL de Medicaid de Floride, à compter du 1er janvier 2023.

- En décembre 2022, Click Therapeutics, Inc. (« Click »), leader des thérapies numériques™ pour les traitements médicaux sur ordonnance, a annoncé avoir reçu la désignation de dispositif révolutionnaire de la Food and Drug Administration (FDA) américaine pour le CT-132. Le CT-132, un traitement numérique sur ordonnance de Click, est en cours de développement comme traitement préventif d'appoint pour les migraines épisodiques chez les patients âgés de 18 ans et plus.

- En juin 2021, Voluntis (Euronext Growth Paris, Ticker : ALVTX – ISIN : FR0004183960), leader des thérapies numériques, et ses principaux actionnaires ont annoncé être entrés en négociations exclusives avec AptarGroup, Inc. (NYSE : ATR), leader mondial des solutions d’administration de médicaments, de distribution de produits de consommation et de sciences des matériaux actifs, en vue d’une éventuelle acquisition de la totalité des actions en circulation de Voluntis par Aptar.

- En octobre 2020, Livongo a conclu un partenariat avec Guidewell Mutual Holding Corporation. Grâce à ce partenariat, Livongo aura accès à ses membres sélectionnés. Livongo pourra ainsi contacter les patients diabétiques de Guidewell et les accompagner dans la planification de leur parcours de soins. Les membres bénéficieront d'une expérience de soins virtuels complète, incluant des appareils connectés, des données scientifiques avancées et la télésanté. Cela permettra à l'entreprise de gagner davantage de clients.

- En août 2020, ResMed a collaboré avec Novartis et connecté la plateforme Propeller Digital Health aux médicaments à prise unique quotidienne Enerzair et Atectura Breezhaler, disponibles hors des États-Unis, pour le traitement de l'asthme. Cette collaboration constitue une avancée importante pour l'amélioration des résultats des patients et l'observance thérapeutique des maladies respiratoires chroniques. Elle augmentera la valeur marchande de l'entreprise.

Analyse régionale

Géographiquement, les pays couverts par le rapport sur le marché de la thérapie numérique (DTx) en Europe et en Amérique du Nord sont les États-Unis, le Canada, le Mexique, l'Allemagne, le Royaume-Uni, la France, l'Italie, l'Espagne, les Pays-Bas, la Russie, la Suisse, la Turquie, la Belgique et le reste de l'Europe.

Pour plus d'informations sur le marché des thérapies numériques (DTx) en Europe et en Amérique du Nord, cliquez ici : https://www.databridgemarketresearch.com/reports/north-america-and-europe-digital-therapeutics-market