Le marché mexicain des instruments d'analyse englobe une gamme d'appareils et d'instruments utilisés pour tester, mesurer et analyser les propriétés chimiques, physiques et biologiques dans divers secteurs, notamment l'industrie pharmaceutique, la santé, l'agroalimentaire et la surveillance environnementale. Les principaux segments comprennent la chromatographie, la spectroscopie, la spectrométrie de masse et l'analyse électrochimique. Ce marché est porté par la demande croissante en matière de contrôle qualité, de conformité réglementaire et de progrès technologiques en matière de techniques d'analyse. Des facteurs tels que l'essor des activités de recherche, la hausse des investissements dans le secteur de la santé et l'accent mis sur la durabilité environnementale contribuent à la croissance du marché. Les principaux acteurs du marché sont des fabricants nationaux et internationaux, contribuant à un paysage concurrentiel axé sur l'innovation et le lancement de solutions analytiques avancées.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/mexico-analytical-instruments-market

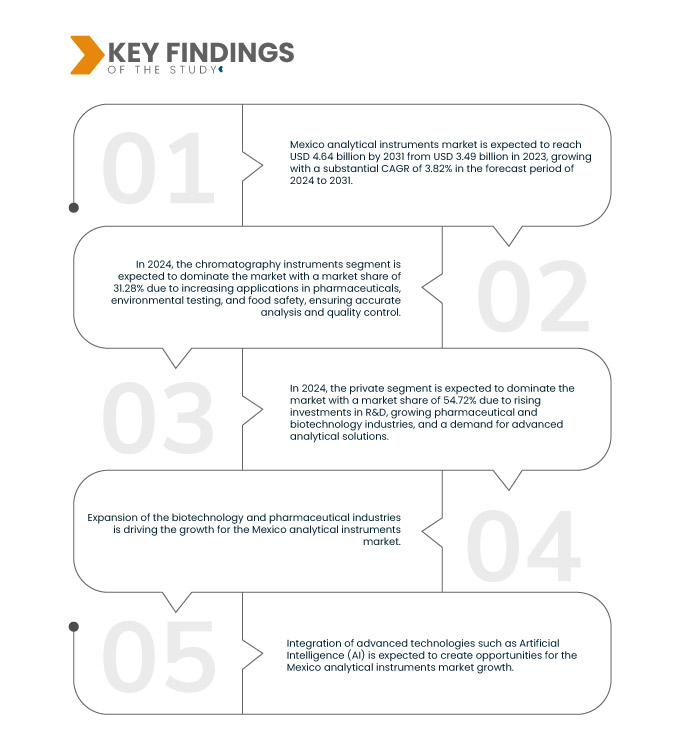

Data Bridge Market Research analyse que le marché mexicain des instruments d'analyse devrait atteindre 4,64 milliards USD d'ici 2031, contre 3,49 milliards USD en 2023, avec un TCAC substantiel de 3,82 % au cours de la période de prévision de 2024 à 2031.

Principales conclusions de l'étude

Adoption croissante dans les soins de santé et les diagnostics

Le secteur de la santé au Mexique connaît une transformation profonde en raison de l'adoption croissante d'instruments d'analyse avancés, favorisée par la prévalence croissante de maladies chroniques telles que le diabète et les maladies cardiovasculaires. Cette forte demande d'outils de diagnostic précis améliore les résultats pour les patients et rationalise les opérations de santé. Les initiatives gouvernementales visant à améliorer les infrastructures de santé facilitent les investissements dans les technologies d'analyse modernes, renforçant ainsi les capacités de diagnostic et la qualité globale des soins. De plus, l'accent mis sur la médecine personnalisée et l'importance croissante accordée à la recherche et au développement dans les secteurs pharmaceutique et biotechnologique stimulent la demande d'instruments d'analyse de haute précision, propulsant ainsi la croissance du marché.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2024 à 2031

|

Année de base

|

2023

|

Années historiques

|

2022 (personnalisable pour 2016-2021)

|

Unités quantitatives

|

Chiffre d'affaires en milliards USD

|

Segments couverts

|

Instruments ( instruments de chromatographie , instruments de spectroscopie , analyse thermique , jauges d'épaisseur de revêtement et autres), secteur (privé et public (gouvernement)), application ( produits pharmaceutiques , alimentation et boissons, mines et minéraux, fabrication de produits chimiques, pétrole et gaz, électronique et semi-conducteurs, textiles, automobile, aérospatiale et défense, et autres), canal de distribution (ventes directes et ventes indirectes)

|

Acteurs du marché couverts

|

Thermo Fisher Scientific Inc. (États-Unis), Agilent Technologies, Inc. (États-Unis), Waters Corporation (États-Unis), PerkinElmer Inc. (États-Unis), Bruker (États-Unis), Avantor, Inc. (États-Unis), Carl Zeiss AG (Allemagne), Eppendorf SE (États-Unis), Illumina, Inc. (États-Unis) et METTLER TOLEDO (Suisse) entre autres

|

Points de données couverts dans le rapport

|

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande.

|

Analyse des segments

Le marché mexicain des instruments d'analyse est segmenté en quatre segments notables basés sur les instruments, le secteur, l'application et le canal de distribution.

- Sur la base des instruments, le marché mexicain des instruments d'analyse est segmenté en instruments de chromatographie, instruments de spectroscopie, analyse thermique, jauges d'épaisseur de revêtement et autres.

En 2024, le segment des instruments de chromatographie devrait dominer le marché mexicain des instruments d'analyse

En 2024, le segment des instruments de chromatographie devrait dominer le marché avec une part de marché de 31,28 % en raison de l'augmentation des applications dans les produits pharmaceutiques, les tests environnementaux et la sécurité alimentaire, garantissant une analyse précise et un contrôle qualité.

- Sur la base du secteur, le marché mexicain des instruments d'analyse est segmenté en privé et public (gouvernement).

En 2024, le secteur privé devrait dominer le marché mexicain des instruments d’analyse

En 2024, le segment privé devrait dominer le marché avec une part de marché de 54,72 % en raison de l'augmentation des investissements dans la R&D, de la croissance des industries pharmaceutiques et biotechnologiques et d'une demande de solutions analytiques avancées.

- En fonction des applications, le marché mexicain des instruments d'analyse est segmenté en secteurs pharmaceutique, agroalimentaire, minier et minéraux, chimie, pétrole et gaz, électronique et semi-conducteurs, textile , automobile, aérospatiale et défense, entre autres. En 2024, le segment pharmaceutique devrait dominer le marché avec une part de marché de 28,45 %.

- En fonction du canal de distribution, le marché mexicain des instruments d'analyse est segmenté en ventes directes et ventes indirectes. En 2024, le segment des ventes directes devrait dominer le marché avec une part de marché de 90,51 %.

Acteurs majeurs

Data Bridge Market Research analyse Thermo Fisher Scientific Inc. (États-Unis), Agilent Technologies, Inc. (États-Unis), Waters Corporation (États-Unis), PerkinElmer Inc. (États-Unis), Bruker, Avantor, Inc. (États-Unis) comme les principaux acteurs du marché.

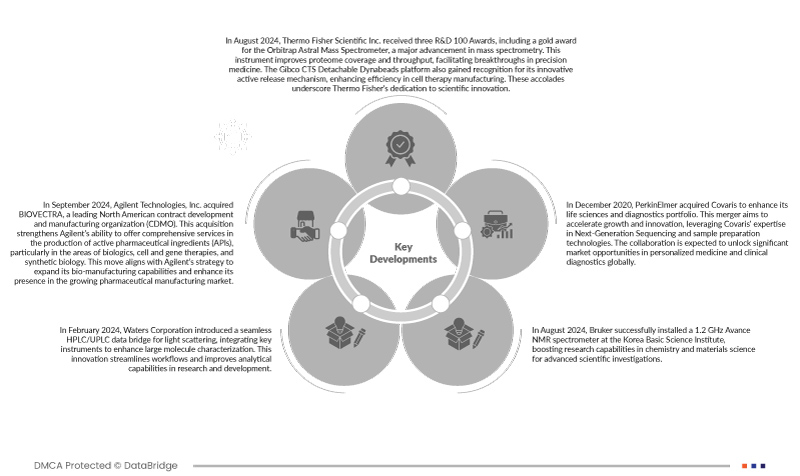

Évolution du marché

- En août 2024, Thermo Fisher Scientific Inc. a reçu trois prix R&D 100, dont une médaille d'or pour le spectromètre de masse astral Orbitrap, une avancée majeure en spectrométrie de masse. Cet instrument améliore la couverture protéomique et le débit, facilitant ainsi les avancées en médecine de précision. La plateforme Gibco CTS Detachable Dynabeads a également été reconnue pour son mécanisme innovant de libération active, améliorant l'efficacité de la fabrication des thérapies cellulaires. Ces distinctions soulignent l'engagement de Thermo Fisher en faveur de l'innovation scientifique.

- En septembre 2024, Agilent Technologies, Inc. a acquis BIOVECTRA, un leader nord-américain du développement et de la fabrication sous contrat (CDMO). Cette acquisition renforce la capacité d'Agilent à offrir des services complets de production de principes actifs pharmaceutiques (API), notamment dans les domaines des produits biologiques, des thérapies cellulaires et géniques, et de la biologie synthétique. Cette opération s'inscrit dans la stratégie d'Agilent visant à développer ses capacités de biofabrication et à renforcer sa présence sur le marché en pleine croissance de la fabrication pharmaceutique.

- En février 2024, Waters Corporation a lancé une passerelle de données HPLC/UPLC transparente pour la diffusion de la lumière, intégrant des instruments clés pour améliorer la caractérisation des grosses molécules. Cette innovation simplifie les flux de travail et améliore les capacités analytiques en recherche et développement.

- En août 2024, Bruker a installé avec succès un spectromètre RMN Avance de 1,2 GHz à l'Institut coréen des sciences fondamentales, renforçant ainsi les capacités de recherche en chimie et en science des matériaux pour des investigations scientifiques avancées.

- En décembre 2020, PerkinElmer a acquis Covaris afin d'enrichir son portefeuille de produits en sciences de la vie et en diagnostic. Cette fusion vise à accélérer la croissance et l'innovation, en s'appuyant sur l'expertise de Covaris en matière de séquençage de nouvelle génération et de technologies de préparation d'échantillons. Cette collaboration devrait ouvrir d'importantes perspectives de marché dans les domaines de la médecine personnalisée et du diagnostic clinique à l'échelle mondiale.

Selon l'analyse de Data Bridge Market Research :

Pour plus d'informations sur le rapport sur le marché mexicain des instruments d'analyse, cliquez ici : https://www.databridgemarketresearch.com/reports/mexico-analytical-instruments-market